Original Author: Connie Wang

What defines a creator economy?

I see two key aspects of the creator economy:

(1) Creators are able to exchange unique personal content to fans and followers and monetize traffic.

(2) Build tools and infrastructure to create or manage content. On an individual basis, creators often look like independent influencers, bloggers, videographers, and writers. For businesses building the backbone of the creator economy, this includes platforms to host content, software to manage it, and financial enablers.

Why should we care?

Because of its ubiquity, the maker economy will be called the economy. Over the past few years, weve seen a new work culture emerge - where people want to be able to set their own hours, wages and types of work. As new work models and job definitions expand, such as the gig economy, people are able to set their own schedules. However, people are moving away from monotonous and repetitive workflows and towards creative ways to make money on their own terms. About ten years ago, it was not realistic for people to monetize their creative hobby or passion - until now. People are able to monetize their creative interests and follower relationships through the new platform.

Younger generations flock to the creator economy to monetize their passions and interests. In fact, surveys show that 29% of Gen Z kids want to be YouTubers! Ultimately, everyone is a content creator in some way, shape or form. The presence of social platforms will shift attention from task-based work to coaching, service, and the arts.

Creators with large audiences are the influencers of their generation. According to Morning Consult, three-quarters of millennials and Gen Zs follow influencers on social media, and more than half of them trust influencers to give them good advice about the brands and products they promote. Social media has become a platform and driver of consumer decision-making. Younger generations trust the advice of those they follow, through which their views of culture and the world are shaped.

In the future there will be more opportunities to monetize by launching new platforms. No doubt, businesses and investors are watching closely. Creator economy startups have raised four billion dollars in funding so far in 2021. Last month, older platforms like Pinterest tried to grab creator share by introducing live shopping from popular influencers. Dropbox is trying to introduce creative tools for companies to collaborate on sharing and editing video content. TikTok and Clubhouse have started trying to monetize by launching their creator funds last year.

Who is the creator?

The global market size of the creator economy is estimated at about $100 billion and growing as more and more people move from part-time to full-time creators.

Around 3 million creators are thought to be producing content full-time on the major platforms. In general, full-time creators can be measured by subscriber count and annual revenue. According to Neoreach, roughly 43% of creators earn more than $50,000 per year from pure content. Most creators earn their income from brand partnerships and advertising revenue, with YouTube taking the lions share of revenue.

In addition to full-time creators, 47 million people are amateurs or amateurs who have the potential to move into full-time creator roles. This is important as younger generations increasingly look to monetize their passions and interests, thereby giving birth to the next generation of independent creators and individual entrepreneurs. These emerging artists, stalwart creators, and individual entrepreneurs are focused on growing their social presence across platforms and monetizing their followers directly.

While more and more amateur creators are turning into full-time creators, the power curve for the top creators accounts for most of their income and spending. Lets take Addison Rae as an example. Addison Rae is a popular Gen Z influencer who started with Hype House and is now considered one of the highest paid influencers. In 2020, she is the highest paid TikToker with an estimated earnings of $5 million. that year. She currently has 86 million followers on TikTok and 40 million on Instagram. According to Rockwater, 2/3 of her income comes from sponsorships and partnerships. The brands she has worked with include Iamkoko and Fanjoy co-branded products with her, and she has been a brand ambassador for American Eagle, as well as SKIMS and FashionNova. She also recently launched new ventures in the music and podcasting space. Addison is categorized as an elite creator earning more than $1 million a year, the people who make up most of the value of the creator economy.

The Landscape of the Maker Economy

I have broken down the following main categories within the creator economy:

1. Social Media – a heavily used content discovery platform that creators use to amplify their reach

Social Media: Clubhouse, TikTok, Discord, Instagram, YouTube

Social Gaming: Twitch, Discord, Shotcall

Social Networks: Lex, Snap

2. Exclusive creatorsFan Content - A platform for creators to publish exclusive content for fans to access, providing direct content distribution control and means of monetization.

Fan Memberships: Patreon, Onlyfans, Substack

1:1 mentoring: Mentorcam, Metafy, Cameo

Creative Media: DAOrayaki, Bankless, Mirror

3. Participatory learning - accessible online learning websites, more sources of teachers, more attractive learning content and teaching methods.

Queue-based: Maven, Circle

Interest-based: Skillshare, Masterclass

Education/Higher Education: Outlier

4. Content editors – software to better generate and edit content. AI-layered tools are creating faster, more efficient workflows across a variety of consumer and B2B use cases.

Visual: Kapwing, Canva, Facet

Video: Descript, Biteable, Milk Video

Text: Copy AI

Website: Webflow

5. Financial Tools – Business tools for creators to distribute revenue, send payments, and generate financial insights. For banking, this newer category includes credits and loans tailored to creators.

Payment: Stir

Banking: Karat, Oxygen

6. Shopify for Creators – Startups that allow creators to easily launch new businesses such as merchandise, product lines, courses, and offer multiple products in one place.

Goods: Pietra, Merch, Cala

CRM:Beacons、Stan、Pico

Events: Moment, Playground, Welcome

Podcast: Redcircle, Chartable

7. E-Commerce and Marketplaces – New categories for consumers to shop and buy/sell unique assets.

Live: Popshop, Supergreat

Collections: Whatnot, Sorare

NFT/art: OpenSea, Rarible, SuperRare

8. Infrastructure - the enabler of the next generation of web3 and frictionless e-commerce.

Cryptocurrencies: Bitski, Venly

E-Commerce: Shipbob, Fabric, Postscript, Bolt

Courses: Teachable, Kajabi, Podia

9. Other/new asset classes – nascent categories that democratize access to traditional industries through crowdfunding.

Social Investing: Trading TV

Music: Royal, Indify

Movement: Topshot

creator trends

Multi-platform presence requires greater collaboration and integration

Most creators run communities of followers on multiple platforms, although most use Instagram as their primary channel. Creators will continue to diversify their revenue streams. While YouTube still accounts for the majority of monetized dollars, that percentage is slowly changing due to the explosion of new platforms that are just starting to try to monetize (i.e. TikTok, Clubhouse, Substack). Beyond these popular social media platforms, there are new opportunities for creators to monetize in specific niche verticals, such as 1-on-1 game coaching (Metafy) or writing through crypto (Mirror). In general, creative sharing, via encryption, and creator content tools appear to be growing rapidly.

Community building is essential

Creators need real engagement and followers to monetize themselves. As kk.org wrote in an article called 1,000 True Fans, its not about the number of views/following, its about the direct connection. If the creator has a few real followers who will keep buying the creators work, they can earn a decent salary.

Creators need tools to manage their engagement and business

Creators need tools to gather their revenue streams and analyze them to grow their businesses. Creators are now micro-businesses with multiple revenue streams, making money from fans through multiple channels: social media ad revenue, brand sponsorships, brand partnerships, merchandise, knowledge courses, podcasts, books/webinars, etc. So without the right content curation, financial management, data-driven and fan engagement tools in place, it will be harder for creators to manage, track and grow their business.

Tools rely on creators who already have a following

Market opportunities

Market opportunities

New Creator Platform

New Creator Platforms – New platforms to publish and engage with content will continue to form. In particular, NFTs are creating a whole new realm of creation and digital ownership. Digital goods that were previously difficult to monetize have been acquired via NFTs – digital art (Open Sea), music royalties (Royal), research papers, tweets (Valuables by Cent), and even clips of music videos or sports moments (Top Shot) .

New models of participatory learning - More and more creators are leveraging existing platforms to monetize knowledge sharing through tutorials, events or classes. Media consumption creates a more engaging channel for online learning. Examples include creators or experts who create their own courses (Skillshare, Maven) - varies by category or specialization. In the B2B space, companies will invest in education (Outlier), employee learning/training systems, virtual events/conferences (Hopin), and trade schools.

Other tools and infrastructure

E-commerce for creators – In e-commerce, creators have a greater opportunity to launch their own direct products or services without brand partnerships (led by top creators). Emerging startups like Merch and Pietra are bridging the gap between brands and creators by allowing creators to create their product lines “out of the box” by partnering directly with established suppliers.

Tailor-made financial management - Creators lack financial infrastructure for payments, business management, and banking. Most creators turn to freelance accounting and invoicing software providers like Freshbooks or Honeybook. Other direct p2p apps like Venmo, Cash App, Paypal are easy to use for payments, but are not deeply integrated into the creator ecosystem or compatible with these sites, which is what Stir aims to solve. In banking, players like Karat offer digital creators tailored lines of credit and savings. Creators have the opportunity to gain greater insight into their revenue streams, access credit, make collaborative payments, and automate tax and compliance needs.

AI-enabled content generation software—the traditional mode of creating and editing content—whether text, video, live-streaming, photos, audio, will be 10x faster with AI-powered recommendations. On the B2B side, exciting application examples include automated copywriting for marketing teams (Copy.AI), video and audio editing/transcription for research teams (Descript, Dovetail), personalized video for sales teams (Tavus), designed Smart photo editing teams (Facet), and even slideshow templates for business teams (Beautiful.AI, Matik).

How New Startups Can Stand Out

Experienced management team in content operations

Teams that understand what creators do, whether they experience the creators lifestyle first-hand or work for a related media platform, can market creators more effectively. Examples include Jack Conte, the founder of Patreon, a musician himself who also created a platform to crowdfund his music videos. Other examples of industry insiders becoming founders are Stir, whose management team hails from YikYak, Facebook and Brex. Karat Financials team combines Instagram and YouTube experience. These founders care deeply about helping creators, working closely with them on marketing and product feedback.

Attract creators to go viral with their software

Creators are very keen on sharing tool recommendations. Creators who like a product share it with each other through word of mouth, or advertise to their follower base, creating a positive flywheel that lowers acquisition costs. The way the team creatively tries to market their products cost-effectively is through their own social media content, viral expertise, and direct collaborations with other creators. There are of course other approaches, such as in the payment space, including peddling creator-friendly terms with zero transaction fees to lure creators away from larger competitors.

Take creator income as a core indicator

Measuring how creator revenue grows over time is a positive indicator that the platform is providing a valuable service to creators. The more creators earn on the platform early on, the higher the creator’s retention rate and the more revenue they can earn through additional analytics, collaboration, and services in the future. Higher earning and growing creators tend to stay on the platform better.

Content discovery is critical

Any creator tool that includes creator/user content, such as Kapwing, Pinterest, or Canva, needs to create network effects through delightful content discovery and sharing. Platforms that successfully recommend great content generate higher user retention and creator engagement. Studies have shown that fans are willing to pay more for each additional creator—adding to the creator’s wallet, not dividing it—which is why creators find that it’s actually beneficial to both parties, rather than cannibalizing the creator.

current profit model

Creators will flock to platforms with mass reach (to acquire audiences) or a fair share of revenue (to monetize).

The ad-driven model is suitable for mainstream distribution platforms with high consumption. YouTube introduces several business models through its partner program. YouTube users can earn through advertising, subscriptions, donations, live streaming and YouTube Premium. YouTube accounts for 30% of subscriptions. YouTube is starting to provide more spending transparency, introducing a new metric called revenue per mile (RPM). RPM measures the total revenue a creator earns (from advertising and other monetization areas) per 1000 views after YouTube gets a cut. Its ad-driven revenue requires creators to be inclined to produce videos with more than 1 million views. Ad-driven monetization is often less transparent and more complex.

Brand partnerships offer higher rewards for creators on major platforms. TikTok and Instagram allow creators to partner with brands to post content. Creators will post photos or ads with the hashtag Collaboration on Instagram. On TikTok, branded content must be tagged with #ad. Brand deals are highly dependent on creators and payment structures (i.e. engagement per view or per post). TikTok is the latest contender to achieve scale and more recently monetize creators. TikTok launched its Creator Fund, a $200 million program expected to grow to $1 billion over the next three years, to pay eligible creators. These creators need more than 100,000 video views in the past 30 days and will be paid based on various factors in the video, which TikTok did not elaborate on.

Tips are a newer feature that go directly into the creators pocket, but in smaller amounts. Newer platforms such as Clubhouse have recently introduced tipping features, but creators have yet to fully monetize the platform. TikTok also recently introduced tipping via gifts, with 66 coins per $1 for creators to cash in, but tipping can be infrequent and creators need to be part of those platforms’ partnership programs.

Creator subscriptions break away from the creator/fan relationship, but with less reach. Patreon and Only Fans have become more creator-friendly by reducing subscription fees (about 20%), and they allow creators to set membership rates from fans. However, most membership fees and donations range between $1-20 on Patreon and $4-20 on OnlyFans. Both platforms are limited in content discovery; fans join after being encouraged by creators or manually searching for people to follow. As a result, creators are primarily turning fans to Patreon as recurring income, rather than using Patreon to grow their following.

open market comparison

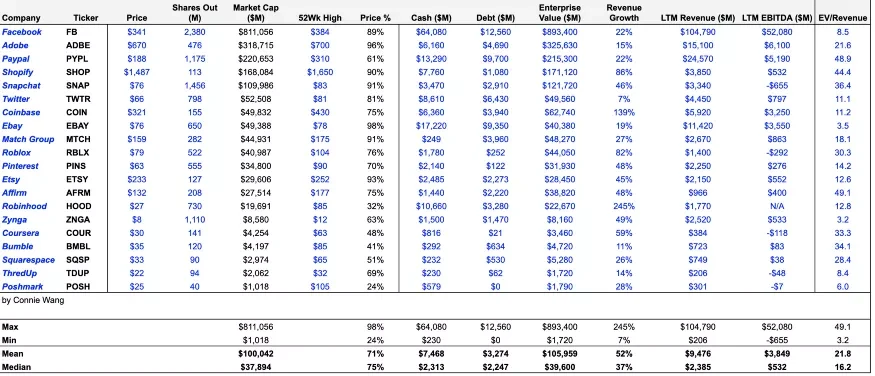

I have selected a range of public comparables in social media, creator software, fintech/payments, e-commerce platforms, gaming, learning and p2p marketplaces. These companies recently traded at an average EV/Revenue multiple of 21x. Candidates for an upcoming IPO are evaluated on a variety of factors, including growth, profitability and profit margins.