This article comes fromMedium, the original author: Nic Carter, compiled by Odaily translator Katie Ku.

, the original author: Nic Carter, compiled by Odaily translator Katie Ku.

In mid-January, a blogger nicknamed Crypto Anonymous published an article claiming that the price of Bitcoin was supported by the issuance of unsecured Tether. The analysis, drawn in part from data provided by a provider called CoinLib, is said to show the flow of funds within the cryptocurrency ecosystem. As I will demonstrate, the data is not strong enough to prove that Bitcoin liquidity is dominated by Tether, and judging based on these data is easily misleading. Unfortunately, the mainstream financial media is currently amplifying these false claims (Note: This article is not intended to debunk the Big Short article.)

secondary title

Fake volume is a well documented problemWhen I read the Big Short article, I quickly realized that the author, called Crypto Anonymous, wasnt really a cryptocurrency market participant at all. If you are a real trader who takes a gamble in the cryptocurrency market with the target capital in hand, it is impossible not to know that the exchange using the CoinLib example is not trustworthy, and the data obtained from it is therefore completely unreliable. As you may be wondering if I am qualified to discuss this topic, let me tell you that I am the co-founder of Coin Metrics, a data company that empowers financial institutions, asset managers, and banks with encrypted market data. Our CM team is well aware of this exchange data quality issue and has developed a 36-point whitelist framework that applies quantitative and qualitative tests to exchanges to determine if they are providing honest data.

As we expected, many exchanges did not pass these tests. Frankly, not many exchanges or trading venues are up to the standard that public market investors expect from a data quality standpoint, although that is changing.

Coin Metrics is not alone in pointing out that exchanges are facing data quality issues and we need a robust whitelisting framework for reliable volume assessment. Asset management firm Bitwise stated in a report to the SEC that 95% of the purported cryptocurrency trading volumes are fake, which puts credible onshore exchanges (using fiat connections) and offshore exchanges ( Tether is often used) clearly separated. Bitwise maintains a reliable quantitative data index based on the whitelist framework. Alameda Research, one of the industry’s largest market makers, backed Bitwise’s research with a report of its own junk data and runs its own fake volume monitor.

Data provider Messari also employs a whitelist approach to derive “real volume” data, noting in its methodology that “many exchanges are known to engage in wash trading in order to inflate volume.”

Similarly, industry trading publication The Block manages their own whitelist of exchanges, which is broader in scope than the one designed by Bitwise. Coin ranking site CryptoCompare likewise publishes an exchange benchmark that attempts to correlate purported trading volumes to it. In short, anyone who pays any attention to this industry is well aware of this problem. It is unbelievable that a long-time cryptocurrency trader is unaware of this fact.。

This kind of information is not uncommon. Industry leader CoinMarketCap strives to obtain reliable volume data that has been well documented in the mainstream media. In 2018, I discussed the poor incentives that lead ranking sites to uncritically accept false volumes. In short, start-up exchanges falsify data to make them appear liquid and active, both to encourage tokens to pay listing fees and to encourage traders to participate on the platform. Ranking sites often have monetary transactions with the exchanges they cover, so there is little incentive to sift through the data.

This problem is specific to the crypto market. Anyone who pays any attention to this industry should know that Tether-based exchanges are prone to inflated trading volume. This naturally distorts the assessment of market liquidity and thus exaggerates Tethers impact on the market. Remember, it is often the offshore, non-fiat interconnected exchanges that are generating the volume, so uncritical data ends up exaggerating Tethers role in Bitcoin price formation

Why is this a problem? Because CoinLib takes data output from marginal exchanges at face value, and less sophisticated analysts like “crypto-anonymous” bloggers use it to spread claims about Bitcoin liquidity.

If you look at the seven most liquid exchanges based on CoinLib data, only Binance, Coinbase Pro, and Bitfinex pass most of the whitelist framework listed above. In the Coin Metrics trusted volume framework, Lbank, ZB, and HitBTC—the three largest exchanges in the CoinLib sample—have not been audited and are considered untrustworthy. Data provider Nomics filters exchanges for trustworthiness, giving Lbank, ZB.com, and Bit-Z a C grade, and HitBTC an A-. Cryptocompare gave ZB.com, Lbank and Bit-Z a C grade, and HitBTC a B grade. Messari and Bitwise only include Binance, Coinbase and Bitfinex data from the top 10 exchanges cited by CoinLib. The Blocks index of 24 legitimate exchanges considers only 4 of the top 10 exchanges listed by CoinLib to be trustworthy. We are referring to billions of fake USDT volumes.

So if you really dig into CoinLibs data, those serious mistakes become very apparent. Lbank, ZB, BitZ, and HitBTC are all exchanges that only rely on USDT. Each of them had a low score on the data aggregator, or was excluded from the whitelist. But CoinLib took a naive view, uncritically accepting their claimed transaction volume figures as fact.

secondary title

The Wall Street Journals Fact-Checking Failure

Now, anonymous posters on Medium are also a problem. For all we know, crypto-anonymous bloggers may have substantial short positions and may be talking about their ledgers. We have absolutely no reason to believe what they say about buyer beware. But when these statements are re-reported by mainstream financial publications and treated as fact, we enter a world where news is not based on facts.

Unfortunately, thats whats happening these days. Wall Street Journal columnist Andy Kessler wrote an article titled Behind the Bitcoin Bubble. In this post, he repeats the claims of the Crypto Anonymous blogger, effectively endorsing them. “Bitcoin is nothing, it’s a castle in the air, a concept of an idea,” Kessler wrote.

[A] A user called Crypto Anonymous (Know Your Customer anyway) did some research and found that as many as two-thirds of transactions on any given day were buying Bitcoin with Tether […]

Normally, if you were a columnist writing for the most respected financial publication, you would probably try to assess the data behind the assertion rather than accepting it uncritically. But Kessler didnt do that. He just blindly repeated a claim made up by an anonymous blogger in order to imply that the price of Bitcoin is somehow dependent on Tether.

Kesslers misconceptions abound. First, CoinLibs data doesnt tell much about Bitcoins liquidity situation. Bitcoin has a very deep and direct relationship with the liquidity of fiat currency. The asset does not depend on Tether for transactions. Almost none of the U.S.-based exchanges used Tether, where most of the worlds cryptocurrency transactions take place. These exchanges are directly connected to banks such as Silvergate, Metropolitan and Signature. Gemini and Coinbase even called themselves JPMorgan Chase as a service provider. A number of heavily regulated entities, such as CME, ErisX, and Intercontinental Exchange (via Bakkt), trade bitcoin derivatives under the supervision of the Commodity Futures Commission. Others such as Cash App, Paxos, Paypal, BlockFi, Robinhood, Bitwise, and Grayscale all offer various forms of exposure to Bitcoin and are connected to the commercial banking system and, in some cases, public companies, while No Tether involved. Finally, there are cryptocurrency companies like Avanti, Kraken Financial, and Anchorage, all of which have shiny banking charters (whether through states like Wyoming or at the national level). It can be said that in the United States, the encryption market is closely integrated with the commercial banking system without any dependence on Tether.

Stablecoins, while an increasingly active piece of financial infrastructure, are not necessary to support bitcoin transactions in the United States. Today, Bitcoin has robust, regulated, and massive USD liquidity. Tether could evaporate overnight, with no effect on the U.S. bitcoin market.

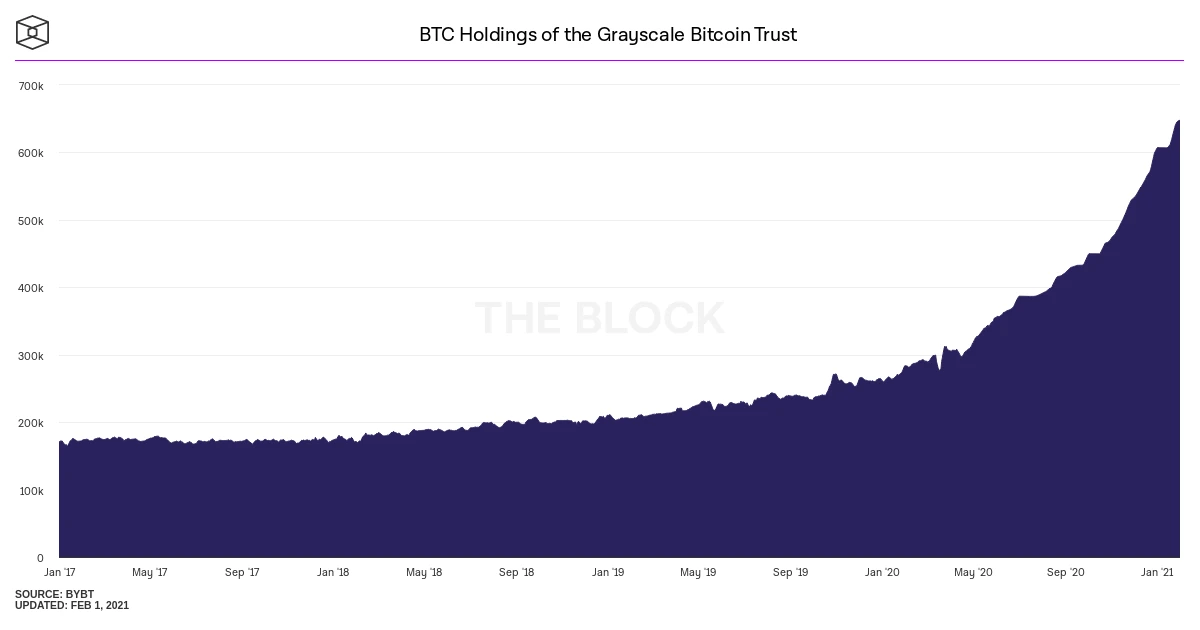

The second mistake Kessler made was to confuse transaction volume with liquidity. Transaction volume simply means asset transactions. CoinLibs graphs are meant to show money flowing from/to Bitcoin, but they dont do that. Instead, they show the compressed results of extremely mixed volumes.Real inflows are difficult to measure directly, but there are some proxy indicators available. Grayscale Bitcoin acquisitions indicate an actual inflow of assets. ItBit data is considered by some to be a proxy for Paypal bitcoin transactions. Square publishes its customers bitcoin purchases in its quarterly reports. In fact, public company Microstrategy acquired 708,000 bitcoins. Coinbase will soon publish a draft registration S1 form to give investors a better understanding of the relationship between their trading volume and capital inflows. We keep hearing that NYDIG, Coinbase Prime, and my former colleagues at Fidelity Digital Assets have facilitated hundreds of millions of dollars in acquisitions.

The point is, the BTC/USD onshore market is massive and its scope can be determined through public sources if you pay attention. Additionally, since exchanges vary widely in the sophistication of their customer bases and fee structures, exchanges trading volumes must be correlated.

image descriptionBitcoin held by GBTC - actual inflows (data from The Block)

It cannot be denied that Tether is very important in the crypto market. It is the primary (but not the only) currency traders use to settle and maintain balances on exchanges, especially those not connected to the U.S. banking system. It denominates derivatives contracts on many offshore crypto exchanges. But it is completely wrong to think of Bitcoin’s liquidity as homogenization, and more importantly, as inflow.

Grayscale’s bitcoin purchases (purchases in actual U.S. dollars) constituted the inflow. USDT-denominated offshore crypto exchanges falsify order books and create wash trades to make them appear liquid, which has nothing to do with price formation. Its just confusing.

Kessler contacted the New York Attorney Generals Office (NYAG) to inquire about their investigation of iFinex Inc. But he didnt bother to censor the exaggerated claims made by anonymous bloggers based on junk data. He could have spent 5 minutes calling any cryptocurrency trader or market participant and asking them if CoinLib is a reliable source or if ZB.com is a trustworthy exchange. But he didnt because he wanted to believe a made-up story, which was also matched by the data provided by the anonymous blogger.Look, I understand that encrypted data can be mixed. But to comment on cryptocurrency issues, especially ones as immensely complex as the liquidity situation of Bitcoin and other globally traded cryptoassets, you cant rely on superficial data analysis. If you turn the assumptions of traditional markets upside down, youre going to go wrong.