first level title

1. Application background of THORChain

THORChain proposes a solution to this problem. Founded in 2018, THORChain is an independent Layer 1 ecosystem that provides users with direct transactions of native currencies. Customers can conduct decentralized transactions on native currencies without going through the regular KYC process of CEX.

first level title

2. THORChain background and team

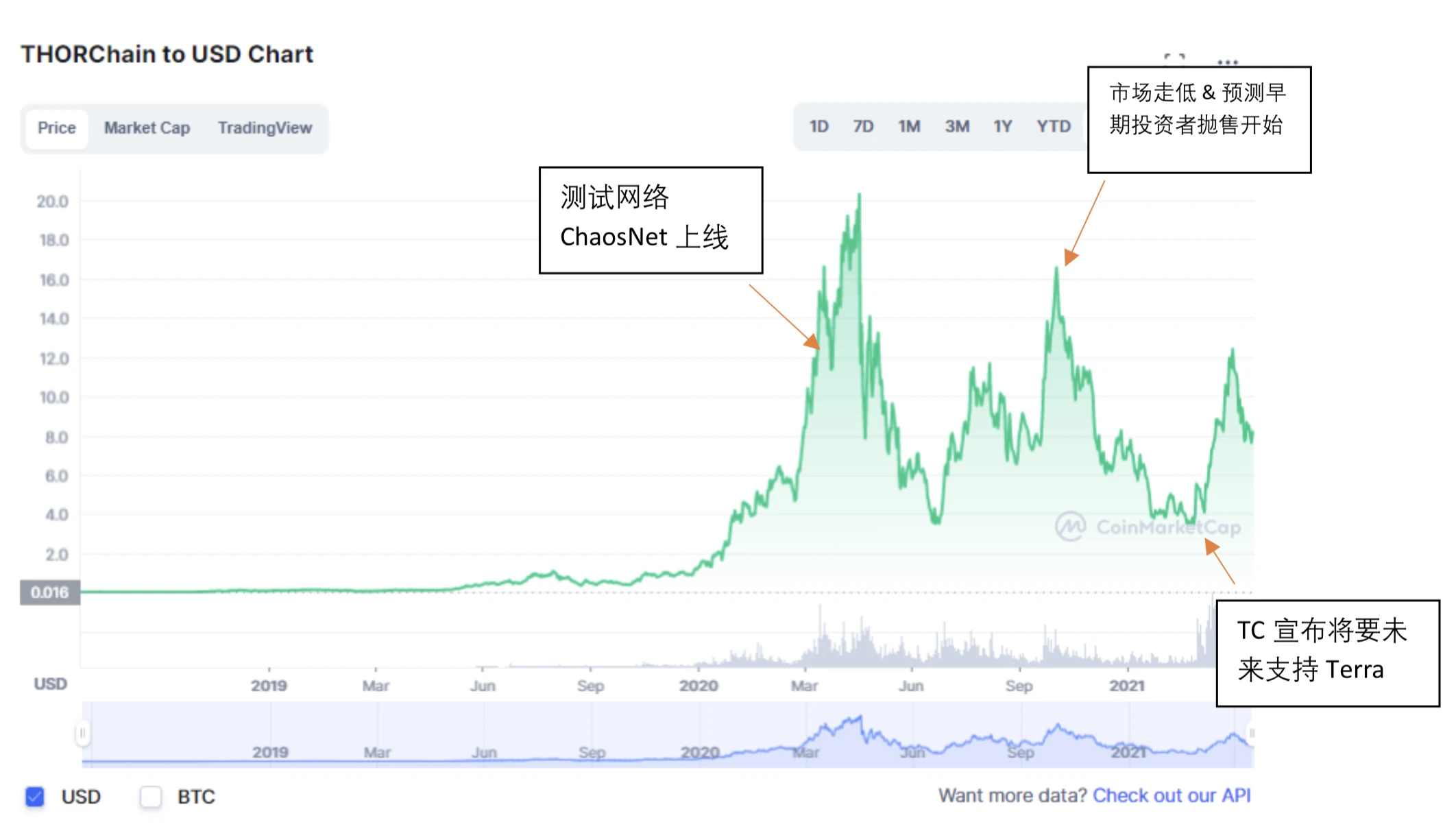

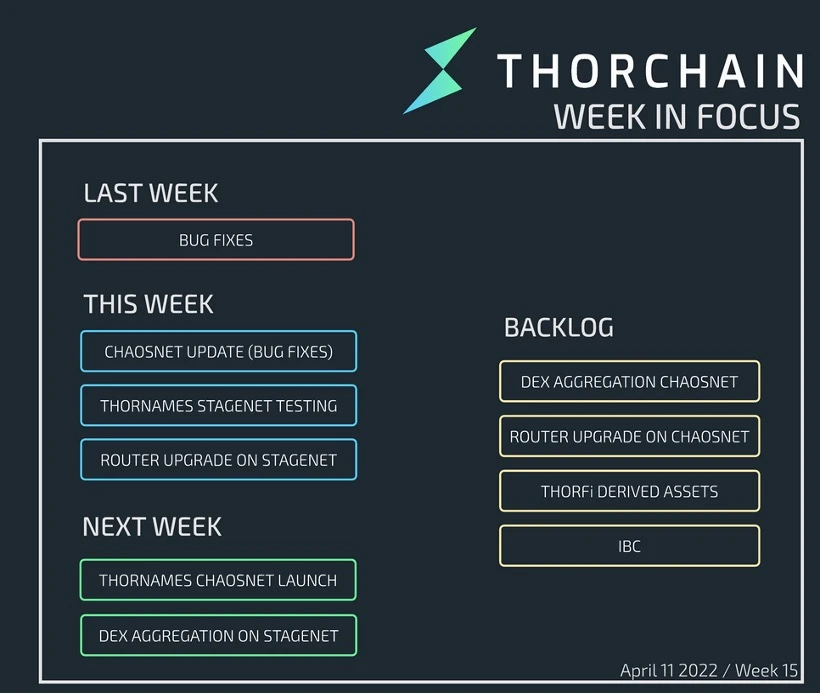

THORChain first appeared in Binance Hackathon in 2018. The THORChain team made a prototype of THORChain with the goal of developing a DEX in the competition. After that, the THORChain team continued to develop THORChain technology. The team will officially launch ChaosNet, THORChains test network, on April 13, 2021.

Chad joined THORChain in 2019 and studied at the University of Massachusetts Dartmouth. After graduating in 2005, Chad worked as a software developer at various companies. Chad officially understood and entered the crypto field in 2017, and founded his first company, Cryptocades, in the same year. Cryptocades used the idle computing power on gamers computers to mine Monero, but the company quickly encountered technology after launching the Beta version. Issue, closed after six months. After that, Chad joined an online career application platform company called Octagon Careers as CTO. Octagon Careers closed down five months later, and then Chad joined THORChain.

first level title

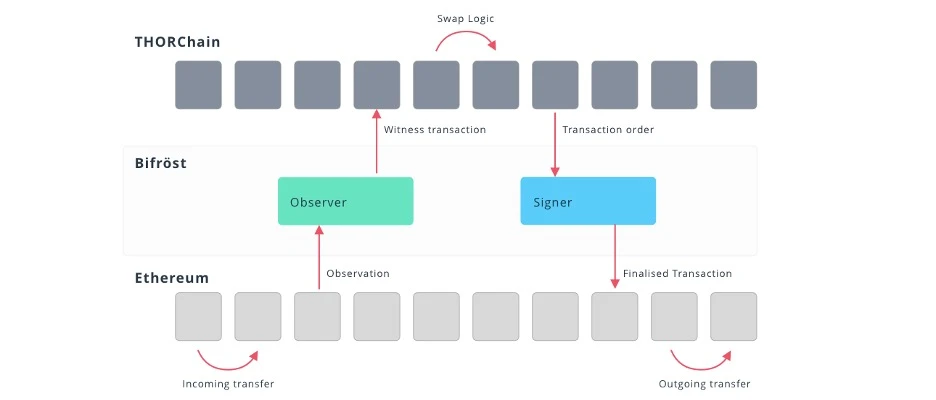

THORChains multi-chain ecological currency transaction adopts the traditional cross-chain bridge and DEX liquidity pool. In a nutshell, THORChain conducts cross-chain transactions by arranging its own wallets in different chains (such as Ethereum, BTC), and at the same time enhances liquidity for different tokens through liquidity pools.

1. Vaults

secondary title

To understand THORChains transaction system, you first need to understand how THORChains wallets (Vaults) operate on different chains.

THORChain has two different forms of Vaults, Inbound Vaults and Outbound Vaults. Inbound Vault is responsible for receiving assets sent by users to THORChain, while Outbound Vault is responsible for sending assets to users.

The settings and consensus of the two Vaults are also different. There will only be one main Inbound Vault on any chain, but there can be multiple Outbound Vaults. Inbound Vaults consensus is more rigorous and slow, while Outbound Vaults consensus is more rapid.

secondary title

The underlying building language of THORChain adopts Cosmos SDK developer software, and adopts Cosmos Tindermint consensus protocol. The Tindermint consensus protocol is a BFT-based PoS consensus protocol with a 33.3% (1/3) fault tolerance rate, which is consistent with the Cosmos fault tolerance rate. However, THORChain has not been connected to Cosmos IBC and is a separate chain.

3. Vaults Cont.

secondary title

For each asset entered into the Inbound Vault, it needs to be verified by the consensus of all verifiers. The verifier decides the address to which the user wants to send the asset, and at the same time needs to verify whether the asset has entered the vault of THORChain. However, Outbound Vault does not require all verifiers to participate in the verification, only a small number of verifiers are required to verify.

TSS is very similar to the Multisig used by the DAO organization on the traditional Ethereum to manage the Treasury. The only difference is that Multisig operates through Smart Contracts, while TSS operates encrypted through cryptography. So Multisig can only be used on Ethereum, while TSS can be used on any ecology. Each transaction requires the signature of 2/3 participating validators to complete the verification.

secondary title

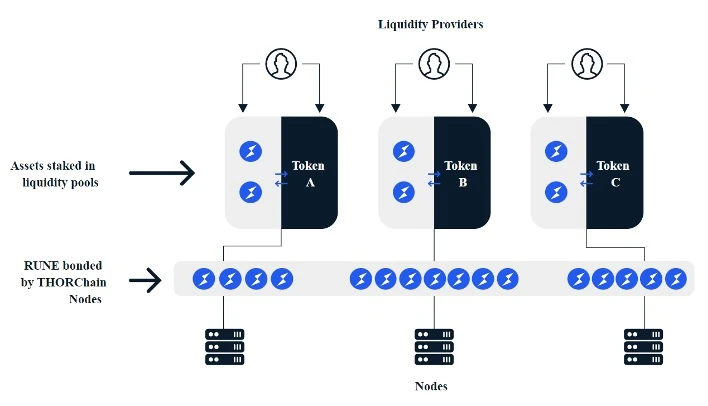

4. Liquidity pool

The second operating core of THORChain is the liquidity pool. There are usually two types of assets in a liquidity pool - THORChain native token (RUNE) and non-RUNE assets. The liquidity pool is initiated and operated by the verifier. Whenever a verifier wants to initiate a new pool, it must pledge RUNE, which is approximately twice the value of non-RUNE assets in the liquidity pool, into the ecological vault. This can ensure that the verifier will not steal the property in the pool privately. If the verifier is found to be stealing, the mortgage RUNE of 1.5x the stolen amount will be deducted.At the same time, there is another key core point of THORChain:THORChain does not utilize oracles to maintain the currency value within its ecosystem

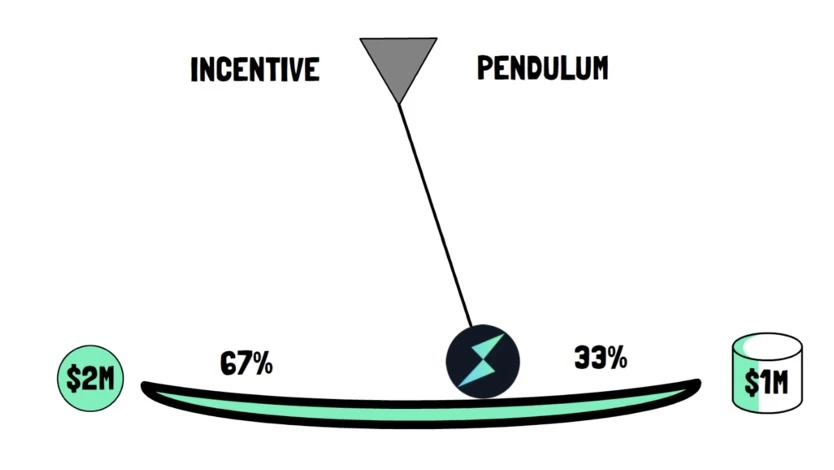

The RUNE in the THORChain ecosystem is mainly distributed in two places - the RUNE pledged by the verifier in the Vault and the RUNE in the liquidity pool. THORChain needs to ensure that the pledged RUNE in the Vault accounts for 67% of the total RUNE, while the RUNE in the liquidity pool accounts for 33% of the total. In this way, THORChain can guarantee that the value of RUNE held in the ecology will be three times that of the underlying assets. THORChain achieves distribution balance by adjusting the rewards of the liquidity pool and the rewards of the pledge.

first level title

4. THORChain economic system

There is only one native token, RUNE, in the THORChain ecosystem. RUNE is mainly used to pay transaction fees and future ecological management.

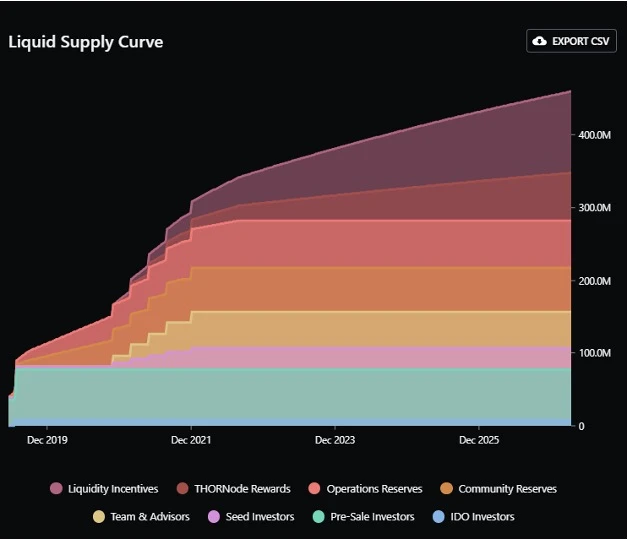

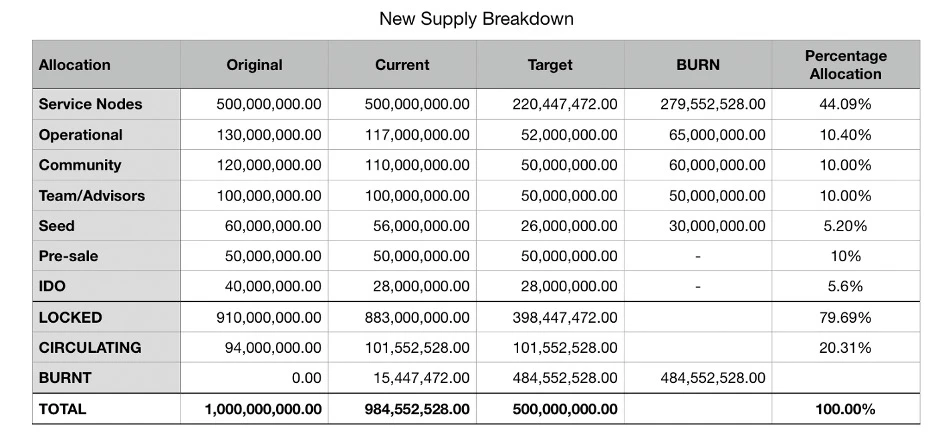

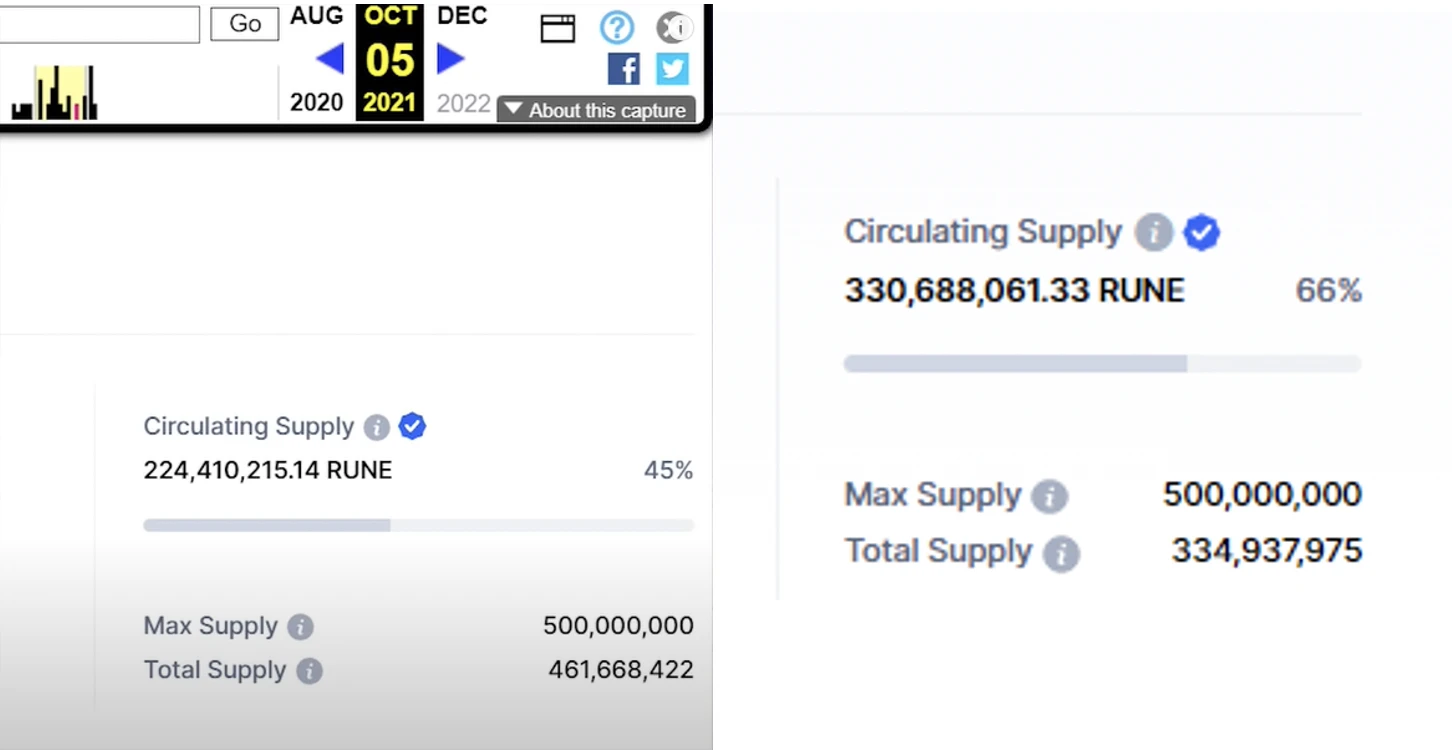

At the beginning of the project, THORChain mint all 1B RUNE tokens, but in October 2019, the management team destroyed half of the RUNE tokens in the inventory. At present, the maximum flow of RUNE tokens is 500M, and there are currently 300M RUNE circulating in the market.

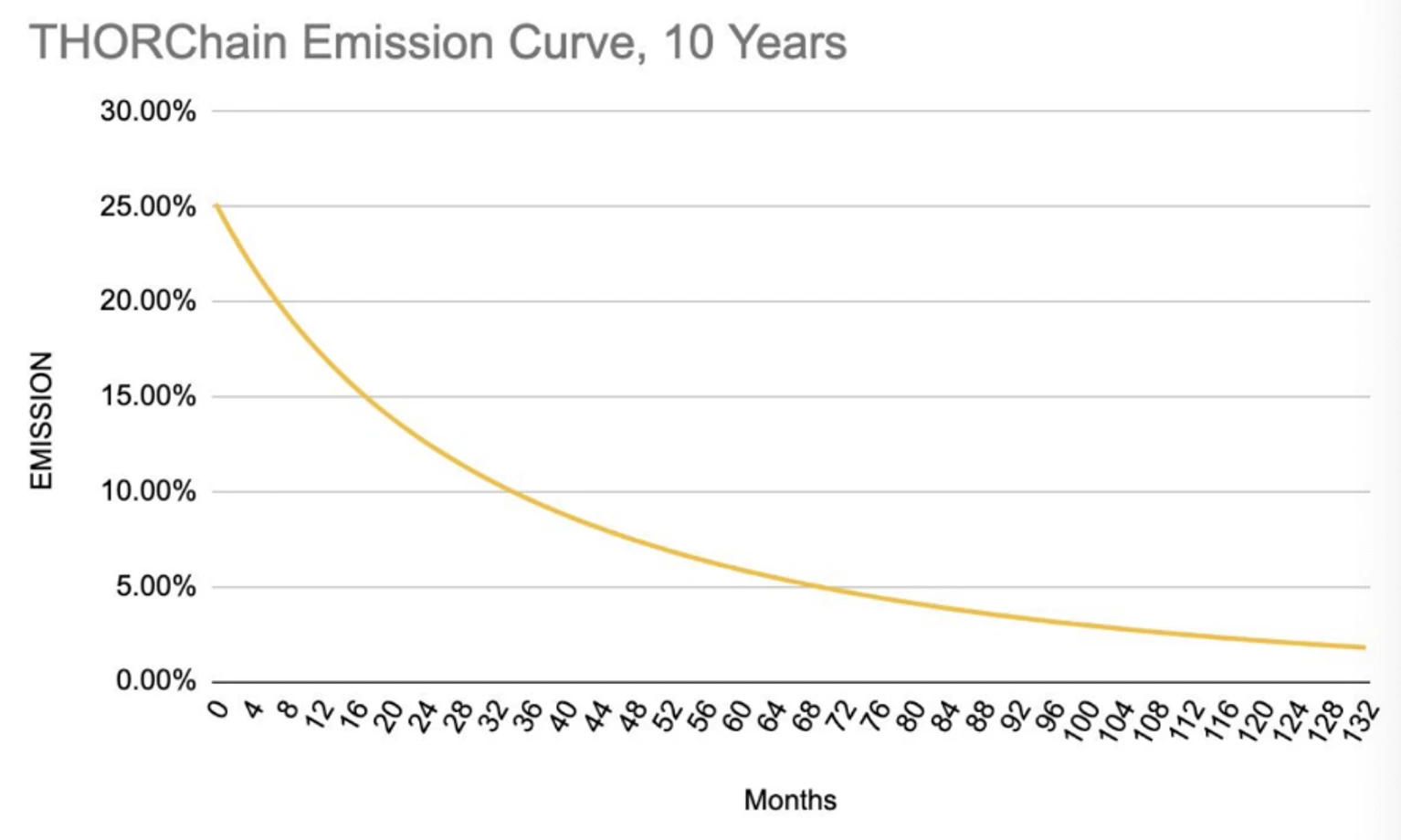

The RUNE program will be fully distributed within ten years and is currently in its fourth year.

According to the supply forecast of RUNE, most of RUNE will be rewarded to the validators of the ecology.

The early distribution of RUNE is shown in the figure below, in which a large amount of RUNE is reserved for validator rewards.

RUNE price trend:

first level title

5. RUNE Price Forecast

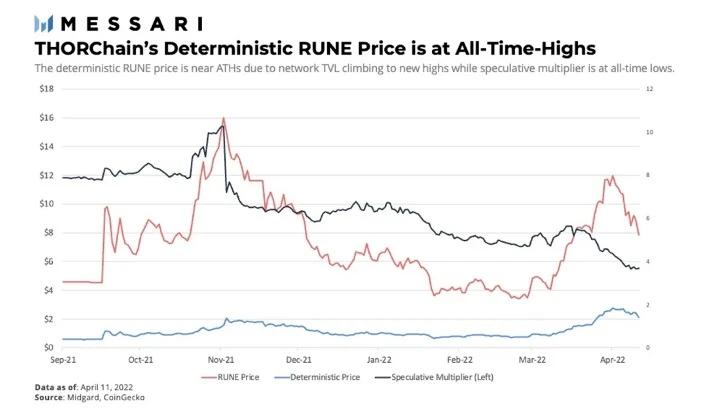

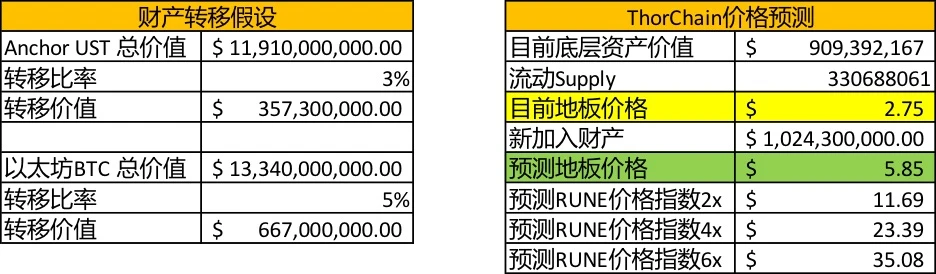

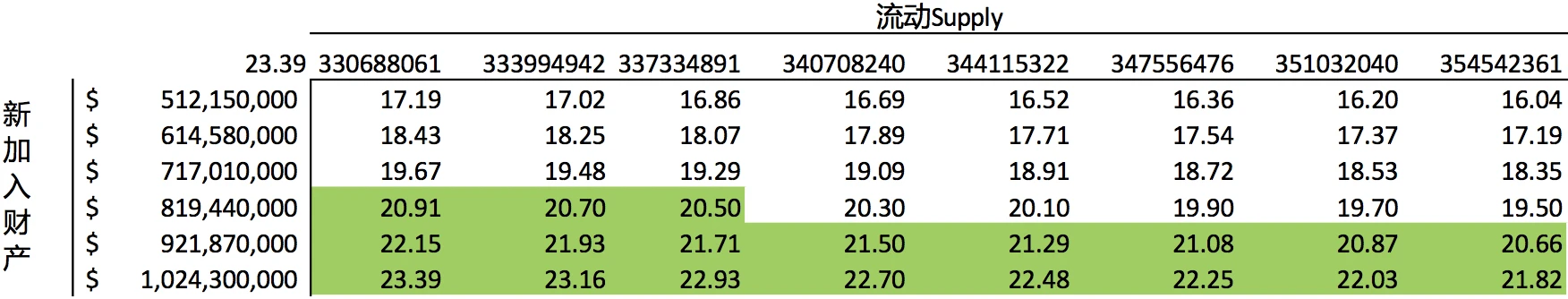

Due to the structural layout of THORChains overall ecology, when every dollar of non-RUNE assets is added to THORChains liquidity pool, THORChains overall ecology will dynamically anchor and lock three dollars of RUNE, so the overall value of THORChains ecology can be estimated, as follows picture:

According to the non-RUNE assets in the liquidity pool, we can calculate the floor price of RUNE. In a perfect situation, the price of RUNE should be three times the price of the floor. Currently, the price of RUNE is roughly three times the price of the floor.

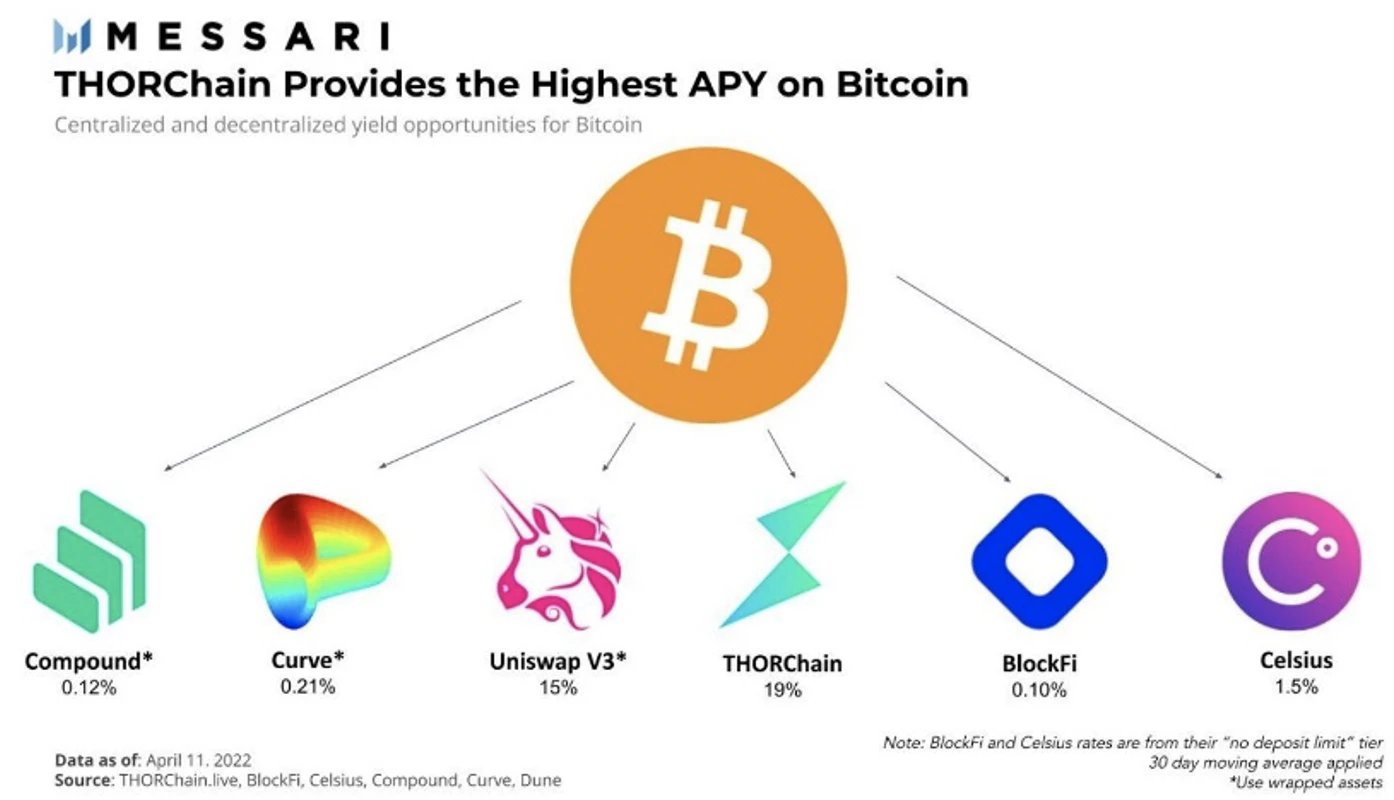

Through this estimation method, we can calculate according to the number of new asset staking that THORChain will attract in the future. At present, THORChain has the highest staking APY among different ecology:

In the past year, RUNEs price index has averaged 6x, and if we take a conservative estimate, the price will be $23.39, exceeding the past ATH. The picture below shows the Sensitivity test, and the green mark is the price prediction higher than ATH.

first level title

6. THORChain financing journey

THORChain has raised four times so far:

1. Seed Round: In 2018, unknown investors invested 600K USD. During this period, THORChain participated in the Hackathon organized by Binance

2. Private Sale: In July 2019, True Ventures led the investment of 1.6M USD

4. Strategic Round: In September 2019, RUNE tokens worth 3.25M USD were sold to unknown investors via OTC

first level title

THORChain will launch the main network in the future, which is officially expected to be in July 2022. At the same time, THORChain currently supports BTC, ETH, LTC, BNB, and BCH, and will add more tokens in the future. The official also stated on Twitter that the deployment of IBC has been put into the development plan.

Eight, THORChain risk

secondary title

1. Insufficient code security

The hackers attack is actually a problem loophole in the THORChain code. The code of THORChain is too complicated, with more than 200K lines of code, while the average ecology only has about 2000 lines of code. THORChains code is too complex to be fully audited.

secondary title

Since the underlying code of THORChain is too complex, it will be more difficult for developers to develop Dapps on the platform.

secondary title

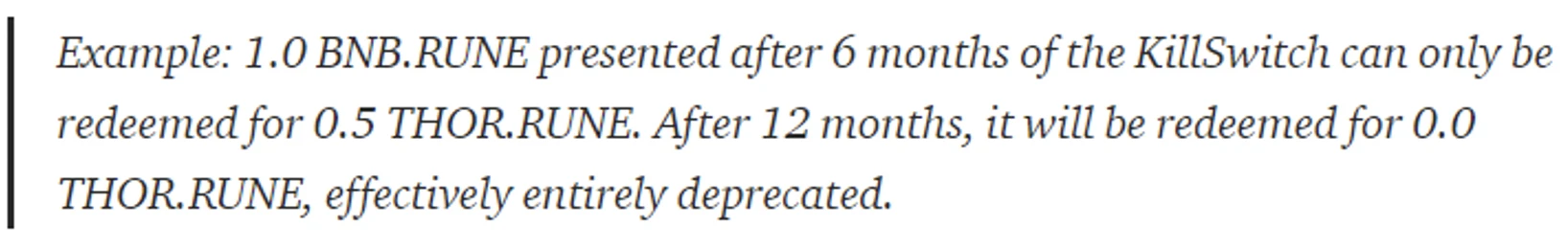

3. Mainnet launch risk

However, during this conversion process, RUNE will lose its price reference on the exchange. During the process, it will be vulnerable to hacker attacks or a large number of speculative transactions, causing the price of RUNE to collapse.

secondary title

The management of THORChain has not disclosed their identity information until today. Combined with the massive sell-off of RUNE in the past few months, there is a potential risk of bad management by the managers.

first level title

Nine. Summary

THORChain has a lot of risks, but its underlying technology and ecological economy are good, and it has great potential.

Among them, the launch of the mainnet will be a big catastrophe for THORChain, and the RUNE conversion process of the mainnet launch will cause a lot of risks to users who currently hold RUNE. For institutional and individual investors, the undisclosed team information reflects a bad signal, and it is difficult for people to believe in the qualifications of the management team.

References:

References:

https://docs.thorchain.org/

https://thorchain.medium.com/

https://thorchain.org/document-library

https://github.com/thorchain

https://github.com/thorchain/Resources/tree/master/Whitepapers

about Us

about Us