first level title

(1) Preface: Why do we write such a theoretical article?

Chain games, as the name suggests, are games that run on the blockchain. As players or investors, we dont need to know too much about the operating mechanism and technical issues behind the game, just have fun and earn more. However, since the second half of 2021, the turmoil of the chain game Tugou running away has caused many Gamefi players to suffer a lot of losses.

As an emerging industry, chain games, how to judge whether a project in the industry is worth investing in, how much to invest, and how long its life cycle is really worth studying. The economic model of a chain game project is the most difficult subject in the project, and it is also the most dazzling jewel in the crown of the project.

The content group of the Gua Tian Guild has such a group of wayward and strange friends who can connect for an hour or two every day, discussing various game economic models without getting tired. We are happy to share and are good at summarizing. In the next few weeks, we will gradually gather the discussion points into beating texts. We hope that more Gamefi players can see that they can choose the most suitable game for themselves while reducing losses. chain tour.

Ok, here we go! First draw the key point: the chain game economic model refers to the theoretical structure of the dependence relationship between all variables related to economic phenomena in the game. So complicated and a mouthful, isnt it? Well, dont give up, this may be the only seemingly profound sentence in this series of long articles. We will write in vernacular from now on.

The chain game economic model is simply the change between the price and quantity of all NFTs and tokens in the game. Understand it, and you can know what cycle the whole system relies on, which party the selling pressure is given to, under what circumstances can it spiral forward, and under what circumstances will there be risk points.

This long article adopts the logic of engineering men and divides it into three levels for analysis: 1. The basic main model (single currency, dual currency or multi-currency); 2. Model variation (defi nesting, NFT attribute superposition, etc. etc.) 3. Auxiliary means (time tax, lock-up period, burning, etc.)

first level title

(2) Four modes of the single currency model

Let’s start with the relatively simple single-currency model: a single-currency project is a unified token, and the economic cycle in the game is maintained by a single currency. Typical cases such as Crypto Zoon, Playvalkyr, Hashland, Radio Caca, etc. Adopt this token model (ZOON only added sub-coins in the later stage).

secondary title

Mode A: gold standard in + currency standard out

This is a model commonly used by projects at the beginning of the Gamefi boom in 2021, which is to use USDT or BNB to buy NFT, and the tokens (that is, TokenA) are issued through the game. It is found that there is no such model. Defi for mining is basically this model . The feature is that the entry threshold is fixed, and the income fluctuates with the currency price.

If the currency price is in an upward trend, the payback period will decrease as the currency price rises. In this mode, once the positive spiral will form a strong Fomo emotion, but then it will also enlarge the space for output and consumption, which is easy to cause a death spiral and is irreversible. Under this model, once it enters the downside space, the local dog project is ready to run away, while the reliable project will continue to support the market with real money, and at the same time, it will continue to release benefits to attract new players, flatten the K line, and delay Downtime.

It can be found that most of the Tugou projects like to adopt the A mode: the real money such as USDT is put into the pocket, and the tokens issued by the mint are sent to the players.

secondary title

Mode B: Gold Standard In + Gold Standard Out

Because the A model is used too much, some project teams have developed the B model of gold standard output: Arent you afraid that the tokens issued will fall too fast? If I give you tokens directly according to the number of tokens on the fixed gold standard, wont that solve the problem! For example, if you decide to send 100U every day, and the currency price was 1U yesterday, then you will be given 100 TokenA yesterday; if the currency price becomes 0.5U today, wouldn’t it be good to give you 200 TokenA today?

B mode is really a good innovation! Not only the entry threshold is fixed, but also the income Nissan is fixed. In the rising trend of the currency price, due to the reduction of the corresponding output quantity, the payback period is basically stable; while in the downward trend of the currency price, the gold standard income that players get every day in a short period of time remains unchanged.

But is it really that good? It’s not that simple. A lock-up period is generally set for withdrawals in mode B. For example, the 200 TokenA in the above case may be required to be withdrawn after 7 days, so the currency price after 7 days may not be 0.5U.

Talk about a well-known case on BSC: PlayValkyrio, Valkyrie. His family is a typical B model: gold standard in, gold standard out, and the mechanism, style of painting, and narrative are not excellent, but there were few gold standard games on the market at that time, and the overall chain game environment was thriving. It was also able to spiral forward in the first two weeks, and then it took another two weeks to enter the downward spiral of death.

Maybe some friends mentioned that Binance hero BNBH is not a more famous gold standard out case? The situation of his family is more complicated, and we will focus on gossip in the case analysis in the following pages. So we emphasize again that how the model can only help us better analyze the profitability and risk points of the project. The judgment of the entire project requires more dimensional analysis, such as the reliability of the team and the perfection of the contract code. The Hashland game that some friends of the Guatian Guild have been playing is the A mode. Although the model is not perfect, it is judged that the shareholders behind it are strong, and the possibility of the team running away is very small. Although the currency price has been falling for a long time, at least from the game public beta to the present It has been continuously updated for more than 3 months, and there have been three opportunities for players to get rich in the middle.

secondary title

C mode: currency standard in + currency standard out

The characteristic of the C mode is that both the entry threshold and the income fluctuate with the currency price. ** In the upward trend of currency prices, the C mode will greatly accelerate the income of old players, and the C mode is the acceleration model of opening and closing! ** For example, the price of TokenA on the first day is 1:1, and the threshold is 100 TokenA. Players only need to spend 100U to enter the field, and 10 TokenA can be played a day; 10 TokenA, worth 20U, but the entry threshold for new players has also been raised to 200U!

Is it very familiar? By the way, Raca is a model of this model. The project team invited Musk’s mother and CZ to hold an AMA at the beginning, so players continued to come in, and new players kept using more U to buy meta beasts. NFT, after becoming an old player, keeps attracting new players to enter the arena, and the admission ticket is getting higher and higher, so it is not uncommon for a Yuan beast to increase hundreds of times.

**C mode is the most likely to bring Fomo emotions, and myths of creating wealth abound. As long as the players basic disk is large enough, it is easy to form a positive spiral at the beginning. The essence is that old players not only enjoy the dividends brought about by the rise in currency prices, but also suck blood from the high entry fees of new players. **C mode is the most thorough way to embody the essence of the outer circulation (old players dig new players’ principal), and it is also the most commonly used single currency model for a large number of plate projects that want to get rich overnight.

secondary title

D mode: currency standard in + gold standard out

At present, there seems to be no project using this mode, and it is not friendly to the project party or the players. For the project side, what they receive is their own tokens, and what they give is real gold and silver, which seems unnecessary; Certainty. So almost no games currently use this mode.

Our judgment on the D-mode chain game: this is created by an ignorant team, unless the project has particularly powerful functions in subsequent mutations or assistance that require the use of D-mode at the beginning.

Use a table to summarize the four modes of ordering tokens. The evaluations in it are all based on an assumption: the four modes have the same project team, the same market environment, and the same number of players entering the game.

first level title

(3) Basic lessons of the dual-token model

After talking about the single-token model, the enthusiasm of the feedback from the friends is higher than that of the gossip series Chain Game Evolution History we wrote before. The main reason is that players can follow the careful thinking of the project side to figure out this The general development idea of the game. After reading the article, many friends discussed in the community why the single-token game they played was cut off, and then used the four modes to play it, and then suddenly realized the long oh. So lets make persistent efforts and start talking about the most popular dual-token model.

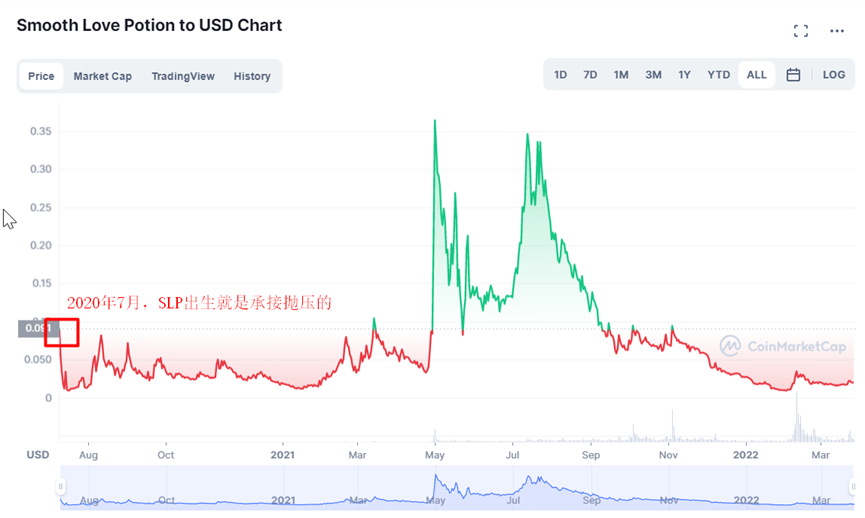

The beginning of the dual-token model comes from the first half of 2020. Axie, the big brother of the chain game, introduced the sub-coin SLP (every time I see the English name of SLP, smooth love potion, I can’t help but associate it with evil, I don’t know Is it the name that MASA came up with), as a new token to undertake the selling pressure of the original single-token AXS, this is the beginning of the dual-token model.

Friends who are familiar with Axie know that the Axie model before the introduction of SLP is a single token, which is the A model mentioned in the first article of our series: gold standard in, currency standard out. Of course, the reliable Axie team is not running around, and there are a large number of new users to take over, plus various PE bosses continue to give money, so Axie in the A mode has been engaged in for more than a year. But the project team should know that the superstructure determines the fate. Once there is no new player entering the A mode one day, it will be the beginning of the death spiral.

image description

* The above information is from CoinMarketCap

first level title

(4) Classification of the dual-token model in actual combat

The content team of the guild struggled for a long time when discussing the classification of the dual-token model, because if the ABCD four models of single-token X-based entry, Y-based output are used to classify, many categories can come out. There are four kinds of coins, four kinds of sub-coins, 4×4, it is unrealistic, and more importantly, there are not that many types in real projects. Further, we discovered a phenomenon: most of the relatively new dual-currency models adopt the model of coin-based input and currency-based output, such as BinaryX’s parent currency in and sub-coins out; another example is Starsharks’ sub-coins in and sub-coins out .

what reason? The answer from our team is: under the dual-token model, the space for model adjustment is highly flexible, and there is no need for decentralized adjustments under the gold standard model. Under the gold standard, the oracle mechanism is needed to clarify the corresponding token quantity, and the dual-token model is complicated when using the gold standard. (From a family point of view, I still hope that you can discuss this issue further)

So how to classify it? K God used a way of thinking to solve this problem, or return to our careful thinking of the project team: after the sale of Genesis NFT, what method will the project use to increase the number of NFTs on the market to satisfy new players? NFT demand.

secondary title

The first mode: reproductive consumption

In this mode, the second-generation NFT and subsequent NFTs all come from the reproduction of Genesis NFT, and the official will no longer sell blind boxes.

The parent NFT generates a child NFT, and the child NFT can have different attributes for new players to enter. During the breeding process, certain tokens need to be consumed to mint new NFTs, which is the main means of consumption of tokens in this mode. Therefore, compared with the single-currency model, the dual-currency model only allocates consumption and output to child and mother coins in different proportions to determine which currency the main selling pressure falls on.

For example, the AXIE mentioned above clearly produced a large amount of SLP and a very small amount of AXS in the game, but only a certain amount of AXS and SLP were consumed in the breeding consumption. As the number of NFTs increases, the selling pressure of the sub-token SLP will also increase, resulting in a gradual decline in prices.

Breeding and consumption games are inherently gambling. Everyone wants to try their luck to give birth to a baby with high attributes, and they can give birth at any time. The idea of centralized control is weak. Test the teams model design ability.

secondary title

The second model: blind box sales

Compared with the breeding and consumption type, the blind box sales type is simple and crude: the number of NFTs in the game is determined by the project party. When the market is good, there will be a wave of additional sales; In this mode, according to the different pricing methods of the blind box, it is generally divided into three types: U blind box, parent coin blind box, and sub-coin blind box. From these three pricing models, we can also see the project side’s thinking on the whole game:

U Blind Box: ** As the name suggests, buy NFT with value tokens such as U or ETH. The entry of a large number of players will bring a large amount of capital accumulation. The project party can use the funds from selling NFTs to support the currency price, promote publicity, PVP competitions, or run away with money... The U blind box method will bring a lot of money to the project party. With relatively free funds, there is a chance to create blockbusters. Of course, the risk is relatively greater for players. This is also the way most local dog chain games adopt.

It is recommended that players adopt a strategy: high risk and high return, with small gain big.

** Mother currency blind box: ** A large number of players need to use U to exchange for mother currency, and then buy NFT, which will consume a lot of mother currency. An upward driving force, and it is easier for the project side to control the market: when the price of the mother currency is too high, it is not conducive to newcomers to enter the market, and some mother currency can be sold to let the price return. As for the sub-coins, the project party is either very confident that the game mechanism has enough sub-coins to consume, or they simply give up the sub-coins and cause unlimited selling pressure.

It is recommended that players adopt a strategy: short-term speculation in the mother currency may be better than playing gold in the game.

image description

* Data source: DexGuru

Blind box of sub-coins:** A large number of players need to exchange U for sub-coins, which will consume a lot of sub-coins. This model is a bit like the breeding consumption type. The project side hopes to balance the price of sub-coins from within the game. Extend the life cycle of the game as much as possible to develop and update more game mechanisms to promote the inner loop.

It is recommended that players adopt a strategy: play gold with peace of mind, and be happy steadily until the number of entrants is significantly reduced.

image description

* Data source: DexGuru

Of course, some large-scale projects will directly announce that most of the funds (whether it is U or sub-parent coins) from blind box sales will be directly destroyed or entered into the vault! From the player, for the player. The reason why StarSharks is popular is that 90% of the sub-coins obtained from the blind box sale are announced to be destroyed. When encountering this kind of project, players can pay special attention to it. The team is bright and the future is promising.

first level title

(5) Summary of the main model of single and double tokens

The basic main model is only the underlying structure of a chain game, so for any chain game, we cannot simply rely on the main model to judge whether the project is good or bad. Whether it is a single currency or a dual currency model, its essence is The newly entered funds are for old players to play to earn. As parameters such as currency prices and entry thresholds increase in a positive spiral, if the entry speed of new players cannot keep up with the output speed of old players, there will be an inflection point, and eventually lead to a death spiral. Therefore, for a chain game Always pay attention to three parameters: the number of new players, the number of active players, and the comparison between output and consumption.

During the continuous evolution of Gamefis entire track, each project is looking for its own key. Some strive to support the price through certain funds and game mechanisms in the cycle of eliminating bubbles, forming a cycle system of positive rise, fomo expansion, bubble elimination, bottom stabilization and restart. Some use mechanisms such as massive consumption + lock-up + disk control to delay the time of bubbles and death spirals in order to seek a longer life cycle and gradually achieve the transformation from outer circulation to inner circulation. Many new chain games show innovative mechanisms.

first level title

(6) One of the economic model variations: Gamefi+Defi

Most of the Gamefi projects in 2021 will basically take the simple Defi1.0 product code, change the skin and launch it. This model is already relatively low, not the Gamefi+Defi defined in this chapter. Variation mode.

secondary title

DEFI Mechanism 1: Pledge Mining

The core of Defi is staking mining, using a single currency pledge or a single currency and stable currency U to form an LP pledge, and release rewards linearly according to the Defi mining method. This mode mostly appears in the dual-currency model, because the mother currency as the governance token has less empowerment in the game, so the mother currency and U are used to form LP pledge mining to reduce the circulation of the mother currency and stabilize the price .

According to the different pledged mining output, it can be further subdivided into:

First, staking rewards are sub-coins:

This is the simplest method, and it is also the favorite method used by many projects in the last cycle. The sub-coin has become a trash can: it is not only the target of gold withdrawal in the game, but also bears the selling pressure caused by NFT interest generation, and finally needs to bear the selling pressure caused by the pledge mining of the parent currency. During the FOMO period, sub-coins will drag the parent currency up, but once the in-game consumption of sub-coins cannot keep up, the supply of sub-coins will seriously exceed the standard, and the in-game gold earning and parent currency pledge revenue will drop at the same time, and funds will flee, and the death spiral will continue. The speed will be extremely fast.

Second, the staking reward is the mother currency:

This method often uses the LP pledge of the mother currency and the stable currency combination, and gives users extremely high annualized returns in the early stage to attract funds, but like the second pool of Defi, high annualized returns cannot last for a long time, and must The pledge is replaced by the in-game mother currency empowerment within a controlled period of time.

Taking DNAxCAT as an example, in the early stage of the game, the stable 400-500% annualized income on the yooshi platform attracted a large amount of capital pledges. With a certain market popularity of the game, its parent currency DXCT can rise 3-4 times against the trend, but Due to problems such as in-game reproduction, the currency price began to decline, and the high annualized income could not be sustained. When the LP income dropped to about 100%, players left the field and a large number of funds fled, which exacerbated the decline of the project.

Third, special staking rewards

This method no longer rewards Token directly, but uses special points, rights, medals and other soft tokens that need to be embedded in the game. These soft tokens need to be designed to be closely integrated with the gameplay and content of the game , and players recognize its value. This is a pledge method currently recognized by Guatian. It does not directly generate selling pressure on the parent currency or sub-coins, but is naturally integrated into the operation of the game.

secondary title

DEFI Mechanism 2: The Magical Use of Ve Mode

The Ve mode first appeared in Curve, a Defi smart pool. Simply put, it re-pledged the token asset CRV of the Curve project to generate a second-tier token veCRV (you can think of it as a certificate after asset securitization in the real world. ). With the same amount of CRV, the amount of veCRV given to pledge users is different according to the lock-up time. The basic function of vetoken is to vote, which gives more rights to project fans: a fan who locks 10 tokens for 4 years may get more rewards than an ordinary user who locks 1000 tokens for 1 month. The more Vetoken you have, the greater the voting power for various decisions of the project.

In the pledge design of some recent Gamefi economic models, the above-mentioned Vetoken gameplay also appeared, which is used to vote on certain modules in the game. For example, the frog Hoppers on the avalanche produced veFLY by staking the token FLY, and veFLY can vote for four different copies, and the system will distribute additional FLY rewards to different copies according to the votes.

Thinking about it further, is it possible to vote to decide which dungeon gets more token rewards? In this way, players have the urge to vote for the copy they like or are familiar with, or the copy that is more suitable for their NFT deck team; moreover, can they vote to decide how to allocate the game treasury (if any)? By the way, Vetoken naturally integrates the popular DAO mechanism into Gamefi, and the DAO Vault that will be explained in the next article Auxiliary can make good use of Vetoken.

secondary title

DEFI Mechanism Three: Defi Gamification

This mechanism is quite special. It presents the DEX, AMM and other functions in Defi in the form of games, and combines part of the games own content. It tries to attract funds to enter the market through the combination of Defi and Gamefi, and then rely on the game content and Defi. Proceeds keep funds. This model is a bit like the software for teaching children to learn English. The essence is to learn English, but the upgraded model after passing the level makes you feel the fun of learning and playing games at the same time.

first level title

(7) Economic model variation 2: Gamefi+NFT

Looking around, NFT seems to have become a prerequisite for all current chain games, and no game will say that it does not need NFT. For the project side, in addition to Token can be exchanged for funds, selling NFT can also be used to get funds. As long as there are players willing to pay, why not do it? For players, the NFT craze that started in Q3 last year made it possible to earn several times by getting a good NFT whitelist. Why not make money if you have money? Under this consensus, NFT has become an indispensable module in Gamefi.

secondary title

First, the NFT of ticket nature

To put it simply, this kind of NFT is just the threshold to enter the game. To put it bluntly, it is the code of ERC721 or ERC1155. If the game is well done, the value of this kind of NFT will be high; if the game is not well done, the value of this kind of NFT will be low. . The land of some games, such as the Land NFT sold by Mavia some time ago, looks very ordinary in the picture, but because the game stipulates that you must have a land to play, everyone is fighting for the white list. Mavia is a popular game, and its NFT price can be 5 times higher than Mints price at its highest.

Another classic NFT ticket case is the Wolf Sheep Game. The gameplay of the first generation is not complicated: there are initially 10,000 genesis NFTs for players Mint, of which players have a 90% chance to cast a sheep, and a 10% chance to cast a wolf. Sheep can enter the barn to mine at a rate of 10,000 tokens per day, but when you need to obtain income, you need to hand over 20% of the reward to the pledged wolf. When you need to retrieve the sheep, you must keep the income for 2 days and There is only a 50% chance of bringing it back. Subsequent players need to use certain tokens to mint NFT to enter the field. In addition to gaining income, wolves have the opportunity to steal this NFT every time a player mint NFT.

The Wolf Sheep game created camp confrontation, and NFT steals ERC-20 and ERC-721. When the income is the highest, the wolf can pay back in one day, and the sheep can pay back in three days. The high income made the price of NFT during that time also keep rising. In the follow-up, imitation disks have been continuously improved, and more game mechanisms have been added to make the entire system richer and more balanced. For example, Wizards And Dragons, Pizza Game, etc., all maintained their popularity for a period of time at that time.

secondary title

Second, NFT with its own value

To give the simplest case, Yuga Labs’ Boring Ape is the top player in the NFT circle, so whether he lists Apecoin or finds a game that Nwayplay is working on, it will not affect the value of NFT itself. Too much influence, community and consensus are the key to influence this type of NFT.

Boring Ape is a case of crossing from the NFT circle to the Gamefi circle. Is there any case of crossing from the Gamefi circle to the NFT circle and establishing an NFT case with its own value? It seems that there is not yet, but some projects are beginning to show signs, such as Chikn Avalanche Chicken on AVAX. His family’s model is also very simple. Players own chikn NFT, pledge to produce eggs, get token eggs, pledge egg LP, Feed can be obtained, feed can feed NFT, increase its weight to get more eggs, and cycle in this way.

It is not difficult to see that compared to the ordinary dual-currency model, Chikn’s model is just an extra layer of nesting dolls, but the meme attribute of its NFT itself and the space brought by multiple nesting dolls have begun to allow players to have a better understanding of the community. A certain sense of dependence, consensus is being established, and the result is that the price of NFT has not decreased as the price of its tokens has decreased. Chikn is still alive on the avalanche chain. Of course, the initial model is still too simple, so the subsequent imitation projects have added a lot of their own gameplay, such as Avalant, Hoppers...

secondary title

Third, the NFT in the running of the game

Some soft tokens in the game can also be set up with NFT, but the premise is to make players feel that these soft tokens are valuable, or are recognized and worshiped by everyone (endowed with social attributes).

A few days ago, Guada had been discussing the token types of the chain game model with the CEO of a game. During the discussion, Guada made a breakthrough on a problem that had troubled him before: how can the guild battle system be combined with the current dual-token model? stand up? The previous idea was whether the guild battle rewards should be the mother currency or sub-coins or even the third type of tokens. After a long time of argumentation, there are problems. The day before yesterday, I thought of using a special NFT as a reward. All guild members of the Victory League can use this NFT as a medal. At the same time, this NFT can accelerate or double the empowerment of gold in the game.

first level title

(8) Summary of economic model variation patterns

The two types of variation model innovations introduced above are just the ones that are used more frequently or are more popular in the development process of this wave of chain games, and do not represent all of them. And modes can also be nested with each other, such as the avalanche frog Hoppers mentioned in the article, NFT has a meme attribute, cooperate with Trade Joe to have FLYs LP pool, and use Vetokens lock-up mechanism in the game, etc.

The content of the Gamefi track is gradually enriched, the number of gameplays is increasing, and the mechanism is becoming more and more complicated. We don’t know who will become the next tipping point, but players can think more and more after being exposed to these fresh ideas for the first time. When you collide, you can also have a good idea on your own.

first level title

(9) Auxiliary means of economic model

Compared with the model backbone and variation model discussed earlier, the auxiliary means are just like adding a little mango and strawberry to a piece of already delicious mousse cake, which will not change the overall taste. , but it will make it richer in color and more attractive in taste.

Auxiliary means are mapped in the chain game, which are some small means and tricks. The more auxiliary means, the more complicated the whole chain game will look. The core point of these auxiliary means is to delay the life cycle of the chain game. There is no absolutely easy-to-use auxiliary means. What is more important is to judge what stage the project is in, what kind of changes in the market, what kind of emotions the players have shown, and what kind of trends in the data on the chain. what kind of aids.

secondary title

1. Time Tax and Lock Threshold

Time tax: The project party will set a tax rate for withdrawing income based on the players PlaytoEarn expectations, and the tax rate will gradually decrease over time. For example, if you play the income and sell it today, you may have to pay a 20% income tax , It will be 15% if you sell it again tomorrow, and the time tax will not be reduced to 0% until the fifth day.

Locking threshold: The project party will lock the players PlaytoEarn earnings, and set a fixed threshold to withdraw, or the number of days locked, or the number of locked Tokens, etc.

The purpose of time tax and locking threshold is to reduce the pressure of players to concentrate on selling. It is the most basic and common method in the current Gamefi track. Time tax can release the selling pressure of tokens more evenly in a time period and lock the threshold. It is simply and rudely pulling back the selling pressure for a period of time.

secondary title

2. Limited centralized control panel

Seeing the word centralization, many old players in the currency circle scoffed, thinking that it deviated from the essence of the blockchain. In fact, Gua Tian personally believes that there is no right or wrong between centralization and decentralization. Moreover, in the current environment where the entire industry cannot solve the impossible triangle, chain games should consider how to use them in different stages. , in order to ensure the stable development of the overall project.

For chain game projects, our team insists that on the premise that the project party does not do evil (good faith project party), the introduction of limited centralized control in the early stage of the project is conducive to the long-term development of the project. In the early stage of most chain game projects, like a newborn pony, it is very fragile and unstable. However, due to various factors such as gameplay and publicity that will attract a large amount of funds, the funds will flow into the game in a very short period of time, causing the NFT or Token to rise rapidly, creating a bubble; once the hot money withdraws, it will quickly cause the bubble to burst, assets to be trampled, and a death spiral. This situation will greatly shorten the life cycle of the project. Therefore, we believe that it is necessary to introduce a limited centralized control panel in the early stage, to support the horse, and to go for a journey.

What will the project party do with limited centralized control panel? In one case, the project party can slow down the inflation rate of NFT or Token through the internal mechanism setting of the game, supplemented by the regulation of certain parameters. For example, the mining of BNX and the regulation of yield parameters of copies, such as the quantity and price of NFT released by Daofarmers PAAS mechanism.

In another case, the project party makes a market for LP through early token regulation, stabilizes the token price, and tries to maintain a constant payback cycle for players. For example, PokeMoney has done a good job in peer-to-peer promotion recently. According to the analysis of the data on the chain, our team found that the project party has a high degree of control over the sub-coins, and fixed the payback period of players at 30-40 days to keep the project in the period of strong sales heat and stability.

secondary title

3. Establishment of treasury

The treasury is where the project party stores part of the blind box income, market fees or transaction slippage and other agreement income in a fixed address, as a game treasury for the subsequent development of the game. for players.

In the recent period, the treasury has gradually changed from a project treasury freely distributed by the team to a DAO treasury composed of contracts, LPs, etc. It is up to players to decide how to use the assets in the DAO treasury according to the rules of procedure.

No matter which method is used by the treasury, its purpose is to express a benign signal to the players in the direction of the well-intentioned project, which reduces the risk of RUG on the surface of the project and enhances the consensus of the players. For example, the former 2000WU treasury of DNAxCAT, or the recent 800WU treasury of DAOfarmer, can retain some old players during the downhill cycle of the project.

Here we go back to a pit left in the single token model: a special instance of BNBH Binance Hero. BNBHs treasury is part of the P2E in-game. Players can obtain NFT by consuming tokens to buy blind boxes. The project party will regularly exchange the tokens sold by blind boxes for BNB through the secondary market and add them to the treasury (reward pool). All players in the game All proceeds come directly from the treasury. However, from December 6th to 7th, 2021, some giant whales concentrated on withdrawing a huge amount of BNB from the vault, which caused all players to panic sell BNBH tokens, and the currency price fell, ending last years Gamefi boom. In other words, as long as there are enough BNB in the treasury, the players can safely play gold. Therefore, BNBH gold-playing players only need to keep an eye on the data on the chain of the treasury address, and they can still escape immediately. .

first level title

(10) The end of the big reveal of the chain game economic model

The engineering mans planning ability is still good, the last chapter happens to be the tenth chapter, a little proud. Let’s talk about it. This series is the first co-written manuscript by members of the content team of Guadatian Association. The main structure and first draft are written by Kluxury (Twitter account is @LuxuryWzj). Text polishing, plus 1500-2000 words, each article is controlled at about 3000-3500 words.

Before writing, the idea and tone of the whole series have been discussed in the content group of the guild for a long time. I would also like to thank Lao Wu, a member of the content group, for contributing many cases and opinions. After everyone reached a consensus on the consensus, they began to create.

We set the tone for this series, which is to let players understand how the project team designs models, and then formulate their own plans for how to play this chain game. In addition, the style of writing we insist on in this series is to write even for beginners with only a little blockchain knowledge. I can understand the chain game model article, so we deleted a lot of professional terms and tried to explain in vernacular and cases. This is also an explanation of the suggestion Can the writing of the article be more professional mentioned by some enthusiastic melon friends. We hope that more players who are interested in chain games will not be confused when they first enter the circle, and come to play first. Make this industry bigger.

Next, I will share the ending of this series written by K with all friends, so that you can feel Ks pragmatic thinking:

So far, I have disassembled the economic model of the current chain game from my personal point of view, which also involves many once mainstream projects. Although we often ridicule that the current chain game is a plate and a Ponzi scheme, Gamefi is still a game in essence. The gameplay and economic model are indispensable. It is just the current environment, technology, user groups and other factors. The reasons for this cause the economic model to be overemphasized.

Finally, I would like to share my personal strategy for playing blockchain games. 1. Look at the popularity, which is the basis for judging whether to enter the market. Twitter, Discord, Telegram, dissemination of stories, mentions of various groups, Dappra ranking, number of users on the chain, etc., find your own criteria for judging based on experience. 2. Judging the economic model and risks by looking at the data, and deciding the strategy for entering the market. Speculating in coins or making gold, reinvesting or mining, withdrawing and selling... 3. Judging the inflection point by looking at the data, and deciding when to leave the market.

Finally, some summaries of Gua Tians personal style:

The entire Chain Game Economic Model Revealed can be regarded as a bikini lady on the beach. The main body of the economic model mentioned in the first and second articles is the ladys figure, and a good figure is the root of attracting attention; the third article The means of variation mentioned is the style and color of the bikini, and if it is matched with the figure, it will be the water lily; the auxiliary means mentioned in the fourth article is the embellishment on the bikini, which may be a butterfly or a flower. It is eye-catching.

But after discussing, writing, and analyzing the whole series, Guatian felt lost, because he got a personal judgment that he felt a little bit before but was unwilling to admit: the current chain based on the token model (token-economics) as the main body The game economic model will fall into a death spiral sooner or later, and the four articles in the entire series are just how to delay it.

I have been thinking: Does the Gamefi mode of PlaytoEarn represented by Axie really completely represent all the tracks of chain games? Probably not. It cannot be said that Axie has biased players. It can only be said that the introduction of Axie’s dual-token model in 2020 is a great innovation, but after 2022, a more complete model is needed to better interpret blockchain games.

To expand the scene, such as the metaverse scene, the chain game is only a link in the metaverse scene, and the life cycle of the chain game is also supported by other brother scenes in the entire metaverse.

Make chain games fun, so fun that players in the encrypted world are motivated to start krypton gold for this game;

Transform the current model mechanism from token economics to NFT economics with stronger asset accumulation and less liquidity;

To expand the scene, such as the metaverse scene, the chain game is only a link in the metaverse scene, and the life cycle of the chain game is also supported by other brother scenes in the entire metaverse.

Let us look forward to and create a better and smoother chain game economic model together.

Special thanks to the on-chain data platform Footprint Analytics team for their data support, we like to communicate with data controllers every day; and thanks to Nathan from the CryptoPlus+ community for his great recommendation! Looking forward to discussing with more friends!

Welcome to reprint, originality is not easy, please indicate Guadain Laboratory W Labs produced

Welcome to reprint, originality is not easy, please indicate Guadain Laboratory W Labs produced

The beta version of the Guadatian laboratory website:https://discord.gg/wggdao

Melon Field Lab Twitter:https://twitter.com/GuaTianGuaTian

The in-depth research of Guadain Laboratory Mirror:https://mirror.xyz/iamwgg.eth

Melon Field Laboratory Medium:https://guatianwgg.medium.com/

The beta version of the Guadatian laboratory website:http://wggdao.com/