Reviewing the whole story of encrypted Lehman: What triggered the serial liquidation?

first level title

Celsius and the Three Arrows Crisis: The Lehman Moment in the Currency Circle

The panic continued to spread in the market last week. One of the reasons is that VC Three Arrows Capital (3AC), one of the most active and most powerful VCs in the industry, is facing liquidation. 3AC is one of the largest customers of global loans. It borrows a large amount of funds from major CeFi platforms (such as BlockFi, Genesis, Nexo, Celsius), among which Celsius is 3AC's largest creditor. If 3AC really collapses, the institutions that lend to 3AC will bear huge risks. A series of chain reactions ensued:first of allCeFi platform

If the loan cannot be recovered, the funds will be recovered by liquidating the collateral, and the difference between the liquidation and the loan will be borne by the CeFi platform.when panic arisesCeFi platform

Faced with the pressure of redemption by users, the CeFi platform further withdraws credit from the system to protect itself. The same amount of assets, less money, and asset prices drop accordingly. When liquidity is withdrawn, each participant's overall balance sheet shrinks, market makers' ability to provide liquidity decreases, and bid and ask spreads widen.forfund

For example, as volatility increases, they need to deleverage to maintain the same risk value.falling asset pricesmechanism

A large number of mortgage assets have been liquidated, and the credit scale of the entire market has shrunk sharply, leading to continuous deleveraging.LPGiven the heightened risks,

Liquidity will be redeemed in preparation for thunderstorms such as UST and Celsius.

During the subprime mortgage crisis in 2008, Lehman Brothers fell into a liquidity crisis due to its rapid expansion, high-leverage operations, and misjudgment of the situation. In the end, he collapsed with a huge debt. The ensuing collapse of market confidence was out of control. In an environment where the macro economy is uncertain, interest rates are gradually rising, and the US FED is tightening water, it is difficult for cryptocurrencies to be independent as risky assets. The thunderstorm crisis of large institutions has already laid the groundwork when UST collapsed. Investment institutions and market makers suffered heavy losses in the UST crash. The sharp drop in mainstream asset prices became the last straw that crushed the camel. High leverage triggers serial liquidations, and subsequent thunderstorms may continue, which is why Celsius and the Three Arrows crisis are compared to the Lehman moment in the currency circle.

first level title

What pulled the trigger on the serial liquidation

As for the reasons for the collapse of the encryption market and the serial liquidations, as insiders, we may not be able to see the whole picture, but we can get a glimpse of the leopard through some excellent opinions in the market. At present, there are roughly the following mainstream voices in the market regarding this liquidation:

1. The Fed raises interest rates in response to high inflation, and global financial markets fall

Since the Federal Reserve announced Tapper in November last year, the encryption market has peaked. After entering May, US President Biden, the Secretary of the Treasury and the Secretary of Commerce and others have frequently spoken out on the issue of inflation. Fighting inflation as the primary issue of the current US economy has reached a general consensus at the US policy level, and the market has slowly declined. When the CPI index released by the US Department of Labor on June 10 reached a 40-year high of 8.6%, exceeding the expectations of all economists surveyed, the market fell sharply. To curb inflation, the Federal Reserve announced last Wednesday the largest interest rate hike in nearly 30 years, raising interest rates by 0.75 percentage points. Although the market expectations have been given in advance through media briefings, when the boots landed, various financial markets continued to fall under the influence of pessimistic economic outlook expectations. In the midst of US interest rate hikes, global financial market declines, and expectations of economic recession, market liquidity will weaken, and funds will withdraw from emerging markets and turn to more stable investment targets.

2. After the Luna incident, institutions were damaged, market liquidity weakened, and institutions’ ability to resist risks weakened

After the Luna incident, several super-large crypto market makers were severely injured, and many investment institutions also suffered heavy losses. Whether it was providing liquidity to UST or allocating assets on UST and Luna, they were all severely frustrated. These market makers used to be important maintainers of the liquidity of the crypto market. Since the Luna crash, the liquidity of the entire crypto market has been much weaker. When an institution suffers from a run or a debt request, there is not enough liquidity in the market to ensure the full exchange of assets, which will cause the institution to suffer greater losses during the sell-off process.

3. Institutions actively or passively deleverage

Proper leverage is a normal business strategy when the market is on the rise. At the moment when global liquidity is tightening, cryptocurrencies continue to decline during the interest rate hike cycle, and high leverage has become a reminder of previous aggressive expansion. With the shrinking of collateral, these institutions need to take the initiative to reduce positions and repay loans to deleverage, or Subject to liquidation and passive deleveraging.

4. A large number of centralized institutions in the encryption industry operate opaquely

Although DeFi uses anonymization to overcome the information asymmetry problem that has always existed in the financial market, the underlying assets invested by the centralized institution are not transparent enough, and there will be potential risks such as mismatch of the term of the fund pool and misappropriation. The inability to timely and fully understand increases the risk of a sudden market crash and panic. In the past, Celsius lost more than 70 million U.S. dollars due to the theft of stakehound, but kept it secret, and eventually it was exposed, resulting in a crisis of trust. There was also a DeFi project, Stablegains, that embezzled customer funds and deposits to Anchor to earn interest. The UST collapse caused customers to suffer A lot of losses.

5. Heavy reliance on on-chain collateral (encrypted assets)

The Bank for International Settlements (BIS) believes that: DeFi relies heavily on the characteristics of on-chain collateral (encrypted assets), which not only fails to protect the field from the impact of the market "boom-bust" cycle, but also falls into a liquidation spiral.

BIS explained that in order to ensure that lenders are protected, DeFi platforms set a liquidation ratio relative to the borrowed amount. For example, a collateralization rate of 120% may be accompanied by a liquidation rate of 110%, if collateral is liquidated below this threshold. The smart contract stipulates that at this point anyone can act as a liquidator, forfeit the collateral, repay the lender, and pocket a portion of the remaining collateral. The profit drive ensures an adequate supply of liquidators, mitigating potential credit losses for lenders.

“Due to the anonymity of the borrower, over-collateralization is common in DeFi loans,” BIS pointed out that in order to avoid forced liquidation, borrowers usually submit encrypted assets higher than the minimum requirements, resulting in a higher effective mortgage rate. Given the "boom-bust" cycle in the crypto market, the fact that "over-collateralization and liquidation ratios do not eliminate the risk of credit loss. In some cases, collateral values fell rapidly, and borrowers did not have time to unwind before they depreciated." loans, resulting in losses to the lending institution.”

6. The market lacks reasonable supervision and safety cushion

Celsius is not registered with the U.S. Securities and Exchange Commission (SEC), which means it is rarely subject to risk management, capital and disclosure rules, and also means that regulators are less willing to bail out when major financial risks arise. powerful.

The recent strong deleveraging is all about the Lehman moment in the encryption market. Looking back at the 2008 financial crisis, although the US government did not rescue Lehman from bankruptcy, it also saved many financial institutions, including the subsequent flooding of the financial system. The brink of collapse was pulled back. It is conceivable that without external assistance and related mechanisms, the US capital market would have been even worse in 2008 and March 2020. From this point of view, the strong deleveraging of the encryption market this time is also self-clearing without any market mechanism under supervision. Qinbafrank believes that this is a classic interpretation of the market mechanism.

first level title

The Boom and Crisis of DeFi Matryoshka

The biggest value proposition of DeFi is that it is interoperable. Our financial system can interact with the larger ecosystem, which means that anyone can combine two protocols (such as Aave and Synthetix) to create new products and innovate user experience. A good product will soon have a network effect, because liquidity will also be transferred to each other, which will completely subvert the traditional financial industry.

- Stani Kulechov, founder and CEO of Aave

DeFi was born thanks to smart contract technology, which allows anyone to use complex financial products easily and simply. At the same time, it is also composable, that is, applications and protocols can interact in a permissionless manner. While improving the utilization rate of funds, each new DeFi application can also be connected to existing applications to enhance its functions and practicability.

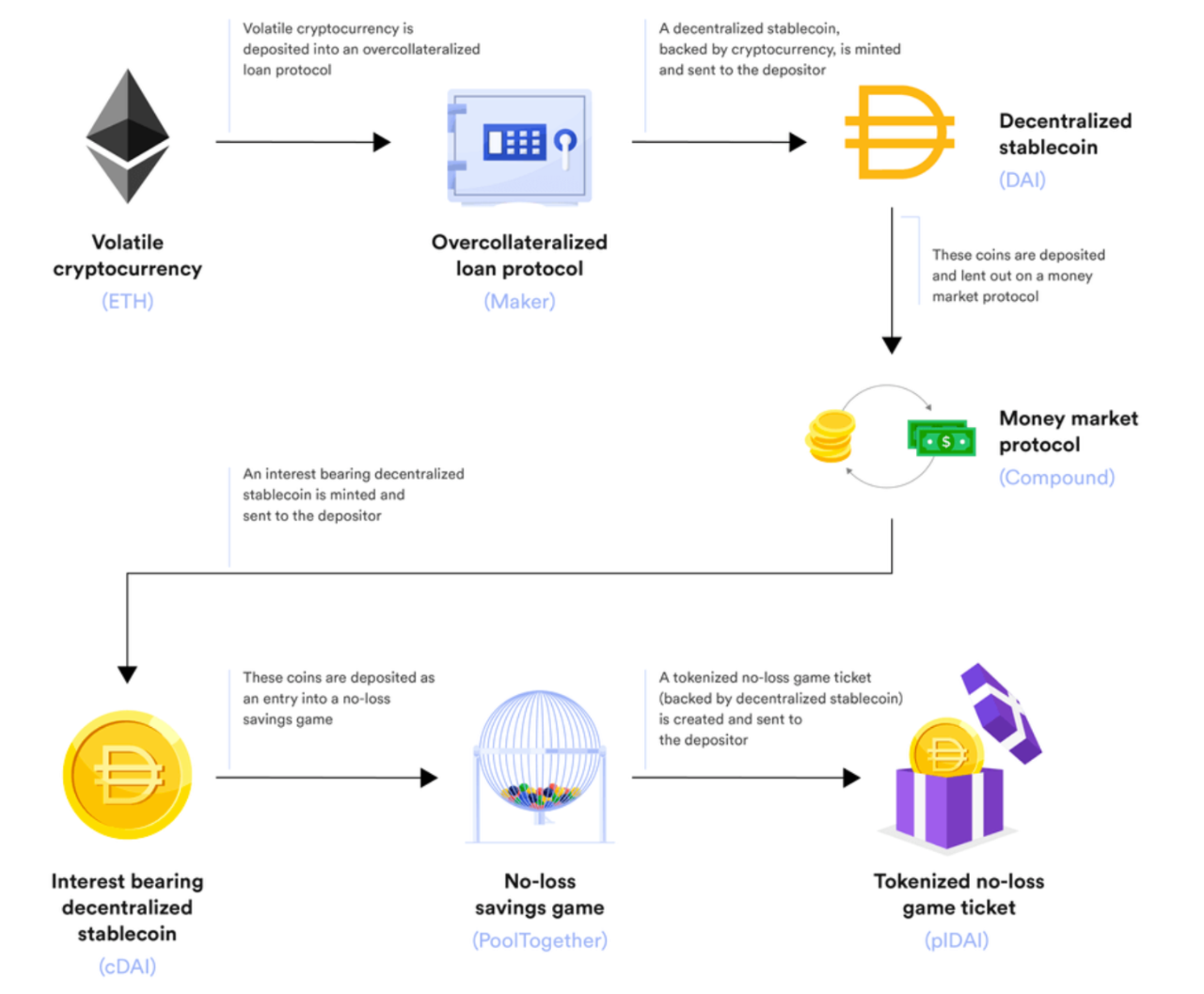

After users lend assets or provide liquidity in DeFi, they will receive certificate tokens. For example, Compound’s cToken, Yearn’s yToken, and Uniswap’s LP Token. In order to further improve the utilization rate of funds, some platforms began to accept these derivative Tokens as collateral, and then issued another Token for the collateral, and the matryoshka was born in this way. As liquidity mining detonates DeFi Summer, users can also get platform governance tokens as rewards, and the potential value of governance tokens further motivates users to "matry dolls". A sum of money from users may generate various other coins one after another, and the concept of governance coins pushes the "matryoshka" to a climax. The DeFi market is getting bigger and bigger, and participants are getting more and more benefits. In a bull market, it does.

The popular "matryoshka" model of DeFi is very similar to the subprime mortgage on Wall Street in 2008. The "matryoshka" model deeply binds various DeFi platforms together. And ETH is the collateral at the bottom of most assets. If ETH falls, there will be a chain reaction.

The Three Arrows capital crisis has made people discover that one of the most popular strategies among various institutions is to borrow ETH at a low interest rate of about 2%, and pledge on Lido to obtain about 4% of the income of stETH production, and then use stETH as Collateral, lend out ETH on Aave in a circular manner, and increase leverage in this seemingly low-risk way. Celsius has nearly 450,000 stETH at its peak, and the platform will deposit these stETH into Aave as collateral, and lend out stablecoins or ETH to meet users' redemption needs. It is not difficult to see the model of "matryoshka + revolving loan" if you look carefully.