Source: Blue Shell Academy

Author: Rachel

In the summer of 2020, DeFi ushered in an explosive growth momentum. The prosperity of the ecology allowed Ethereum, the main battlefield of DeFi, to reach new heights under this wave of decentralized financial innovation. Problems such as congestion that occurred in 2017 were once again exposed. It is even more difficult, and the performance problem is seriously dragging the hind legs of Ethereum, and the expansion is urgent.

In the past year, the capacity expansion track has risen rapidly, becoming a favorite in the market, and gradually becoming crowded. Polygon is one of the few that can stand out from the encirclement, and whose ecology has improved slightly. Among the many expansion plans, Polygon not only developed a series of native projects based on itself, but also attracted Aave, Curve, Sushiswap and other leading projects of the Ethereum ecosystem to settle in, forming an open and multi-faceted ecological scene.

Looking at the development history of Polygon, it took nearly half a year for it to become popular. Since Matic Network announced its name change to Polygon on February 10, its ecological expansion has started rapidly, especially in the second quarter of this year. The development speed is amazing. According to the Dappradar report, not only did Polygon make a huge leap in usage in the second quarter, but Polygon also surpassed Ethereum, with more than 73,000 unique active wallets per day, a figure that soared 13,000% year-on-year, an increase compared to the previous quarter. 845%.

Polygon has nearly 500 integrated projects, an increase of more than 3 times in the second quarter

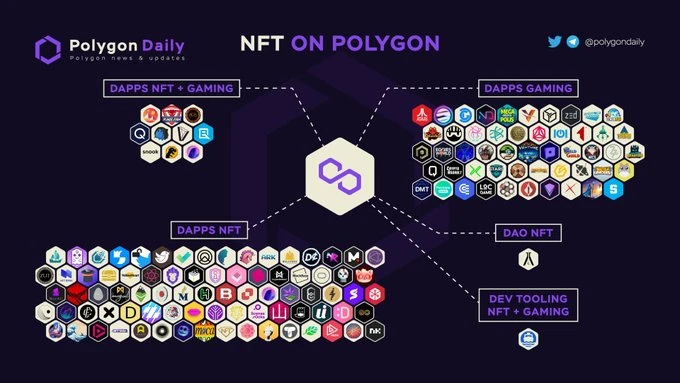

Up to now, Polygon has been on the mainnet for more than a year. Although its ecological scale is still far behind that of Ethereum and BSC, as far as it is concerned, the Polygon ecosystem has formed a network covering DeFi, NFT+ games, DAO, B2B, wallets, and oracle machines. , A comprehensive ecosystem of development tools.

According to the latest information on Polygon’s official website, there are currently 255 DeFi projects, 149 NFT+ game projects, 22 DAO projects, 10 B2B projects, 16 wallet projects, 9 oracle projects, and 25 development tools integrated into the Polygon ecosystem. Including Polygons native projects, integrated projects, and cooperative projects, there are more than 480 projects in total, and a diverse ecosystem based on DeFi and NFT+ games has been built. In the first quarter of this year, the total number of projects deployed on the Polygon network was around 120, most of which were NFT+ games.

The top projects of Ethereum have settled in, and the total lock-up volume of Polygon has risen sharply

The total lock-up volume is an important indicator to measure an ecological growth trend and usage scale. According to DeBank data, Polygon’s total lock-up volume is currently hovering around US$5 billion, a drop of about 35% from the highest point of US$7.9 billion, and the actual lock-up volume has exceeded US$4 billion.

The entire second quarter was a period when Polygon shined. The total lock-up volume rose from 79 million US dollars, which lasted two months, and increased by more than 100 times, exceeding 7.9 billion US dollars. As of the end of June, Polygons total lock-up volume remained above $5 billion, maintaining an increase of more than 60 times.

The most influential black swan in the second quarter was the 5.19 event. Although the total lock-up volume of major ecosystems including Ethereum was affected by 5.19 and dropped sharply, looking at the upward curve of Polygons lock-up volume , it can be seen that 5.19 has little impact on it, and the red box in the figure below is May 19. At present, Ethereum and BSC belong to the ecology with a large amount of locked positions. After 5.19, the locked positions of the two decreased by 20 billion US dollars (26%) and 10 billion US dollars (38%) respectively. Compared with Polygon, which has a small base , after falling by 1.2 billion US dollars (21%), it quickly rebounded to 900 million US dollars the next day, and then after a short correction, it completely widened the gap with the gentle curve of Ethereum and BSC ecology, and rose all the way.

The ability to quickly increase the total lock-up volume is due to the fact that several leading Ethereum projects have settled in Polygon. Among them, the leading loan Aave, the leading DEX Sushiswap, and the leading AMM Curve have the strongest momentum, bringing significant traffic effects to Polygon. At present, Aaves lock-up volume on the Polygon chain is stable at 2.1 billion US dollars, with a maximum of 3.8 billion US dollars, contributing half of Polygons lock-up volume; Sushiswap and Curve are firmly in the top five on the Polygon chain. The lock-up volume is currently stable above $1 billion.

Source: DeBank

QuickSwap ranks No. 1 in transaction volume, and Polygons native project rises

Since April, the trading volume of QuickSwap, the largest DEX on Polygon, exceeded US$100 million, and then stabilized above US$100 million. On June 16, the trading volume once exceeded US$1.25 billion, surpassing the trading volume of Uniswap and Pancakeswap. This is currently the only project whose DEX transaction volume on the Polygon chain ranks among the top ten projects.

Although QuickSwap ranks slightly lower in terms of transaction volume, in terms of 24-hour transaction frequency, QuickSwap hovered around 200,000 in May and 250,000 in June; the number of 24-hour transaction users also increased from 7,000 in May The rest increased to 15,000-25,000. In terms of the number of trading users and trading frequency at the end of June, QuickSwap is second only to Uniswap, Pancakeswap, and Mdex.

Polygons first black swan SafeDollar appears, security controversy emerges

In the second quarter, the BSC ecology fell into a security black hole and encountered multiple serial attacks, resulting in a loss of more than 200 million US dollars. The development momentum of the Polygon ecology in April and May and the security level did not make too much disclosure.

Since late June, it is unknown whether the expansion of the Polygon ecosystem has attracted the attention of hackers. Three security incidents occurred in the Polygon ecosystem within 10 days. Part of the collateralized stablecoin project Iron Finance was hit by a bank run and its tokens were zeroed. The first income farm Polywhale Finance officially announced that it was running away. The algorithmic stablecoin project SafeDollar was attacked by hackers and issued maliciously.

summary

summary

Blue Shell Academy believes that Polygon will show exponential growth in the second quarter of 2021. Even under extreme market conditions, it will still rebound rapidly, and it will start to show a flat development after late June.

In May, the public chain ecology showed different degrees of decline. However, Polygon was not affected by this. Instead, it attracted other ecological forces after that. It was the only public chain ecology that showed an upward trend after 5.19. Polygon may be the biggest winner of the DeFi ecosystem in the second quarter.

Polygons own ecological projects, integration projects, and cooperation projects have grown rapidly in the second quarter. By the end of June, Polygons ecological projects had exceeded 480, an increase of more than 3 times. Among them, there are more than 250 DeFi projects, accounting for most of the Polygon ecosystem, followed by the NFT+ game sector.

The key driving factors behind the growth of Polygon users, locked positions and transaction volume still come from the influence of the Ethereum ecosystem. As a solution to Ethereum’s ecological congestion, it began to attract the settlement of Ethereum’s top projects in April, bringing At the same time, the soundness of native ecological projects has contributed to the ecological situation of Polygon diversity.

QuickSwap, the leader of Polygons ecologically native DEX, made great efforts. The trading volume ranked among the top ten DEX rankings in the second quarter. The top five of all ecological DEX.

The hacking of the algorithmic stablecoin project SafeDollar may lead to two situations in the Polygon market. Properly controlled Polygon may remain stable in the third quarter and then go up. How to produce a chain reaction like the BSC ecology, then the Polygon ecology may start here go downhill.

Blue Shell Academy: It is a research institution established on the basis of the world-renowned trading platform LBank, based on in-depth technical research, based on output data thesis, and based on the logic of disseminating value investment.