This article comes fromhackernoonThis article comes from

Imagine that one day you enter a coffee shop and find that you can pay with ETH, but you only have Bitcoin in your wallet. If this situation becomes a reality, then we have to discuss the problem of lack of interoperability in the current blockchain ecosystem.

secondary title

What is interoperability (cross-chain)?

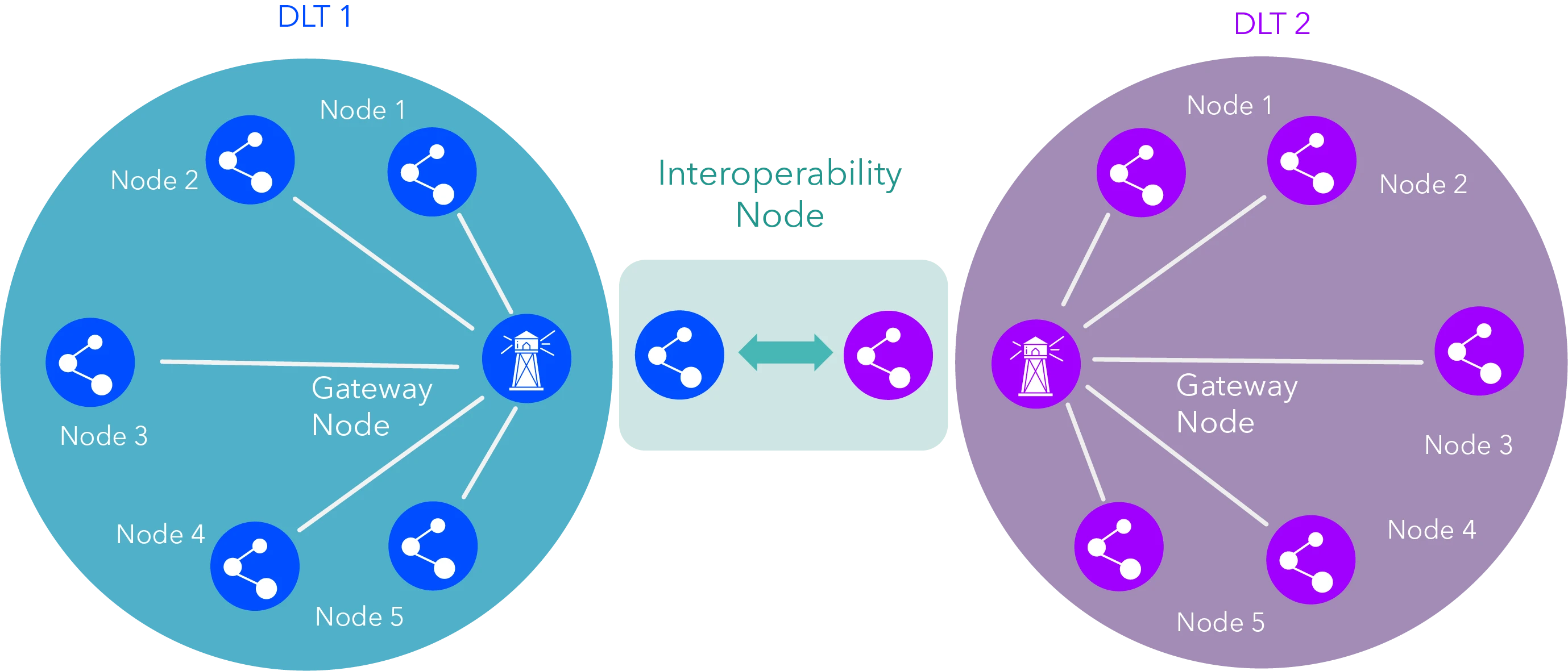

Interoperability is simply cross-chain communication, where two or more completely different systems communicate with each other and conduct transactions. However, most payment architectures in the traditional financial system are not interoperable.Depending on how the store accepts payment, you can pay with a credit or debit card.

If you are traveling abroad, as long as your bank card is interoperable, you can pay regardless of the local currency, and this is the advantage of interoperability.

In the field of blockchain, interoperability means that two or more blockchain systems communicate with each other and conduct transactions. Taking the example of buying coffee at a coffee shop, as long as both shops have a decentralized payment system, even a shop that only accepts Bitcoin payments can be paid with ETH. But at present, this situation does not exist in reality.

A web service with an API (Application Programming Interface) can communicate with a specific web service. The API acts as a communication layer between web services and other servers in the network. However, there is currently no cross-chain communication protocol for the blockchain, only independent systems.

In order to solve the problem of cross-chain interoperability, various limitations and inefficiencies that currently exist must first be solved. Lets discuss it together.

secondary title

Centralized Interoperability

In the payment process, the centralized method of many third parties provides convenience for cryptocurrency conversion. But why do we still need this centralized intermediary?

Most centralized systems have custodial wallets. When you spend with different cryptocurrencies, you can perform currency conversion independently through Atomic Swap (atomic swap) or according to the market currency exchange rate.

secondary title

Atomic Swap

Atomic swap is a cross-chain transaction technology that allows users to convert currencies on a point-to-point basis.

However, atomic swaps have a limitation. Both blockchain networks need to use the same hash algorithm and support the execution of HTLC (hash time-locked contracts), and currently only a few blockchains share the same hash algorithm.

secondary title

Wrapped Bitcoin Contract (WBTC)

Wrapped Bitcoin Contract (WBTC) is a special smart contract that provides cross-chain communication between Bitcoin and Ethereum networks. WBTC is an ERC-20 token that is pegged to Bitcoin at a 1:1 exchange rate.

There are two problems in the WBTC contract. The first is that the contract is only applicable to Bitcoin and Ethereum, and the second is that it still relies on third-party hosting, which is essentially centralized. Receiving WBTC requires the custodian or merchant to pass the KYC certification and anti-money laundering (AML) steps. Only after the users identity authentication is successful can the entire transaction be completed.

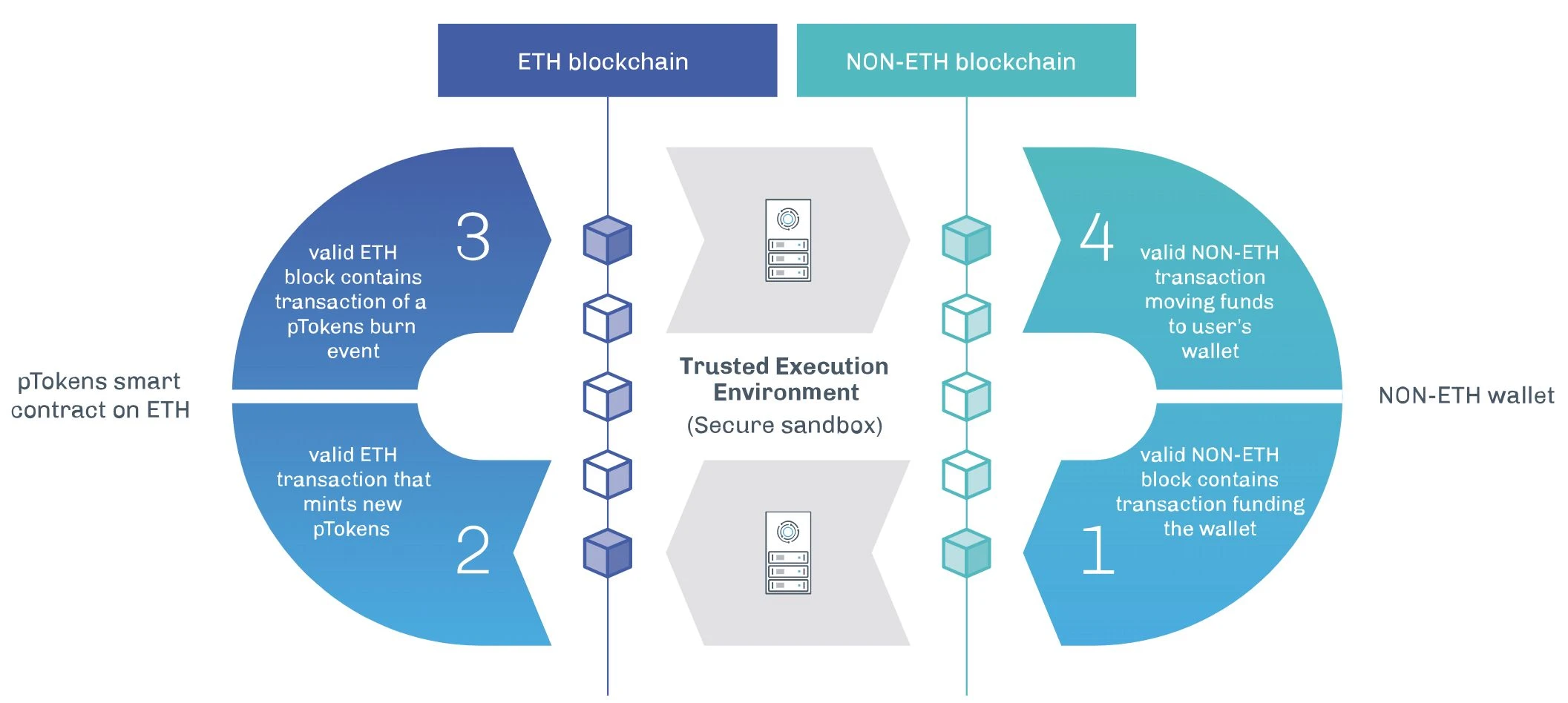

pTokens

secondary title

pRToken is a cross-blockchain solution developed by Provable Things. All pTokens can be pegged to other related assets. Anyone can mortgage a certain amount of assets (such as EOS and BTC) on the relevant pTokens smart contracts, and link them to pEOS and pBTC at a ratio of 1:1.

The TEEs that secure the pTokens infrastructure represent another layer of protection for the network. TEE operators are verifiers, ensuring the issuance of pTokens or other assets.

secondary title

Why is cross-chain interoperability critical for DeFi?

DeFi, or decentralized finance, is a series of financial services delivered through smart contracts on the blockchain in a decentralized environment. So far, the blockchain has subverted the original currency system through a point-to-point currency system.

However, will there be any impact on financial services like banking, lending, savings, etc.? This is what we are talking about DeFi (Decentralized Finance) bringing the traditional financial services ecosystem into the world of blockchain and cryptocurrency.

We have subverted the monetary system, lets reshape the entire financial system. This is the motivation behind the DeFi movement.

But without the establishment of cross-chain interoperability, the DeFi movement is just a fleeting event. Just imagine that each blockchain represents a kind of economic development. If they cannot cooperate with each other, the entire ecosystem will not be able to develop, let alone take over the entire traditional finance.

At present, blockchains are developed independently, which makes it impossible to communicate and trade between chains, so the birth of third-party hosting services makes the ecosystem more and more centralized, and the blockchain is decentralized. The essence is also becoming more and more blurred.These platforms we will discuss next will change the phenomenon of the DeFi industry and promote development and application landing. The blockchain network will pave the way for a new financial system in the future.

Cosmos

secondary title

Cosmos is dedicated to realizing the communication interconnection between individual blockchains. The Cosmos network uses Tendermint as the core, adopts Byzantine fault tolerance based on Proof of Stake (PoS) and a point-to-point Gossiping protocol like Bitcoin.

In order to achieve interoperability, the Cosmos project follows the Inter Blockchain Communication Protocol (IBC). The Cosmos blockchain is based on Tendermint and consists of the following two components:

Hub——Hub is the main blockchain of Cosmos, with Tendemint as the core foundation;

· Zones——Zones are independent and independent blockchains that are connected to the Hub.

Independent zones can be issued or connected to any external blockchain network such as EOS or Ethereum. Communication between Hubs and zones is achieved through a common IBC protocol. For example, hubs and zones are based on the Tendermint protocol, but both can issue ERC-20 tokens independently.

Hub is like a decentralized exchange. All tokens or tokens are converted through atomic swaps, which greatly increases the circulation between networks. In terms of consensus, the Cosmos blockchain uses ATOM tokens, and ATOM is equivalent to the mortgage of all participating proof-of-stake (PoS) consensus nodes. If the proof-of-stake (PoS) nodes encounter a malicious attack, their mortgaged ATOM tokens will be automatically destroyed, and all participating nodes on the network will also be transferred.

Fusion

secondary title

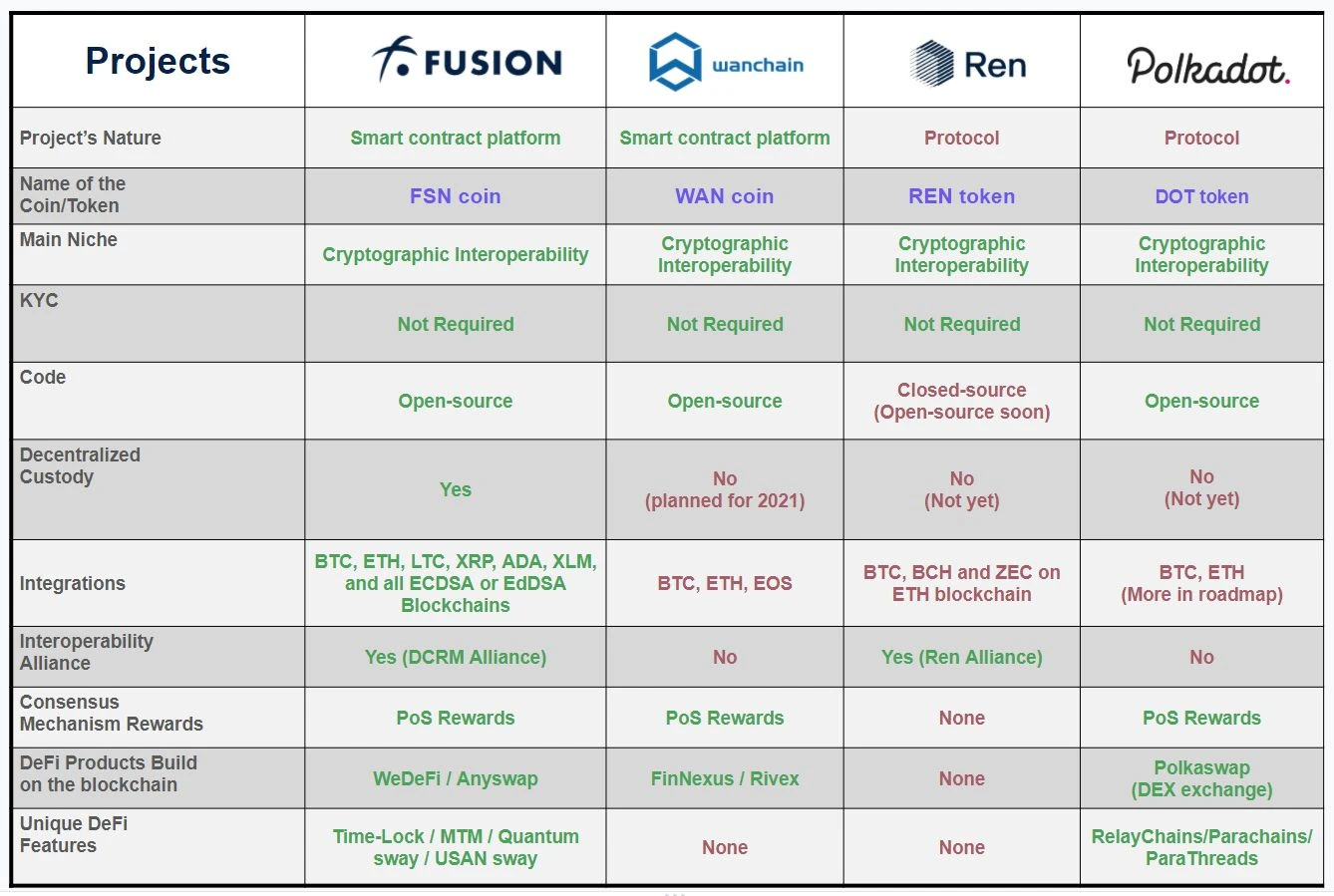

As a cross-chain interoperability platform, Fusion is committed to decentralized financial services for the masses and provides a series of interoperable financial products.

Fusion establishes a set of financial-related application programming interfaces (APIs), allowing developers to build cross-communication financial applications based on blockchain protocols, which will lead the next generation of financial innovation.

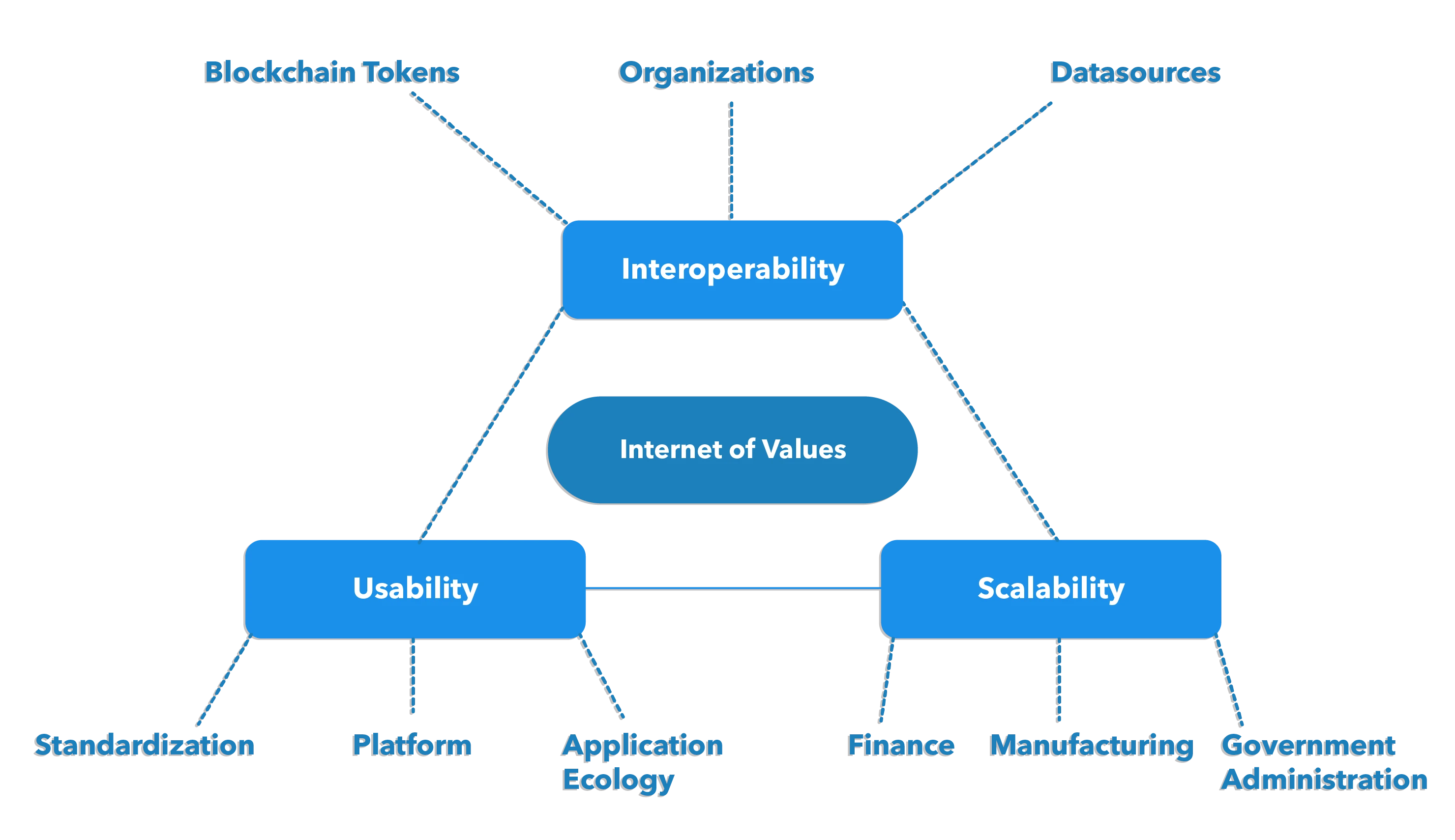

Fusion has also been redefined as Internet of Value, limited to value exchange via the Internet. The Fusion platform recognizes the value of the Internet. In fact, the realization of value is not only through transactions, but also through usability, scalability and interoperability.

Fusion is a scalable platform with a focus on interoperability and configuration. Fusion uses some new consensus mechanism of Ticketed Proof of Stake (TPoS), which is a purpose-built consensus for securing transactions on the Fusion network. The average block time on Fusion is close to 15 seconds and supports a throughput of 2500 to 3000. Fusion is currently ranked 12th on coinstats, making it one of the most frequently used networks.

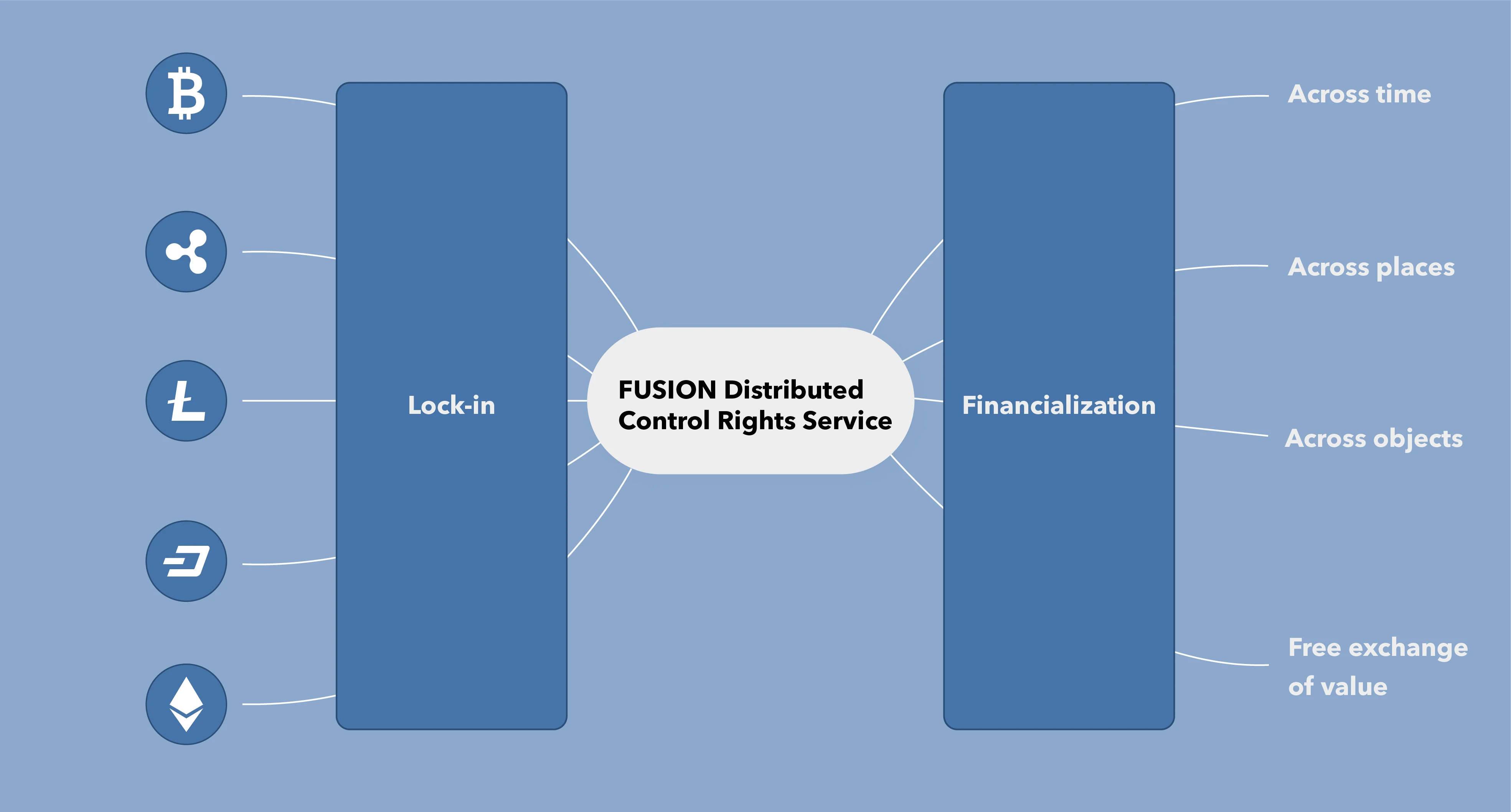

To achieve operability, Fusion uses its patented technology - Distributed Control Rights Management (DCRM).

DCRM distributes and stores private keys across network nodes by using sharding. On a traditional escrow model, keys are kept by a centralized server, which increases the possibility of breaches. On DCRM, the key is not kept by a central server, but is divided into many shards and encrypted and distributed on the global network.

The worlds leading and innovative cryptographers also participated in the DCRM project, including Rosario Gennaro, a computer science professor at the City University of New York, Steven Goldfeder, a postdoctoral researcher at Cornell Universitys computer science department, Louis Goubin, a computer science professor at the University of Versailles, and Advanced Security at CtyptoExperts. Postdoctoral Pascal Paillier, expert and CEO.

Fusion is one of the platforms on which financial applications can be built, and has a large number of financial APIs. Fusion has all the common functions of the financial industry, but these functions are not available on other chains.

With the time-lock feature, Fusion recreates time-based financial transactions, and users can capture time value from their digital assets. In todays financial market, some institutions establish financial structures and obtain time value from assets to meet market demand, such as bonds and futures.

This approach is very expensive, inefficient, and takes days or even weeks to roll out these financial facilities. Fusion invented a fast and efficient way to get time value from assets. Fusions time block locking feature digitally embeds the value of time. This way anyone can exchange time value on Fusions decentralized and trustless quantum exchange.Fusion Wallet has a short address scheme for Universal Short Account Number (USAN)

With a unique consensus mechanism and various technical supports, Fusion is trying to establish a true sense of cryptocurrency finance and decentralized finance, and focus on developing feasibility, scalability and interoperability.

secondary title

Anyswap protocolUnlike the platforms we discussed earlier, Anyswap to be discussed here is different and based on the DCRM protocol. From a technical perspective,Anyswap is an automated market maker (AMM), just like Uniswap.

Users mortgage digital assets on Anyswap and conduct seamless transactions with other assets, all in a decentralized environment.

The exchange pairs provided by Uniswap are limited to Ethereum and ERC-20 tokens, while Anyswap is more progressive and allows cross-chain token exchange, which brings higher circulation. As of now, the Anyswap platform supports Fusion (FSN), Tether (USDT) and Ethereum (ETH). In the future, Bitcoin, Ripple and Litecoin will also join the platform as exchange pairs.

The only limitation of Anyswap is that it can only exchange 95% of the total amount of tokens or token types without further replacement or tokens that use ECDSA/EdDSA as the signature algorithm.

The Anyswap architecture consists of three main components:

· Decentralized cross-chain bridge - using the DCRM protocol, users can mortgage tokens and conduct digital asset transactions;

· Cross-chain exchange - With fast asset liquidity, users can quickly exchange between coins;

secondary title

Polkadot

PolkadotPolkadot is a network that connects different blockchains through a unified platform. On a deep level,

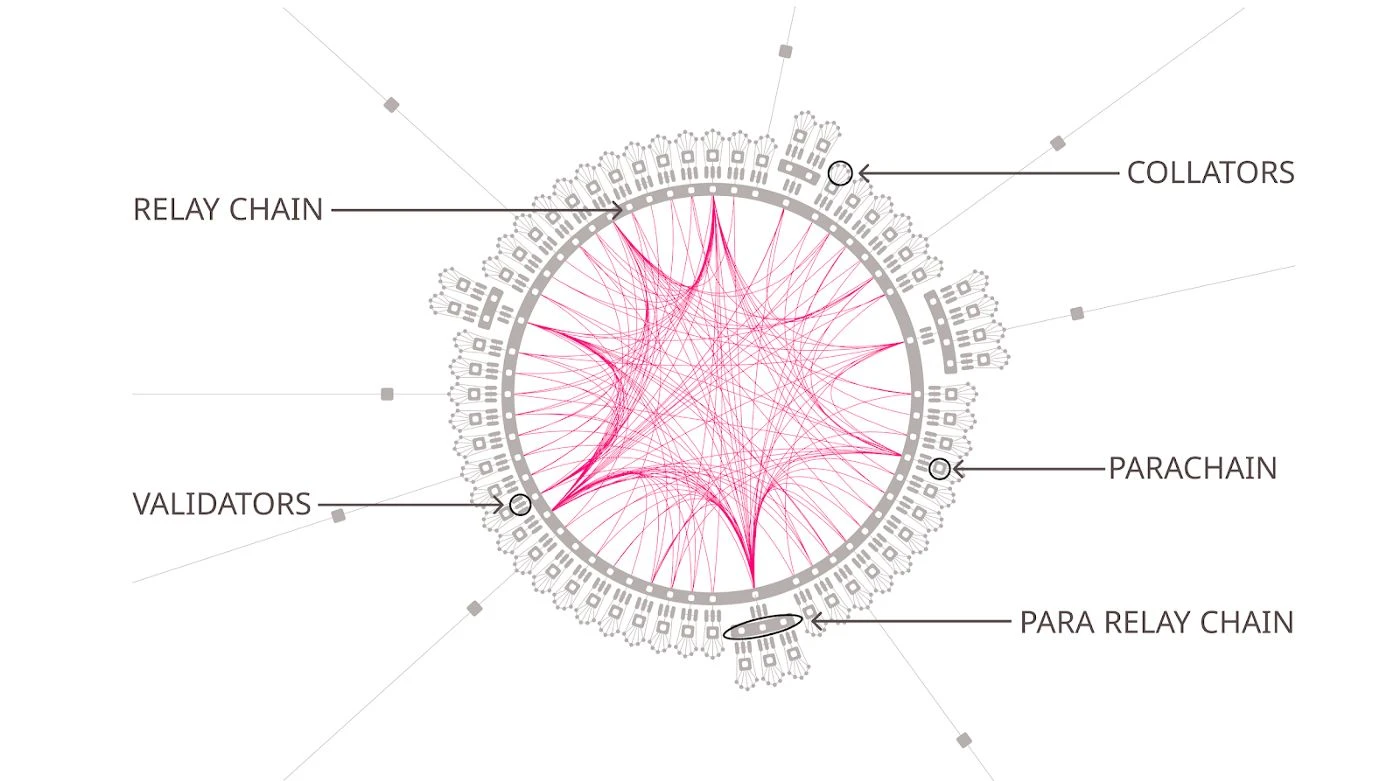

Polkadot has the same architecture as Cosmos. Its main chain is the relay chain, which connects different blockchains through bridge chains.

Lets analyze the components of the Polkadot network together, so that we can better understand how the platform operates:

Relay chain - the relay chain is the main chain of Polkadot, just like the Hubs of the Cosmos network, connecting all independent blockchains;

· Parallel chains - Parallel chains are chains that are parallel to each other, built on the Polkadot layer, and run in parallel, just like the Zones of the Cosmos network;

Bridge chains - These separate blockchains connect external blockchain networks such as Ethereum to the main relay chain. All cross-chain communication and relay chains of the external chain need to pass through the bridge chain;

Validator - there are some nodes on the Polkadot network that are responsible for validating functions and adding blocks to the relay chain;

Collators — there are nodes on the parachain responsible for collecting all transactions and adding them to the transactions in the block, which will later be added to the main relay chain.

Transaction volume and verification process are still done independently, which means more efficient. The Polkadot network has DOT tokens as fuel, which are used in governance and payment of handling fees.

secondary title

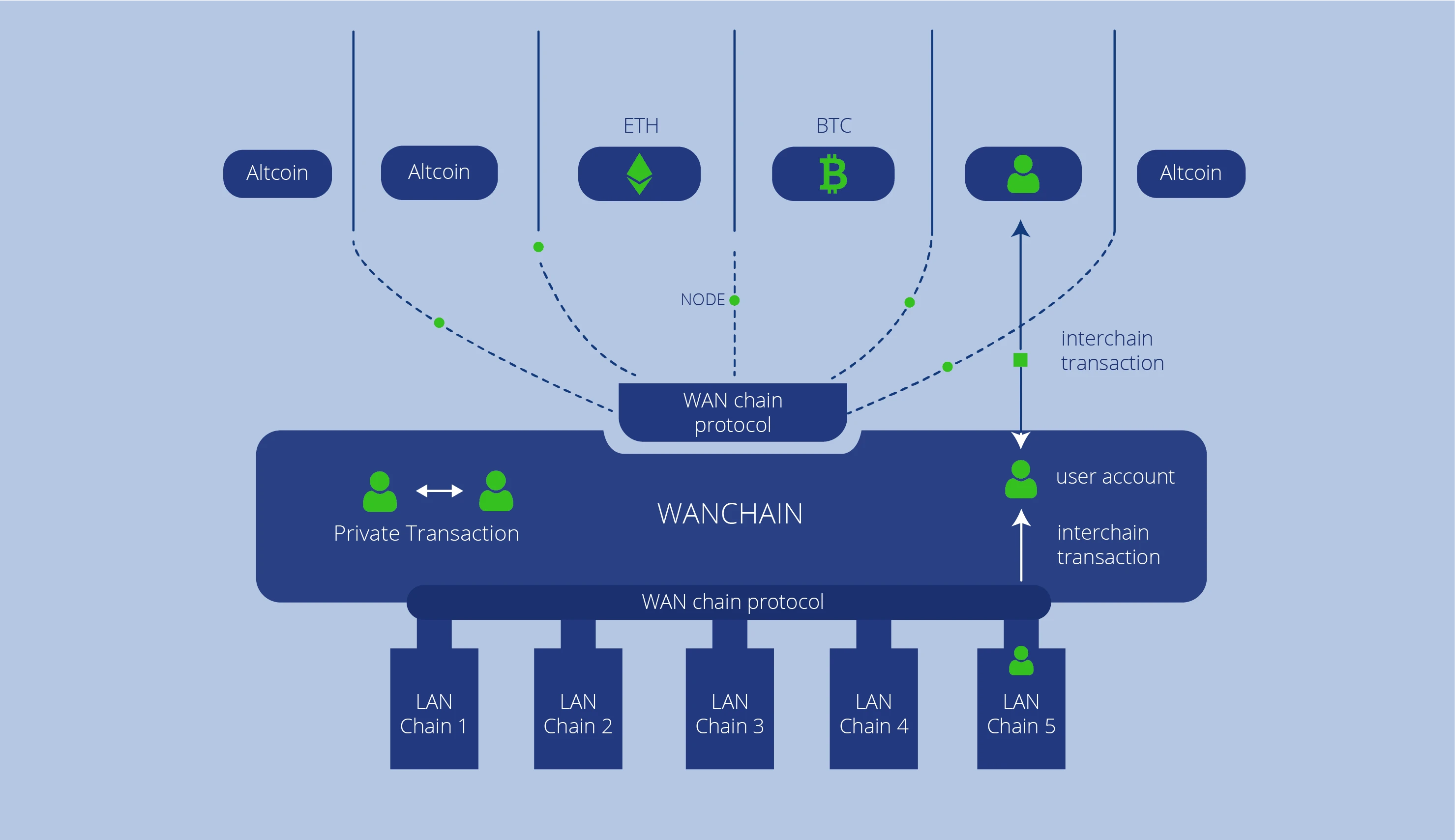

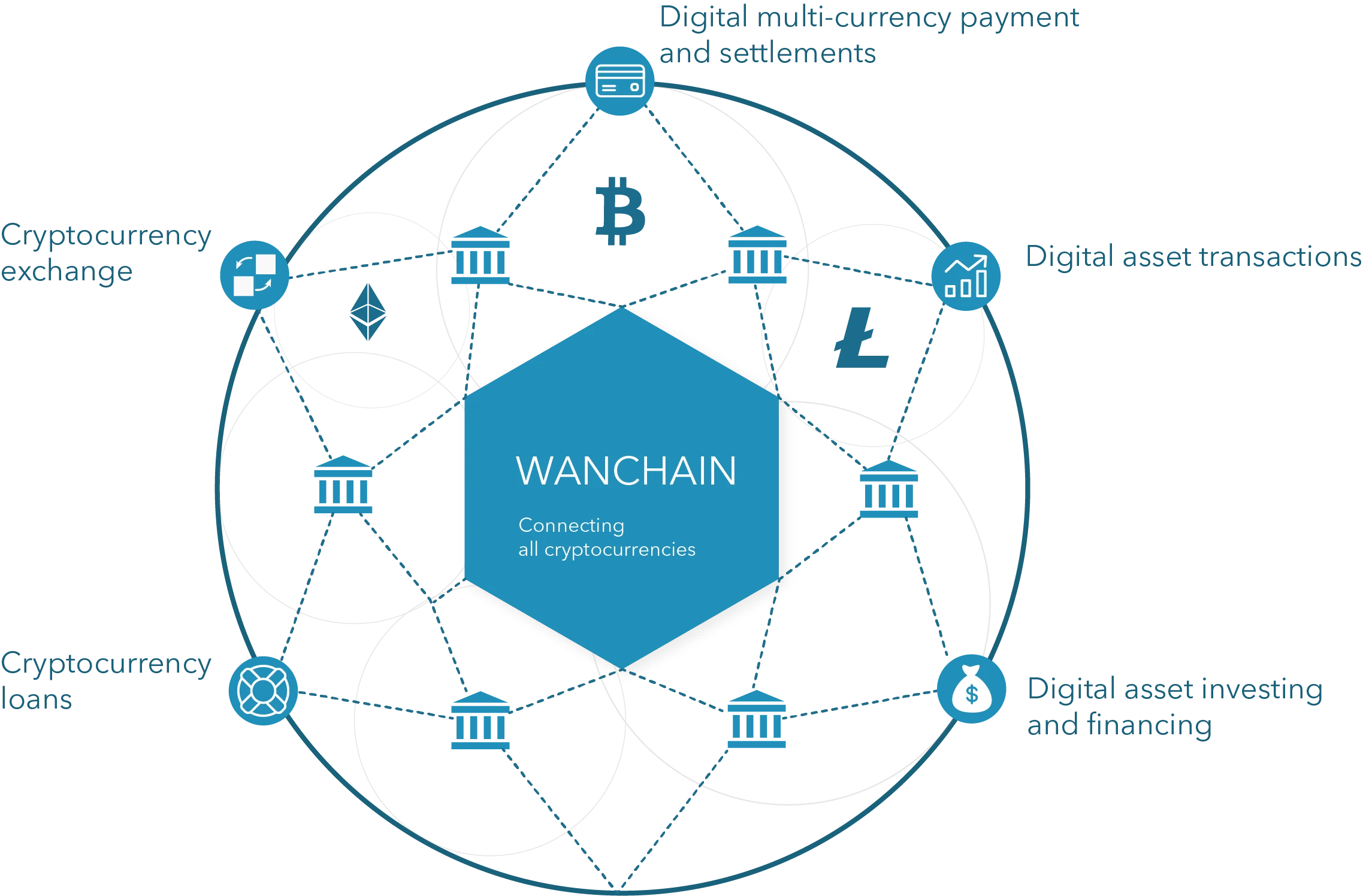

Wanchain platform

Wanchain has an entire independent infrastructure, and through a unified architecture, it focuses on the development of digital asset transaction services between different blockchain networks. This is currency agnostic platform that provides interoperability between different blockchains.The biggest advantage of the Wanchain platform is that its cross-chain asset transaction function is different from other competing platforms.

Wanchain can be connected with all major blockchain platforms, such as Bitcoin, Ethereum, EOS, etc. Wanchain can realize asset conversion without exchanging any original assets or passing through bridge chains.

All blockchain groups, including companies, whether public or private, can directly connect to the Wanchain protocol and transfer assets to the Wanchain platform. This conversion is two-way, and assets can also be converted from the Wanchain platform to the original blockchain network.The Wanchain protocol has a high degree of security and built-in privacy features, so assets are absolutely safe during the conversion process.

Wanchain achieves a high degree of security under the combined effects of multi-party computing power, threshold key sharing, ring signatures and one-time addresses.

In the decentralized industry, we really need a platform like Wanchain because it will bring higher liquidity to the market. Decentralized finance is about digital finance in a decentralized ecosystem. Platforms like Wanchain facilitate all decentralized services such as lending, investment asset conversion, and full-fledged exchanges.

Ren

secondary title

Ren is another quality project working on general interoperability. On any chain, any asset can be converted to any application, and the total amount is not limited. Sounds amazing right? Let’s take a closer look at how Ren does it:

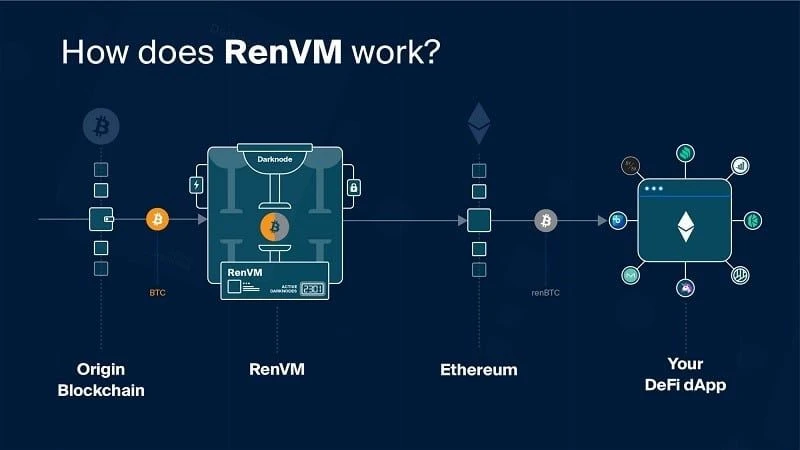

Ren achieves universal interoperability through various technologies, notably RenVM, a decentralized unrestricted trust-free escrow using a tokenized presentation model.

In the tokenized presentation model, users lock assets through custodians. Custodians develop a 1:1 ratio of backup tokens on other chains. The problem with this model is that in most cases, the custodian can only be fully or partially centralized. On the other hand, RenVM solves this problem, but in a completely decentralized and trustless way.RenVM uses the RZL MPC algorithm to manage ECDSA keys without modifying or leaving any records.

Use a combination and algorithmic adjustment of fees to ensure that there is no opportunity for the opponent to take advantage of the attack. RenVM solves the technical and economic difficulties of many existing interoperability design problems.

RenVMZ supports the following three types of cross-chain transactions:

· Locking and minting - users initiate transactions and use the original chain and the main chain. For example: send BTC from Bitcoin to Ethereum, the transaction will be locked when it goes through the RenVM process, and after passing the verification, new tokens will be minted at a ratio of 1:1 to the locked assets;

secondary title

Summarize

Summarize

The train of decentralization is moving forward at an accelerated pace, and the lack of interoperability is currently the biggest obstacle to the development of the platform. There have been many corresponding solutions in the past, but all have limitations of various sizes. But all have laid the foundation and accumulated professional knowledge for the development of the future platform.Among all the platforms mentioned above, Fusion is a platform with a high degree of decentralization. With the assistance of the DCRM protocol, true decentralization can be realized. The Threshold Signature Scheme (TSS) and the multi-party computing power (MPC) of the sharding key make the centralized service of the custodian no longer meet the conditions of decentralized finance