Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

Editor | Hao Fangzhou

According to the Ethereum Foundation blog, the ethereum merger differs from previous network upgrades in two ways. First, node operators need to update both consensus layer (CL) and execution layer (EL) clients, not just one of the two. Secondly, the upgrade is activated in two stages: the first stage, named Bellatrix, is carried out at Epoch 144896 on the beacon chain, corresponding to 19:34:47 on September 6, 2022, Beijing time. The second phase, named Paris, triggers the merger when the TTD on the execution layer reaches 587500000000000000000000, which is expected to be between September 10th and 20th, 2022.

Second, the secondary market

1. Spot market

Second, the secondary market

(ETH daily chart, picture from OKX)

1. Spot market

image description

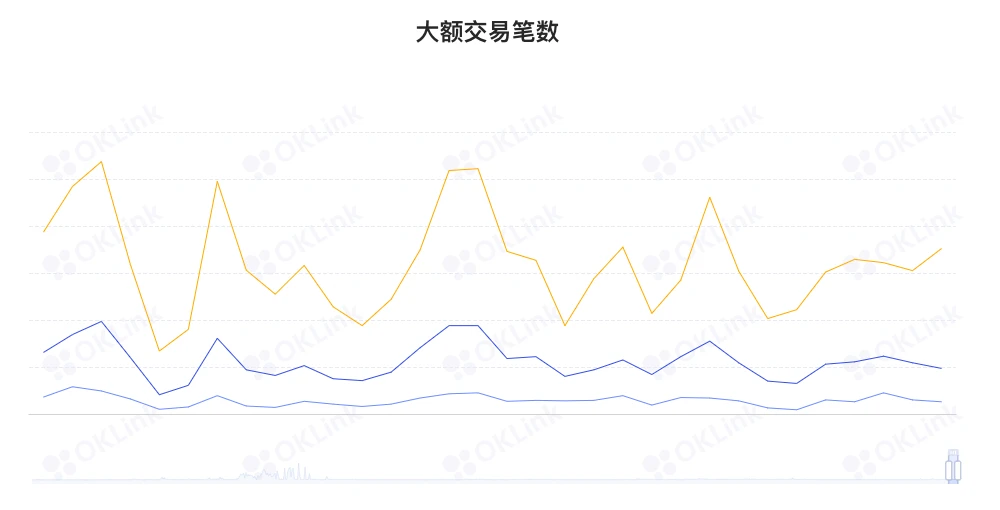

OKlink data2. Large transaction

3. Rich list address

OKlink data3. Rich list address

3. Ecology and technology

1. Technological progress

It shows that the total amount of pledged ETH in the entire network is 13,389,319 ETHs, an increase of 47,886 ETHs from last week; from the perspective of the distribution of holding addresses, exchanges accounted for 10.79%, a decrease of 0.25% from the previous month; DeFi projects accounted for 17.07%, an increase of 0.02 from the previous month. %; large addresses (top 1,000 addresses and excluding exchanges and DeFi projects) accounted for 38.45%, up 0.1% month-on-month; other addresses accounted for 33.72%, up 0.14% month-on-month.

1. Technological progress

(1) The twelfth shadow fork of the Ethereum mainnet is expected to take place on August 31

The configuration of the twelfth shadow fork of the Ethereum mainnet has been released. The Total Terminal Difficulty (TTD) is expected to arrive at around 14:00 CEST on August 31 (20:00 Beijing time). Twelve shadow forks.

All mainstream Ethereum clients such as Lighthouse and Geth have launched Merge Ready clients to upgrade the Ethereum mainnet to PoS. Node operators must update to the latest version of the client within two weeks (not before September 15) to prevent nodes from leaving the network due to the Bellatrix fork on September 6. (Trustnodes)

2. Voice of the Community

According to the Ethereum Foundation blog, the ethereum merger differs from previous network upgrades in two ways. First, node operators need to update both consensus layer (CL) and execution layer (EL) clients, not just one of the two. Secondly, the upgrade is activated in two stages: the first stage, named Bellatrix, is carried out at Epoch 144896 on the beacon chain, corresponding to 19:34:47 on September 6, 2022, Beijing time. The second phase, named Paris, triggers the merger when the TTD on the execution layer reaches 587500000000000000000000, which is expected to be between September 10th and 20th, 2022.

2. Voice of the Community

Vitalik Buterin, the founder of Ethereum, tweeted that people still underestimate the superiority of cryptocurrency payments, not to mention its resistance to censorship, and the fact that it is more convenient to use is enough to prove its advantages. Cryptocurrency payments have greatly facilitated international commerce and charity, and sometimes even domestic payments.

3. Project trends

(2) Report: The merger of Ethereum may have a negative impact on DeFi protocols and stablecoins

According to a report published by DappRadar, Ethereum’s upcoming merger could significantly affect how DeFi protocols operate on-chain.

3. Project trends

According to Banteg, the core developer of Yearn, on his social platform, there are currently two Ethereum verification node operators who have promised not to conduct censorship, namely Lido and Coinbase. In response to doubts about whether Lido is sufficiently decentralized, banteg said that Lido verification nodes are operated by 30 different organizations. According to Nansen data, these two operators control 38.34% of the pledged ETH, of which Lido controls 31.1% of the pledged ETH.

(2) ETHW Core released the second code update to enforce EIP-155 to prevent replay attacks

The Ethereum PoW fork project officially issued a document saying that ETHW Core released the second code update to enforce EIP-155. After this update, all transactions must be signed using the chain ID. This will protect ETHW users from replay attacks from ETHPoS and other forked tokens. In addition, the contract freezing function has been pulled into a separate branch, and all integration and testing have been completed. Whether this feature will eventually be pulled into the master branch will be decided at the core meeting on September 1st.

(3) The Ethereum pledge agreement Swell Network has been launched on the Ethereum mainnet

Swell Network, the Ethereum pledge agreement, launched the Ethereum mainnet through Guarded Launch. This launch is a multi-stage release plan, in which each stage has a corresponding ETH threshold, which will be actively managed by DAO to support the initial guidance of the protocol, and the first stage has been completed at 8:00 on August 22, Beijing time start.

(4) Polygon Miden released Miden VM v0.2

Polygon Miden, Polygons STARK-based Ethereum compatible solution, released Miden VM v0.2. This version of Miden VM is Turing complete and has read-write random access memory (read-write random access memory), which can execute any program. Also added support for regular 32-bit unsigned integer arithmetic.

According to data from Crypto Fees, the Arbitrum ecological derivatives protocol GMX has a daily transaction fee of 457,900 US dollars, exceeding the Bitcoin network transfer fee of 226,000 US dollars, second only to Ethereum (2,691,400 US dollars), Uniswap (1,644,600 US dollars), BNB Chain ( $626,100).

(6) The Graph launched the nested query function

The decentralized index protocol The Graph announced the launch of the nested query (Nested Queries) function. Subgraph developers can filter by subfields to more flexibly manage data views from subgraphs. In addition, The Graph will announce the next blockchain to be integrated after Ethereum within 3 days.

(7) Compound launched the multi-chain lending protocol Compound III, and first deployed the USDC market on Ethereum

According to news on August 24, the DeFi lending agreement Compound tweeted that the proposal to launch Compound III and first deploy USDC on Ethereum has been approved, and Compound III will be launched on August 26. At the end of June, Compound Labs released the code base of the multi-chain lending protocol Compound III to the community. Compound III is designed with the borrower in mind and is capital efficient, gas efficient, secure and easy to manage. Major changes include: Compound III deployments have a single borrowable (interest-bearing) underlying asset, collateral size limits are set for each collateral asset, there are separate collateral factors for borrowing and liquidation, the risk management/liquidation engine has been completely redesigned, direct Use Chainlink for price feeds, etc.

(8) Coinbase will list cbETH, which represents pledged ETH and pledged interest

Coinbase will support Coinbase Wrapped Staked ETH (cbETH) on the Ethereum network. The cbETH price does not track the ETH price 1:1. cbETH represents the pledged ETH plus all its accrued pledge interest, starting from the conversion rate and balance of cbETH when initializing Start (19:34 UTC, June 16, 2022).

Currently, Coinbase already supports cbETH deposits, and if the liquidity conditions are met, trading will begin on or after 9:00 AM PT on August 25, 2022. Once a sufficient supply of the asset is established, trading for the CBETH-USD trading pair will be launched in stages.

The EIP-3475 proposal proposed by the decentralized bond ecological platform D/Bond has been approved and accepted as a new API standard ERC-3475.

4. Borrowing

DeFiLlama 4. Borrowing

5. Mining

(data from etherchain.org)

etherchain.org5. Mining

4. News

(data from etherchain.org)

4. News

(1) Data: Addresses holding more than 100 coins in Ethereum reached 45,589, a new high in 16 months

According to Glassnode data, the number of addresses holding more than 100 Ethereum reached 45,589, a new high in 16 months. According to previous monitoring, the 16-month high on August 23, 2022 was 45,583.