Original author: Naly

Original translation: TechFlow

Trustless Economy - Understanding Ethereum

The functioning of human society fundamentally depends on trust. From personal relationships to global economic systems, trust is the bond that binds us together.

The key question is, how strong is this bond?

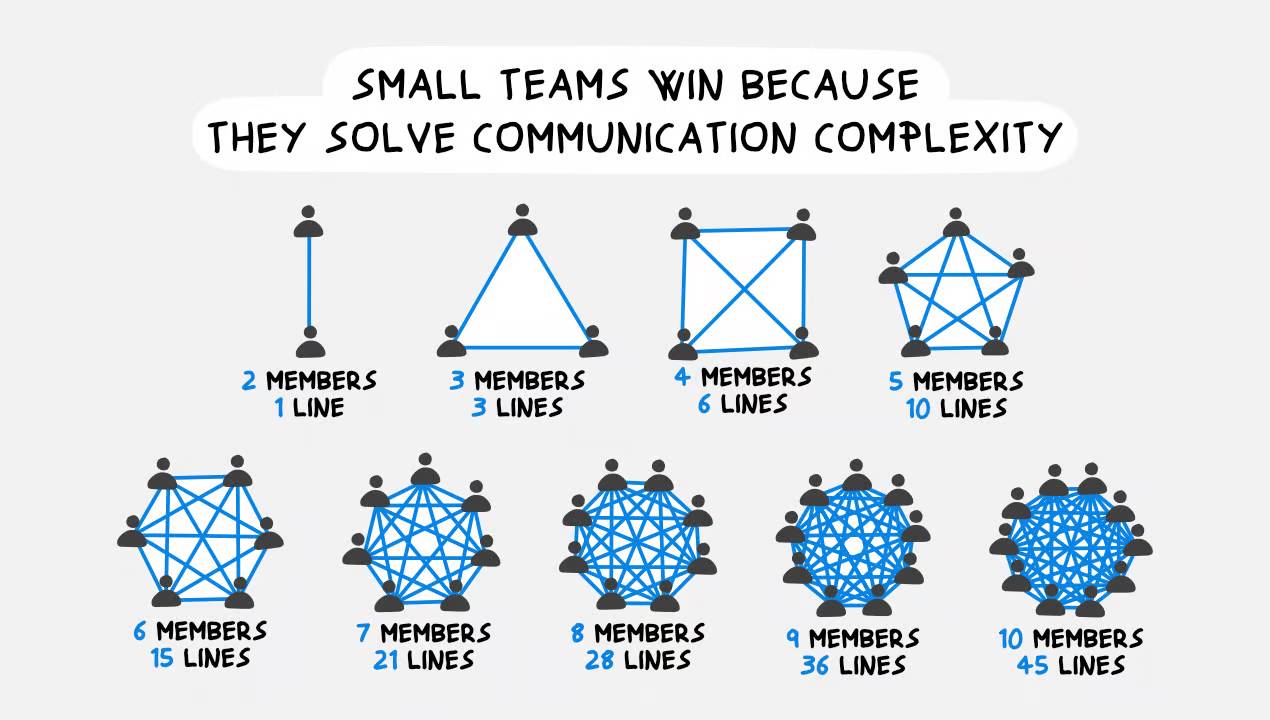

In a small-scale environment, trust can be very strong. This is because trust is based on relationships, knowledge, and direct responsibility, and a person’s reputation directly impacts the relationships they build.

However, as the number of interactions increases and scales, the relative strength of trust becomes very fragile. Why? The larger the group, the fewer personal connections are made, the less influence reputation has, the better the incentives must be, and the better the system must work.

Table of contents

Trustless Economy - Understanding Ethereum

Trust Story

Big Game

The Birth of Ethereum

Decentralized Stablecoins

Lending Market

Decentralized Exchanges

Liquid Staking Protocol

Strength in numbers

Trustless Code

Bitcoin and Ethereum

World Computer

Economic security

Programmable Economy

Decentralized Applications

Decentralized Finance

Decentralized Autonomous Organization

Trustless Economy

Case

In Sapiens: A Brief History of Humankind, Yuval Noah Harari explains that trust can be maintained in groups of up to about 150 people, a number known as Dunbar’s number. When group sizes exceed this number, humans rely on the development of shared myths, religions, and ideologies.

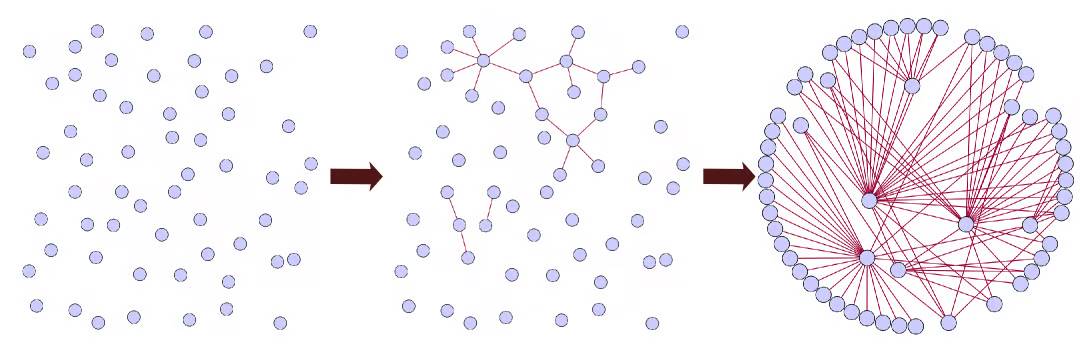

In today’s age, as relationships scale to larger organizations, corporations, or global markets, society’s solution is to institutionalize trust—in effect, to weave a narrative that renders certain individuals in the system reputationally “trustworthy.”

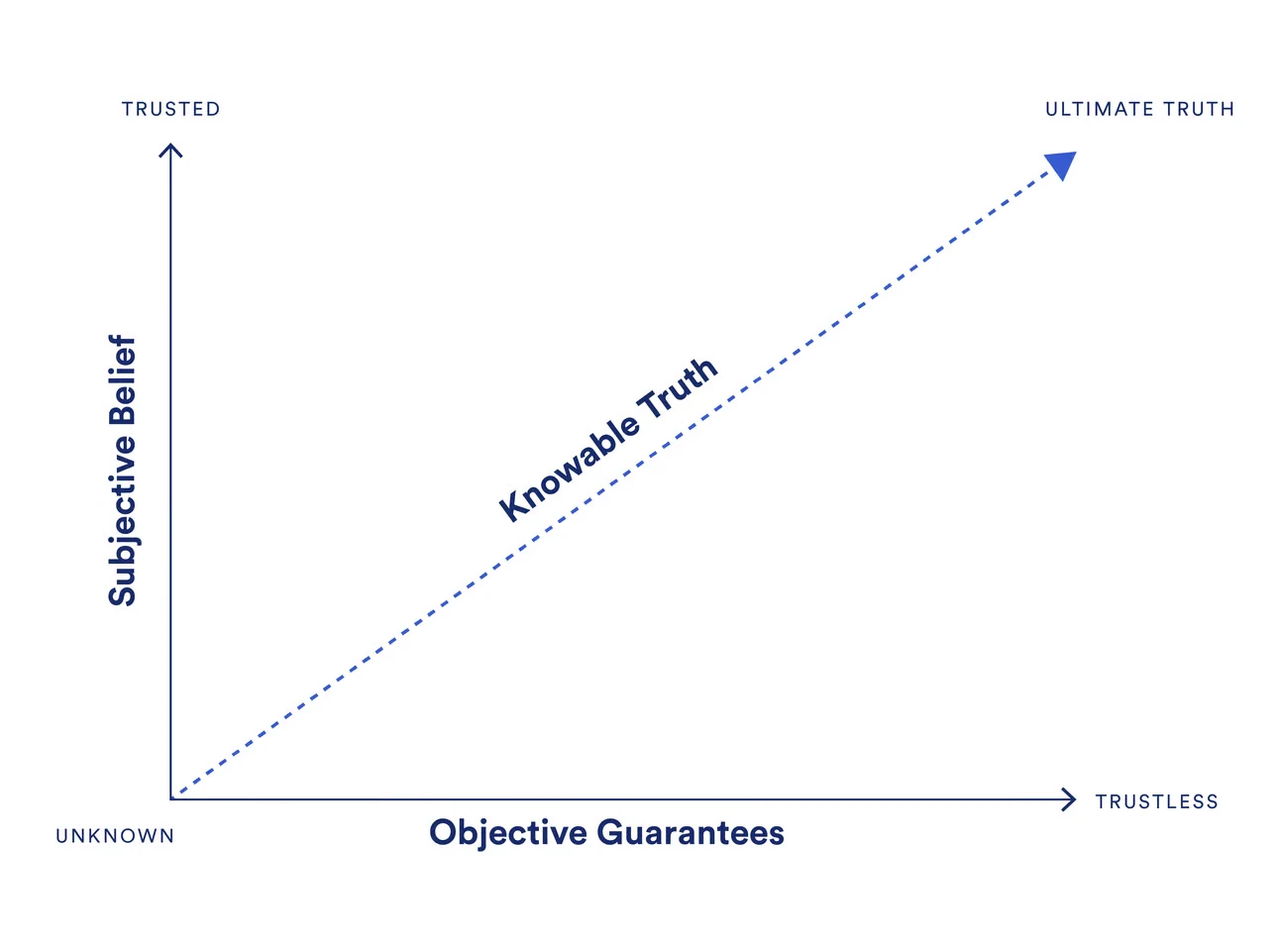

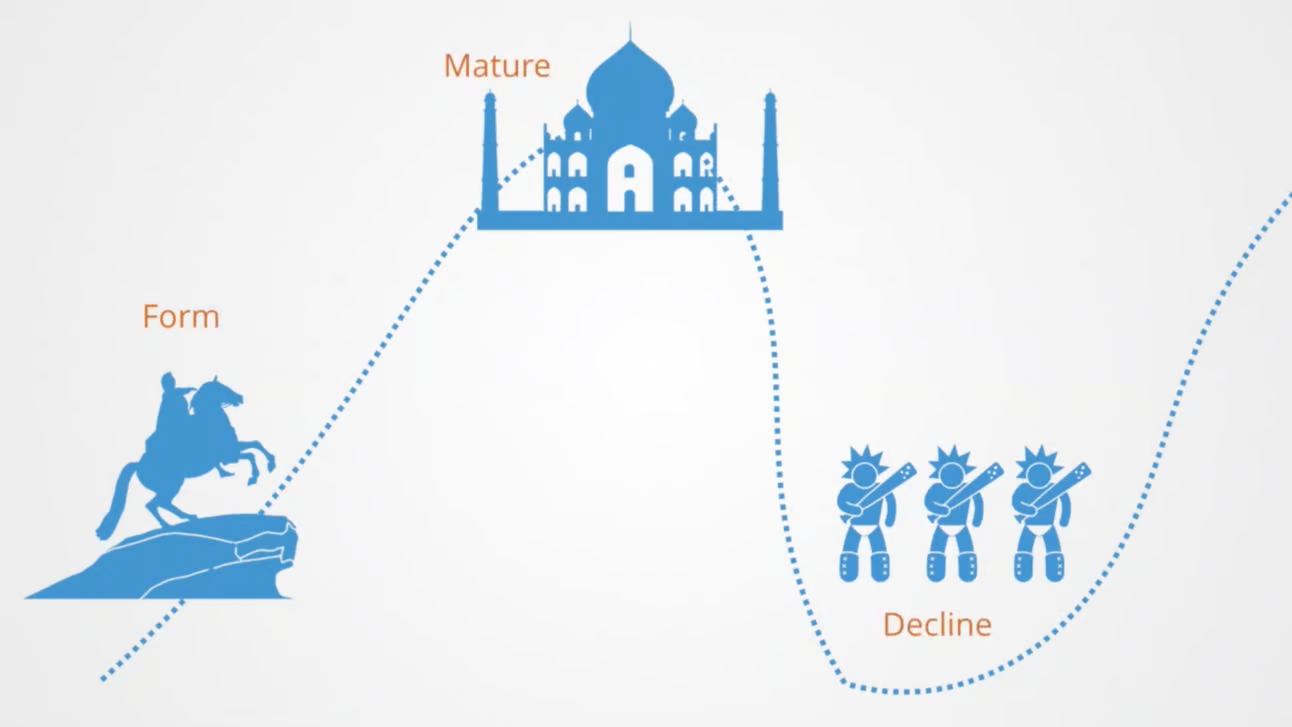

The figure below shows one way to visualize this.

As simple as it sounds, this doesnt always work.

In the 2008 financial crisis, financial products that were considered very safe (AAA rated) by these “trust certified” banks and credit rating agencies turned out to be exactly the opposite. The banks wrapped shoddy assets in fancy wrapping paper and sold them as quality assets. Once people realized this, the system collapsed, catastrophically.

The stock market plummeted, with the global stock market value evaporating by about $30 trillion. House prices in the US real estate market fell by 30%, and more than 3 million houses were repossessed.

To understand the sheer size of $30 trillion, consider this: If you stacked $1 bills, they would be about 2 million miles high, more than eight times the distance from the Earth to the Moon. Alternatively, if you spent $1 million a day, it would take more than 82,000 years to spend them all!

The 2008 financial crisis is just one of many examples of catastrophic failures of trust that have paralyzed systems.

Enron Scandal (2001) : Enrons fraudulent accounting practices led to its bankruptcy and eroded trust in corporate governance and auditing standards.

Wells Fargo Account Fraud Scandal (2016) : Wells Fargo employees created millions of unauthorized bank and credit card accounts, resulting in significant financial losses and a loss of trust in the bank.

Facebook-Cambridge Analytica data scandal (2018) : Cambridge Analytica’s collection of personal data from Facebook users without consent highlighted the risks of centralized control over personal data.

Equifax data breach (2017) : A major data breach at Equifax exposed sensitive information of 147 million people and undermined trust in centralized credit reporting agencies.

Great Game

Why do these trusted entities continually betray our trust?

Is this just innate greed in all humans, or is there a mathematical reason for this? It turns out it’s both.

Life is one big game. You roll the dice, advance on the board, buy houses, collect $200 when you pass a level, level up your skills, build alliances, make enemies, and ultimately build and break trust. Its a never-ending cycle.

To quantify the big decisions in life, we can turn to game theory—the mathematical study of strategic interactions.

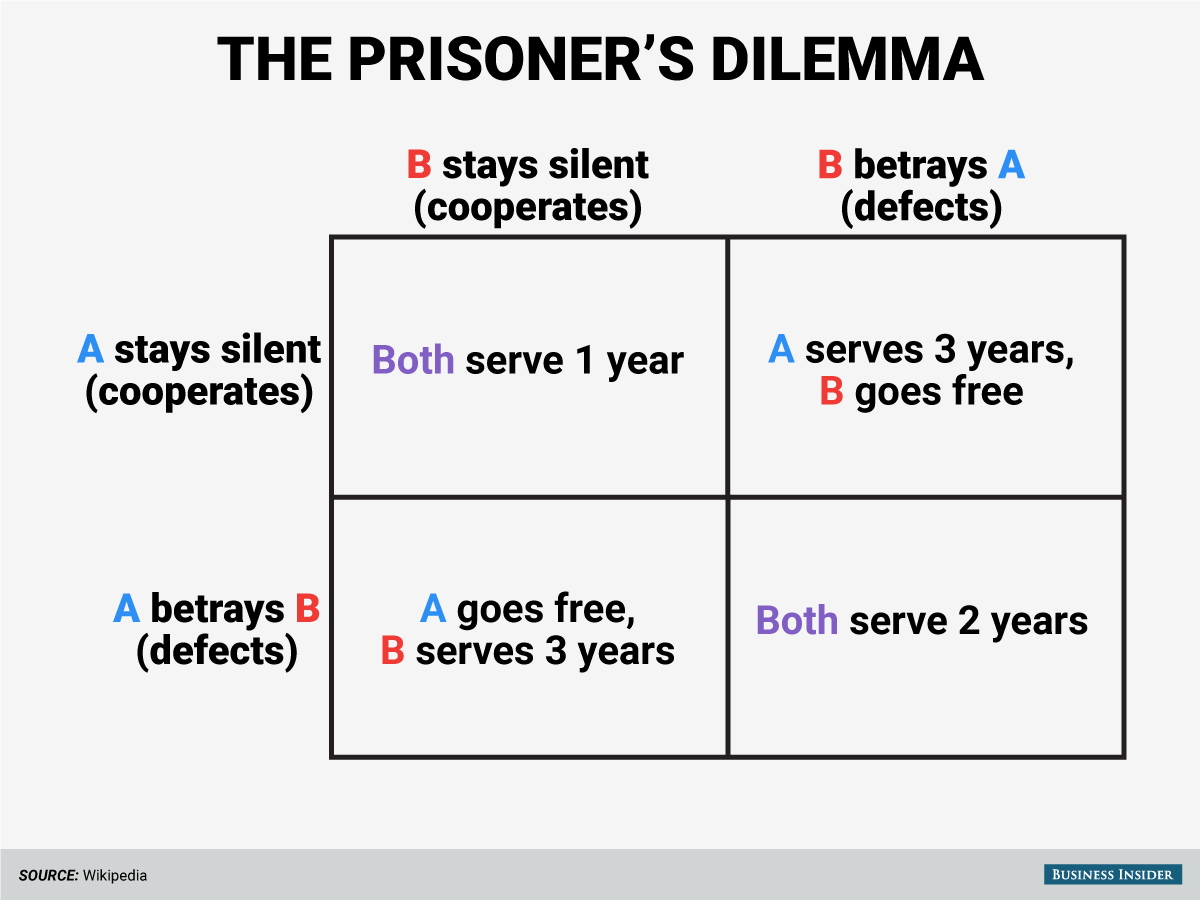

The most common introduction to this field is the prisoners dilemma - a game in which two people are arrested and imprisoned separately. They can choose to cooperate and remain silent, or betray each other.

If both parties remain silent, they will serve a short sentence. If one party betrays and the other party remains silent, the betrayer will be released and the silent party will serve a longer sentence. If both parties betray the other party, they will serve a medium sentence.

This dilemma illustrates the conflict between individual rationality and collective rationality, and how the pursuit of individual self-interest can lead to worse outcomes for society as a whole.

If we map this mechanism over many iterations, and calculate the probability of success (cumulative score), you might expect a traitor society to increase; as the old saying goes - good guys never win.

In fact, the results were quite different. Once the game was iteratively programmed into a computer and allowed to run thousands of times, with the scores accumulated, some interesting findings were revealed.

The most successful computer programs are called tit-for-tat and have the following characteristics:

Kindness : Not the first person to betray

Revenge : If your opponent betrays you, strike back immediately

Forgiveness : Revenge without Holding a Grudge

(For more on game theory, see the video .)

So, is being nice and trustworthy good for society?

I mean, it makes sense - in almost every situation in life, its better to work together. This is evident in team sports, relationships, and business. Those who work well together are often the best!

What I find particularly interesting is that when mapped onto longer time spans and onto areas like biological evolution, another pattern emerges.

(For more on evolutionary game theory, please refer to the video .)

As cooperative societies grow, they reach a point of instability, because any individual prone to defection immediately upsets the equilibrium, degrading interpersonal relationships (see above, Dunbars number). This is evident in the formation of cooperation within nations or corporations, the rise of empires until they reach maturity, and their inevitable decline once internal defections and imbalances set in.

In short, on a team of good people, it only takes one bad actor to take advantage.

Evolutionary selection favors strategies that base their decision on helping on the recipient’s prior reputation. In small-scale environments this is possible, but as groups grow beyond the 150-person limit we discussed earlier, there is a point at which the reputation-based central authority fails.

In order for a broad and advanced cooperative society to be possible, there must be a supporting structure. I and many others believe that the global financial system and the livelihood of every member of society cannot depend solely on the good words of those who are financially motivated to manipulate the truth for their own gain.

Financial trust urgently needs to be redefined .

Creation of Ethereum

Strength in numbers

In 2009, Bitcoin was created as a financial model that seeks to eliminate trust issues in the financial system through an immutable monetary asset.

Bitcoin achieved this by introducing the blockchain, a decentralized database secured by a large number of computers and powered by a finite unit of currency, Bitcoin (BTC).

Bitcoin is a peer-to-peer and cryptographically secure network. It allows all users to keep their own funds and is governed by an issuance schedule that cannot be arbitrarily inflated by a single authority. These factors have led to Bitcoin being hailed as digital gold.

Check out the article below for an overview of the Bitcoin network.

Figure: Permissionless Economy - Bitcoin

Untrusted code

Six years after the birth of Bitcoin, Vitalik Buterin envisioned a more general blockchain that would not only allow users to hold and transfer digital assets, but also leverage the immutability of the blockchain to create trustless applications and build decentralized sub-economies.

These statements may seem confusing at first, so be patient.

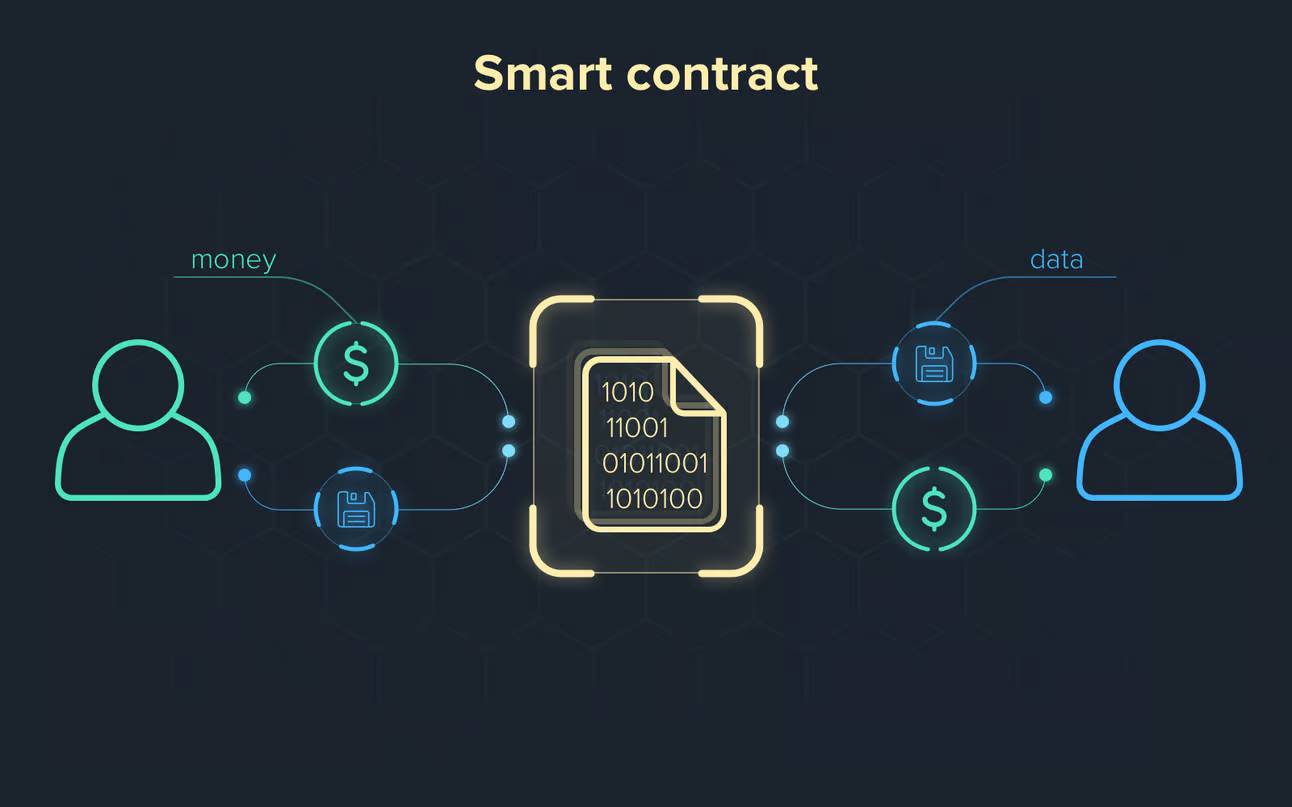

The most important thing to understand is that the core innovation of Ethereum is smart contracts .

A smart contract is a digital agreement that automatically executes and enforces agreements under predefined conditions through code, eliminating the need for human intervention.

The implementation of these contracts relies on some key blockchain features:

Immutable ledger : Once a contract is deployed, its terms cannot be changed.

Decentralized Economic Security : The network is secured through economic incentives and a large number of network participants rather than a single central entity.

You can think of a smart contract as a recipe book that automatically creates a dish when all the ingredients are ready. Once the code (the recipe in this metaphor) is provided, no human intervention is required.

This recipe is open source, meaning everyone can review what will be made (and how) before agreeing to the contract. It is also immutable and cannot be changed once deployed.

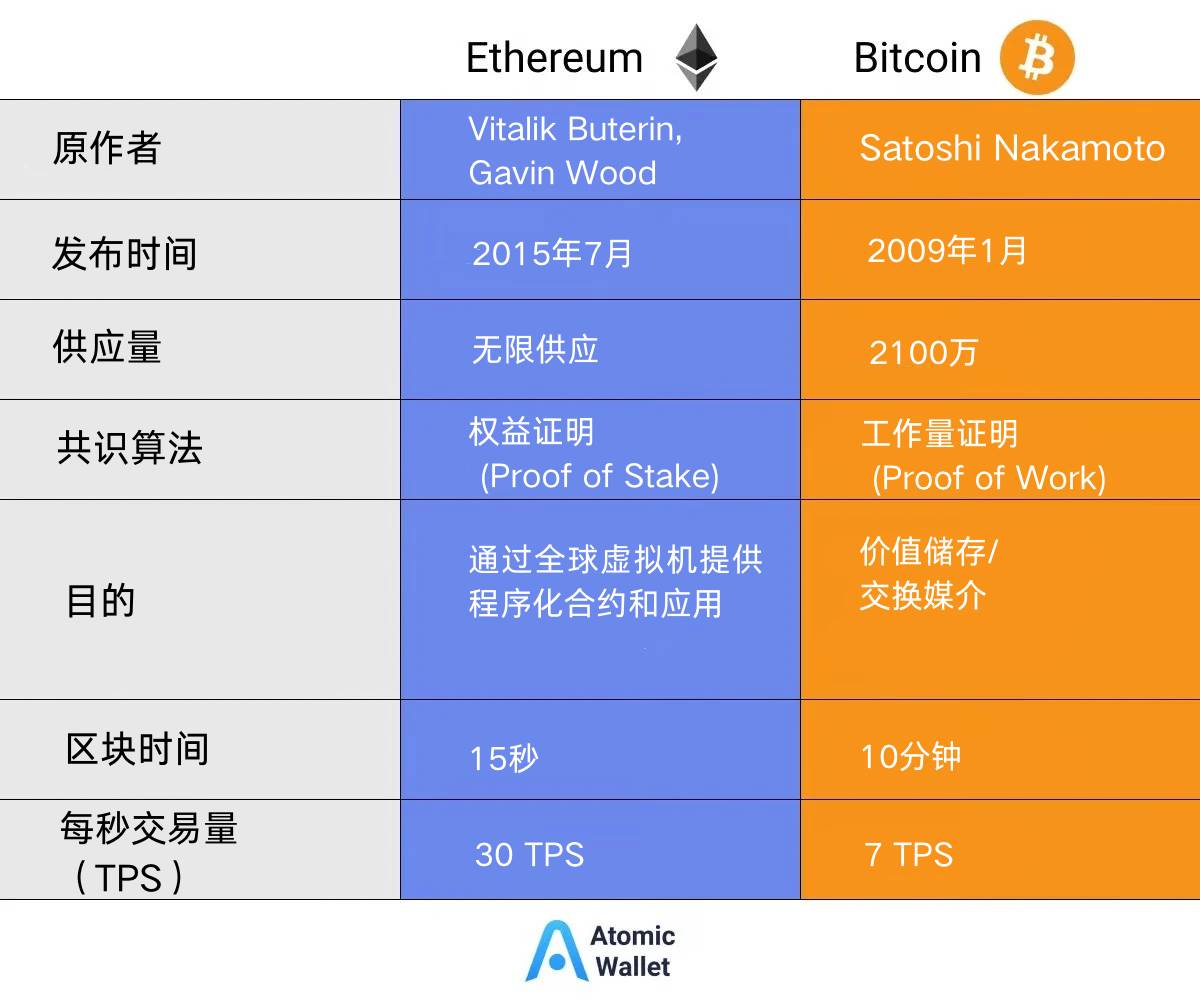

Bitcoin vs Ethereum

Looking at Bitcoin and Ethereum from a macro perspective, the Bitcoin network can be likened to a very secure calculator. Just like a calculator performs arithmetic operations, the Bitcoin network efficiently handles peer-to-peer value transfers.

Ethereum can be compared to the Apple App Store - it provides a basic platform for developers to build and run applications.

Just as the App Store provides a secure environment for apps on your iPhone, Ethereum provides a decentralized and programmable blockchain environment for creating and executing smart contracts and decentralized applications (dApps).

Continuing with the analogy, while Bitcoin is a transaction network, Ethereum is like an entire computer.

World Computer

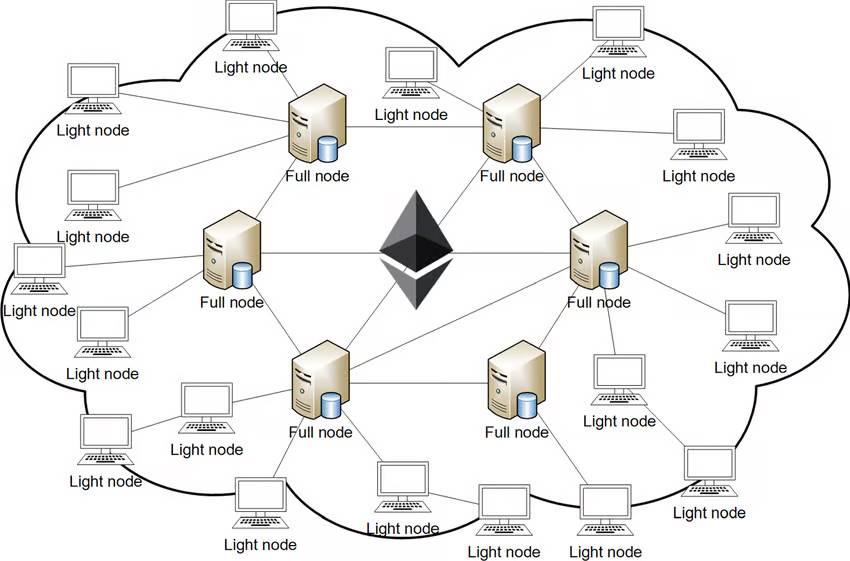

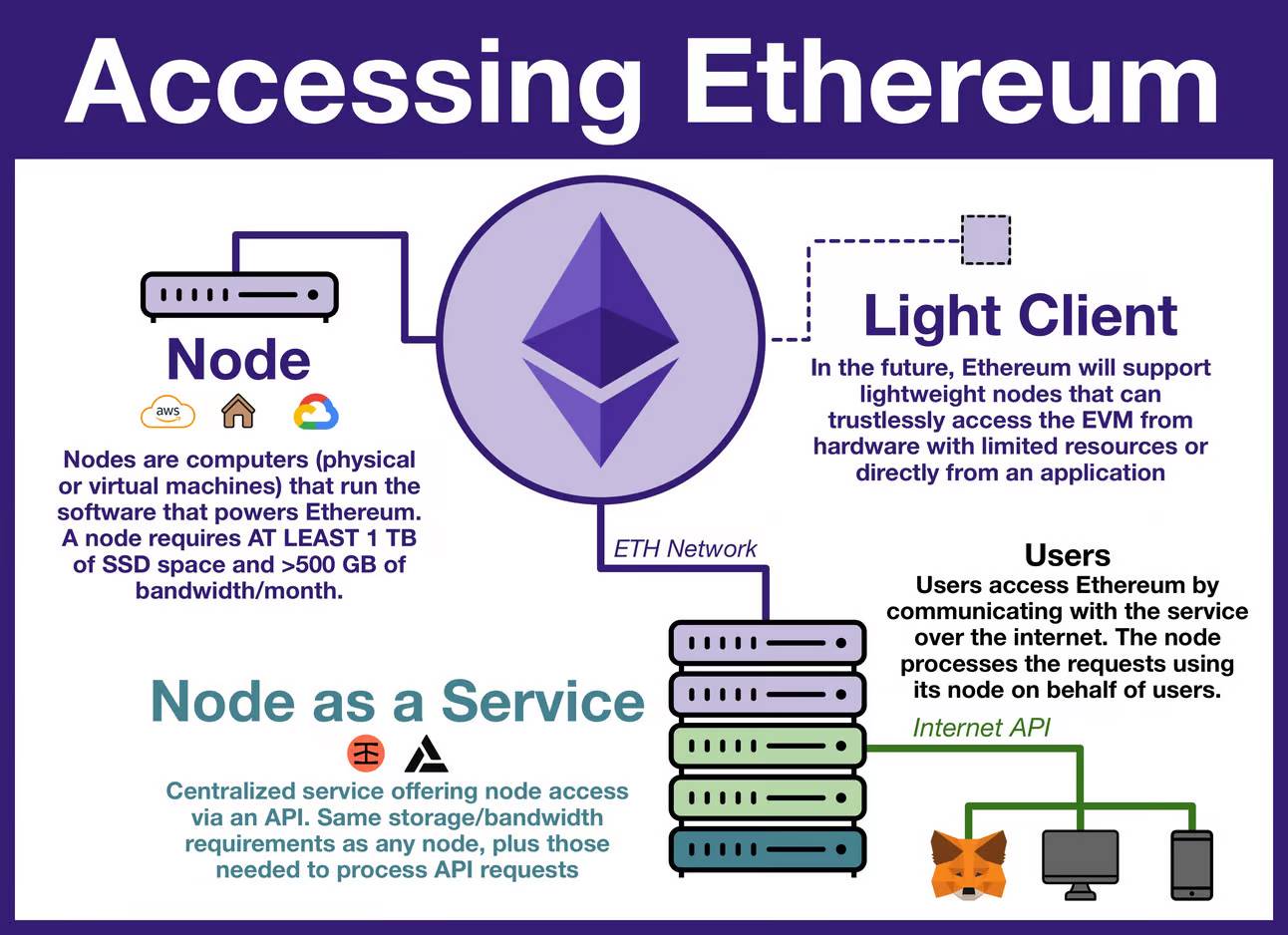

Unlike traditional computers, where the state is internally implemented (i.e. the specific state of a system or software at a specific point in time), the Ethereum computer, also known as the Ethereum Virtual Machine (EVM), operates by executing contracts across a vast network of computers.

When a transaction is executed on the Ethereum blockchain, the EVM ensures that every computer (or node) in the network processes and approves the transaction in the same way.

Each time a new set of transactions is added, it is called a block - hence the name blockchain. Public blockchains like Ethereum allow anyone to add data, but they cannot remove it.

The network is powered by the cryptocurrency Ether (ETH), which is used to pay for computing resources to process transactions. Each transaction requires ETH to execute, which means that if Bitcoin (BTC) is digital gold, then Ether (ETH) is digital oil.

In a recent report , the Industrial and Commercial Bank of China (ICBC), the worlds largest bank, praised the growth of Ethereum and Bitcoin. The bank compared Bitcoin to gold due to its scarcity, while calling Ethereum digital oil, noting its role in providing a powerful platform to support numerous Web3 innovations. - FXStreet

It’s important to note that when we say transactions, unlike the Bitcoin network, we don’t just mean the sending of funds. On Ethereum, a transaction is any action that changes the state of the network, and thanks to the creation of smart contracts, this could be anything from deploying a new contract to voting on governance or purchasing new items in an on-chain game. (More on this later)

Economic security

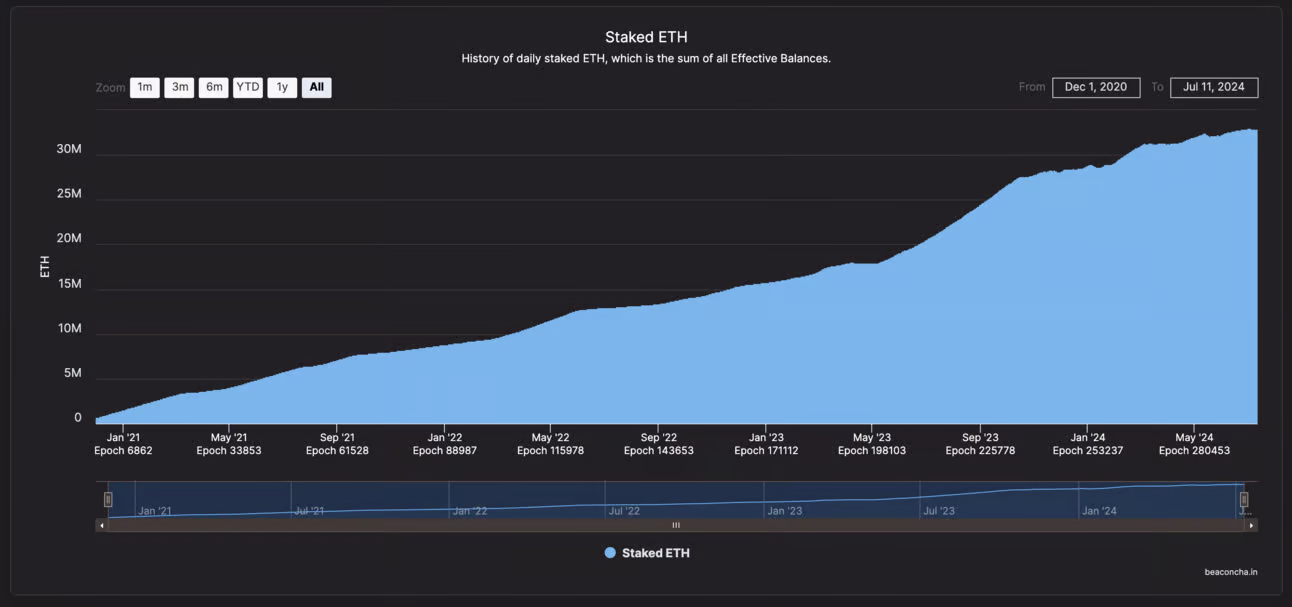

Figure: More than 30 million ETH is staked on the Ethereum network

One of the first questions that comes to people’s mind regarding the Ethereum network is security. How can we ensure that these smart contracts are secure?

Ethereum is economically secured through the Proof-of-Stake (PoS) consensus mechanism.

In PoS, the state of the network is changed through validators — participants responsible for storing data, processing transactions, and adding new blocks to the blockchain.

To become a validator, a user must lock up Ether (ETH) as collateral and run the necessary computing hardware to maintain and update the state of the network. To illustrate how a new block is added, assume that two simple transactions occur within a block.

John sends 1 ETH to Betty.

Developer Bob spends 2 ETH to create a new smart contract.

The job of all validators in the network is to verify these two transactions and update the network state accordingly. In this example, the validators need to ensure that Johns account is reduced by 1 ETH, Bettys account is increased by 1 ETH, and a new smart contract is created and recorded on the blockchain.

Validators in the network update the state on their local hardware, and once a majority (more than 50%) of validators agree that the transaction is valid and the state change is correct, the next block is added. This consensus mechanism ensures the integrity and accuracy of the network state.

If a validator is dishonest and lies about the state of the network (for example, updating their local computer to say that John sent 1 ETH to George instead of Betty), and more than 50% of network participants disagree, they risk being slashed and losing some or all of their staked ETH.

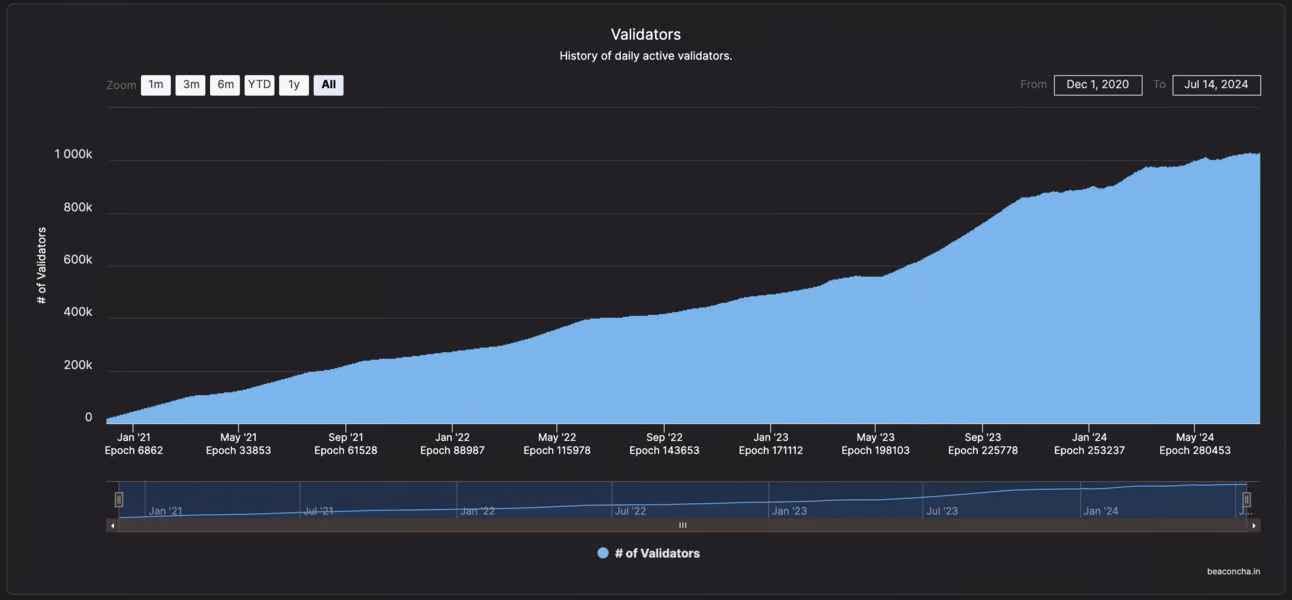

Figure: There are more than 1 million validators on the Ethereum network

Validators are rewarded through newly minted ETH and transaction fees, which provides them with a financial incentive to act in the best interest of the network.

Simply put, participants are financially incentivized to ensure the security of the Ethereum network.

This 50% rule means that if someone wants to tamper with information or cheat the system, they need to control more than half (51%) of the computers on the network. Currently, this would cost about $103 billion.

This is almost impossible for the following reasons:

Market Liquidity : Ethereum markets lack sufficient liquidity to handle $103 billion in purchases without causing extreme price volatility.

Exchange limitations : No single exchange or combination of exchanges can handle such a large purchase in one transaction.

Regulatory and compliance issues : A purchase of this size would attract the attention of regulators and require compliance with extensive anti-money laundering (AML) and know your customer (KYC) regulations.

Counterparty risk : Finding enough sellers to meet $103 billion in ETH demand is nearly impossible.

Programmable Economy

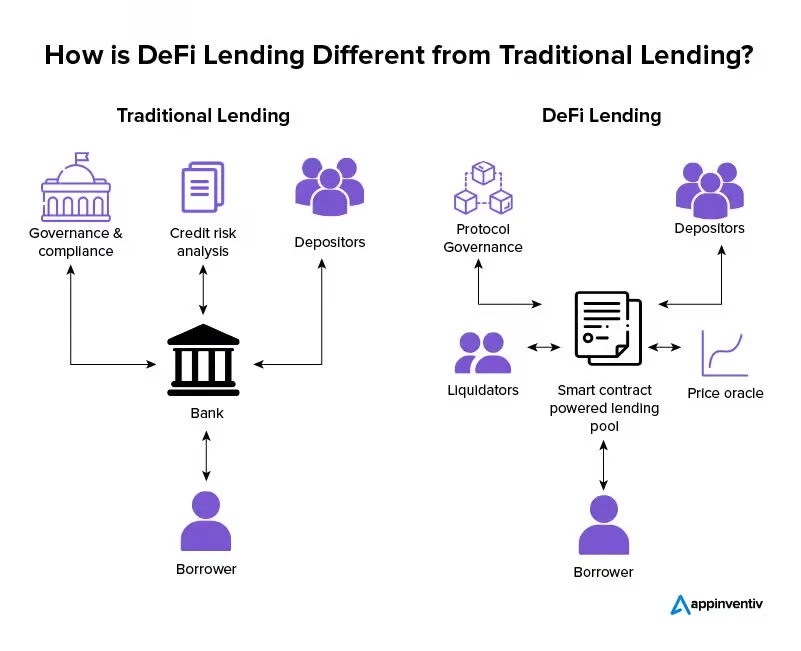

We learned that Ethereum not only enables transactions and storage of financial value, but also allows the creation and execution of trustless protocols based on predefined instructions.

This means that while Bitcoin created a finite decentralized unit of currency, Ethereum created the possibility of a new financial system.

Whereas financial systems traditionally required intermediaries such as banks and lending agents, smart contracts make it possible to program decentralized applications (dApps) that no longer require human intervention once deployed.

Decentralized Applications

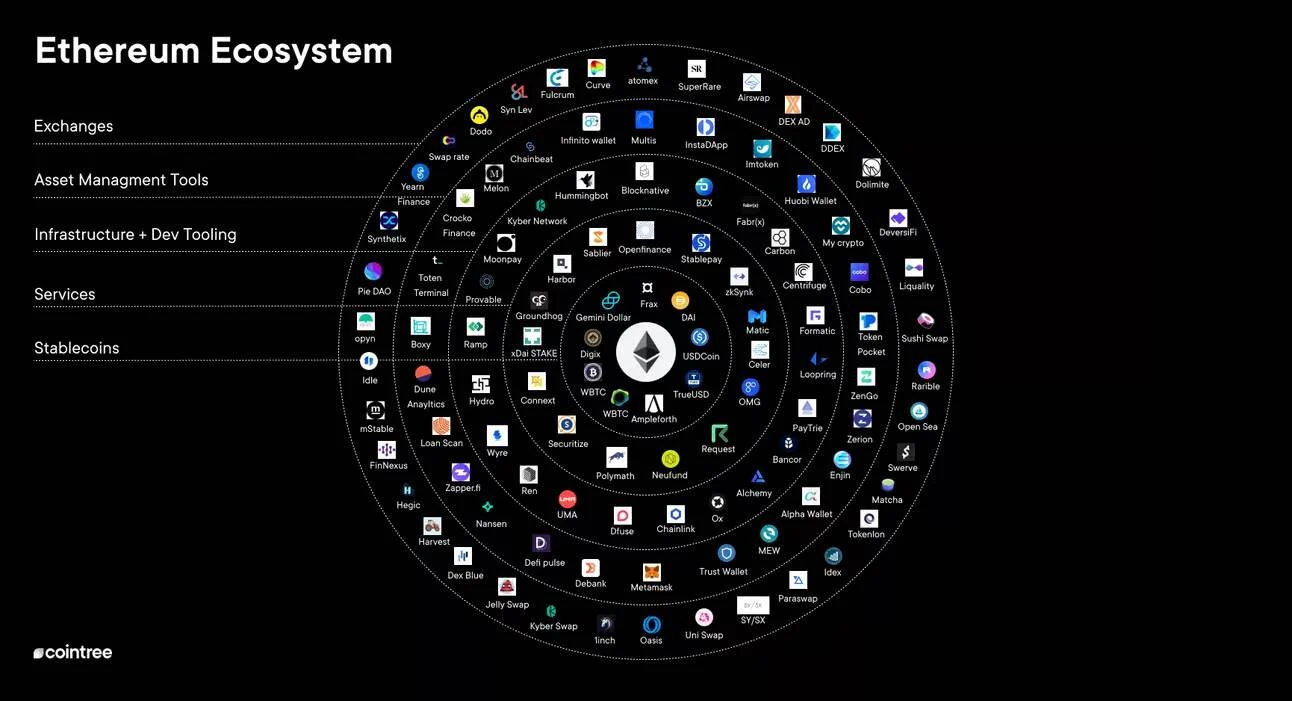

So, what decentralized applications can be created?

Almost anything that requires protocols, intermediaries, trust, and centralized points of failure can leverage blockchain technology to decentralize and de-stress the system.

From supply chain management and healthcare to gaming and digital identity, the potential design space is endless. In addition to being able to eliminate human intermediaries, blockchain technology also improves the efficiency and connectivity of data. Todays isolated and outdated databases are evolving towards more efficient and connected technology layers.

Blockchain, the digital record-keeping technology used in Bitcoin and other cryptocurrency networks, is a potential game-changer in the financial world. But it also holds great promise in supply chain management. Blockchain could significantly improve supply chains by delivering products faster and more cost-effectively, enhancing product traceability, improving coordination between partners, and helping obtain financing. —Harvard Business Review

The area gaining the most traction so far is decentralized finance, or DeFi for short.

Decentralized Finance

On-chain lending markets enable anyone with an internet connection to provide tokenized assets and earn interest by lending them out. These transactions are conducted without the intervention of middlemen, with only a piece of cryptographic code predetermining the interest rate through a mathematical model of supply and demand mechanisms.

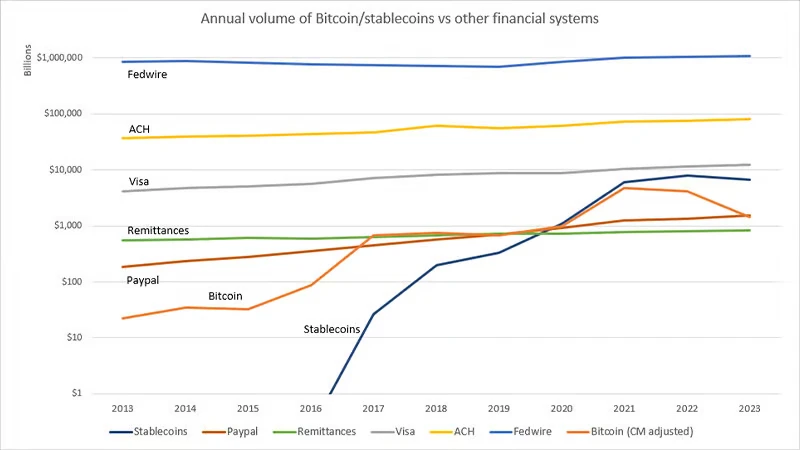

The emergence of stablecoins offers users tokenized versions of national currencies like the dollar and the euro — a $161 billion industry that has attracted adoption from traditional financial giants like Visa and Paypal.

Image: Visa

Stablecoins are backed by transparent off-chain reserves (like U.S. Treasuries), or pegged to the dollar but backed by ETH, giving anyone, anywhere instant access to the online tokenized currency of their choice.

This technology is particularly important in countries where currency inflation and devaluation are caused by greed and manipulation of centralized power.

For example:

Venezuela : Due to hyperinflation, many Venezuelans have turned to stablecoins like Tether (USDT) to store value and conduct transactions, thereby bypassing the unstable Bolivar.

Argentina : Faced with high inflation and currency controls, Argentines are increasingly turning to stablecoins to protect their savings and facilitate international trade.

Turkey : Amid economic uncertainty and currency devaluation, Turkish citizens have adopted stablecoins to protect their wealth from lira fluctuations.

Essentially, stablecoins give fiat money internet superpowers, allowing it to circulate like other internet data. — Circle

Let’s take a deeper look at some of the most prominent decentralized finance (DeFi) protocols.

Decentralized Stablecoins

The first decentralized application (dApp) built on Ethereum was Maker DAO, a protocol that allows users to create and manage a decentralized stablecoin called Dai. Dai is pegged to the US dollar but backed by ETH.

To obtain Dai, users need to provide Ether (ETH) as collateral in a smart contract. Once generated, purchased, or received, Dai can be used like other cryptocurrencies: it can be sent to others, used to pay for goods and services, or even held to earn interest through the Dai Savings Rate (DSR) feature in the Maker Protocol.

Lending Market

Aave is a decentralized non-custodial lending protocol where users can participate as depositors or borrowers. Depositors provide liquidity to earn passive income, while borrowers can borrow these assets for other DeFi applications.

Users can provide the assets and quantities of their choice and earn passive income based on market demand. After providing assets, users can borrow using those assets as collateral.

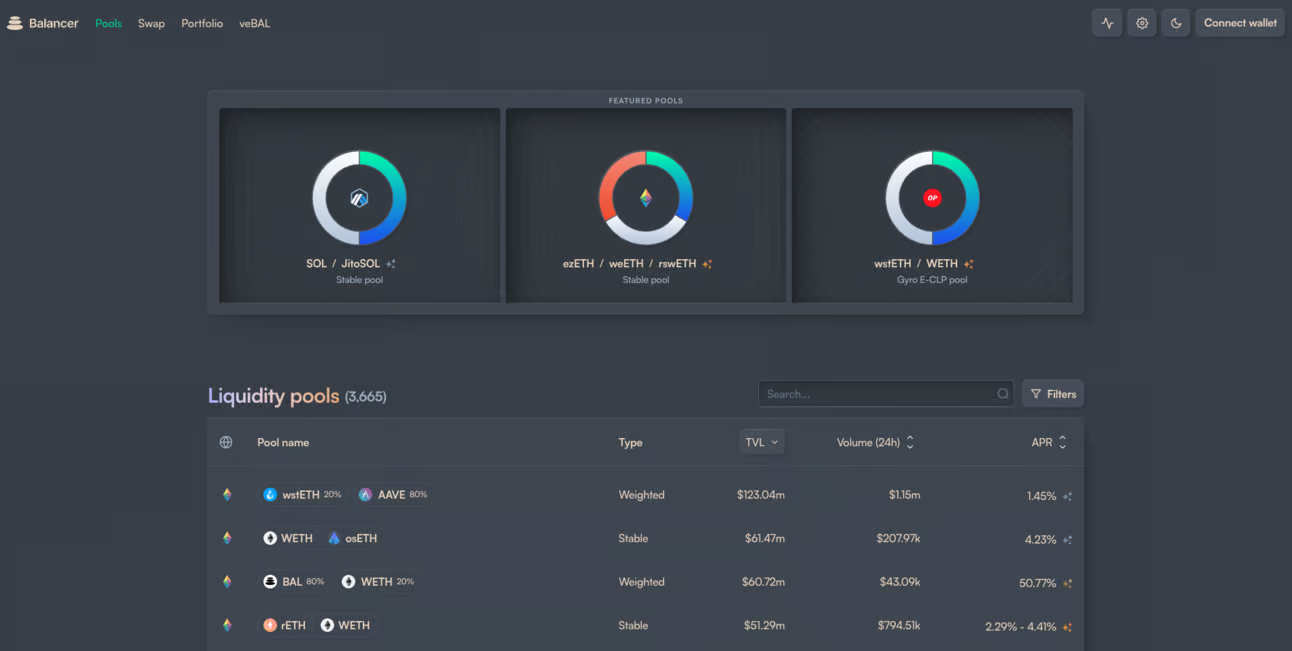

Decentralized Exchanges

Balancer is a decentralized exchange (DEX) protocol that allows users to exchange various cryptocurrencies directly from their wallets without the need for a central authority or intermediary.

Balancer uses an automated market maker (AMM) model where liquidity providers deposit token pairs into a liquidity pool, and the price is determined by the ratio of tokens in the pool through a mathematical formula. Users are incentivized to provide liquidity in order to earn a portion of the transaction fees generated in the pool.

Liquid Staking Protocol

Lido Finance is a decentralized finance (DeFi) protocol that provides liquid staking solutions for various Proof-of-Stake (PoS) blockchains.

Instead of locking their crypto in a staking contract, users can stake their assets through a liquid staking protocol like Lido, which will stake on their behalf and return a liquid asset.

This approach allows users to enjoy staking rewards while maintaining liquidity of their assets, enabling more flexibility and participation in the DeFi ecosystem.

Decentralized Autonomous Organization

Thousands of financial applications have been formed based on the concept of decentralization, removing the power hierarchy in traditional finance and replacing it with decentralized autonomous organizations (DAOs).

A DAO is an organization that runs on a blockchain and whose rules and decisions are encoded in a computer program rather than controlled by a central authority. Members of a DAO typically hold governance tokens that give them voting rights, allowing them to propose and vote on matters such as funding allocation, financial management, and project development.

This decentralized structure ensures transparency, as all operations and transactions are recorded on the blockchain, and allows for a more democratic decision-making process, with power distributed among all members rather than concentrated in the hands of a few.

Trustless Economy

We have covered a lot of ground, so let’s wrap it up and draw conclusions.

Collaboration is a feature of every great society, but when groups grow beyond 150 people, the ability to build strong relationships diminishes, replaced by reliance on narratives, stories, and centralized institutions.

While the formation of these entities allows groups to expand and build complex social structures, it also creates very unstable organizations, allowing a bad actor to use the power of the collective to his own advantage.

Game theory tells us that being good is good for the growth of society. But history also shows that a society full of good people is easily eroded by bad actors.

In order to achieve the next wave of a widespread and advanced cooperative society, there must be a new support structure to make it happen.

What’s interesting about smart contracts is that they don’t try to build structure around an imperfect model, but rather they completely redefine that model.

The current society concentrates the power of trust in central institutions, and the introduction of smart contracts provides society with a new infrastructure to support the development of the next generation of trust-minimized applications and services. —— ChainLink

I, and many others, believe that the global financial system and the livelihoods of every member of society cannot depend solely on the “nice words” of those who have a financial incentive to manipulate the truth for their own gain.

And you?