first level title

1. Overview of Osmosis

Since it is a DEX based on a separate blockchain, the degree of customization is higher than other DEXs developed by smart contracts.

first level title

The operation of Osmosis is similar to other AMMs. Liquidity Provider adds token pairs to the Liquidity Pool as liquidity and becomes the counterparty of the trader; LP receives LP token GAMM as a certificate for adding liquidity. At present, the function is relatively single, and it has not yet integrated other DeFi-type applications.

text

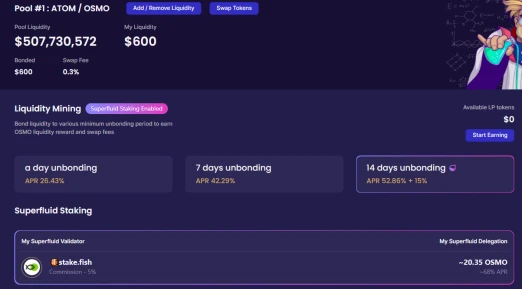

Including transaction cost, number of token pairs, weight and market maker strategy (curve) can be customized by users. Whether the liquidity pool can receive OSMO token rewards needs to be decided by community voting; but for liquidity pools that do not receive incentives, creators can add external incentives and set time, quantity and other variables by themselves. Creating a liquidity pool requires paying 100 OSMO to the community.

text

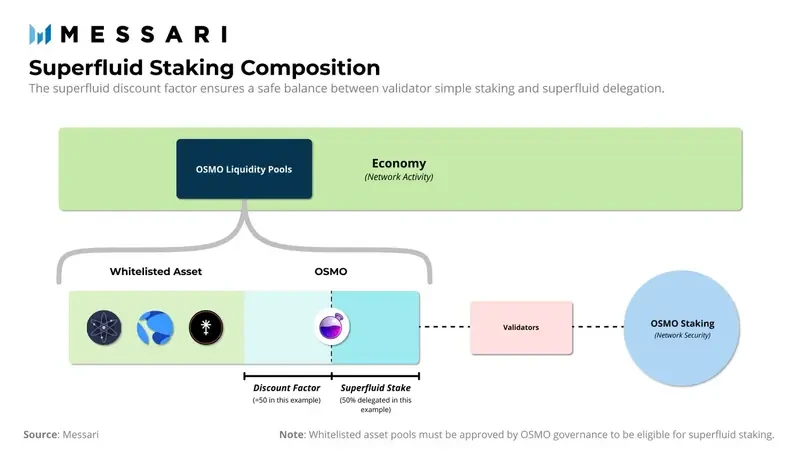

(2) Superfluid pledge Superfluid

Superfluid staking allows a liquidity provider to use its native OSMO token to provide liquidity while using the same token for staking. This innovative LP Staking model not only improves the capital efficiency of users, but also brings security to the underlying network, which is a win-win situation.

Compared with the existing LP token derivatives model, this method has lower systemic risks.

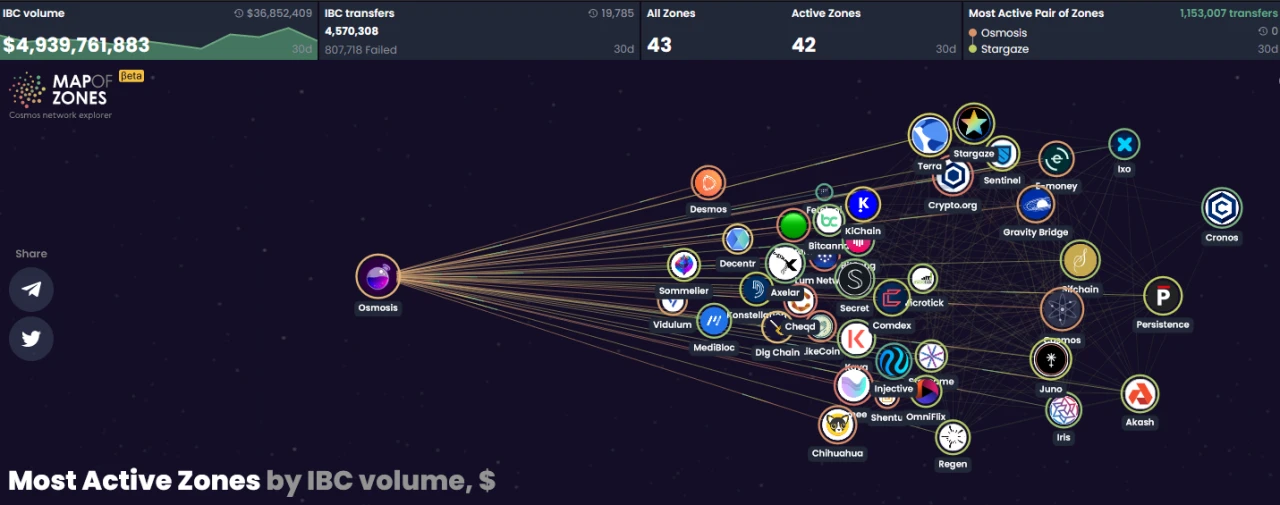

(3) Interfluid Staking Interfluid

According to an interview with founder Aggarwal, Superfluid Staking is just the first step in the Osmosis vision. The next step is to develop Interfluid Staking, a service that extends hyperfluid staking to other chains, allowing other Cosmos chains to use the liquidity pool on Osmosis to secure their respective networks. For example, if JUNO/OSMO is approved as an ultra-liquidity pool token pair on Osmosis, the Juno network can use some of the Juno in the pool to improve its own security.

The chains using the Interfluid function form a large cross-chain network, and Osmosis becomes the Staking hub in the network.

(4) Integrate CosmWasm

In the future, the functions of Osmosis will be further enriched and improved.

first level title

3. Investment institutions

On October 28, 2021, Osmosis raised $21 million through a token sale (OSMO price was about $5.8 at the time), led by Paradigm, Robot Ventures, Nascent, Ethereal, Figment, Terra founder Do Kwon, Compound founder Robert Leshner, etc. Participate in voting.

Charlie Noyes said on Twitter that he and Sunny Aggarwal, one of the founders of Osmosis, have had a cooperative relationship and friendship for more than 4 years. Osmosis will further promote the expansion of IBC and solve MEV and privacy issues.

first level title

4. Founding Team

Sunny Aggarwal

The project is developed by Osmosis Labs, founded in January 2021 by Sunny Aggarwal, Josh Lee and Dev Ojha. The three founders all have working backgrounds in Tendermint and have participated in various projects including the development of the underlying architecture of the Cosmos ecosystem and the Keplr wallet.

Josh Lee

Indian, UC Berkeley EECS background, is the co-founder of Blockchain at Berkeley, worked as a Course Designer and Lecturer in Berkeley; as a Research Scientist during Tendermint, he is the core developer of Cosmos SDK, and he is also the co-founder of the verification node Sikka company -founder.

Dev Ojha

Korean, once worked as an editor and researcher in South Koreas blockchain media; later worked as an analyst at Tendermint, mainly responsible for strategy, ecosystem development, etc., with a function biased towards product manager/project manager, and also the co-founder of the Keplr wallet team.

The founding team has a strong technical background, complemented by product managers, and the team structure is reasonable.

first level title

5. Token economy

The native token OSMO supports all functions of the Osmosis application chain, including: security staking, community governance, LP rewards and handling fees, setting up liquidity pools, and paying transaction handling fees.

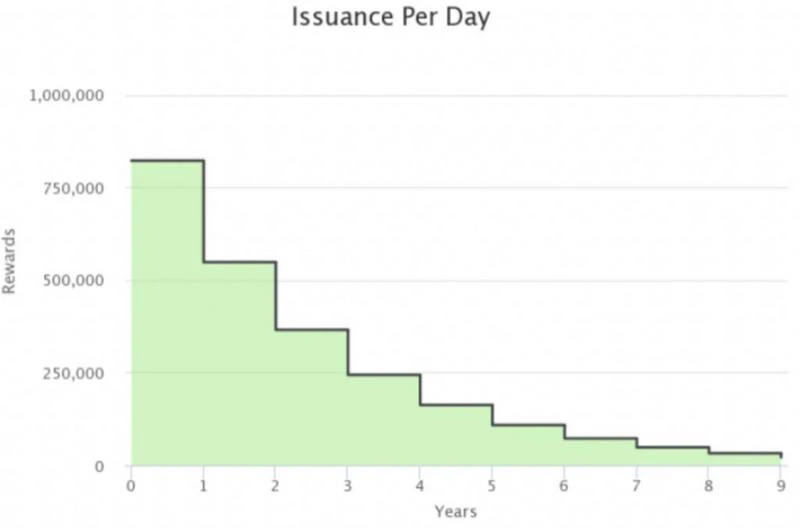

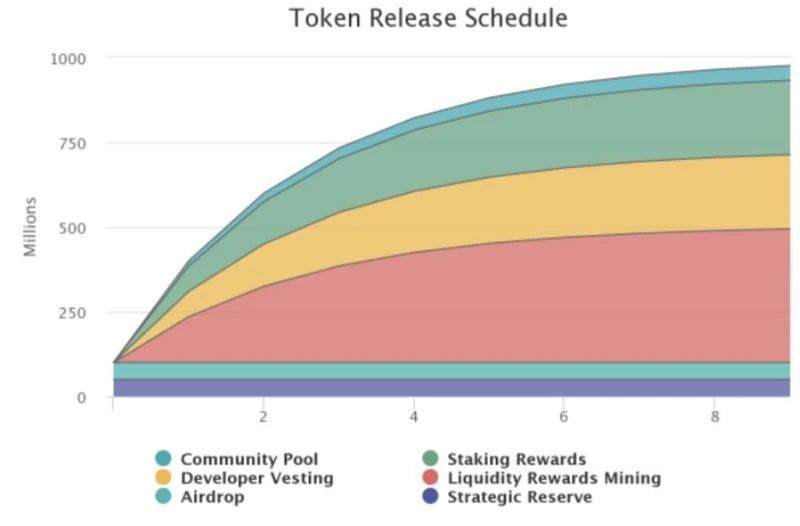

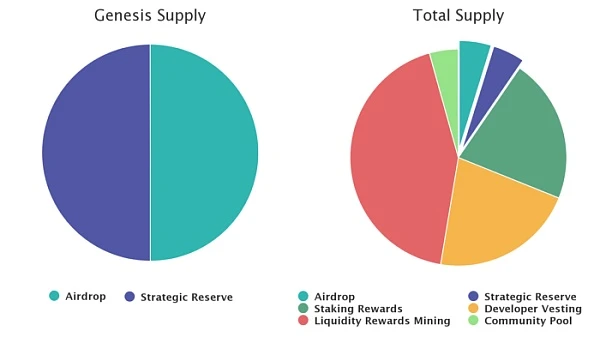

There are a total of 100 million Genesis tokens, 50% of which are distributed to ATOM pledgers and LPs through airdrops and activities at launch, and 50% are reserved for community strategic reserves. New tokens will be issued through staking rewards, developer rewards, community pools and liquidity mining incentives, of which the total of staking rewards and liquidity mining incentives will account for 70%.

Token distribution is more user-friendly, the current inflation is high, and the pledge rate is low (35%).

first level title

6. Token Valuation

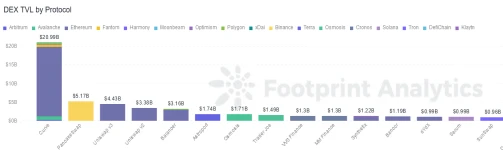

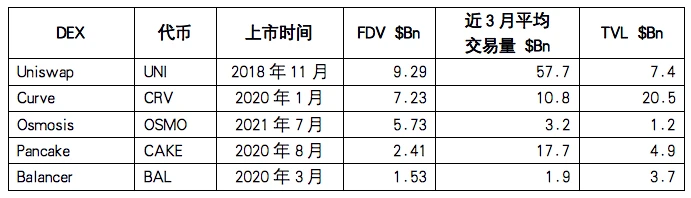

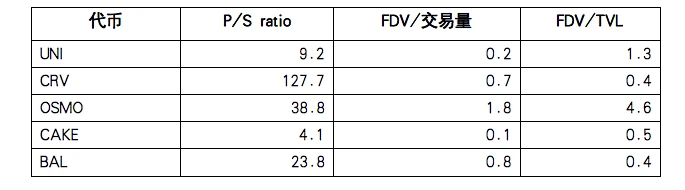

Since different DEXs have different methods of calculating transaction fees, the horizontal comparison of P/S ratio is of little reference significance. However, through FDV/TVL, it can still be found that the overall valuation of OSMO tokens is higher than that of other DEXs. It can be considered that the market is significantly optimistic about the future development of Osmosis. The current price already includes the market’s expectations for the future development of Osmosis and the addition of IBC cross-chain.

At the end of 21, the Cosmos ecology was active as a whole, and there were many airdrops; Carbon was upgraded at the end of February this year; these two positive events have brought about the rise of OSMO. At present, TVL and currency prices have recently deviated to a certain extent, and the price of OSMO has fallen sharply due to the impact of the market , Started valuation restoration, combined with the macro environment, we believe that the current price is average, and we need to pay attention to whether the TVL will continue to fall sharply in the later period.

first level title

7. Current Weaknesses and Future Prospects

The pledge rate is only 35%, relatively safe

Response: The official said that the shared security function of Cosmos Hub will be enabled in the future

first level title

8. Summary

first level title

Reference:

https://app.osmosis.zone/pools

https://www.mintscan.io/osmosis/

https://thedefiant.io/paradigm-backs-cosmos-dex-osmosis/

https://messari.io/asset/osmosis/research

https://docs.osmosis.zone/overview/

https://medium.com/osmosis

about Us

about Us