JZL Quantitative Research Topic: Detailed Explanation of Quantitative Organization B2C2 Extending from Crypto to Traditional Fields

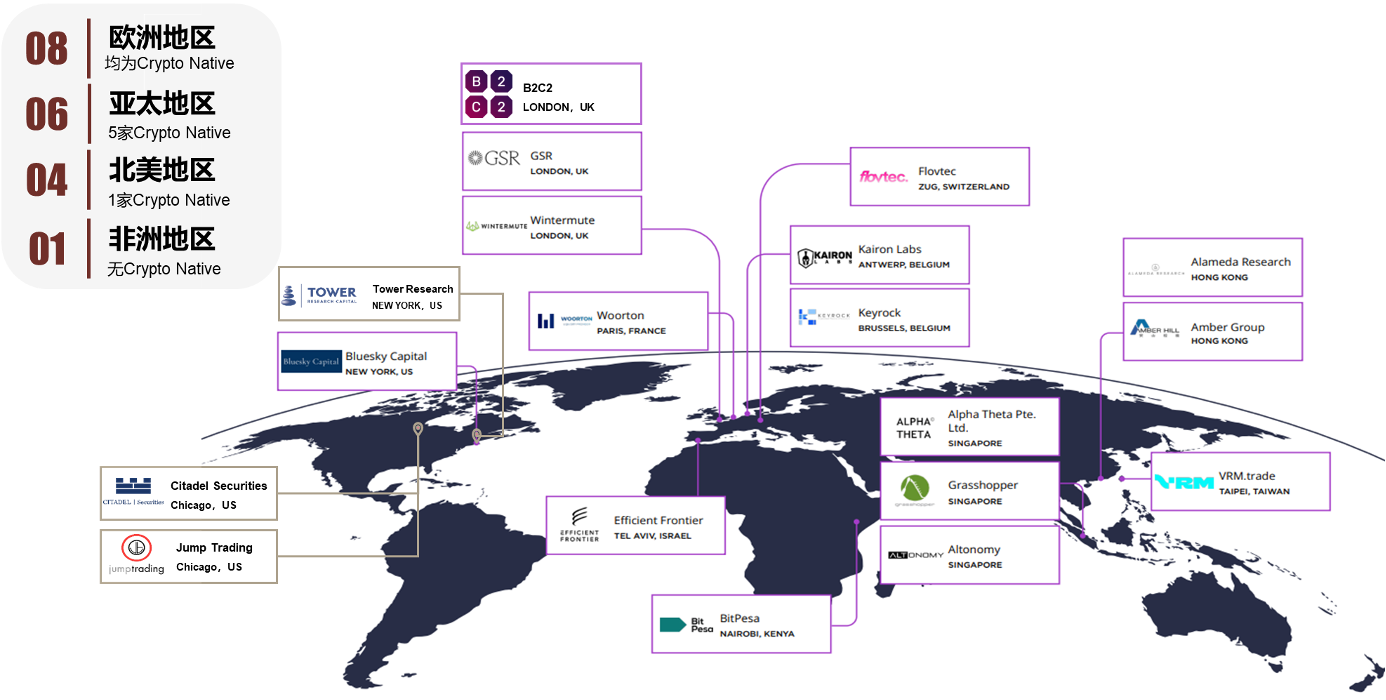

Overview: Arrangement of Crypto’s top quantitative institutions (including traditional cross-border)

first level title

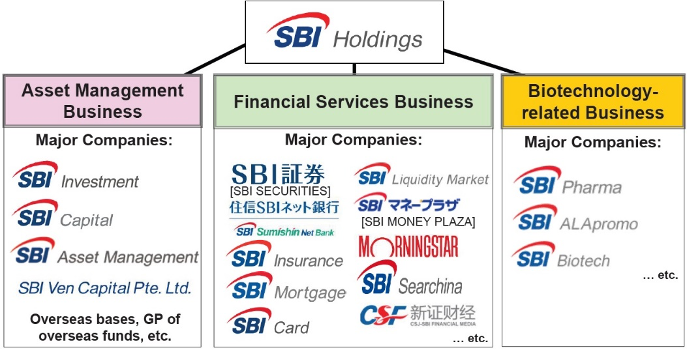

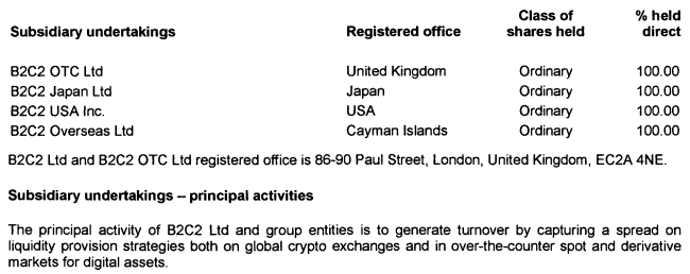

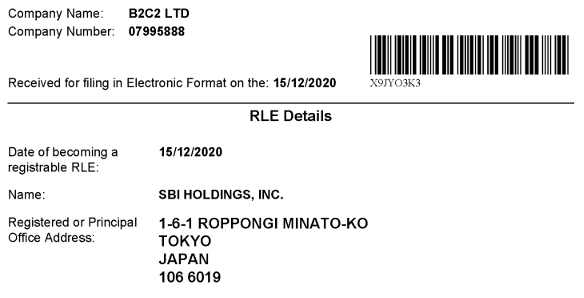

Introduction to B2C2background:[1]Established in the UK in 2015, affiliated to Japan's SBI Holdings

. B2C2 of SBI Financial Services, a wholly-owned subsidiary, is one of the largest cryptocurrency liquidity providers in the industry and a leader in OTC OTC trading;“We don’t have consumers as clients, we only deal with institutions(retail brokers , asset managers, family offices, hedge funds, banks), who must do a minimum amount of volume per month.” — From Flavio Molendini

client:Coverage area

- source of income:Spread. We make money from that spread, the difference between the buying and selling prices.

secondary title

Acquisition history

In July 2020, SBI Financial Service, a wholly-owned subsidiary of SBI Holdings, acquired a small stake in B2C2, and in September of the same year, B2C2 was added to the ranks of "VCTRADE Pro" market makers provided by SBI VC Trade, a virtual currency exchange of SBI Holdings;

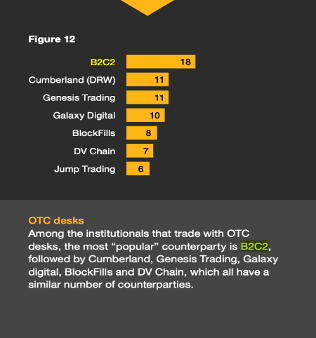

After the completion of this acquisition, B2C2 will become a cryptocurrency-focused department of SBI Holdings Inc., helping B2C2 to consolidate and improve its position in the global liquidity market and expand SBI's influence in the encryption field; the Crypto Trading Report released by PWC in 2022, B2C2 beat Genesis Trading, Jump Trading and other institutions, and was selected as the most popular OCT DESK in 2021.

Business and Planning

backgroundbackground

: London is one of the largest financial markets in the world, with the largest foreign exchange and commodity trading scale in the world, which has promoted the rapid development of the market maker system in the UK. Wintermute, GSR and B2C2 were all established in the UK;Main business

: B2C2 mainly engages in two businesses, namely block trade of digital currency and market making. Additionally, B2C2 began expanding its derivatives business over a year ago to complement its significant spot trading business:

1) Provide transaction execution services for hedge funds;

Provide basic services1) for crypto miners, corporates and wealth management companies that need to hedge risk and cash flow, or design more complex products for them;

2) Provide UK customers with Contract for Difference (CFDs) products through its FCA-regulated B2C2 OTC Ltd. This product predicts the rise and fall of cryptocurrency prices and uses leverage to make high-risk investments to earn potential net profits.

ž Business planning: With the entry of SBI Holding Inc. in 2020, and the joining of Nicola White (CEO of US) and Thomas Restout (CEO of EMEA) in 2022, B2C2 will consolidate its position as a leading market maker in the encryption field, Gradually expand to traditional business areas:

1) The technical team is building an end-to-end institutional-level service system that is currently lacking in the cryptocurrency market;

2) Join the International Swaps and Derivatives Association (ISDA), the Futures Industry Association (FIA), etc.;[1]license, and further expand into the traditional Swap trading field.”

secondary title

Risks and Measures

liquidity risk

1) Maintain sufficient balances to meet repayment and business operation needs;

2) Use internal margin tools to coordinate positions and margin ratios.

Foreign exchange risk

Hedging by matching assets with liabilities and holding offsetting currency exposures

credit risk

1) Avoid cooperation with unregulated exchanges and monitor risk exposure in real time

2) Cooperate with partners with capital strength, and at the same time require them to provide mortgage credit enhancement and monitor the collateral in real time;

1) Monitor market risks in real time by employing a dedicated risk management team and deploying internal risk models, exchange risk prediction models, and position management models.

core staff

core staff

- The founder team has a "development" + "transaction" background, and the management team comes from well-known Wall Street investment banks and the Big Four accounting firms.

Sector Division and Technology

Front-Office: before and during the trade is called the front office, because it needs to be so fast, we use Java and Rust;

Back-office (Back-Office): anything after the trade is the back office (such as reporting, accounting, sending emails, etc.). The back-office is Python and Django, REDIS, Kafka. Django is a Open source web application framework. Redis is an open source (BSD licensed), in-memory data structure server that can be used as a database. Kafka is a high-throughput distributed publish-subscribe messaging system that can handle all action stream data of consumers in the website.

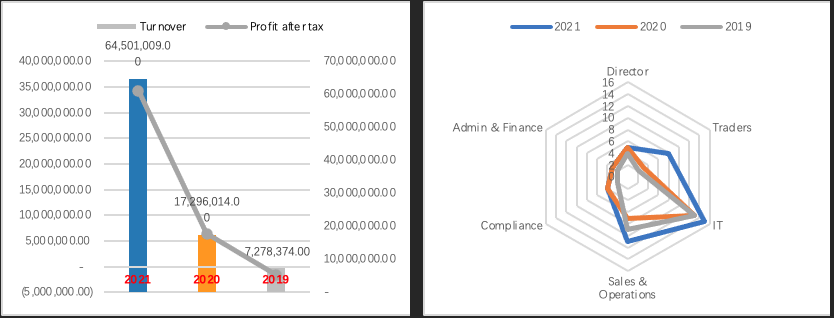

team composition

Considering the revenue scale of B2C2 in the past three years (the revenue in 2021 is 64.5 million pounds, an increase of 270% compared with 2020), the IT team has always maintained a relatively high staff composition (13-15 people), even if the main business income is less than 8 million In 2019, the ratio of Trader & IT reached 1:6.5;

Sales & Op and Traders gradually expanded with business expansion, including Sales & Op team with 11 people and Traders team with 8 people;

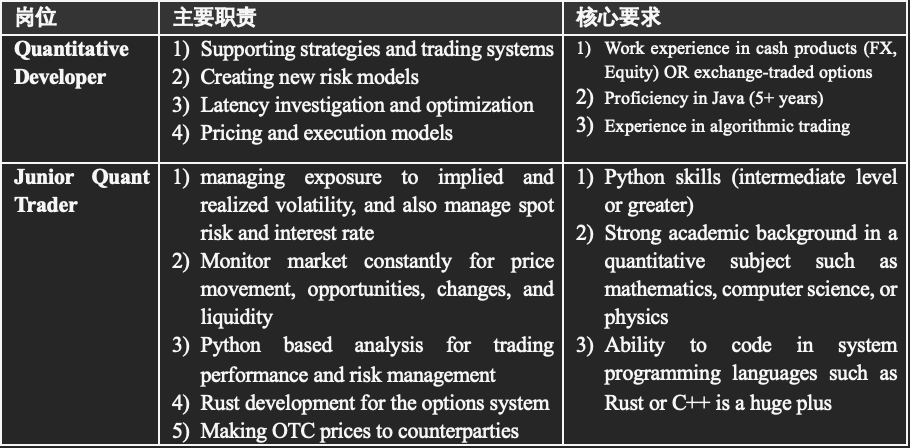

job openings

configuration reference

Citadel's front office business adopts a multi-manager platform system, that is, recruiting a large number of PMs, and each PM recruits several researchers to form a small team according to the needs, so as to be relatively independent from each other, compete internally, and survive the fittest according to the income;

Jump Trading internally divides dozens of trading groups, each responsible for researching, developing, operating and maintaining their own strategies, and sharing the company's technology platform and hardware infrastructure. There are four main positions, namely Algo Trader, R&D Engineer, Software Engineer and Data Engineer. Among them, algorithmic traders are relatively comprehensive. They understand products and can also do data mining/machine learning, develop strategies, and write codes; R&D engineers are mainly system architects, focusing on researching low-latency systems; software engineers are responsible for conventional software system development ; Data Engineers are responsible for processing data from different sources for use by the trading group.

Difficulties and challenges

Stable: Customers do not accept downtime, and the platform must operate in a zero-downtime environment. have to operate in a zero-downtime environment where there can be no maintenance (actually have one hour of maintenance per week, but working hard to reduce that to zero)

Hiring: Hiring, especially for IT positions, is always one of the last things the management team does. It takes a lot of effort, especially in IT, it takes 100 interviews to hire one.

portfolio

portfolio

Up to now, B2C2 has invested in two centralized exchanges, CoinFLEX and LGO Exchange:

Up to now, B2C2 has invested in two centralized exchanges, CoinFLEX and LGO Exchange:

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Website www.jzlcapital.xyz

Twitter @jzlcapital

contact us

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.

If there are obvious facts, understandings or data errors in the above content, welcome to give us feedback, and we will correct the report.