Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

secondary title

Second, the secondary market

1. Spot market

Earlier news, Ethereum changed the name of the hard fork that merged ETH1 and ETH2 from Merge to Bellatrix. Recently, superphiz, a community security consultant on the Ethereum beacon chain, said that Bellatrix, the Ethereum merger fork, will merge the current chain with the new PoS beacon chain. The fork will not enable withdrawals from the beacon chain, which is expected to enable pledged ETH withdrawals approximately six months after the merger. Post-merger, traditional GPU mining will no longer take place on Ethereum, instead, the network will be secured by Proof-of-Stake (PoS) validators who will begin receiving transaction fee rewards upon merger. In addition, superphiz expects that Bellatrix will be implemented in June 2022, and the beacon chain pledge ETH withdrawal will be opened in December.

In terms of the secondary market, the current ETH price may pull back slightly in the short term, with support at $2,800, $2,500, and resistance at $3,500.

According to OKEx market data, the price of ETH once fell to US$3,000 last week, and closed at US$3,097 during the week, a month-on-month decrease of 18.8%.

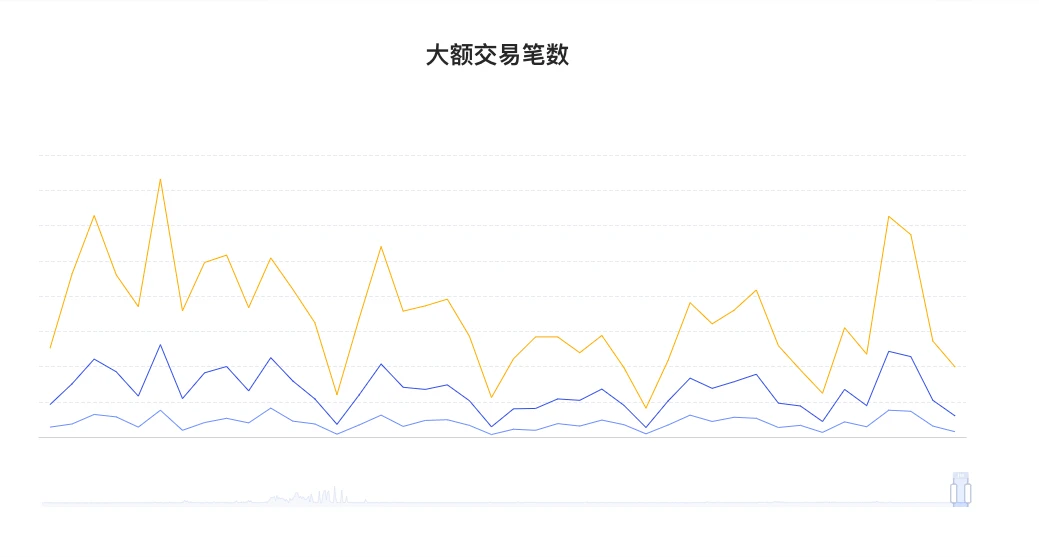

2. Large transaction

OKlink dataThe daily chart shows that the price is currently on the lower track of the Bollinger Band and will continue to test the $3,000 mark; the lower support levels are $2,800 and $2,500, and the upper resistance level is $3,500.

OKlink dataThe daily chart shows that the price is currently on the lower track of the Bollinger Band and will continue to test the $3,000 mark; the lower support levels are $2,800 and $2,500, and the upper resistance level is $3,500.

3. Rich list address

OKlink dataIt shows that the number of on-chain transfers rose slightly last week, and above 1000 ETH increased by 10% month-on-month, but above 2000 ETH and above 5000 ETH decreased by 2.5% and 9.3% month-on-month, respectively, and the enthusiasm for large-amount giant whale transactions declined slightly. .

3. Ecology and technology

1. Technological progress

OKlink data

On January 7th, Ethereum core developers held a conference call. Ethereum developer Tim Beiko updated the content of the meeting and said that the Ethereum 2.0 test network Kintsugi conducted a lot of tests, but Ethereum developer Marius VanDerWijden successfully cracked the network again, and the network did not generate blocks for about 13 hours. Hope to launch one more merged testnet, which may be the last one before the merger. Additionally, the next conference call will take place on January 21.

Ethereum beacon chain community security consultant superphiz said that the Ethereum fork Bellatrix will merge the current chain with the new PoS beacon chain. The fork will not enable withdrawals from the beacon chain, which is expected to enable pledged ETH withdrawals approximately six months after the merger. Post-merger, traditional GPU mining will no longer take place on Ethereum, instead, the network will be secured by Proof-of-Stake (PoS) validators who will begin receiving transaction fee rewards upon merger. In addition, superphiz expects that Bellatrix will be implemented in June 2022, and the beacon chain pledge ETH withdrawal will be opened in December. Earlier news, Ethereum changed the name of the hard fork that merged ETH1 and ETH2 from Merge to Bellatrix.

2. Voice of the Community

(2) Ethereum Developers Conference: Or the last merged testnet will be launched before the merger

On January 7th, Ethereum core developers held a conference call. Ethereum developer Tim Beiko updated the content of the meeting and said that the Ethereum 2.0 test network Kintsugi conducted a lot of tests, but Ethereum developer Marius VanDerWijden successfully cracked the network again, and the network did not generate blocks for about 13 hours. Hope to launch one more merged testnet, which may be the last one before the merger. Additionally, the next conference call will take place on January 21.

(3) Vitalik proposed to explore the possibility of multi-dimensional pricing of transaction fees

Vitalik Buterin launched a proposal to explore the possibility of multi-dimensional pricing of transaction fees. According to the article, in EVM, there are actually different restrictions on various resources, such as the calculation time occupied by EVM (EVM usage), block data (Block data), witness data (Witness data), state size (State size) . Our current resource pricing model simply abstracts this resource into Gas, which cannot optimize the Gas cost. Previously, the community’s main objection to multi-dimensional pricing was that it would increase the threshold for packaging blocks and lead to the centralization of miners. V God believes that after MEV and EIP1559, the concerns of these objections have been greatly alleviated, and the multi-dimensional pricing model, in addition to optimizing Gas costs, will also add another layer of DoS protection to Ethereum.

(1) V God: Extremism in the encryption community is very unhealthy

Vitalik Buterin, the co-founder of Ethereum, said in an interview that extremism in the encryption community is very unhealthy and he doesnt think anything outside the Ethereum ecosystem is boring and illegal, expressing his disapproval of Zcash and Tezos is interested and thinks something really interesting is happening in Zcash and Tezos.” Zcash developers previously announced that the project will switch to the Proof-of-Stake consensus algorithm in line with Ethereum’s roadmap. With this At the same time, Vitalik said that many communities are only lip service to the practice of decentralization, and have not actually taken action, but he firmly believes that there are some respectable communities in the cryptocurrency field, and their interest is not only to make quick money, Ultimately, decentralization is what this market is about, he said. (newropeans)

(2) V God: Ethereum Layer 1 is not ready for direct mass adoption

Vitalik Buterin (V God) reiterated the urgent need for Ethereum scaling solutions. In the latest Bankless podcast, Vitalik discussed the development of the Ethereum network over the past year, as well as future expansion plans. Although Ethereum has made significant progress in 2021, such as the London hard fork, which includes the fee burning mechanism EIP-1559, it still faces high gas fees. Buterin admitted that in order for a blockchain to gain mainstream adoption, it has to be cheap. However, he also acknowledged that current fees are one of Ethereums most pressing concerns. “Current Ethereum, Layer 1, is not yet a system ready for immediate mass adoption,” he explained, before highlighting the need for second-layer scaling solutions such as rollups. (Crypto Briefing)

(3) Developers refute JPMorgan Chases statement that Ethereum may lose its dominant position in DeFi

Ethereum core developer Tim Beiko said that Rollups are now live and sharding will reduce their cost, but the technology works and has now been massively de-risked. When you look at the data, Ethereum is still the most used chain.

3. Project trends

Lending agreement Vesta Finance announced the completion of angel round financing, Tetranode, DCFGod, Fiskantes, Not3Lau Capital, Sam Kazemian, 0xmons, Wangarian, PopcornKirby, Nick Chong, Calvin Chu, Jae Chung, Anthony Sassano, Eric Conner, Mariano Conti, Shuyao Kong, Feir Waiting for angel investors to participate in the investment, the specific financing amount has not been disclosed yet.

(4) Co-founder of EthHub: Ethereum was built to survive the next 1000 years

3. Project trends

(1) The lending agreement Vesta Finance completed the angel round of financing and will release the initial version in mid-January

Lending agreement Vesta Finance announced the completion of angel round financing, Tetranode, DCFGod, Fiskantes, Not3Lau Capital, Sam Kazemian, 0xmons, Wangarian, PopcornKirby, Nick Chong, Calvin Chu, Jae Chung, Anthony Sassano, Eric Conner, Mariano Conti, Shuyao Kong, Feir Waiting for angel investors to participate in the investment, the specific financing amount has not been disclosed yet.

However, on Dec. 4, Uniswap did process $4.1 billion in volume. This means that its daily revenue is about $10 million, so it can be estimated that its peak revenue during the year will be $4 billion, or a fully diluted market value of $80 billion, which means that Uniswaps highest pricing range will be from the current 20 The dollar rose to $80. (Trustnodes)

With the new financing, Livepeer plans to expand its market share. Petkanics said the project plans to release a massive upgrade called Confluence early this year that will move Livepeers internal protocol from ethereums base layer to layer 2 network Arbitrum. This will also keep the Livepeer Token (LPT) and core security mechanisms anchored to Ethereum.

In the future, Livepeer also plans to expand its capabilities across the media value chain, including video NFT support. It is reported that Livepeer is a decentralized video transcoding platform that converts video from one file format to another.

In July last year, Livepeer announced the completion of a $20 million Series B round of financing, led by Digital Currency Group (DCG), with participation from Coinbase Ventures, CoinFund, and Northzone. (The Block)

Livepeer, a decentralized live video platform based on Ethereum, completed a $20 million B+ round of financing. Alan Howard and Tiger Global, as well as existing investors such as Digital Currency Group, Northzone, and Warburg Serres participated in the investment. Doug Petkanics, co-founder and CEO of Livepeer, said the new round of financing is also equity financing, bringing Livepeers total funding to date to approximately $51 million.

In the future, Livepeer also plans to expand its capabilities across the media value chain, including video NFT support. It is reported that Livepeer is a decentralized video transcoding platform that converts video from one file format to another.

(4) OpenSea (Polygon) sold nearly 2 million NFTs in December last year

(5) Samsung has reached a cooperation with Decentraland, and the virtual Samsung 837X store will be open for a limited time

4. Borrowing

DefipulseSamsung Electronics America has reached a cooperation with Decentraland, an Ethereum-based metaverse platform, and the virtual Samsung 837X store will be open in Decentraland for a limited time. “This is one of the largest branded land acquisitions in Decentraland’s history,” Samsung said. (The Block)

4. Borrowing

5. Mining

(data from etherchain.org)

etherchain.orgFrom the perspective of individual projects, the top three lock-up values are: Maker $16.02 billion; Curve $15.17 billion; Convex Finance $11.37 billion.

4. News

image description

(data from etherchain.org)

4. News

(1) Tether freezes USDT worth more than $1 million in a single address

On-chain data shows that Tether froze over $1 million worth of USDT last week. Considering that this belongs to a single blockchain address, this number is very large. Tether called the AddedBlacklist function on December 30 to block this address in the transaction.

This address is now unable to transfer frozen funds. It is understood that when Tether blacklists an address, it freezes the USDT balance of that address. Its unclear who owns the address, which also holds many other sub-five-figure tokens that havent been transferred yet. Data shows that Tether has banned blockchain addresses since 2017, and has blocked more than 500 addresses on Ethereum so far. (The Block)

(2) 2021 Web3 Developer Report: More than 18,000 monthly active developers submitting code in open source encryption and Web3 projects

Official news, Electric Capital released the 2021 Web3 Developer Report, which identified nearly 500,000 code repositories and 160 million code submissions. The report states:

2,18,000+ monthly active developers committing code to open source crypto and Web3 projects;