JZL Capital Blockchain Industry Weekly Report No. 23: The currency market is standing still, beware of the second dip

summary of the week

first level title

summary of the week

- The popularity of goblintown.wft, a novel NFT project, is soaring. Will it become the next BAYC?

1. Industry dynamics

secondary title

1. Industry dynamics

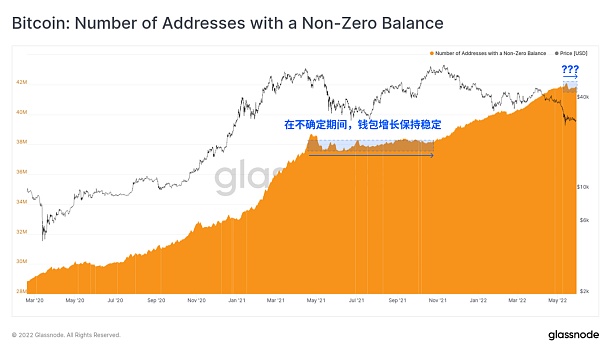

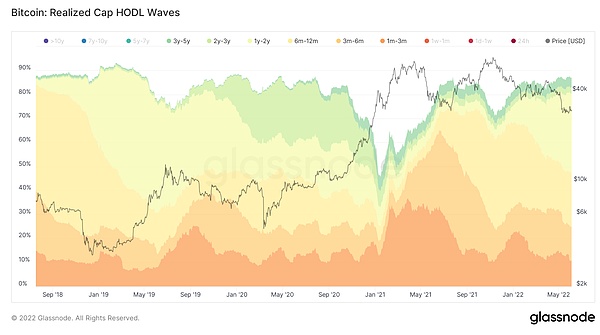

At the beginning of this week, the market followed the momentum of the U.S. stock market’s rebound last week. After a slight rebound of about 9%, Bitcoin returned to around $30,000. As of writing, Bitcoin closed at 29970, up 2.58% from last week. Compared with the 8-week continuous decline, Ethereum is slightly weaker, standing still after a week, only up 0.81%, closing at 1807.49. It is obvious that the current rebound momentum is insufficient, and standing still often means that the bottom has not been proven. In the environment of raising interest rates and shrinking balance sheets, there is no shortage of possibilities for the currency market to bottom out again.

In contrast, the U.S. stock market only had four trading days last week. Not only did the broader market fail to continue last week’s rebound momentum, but it went out of the platform consolidation. After a week, it can be said that it is standing still. The poor rebound also means that the bottom has not yet been proven. The U.S. non-agricultural data is released on Friday as usual. The U.S. added 390,000 non-agricultural jobs in May, exceeding the expected data of 325,000. Although it looks good on the surface, 20% of the increase is in the number that should have been large The tourism and entertainment industry is huge, and it has not returned to the level before the epidemic. The employment situation of technology companies in the U.S. stock market is not optimistic, and there are rumors that some Silicon Valley companies are freezing or even laying off employees, which may be a harbinger of business decline. As can be seen from the graph, the number of layoffs of technology companies in May is "outstanding", much higher than that of all months in a year. Among them, Tesla suddenly laid off 10% of its employees and froze global recruitment, which caught investors by surprise. Poor quarterly financial report expectations are the main problem. After experiencing the long-term dividends of the epidemic, technology stocks are subject to the recovery of the epidemic and the shortage of supply chains. The reason for such a fast-growing company like Tesla to make this decision is that steady operation is the first choice in such a market environment.

2. Macro and analysis

secondary title

2. Macro and analysis

The short-term BTC is still trading sideways at around 30,000USDT. We judge that as the next FOMC meeting approaches, the market will fluctuate up and down with the speeches of Fed officials. It is recommended to pay close attention.

BTC has not fallen below the previous low point, and will go sideways at around 30,000 USDT, and the relationship between short-term fluctuations and the Nasdaq will increase.

The trend of ETH follows BTC, but the overall volatility is greater than that of BTC, and the lower 1700USDT is barely holding. Because of the relationship between Defi and ETH, we recommend that you pay close attention to ETH when it falls. It cannot be ruled out that if it falls sharply, it will cause a large blood loss in digital currency.

The Nasdaq index rebounded to around 12,000, and we judge that it will still rebound in the future, and the rebound range is between 12,500-13,000.

U.S. bond interest rate: The 2-year U.S. bond basically peaked and fell, reflecting the Fed’s expectation that the interest rate will reach more than 2.5% before the end of the year, and the possibility of a subsequent sharp jump is less.

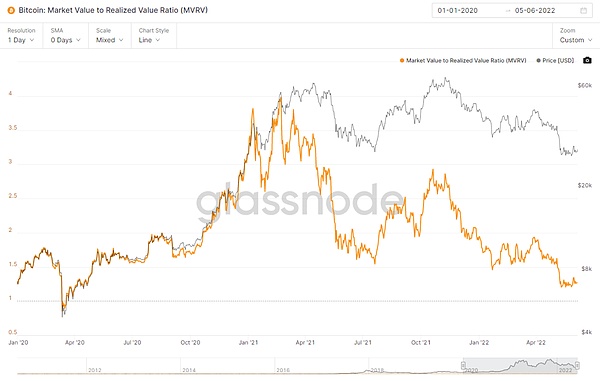

2. MVRV: 1.267, the cost performance is the same as Ahr999.

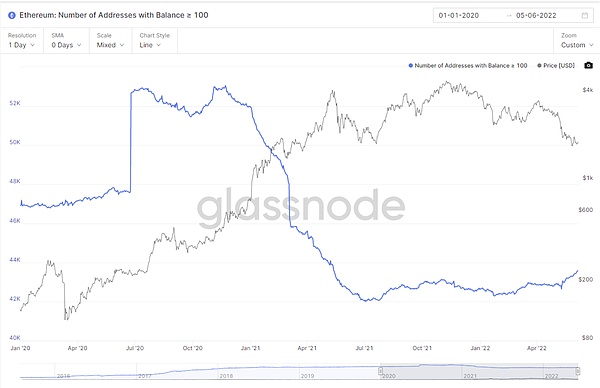

4. Changes in the number of ETH addresses: the number of addresses holding more than 100 coins has risen again, but the number of addresses holding more than 1,000 coins is generally stable.

3. The number of BTC addresses: the number of addresses holding less than 10 coins is still entering the market quickly, and the number of addresses holding more than 10 coins is basically sideways.

We believe that the short-term market is dominated by consolidation. The FOMC meets in the middle of the month. We judge that before the meeting, the market will be in a sideways stage, and the ups and downs will not be too obvious.

3. Summary of Investment and Financing

secondary title

3. Summary of Investment and Financing

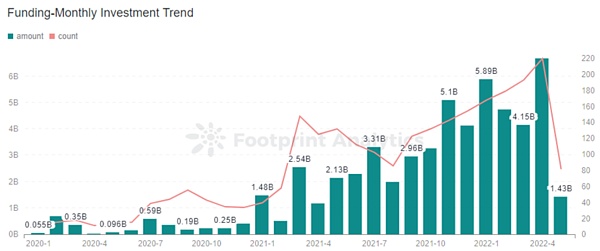

1. Review of investment and financing – the market is cold, and the scale and quantity of financing have been "double-killed"

• During the reporting period, 40 investment and financing events were disclosed, with a financing of approximately US$1.2 billion. In terms of specific tracks, the 19 projects on the Web 3.0 track accounted for nearly 50%, and the 9 projects on the Cefi track accounted for about 25%.

•Looking back at May, due to the negative market sentiment, the number of disclosed financing and the total amount of financing dropped sharply compared with April, of which the total amount of financing dropped from 67 Billion in April to 1.43 Billion, a drop of more than 75%; the number of projects decreased from 4 The number of 220 in the month was reduced to 82, a decrease of more than 60%.

4. Encrypted ecological tracking

secondary title

1)Polygon:

4. Encrypted ecological tracking

1.Layer2 expansion

2)Optimism

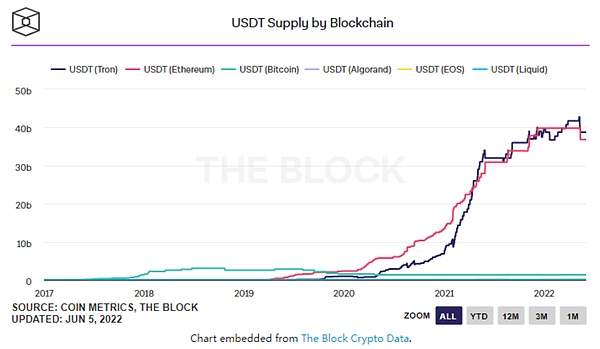

• Tether announced that it has issued USDT on Polygon. So far, Polygon is the 11th blockchain deployed by its native USDT Stablecoin. There are currently more than 19,000 dApps running on Polygon. Users can now transfer funds in and out of the Polygon ecosystem through USDT and generate income. The two most active public chains using USDT are ETH and TRON, and the connection of Polygon will provide users of the Ethereum ecosystem with cheaper transfer options.

• Polygon is currently launching a "relatively" uncapped multi-million dollar fund to help projects on Terra migrate to Polygon, according to the CEO of Polygon. Among them, OnePlanet, the NFT trading market on Terra, is about to migrate to Polygon. The CEO also said that the migration of 50-60 Terra projects may be completed by the end of 2022. Polygon seems to be at the forefront of competing for Terra's existing customers.

2. NFT

•Optimism, one of the four kings of Layer 2, completed the token airdrop last week, but the price performance of the token is not satisfactory. The market has always had high expectations for OP, according to the valuation of other Layer 1 projects In contrast, OP has a price of at least $3-5 before circulation, and so far OP has closed at $1.2. The main reason for the failure of OP's Marketing is that the scientists jumped ahead. OP had publicly tested the token contract a few days ago. Therefore, before the airdrop application front-end UI was officially opened, many scientists bypassed the front-end and directly interacted with the contract. , get the airdrop in advance and sell it. In the era of open source code, many non-computer users can also complete abnormal work through simple copy paste.

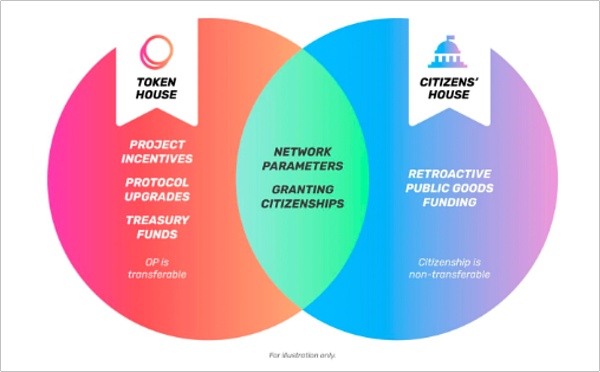

•Vitalik tweeted on Friday that he was proud of Optimism's governance system. Optimism's governance system is divided into Token House and Citizens House. The Token House is a normal Token holder. They vote through the tokens in their hands and can be sold transfer of voting rights. Citizen House, on the other hand, determines its own governance rights by holding a non-transferable NFT (V God calls it "Soulbound"). They are regarded as a group that considers the longer-term interests of the project, and Soulbound's distribution mechanism It will be determined by the opinion of Token House. As early as January 2022, V God shared his vision of soulbound through his personal blog, and now Optimism has made him a reality. Some people say that this method disperses the governance value of Token, which is a bad sign for them. Whether it is good or bad in the end, we will wait and see.

1) NFT dynamic summary:

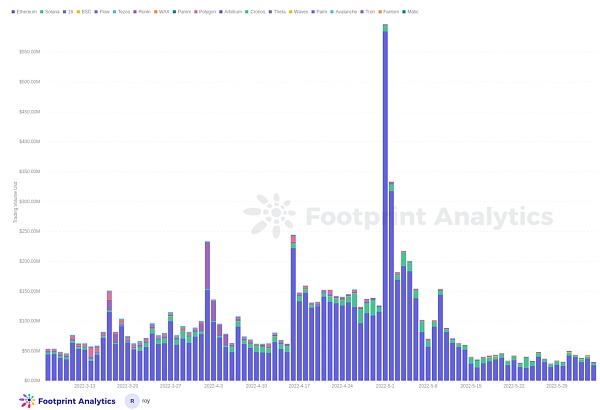

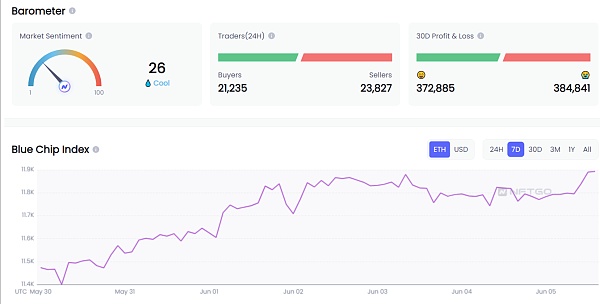

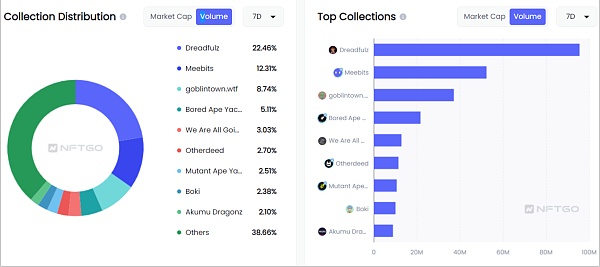

• The trading volume of different public chains has stabilized in the past week, with the daily trading volume around 30-50 million US dollars, which is also likely to be the bottom of the daily trading volume of NFT in the current bear market.

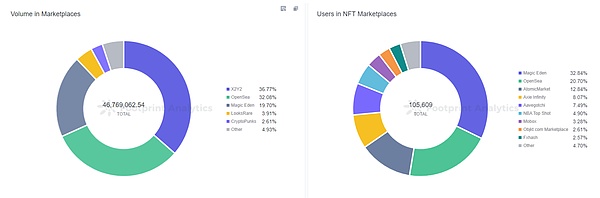

• The top three NFT markets with recent trading volume are X2Y2, Opensea and Magic Eden. At the beginning of X2Y2, through the "vampire attack" on Opensea, it still effectively improved its position in the market (however, the currency price trend is not satisfactory, as shown in the figure below). At the same time, Magic Eden also obtained it with the connection between Solana and Opensea. Own NFT "Summer". We will start a special research on the NFT track in the near future, and the corresponding research reports will also be uploaded on various encrypted media, so please pay attention.

•As the crypto market based on Bitcoin has recently stabilized (BTC fluctuates around $30,000), although the market sentiment is still not high, the market value of blue-chip projects in the NFT market has shown a slight upward trend.

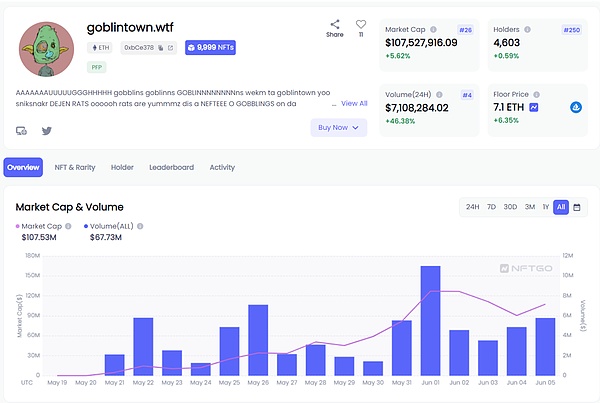

2) This week's NFT project introduction: GoblintTown.wtf3

•Recently, the free minted NFT project goblintown.wtf swept the NFT field, and the floor price reached 8.2 ETH (now 7.1 ETH) in just 14 days. On June 2, Goblintown#6485 was traded at 77.75ETH, setting the highest price for this series of NFTs.

• On May 19, 2022, GoblintownNFT was launched on the Ethereum chain through a free public sale. It was launched without any prior marketing and without any information. Author's note: Creative Commons license is a creative commons license agreement, which means giving up copyright), no roadmap and Discord, 1 mint per wallet, and only gas fee to be paid. Additionally, the site states that the anonymous creator of goblintown has kept 1,000 NFTs for himself, out of which the total number of NFTs in the series is 9,999.

• Its unique style of painting and the spread of meme characteristics made the project quickly gain the attention of the community in a short period of time. Apart from all kinds of different magical creatures, Goblintown's 1/1 collection is also imitating some well-known characters, such as Kevin from Pixelmon , SteveAoki, the electronic dance music musician who is famous on Twitter, the headmaster of Hogwarts in Harry Potter and the Hawkeye Clint Barton in Marvel.

• “AAAAAAAUUUUUGGGHHHHHgobblinsgoblinnsGOBLINNNNNNNNNnswekmta goblintownyoosniksnakrDEJEN RATS ooooohrats are yummmzdis a NEFTEEE O GOBBLINGS on da BLOKCHIN wat? oh. crustybuttda goblinkingsay GEE EMMM DEDJ EN RUTS anqueenie saayHLLO SWEATIES ok datsall byeby” — an introduction to the goblintown.wtf collection. The special language, Mint without fees, and operations without Discord and without roadmaps allow this project to experimentally demonstrate the belief in consensus and novelty hunting in the NFT market.

• As word spread about this hot and strange project, savvy NFT players quickly minted this NFT and started introducing these goblins to more people. While intimidating, the artwork itself has a high-quality style. This is true of the project's smart contract, as is the goblintown.wtf website. Its crypto-savvy Dadaist approach to social media also suggests that the creator is an interesting NFT veteran, not a novice.

Dadaism, is an art movement that emerged in the school of art between 1916 and 1923, an anarchist art movement that seeks to discover true reality through the abolition of traditional cultural and aesthetic forms. Dadaism was led by a group of young artists and anti-war activists who expressed their desperation for bourgeois values and World War I through anti-aesthetic works and protests.

•As interest in collecting such hideous characters grows, rumors spread that Yuga Labs is behind goblintown.wtf - these masters must have a lot of experience, which is the prevailing opinion. Another rumor, that the artist Beeple was a founding member of the project, was denied by the artist himself.

•According to the data disclosed by Nansen's official social media account, there are currently 184 "boring ape" BAYC holders who also hold "Goblint" GoblintTown.wtf, accounting for about 2.94%. Nansen pointed out that a big difference between "Boring Ape" BAYC and "Goblint" GoblintTown.wtf is that the former was created for boring "industry veterans" during the crypto bull market, while the latter was created during the crypto bear market It is sold on the Ethereum chain through a free public sale.

• It has to be said that GoblintTown.wtf has achieved quite dazzling results at this stage. As more and more information about follow-up projects surfaced, and with the appearance of countless imitations, the future direction of the project is still unknown. But what can be seen is that in this new era, all recognized behaviors can be monetized or certified. Is this a new Renaissance or an information bubble?

2) NFT related financing

• On May 31, 8 months after the project was established, Kryptomon, a blockchain NFT game headquartered in Germany, announced the completion of a $10 million private equity round of financing, led by NFX, PLAYSTUDIOS, GriffinGaming Partners, TalVentures and former Citigroup CEO Vikram Pandit participated in the investment. NFX is a venture capital institution headquartered in San Francisco, USA and Herzliya, Israel, focusing on Seed Round and Pre-seed Round companies, and has participated in early financing such as Lyft. PlayStudios is a leading mobile game company (Nasdaq: MYPS) developing and publishing games including Tetris, POP! Slots and more.

• Kryptomon is an NFT Metaverse game that includes elements such as Pokémon, Cryptokitties, and Tamagotchi. According to its official data, thanks to two rounds of blind box sales launched on the Binance NFT marketplace, Kryptomon was generated in less than 5 months $13 million worth of NFT transactions.

• Encrypted Baby is a "P2E" NFT game based on blockchain technology. In the world of encrypted babies, it is full of the most cutting-edge metaverse concepts, but also has a strong sense of nostalgia. Players can feel the battle elements of Pokémon, Tamagotchi and other games at the same time, and the charm of random synthesis of multiple NFT projects such as CryptoKitties. Players will play the role of the trainer of the encrypted baby, and grow together with their encrypted baby partners through a variety of activities such as nurturing and fighting. At the same time, each encrypted baby individual has a unique but variable genetic code composed of 38 random parameters. The complex and diverse genetic code not only ensures the uniqueness of each encrypted baby, but also makes the encrypted baby more humane in the game.

• Mategrave is headquartered in Los Angeles, USA, designed and developed by Willow, a well-known Chinese-American. As the world's first meta-cosmic cemetery project, MetaGrave, users can not only choose cemeteries in different parts of the world according to their own needs, but also choose various tombstones such as imperial mausoleums, ordinary, and simple tombstones. Both the cemetery and the tombstone will be Presented in the form of scarce NFT. Each tombstone serves as a key to the user's private memorial, where they can store and display the memories of their loved ones as text, images, videos, sounds and more. It is reported that MetaGrave's first batch of whitelist pre-sale activities will start soon.

1) Data review

3. GameFi chain games:

1) Data review

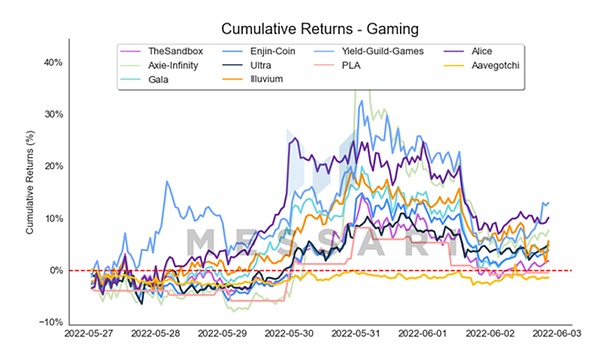

•Gamefi concept tokens experienced a sharp rise during the reporting period, and some currencies such as AXS and YGG rose by more than 30%, but the increase gradually converged in the latter part of the reporting period. During the reporting period, YGG led the Gamefi concept token with a 13% increase, followed by Alice with a 10.1% increase, and AXS ranked third with a 7.7% increase.

2) Institution of the week – BinanceLabs: Fund raising of US$500 million completed, the person in charge leaves•GameFi platform GEMS announced that it has received a $50 million investment commitment from GEM Digital Limited (“GEM Group”), a digital asset investment company in the Bahamas. Up to now, GEMS has reached partnerships with more than 80 blockchain and e-sports companies, and will further enhance products and expand the ecosystem globally (mainly in Asia);

•On June 2, BinanceLabs, the venture capital and innovation incubation arm of Binance, announced the establishment of a US$500 million investment fund, with investors including DST Global, BreyerCapital and some family offices. The new fund aims to discover and support potential DeFi , NFT, games, metaverse concept projects and founders,

It is enough to reflect that in the downturn of the encryption market, venture capital institutions focusing on the field of cryptocurrency are still full of confidence;

• Just last month, BinanceLabs executive director Nicole Zhang (Zhang Jianqiao) also left BinanceLabs to go to Link Capital as an investment partner of Link Innovation Fund.

1) Dynamic summary of the public chain:

4. Infrastructure infrastructure

1) Dynamic summary of the public chain:

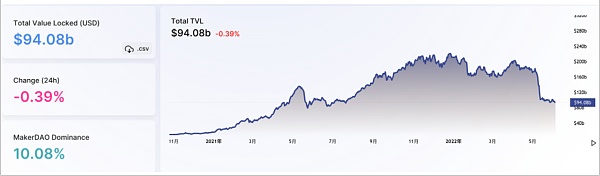

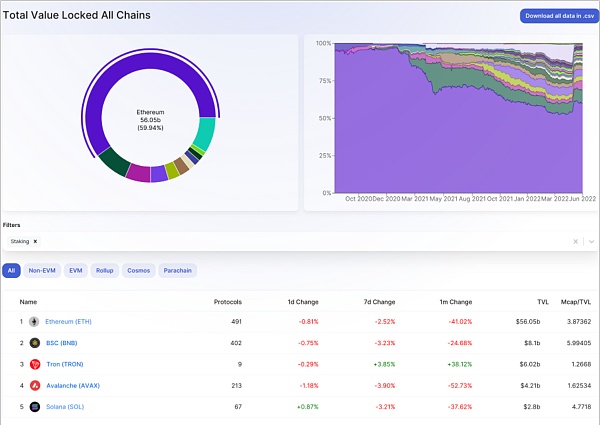

• The TVL of the encryption market is still at a low level and slowly declining, and the overall lock-up volume (including Staking) of each public chain has decreased from US$96 billion to US$94 billion;

• The proportion of Ethereum increased slightly, from 59% last week to 60%. The top five rankings are unchanged.

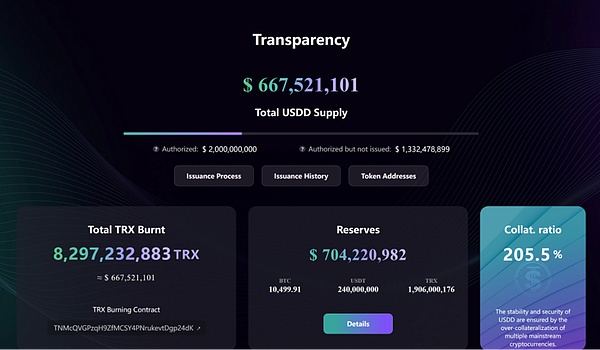

• Updates on Tron and USDD

USDD is authorized to issue USD 2 billion;

FalconX and TPS Capital become the seventh and eighth members and whitelist institutions of TRON DAO Reserve:

- FalconX is a reliable institutional crypto trading platform built for financial institutions. FalconX simplifies the complex landscape of digital assets for institutional clients through seamless price discovery and trade execution strategies with zero slippage and zero hidden fees.

- TPS Capital officially became a member and whitelist organization of TRON DAO Reserve. TPS Capital is the official OTC platform of Three Arrows Capital, which provides progressive trading brokerage services, develops and deploys its own proprietary trading algorithms to take advantage of arbitrage opportunities in all dimensions. Its focus includes but is not limited to OTC liquidity provision, market making, lending and borrowing across various asset classes, etc.

- Total members at this stage: AlamedaResearch, AmberGroup, PoloniexExchange, Ankr, Mirana, Multichain, FalconX, ThreeArrows Capital.

- As a prerequisite for USDD over-collateralization, the Federal Reserve Bank currently holds 10,500 BTC, 1.9 billion TRX and 240 million USDT reserves, plus the destruction of 8.29 billion TRX in the contract, the total amount is 1.37 billion USD, which is 667 million USD USD Mortgage guarantee, the total mortgage rate of USDD currently exceeds 200%.

2) Key investment introduction

- This upgrade enables USDD to fully internalize the over-collateralization attribute on the basis of decentralization, adding another layer of protection to USDD's super stability and risk management, and referring to Maker's model to create a risk-free stable currency. On the other hand, global users can query through the on-chain contract 24 hours a day, and the pledge rate will also be displayed in all channels, which is highly transparent and can be checked in real time.

2) Key investment introduction

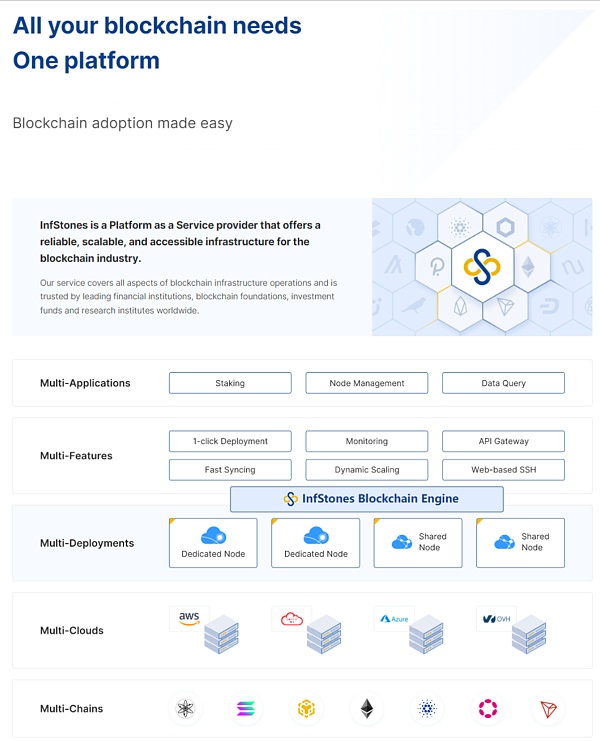

•Blockchain infrastructure provider InfStones completed a $66 million financing, led by SoftBank Vision Fund 2 and GGV Capital, with participation from INCE Capital, 10T Fund, SNZHolding and A&T Fund.

• As the most widely used Staking and infrastructure platform as a service (PaaS) provider in the blockchain industry, InfStones provides services to various types of institutional clients around the world, and is in Ethereum, BNBChain, Cardano, Polygon, Polkadot, Solana, Tens of thousands of nodes are supported on more than 50 chains such as Chainlink. By using InfStones' blockchain infrastructure, various types of enterprise organizations, including application developers, hosting providers, asset managers, and data analysts, can more easily expand their business into the Web3 field.

•Cooperate with Binance in February 2021 to provide core infrastructure support for Ethereum 2.0 services. InfStones provides Binance with infrastructure services including Ethereum 2.0 validator nodes.

•A round of financing of US$10 million will be completed in August 2021. This round of financing was led by Qiming Venture Partners, followed by DHVC, HashKeyCapital, Plug and Play, SNZ Holdings, and the family office of Fosun International co-founder Liang Xinjun.

•InfStones core team is composed of senior engineers and executives from world-renowned technology and financial companies. CEO Dr. Shi Zhenwu received a Ph.D. in computer science from the Georgia Institute of Technology in the United States and worked as a senior software engineer at Oracle. CSO Dr. Xue Liu is a professor at the School of Computer Science, McGill University, Canada, and a member of the Canadian Academy of Engineering. InfStones' technical team is composed of former senior engineers from Google, Oracle and Microsoft and distributed around the world.

2) Cosmos ecology

• Dr. Shi Zhenwu said: "Our vision is to become the AWS of the blockchain industry, providing an easily accessible and versatile platform for the blockchain industry to meet current and future needs, as Proof of Stake (PoS) becomes the big The consensus mechanism of choice for most projects, we have increasing opportunities to meet their infrastructure needs and make blockchain application development as frictionless as possible.”

2) Cosmos ecology

• Return of Jae Kown

According to CoinDesk, Cosmos development company Ignite (formerly Tendermint) will split into Ignite and NewTendermint.

Former Tendermint co-founder Jae Kwon will serve as CEO of NewTendermint. Previously, Jae Kwon resigned in February 2020. The official statement was to fully develop other projects, but the company director Zaki Manian tweeted that his resignation was to evade responsibility, and accused him of poor management, hindering the development progress of IBC, wasting resources and leading to brain drain, etc.

Peng Zhong, the current CEO of Ignite, will continue to serve as the CEO of the restructured Ignite, after Peng Zhong became CEO in May 2020, renaming Tendermint to Ignite in February this year.

•Cosmos Builders Foundation

Ignite and NewTendermint stated that the two companies will be completely independent. Ignite will continue to focus on the development of its flagship product Emeris (cross-chain DeFi product) and the Ignite CLI developer toolkit; NewTendermint will focus on the development of core blockchain infrastructure, including TendermintCore, CosmosSDK, and smart contract platform Gno.Land (to be built using the new Tendermint).

There are conflicts between Jae Kwon and another Tendermint co-founder Ethan Buchman, core contributor Zaki Manian, and the company's top management. The return of Jae Kwon will inevitably cause the company to split. However, the marketing and community management of Cosmos have been handed over from Ignite to the non-profit organization Interchain Foundation in March this year, with Ethan Buchman as the chairman, and the management of the Cosmos ecology has always been relatively decentralized and loose, so the return of Jae Kwon has no impact on the price of ATOM. have a significant impact.

On June 2, the non-profit organization Cosmos Builders Foundation announced its official establishment. The organization will raise funds from the blockchain connected to IBC and then redistribute them to two types of builders in the Cosmos ecosystem, including IBC Infrastructure and The Cosmos Stack, which is dedicated to supporting and expanding the Cosmos ecosystem by funding developers and infrastructure.

The Cosmos Builders Foundation is built using the DAO model. The main committee members include ZakiManian (Sommelier), JackZampolin (StrangeloveVentures), Sunny Aggarwal (Osmosis), Jessy Irwin (Agoric), Marko Baricevic (Interchain), Ismail Khoffi (Celestia), Ethan Frey ( Confio), Adi Seredinschi (Informal Systems), and Cory Levinson (Regen Network).

Compared with other public chain ecological funds, the Cosmos Builders Foundation obviously lacks investment from institutional investors, which is also one of the characteristics of the Cosmos ecology. But whether an ecological fund that lacks capital intervention and centralized leadership can play a role in promoting the development of new projects, let us wait and see.

•Utopia

text

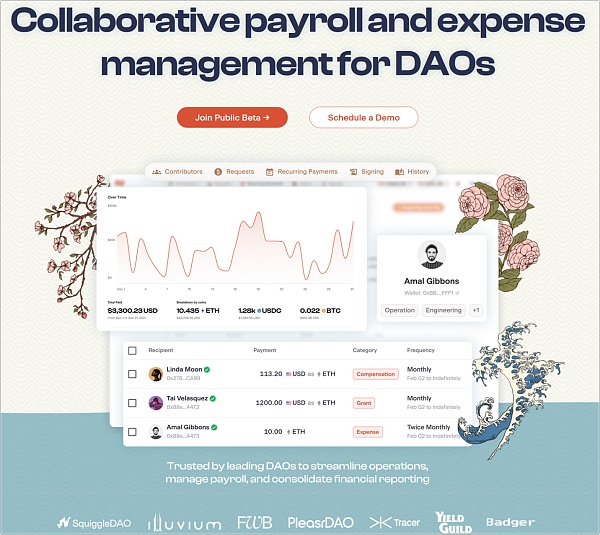

5.DAO Decentralized Autonomous Organization

Utopia, a DAO salary payment system, announced the completion of a $23 million Series A round of financing, with a post-investment valuation of $115 million, led by Paradigm, with participation from Kindred Ventures, CircleVentures, Gusto, CoinbaseVentures, InfinityVentures Crypto, and DistributedGlobal. The new funds are mainly used to develop and grow the team and develop and create new features.

Utopia is a salary and expense management system based on Gnosis Safe. Its functions include: budget system, bookkeeping system, on-chain hosting, payment system, and reporting system. The functions that will be added in the future include: human resource management, financial analysis, fund and wealth management, legal compliance of DAO (such as tax declaration, medical insurance), etc.

It can be understood that Utopia is the SAP or Oracle of the Web3 era, providing basic service services (SaaS) for a new type of company form - DAO. In addition, because of the financial information of many DAOs, Utopia is also expected to become a commercial bank for DAOs. It can conduct risk assessments based on the information it has, and provide DAOs with financial services such as wealth management products, insurance, credit loans, ratings, and guarantees. .

•Dework

The founder team is relatively young, and 3 of them are Asian. The main purpose of building Utopia is to solve the pain points of DAO in salary and human resource management. After this financing, Calvin Liu, who was the Strategy Lead of Compound Labs, will join the team as Head of Strategy.

Utopia once completed a financing of US$1.5 million in October 2021, led by Kindred Ventures; both financings were equity financing, and there is currently no plan to issue tokens.

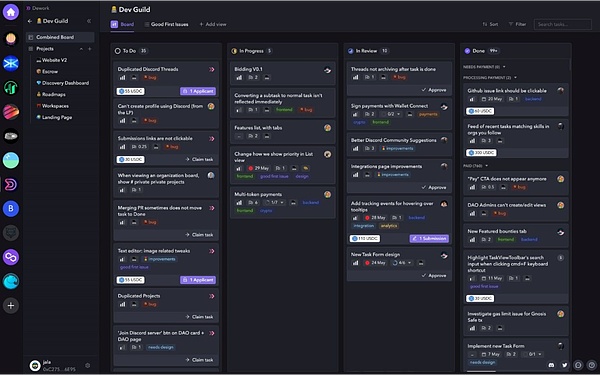

DAO management platform Dework completed a $5 million seed round of financing led by Paradigm and Pace Capital. Individual investors include former Coinbase CTO Balaji Srinivasan and Polygon founder Sandeep Nailwal.

Its biggest feature is the integration with Discord, users can use Discord to log in directly to facilitate participation in various activities of DAO. At the current stage, many DAO organizations choose to use Notion as a collaboration tool, such as SeeDAO, but the main function of Notion lies in note-taking and document writing.

The emergence of Dework provides a crypto-native collaboration method for many DAOs, integrating wallets and Discord, and the role of identity on the chain will also be magnified.

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Website www.jzlcapital.xyz

Twitter @jzlcapital

contact us

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.

If there are obvious facts, understandings or data errors in the above content, welcome to give us feedback, and we will correct the report.

Note: JZL Capital currently has a Cosmos ecological theme fund. The opinions in this article may have a high degree of interest correlation with the company. This report should not be used as investment advice.