Inscription: 312 will be in March again, and we are fortunate to witness and participate in the encrypted financial market has truly entered a new level.

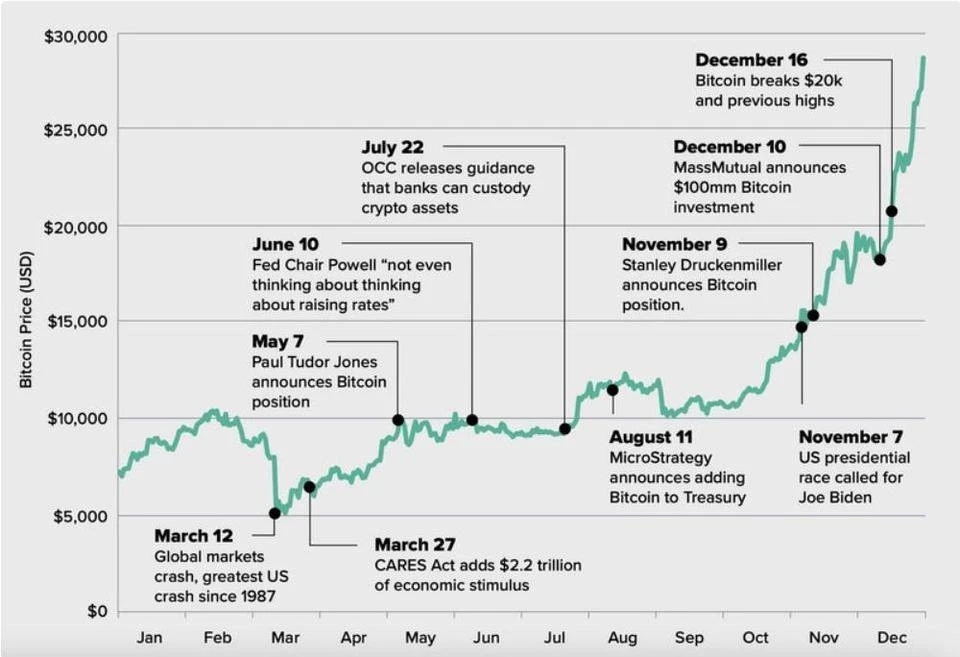

In March 2020, the U.S. stock market was affected by the epidemic, and the global financial market was hit hard. On the 12th of that month, Bitcoin, which accounted for the highest proportion of the cryptocurrency market value, also fell sharply, with the largest single-day drop exceeding 50%. Since then, the world has started to cut interest rates. The United States launched the first wave of rescue plans after the epidemic, and the liquidity was replenished, and the overflowing liquidity also opened up the frenzy of the encrypted financial market in 2020. Its March 2021. Based on its in-depth research and participation in the encrypted financial market, Amber Group reviewed and analyzed the key changes in the market during the year.

BTC/USDT price change in one year

Liquidity Mining: The Explosion of the COMPOUND Model

From the end of May to mid-June 2020, Compound launched the token distribution model of borrowing and mining, which detonated the decentralized financial market in one fell swoop. Various decentralized market makers joined in one after another and scrambled for liquidity, prompting a surge in the popularity of the DeFi market. Other DeFi subdivisions are also known to the public in this atmosphere, such as DEX, oracle machines, derivatives, insurance, algorithmic stable coins, DAO, etc. Many DeFi participants have begun to explore compatible solutions between encrypted finance and traditional finance, or try to solve the related pain points of traditional finance, and continue to bring innovations in technology and solutions. But at the same time, inevitable problems such as unqualified code audits, hacker attacks, and man-made evils have also caused many followers to think about the more realistic landing scenarios of decentralization and potential systemic risks.

Grayscale Fund: The Entry of Large Institutions

Looking at the encrypted financial market after 312, the figure of Grayscale Fund cannot be avoided. In April 2020 alone, Grayscale bought 11,236 bitcoins, accounting for 21% of bitcoin mining output that month. Even after a period of time (June to December 2020), the daily purchase volume of Grayscale has become a barometer of the market. As of now, Grayscale has held more than 655,200 bitcoins and 3,173,100 ethereums, and the total management scale of its funds is about 46 billion US dollars.

image description

Grayscale Fund 2020 Q4 Report

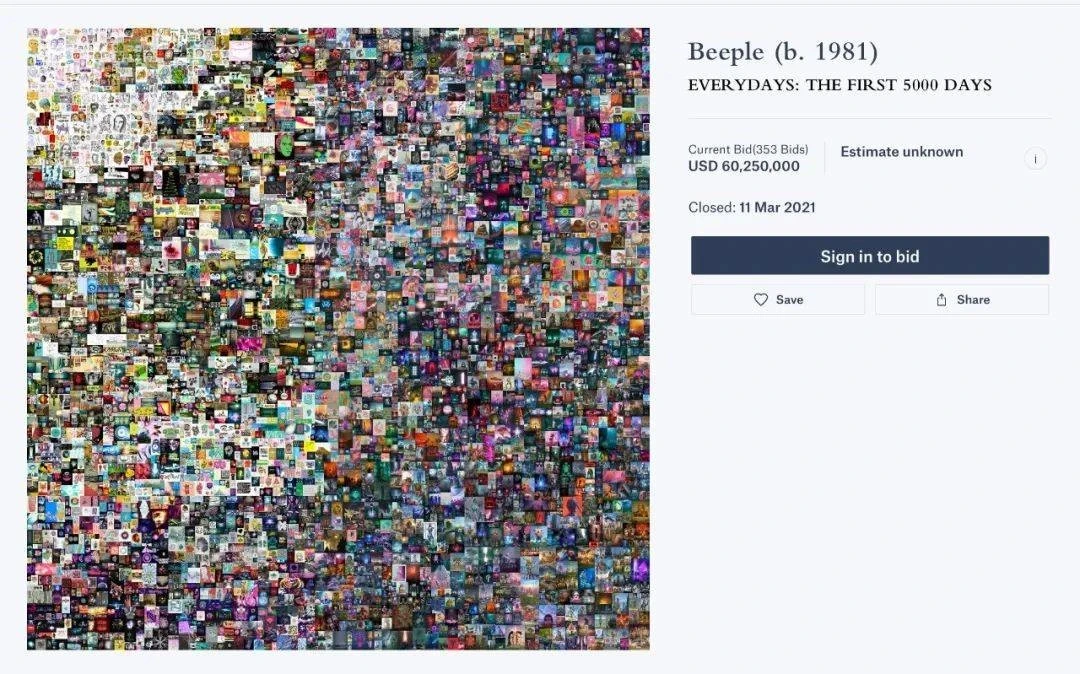

Non-homogeneous tokens: a new track for the ownership of encrypted assets

image description

‘Everydays: The First 5000 Days’ by Beeple

Value changes: industry consensus is returning

In the year after 312, the majority of industry participants witnessed the breakthrough of the overall market value of cryptocurrencies and the growth of various decentralized financial projects. It is not difficult to find that after the savage growth since July 2020, the market has calmed down and is returning to calm. However, the overall market can still remain strong, which is mainly due to the landing of more real scenarios; the influx of professional encrypted financial service institutions such as Amber Group; the growth of the number of users, and the emergence of more products that can meet user needs.

According to the research data of Amber Group, the next stage of the blockchain and encrypted financial ecology may be based on a stable and reliable public chain, the possibility of realizing large-scale user needs, and the interoperability between different blockchains. Really make blockchain technology really play its role. The token price is a relatively unimportant part of the different indicators reflecting its value.