first level title

Report at a Glance

The cryptocurrency trading platform FTX.com set off a Lehman storm in the currency circle. Bitcoin, Ethereum, etc. plummeted in response. The cryptocurrency circle was hit hard, causing market panic. The bear market is bound to be postponed. It is still difficult to judge when it will bottom out . Whether it is extreme or not, R3PO always believes that the bull market is ahead. In the long cold winter, where to accumulate strength is the key to whether the spring can flourish. Far-sighted capital is increasing its investment in infrastructure construction. track input. R3PO believes that it is time to rethink how to manage our assets in a safer way. Web3 wallets should also find their own opportunities from the crisis. The weak are fearful, and the strong are already acting. Cobo is already planning to use MPC more securely. To manage assets, more encryption technology will keep our assets safe, which is also a rite of passage for returning to the process of decentralization.

R3PO conducted in-depth research on the current Web3 wallet track, not only looking up and down at the wallet market from the perspective of industry researchers, but also returning to the perspective of users to pay attention to the user experience of the wallet itself. The following keywords and insights are some of the rules that R3PO has glimpsed in the research, for readers reference. For more detailed data and analysis, please refer to the text of the report.

Trend: Towards smart contract multi-chain multi-signature wallets, wallets become the main distribution center for traffic and applications

Smart: Smart contract solutions will be divided into two technical routes: AA (account abstraction) and EOA+contract

Security: The secure multi-party solution (MPC) will become a technical solution for multi-signature, co-management, and social recovery

Ease of use: Web2s insensitivity, no private key, and recovery combined with Web3s data ownership and privacy protection

Rich: Dapp Store, service, B/C terminal, and Swap will become the source of profit for various wallets

first level title

report text

You control the private key, which is your asset.

This sentence is extremely precious after the FTX thunderstorm. In the process of decentralization, security has never been raised to such a high level. Binance has occupied 70% of the spot market after bursting the bubble, but this is Is the future of cryptocurrencies we want?

R3PO believes that it is time to rethink how to manage our assets. Web3 wallets should also find their own opportunities from the crisis. The weak are fearful, and the strong are already taking action. Cobo has already planned to use MPC to manage assets more securely, more Only advanced encryption technology will keep our assets safe, which is also a rite of passage to return to the process of decentralization.

The development history of the wallet itself has been described in detail many times by various organizations and from various perspectives. In this Binance vs. FTX, we found that the wallet and the data on the chain are the only way for us to spy on who is Pinocchio. Don’t look at him What you are talking about depends on how many coins are in his wallet.

Deconstructing the development history and technical route of the wallet from the wallet itself can deeply understand the essence of the wallet, but this is only a part of the product, and the user perspective is the other half of the circle. R3PO believes that users pay less attention to the complexity of wallet classification and the variety of technical routes, and they pay more attention to the intuitive experience of wallets, which we summarize as security, ease of use and rich functions.

Security lies in whether it can match the asset security of the benchmark bank;

Ease of use lies in whether it can match the seamless experience of Alipay and credit cards;

The function is to meet the actual needs of users in Web3, such as asset accumulation, DeFi, NFT display, etc.;

This report is divided into four parts: the origin and classification of wallets, the functions and expansion of existing wallets, the development direction of wallets, and the overall market size of existing wallets.

secondary title

Origin and classification of wallets

The 1.0 state of the wallet can be classified as the address is the wallet and the hard disk is the wallet. At the beginning of Bitcoin, there are basically no product types that specialize in asset management. For example, Satoshi Nakamoto believes that in order to maintain anonymity, it should Each transaction uses a different wallet address.

Before the emergence of ASIC mining machines, personal computers can participate in mining, and the hard disk itself can store bitcoins, so the hard disk can also be regarded as the earliest prototype of a hardware wallet.

Wallet 2.0 emerged following the industrialization of bitcoin mining. Miners need to store bitcoins to share profits with mining pools and sell them at a price. The time difference between mining and selling creates the actual demand for wallets

From 2009 to 2013, the wallet at this time only has the most basic functions such as single chain, storage and withdrawal. The representative product is Bitcoin Core (Bitcoin-qt), a full-node, high-security wallet established by developers in 2011. Use private keys to manage wallets.

But in essence, this is not the same product as the current wallet. It is closer to the node synchronization software of Bitcoin, and the overweight product form also prevents it from becoming a mainstream choice.

Wallet 3.0 comes with the emergence of the Ethereum ecosystem.

Since 2014, with the emergence of Ethereum, multi-chain and smart contract wallets have become mainstream. The former represents domestic wallets such as Bixin and imToken, while the latter has Gnosis-Safe, which focuses on asset management, and began to explore smart contracts and B-side Asset management type.

Since 2018, DeFi, NFT, and richer Dapps have become mainstream trends. The main function of wallets other than asset management is to interact with Dapps, such as the emergence of meta wallets such as MetaMask and WalletConnect.

The key words of Wallet 4.0 are smart contracts, multi-chains, and multi-signatures. With the progress of Ethereum account abstraction, it has become possible to remove EOA accounts and keep smart contract account types separately. Multi-chains are gradually developed through EVM compatibility and cross-chain bridges. Realization, and the booming MPC mode leads to the practical application of account multi-signature, which greatly improves social recovery and security. The main representative products include Zengo, Bitizen, M-Safe and other main products.

Regarding the classification of wallets, from the perspective of users, there are only differences in products and functions. For example, MPC said it provides security and multi-signature technology, and G-Safe is a professional tool for DAOs and institutions. Some products, such as imToken, etc., can be understood as consumer-oriented, software-type, decentralized, multi-chain wallets.

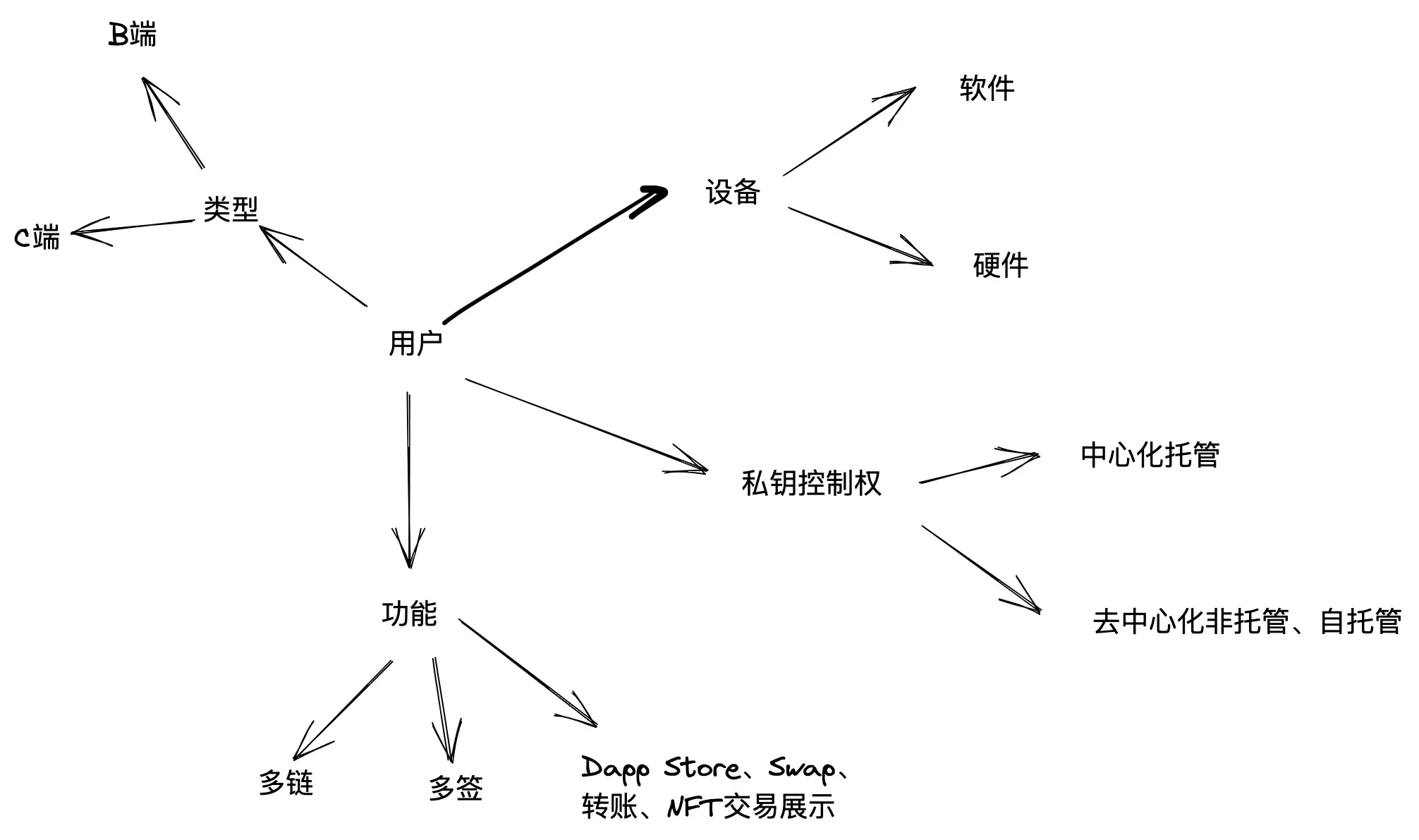

Caption: Abstract classification of wallets

image description

When dividing from the wallet itself, the division dimensions are more diverse, such as hot and cold, media, etc., but most wallets can be violently divided into two perspectives: equipment and hosting type.

secondary title

Functions and extensions of existing wallets

From a macro perspective, wallet functions can be abstracted into three types:

1. Flow/capital entry

In the encrypted world, the exchange is the largest traffic distribution center and token trading scene. After the boom of NFT, the NFT trading platform is expected to become the second CEX role.

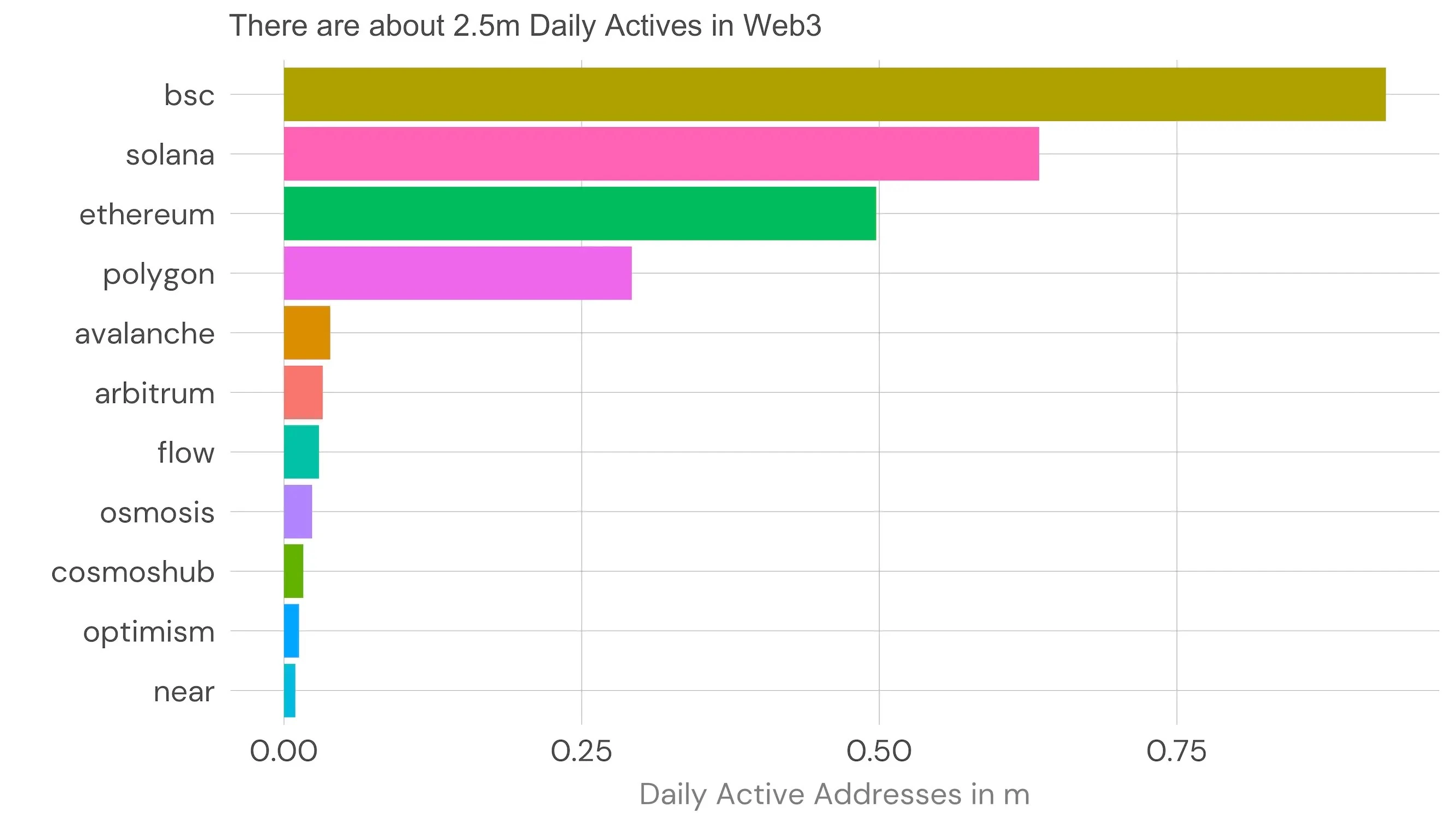

From the data point of view, 2.5 million wallets are active every day on the leading public chain, and BNB Chain, Solana, Polygon and Ethereum account for more than 80%.

A high EQ means that the on-chain wallet is in the early stages of development, and a low EQ means that decentralization is still far away.

Caption: Web3 Monthly Live

image description

2. Dapp Store/Connect/Swap

Image credit: Dune

The main function of the current wallet is not asset management. At least asset management is only meaningful for institutions and DAOs. The purpose of individual users using the wallet is to interact with Dapp.

From this perspective, it can be subdivided into two modes: linking and bidding ranking. The linking mode is represented by Metamask, and its product mode can be summarized as three steps: activation, interaction, and signature. Both chains support user-defined. From this perspective, Metamask is also a multi-chain wallet. For example, it supports user-defined chains such as BNB Chain.

The Dapp Store display and ranking model is most typical with Bitkeep, which directly displays and promotes Dapps in the product, as well as direct currency listing, NFT listing and other heavy operation models, aiming to realize user behavior, which is in Web3 The era cannot be a flexible move after data is realized, and the traffic business never sleeps, but the path changes.

The Swap function is currently the most direct traffic monetization mode for wallets. Compared with Dapp display, it is more direct and closer to the user side. For example, the only direct source of profit for Metamask is the built-in Metamask Swap function, but this is based on its 30 million active users. Based on the user base, it is difficult to be imitated by other wallets.

3. Expansion of wallet functions

On the basis of the above functions, the wallet will gradually integrate with more functional models in 2021, such as DID, SBT, NFT display and other functions that are more related to personal characteristics.

Of course, at the current stage, such functions are still relatively cutting-edge and difficult to implement, but the wallet is indeed a good entrance for on-chain identity recognition, especially when privacy protection is becoming more and more important.

secondary title

The direction of the wallet

We put the development direction of the wallet ahead of the market because of the overall consideration that changes in user experience will change the current market structure. The current wallet market is at the threshold of another change, and it is also a good time for latecomers to enter the market.

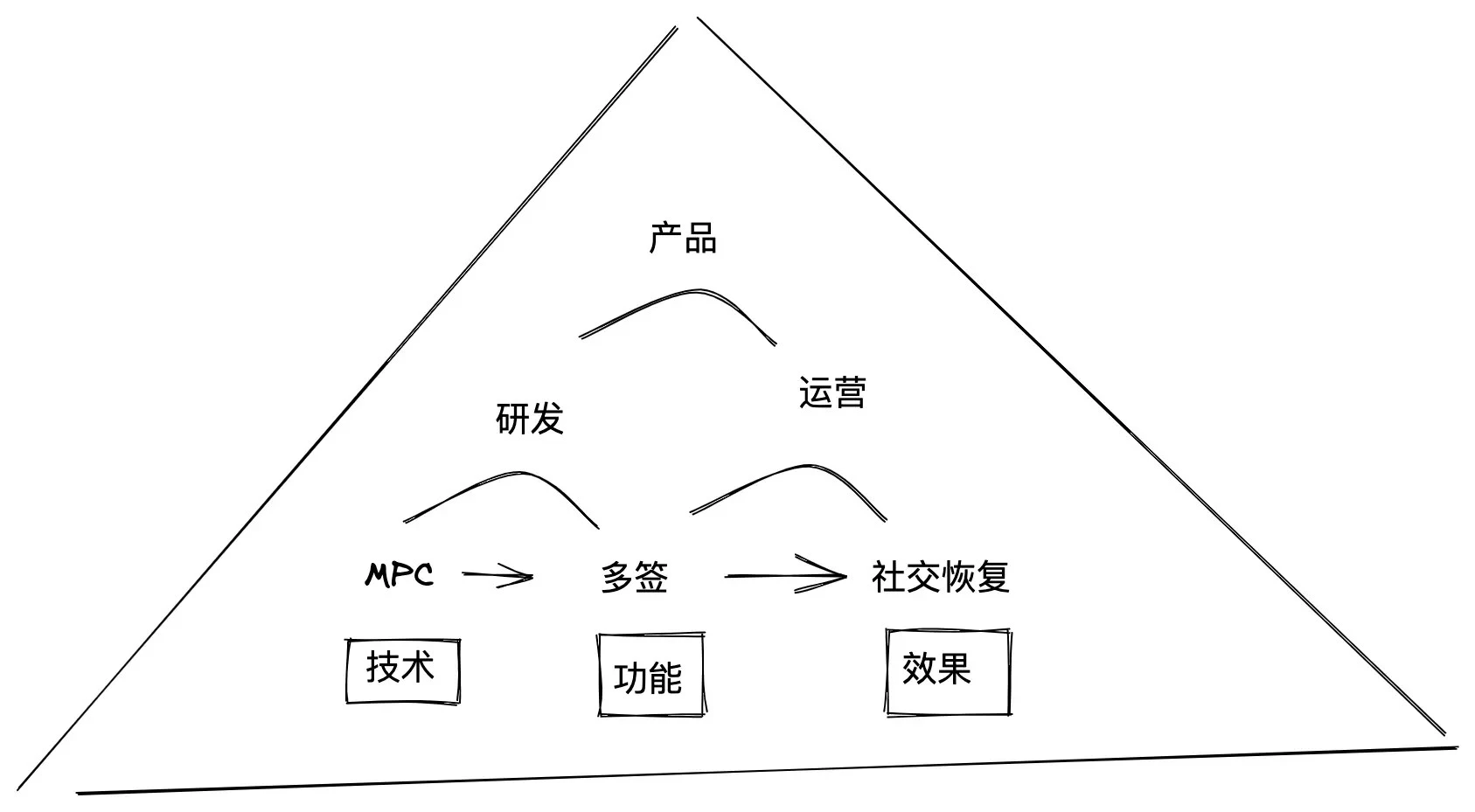

First of all, start from breaking the superstition of technology. Whenever a new round of narrative models begins to appear, the promotion of technology becomes a fixed routine, such as the technical advantages of the Move language, the importance of MPC to wallet security, the universalization of ZK technology, etc. But this is not the whole story. Technology is only a component of function, and function will lead to changes in the market structure.

We mentioned the smart contract multi-chain multi-signature wallet earlier, which can be deconstructed into the following equation:

Smart contract multi-chain multi-signature wallet = easy to use + security (1)

Ease of use + security = AA + MPC + EVM multi-chain (2)

From the perspective of more complex function realization, the future form of the wallet is a multivariate evolutionary process. How to realize the smart contract multi-chain multi-signature wallet in the experience accumulation of MPC and other technologies, ease of use and security is a very difficult process. .

Caption: wallet technology and product relationship

image description

Image credit: R3PO

It is not difficult to simply talk about MPC, but there is still a long process of product iteration from technical principles to market competition. For example, we all know that Layer 2 with Ethereum must have been born in the ZK series, but which product obtained it? Ultimate victory is not a process that can be asserted immediately.

The main products are Fireblocks for B-end users, ZenGo for C-end users, and middleware Security Heron that will provide security services for Metamask.

Fireblocks

text

One of Fireblocks customers, Revolut (valued at $5.5 billion and one of the largest fintech companies), is using Fireblocks MPC to introduce encryption services to 13 million retail customers around the world. This infrastructure is used to provide a secure payment rail for digital asset transfers. With the MPC Wallet, Revolut can add cryptocurrency-involved product lines and retail-oriented features.

ZenGo

text

Safeheron

Zengo is a relatively mature wallet product based on MPC technology, no private key, and EOA account. The latest round of financing is 20 million US dollars. Investors include Insight Partners and Samsung. Having received Samsungs leading investment, Zengo has the opportunity to obtain the huge channel advantage of Samsung mobile phones. When creating an account, ZenGo creates two key shares, one stored on your mobile device and the other on ZenGo servers. Regarding the wallet exit mechanism, the solution is to design a corresponding private key recovery program and entrust it to a trusted third party for safekeeping. Once Zengo products cannot continue to provide services, the third party will verify and disclose the private key recovery program. A private key can be created for export and backup.

It has reached a cooperation with Metamask and will provide it with an overall MPC solution. The current product suite includes:

MPC Wallet API,MPC Wallet APP, customers can manage digital assets with multiple people;

Support customers to write programs to automatically sign transactions without worrying about private key disclosure;

The MPC Web3 browser plug-in supports customers to access the Web3 protocol through multi-person audit.

From this perspective, the general outline of technology, and the rapid iteration of products and the speed of responding to market demand are the keys to solving problems. This is a continuous process in which operations are greater than technology.

But this is not to say that technology itself is not important, but to emphasize that technology is the first step, and the market is the final judge to test the applicability of technology.

The main features of the smart contract wallet are as follows:

Seedless

text

There is no private key in the contract wallet account, and there is no need to back up private key fragments. Binding specific user information (such as device information, email account, etc.) Lost encrypted assets, truly realizes no private key storage;

Multi-signature scheme

Gasless

The CA account supports further programming and can more conveniently implement the multi-signature mechanism. For example, M-safe, by creating multi-signature wallets based on different addresses, realizes joint management of organizational assets, and meets asset management service requirements such as transfer control, transaction review, and transaction records.

The CA account can specify gas to pay on behalf of the user, avoiding the lack of service fees affecting the transfer process and optimizing the user experience, but in extreme market conditions, network congestion may lead to a sharp increase in service fee expenses, especially the logic of smart wallets is more complex than EOA wallets , so the gas for creating a wallet and each operation will be more expensive. It is necessary to consider the long-term benign development model of product functions. The Argent wallet paid more than 50 ETH handling fees during extreme market conditions. Considering this problem, Unipass adopts the following plan: use the project party to pay gas to solve the problem of new user transfers, and then plan to develop a fee deduction function to attract users and improve user experience while ensuring the continuous operation of the function and saving operating costs.

After its final completion, the smart contract account will promote the private keyless wallet process and support more complex DeFi product forms such as gas-free interaction.

In short, MPC can make private keyless more secure, and AA can realize truly complex intelligent interaction.

secondary title

The overall market size of existing wallets

According to a new report by US-based market research and consulting firm Grand View Research, the global crypto wallet market size is expected to reach $48.27 billion by 2030, at a CAGR of 24.4% during the forecast period.

According to a report by Triple-A, by 2022, it is estimated that there will be more than 320 million cryptocurrency users worldwide, while the number of global cryptocurrency wallet users reached 84.02 million as of August 2022, compared to 76.32 million in August 2021 user.

At least within the currency circle, there is still the possibility of user conversion. The current wallet has not been fully recognized, and most people still mainly use exchanges to manage assets.

In this process, including the Bitcoin legalization process started by El Salvador, DeFi, and the popularity of NFT are the most important factors. After September 2021, 2.7 million Salvadorans have become Chivo wallet users, and Lightning can be used directly on it. Network transfers and other operations.

From the perspective of the outside world of the blockchain, the mainstreaming of DeFi, the out-of-circle of NFT, and concepts such as Web3 and Metaverse have become new economic growth points in various countries and other multiple favorable factors, which jointly promote the increase of wallet users.

In terms of segmentation, it can be deconstructed into the following trends:

The increase of supporting merchants: For example, the lightning network payment service provider Strike continues to gain customers in Latin America, and according to Bit Pay’s research, 40.0% of consumers who pay with cryptocurrency are new merchants, and their purchase amount is credit card purchases twice the amount.

C-end users contribute to the number of users, and B-end users contribute to profits: individual users account for more than 62.0% of the revenue share in 2021, and North America dominates the wallet market, accounting for more than 30.0% of the revenue share.

Swap is still an important source of income: Swap generated more than 40.0% revenue share in 2021.

Caption: wallet classification

secondary title

Summarize

Summarize

When the cryptocurrency market comes to the match point again, the harm of CEX superimposed opaque management measures is still continuing. Only when user funds are circulated on the chain can the ownership be truly guaranteed, otherwise they can only continue to encounter misappropriation again and again, and no one will benefit Stick to principles.

Copyright statement: If you need to reprint, please add the assistant WeChat to communicate. If you reprint or wash the manuscript without permission, we will reserve the right to pursue legal responsibility.

Disclaimer: There are risks in the market, and investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, viewpoints or conclusions in this article. The above content does not constitute any investment advice.