This article comes fromHackmoonThis article comes from

secondary title

Introduction

Introduction

A very nice use case for the Bitcoin banking system was provided in a recent Coindesk interview with Nic Carter. However, looking at his point of view from a long-term perspective, Bitcoin will play an important role in the reform of the traditional banking industry. I would like to look at this issue from another perspective, namely from the perspective of emerging economies.It includes all those markets/economies that are not in the small club of fully developed economies, such as Europe, the US, and Japan, and now China and Russia also belong to this small club. Regardless of the definition,

Emerging economies all have one thing in common: their relatively weak currencies, the risk of sudden capital flight, and immature banking and credit systems.

This is one of the main factors hindering local investment and economic development.

Partial dollarization of these economies is common, and it at least lessens the disastrous effects of hyperinflation or double-digit inflation on local populations such as Venezuela, Argentina or Turkey. The effectiveness of capital controls will increase significantly in the future as more and more cryptocurrencies are reduced in use globally. As a result, emerging economies will accelerate the pace of local currencies replacing cryptocurrencies and crypto-fiat currencies (i.e. stablecoins), such as Bitcoin or Tether/USDt, true USD or USDC, which are readily available and will gradually replace national currencies.

secondary title

secondary title

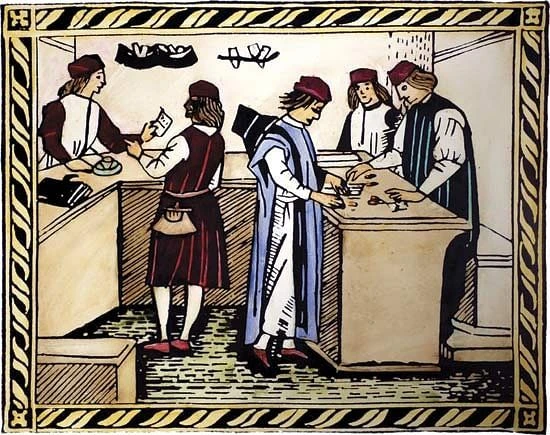

The Lost Art of Commercial Banking

In 1974, self-taught American economist EC Harwood wrote an article entitled The Lost Art of Commercial Banking. Harwood founded the American Institute of Economic Research in 1933, predicted the 1929 recession, guided clients to invest in gold, witnessed inflation in the 1970s and wrote the book The Lost Art of Commercial Banking. Currency debasement was the hottest topic of the day after Nixons infamous 1971 dollar default and breaking golds peg to the dollar.

EC Harwood points out that the period between the end of 1800 and 1914 before World War I represented the zenith of development in monetary affairs in Western civilization. It facilitates commerce and enables long-term accounting records that are meaningful rather than false. The development of thrift institutions, life insurance, and pension funds encouraged not only trade between nations but also a huge increase in useful capital.

It is generally agreed that this period marked perhaps the most far-reaching advances humanity has made in the evolutionary development of the money and credit systems that serve modern industrial societies. Another fact is that at that time gold was the international monetary base common to all the major industrial countries of the world and many others.

But Harwood is not your standard radical. He is a practical man with common sense, not a theoretician. He understands the history of currencies, and in an era of increasing globalization and trade, he proposes practical solutions to the well-known problem of devaluation of French currencies.

In fact, he also criticizes the more aggressive stance of proponents of a 100% reserve standard, which limit the purchasing media used to gold and possibly silver coins or paper money, and checking accounts directly representing these. The purchasing media used are limited to Gold, silver coins or paper money and checking accounts that directly represent these currencies. They date back to the Middle Ages, when there was no sound commercial banking system. In modern industrial civilization, they make no recommendations as to how they will deal with the sale of a large number of products .Other proponents of the gold standard proposed a simple solution, which was to raise the price of gold and restore the convertibility of money into gold.

But what they dont seem to realize is that massively inflationary buying media exists and is destroying the worlds money supply just as it pollutes billions with counterfeit money.

In fact, not even the gold standard by itself could solve the problem of currency debasement unless one applied what he defined as the fundamental principles of sound commercial banking that commercial banking was a lost art. So what exactly is this lost art?The proper functioning of the commercial banking system is crucial to the development of a capitalist economy.

Its two main functions are saving and borrowing, and its core is to earn profits between the savings rate and the loan rate. But banks can lend by withdrawing deposits or by creating new money. The differentiating factor, according to Harwood, is that new money is only created when that money is invested productively, that is, when that money increases the amount of goods and services in circulation (i.e. companies build factories to make cars), whereas Not when that money is financing consumer spending or any other non-productive investment (i.e. the individual gets a loan to buy that car). In the first case, bankers can create new money because it is non-inflationary.

In the second case, purchases should be made by withdrawing money from savings/deposits, since creating new money (not offset by increased productive goods) leads to inflation.

Today, this does not happen for the simple reason that there is no fixed relationship between fiat and real assets such as gold. But the effect of a massive devaluation is the same, it just fades in time and is not immediately apparent due to central bank interventions, manipulations and bailouts. Take a look at this chart of gold against the dollar and you can see the hyperinflationary loss of purchasing power since 1971 when gold hit $35 against the dollar. Today, you need $1,830 to buy an ounce of gold. This represents a 52-fold increase in 50 years.

secondary title

Opportunities in Emerging Economies: A Bitcoin-Centric Commercial Banking System

Now lets fast forward to 2021 and see how Responsible Business Banking at EC Harwoods can be implemented today.

The first thing to consider is that we are unlikely to go back to some sort of gold standard. Or at least not like it used to be. For a variety of reasons, our economy and society today require a different type of hard asset/sound currency upon which a new financial system can be built. Gold is not a good fit for this use case for a number of reasons, three of which are the most important:

Auditing gold is subjective.

Auditing gold reserves means trusting the auditors. This is a subjective evaluation, not an objective evaluation.

Gold is difficult to circulate, complex to withdraw, and expensive to store. These issues are workable for central banks and bullion banks, but are major hurdles for smaller commercial banks and their clients.

It is impossible to track claims of gold. In a fractional paper currency system, where gold is re-hypothecated multiple times, it cannot be determined how many claims/IOUs exist on each ounce of physical gold. Some sources say more than 100. Some people say more. Basically, the over-financialization of paper gold makes it worthless as collateral unless you are prepared to actually hold it. If you dont hold it, you dont own it.

Of course, gold still plays an important role in the international monetary system at the level of governments and central banks. It could be used in what some are calling a currency reset or a new Bretton Woods system, where governments and central banks around the world decide to re-monetize gold, making it several times more expensive than it is today .

Balance their huge debts and shore up their rapidly expanding French currency.

Below this level, the modern digital commercial banking system requires a new kind of hard asset/sound currency to fulfill the reserve function. This asset can be easily deposited, withdrawn, kept, and audited 100% reliably and objectively.

And this asset can only be Bitcoin.

Why Bitcoin is digital gold, I have explained in some previous articles that central banks of smaller countries and developing economies should hold Bitcoin instead of gold as currency reserves.Bitcoin is 100% proof-of-reserve auditable, has zero carry costs, and can be easily self-custodial and withdrawn into personal wallets, making it the perfect modern reserve asset and collateral upon which to build Solid banking infrastructure.

Aims to revive Harwoods benign merchant bank.

First, it will force commercial banks to create fiat currencies only within certain strict parameters without causing a currency explosion, since everyone can see the amount of new crypto-fiat currencies created by banks transparently and in real time on the blockchain And compare it to the amount of bitcoin held by the bank as a reserve. Second, depositors can withdraw bitcoins lent to the bank if the bank draws excessively due to the creation of crypto-fiat, increasing the risk of a bank run. Therefore, if banks want to remain solvent, they will have an incentive to remain effective within accepted parameters and there will be no bailouts. The market is free to price each banks risk, and banks that will have full reserves will pay lower deposit rates, while fractional reserve banks will pay higher rates because they are perceived to be riskier.

If you think Im just fantasizing, youre wrong. This art of crypto banking already exists and it is here to stay and replace banking today.

“We offer these banking products because we operate in a cryptocurrency-first world, at a global and digital scale that would not be possible in a traditional banking context,” said BlockFi founder Zach Prince. If we can start building new infrastructure from a blockchain and cryptocurrency-first mindset and still bring in capital from the old world. We can offer these bitcoin-specific products, and that’s what we’re really excited about.”

In other words, with BlockFi, you can borrow or lend Bitcoin and the cryptocurrency USD. BlockFi leverages traditional cheap USD credit liquidity pools to swap fiat currency for stable currency USD (such as USDt) and lend it to clients in emerging economies for higher yields while holding Bitcoin as collateral. They employ strict loan/collateral ratios and liquidate when the collateral ratio falls below a certain safe level. The borrower of the stablecoin USD is happy because he can borrow in a stronger currency and at a lower interest rate than the local currency.

Because companies like BlockFi or Compound Finance will first target needy clients in emerging economies, the real risk is that the local banking sector is shunned and the local economy is crypto-dollarized (by using USD-denominated stablecoins). This will have long-term adverse consequences for emerging economies, both geopolitically and economically.Therefore, political and business leaders in these countries should quickly realize that

There are not many opportunities to enter the bitcoin space and reshape the local banking industry around a bitcoin-centric model rather than a dollar-centric model. At least aside from being sound money, Bitcoin is no one’s money, no one’s money, no geopolitical bias, no political risk.

Emerging economies also have the advantage that their local banking systems are not yet as fully mature as those in the US or Europe, making the former more flexible and responsive to sudden changes than the latter.

However, moving towards the aforementioned Bitcoin standard in the commercial banking space is not solely the task of the local banking sector. This is a transformational process involving the whole of society, and it will require smart and courageous political leaders and regulators to seize the opportunities before them as quickly as possible. If they can do it, emerging economies can lead this revolution, and in 5 to 10 years they will find themselves at a great advantage over both their direct competitors and advanced economies.

Emerging economies need to develop a competitive framework to kick-start the crypto industry and activate a virtuous circle:

(a) Adopt crypto-friendly regulations that primarily address the identification and legal status of digitally tokenized assets such as stablecoins and tokenized securities. Regulatory frameworks implemented in Liechtenstein, Switzerland and the US state of Wyoming are good examples.

(b) Implement a flexible cryptocurrency banking charter that primarily regulates the issuance and custody of cryptocurrency assets, as implemented in Wyoming for special purpose sector institutions. AvantiBank recently granted a Wyoming-based crypto bank a charter to custody crypto assets and issue crypto-fiat dollars. Notably, the U.S. Office of the Comptroller of the Currency recently issued an opinion letter allowing U.S. banks to use blockchain infrastructure and existing stablecoins or issue their own. If confirmed by coherent government policy, this could be a fundamental paradigm change that could spark a global shift to cryptocurrency banking.

This is an important question that regulators and politicians in emerging economies should mull over: U.S. regulators have come up with the simplest and fastest solution of all, simply plugging into the Bitcoin blockchain to build a The new banking infrastructure, its a very smart approach.

(c) Encourage the establishment of local cryptocurrency exchanges.

(e) Provide incentives to attract crypto capital/investors and good human capital. Tax benefits are very important. Money goes where its treated better. But human capital also migrates to places where business opportunities and living standards are better, or at least better prospects. Citizenship by investment or years of permanent residence is also sought after. There are a lot of very talented individuals and investors in the crypto space who are ready to leave Europe or the US and move to places where their money is treated better, fundamental freedoms are truly enforced, and the crypto investment environment is friendlier. This is a rapidly growing global movement. Right now, while Europe and the US are rapidly becoming oligarchy-run, damaged cores, police states and high taxes will confiscate the surplus wealth once produced by the middle class (certainly not the super rich), the emerging economies in South America and Asia could provide a Crypto capital and talented people provide a safe haven. Small countries such as Uruguay (also known as the Switzerland of South America), Costa Rica, or Singapore could reap huge dividends from this clever policy.

secondary title

bitcoin reset

The lost art of merchant banking that Harwood describes is essentially the basis of industrial capitalism. Paradoxically, this is exactly what China is doing now, according to the American economist Hudson: “While the United States does not acquire wealth through investment. But in terms of finance, China acquires wealth through traditional means of production. Regardless of You call it industrial capitalism, state capitalism, state socialism, or Marxism, it basically follows the logic of the real economy, the real economy, not financial spending. So China is operating as a real economy, increasing output, become the factory of the world, as Britain used to be.

Essentially, this is industrial capitalism versus financial capitalism.

The idea of capitalism in the 19th century was to get rid of the landlord class. It was to get rid of the rentier class. It was essentially to get rid of the banker class

Americans today say that public investment is socialism. Its not socialism. Industrial capitalism. Thats industrialization, thats basic economics. How the economy works, and the concept of how it works is so academically distorted, This is the exact opposite of what Adam Smith, John Stuart Mill, and Marx talked about. For them, a free market economy was an economy without rentiers. But Americans now mistakenly believe that a free market economy allows Renters, landowners, and banks are free to make a fortune. America concentrates planning and resource allocation on Wall Street. This kind of central planning is more corrosive than any government planning.

This pretty much sums up what a fully developed Western economy has become: a neo-feudal economy, a neo-rentier society, very far removed from the industrial capitalist model that made us prosperous and led the world from 1800 to 1970.

secondary title

Summarize

Summarize

Definancialization, the end of negative interest rate bias, and a return to a capitalist productive society based on sound money will all be positive consequences of a system reset. Even better, a new economic revival is looming, based on hard money, a sound banking system, and principles not dictated from above but free market forces and well-coordinated incentives The result of the measure action. Emerging economies would be wise to position themselves at the center of the new Bitcoin standard. They could be at the forefront of a new economic revival that might emulate the success of the small but wealthy Italian maritime republics that led the worlds economic and cultural development from the end of the Middle Ages to the Renaissance. But they have absolutely nothing to lose and everything to gain.