Wintermute: The DeFi head market-making giant that has fallen from the altar

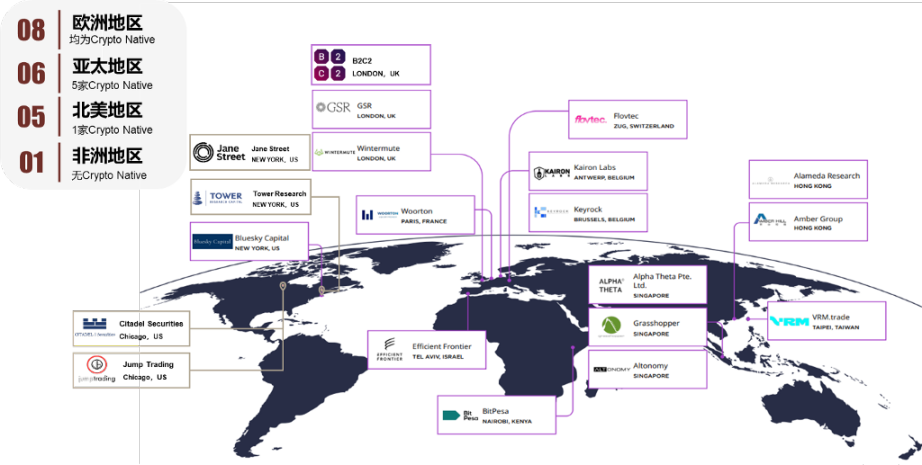

image description: Distribution of Crypto's top quantitative institutions (including traditional cross-border)

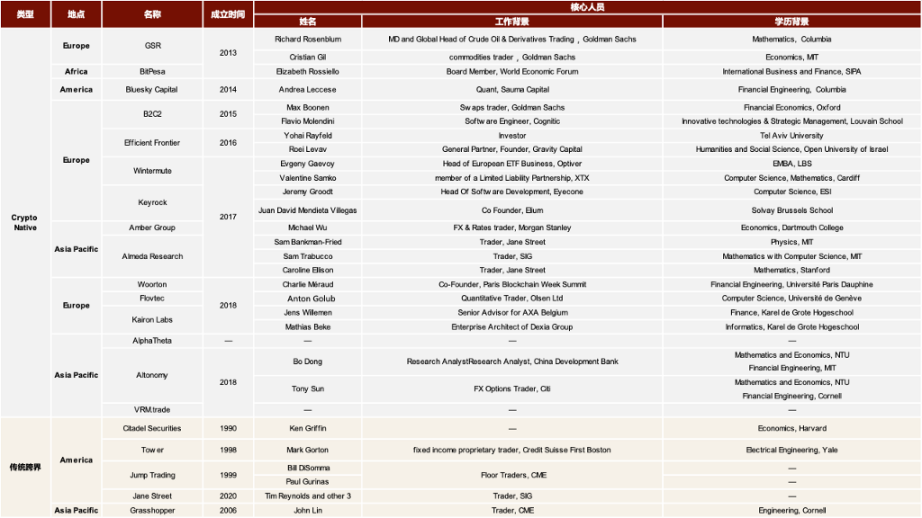

image description: Arrangement of Crypto head quantitative institutions (including traditional cross-border)

first level title

Introduction and Overview

Starting from Defi, Wintermute is one of the largest digital asset algorithmic trading companies in the world. It provides liquidity on almost all leading centralized exchanges, decentralized exchanges and OTC channels. According to the data disclosed on its official website, Wintermute’s daily average The transaction size is approximately US$5 billion;Wintermute is committed to solving the two core problems that prevent crypto from becoming "mainstream finance", namelyInadequate liquidity and inefficient use. The goal is to become atechnology company

, not a financial services company:

2) Build products instead of services.

first level title

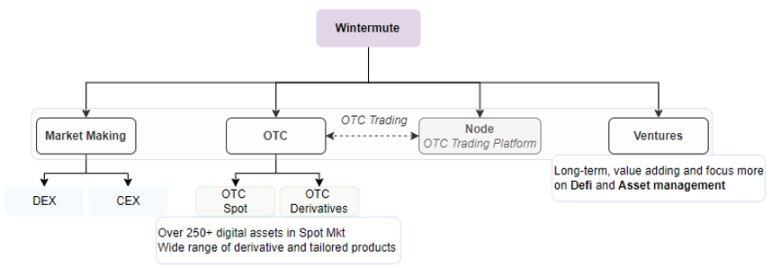

Business structure

Market maker business

Wintermute Trading Ltd. and Wintermute Asia Pte. Ltd. are Wintermute’s self-operated trading companies that provide liquidity support for Cryptocurrencies. It should be noted that neither of the two companies is allowed by local regulatory agencies to hold/manage customers’ fiat currency and digital currency assets;

OTC business

Provide users with spot and derivative services. Wintermute received approval from the UK Financial Conduct Authority (FCA) in March 2022, allowing it to carry out crypto-related OTC Spot (OTC Spot) business in the UK. According to an interview with the company COO Marina Gurevich, the application took more than one and a half years;

According to FCA data, since 2020, more than 240 institutions have applied to the FCA to conduct crypto-related businesses in the UK, of which 153 have been rejected or withdrawn. Only Galaxy Digital UK Limited, Fidelity Digital Assets, LTD., eToro ( 38 institutions including DRW GLOBAL MARKETS LTD and DRW GLOBAL MARKETS LTD have passed the requirements of the Money Laundering, Terrorist Financing and Fund Transfer (Payer Information) Regulations (MLRs) in 2017, and have completed registration with FCA, and Wintermute Trading Limited is One of the 8 approved this year;

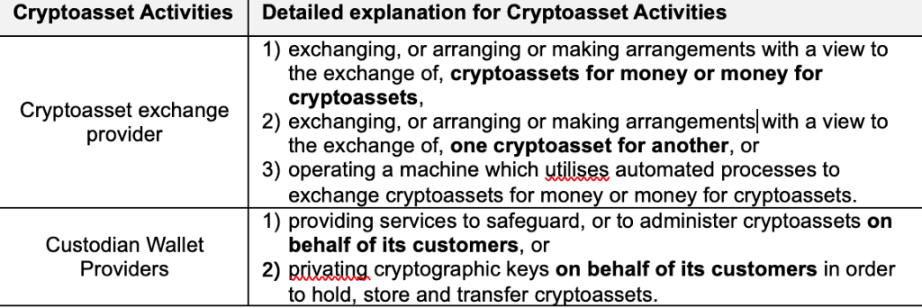

As of now, crypto-related businesses that are allowed to be carried out in the UK under the conditions of MLRs include Cryptoasset Exchange Provider and Custodian Wallet Providers:

Regarding FCA registered cryptoasset firm, according to FCA regulations, starting from August 11, 2022, any acquisition of 25% or more of an FCA registered cryptoasset firm’s equity must be approved by FCA before proceeding, otherwise a criminal offense will be triggered;vs. B2C2

, due to unbearable regulatory pressure from the FCA, it has transferred all of the company's OTC Spot business to the US subsidiary B2C2 USA from March 21, 2022. It does not carry out any off-site spot business in the UK. Its derivatives business (CFDs ) will not be affected for the time being, and B2C2 OTC Ltd, the entity authorized by FCA under B2C2, will continue to be responsible.

Node (platform business)Wintermute NodeCentralized platform: In April 2022, launched a zero-fee over-the-counter (OTC) platform for institutional clients and accredited investors to trade digital assets and their derivatives

, aims to become a one-stop platform that provides digital asset price discovery, trading and risk monitoring. Users can place orders and execute transactions through social software, trading platforms and third-party service providers;

Decentralized platform: In June 2022, Wintermute launched Bebop, a decentralized transaction aggregator that has no transaction slippage and allows multiple token exchanges at the same time, directly competing with decentralized transaction aggregation platforms such as 1inch. On September 20, affected by the hacker attack on the Wintermute Defi business, Bebop announced the suspension of transactions through its official social platform, and stated that its contracts would not be affected, and there would be no security issues with user funds and private keys.

Ventures (investment business)

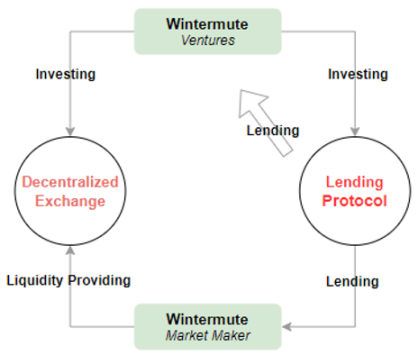

Wintermute is an early participant in DeFi and one of the biggest beneficiaries of DeFi. Its Wintermute Ventures has participated in the investment of more than 50 projects since 2020, mainly focusing on the three directions of Layer 2 expansion, decentralized transactions, and decentralized lending. NFT and DAO currently only have one investment each;by participating in the projectInvest + lend + provide market making servicesfirst level title。

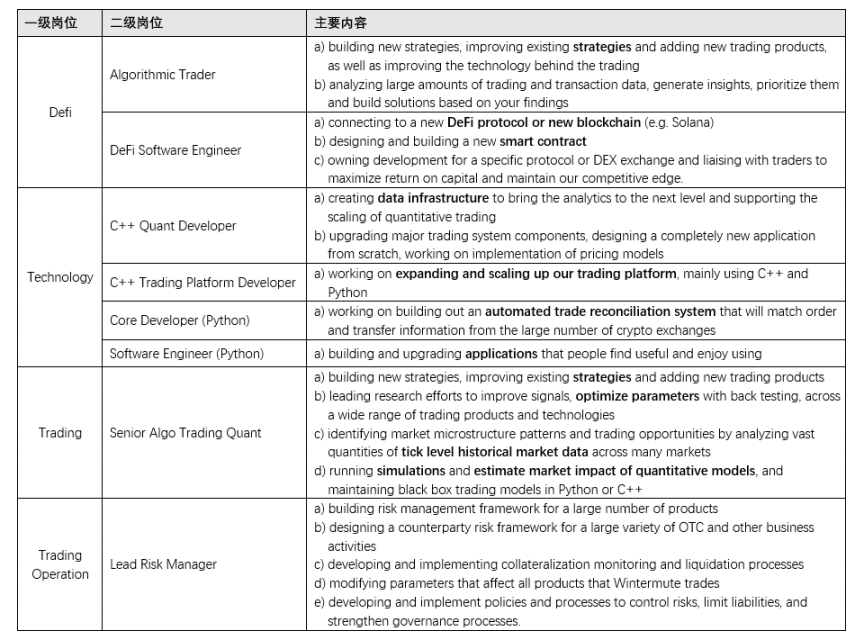

technology stack

Wintermute selects thePythonandC++and

for developing languages;

When CEO Evgeny Gaevoy was asked "what are some of the success metrics that define a best in class market maker" on dYdX AMA, he said that "technology is the first bit, and especially in DeFi, it's super important to be on top of everything".

first level title

financing historyAs of press date,Wintermute has completed 4 rounds of financing in total, disclosing a financing amount of over US$23 million

. More than 10 investors including Lightspeed Ventures, Pantera Capital, Fidelity, Blockchain.com, Coinbase Ventures participated in the investment;

1) In September 2018, Wintermute Trading completed a seed round financing with undisclosed investors and investment amount;

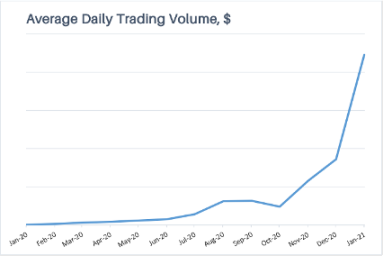

2) In February 2020, Wintermute Trading completed a million-dollar seed round financing led by Blockchain.com Ventures and participated by other angel investors to strengthen its algorithm platform and expand its team;3) In June 2020, Wintermute Trading completed the investment led by Lightspeed Ventures, followed by existing investors$2.8 million in Series A funding

, to accelerate the expansion of liquidity in derivatives, OTC and DeFi products;2,4) In January 2021, Wintermute Trading completed the investment led by Lightspeed Ventures, with participation from Pantera Capital, Sino Global Capital, Avon Ventures, Hack VC and existing investors, used to expand the scale of derivatives business. For this round of financing, Lightspeed and Pantera respectively made the following comments on Wintermute:

a) Lightspeed:“Wintermute has grown almost 25x since Lightspeed led the company’s Series A round just six months ago.

b) Pantera:In December 2020, Wintermute handled $30 billion in monthly trading volume, with 60% monthly revenue growth through 2020.

first level title

Directors and share arrangements

According to the data disclosed by Company House, the three directors on the board of directors are all from Wintermute management, including Evgeny Gaevoy, Valentine Samko and Marina Valerievna. The investor appointed directors Jeremy Liew (Partner at Lightspeed) and Samuel Harrison (Partner at Blockchain.com) will resign simultaneously on May 23, 2022;

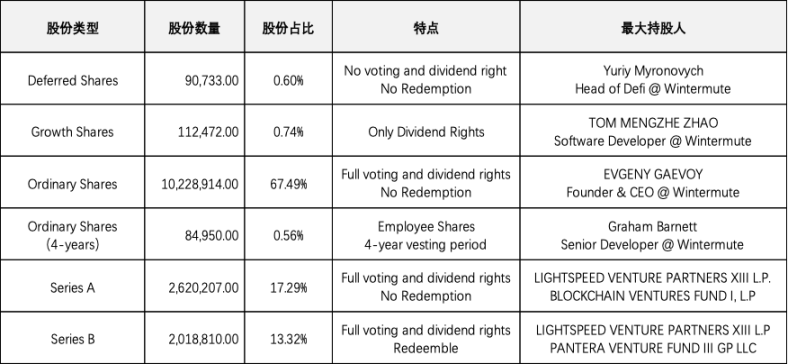

According to the data disclosed by Company House, Wintermute has issued a total of 15,156,086 shares to 88 shareholders (including institutional shareholders, individual shareholders and core members), including 6 types of shares including Deffered, Growth and Ordinary. Founder EVGENY GAEVOY, in addition to owning Ordinary Share, participated in the subscription of shares in Series A and Series B rounds respectively, and the actual controller of the company is the company's actual controller who directly holds 5,043,200 shares directly, accounting for 33.27% of the issued shares;Deferred Shares,issued with the intention of being converted into ordinary shares under certain circumstancesaboutAny Deferred Shares may be purchased by Wintermute at any time at its option for the aggregate sum of 1 penny for all the Deferred Shares registered in the name of any holder without obtaining the sanction of the holder.”

, the company clearly stated in the Articles of Association disclosed by the Company House that “Growth Shares,Growth shares’ are a special class of shares that allows employees to participate in the value of a company over and above a valuation hurdle. By setting the hurdle at an appropriate rate the Growth Shares should have only a minimal value on issue, so there is little cost for the employees subscribing for the shares.

aboutOrdinary Shares(4-years)about

, Wintermute has issued a total of 84,900 shares to 19 employees including Senior Developer Graham Barnett. The shares will be released within 4 years. During the period of incomplete release, the share holder does not own any voting right or dividend right.Series B SharesaboutRedeemable", probably due to the company's urgent need for funds, when Series B raised funds, it agreed with investors to repurchase the shares held by Series B investors after a certain period of time or on a fixed date.

first level title

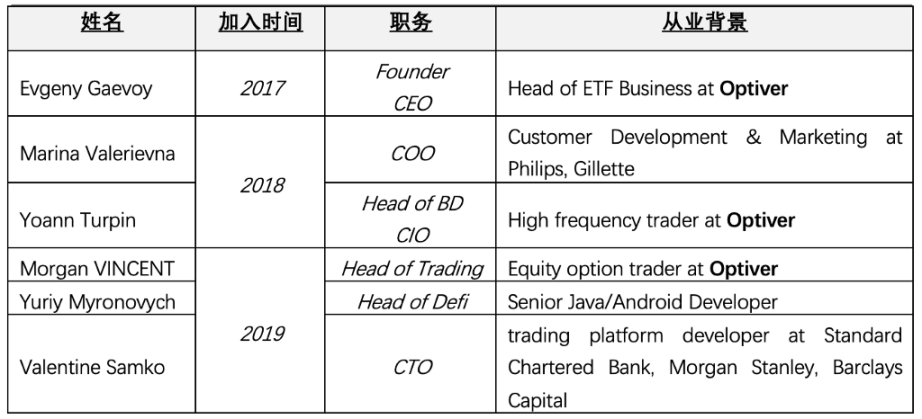

core staffThe core team consists of "Trader + Software Engineer

Optiver is a leading global quantitative agency established in the Netherlands in 1986. It employs more than 1,600 people worldwide. Its net trading (Net Trading Income) income in 2021 will be 2.3 billion euros (down 28% from 2020's 3.2 billion euros) , Citedal's full-year net transaction revenue in 2020 is US$6.7 billion);

first level title

In addition to the investment portfolio and Defi lending, it can also be seen in the structure setting that the Defi business has a very important position in Wintermute, and a Defi business department is specially set up;

first level title

crisis and challenge

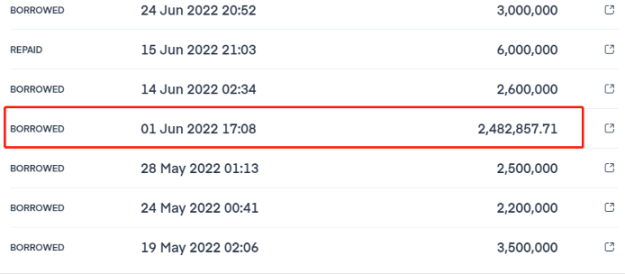

Since 2022, due to the negligence of Wintermute's internal management, there have been two serious asset losses in succession, and the resulting chain reaction, leading to Wintermute may face a severe liquidity crisis:

OP event

On June 9, 2022, Optimism officially issued a document stating that 20 million OP tokens allocated by the Optimism Foundation to the cryptocurrency market maker Wintermute were stolen. According to Optimism official information, in order to prepare for the launch of OP tokens, the Optimism Foundation invited Wintermute to provide liquidity supply services to facilitate a smoother experience for OP users to participate in collective governance. The Foundation's "Partner Fund" therefore allocated a temporary grant of 20 million OP tokens to Wintermute. Since the address provided by Wintermute is multiple addresses on the Ethereum chain, and the address has not been deployed to the Optimism chain, Wintermute cannot access the token. Fortunately, the hacker returned 17 million OP tokens out of the 20 million OP tokens on June 10. coins, greatly reducing the losses caused by Wintermute.

DeFi hacker

About 73% of the $160 million stolen from Wintermute's decentralized finance (DeFi) business was in stable assets (DAI, USDT, USDC, USDP), 8% in WBTC, Nearly 70 blue-chip currencies such as Sand, Uni, Aave, Ape, and Sushi. The hacker obtained 111,953,508 3Crv by adding liquidity to the Curve DAI/USDC/USDT pool, which is currently the third largest holder of 3Crv;

The $160 million asset loss ranks fifth on the 2022 DeFi vulnerability loss list, second only to Ronin Network ($624 million), Wormhole Bridge ($320 million), Nomad Bridge ($190 million), and algorithmic stablecoin projects Beanstalk Farms ($182 million).

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Website www.jzlcapital.xyz

Twitter @jzlcapital