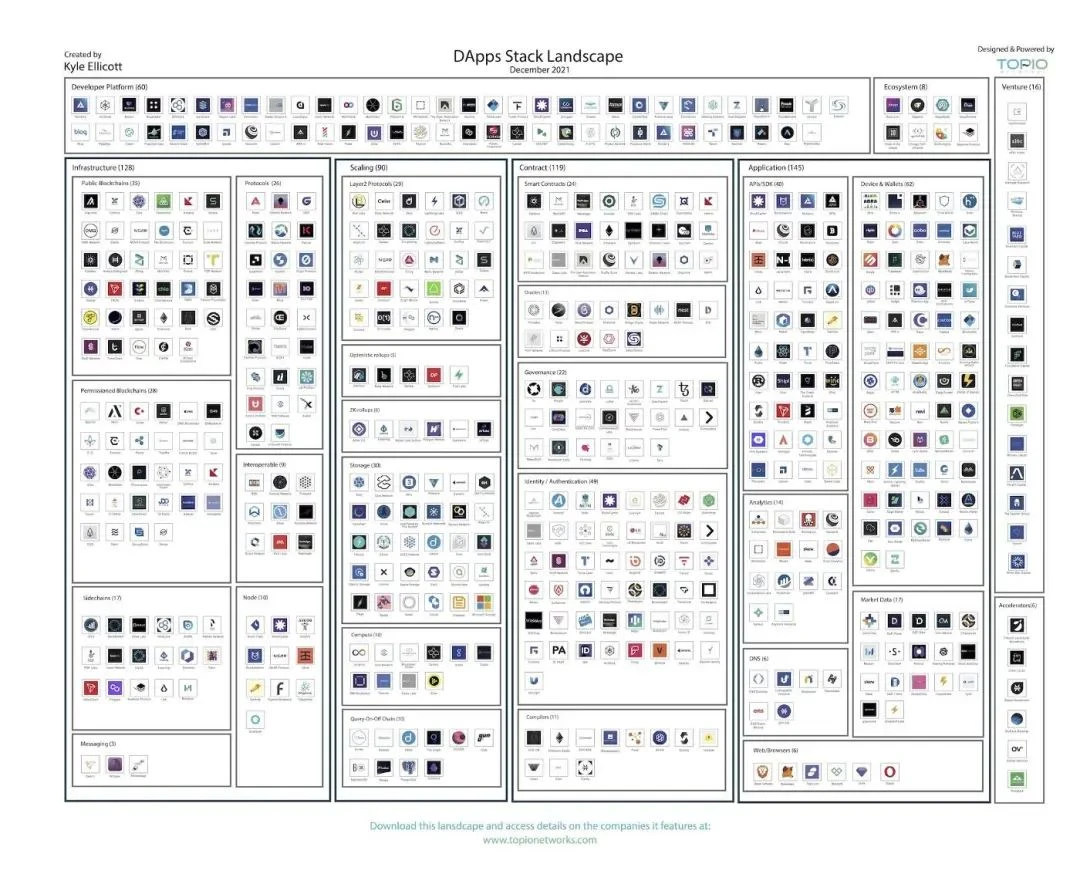

Author: Kyle Ellicott

Original Title: The State of Decentralized Applications (dApps) — H2 2021 Review

image description

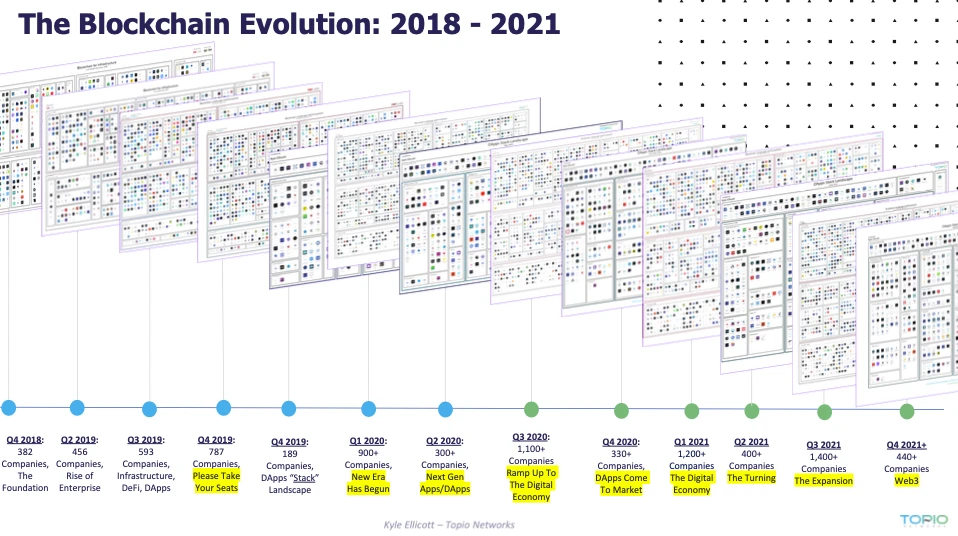

Industry changes since Q4 2018

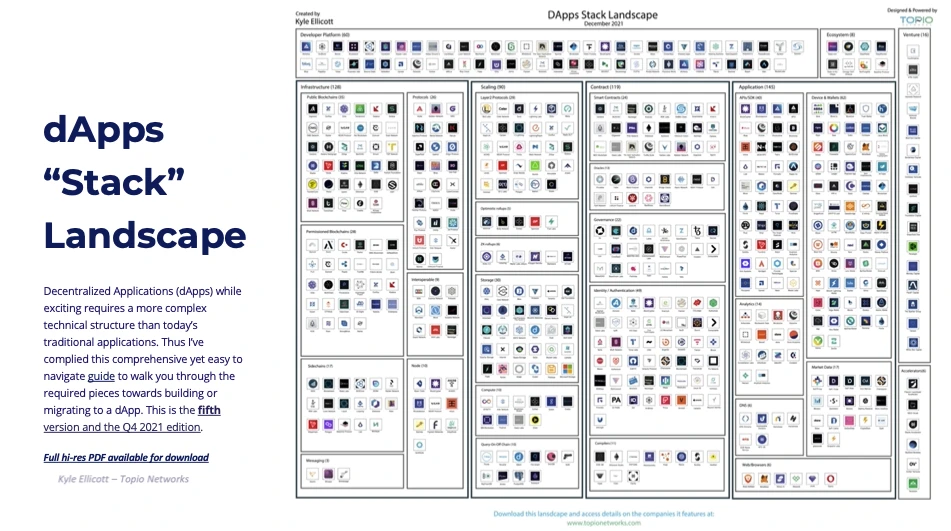

Todays dApps landscape:

image description

Q4 2021 Decentralized Applications (dApps) Landscape by Kyle Ellicott

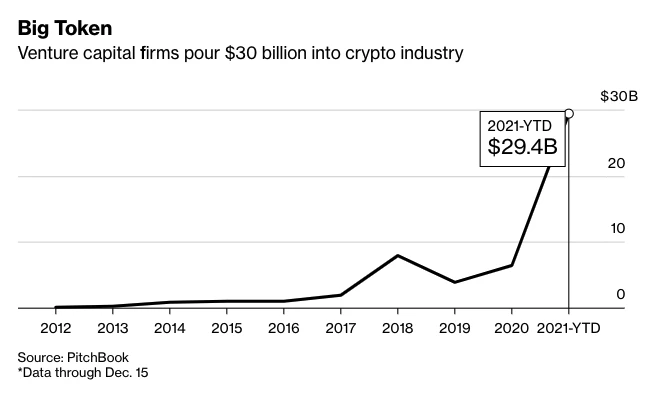

VC and Funding:

In the second half of the year, the capital deployment of the entire field continued to grow. In the third and fourth quarters, there were more than 62 public investments, and ConsenSys (November), Alchemy (October), and DeSo (September) raised more than US$100 million. , Blockdaemon (September), and Dapper Labs (September).

The ranking of venture capital funds has also changed, with Coinbase Ventures topping the list, followed by Digital Currency Group ( DCG ), Andreessen Horowitz ( a16z ), Pantera Capital and CoinFund.

At the same time, some newcomers entered, such as from Variant Fund ($110M, Fund II ), Paradigm ($2.5B Fund II ), Borderless Capital ($500M Fund II ), Chapter One ($40M ), and Solana, Polygon and Oasis Protocol foundations, which added an additional $40 million this week, bringing their total fund size to $200 million.

image description

Source: Pitchbook Bloomberg

Layout breakdown:

Building dApps is different from what was done in the web2 and mobile era before. For ease of understanding, Ive broken down this layout diagram into sections that will help you understand what each building block (or layer) does as you read it.

L 0+1/Infrastructure (Blockchain, Protocol, Node+)

L2/Scale (L2s, Aggregate, Store, Query, etc.)

L 3/contract (smart contract, oracle, authentication, etc.)

L 4/Applications (API, Wallet, DNS, etc.)

Key directions:

In December 2021, I mentioned that the following key directions were on the verge of moving, and sure enough, in January 2022 they have made great progress.

1/Agreement

2/Rollups

3/DNS ( .ENS .BTC .SOL)

4/DAO

5/ Contract language - Solidity vs. Clarity

6/ wallet (authentication)

protocol. As more and more protocols are launched and developed from testnets to mainnets, the topics are varied. Such as the CityCoins protocol, where developers can create CityCoins (such as Miami Coin and NYC Coin) that communities can use to govern better cities, while providing crypto rewards for individual contributors and city governments, all powered by Stacks provide support.

Rollups. Because dApps have the need to maintain competitiveness and improve security, both Optimistic and Zero-Knowledge will become important directions in 2022. For example, ConsenSys and Mastercard (MasterCard) cooperated to launch ConsenSys Rollups, and Polygon, one of the layer-2 solutions, acquired Mir (now Polygon Zero) for $400 million in December.

DNS. Developments between Q4 2021 and January 2022 have shown us that domain names (.ETH .BTC .SOL .crypto, etc.) can be used not only for website or wallet addresses, but also as a means of identification and verification. For example, Unstoppable Domains introduced the option Sign in with Unstoppable that uses NFTs to provide single sign-on services for ETH and Polygon. Allowing users to log in with NFTs (such as yourname.crypto) gives users the ability to control what data can be accessed Permissions to share or display to applications, which is a step closer to users truly owning the Internet. It is expected that in the coming year, around identity-based NFT (LinksDAO, Poolsuite, RAD Live) and domain names (.ETH .BTC .SOL .crypto, etc.) will be more widely used, which also means that the convenience of access will be greatly increased.

Revisiting Turning:

In my last dApps summary covering the first half of 2021, I called what happened in the industry a turning point. The time has come and the changes in the industry have prompted me to decide to re-examine some of the previous content and reflect on What happened in the second half of 2021 and the outlook for 2022:

Protocol developers and maintainers cooperate with traditional venture capital with the goal of developing and improving the industry ecology. [Looking back at Q4, we saw more and larger funds of this form, such as Hederas $5 billion funding, Oasis $200 million, NEAR Protocols $150 million (January 22) + $800 million $21 million from Polygon+ AU21, $300 million from Harmony, and more. I expect this trend to expand further in 2022, as more and more developers continue to enter the industry, the network will become a battlefield for developers and new dApps. In theory, this would also speed up exchanges and cooperation between different networks, as developers look to engage with cross-chain communities. ]

VCs are adding “dApps” to investment research reports and launching new protocols-specific funds. [In Q2, dApps appeared in many investor research reports, in H2, we saw this trend shift to a wider range of specific keywords, such as Web3, infrastructure tools, and ownership economy Play-To-Earn, GameFi, Blockchain Games, DAO Stack and NFT, etc.]

DAO (Decentralized Autonomous Organization) This is a company-like organizational structure with great potential. [We will see this space develop extremely rapidly, such as PleasrDAO bought Wu-Tang Clans album for $4 million, ConstitutionDAO raised more than $40 million in a week trying to buy a US Constitution, but there are also negative ones like SushiSwap case. But I, and many others, still think that 2022 will be a big year for DAOs.

We are seeing investments via SAFTs (Simple Agreement for Future Tokens) making a comeback, and although unlike the boom of 2017-2019, it is undeniable that traditional venture capital and other institutional investors are participating on a massive scale. [In short, investment in the entire space is currently over $30 billion. If you and your company havent started considering these new financing methods, I encourage you to.

Exchanges expand NFTs into the alternative asset class. (such as Binance, Korbit (Korea), Wazirx (India), FTX, etc.)

Cross-chain bridges can allow exchanges between blockchains that have not yet had interoperable permissions. [I touched on this above, and expect to see more mature cross-chain bridge products emerge in 2022.

Consensus mechanisms have expanded from Proof-of-Work (PoW) and Proof-of-Stake (PoS) to Proof-of-Transfer (PoX), Proof-of-Protocol Authority (PoA), and more.

Cloud computing companies are in acquisition mode because they cannot keep pace with the development of decentralized infrastructure. [This space is likely to start heating up in 2022 and take shape in early 2023, largely because of concerns raised by dYdXs outage on AWS in December. ]

More and more companies, governments and small businesses are adding digital assets to their balance sheets.

Business models like Play-To-Earn (P2E) will be widely promoted. [2022 may be the golden year of DAO, I predict that P2E and blockchain games will also become the most prominent themes this year, behind which lies their determination to bring the next billion people into the encryption + web3 world. So, I expect to see more XYZ-To-Earn models across many industries.

lets move:

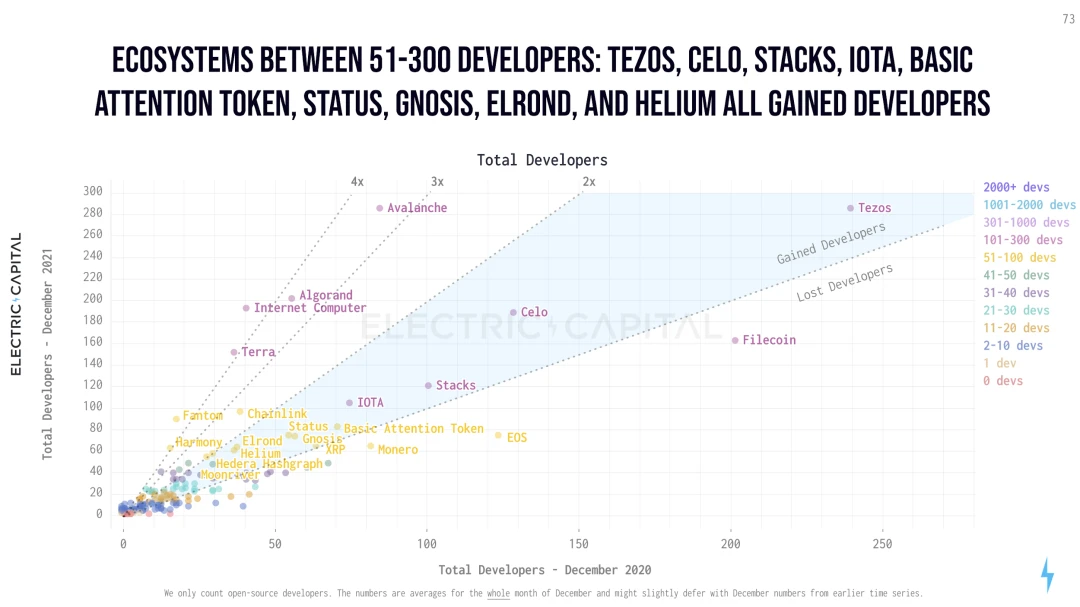

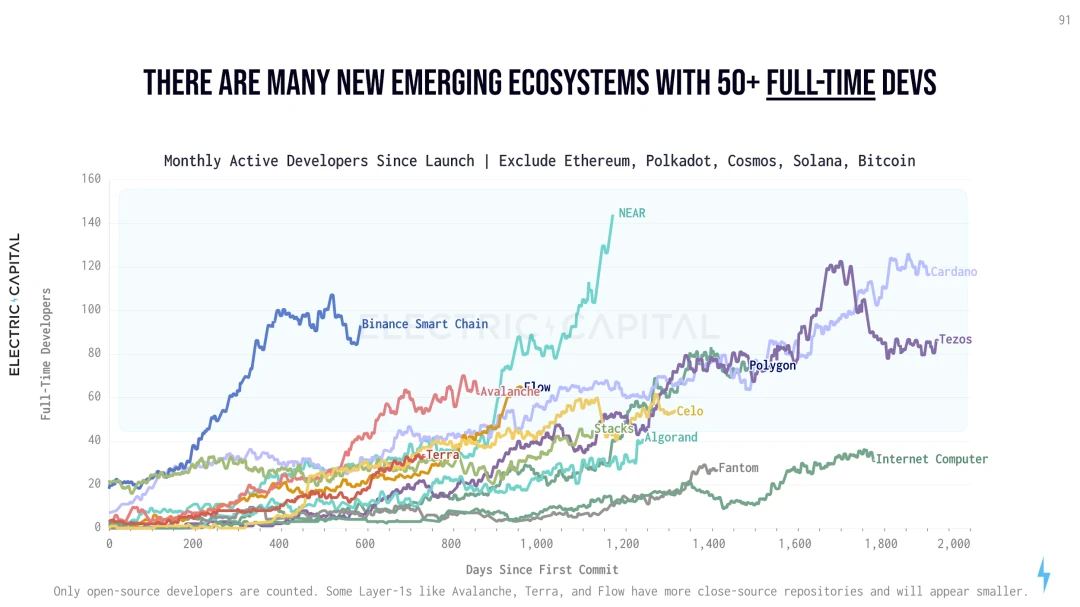

image description

Source: Electric Capita 2021 Developer Report

Taken together, the year leading up to 2022 will be an exciting one. If you are interested in building dApps, web3 infrastructure on the above topics, or want to discuss more about the future of decentralization, please contact us.