By Leslie Lamb | Amber Group

secondary title

Time to democratize crypto finance!

From a single business to an integrated service, as a participant in the encryption industry, we are witnessing and experiencing this transformation of the service model. Under the law of the business jungle where the fittest survive, (single business) specialization is gradually weakened, and the end-to-end service model has become the focus. Full-stack[1]Enterprises that develop in this way have full value chain solutions, and while providing better product experience for end users, they are also accumulating a larger market share.

On the other hand, the race to become a “prime broker” or a crypto “bank” seems to be dominating headlines. If you dont distinguish carefully, you really think that the battle for the throne is going on everywhere. But in fact, the industry supports the contention of a hundred schools of thought and each shines brilliantly. So we really don’t have to believe in these media narrative focuses that “one leaf blinds the eyes and the forest cannot be seen”. From the macro perspective of the forest, think about a bigger question: In the next few years, which companies will become the leaders in the popularization of encrypted finance?

Entering the era of integration, the competition among encrypted financial integration platforms has intensified. Platforms that lack obvious competitive advantages are moving forward with heavy loads and have fallen into the quagmire of homogeneity. We believe that full-stack development is now more necessary than ever, but recognize that it can become a business Achilles heel. The key and challenge to realize full-stack operation lies in how to maintain absolute advantage while expanding rapidly.

First-mover advantage is an all-too-familiar concept in game theory, that is, the game player who moves first often has a certain advantage. From an economic point of view, the first mover to enter the market can also achieve an advantage over potential competitors through greater economies of scale. But if you take a step back and look at the cryptocurrency Wild West era, you will find that the first movers are not necessarily the winners. First movers may reap short-term gains, but those who scale first are more likely to gain long-term competitive advantage.

In his book Zero to One, Peter Thiel talks about the advantage of latecomers: Whoever captures the most important market segments first with potential for viral growth will Become the finalizer of the entire market. [1]. In other words, the latecomer may be the first to complete the expansion.

Entrepreneurs often underestimate the significance of incremental market development, which requires disciplined and gradual expansion. The most successful companies first dominate a specific niche market and then expand to similar markets. Their entrepreneurial stories are similar. They all start from the core business and gradually expand outward. -Peter Thiel

However, incremental market entry can sometimes be at odds with building a full-stack business because it requires the business to focus on a single core product. Take Amazon as an example. At the beginning of its establishment, it focused on the dominance of the online book market, and then gradually entered other niche markets such as music and software, and finally became a global comprehensive shopping e-commerce giant. Furthermore, building a full-stack business requires capturing the entire value chain from the start. For encrypted financial platforms that have entered into integrated construction, it will be especially necessary to build independently or achieve full value chain solutions through strategic cooperation, acquisitions, etc.

Unlike traditional technology or financial industries, the crypto industry develops at an ever-changing pace. How can a company achieve dominance in a specific segment of the market while maintaining a close relationship with a broad customer base? At present, the customer groups of various enterprises in the industry are increasingly overlapping, and how to form a network effect will become a major challenge in building an encrypted financial platform. Investors are becoming more and more sophisticated, and there are more and more companies participating in the competition that can meet the general needs of encrypted asset trading, investment, lending, and storage. With more “copycat” business models emerging, the crypto arena is bound to become more intense.

secondary title

Differentiated perceptions about the encrypted capital market

For a long time, everyone has a differentiated psychological understanding of the retail market and the institutional market. For example, the term institutional-grade is often assumed to be associated with elements of security, compliance, efficiency, trust, and so on. This should apply to retail as well, but strangely no one said retail-grade. We need to change this underlying narrative. On the other hand, many trading venues equate retail investors with speculators who are inexperienced and unable to make sensible investment choices. This is a dangerous assumption that leads to short-sighted thinking. The correct mentality should be to treat retail investors and institutional investors equally. While believing that institutional investors have sufficient investment capabilities, we also believe in the determination and expectations of retail investors to participate in encrypted finance. Of course, we must also realize that retail investors may start with relatively small funds and require more financial-related education. The responsibility of the encrypted financial service platform is to educate investors so that they can make full use of encrypted financial tools to obtain long-term benefits. First of all, the platform must provide equal opportunities so that both retail and institutional investors can have access to mature encrypted financial products. Only companies that fully understand the evolution of the market structure and the changing needs of market participants are the most likely to become leaders in the popularization of encrypted finance.

Previously, the Amber Group wrote an article discussing the maturity of the encryption market, which is mainly divided into three stages:

Growth and diversification: The infrastructure providers of the encrypted asset ecosystem will increase in number and diversify in the services provided to meet the various needs of serving institutions and retail investors.

Competition and Consolidation: These infrastructure providers will compete with each other, accelerating industry consolidation.

Specialization and industry leading effect: With the further specialization of the entire market infrastructure, a small number of institutions in the industry will replace the market position of some traditional financial institutions.

We are rapidly entering the early stages of competition and consolidation.

In 2020, the retail and institutional ends of the encryption market will usher in continuous growth. Data from the Amber Group trading platform shows that the number of customers and the transaction amount traded through the Amber Group platform are growing steadily.

While trading volumes have increased, the stablecoin market is also booming. We see that the market cap of Tether (USDT) has surpassed $15 billion. Stablecoins can facilitate faster capital liquidity and have become a highly liquid alternative for many investors in times of market volatility, lowering the barriers to entry for encrypted finance. As a reliable value transfer mechanism, stablecoins have greatly boosted the transaction volume of decentralized exchanges and centralized exchanges.

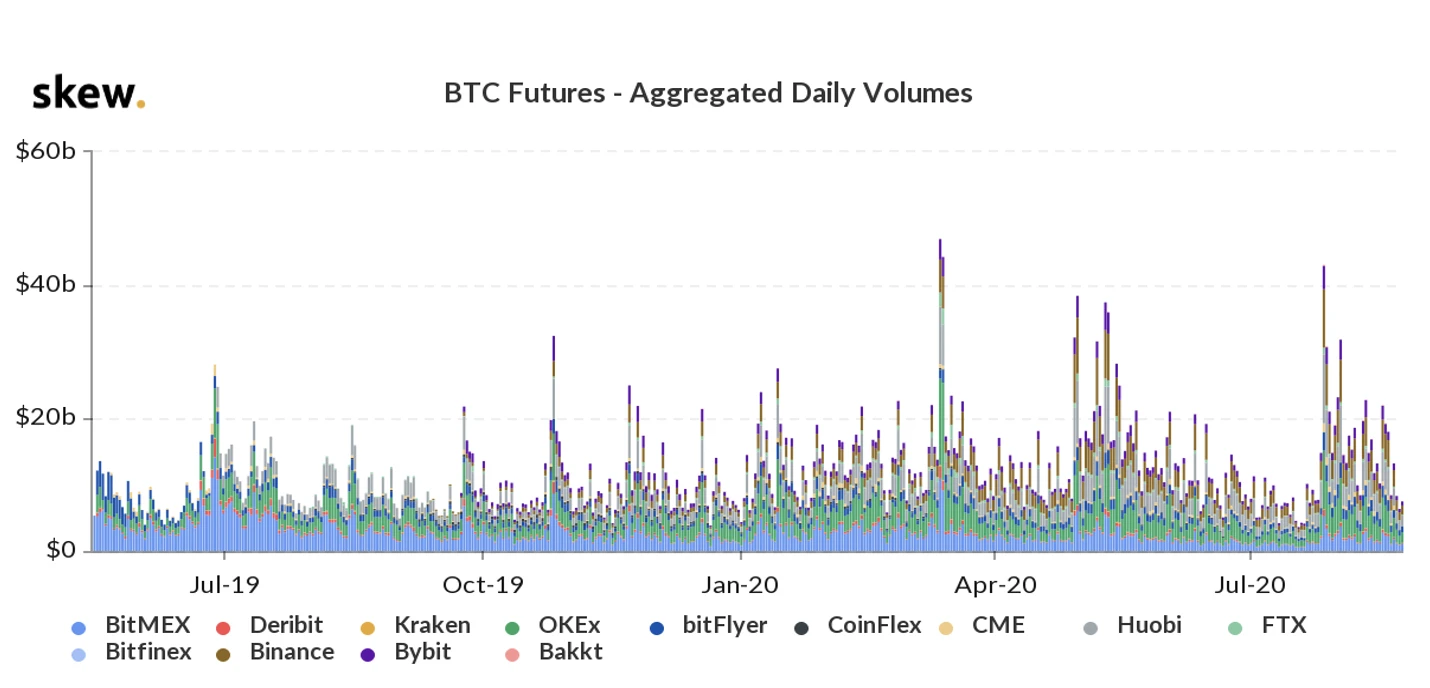

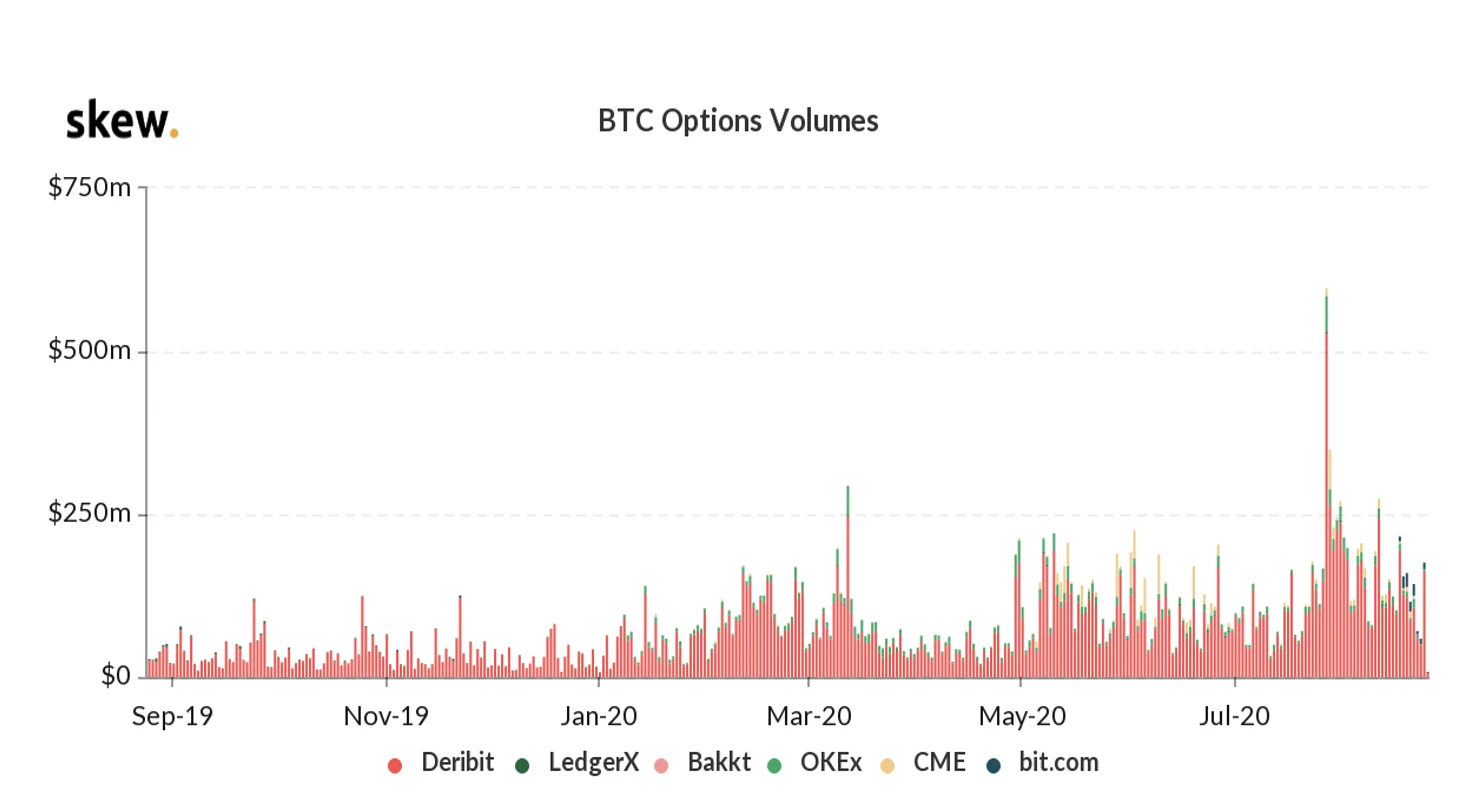

The crypto derivatives market is another major catalyst driving retail and institutional client participation. Now, with more diversified and flexible products, in addition to simply shorting or longing, traders can also execute trading strategies in a wider space.

In the traditional financial field, the trading volume of derivatives far exceeds that of physical derivatives. In crypto finance, we have not yet seen this trend, but with the gradual improvement of infrastructure such as execution and settlement, and the growing demand for hedging and speculation, the use of derivatives such as futures and options is also increasing.

image description

secondary title

Adapt to optionality

secondary title

Focus on long-term development

secondary title

Amber App launched

Amber App is the crystallization of Amber Groups continuous innovation in the encrypted financial institution market for many years. With the Amber App, Amber Group redefines the encrypted financial service platform - jointly built for mature users and new entrants in the encrypted market, making encrypted financial tools more intuitive and easy to use, and committed to bringing long-term benefits to customers. Specifically, Amber App is an intelligent and flexible encrypted financial service application that provides users with products and services such as asset allocation, income enhancement, and risk hedging, and helps users obtain stable and considerable returns in the ever-changing encrypted financial market. Realize differentiated asset allocation. Users can start with the fixed income product Amber Earn and experience the following features:

Stable income

Flexible customization period

No redemption waiting period

High efficiency in the use of funds, trading while managing money

In the era of competition and integration, surpassing the next competitor can only be regarded as a passive defense strategy, which may help companies survive the threat of being eliminated. However, in order to continue to expand and complete the mission of popularizing encrypted finance, companies need to continue to carry out product innovation and build an economic moat[2], maintain a long-term absolute advantage. The Amber App, born of Amber Groups continuous efforts and innovation, has made encrypted assets accessible to more people. It has taken a big step towards the popularization of encrypted finance and accelerated the recognition and use of encrypted currencies by mainstream audiences.

To the future of finance, there is a long way to go, and everything has just begun.

Sources

[1]: Thiel, Peter. Zero to One. 2014

[2]: Hasu. “The Great Race to Crypto Banking.” 2020

[1]Full-stack, full stack, full-stack startup originally refers to an enterprise that has a complete product/service technology that provides the entire value chain activities for the terminal. business plan.

[2]Economic Moat, the economic moat, this concept was first proposed by Warren Buffett, which means the sustainable competitive advantage of a company against the attacks of its competitors—like a moat protecting a castle. The economic moat is a structural feature that enables an enterprise to maintain its competitive advantage all year round, and it is a quality that is difficult for its competitors to replicate.