According to Odaily’s incomplete statistics, a total of 24 domestic and overseas blockchain financing incidents were announced during the week from March 21 to March 27, a decrease from the previous week; There is a significant decline.

The following are the specific financing events (Note: 1. Sorting according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a traditional company whose business involves blockchain):

The following are the specific financing events (Note: 1. Sorting according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a traditional company whose business involves blockchain):

News Yuga Labs (the issuer of Bored Ape Yacht Club) announced today that it has completed a new round of financing of US$450 million at a valuation of US$4 billion, which is also the largest financing in the NFT industry so far. This round of financing was led by a16z, with participation from Adidas Ventures, Animoca Brands, Samsung, Google Ventures, Tiger Global, FTX Ventures, Coinbase Ventures, and Moonpay. Meanwhile, a16z partner Chris Lyons will join Yuga Labs’ board of directors.

Yuga Labs stated that this round of financing will be used to start the game and launch its own metaverse project: Otherside. Wylie Aronow, co-founder of BAYC, said that Otherside hopes to build an interoperable world that is gamified and completely decentralized, while attracting more NFT projects into its own ecology. (The Verge)

Bitcoin mining company Greenidge Generation completes more than $100 million in financing

Bitcoin mining company Greenidge Generation Holdings Inc. (NASDAQ: GREE) announced on Thursday that it has completed two financings totaling approximately $108 million to provide the company with additional liquidity to fund business expansion through 2022.

The financing includes an approximately $81.4 million loan from an affiliate of NYDIG secured by a portion of the Bitmain S19 J Pro Antminer for delivery in 2022, and a secured note of $26.5 million from an affiliate of B. Riley Financial, Inc., secured by Greenidges Spartanburg, SC factory real estate bond.

Cricket NFT platform FanCraze completes US$100 million in Series A financing led by Insight Partners

FanCraze, a Flow-based cricket NFT platform, has completed a US$100 million Series A financing led by Insight Partners, with participation from B Cpital, Mirae Financial, Tiger Global, Coatue Management, Sequoia Capital India, and Courtside Ventures. It is reported that Ronaldo also participated in the investment.

Game developer Gamefam completes $25 million financing led by Konvoy and Play Ventures

Game developer and publisher Gamefam announced a $25 million Series A round led by Konvoy and Play Ventures, with participation from Makers Fund, Bessemer Venture Partners and Galaxy Interactive. Funds from this round of financing will be used to develop games on the metaverse platform Roblox. (Venturebeat)

NFT price evaluation protocol Upshot completes $22 million in financing, led by Polychain Capital

Upshot, an NFT price evaluation protocol, has completed a US$22 million A2 round of financing, led by Polychain Capital. Other specific financing information has not yet been disclosed. Funds from this round of financing will be used to develop pricing models, build teams, and fund new DeFi primitives and related development tools.

It is reported that Upshot’s previous investors include Framework Ventures, CoinFund, Blockchain Capital, Slow Ventures, Mechanism Capital, Delphi Digital, etc. (CoinDesk)

Cosmos smart contract platform developer Phi Labs completed a $21 million seed round of financing led by CoinFund and Hashed, with participation from 1confirmation, IDEO CoLab, Figment, Blockchain Capital, Wintermute, Chorus One, stake.fish, Lemniscap, Cosmostation, and Hypersphere Ventures .

It is understood that the Archway protocol developed by Phi Labs is an incentivized smart contract platform based on Cosmos and rewarding developers. This protocol provides developers with tools to quickly build and launch scalable cross-chain DApps. Get rewarded for your contributions. (Blockworks)

ALTAVA Group, a fashion metaverse platform, has completed a financing of about 11 billion won (about 9.02 million U.S. dollars), led by Blocore and Animoca Brands, Wemade, Spartan Group, Sky Vision Capital and other institutions, as well as The Sandbox co-founder Sebastien Borget, Binance Private investors including former chief financial officer Wei Zhou also participated. Funds will be used to enhance Altabas services, recruit talent and expand marketing.

ALTAVA Group, a Singapore-based company with operations in South Korea, aims to democratize luxury fashion and retail in the Metaverse.

According to previous news, The Sandbox has cooperated with ALTAVA Group to expand the luxury fashion and lifestyle brands in the Metaverse. (Newsis)

Encrypted information service provider The TIE completed a US$9 million Series A financing at a valuation of US$100 million. Blizzard led the investment, and executives from Golden Tree Asset Management, NYDIG, Hudson River Trading, Republic Capital, Gemini Frontier Fund and Nexo participated cast. Additionally, the company announced that John Wu, president of Ava Labs, will join its board of directors.

It is reported that The TIEs core product is the SigDev terminal, which provides market, company and news data on a single platform. With the new funding, the company plans to expand into three verticals: institutional solutions, data redistribution, and token relationships. (The Block)

Ribbon Finance completes USD 8.75 million Series B financing led by Paradigm

According to data from the financing platform AngelList, Ribbon Finance, an on-chain structured product, has completed a Series B financing of US$8.75 million, led by Paradigm. So far, Ribbon Finance has raised a total of $16.6 million.

In January 2021, Ribbon Finance completed a $1.85 million seed round of financing, with investors including Dragonfly Capital, Coinbase, Nascent, and Scalar Capital. In August 2021, Ribbon Finance completed a $6 million Series A round of financing, with investors including Dragonfly Capital, Robot Ventures, and Nascent.

It is reported that Ribbon Finance launched the ApeCoin (APE) call option vault earlier today.

Open Source Software Building Platform Tea Completes $8 Million Seed Round Led by Binance Labs

Tea, an on-chain open source software construction platform, completed a $8 million seed round of financing led by Binance Labs, with participation from XBTO Humla Ventures, Lattice Capital, DARMA Capital, Coral DeFi, DLTx, Woodstock, Rocktree, SVK Crypto, MAKE Group, etc. Proceeds from this round of financing will be used to expand the team and continue to advance its work in protocol, software and community development. (Techcrunch)

Gensyn, a distributed computing protocol, announced the completion of a $6.5 million seed round of financing, led by EdenBlock, with participation from Galaxy Digital, Maven11, Coinfund, Hypersphere, and ZeePrime.

Gensyn is a distributed computing network that monetizes unused computing power in a verifiable way using the blockchain to verify that deep learning tasks have been executed correctly and trigger payments through tokens. (TechCrunch)

Joystream, a decentralized creator platform, completed a financing of US$5.85 million at a valuation of US$60 million, led by Digital Currency Group (DCG), Hypersphere, Defi Alliance, and D1 Ventures.

Additionally, Joystream is preparing to launch a mainnet in the second or third quarter of this year that will allow for a custom DAO, an NFT marketplace for creator videos, and a platform for creators to monetize their videos using their own tokens. (CoinDesk)

Chain game studio LifeForce Games completes $5 million in seed round financing led by Lemniscap

Blockchain game development studio LifeForce Games announced the completion of a $5 million seed round of financing, led by Lemniscap, with participation from CMT Digital, Sfermion, Hartmann Capital, Sterling VC, Ready Player DAO and Neon DAO. Most of the funding was used to build and launch LifeForces first P2E game. (Crypto Ninjas)

Metaverse Game Studio Block Tackle Closes $5M Funding Led by Play Ventures and Cadenza Ventures

Metaverse game studio Block Tackle completed a $5 million seed round of financing, led by Play Ventures and Cadenza Ventures, with participation from Animoca Brands, Coinbase Ventures, and Solana Ventures.

The studios first release will be SkateX, where players can buy skateboard NFTs and vote on game decisions. SkateX will launch a series of 3D animated skateboard NFTs in April. (CoinDesk)

Binance Labs Adds $5 Million in Equity Investment to Metaverse Project Ultiverse

Binance Labs made an additional $5 million equity investment in Ultiverse, a metaverse project. In addition, Nicole Zhang, director of Binance Labs, said that the additional equity investment is to allow Binance Labs to have a say in the future development of the project.

According to previous news, BinanceLabs participated in leading the US$4.5 million seed round token financing of Ultiverse a week ago to expand the metaverse products in the BNB ecosystem. (The Block)

Red Door Digital (RDD), a game company based in Taiwan, China, completed a $5 million seed round of financing, with participation from M6, Shima Capital, Maven Capital, Cryptology Asset Group, and LucidBlue Ventures.

It is reported that Red Door Digital is currently developing three games, the first of which is Reign of Terror, which is scheduled to be released in the summer of 2022. (CoinDesk)

According to official news, the metaverse algorithmic stablecoin project TeaDAO announced the completion of a $4.6 million seed round of financing. Investors include Shima Capital, Signum Capital, UOB Venture Management, LD Capital, PNYX, HyperChain, MXC, Spark Digital Capital, Mapleblock, Momentum 6 , DFG, JSquare, AU21 Capital, X21, Fomocraft, Basics Capital, Parsiq, Newave Capital, CoinW Venture, NFV Venture, 7 OClock Capital, ZBS Capital, AVStar, HG Ventures, Satoshi and Token Hunter etc.

TeaDAO aims to build an ecosystem that combines DeFi 2.0, GameFi, and Metaverse. It plans to launch the mainnet in 2022. It will initially run on BNB Chain and Ethereum, and then expand to other chains.

Struct Finance, a DeFi protocol, completed a $3.9 million seed round of financing, with participation from Blizzard Fund, Assymets Technologies, Avalaunch, Bixin Ventures, FBG Capital, SCC Investments, and Woodstock.

It is reported that through Struct Finance, users can access structured products and customize interest rate tools. Additionally, users can combine these tools utilizing any of the options provided by Struct Finance. (CryptoDaily)

P2E Game KlayCity Receives $3.75M in Seed Funding Led by Krust and Animoca Brands

KlayCity received $3.75 million in seed round financing, led by Krust and Animoca Brands, Naver Z, FriendsGames, AT Capital, OKX Blockdream Ventures, Genesis Block Ventures, Kyros Ventures, ROK Capital, StableNode, PlayDapp, HG Ventures, Exnetwork Capital founder Eric Zoo, Kwon Do and others participated in the vote. The funds raised will be used to continue to build the virtual world and improve the user experience. (Prnewswire)

Horse Racing Game MetaDerby Closes $2.5M Funding Led by Ava Labs and Old Fashion Research

According to official news, MetaDerby, a P2E game based on Avalanche, completed a $2.5 million seed round of financing, led by Ava Labs and Old Fashion Research, Avalaunch, AventuresDAO, Shima Capital, LD Capital, Keychain Capital, Magnus Capital, Hailstone Ventures, IndiGG, Coins .ph, Dux, MVM DAO, etc. participated in the investment.

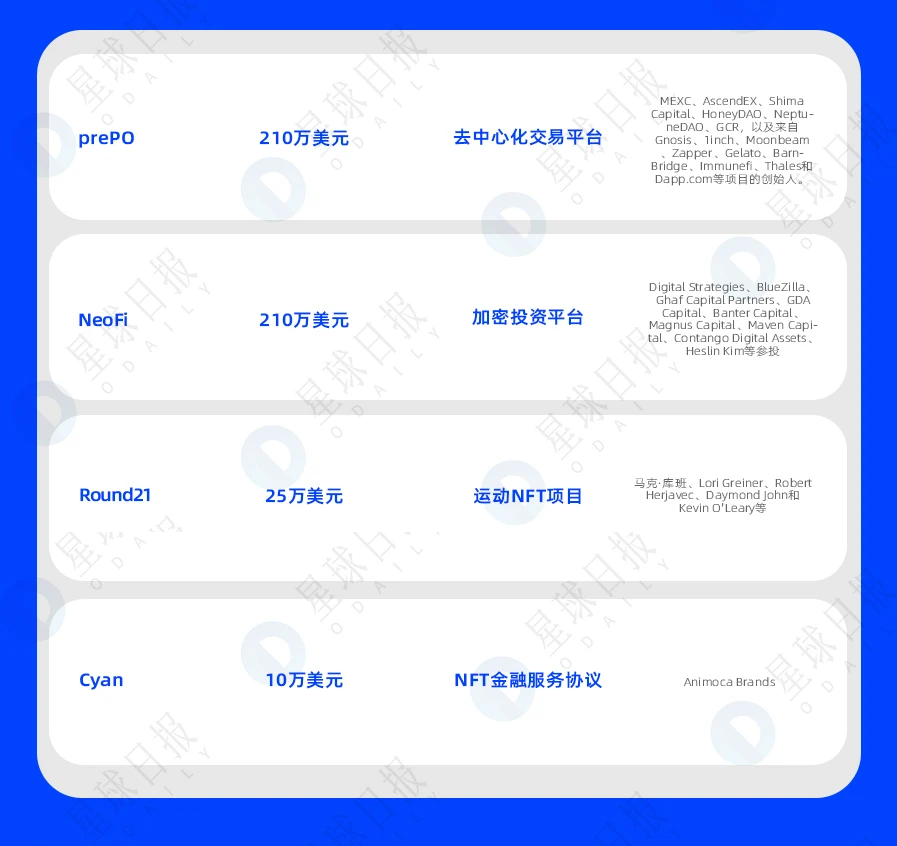

Encrypted investment platform NeoFi completed a strategic financing of US$2.1 million, with participation from Digital Strategies, BlueZilla, Ghaf Capital Partners, GDA Capital, Banter Capital, Magnus Capital, Maven Capital, Contango Digital Assets, and Heslin Kim. (Cointelegraph)

PrePO, a decentralized trading platform focusing on pre-IPO and pre-Token projects, completed a strategic round of financing of US$2.1 million, led by IOSG Ventures and Republic Capital. Participating investors include MEXC, AscendEX, Shima Capital, HoneyDAO, NeptuneDAO, GCR, and founders from projects such as Gnosis, 1inch, Moonbeam, Zapper, Gelato, BarnBridge, Immunefi, Thales, and Dapp.com.

The team plans to launch the token PPO in the second quarter of 2022, and its first generation product will then be launched on Arbitrum. The token sale whitelist is currently open for applications. (Blockworks)

Round21, an NFT project focusing on high-end customized sports goods, won the resident guests of the program on the American venture capital program Shark Tank (Mark Cuban, Lori Greiner, Robert A $250,000 investment from Herjavec, Daymond John and Kevin OLeary, among others, brings the valuation to $8.3 million. (Meaww)

According to official news, Cyan, an NFT financial service agreement, announced that it has received a pre-seed round of financing of US$100,000 from Animoca Brands. The funds will be used to help Cyan launch its BNPL (buy now, pay later) service agreement.

It is reported that Cyan mainly promotes the buy now, pay later service, which is the first agreement to provide financing services for users to purchase NFT. Users can choose to purchase NFT in installments, mortgage NFT to obtain income and other functions. For example, users can purchase BlueChip NFT in four installments within three months, and later functions will be extended to longer periods and more asset classes.

According to official news, Apricot Planet, the Japanese P2E game association, has completed a seed round of financing, and the investor is Animoca Brands. Apricot Planet will use metaverse Job Japan as the new guild brand name.

Bastion, a decentralized lending agreement based on the NEAR blockchain, has completed a new round of financing, with an undisclosed amount. Investors include market maker giant Jane Street, ParaFi Capital, Digital Currency Group (DCG), CMS, and individual investors Darren Lau (The Daily Ape) and 0xMaki.

Bastion’s anonymous founder, N^2, said the project experienced “explosive growth,” with the protocol reaching $200 million in Total Volume Locked (TVL) within 24 hours of launch.

According to previous reports, on March 7, Bastion, a decentralized lending protocol, announced the launch of the Aurora mainnet. The protocol will initially support ETH, NEAR, USDC, and USDT.