Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

secondary title

Second, the secondary market

1. Spot market

On December 24, Ethereum decided to change the name of the hard fork upgrade that previously referred to the merger of ETH1 and ETH2 from Merge to Bellatrix (a star in Orion: Betelgeuse). In the future, the consensus layer will be upgraded using the names of these celestial bodies, in alphabetical order.

In terms of the secondary market, the current ETH price may pull back slightly in the short term, with support at $3,900, $3,500, and resistance at $4,400.

According to OKEx market data, the price of ETH once fell to $3,750 last week, and closed at $4,063 during the week, up 3% month-on-month.

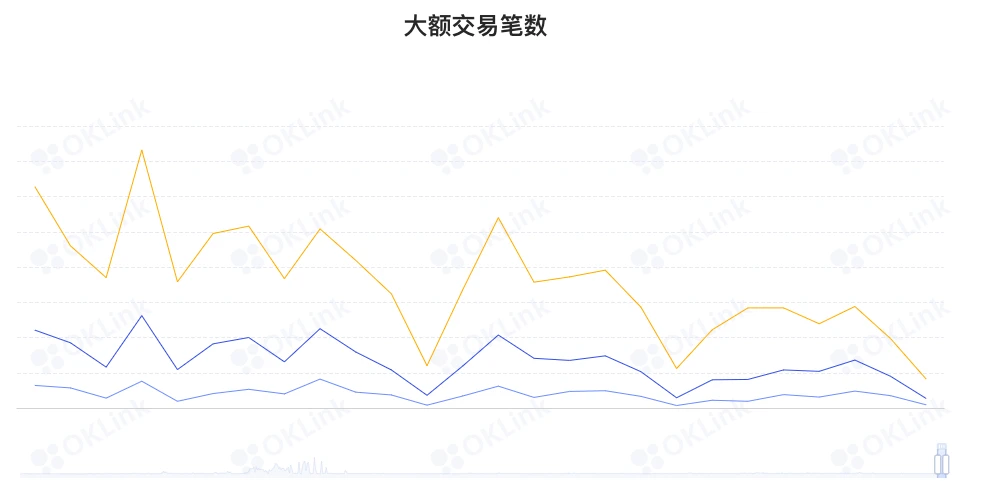

2. Large transaction

OKlink dataThe daily chart shows that the price is currently on the middle track of the Bollinger Band, and is expected to continue to rise to around US$4,400 (upper track); the lower support level is the 120-day moving average of US$3,900, and if it falls below, it will continue to fall to US$3,300 (200-day moving average).

3. Rich list address

OKlink dataIt shows that the number of on-chain transfers dropped sharply last week, with above 1000 ETH, above 2000 ETH and above 5000 ETH decreasing by 32%, 30%, and 23% month-on-month, respectively.

3. Ecology and technology

1. Technological progress

It shows that the current top 300 ETH holdings hold a total of 53.65% of ETH, an increase of 0.28% month-on-month; in addition, the entire position distribution presents an oval structure, and the proportions of each part are: 1st to 100th, accounting for 39.84%, 101st to 300th, accounting for 13.81%, down 0.07% from the previous month; 301st to 500th, accounting for 6.17%, down 0.16% from the previous month; 501st to 1000th, accounting for 7.07%, down 0.13 from the previous month %; after the 1001st place, accounting for 33.14%, a month-on-month increase of 0.01%.

2. Project trends

1. Technological progress

Ethereum changed the name of the hard fork that merged ETH1 and ETH2 from Merge to Bellatrix

2. Project trends

(1) IQ protocol launched BrainDAO, the Web 3.0 metaverse knowledge fund, to realize the vision of IQ V3

Official news, in order to realize the vision of IQ V3, IQ protocol launched BrainDAO today as the first Web 3.0 metaverse knowledge fund. BrainDAO will use IQ tokens to fund the future of knowledge on-chain. According to reports, through IQ V3, Everipedias mission is to connect the real world and the metaverse by creating, curating and preserving all forms of knowledge on the chain, from history to art, from finance to data. In addition to on-chaining knowledge, BrainDAO also focuses on capturing virtual and real-world assets. This broader vision calls for a new DAO that can fund itself and distribute funds efficiently.

(2) Since the launch of the NFT game platform Legacy, sales have exceeded 50 million US dollars

After less than a month of deliberation and voting, at the Ethereum block height 13850929, two members of the decentralized autonomous organization (DAO) approved the merger of Rari Capital and Fei Protocol. The two projects will be merged and unified through token exchange. To TRIBE tokens, the Total Value Locked (TVL) will be $2 billion. (CoinDesk)

(3) The Ethereum push service EPNS mainnet will be launched on January 11

(4) Rari Capital and Fei Protocol community approve the merger of the two projects, which will be unified into TRIBE tokens

NFT mortgage lending platform Arcade announced the completion of $15 million in Series A financing, led by Pantera Capital, Castle Island Ventures, Franklin Templeton Blockchain Fund, Golden Tree Asset Management, Eniac Ventures, Protofund, Probably Nothing Capital, Lemniscap, BlockFi CEO Zac Prince , Quantstamp CEO Richard Ma and others participated in the investment.

Arcade co-founder Robert Masiello said the funding is an equity round that will help Arcade expand its team, launch the platform publicly and attract more users. Arcade is currently available in private beta and will be available to the public early in the first quarter of next year. Arcade currently supports Ethereum-based NFTs as collateral for loans on all ERC-20 tokens, with other blockchains and layer-2 networks being explored for support in 2022. (The Block)

(6) Kintsugi, the pioneer network of Interlay, announced the launch of the merged testnet

(7) Arcade, an NFT mortgage lending platform, announced the completion of Series A financing of US$15 million, led by Pantera Capital

4. Borrowing

DefipulseNFT mortgage lending platform Arcade announced the completion of $15 million in Series A financing, led by Pantera Capital, Castle Island Ventures, Franklin Templeton Blockchain Fund, Golden Tree Asset Management, Eniac Ventures, Protofund, Probably Nothing Capital, Lemniscap, BlockFi CEO Zac Prince , Quantstamp CEO Richard Ma and others participated in the investment.

4. Borrowing

5. Mining

(data from etherchain.org)

etherchain.orgFrom the perspective of individual projects, the top three lock-up values are: Maker 19 billion US dollars; Curve 15.29 billion US dollars; Aave 12.54 billion US dollars.

4. News

image description

(data from etherchain.org)

4. News

(1) Data: 0.09% of SHIB holders control 9% of the circulating supply

WhaleStats tweeted that the top 1,000 ETH wallets accounted for nearly 0.09% of the total 1,075,033 holders. And they currently hold 48,098,038,767,872 SHIB, which accounts for nearly 9% of the SHIB circulating supply (549,150,741,363,587). (U. Today)

(2) Analyst: Ethereum will reach $9,000 in 6 months