Original author: Christine Kim, Vice President of Galaxy Research

Original translation: Luffy, Foresight News

This report provides a comprehensive overview of staking, how it works on Ethereum, and important considerations for stakeholders when engaging in staking. This is the first in a three-part series on staking that will dive deeper into the risks and rewards of various staking activities, including re-staking and liquidity re-staking. The second report will provide an overview of re-staking, how staking works on Ethereum and Cosmos, and important risks associated with re-staking.

introduce

Ethereum is the largest proof-of-stake (PoS) blockchain by total staked value. As of July 15, 2024, ETH holders have staked over $111 billion worth of ETH, or 28% of the total ETH supply. The amount of staked ETH is also referred to as Ethereum’s “security budget” because stakers can be punished by the network in the event of double-spending attacks and other violations of protocol rules. In return for maintaining Ethereum’s security, stakers are rewarded through protocol issuance, priority fees, and maximum extractable value (MEV). The ease with which users can stake ETH through liquid staking pools without sacrificing the liquidity of the asset has led to a demand for staking that has exceeded the expectations of Ethereum developers. Based on the current state of staking, developers expect ETH’s staking rate to grow further in the coming years. To mitigate this trend, developers are considering major changes to the protocol’s issuance policy.

This report will provide an overview of staking on Ethereum, including the types of users who stake on Ethereum, the risks and rewards of staking, and projections for the staking rate. The report will also provide insights into developer proposals to change network issuance in order to curb staking demand.

Staker Type

There are six main types of Ethereum users who can earn rewards through staking. The following table details an overview of each of them:

Among these stakers, the largest number are custodial stakers, i.e. those who entrust their ETH to professional staking node operators. Although there are not many professional operators, they are the type of staking entity that manages the most staked ETH.

Liquidity staking, re-staking, and liquidity re-staking pool protocols are not considered in this analysis because these entities do not directly run the staking infrastructure or fund its use. However, these entities do receive a percentage of the rewards from stakers who use their platform; they are middleman entities that facilitate the relationship between custodial stakers and professional (or amateur) stakers, and are therefore important players in the Ethereum staking ecosystem. Lido is a liquidity staking protocol and is by far the largest staking pool operator on Ethereum, accounting for 29% of ETH staked. Given the adoption and critical role of liquidity staking pools on Ethereum, it is important to understand the risks of liquidity staking.

The next section of this report will delve deeper into the risks of staking based on the technology and entities used to earn staking rewards.

Pledge Risk

The risks associated with staking largely depend on the method and technology of staking. Here are three broad categories that define staking methods and their associated risks:

Direct staking: Users or entities directly operate their proprietary staking hardware and software. The risks of directly staking ETH include staking penalties and slashing risks. Staking penalties due to reasons such as long machine downtime may cause users to lose part of their staking rewards; in addition, slashing events due to reasons such as validator software configuration errors may cause users to lose part of their staked ETH balance, up to 1 ETH.

Delegated staking: A user or entity delegates their ETH to a professional or amateur staker for staking. The risks of delegated staking include all the risks of direct staking, in addition to counterparty risk, as the entity you delegate staking to may not fulfill its responsibilities or obligations. ETH holders can delegate their ETH to a trust-minimized staking service provider, such as an entity controlled by smart contract code, but this carries additional technical risks as the code may have vulnerabilities or the system may be hacked.

Liquidity staking: Users or entities entrust professional or amateur stakers to stake and receive liquidity tokens representing their staked ETH in exchange. The risks of liquidity staking include all the risks of direct staking and delegated staking. In addition, due to market volatility and delays in validator entry or exit, liquidity risk may lead to decoupling events, where the value of liquidity staking tokens deviates significantly from the value of the underlying staked assets.

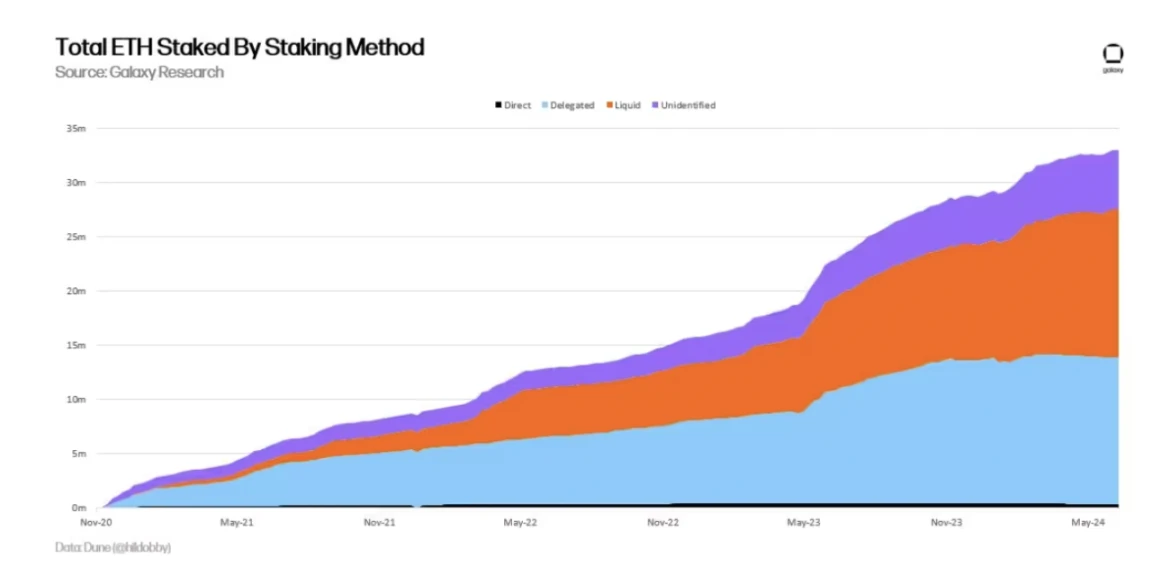

Total amount of ETH staked using three different methods

Another risk to note about these three staking methods is regulatory risk. The further away ETH holders are from their staked assets, the greater the regulatory risk of staking activities. Delegated staking and liquid staking require ETH holders to rely on different types of intermediary entities. In the eyes of legislators and regulators, these entities may need to comply with certain rules and regulatory frameworks to operate, depending on their structure and business model.

In addition to regulatory risks, it is also necessary to elaborate on the protocol risks associated with these three types of staking activities. Protocol risks arise from the fact that the network can impose penalties on users who intentionally or unintentionally fail to meet the standards and rules in the Ethereum consensus protocol. There are three main types of penalties. They are ranked from least severe to most severe as follows:

Offline Penalty: A penalty incurred when a node is offline and fails to perform its duties (such as proposing blocks or signing block proofs). Generally, validators are only penalized a few dollars per day.

Initial slashing penalty: The penalty a validator receives when a violation of the network rules is detected by other validators. The most common example is if a validator proposes two blocks for a slot or signs two attestations for the same block. The penalty ranges from 0.5 ETH to 1 ETH, depending on the validators effective balance, which currently goes up to 32 ETH. Protocol developers are currently considering increasing the maximum effective balance of validators to 2048 ETH and reducing the initial slashing penalty in the next network-wide upgrade, Pectra.

Relative Slashing Penalty: After the initial slashing penalty, a validator may be subject to a second penalty based on the total amount of stake slashed in the 18 days before and after the slashing event. The motivation for the relative slashing penalty is to measure the penalty based on the amount of stake managed by the validator who violated the network rules. The relative penalty is calculated based on the malicious validators effective balance, total balance, and proportional slashing multiplier.

In addition to the three penalties described above, special penalties can be imposed on validators if the network cannot reach finality. (For a detailed overview of Ethereum finality, see this Galaxy Research report ) When the network cannot reach finality, it imposes more severe penalties on offline validators. By gradually destroying the staked shares of validators who are not contributing to the network consensus, the network can rebalance the validator set to achieve finality. The longer the network cannot reach finality, the greater the penalty.

Staking Rewards

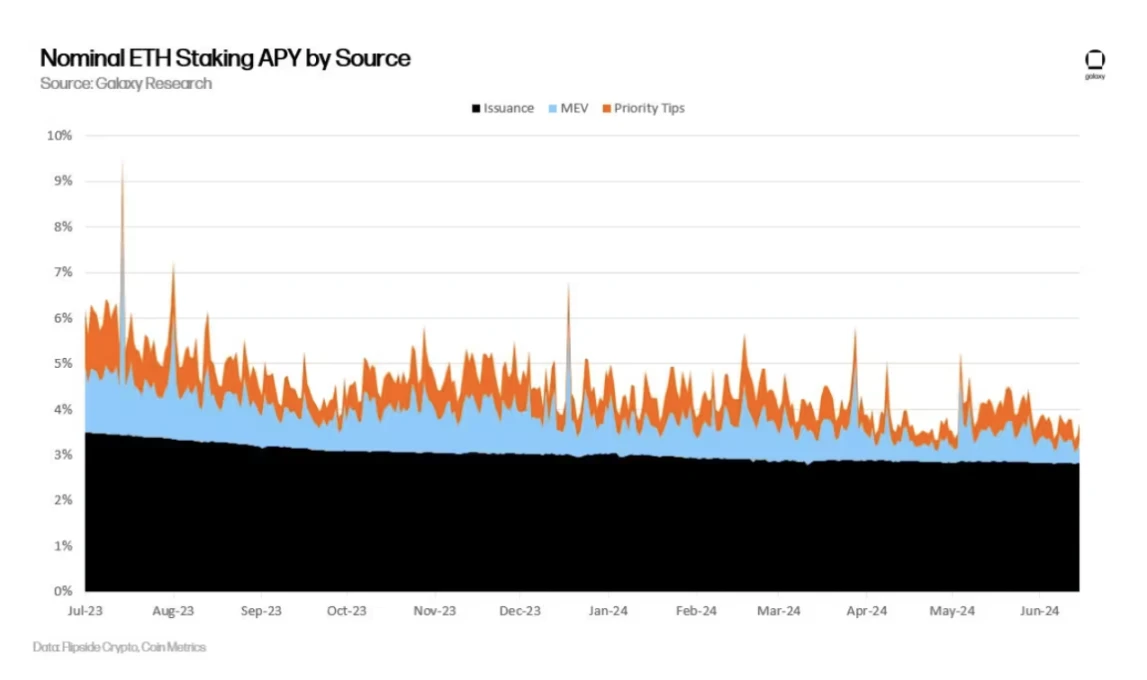

Of course, while taking risks, stakers can also earn an annualized return of about 4% from the staked ETH. These rewards come from new ETH issuance, priority fees attached by Ethereum users to their transactions, and MEV.

ETH staking nominal yield

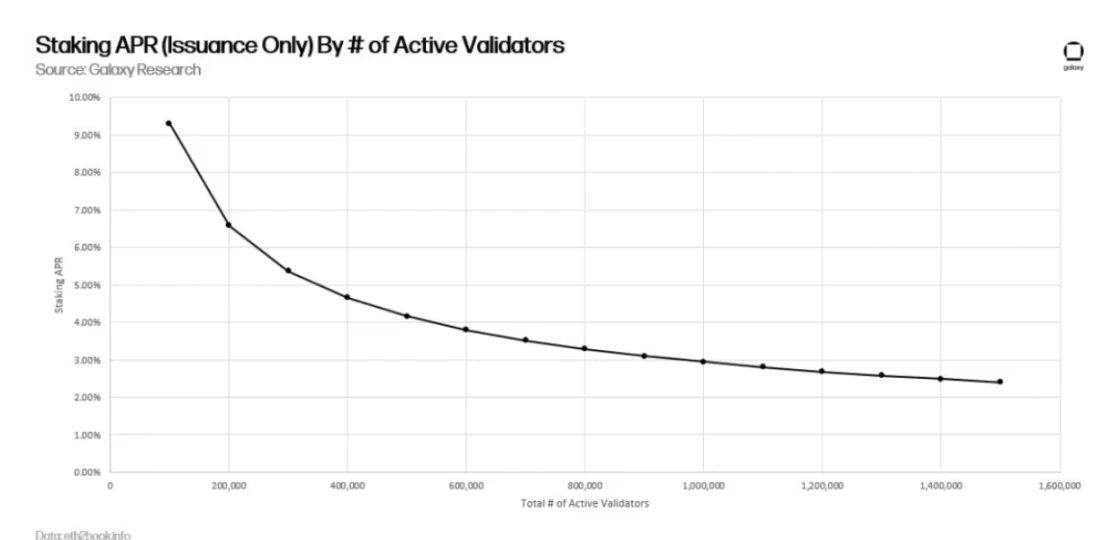

Note that staker rewards have been steadily decreasing over the past 2 years for two main reasons. First, the total amount of staked ETH has increased, as has the number of validators. When the value of stake increases, validators’ issuance rewards are diluted, as shown in the following figure:

Staking yield paid only by ETH issuance

While issuance rewards can be calculated based on the total number of active validators and the amount of staked ETH on Ethereum, the other two sources of income for validators are difficult to predict because they rely on network transaction activity.

Transaction activity has decreased over the past two years, resulting in a decrease in base fees, priority fees, and MEV for validators. Generally, the higher the value of assets transferred on-chain, the higher the willingness of users to pay tips in order to prioritize these transactions in the next block, and the higher the MEV for searchers to profit from reordering within blocks. As shown in the figure below, the dollar value of Ethereum transferred daily is correlated with transaction priority fees:

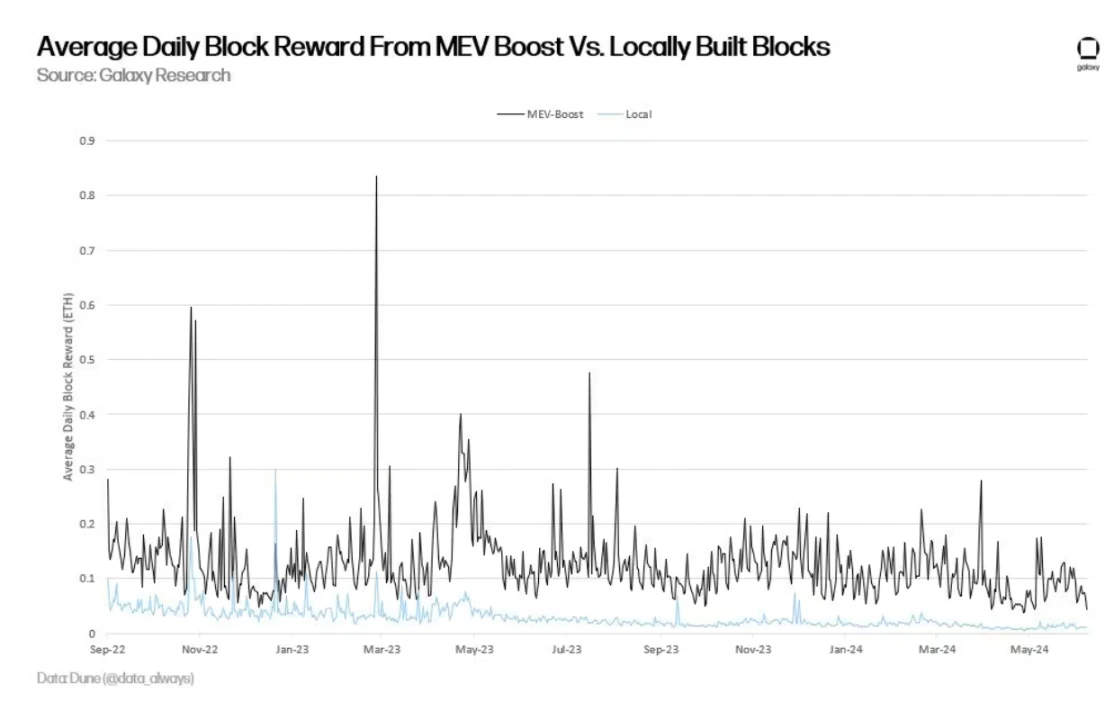

According to Galaxys calculations, MEV can increase validator returns by about 1.2%. Compared to other types of validator income, including new ETH issuance and priority fees, validator rewards from MEV account for about 20%. Some attribute MEV to additional value given to block proposers that does not come from priority fees or ETH issuance. However, others believe that if the priority fee is funded through successful front-running or reverse transactions, it can itself represent MEV profit. To account for the fact that priority fees themselves may contain MEV, other methods compare the value of blocks built with MEV-Boost software and blocks built without MEV-Boost software.

The above chart shows that the size of MEV could be much larger than 20% of validator rewards. According to an analysis by Ethereum Foundation researcher Toni Wahrstätter in October 2023, if validators receive blocks via MEV-Boost instead of building blocks locally, the median block reward will increase by 400%.

Staking Rate Prediction

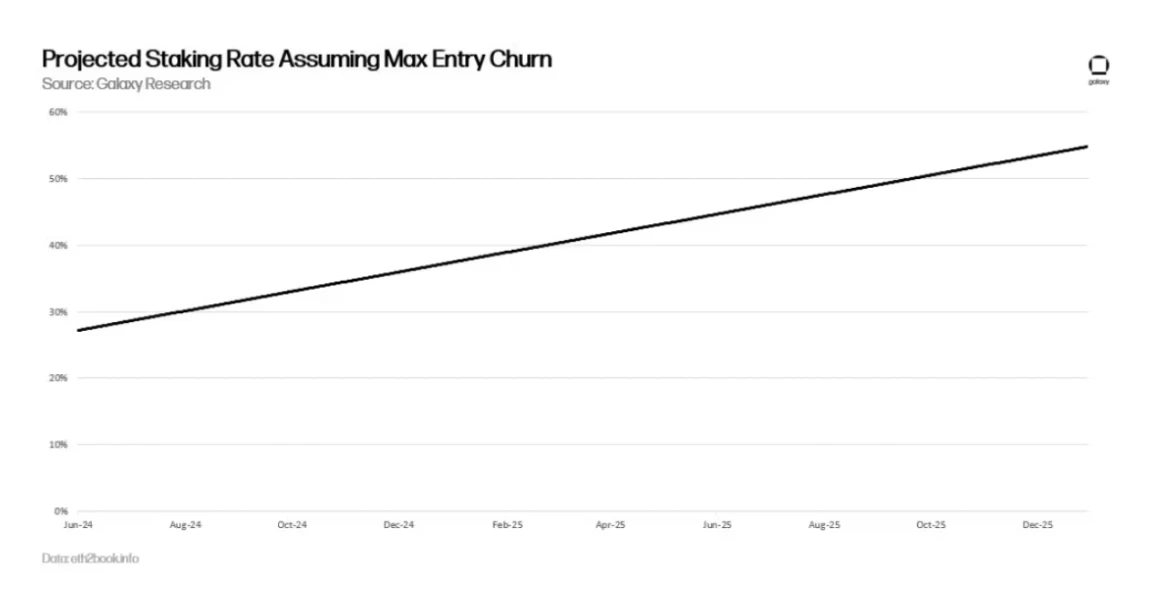

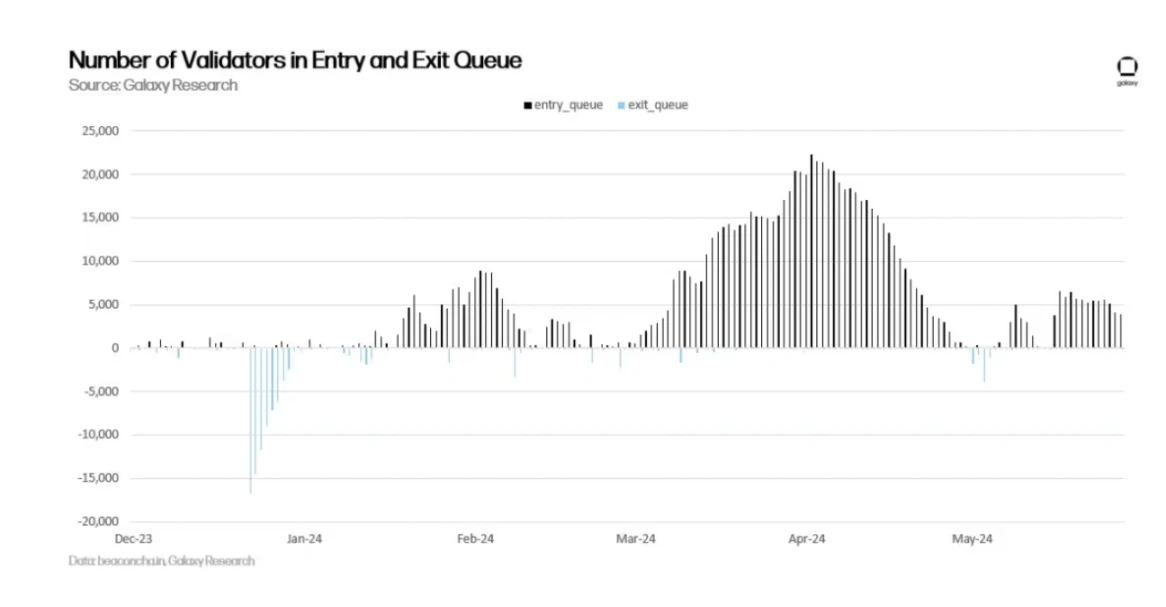

Assuming that staking demand on Ethereum grows linearly as it has over the past two years, the staking rate is expected to exceed 30% in 2024. As discussed earlier in this report, higher staking rates will reduce returns from new ETH issuance. Liquid staking services on Ethereum allow users to easily stake and bypass staking restrictions such as entry queues. Users can earn staking rewards simply by purchasing stETH. Large purchases of stETH will cause the value of stETH on the open market to be out of balance with the value of the underlying staked assets, which in turn will cause a premium on stETH until more ETH is staked on Ethereum. Unlike the purchase of stETH, staking activity on Ethereum is delayed. Only 8 new validators or a maximum of 256 ETH in active balance can be added to Ethereum every epoch (i.e. 6.4 minutes). Therefore, assuming that the number of validators per epoch reaches the maximum between now and the end of 2025, it will take Ethereum more than a year (466 days to be exact) to reach a 50% staking rate.

Historically, demand to enter the Ethereum staking queue has been higher than demand to exit. Although validator entry activity has slowed in recent days, staking demand is expected to surge again for a variety of reasons, including but not limited to additional yield from re-staking, increased MEV from a resurgence in DeFi activity, and regulatory changes in traditional financial products such as ETFs to support staking activity.

Entry and exit queue validators

Developers know it’s only a matter of time before staking rates go higher again and staker returns fall, so they are considering several options for changing network issuance to curb demand for staking.

New ETH issuance change discussion

ETH holders should know that staking yields will change dramatically in the future. Ethereum developers are weighing multiple options to ensure that Ethereums staking rate tends to target thresholds, such as 25% or 12.5%. Caspar Schwarz Schilling, a researcher at the Ethereum Foundation, explained that the main reasons for maintaining a low staking rate include:

Liquidity Staking Token (LST) Dominance: If the staking ratio increases, then the amount of ETH concentrated in a staking pool (such as Lido) may increase, creating the risk of centralization of one entity or smart contract application and the risk of having an outsized impact on Ethereum’s security.

Credibility of Slashing: Related to concerns about LST dominance, high issuance to a single entity or smart contract application could reduce the credibility of large-scale slashing events on Ethereum. For example, if a slashing event occurred that affected a majority of stakers, the protocol could face pressure from ETH holders who might want to make a state change to restore penalized staked ETH balances. Ethereum has only undergone an unscheduled state change once in history, following the infamous The DAO hack in 2016. While unlikely, it is not impossible that an unscheduled state change could be made in response to a large-scale slashing event. In fact, some Ethereum researchers believe that this outcome is more likely in the case of high issuance.

ETH is the trustless base currency: high issuance may lead to insufficient native ETH in circulation and a surge in liquid staking tokens issued by third-party entities. Ethereum researchers said they prefer to promote the use of native ETH for activities other than staking, rather than using less decentralized liquid staking tokens.

Minimum Viable Issuance (MVI): Although the cost of staking is negligible compared to the cost of mining, it cannot be ignored. Professional staking providers require the hardware and software required to run validators, and therefore have operational costs. To stake through these providers, users must pay fees to these providers. In addition, even if users obtain liquid staked tokens by staking native ETH, they will also bear the additional risk of staking through a third party if the staking operation fails. Therefore, it is in the interest of the network to keep staking costs to a minimum, as the additional cost of supporting staking activities means higher issuance, which leads to an inflated ETH supply.

Ethereum developers and researchers are weighing various proposals to reduce the Ethereum staking rate. These proposals include, but are not limited to:

In the short term, staking rewards cut: In February 2024, Ethereum Foundation researchers Ansgar Dietrichs and Caspar Schwarz-Schilling once again proposed a one-time cut in staking yields. The idea was originally proposed by Ethereum Foundation researcher Anders Elowsson. In Dietrichs and Schillings latest article, the researchers suggest cutting the staking yield by 30%. However, this number depends on the specific staking rate of Ethereum. Given the rising staking rate since February, the researchers believe that the proposed yield cut should theoretically be higher. The proposal only requires a simple code change to implement and would suppress the economic incentive for staking by reducing issuance rewards in the short term. The proposal is intended to be a temporary measure to pave the way for long-term solutions such as targeted policies.

Long term, collateral ratio target: Implement a new ETH issuance curve where the higher the collateral ratio exceeds a target ratio (e.g. 25% of total ETH supply staked), the more expensive it is for validators to stake and receive rewards. This idea is based on research by Elowsson, Dietrichs, and Schwartz-Schilling. There are several mechanisms to achieve a target ratio, each differing in the issuance schedule and the degree to which issuance is reduced. For more details on the issuance curve under the collateral ratio target model, read this Ethereum research article .

None of the above proposals will be included in the next Ethereum hard fork, Pectra. However, it is very likely that Ethereum developers will push for proposals to make changes to ETH issuance in subsequent upgrades. So far, discussions within the Ethereum community about issuance changes have been highly controversial and have not reached a broad consensus. The main objections to issuance changes include concerns that reduced staking income will hurt profitability for large staking providers operating on Ethereum as well as individual stakers; proposals affecting issuance to date lack sufficient research and data-driven analysis. It is unclear what the exact target staking ratio should be to achieve MVI, and whether achieving this goal through issuance changes will reduce concerns about the concentration of staking distribution or exacerbate the problem due to the loss of independent stakers. To address some of the concerns about the long-term profitability of independent stakers on Ethereum, Ethereum co-founder Vitalik Buterin shared preliminary research in March 2024 on adding new anti-correlated rewards and penalties that would benefit node operators who control fewer validators.

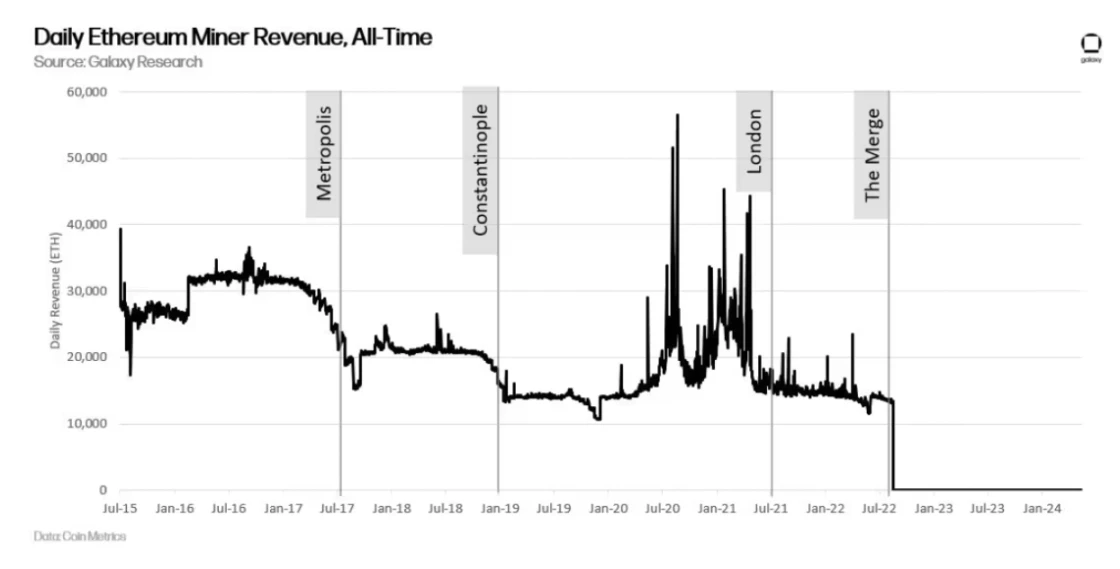

Ethereum’s proof-of-stake blockchain, the Beacon Chain, has had its monetary policy unchanged since its inception in December 2020. However, before merging with the Beacon Chain, Ethereum’s monetary policy went through several revisions in its roughly seven-year history. Ethereum’s initial block reward was set at 5 ETH/block. It was reduced to 3 ETH in the Metropolis upgrade in September 2017. It was then reduced again to 2 ETH in the Constantinople upgrade in February 2019. Subsequently, the rewards miners received from transaction fees were burned in the London upgrade in August 2021, and then mining rewards were completely abolished on the network in the merge upgrade in September 2022.

Changes to Ethereum’s monetary policy under the Proof-of-Stake consensus mechanism are likely to be more controversial than previous changes to network issuance under Proof-of-Work, as the user base affected by the change is much broader. Unlike miners, issuance changes affect a growing number of ETH holders, staking service providers, liquidity staking token issuers, and re-staking token issuers. Due to the growing base of stakeholders involved in securing Ethereum, Ethereum developers are unlikely to change Ethereum’s monetary policy as frequently as in the past. The contentious nature of this discussion may lead to increasing rigidity in policies and rewards related to staking over time. Therefore, as the staking industry built on Ethereum grows and matures, the window of opportunity to change the Ethereum codebase is shrinking and is unlikely to last for long.

in conclusion

The staking economy built on Ethereum is still in its infancy. When the Beacon Chain first launched in 2020, users who staked ETH had no guarantee of being able to withdraw ETH or transfer funds back to Ethereum. When the Beacon Chain merged with Ethereum in 2022, users received additional rewards for staking through transaction priority fees and MEV. When the staked ETH withdrawal function was enabled in 2023, users could finally exit validators and profit from their staking operations. There are also a series of other changes coming on the Ethereum development roadmap that will affect the staking business and individual stakers. While most of these changes will not affect the economic incentives for staking, such as increasing the maximum effective balance of validators in the Pectra upgrade, some will.

Therefore, it is important to carefully evaluate the risks and rewards of staking on Ethereum as the Ethereum roadmap continues to evolve and is implemented through hard forks. Because Ethereums staking economics encompasses many more stakeholders than in the Ethereum PoW era, changes that affect staking dynamics may be more difficult to execute over time. However, Ethereum is still a relatively new proof-of-stake blockchain, and significant changes are expected in the coming months and years, and people need to carefully consider the impact of changing staking dynamics on all relevant stakeholders.