This article comes from CoinMarketCap ResearchThis article comes from

, released with its exclusive authorization, compiled by Odaily translator Katie Koo.

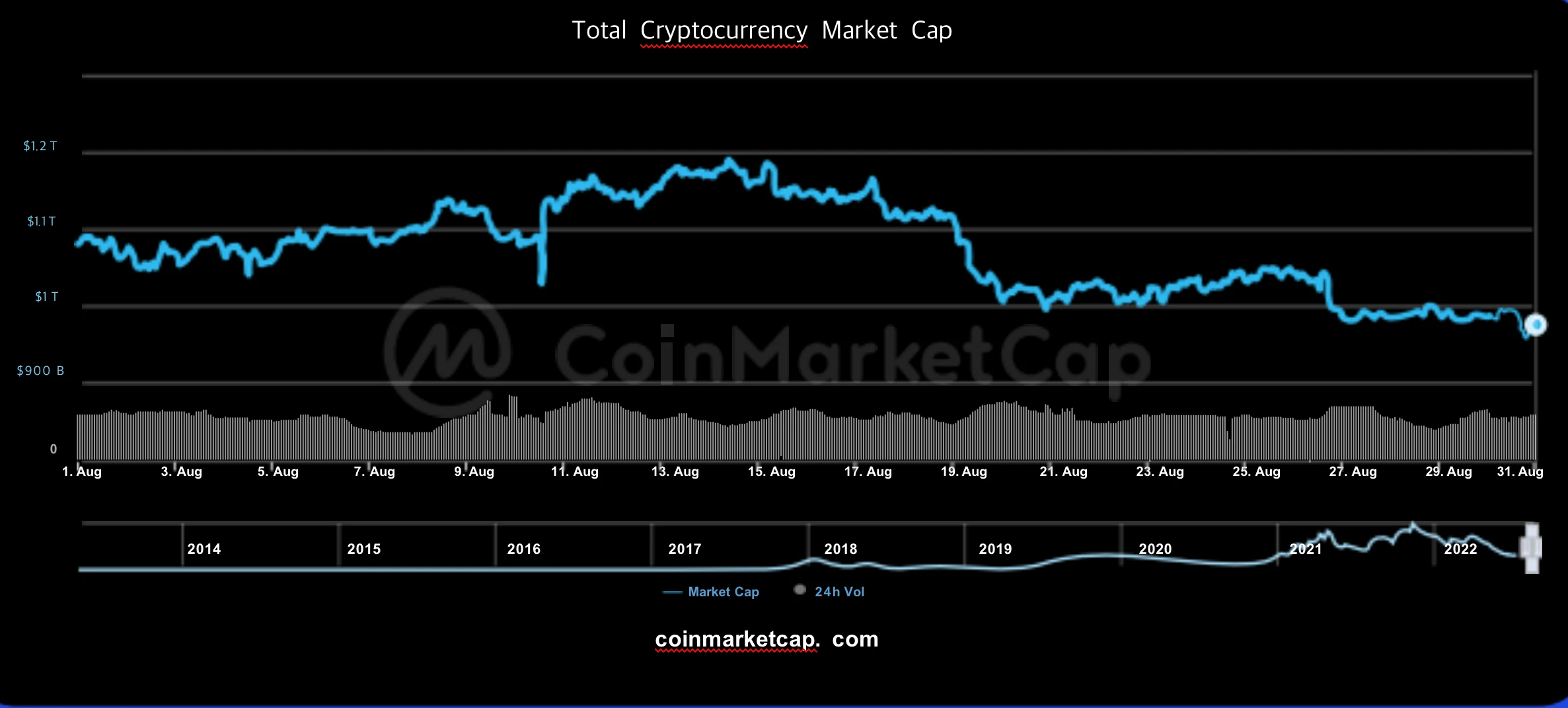

In August alone, the total market capitalization of the crypto market dropped by 9.97%, and it has now dropped below 1 trillion. This is partly due to macro factors and the tough global economic situation.

However, several industries are still growing strongly:

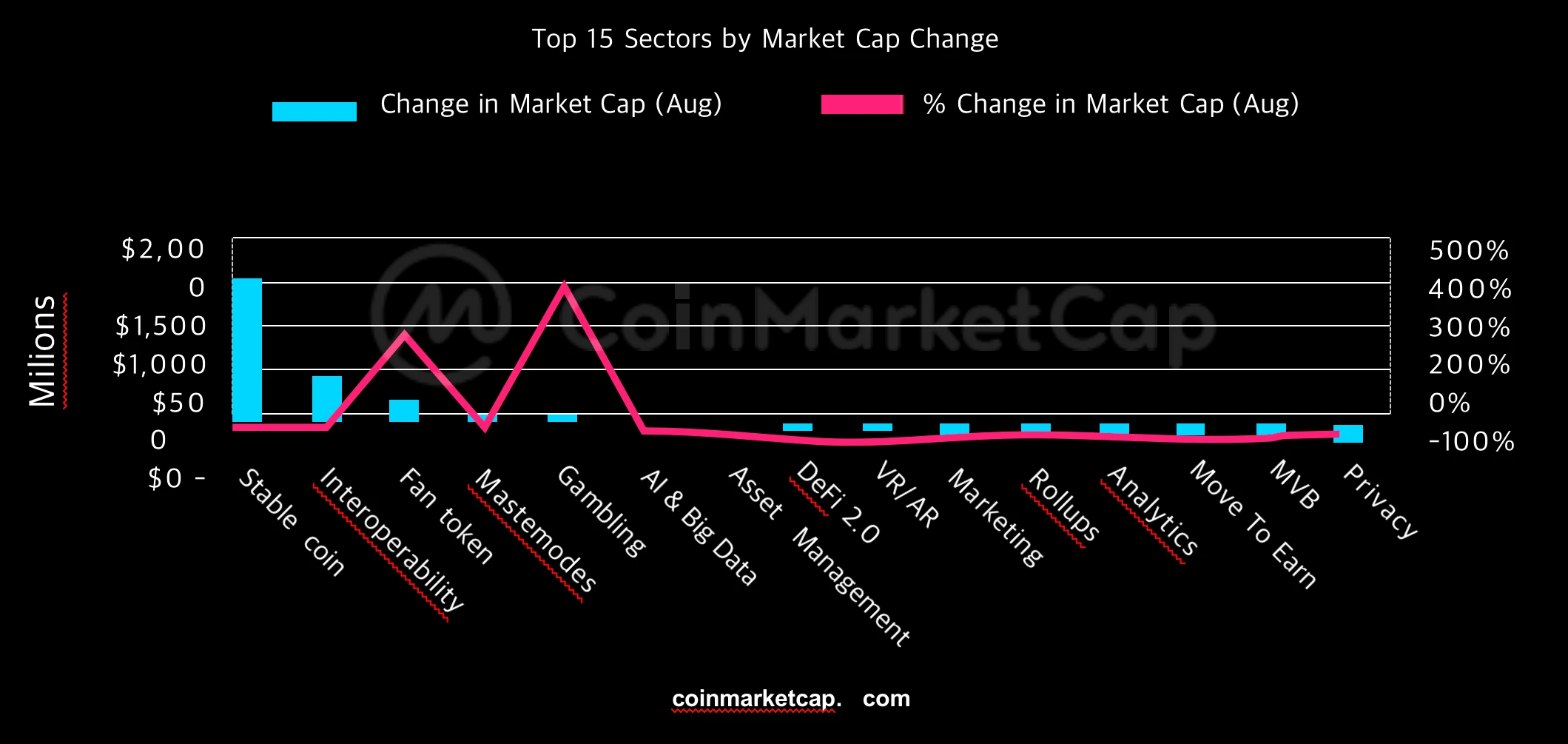

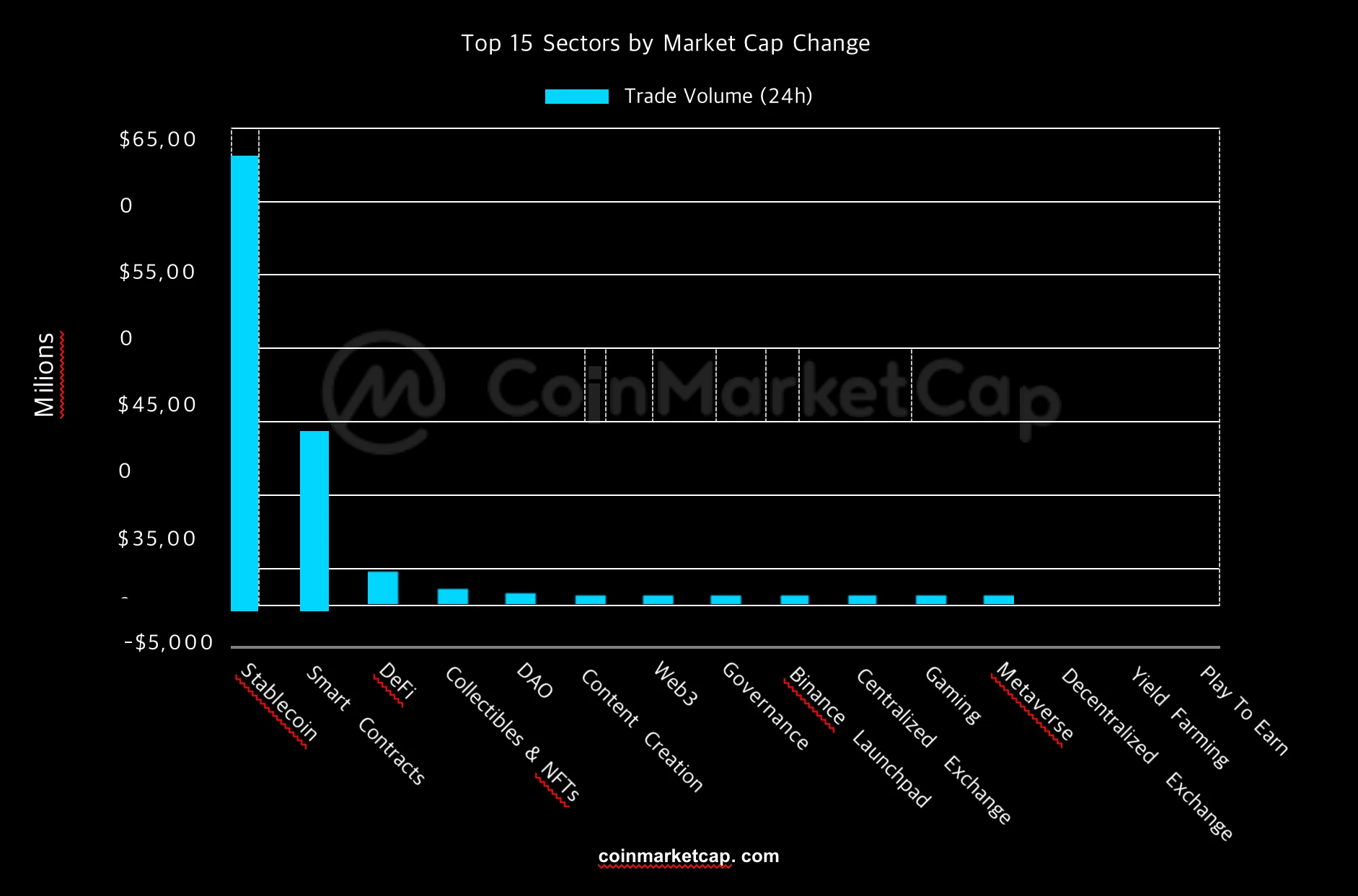

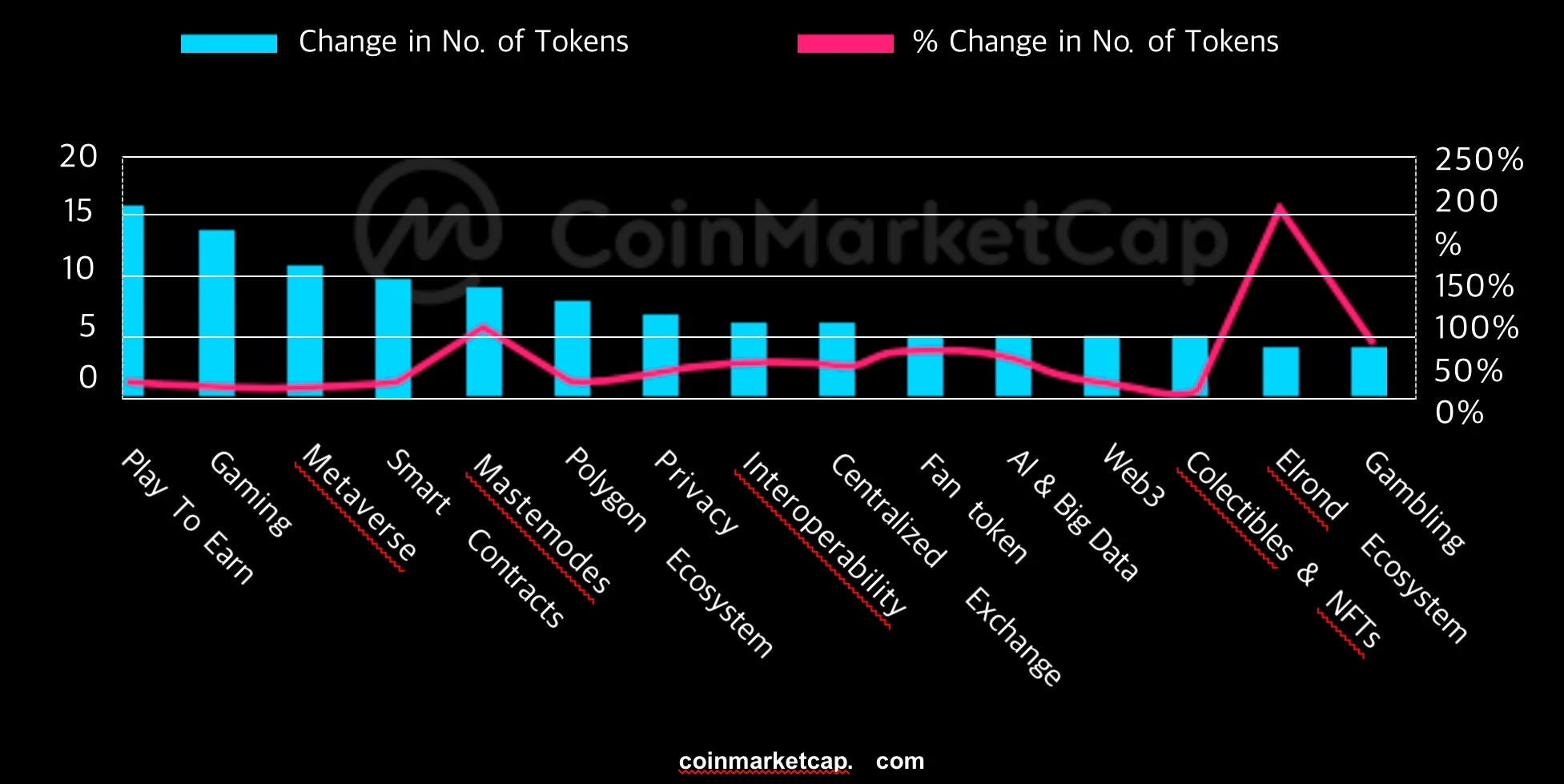

Market value: In August, the market value of DeFi, smart contracts and NFT increased the most; the market value growth rate of the quiz and fan token sectors was the highest, 404% and 262% respectively.

Newly launched tokens: Industries related to GameFi, such as P2E, games, and Metaverse, have the largest number of new tokens launched, with an increase of about 14% in August.

Chapter 1: Crypto Market Composition

secondary title

How did the total market capitalization of the crypto market change in August?

In August alone, the total market capitalization of cryptocurrencies fell from $1.082 trillion to below $1 trillion, a drop of 9.97%.

The following three macro factors have influenced the decline in prices:

Global inflation is still far from under control, at 8.5% in the US and rising in other G20 members. Inflation levels remained unchanged from June/July. There are no clear signs yet that inflation will drop to healthy levels anytime soon.

The Fed continues to raise interest rates at the current pace. Federal Reserve Chairman Jerome Powell sent a strong and clear message in his speech on Friday, August 26: Despite the challenging economic environment, the Fed will continue to raise interest rates. Overall, continued rate hikes mean risky assets such as cryptocurrencies may face a challenging growth environment.

The mood in global markets is pessimistic. The global economy has already begun to slow, with some sectors such as retail and manufacturing showing signs of weakness. Meanwhile, some leading economic indicators are starting to soften. Market sentiment started to slow as investors turned to quality assets.

Next, we use several key discussion points to zoom in and examine the changes in cryptocurrency market capitalization in August.

secondary title

Topic 1: Ethereum Merger

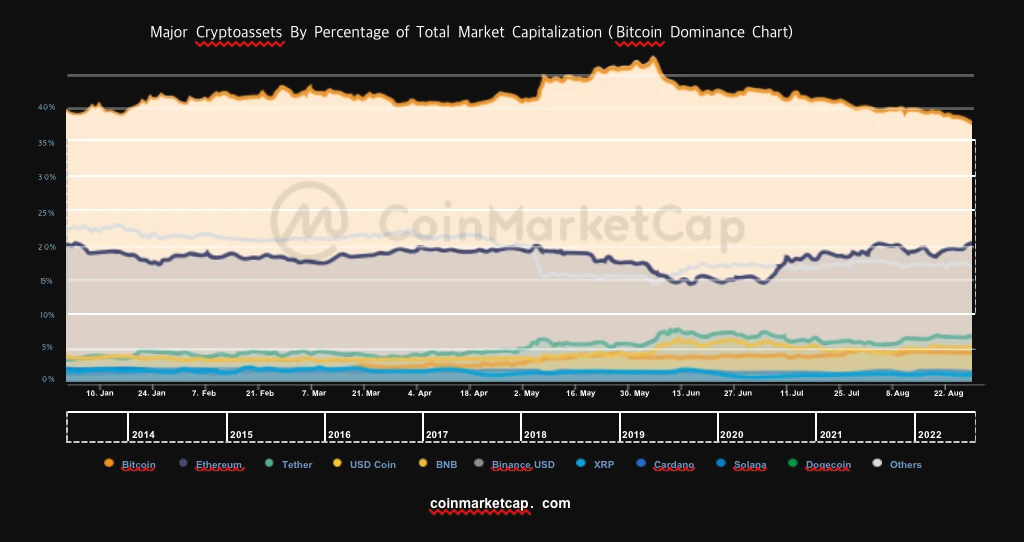

In 2022, the market value of Ethereum has been around half that of Bitcoin. When the merger returned to the spotlight in August, more attention shifted to Ethereum, with the price of ETH rising from $1635.20 (August 1) to $2022.79 (August 14), the most since August The highest level; Bitcoin’s market capitalization accounts for 19.39% of the total cryptocurrency market capitalization, while Bitcoin’s market capitalization currently only accounts for 39.12% of the total cryptocurrency market capitalization – a downward trend observed in the past two months.

secondary title

Topic 2: Industry Analysis - Market Cap, Transaction Volume and New Projects

In August, the market value of most industries showed negative growth. Two major leading industries still saw positive market capitalization changes: stablecoins increased by $1.67 billion; interoperability increased by $536 million. Despite the sideways market movement, the quiz and fan token segments saw the highest percentage change in market capitalization, up 404% and 262% month-on-month, respectively.

We will delve into these two areas in the next section when we analyze social trends.

Stablecoins still dominate in terms of transaction volume; however, smart contracts saw the most positive growth in transaction volume compared to the beginning of the month, with a daily transaction volume of approximately $25 billion as of August 31, 2022. This trend is driven in part by active Ethereum merger transactions and DeFi’s real returns narrative.Bear markets are often considered the best time to build, and based on developments in the GameFi space, we may see this space come out of the sidelines, showing strong growth, and potentially becoming the next wave of cryptocurrency trends.

first level title

Chapter 2: Retail Market Sentiment - How are retail investors reacting to the cryptocurrency market?

As a leading cryptocurrency price aggregator, we use CoinMarketCaps overall page views as a proxy for retail interest in the cryptocurrency market. There have been two major spikes in page views (or retail interest) so far this year. This is because:

First, retail interest surged in late February as tensions between Russia and Ukraine escalated. Bitcoin plunged 10% to nearly $40,000 after U.S. President Joe Biden hinted that Russia could invade Ukraine within days.

On February 24, the price of Bitcoin fell a further 9% to $34,555 due to Russias invasion of Ukraine. The intensification of the war has not only affected cryptocurrencies, the global market has also fallen into a trough.

Since February, pageviews have climbed and are 119.5% higher than the year-to-date average weekly pageviews as the price of Bitcoin recovered to the $44,000 level.

The second surge in retail interest in Bitcoin began in mid-June, when Bitcoin fell from $30,000 to a low of $17,744. Importantly, this breached the psychological level of $20,000, the first time BTC has fallen below its all-time high from the previous cycle.

The 40% BTC crash and broader cryptocurrency sell-off was caused by a combination of factors — a bear market filled with turbulent events both within and outside the crypto ecosystem. Uncertain macroeconomic conditions and rising inflation, combined with the ongoing Russia-Ukraine war, led the Fed to raise interest rates.

In crypto, the $60 billion Terra implosion in May 2022—starting with algorithmic stabilization and eventually leading to a death spiral and bank run—is a chain reaction that affects major crypto lenders and even a leading crypto lender. Hedge Fund.

Weekly page views from mid-June to early July were 81.8% above average. However, compared to the weekly average in August, page views were 48.4% below the year-to-date average, suggesting retail interest correlates with sharp price drops, at least this year.

secondary title

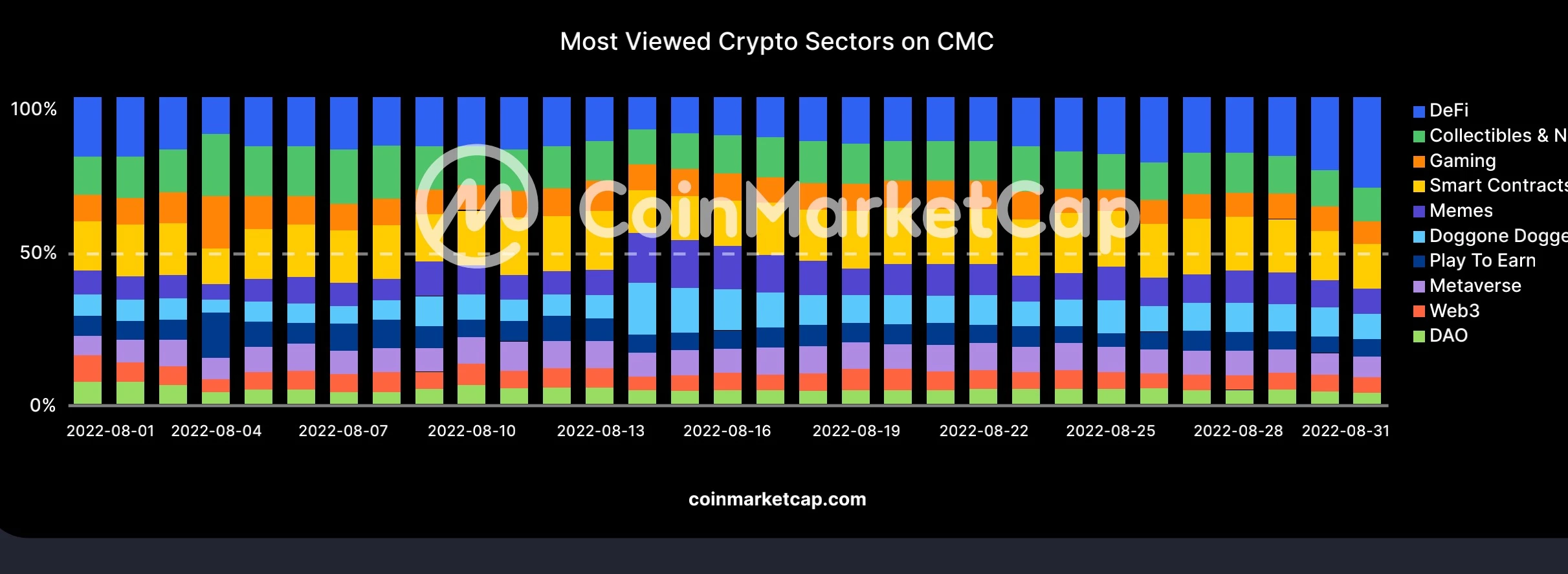

Which areas of encryption get the most attention at CMC?

To determine which cryptocurrency fields have a high degree of attention among users through the most concerned fields on CMC, you can see:

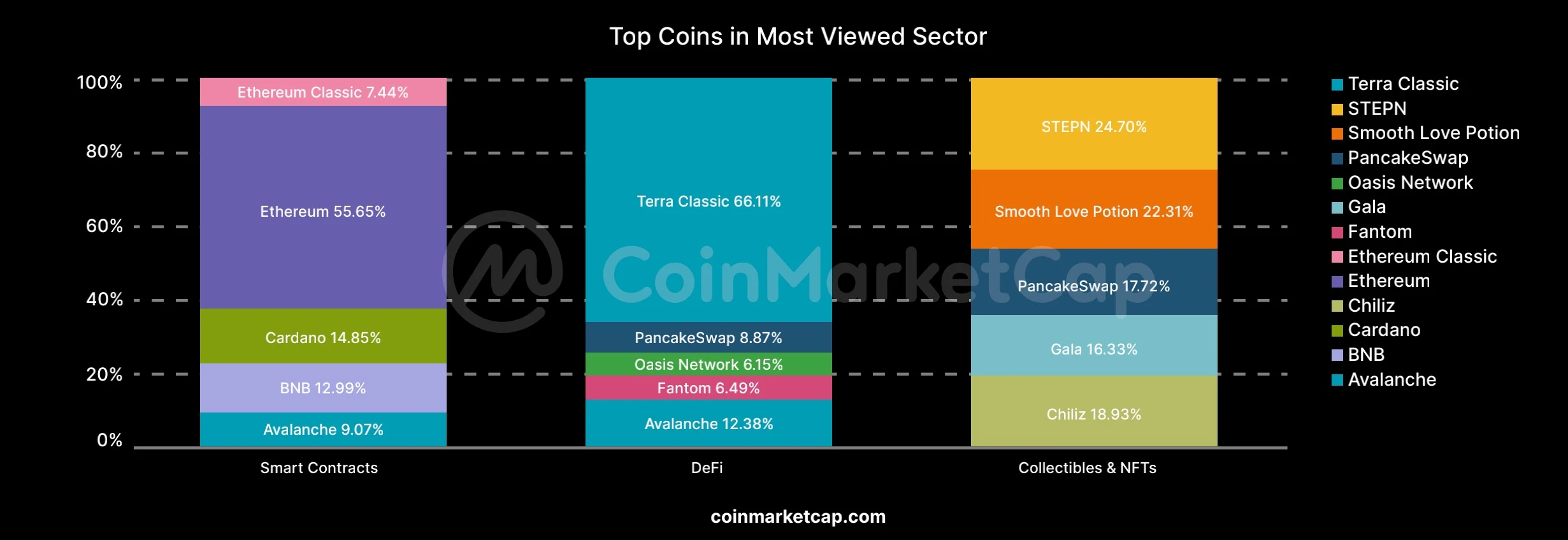

DeFi was the most watched sector in August:

From August 1st to August 31st, page views increased by 34%. Despite DeFi’s poor performance so far this year — with DeFi’s market capitalization plunging 64% and total value locked down 60% — interest in the space remains high. According to Dune Analytics’ dashboard, despite the poor performance of the DeFi market, total unique users have increased by 14% so far this year.

DeFi users proliferate during times of extreme volatility and uncertainty, such as the Terra crash, when certain exchanges suspended trading while permissionless DeFi protocols continued to operate. In fact, within DeFi, the most viewed crypto token is Terra Classic — which recently rallied over 180% thanks to a series of governance proposals, upgrades, burns, and staking by the community.

Smart contract platforms are the second most visited sector:

This includes Ethereum, the pioneering smart contract blockchain, as well as other layer contracts such as BNB, Avalanche, and Solana. While many L1 tokens have experienced double-digit gains, many have suffered greater depreciations during the current bear market. Compared to ETH, AVAX is down 57% and SOL is down 55% so far this year. BNB remains an outlier, up 33%.

The Ethereum merger was completed on September 15, and ETH is the most talked about currency in the smart contract vertical.

After a breakthrough in 2021, the monthly NFT transaction volume on the market hit a record high of $5.63 billion in January 2022. However, transaction volumes fell sharply for the year, falling 89% to $613.46 million in August. Nonetheless, the NFT and collectible space has managed to maintain a high level of community engagement, likely due to one or more of the following trends in the NFT space: introduction of NFT financial protocols, offering loans using NFTs as collateral, airdrops to incentivize The NFT community and the idea of soul-bound tokens, the debacle of the free mint project, and the consolidation of NFT collectibles (eg Yuga Labs acquisition of CryptoPunks IP).

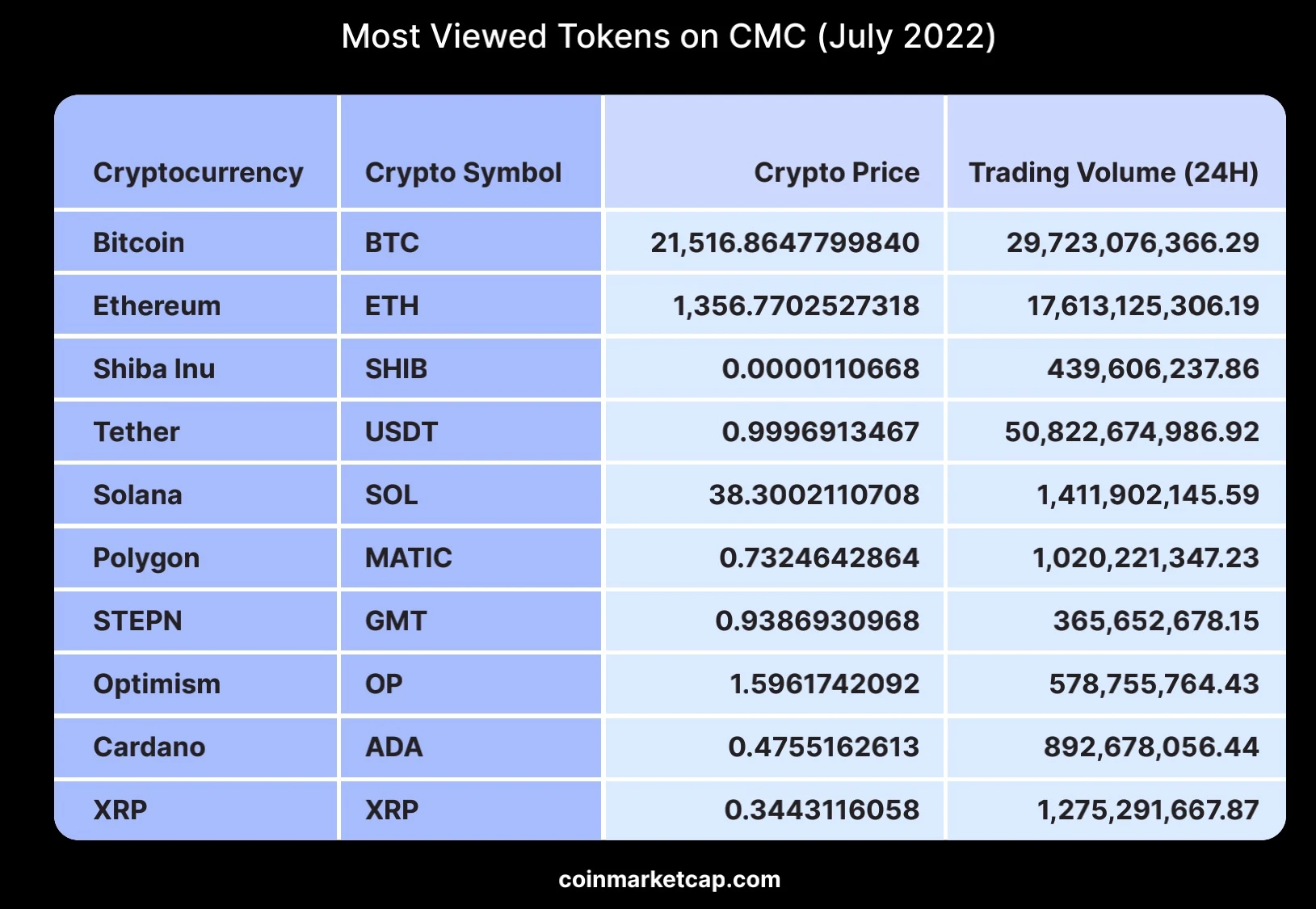

Which tokens are viewed the most on CMC?

July 2022

image description

August 2022

From the top 200 cryptocurrencies we can see that Solana, Bitcoin and Ethereum occupied the top three most viewed cryptocurrencies in August.

Solana jumped from No. 5 in July to No. 1 in August. This is largely due to the following reasons: According to Elliptic, the Solana hack occurred on August 2, and nearly 8,000 wallets were emptied of more than $5.8 million in SOL, Solana-based tokens, and NFTs. The hack came from 4 wallets targeting the private keys of Solana browser wallets such as Phantom, Slope, Solfare, and TrustWallet. According to reports, the Solana blockchain was not compromised during the hack.

It’s not all bad news, however — Solana’s “Validator Health Report,” released in August, assesses the network’s resilience and decentralization. The report highlights three key metrics: validator count, Nakamoto Coemcient, and distribution.

There are more than 3400 validators on six continents, of which 1900 are consensus nodes that generate blocks and 1500 are RPC nodes. Whats more, since June 2021, an average of 194 new nodes have been added per month.

The Nakamoto Coemcient is an indicator used to assess the degree of decentralization of the network. Simply put, it is a measure of the minimum number of nodes required to stop consensus. Solana scored 31 points, one of the highest scores among other proof-of-stake networks.

While Bitcoin and Ethereum remain in the top three most viewed coins.

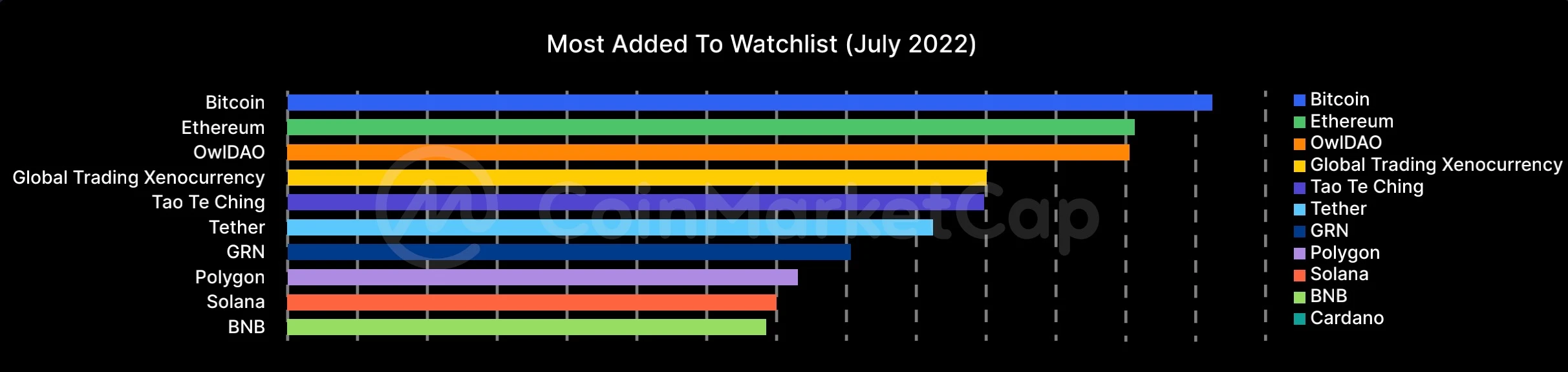

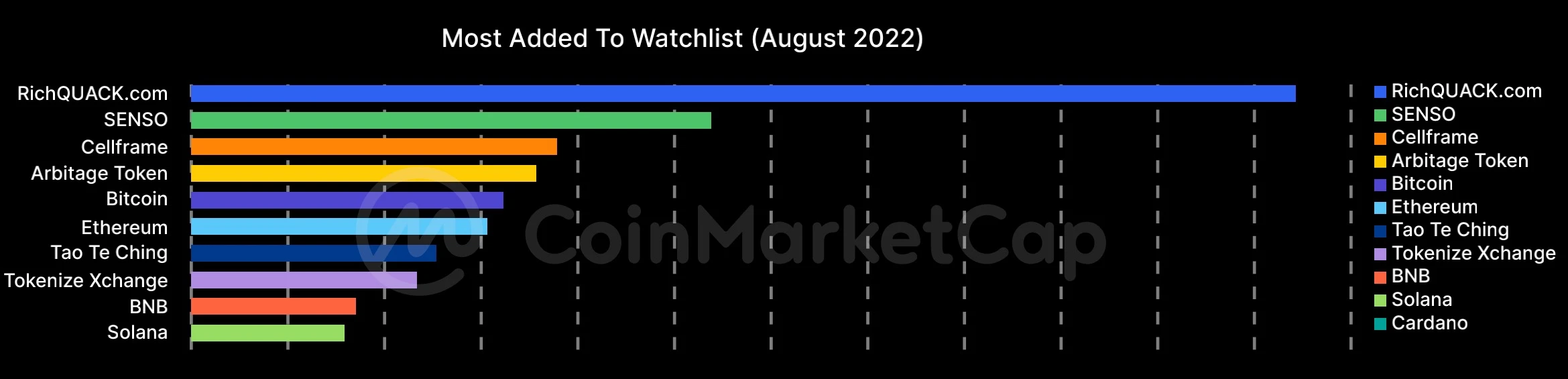

Which coins have been added to the watchlist the most times?

text

Based on the most added crypto tokens to the CMC watchlist, our goal is to break down the tokens that users are most interested in or concerned about.

Besides Bitcoin, other coins that were added to the watchlist most in July and August include: Ethereum (ETH), Tao Te Ching (TTC), Solana (SOL) and BNB. Although the communities of ETH, SOL, and BNB are strong, the situation of TTC (a token trading platform based on BNB Chain) is unclear. In August alone, half of its 100,000 watchlist users were added.

secondary title

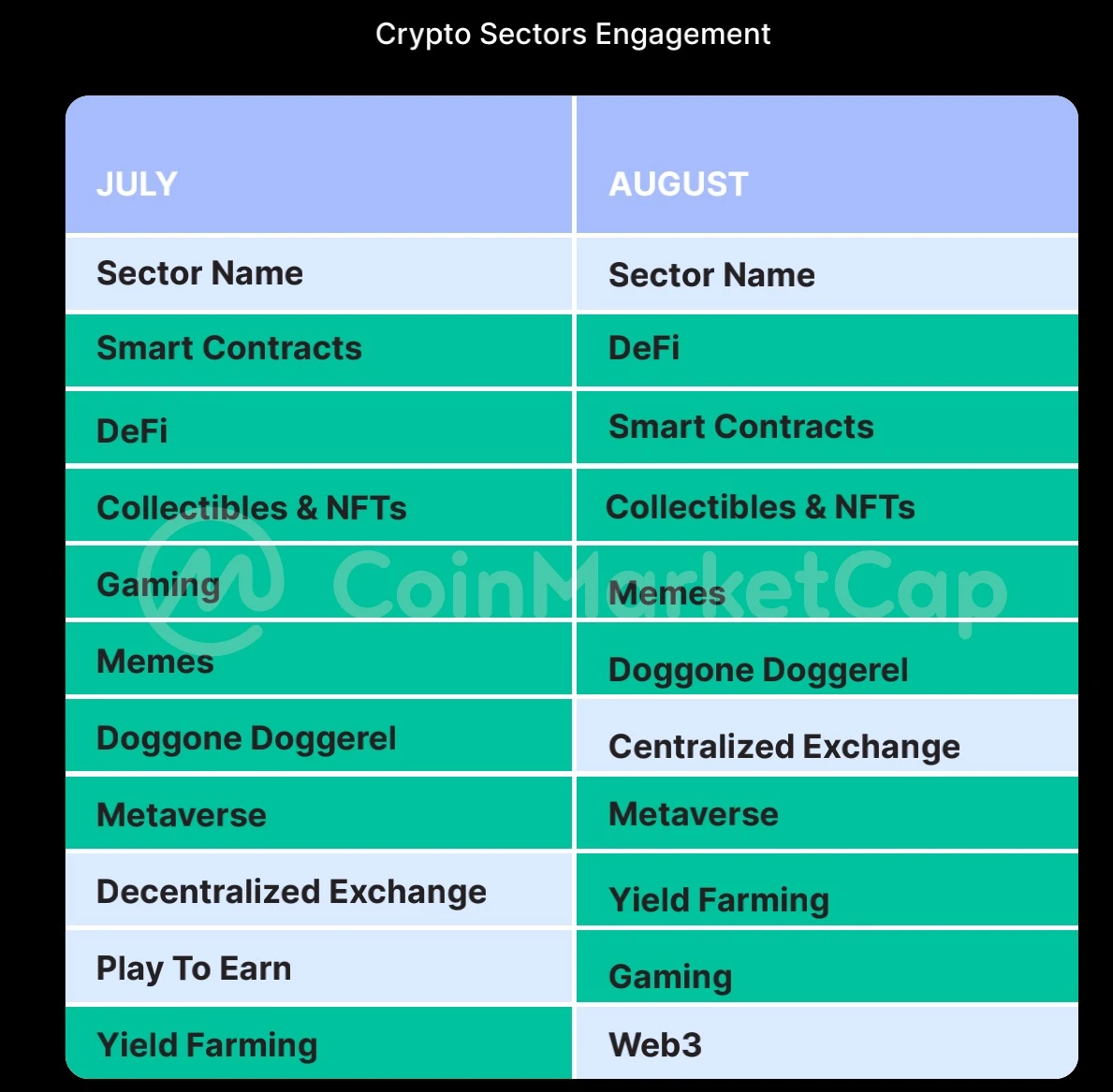

Which crypto sectors have the highest participation?

Another indicator of retail interest is the engagement of the CoinMarketCap community.

DeFi, which is highly correlated with the most watched sector, once again topped the list. The freezing of crypto users’ assets on centralized crypto platforms, and the subsequent liquidation of these platforms, such as Celsius and Voyager Digital, also underscores the importance of the open and decentralized nature of DeFi to crypto participants.

The NFT and collectibles segment remained unchanged at third place. Although it has been discussed above, one thing to note is the importance of the community for NFT projects. This is the key factor that differentiates blue chips from ordinary NFT series or projects.

secondary title

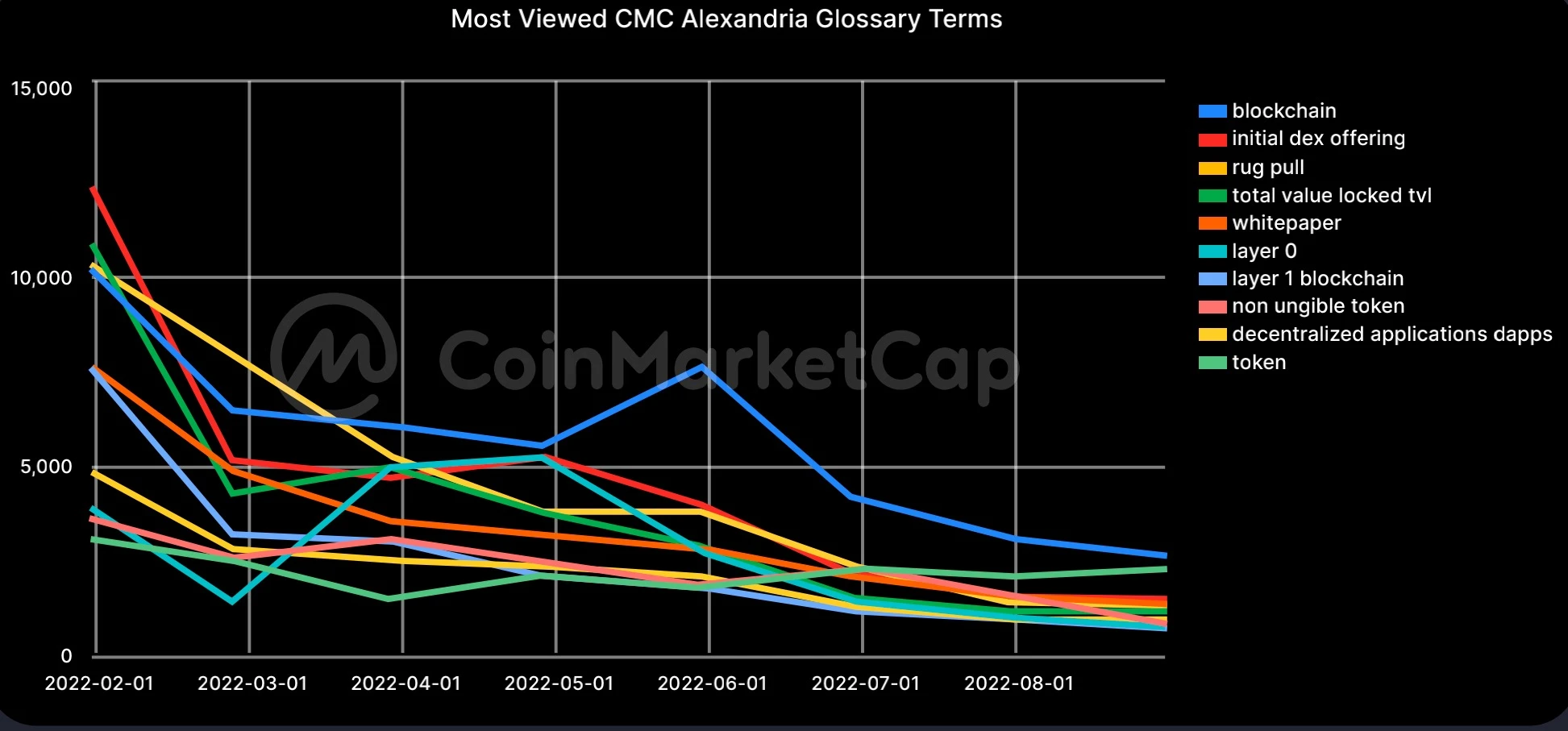

Which encryption terms are users most interested in?

As the ethereum merger heats up, several key terms around blockchain scalability and consensus layers are coming into focus. However, as the bear market continues and prices drop, interest in the search term is generally trending downward.

secondary title

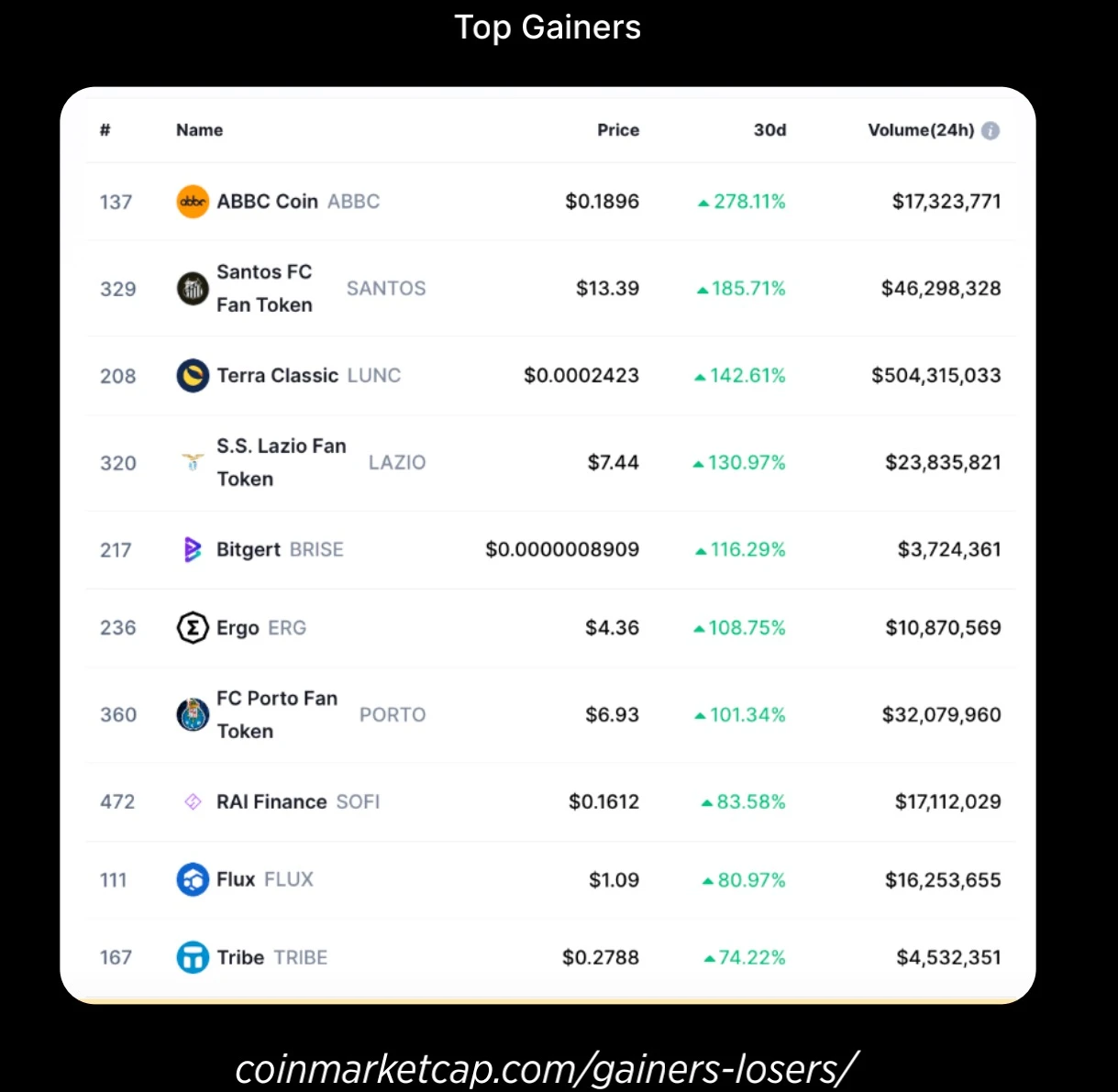

Top Gainers in August

Blockchain payment and digital wallet provider ABBC Coin topped the list in August, with a monthly gain of 278% and a peak gain of 459%. There were a number of reasons for the rise, including the August 19 launch of Buyaladdin, a cryptocurrency-only online shopping mall. ABBC also launched DOMINO DEX, the native decentralized exchange in its ecosystem, in August.

Three of the top 10 are fan tokens, specifically from the Binance Fan Token platform — Santos FC, SS Lazio, and FC Porto. In 2021, Binance Fan Token was launched in partnership with the three football clubs mentioned above, and claims to redefine the fan experience through special benefits and privileges powered by blockchain technology.

All three fan tokens have dropped significantly in value since their launch in 2021, with the largest drops ranging from 90% to 95% — however, in early August, fan tokens rallied sharply, outperforming most of the market.

The fan token industry is currently valued at $428 million and is dominated by two platforms — Binance Fan Token and Chiliz (socios.com). While Binance Fan Tokens are only featured in 4 of the 59 listed Fan Tokens (3 football clubs and the Alpine F1 team), it accounts for 54.5% of the total valuation of the sector.

If fan tokens find product-market fit and scale, there is huge potential and room for growth. Additionally, the interaction between the sports industry and cryptocurrencies is increasing.

As mentioned earlier, the guessing industry is another industry that has seen a significant increase in market capitalization. The global casino and online betting industry is worth $231 billion in 2021, while the sports betting industry is worth $76.75 billion. In comparison, the crypto betting category has a market capitalization of $133.1 million, which is only 0.04% of the two industries mentioned above combined. However, it must be pointed out that CMC’s guessing industry market capitalization only includes tokenized projects.

Another factor that is not included in the crypto market capitalization calculations are non-crypto-native online betting platforms, that is, those platforms that do not focus on cryptocurrencies in the first place. These apps tend to offer Bitcoin as the primary cryptocurrency on top of other forms of payment. Other cryptocurrency options such as Ethereum, Ripple, Litecoin, etc. may also be included.

Despite regulatory concerns, cryptocurrencies and the online gambling industry have many synergies — including being a secure, private, near-instant form of transaction that is well-suited for online transactions. An early use case for bitcoin included its use in online poker tournaments.

Finally, Terra Classic has also rebounded since mid-August, peaking at 215%. This is due to the community burning over 3.5 billion LUNC tokens and holding over 528.8 billion LUNC while introducing governance proposals. A proposal for a 1.2% burn tax will also be announced on September 12.

Chapter 3: Frontiers of the Cryptocurrency Market – August Theme

secondary title

L2 Solutions

Based on CoinMarketCap listing data and market sentiment, the CMC team has seen a clear uptick in interest in L2 solutions.

One network to watch out for is Arbitrum, Ethereums second-layer scaling solution, which has yet to launch its own token. An upgrade to Nitro launched in August made it easier for developers to work on the network and attracted interest from the DeFi community, making its TVL one of the largest in L2.

If general interest in L2 continues to rise, we expect the number of L2-related currencies and tokens listed on CoinMarketCap to rise.

secondary title

Chain optimizations (except L2, zkrollups)

There are three L1 goals that stand out in terms of optimization and scaling:

Aptos, a blockchain built in the Move language, plans to launch its mainnet in winter 2022. Aptos Labs claims it can solve the scalability problem with a hybrid custody option, a modular approach to transaction processing and an embedded on-chain management protocol.

Sei Network is a DeFi L1 blockchain that aims to be a purpose-specific blockchain. Sei aims to optimize the scalability of their L1 blockchain by using a built-in order matching engine and lead protection.

secondary title

Real Yield

In this case, regular yields can create liquidity issues for the recipient, as native tokens are often distributed at extremely high APYs that cannot be sustained over the long term. Projects that offer real yield in ETH or stablecoins might be seen as a positive shift away from unsustainable yield farming and into the DeFi space that returns real yield to users.

secondary title

Dapp

Which fields are being built?

Based on their interactions on marketplaces and listings, the CMC team also sees an increase in the development of decentralized social apps, especially clones of existing apps and websites that claim to be decentralized. Two examples are Lens, a protocol from the Aave company that provides an open-source technology stack to build infrastructure for social applications. Theres also Radicle, which bills itself as a decentralized alternative to Github.

Binance Labs also recently led a funding round for Web3 digital citizenship project Lifeform. Lifeform plans to implement a decentralized visual digital identification (DID) solution to facilitate interoperability between digital and physical.

domain name

domain name

The current belief in the Web3 space is that personalized, decentralized domain names may eventually replace centralized, traditional domain names.

secondary title

Which areas are being funded?

According to the CMC team, DeFi protocols will continue to raise funds by using their own tokens, such as Aave and Curve.

Chapter 4: Global Encryption User Situation

secondary title

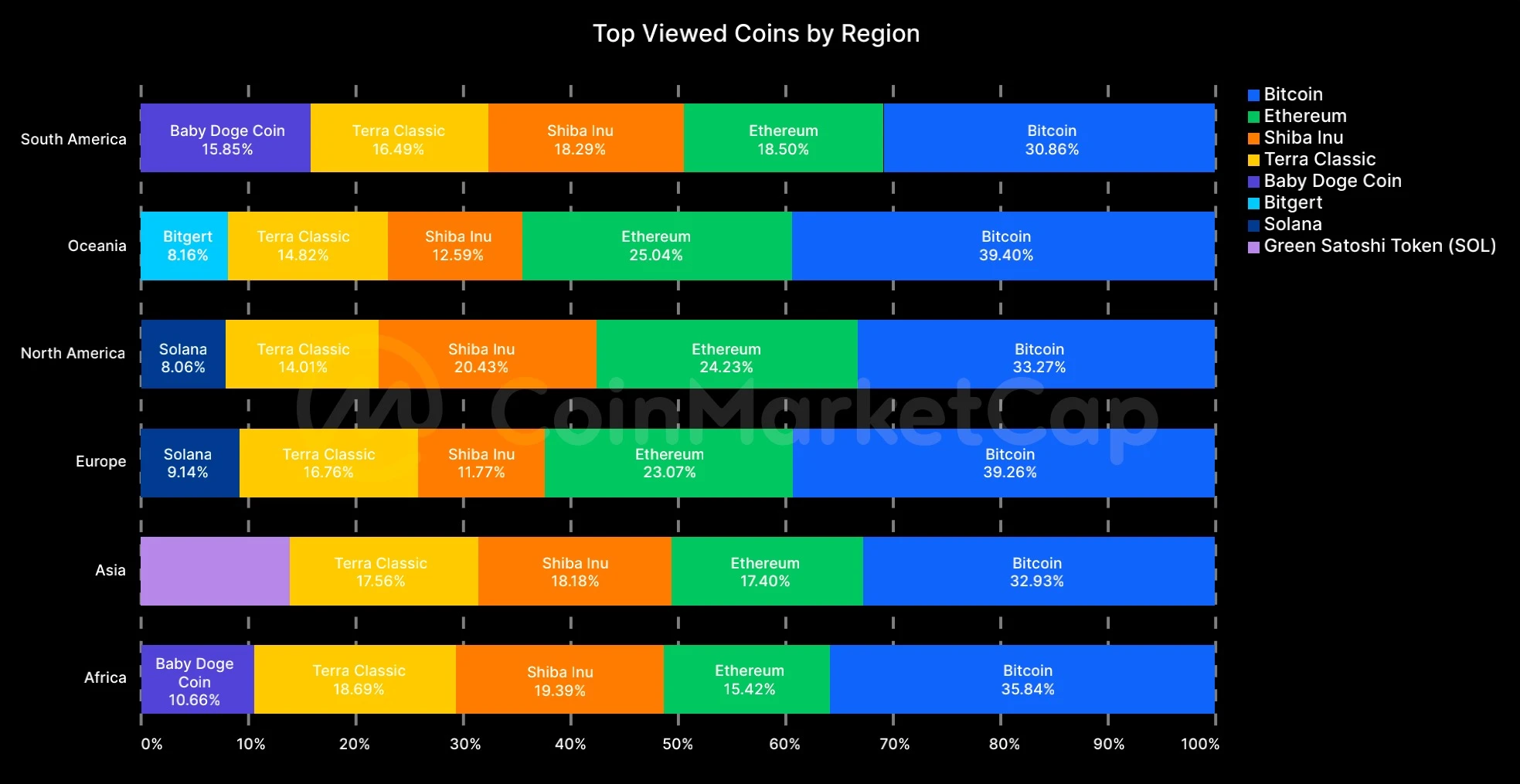

Popular Tokens in Different Regions

South America has long been a crypto hotspot of interest, especially with the rise of P2E over the past few quarters. However, the hot tokens in the Latin American region are not P2E or Web3 tokens, but classic cryptocurrencies like Bitcoin and Ethereum.

Notably, apart from Shiba Inu, only South American and African users are interested in memecoins, which may indicate a strong trend for memecoins in developing regions.

P2E is of most concern to CMCs users in Asia, the only region where interest in P2E tokens is high. STEPNs GST tokens are used as part of the STEPN ecosystem and are a very popular form of exercise in Asia until July 2022 when STEPN users in China are blocked due to regulatory concerns.

secondary title

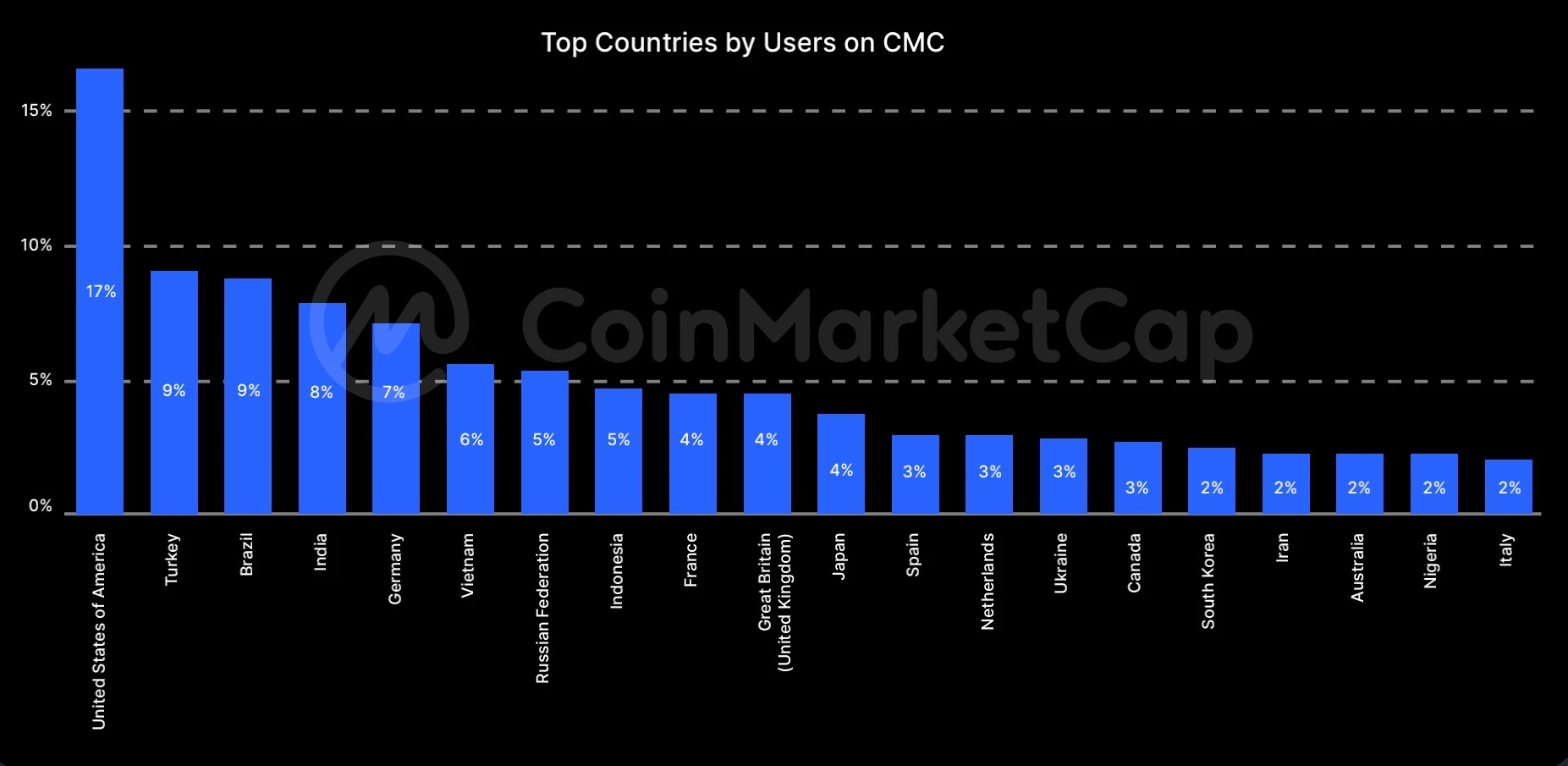

Popular Countries on CMC

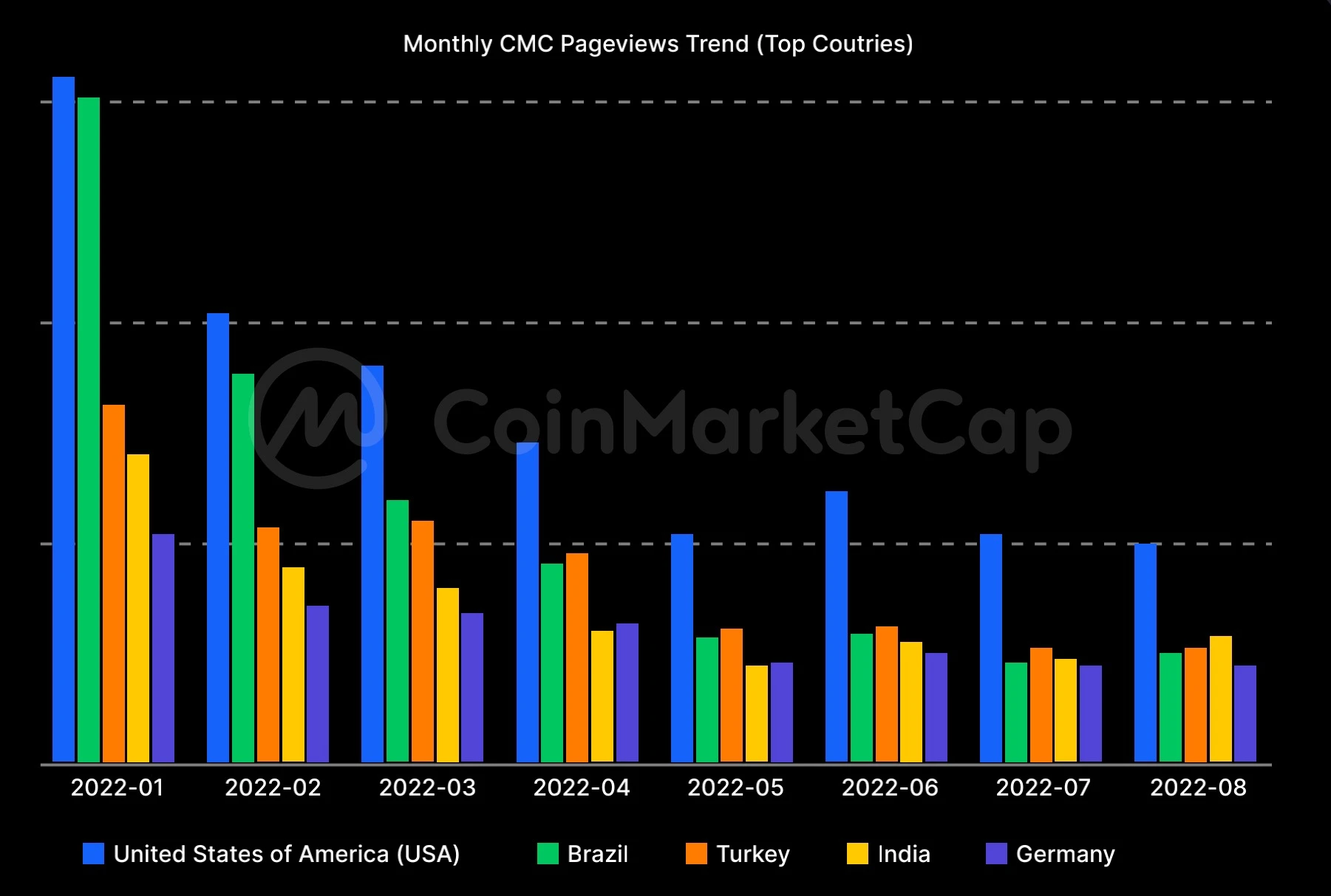

Most of CMCs users are from the United States. Although cryptocurrencies are a global phenomenon, nearly three times as many U.S. users visit CMC as users from the next-ranked country. The next few big countries to join the CMC have similar stories of high inflation, an economic phenomenon that usually leads to a surge in interest in cryptocurrencies.

Turkeys inflation rate is reported to be close to 80% as of August 2022. The country’s government has attempted to introduce a bill to limit the use of cryptocurrencies for more than a year, but the legislation has yet to pass parliament.

Surprisingly, Ukraine did not make the top ten list, despite the relatively high number of news reports about the country’s use of cryptocurrencies to secure financial support in the Russian war. However, it cannot be ruled out that Ukrainians may be using local encrypted data trackers instead of CMC.

US users

image description

The access patterns of US and UK CMC users are similar, and both groups tend to visit CMCs, which is related to the rise and fall of the total cryptocurrency market capitalization. When the market is down, they visit CMC less and when the market is up, they visit CMC more frequently.

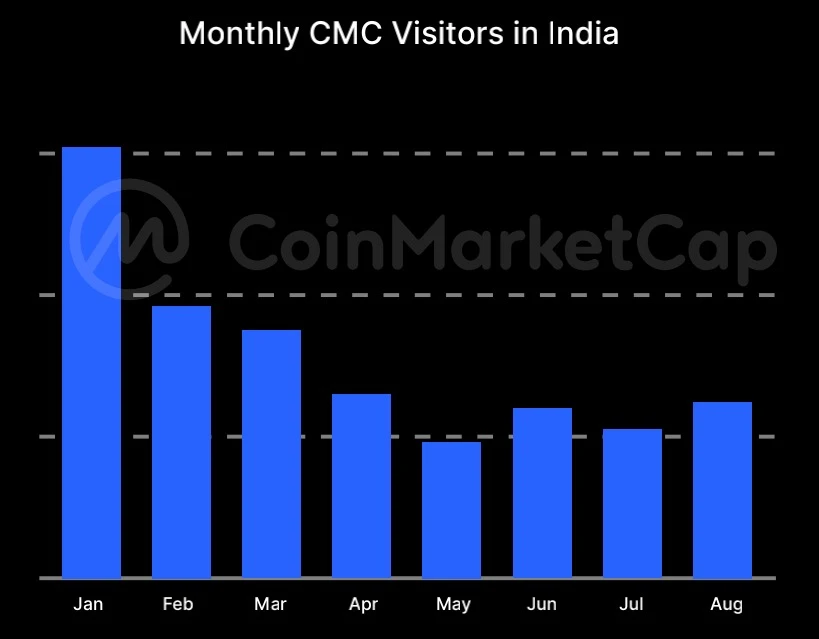

image description

On July 1, 2022, the government of India introduced a new cryptocurrency tax, imposing a 1% tax on all cryptocurrency transactions. However, in the month since the bill was introduced, CMC has only seen a small increase in Indian users, which may indicate that Indian users will not be deterred from their interest in cryptocurrencies by this tax.

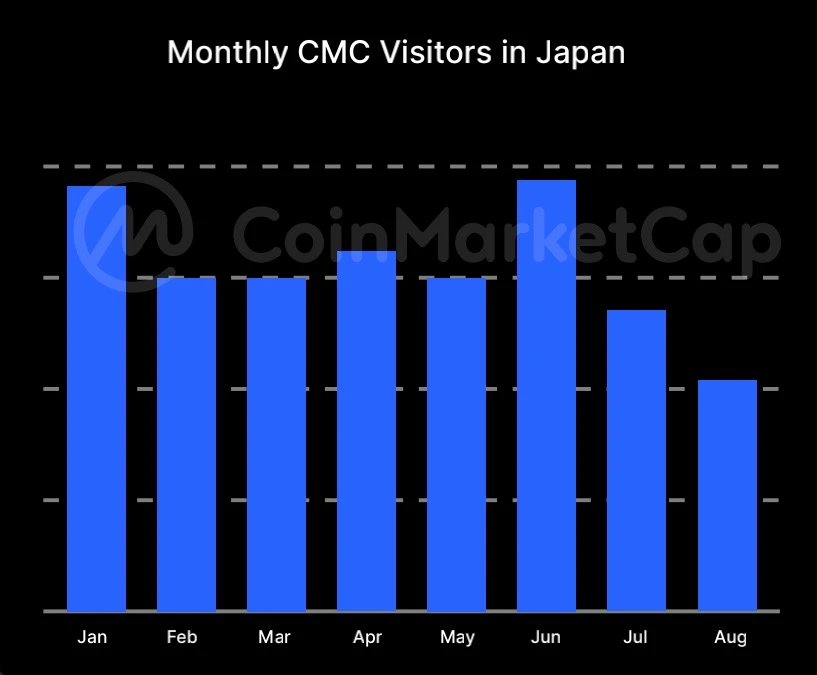

image description

Regardless of overall market trends, Japanese users visit CMC more frequently. This can be attributed to the region’s interest in Move to Earn games such as StepN, whose GST tokens fluctuate in price independently of Bitcoin’s price fluctuations.

CoinMarketCap Research

secondary title