Correlation Study on the Impact of the Merrill Lynch Clock Model on the Cryptocurrency Market

Summary

Summary

At present, the ecology of the cryptocurrency field is becoming more and more abundant, the participants are becoming more and more diverse, and the accumulated funds are increasing. In this case, we need new investment tools to conduct cycle analysis and product selection for the entire field. Therefore, we have conducted research on the relatively mature and well-known Merrill Lynch clock model in the traditional financial field, hoping to transplant it to the cryptocurrency field.

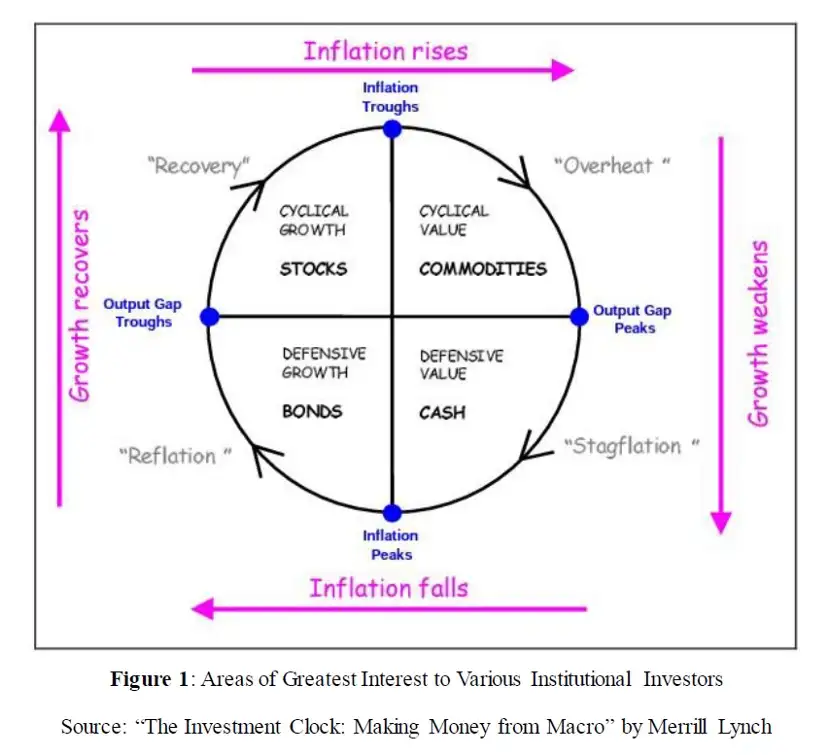

The Merrill Lynch clock model is a macroeconomic analysis and asset allocation model proposed by Merrill Lynch in 2004. It uses output gap and CPI data as the two major indicators to measure economic growth and price level, and through the analysis of the data of the United States since 1970, it draws a series of conclusions, that is, according to the alternating rise of output gap and CPI data The economic cycle can be divided into four periods, which are recession period, recovery period, expansion period and stagflation period. These periods appear one after another and constitute a complete cycle. Based on the clock theory derivation and data verification, we have given the optimal asset allocation in each cycle.

After the global financial crisis in 2008, central banks represented by the Federal Reserve have implemented low interest rate policies for a long time and used quantitative easing many times to stimulate the economy. This has had some impact on the economic cycle under the Merrill Lynch clock, mainly manifested as: the duration of the recession period and stagflation period is shortened, and the duration of the recovery period is longer; the complete cycle of the Merrill Lynch clock no longer exists, and each cycle Alternately; the volatility of various assets has increased, and stocks have performed well throughout the economic upswing period; but strong assets in different clock cycles still conform to the framework of the Merrill Lynch clock.

first level title

1. Traditional Merrill clock model

With the vigorous development of the cryptocurrency field, its overall market value continues to increase, and its types and tracks are becoming more and more abundant. And in the past two years, more and more traditional financial institutions and entities have entered the cryptocurrency field to invest and participate in project development. Facing a situation where the ecology of the encryption field is becoming more and more abundant, the participants are becoming more and more diverse, and the accumulation of funds is increasing, we urgently need new investment analysis tools to conduct cycle analysis and variety selection research on the entire field. Therefore, we have conducted research on the relatively mature and well-known Merrill Lynch clock model in the traditional financial investment field, hoping to transplant it to the cryptocurrency field. Since this is a relatively large and complex project, it will be presented in a series of articles in the future. This article, as the first in a series of articles, will first analyze the Merrill Lynch clock model and its changes after joining QE.

secondary title

1.1 Analysis of the traditional Merrill Lynch clock model:

Merrill Lynch's two indicators for dividing the economic cycle are CPI year-on-year growth rate and output gap data. The output gap data is an economic indicator that measures the gap between an economy's actual output and its full-capacity potential output (that is, capacity). The output gap has both positive and negative directions: it is positive when actual output exceeds capacity, which occurs when demand remains high and leads to higher prices; When output is below capacity, the output gap is negative, which means there is spare capacity due to weak demand and prices will fall.

The measurement of the output gap is a major difficulty of the model. This is mainly because the level of potential output cannot be directly observed but can only be estimated through various methods. The common method of estimation is to select indicators such as PMI, GDP, labor force indicators and capital input to form a production function, and then use the HP (Hodrick-Prescott) filter method to separate the long-term trend and short-term fluctuation of the function, and filter out the short-term periodicity The change yields an estimate of potential output. In addition, the potential output value can also be obtained through on-site surveys of manufacturers. However, there are inevitably errors in the above estimation methods. And what kind of data to use, what method to use to form the function and get the estimated value will determine the accuracy of the model, which is also the secret of each research investment institution. The content of research in this area is extensive and complex, and even a separate article can be written as a research explanation, so I won't go into details here.

As can be seen from the figure above, Merrill Lynch Clock essentially divides the economic cycle using two major factors: economic growth and price level, and selects different assets for allocation according to the difference in the yields of various types of assets under different economic cycles. The logic behind it is that the macroeconomic situation of any country will affect the performance of various assets in the country's market, and will prompt the country to adjust its monetary policy and fiscal policy. While the adjusted monetary and fiscal policies will adversely affect the country's economic conditions, it will also have an impact on various assets in the market. In summary, cyclical changes in macroeconomic conditions and economic policies simultaneously lead to cyclical performance across asset classes.

According to the framework of the Merrill Lynch clock, the economic cycle can be divided into four stages, and each stage has a corresponding strong asset:

Recession period (reflation): Economic growth and price level decline together, even the year-on-year growth rate of GDP or CPI is negative. Commodities fell during this phase, stock markets fell as a result of falling corporate earnings, and the bond yield curve shifted down and steepened. This is when the central bank typically starts cutting interest rates in an attempt to get economic growth back on track. Bonds are the best investment at this stage. Defensive stocks are preferred in stocks. In terms of cryptocurrencies, industry-based projects such as BTC and ETH are preferred.

Recovery: The low-interest rate monetary policy and economic stimulus policies have gradually brought GDP growth back on track, but because the idle capacity has not been fully utilized, that is, the output gap is still negative, so the weak demand leads to product prices still falling , CPI data continued to decline. During this period, benefiting from loose monetary and fiscal policies, corporate profits began to recover, and stocks became the best investment varieties, with cyclical stocks and short-term value stocks preferred.

Overheat: production capacity gradually recovers, the output gap gradually disappears, and the inflation rate begins to rise. At this time, the central bank began to raise interest rates to ensure sustainable economic growth and prevent overheating, but the economic growth rate was still strong. This is the period when bonds start to fall and the yield curve flattens. The stock market faces a balance between corporate earnings growth and high valuations, with cyclical stocks and short-term value stocks performing better. Benefiting from rising inflation during this period, commodities are the best investment options.

Stagflation period (Stagflation): GDP growth slows down and productivity declines, but subject to a positive output gap and strong demand, companies increase product prices to cope with wage-price spirals and protect corporate profits. During this period, the central bank will adopt stricter monetary tightening policy until inflation subsides, which will weigh on the performance of bonds, while stocks have fallen due to the tightening monetary policy and falling corporate profits. During this period, cash assets are the best investment choice, and stocks choose defensive stocks and long-term value stocks.

The cycle framework of the Merrill Lynch clock can also help us conduct research on sector allocation strategies for stocks and cryptocurrencies:

When economic growth accelerates, cyclical industry stocks such as steel and automobiles perform better, and public chain tokens and Defi tokens are preferred in the cryptocurrency field; when economic growth slows down, non-cyclical and defensive stocks are relatively better. BTC is preferred in the cryptocurrency space.

When inflation falls, the financial cost is low, and basic project tokens such as long-term growth stocks and public chains are preferred; when inflation rises, commodities and cash perform best. At this time, it is suitable to choose stocks with hype themes, NFT, GameFi and other types Token.

secondary title

1.2 Merrill Lynch clock model data backtest:

In this part, we will use the annual nominal output gap data released by the Congressional Budget Office (CBO: Congressional Budget Office) and the year-on-year CPI data released by the Bureau of Labor Statistics for backtesting. We took the data from 1970 to 2007 for analysis. After 2008, due to the emergence of new monetary tools such as QE, its impact on the economic cycle has changed the Merrill Lynch clock model. This part will be carried out in the next chapter analyze.

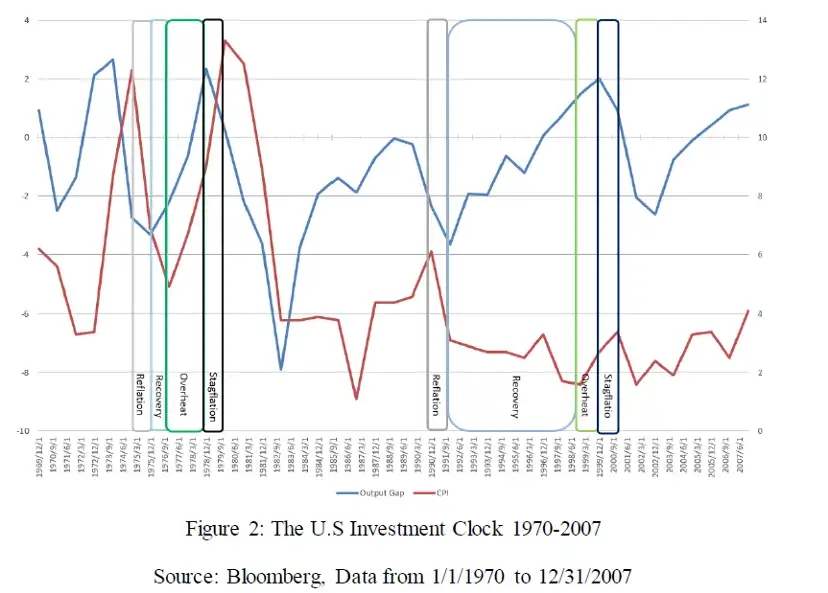

We first divide the output gap and CPI year-on-year data into four cycles according to the model standard, as shown in the figure below. Then the duration of each cycle and the performance of each asset class in each cycle will be counted.

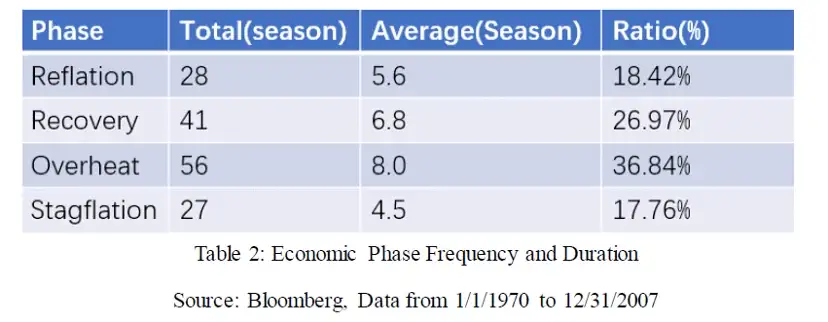

The diagram above shows two typical four-period Merrill clocks. Through statistics, we obtained the total duration and average duration of each cycle in the 152 quarterly data during the backtest period, as well as the proportion of all samples, as shown in the following table:

From the statistical data, we can see that during the 37 years from 1970 to 2007, the time when the economy went up accounted for about 63.81%, and the time when it went down accounted for about 36.19%; the time when inflation went up accounted for about 54.6%. Downtime accounted for about 45.4%. In addition, from the perspective of the average duration of each cycle, the average duration of the recovery period and the expansion period exceeded the stagflation period and the deflation period. The average duration of the recovery period was more than one and a half years, and the average duration of the expansion period was two years; The average duration of inflationary and deflationary periods is about one year and one and a half years, respectively. However, due to the long duration of each cycle and the small number of overall samples, the statistical results are greatly disturbed by extreme sample data. For example, the deflationary period of 1980-1982 lasted 11 quarters, and the economic expansion cycles of 1987-1989 and 1994-1996 also lasted 11 quarters. These few samples had a greater impact on the overall sample data statistics.

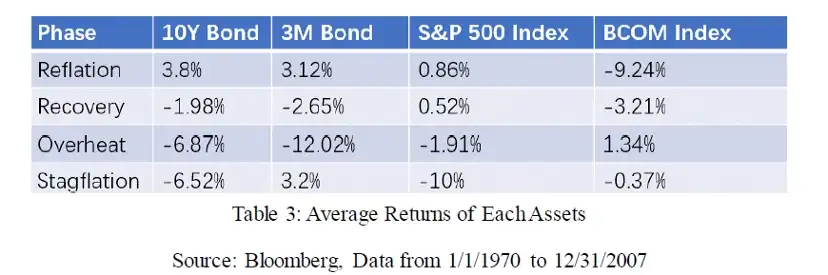

In the next step, we will divide and count the performance of different categories of assets in each cycle according to the time of each cycle. Among them, bond assets use US 10-year Treasury bond data, stock assets use S&P 500 index, commodities use Bloomberg Commodity Index, and cash use US 3-month Treasury bond data. We will separately calculate the quarterly average rise and fall of each asset class in different cycles. Because the rise and fall of different periods are greatly affected by the inflation rate of the period. For example, the inflation rate was as high as 20% in the 1980s, but after entering the 21st century, the inflation rate has been below 3% for a long time. The return performance of the same assets in these two periods The difference is huge. Therefore, we take the real rise and fall after deducting the inflation factor as the standard, and the statistical results are as follows:

From the above results we can see that:

Recession (reflation): The 10-year Treasury note performed best, and short-dated Treasury bonds, represented by the 3-month note, also performed well due to the re-steepening of bond yields. Correspondingly, commodities performed the worst during this period.

Recovery period (Recovery): due to the gradual recovery of corporate profits, stocks performed best, and funds shifted from the bond market to the stock market, making bond performance worse; and subject to product prices still falling, inflation continued to decline, commodity performance remained worst.

Overheat: Due to the high general inflation rate in this stage, the central bank began to raise interest rates, and the real yields of bonds, cash assets and stock markets were all negative, while commodities performed strongly.

Stagflation: Due to the continuous interest rate hikes by the central bank and the decline in economic growth, bonds, stocks, and commodities have been suppressed and performed poorly, while cash assets have outstanding performance.

first level title

2. Merrill clock model after adding QE

secondary title

2.1 Introduction to QE

Let's first understand what the Fed's general monetary policy means are before QE, and how it affects market liquidity and interest rates. Generally speaking, traditional monetary policy measures mainly operate on interest rates. Interest rate can be simply understood as the cost of money. When the economy is overheated and the inflation rate is too high, the central bank will increase the financing costs of enterprises and individuals by raising interest rates, thereby inhibiting enterprises from expanding production and personal consumption; conversely, when the economy declines and the inflation rate falls, The central bank stimulates the economy by cutting interest rates to stimulate business expansion and personal consumption demand.

Taking the United States as an example, the main interest rate tool used by the Federal Reserve to regulate the market is the Federal Funds Rate, which is the interest rate in the American interbank lending market, the most important of which is the overnight lending rate. By adjusting the interest rate, the Federal Reserve can directly affect the cost of funds of commercial banks, and then affect the entire macro economy. However, the chain of interest rate adjustment from the shortest overnight lending rate to the cost of funds in various parts of the macro economy is quite long and complicated, and there are many influencing factors outside the control of the Federal Reserve. Therefore, when the financial crisis broke out in 2008, traditional monetary policy tools partially failed. The Federal Reserve used QE as a monetary tool in order to save market liquidity, especially to curb the soaring long-term interest rates.

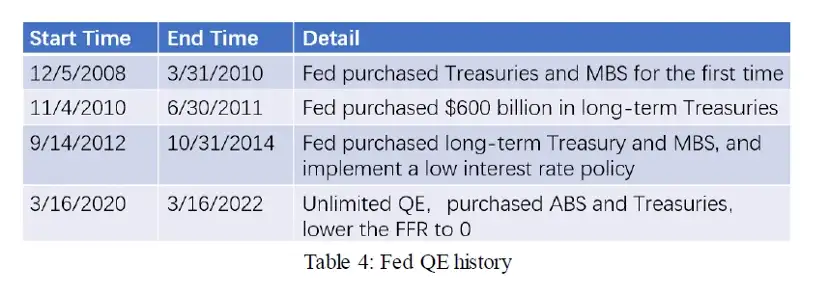

Different from traditional interest rate adjustments, QE refers to the central bank shifting the focus of monetary policy from controlling the cost of funds to controlling the amount of funds. The goal is to maintain the financial system in an environment of loose liquidity by injecting funds into the market. The general method of QE is that the central bank lowers the benchmark interest rate and at the same time buys government bonds and corporate bonds to lower the level of long-term interest rates and maintain ample market liquidity. The monetary policy tool was first proposed by the Bank of Japan in 2001 and is world famous for being adopted by the Federal Reserve during the 2008 financial crisis. From 2008 to the present, the QE policy adopted by the United States is as follows:

secondary title

2.2 Merrill Lynch clock data backtest after joining QE

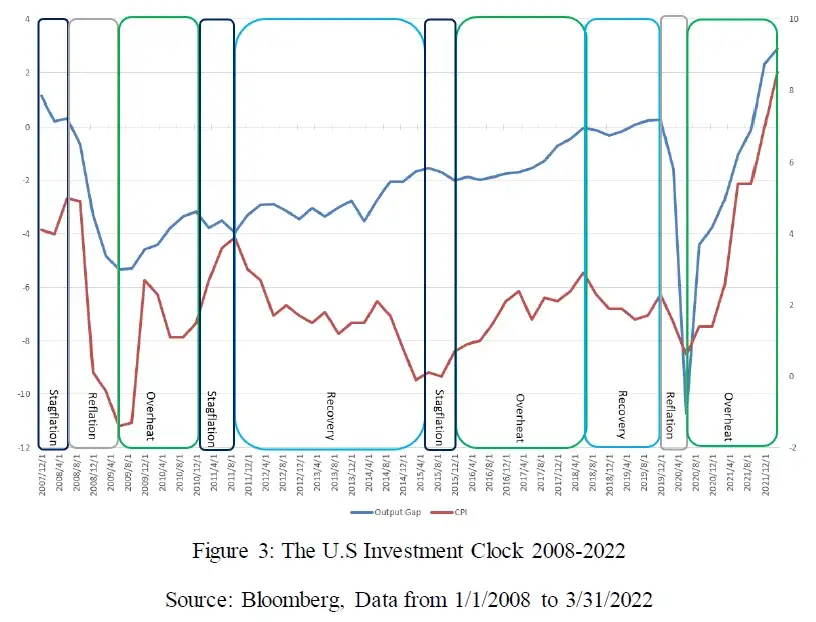

In this part, we also use the annual nominal output gap data released by the U.S. Congressional Budget Office (CBO: Congressional Budget Office) and the CPI year-on-year data released by the U.S. Bureau of Labor Statistics (Bureau of Labor Statistics) for backtesting. The time period taken Analyze the data from 1/1/2008 – 3/31/2022, and the cycle division is as follows:

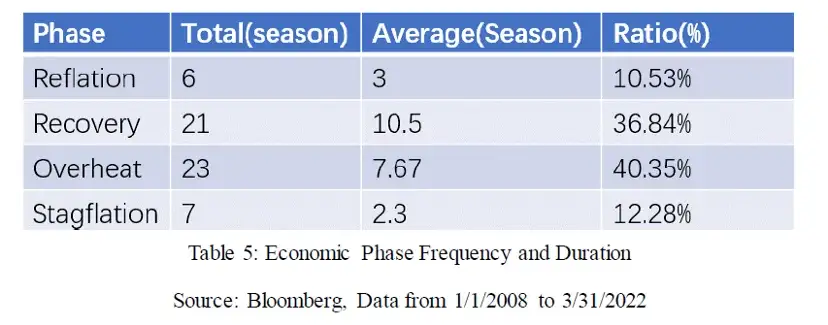

The figure above shows the Merrill Lynch clocks of each period in the time interval, and then we counted the number of occurrences and average duration of each period, as shown in the following table:

By comparing the cycle data before and after 2008, we can find the following characteristics:

a) There is no complete recession-recovery-expansion-stagflation cycle after 2008, often a recession followed by an expansion, or a stagflation between the recovery and expansion .

b) During this period, the production capacity gap has been negative for a long time, lasting from the end of 2008 to the beginning of 2019, which is unprecedented in history. In addition, the year-on-year CPI data for the same period remained below 3% for a long time, basically at the lowest level in the statistical cycle. The combination of the two data can lead to a guess that the economic growth model of the United States during this period has undergone a profound change compared with history.

c) Comparing data such as the average duration of each cycle and the proportion of total time in the two time periods, it can be found that the average duration of the stagflation period and recession period has been reduced from more than 1 year before 2008 to 2-3 quarters, and the recovery The average duration of expansionary periods has increased by almost 1 year, while the average duration of expansionary periods has remained essentially unchanged. From the perspective of the total time proportion, the time proportion of the stagflation period and the recession period decreased by about 5.5% and 8% respectively, the time proportion of the recovery period increased by 10%, and the expansion period increased by about 4%. In short, compared with before, the average duration and total time proportion of stagflation period and recession period decreased significantly after 2008, while the average duration and total time proportion of recovery period increased significantly.

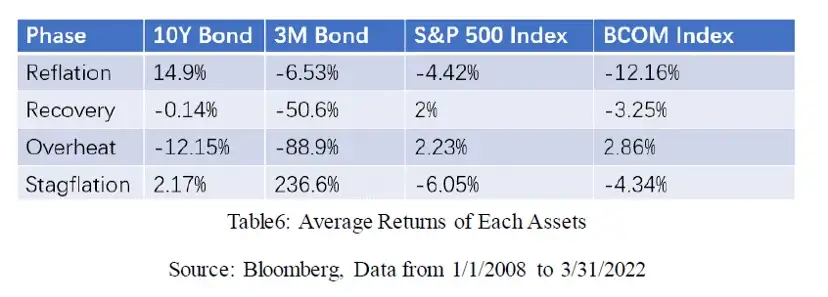

Next, we will also count the performance of different categories of assets in each cycle. The data and statistical methods of the major categories of assets used are the same as above. The statistical results are as follows:

Comparing the above results with backtest performance before 2008, we can see that:

The best-performing asset classes in different cycles still conform to the inferences of Merrill Lynch’s clock framework, that is, bonds perform best during recessions, stocks perform best during recovery periods, commodities perform best during expansion periods, and cash is best during stagflation periods.

The range of changes in bonds and cash assets in different cycles is much greater than that before 2007. For example, the average yield of bonds during the deflation period was 14.9%, which was higher than the 3.8% yield in the same cycle before 2007, while the cash assets during the stagflation period were as high as 14.9%. The 236.6% rise and fall far exceeded the level of 3.2% in the same period before 2007. This is mainly due to high inflation in the 1980s, which caused the Federal Reserve to raise the benchmark interest rate to more than 20%. After that, the center of the benchmark interest rate has been slowly declining, and it has been maintained at 0.25% for a long time after 2008. In the 2015-2018 interest rate hike cycle, the Federal Reserve raised the benchmark interest rate to 2.5%. Due to the influence of the low base, the interest rate increased by 10 times. It is not difficult to understand.

The consistent higher positive returns for stocks during recovery and expansion periods are also different than they were before 2008. This of course corresponds to the bull market in U.S. stocks that has lasted for many years, which is essentially influenced by the Fed’s lowering of the benchmark interest rate to near zero and the ample liquidity.

first level title

3. Analysis of the current economic cycle and cryptocurrency configuration

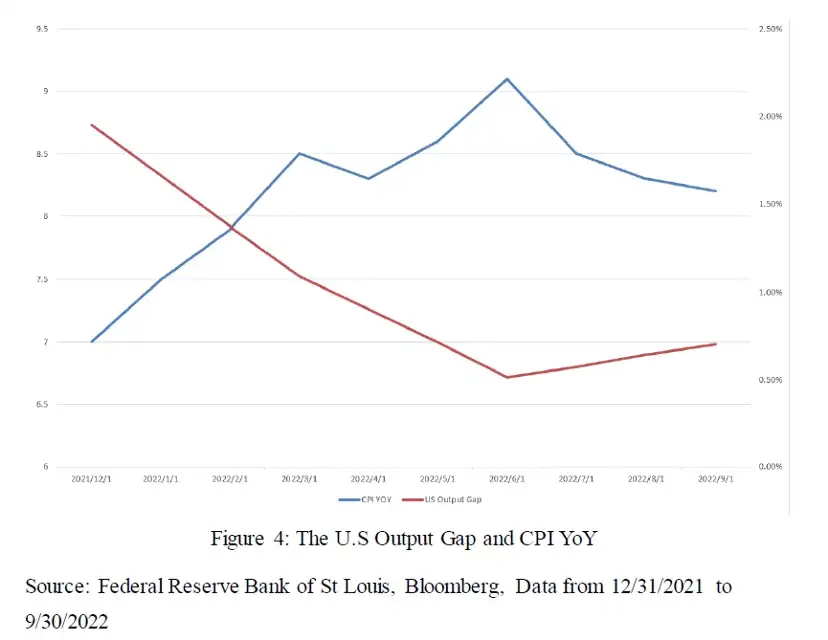

According to the theory of the Merrill Lynch clock, we can analyze the current cycle interval based on the recent output gap data and CPI data. Since the annual nominal output gap data released by the U.S. Congressional Budget Office (CBO: Congressional Budget Office) is currently only updated to the first quarter of 2022 data, here we will use the U.S. output data released by the Federal Reserve Bank of St Louis The gap data and the year-on-year CPI data released by the Bureau of Labor Statistics are analyzed, as shown in the following figure:

From the data shown in the figure above, it can be seen that the decline in the output gap in the first two quarters of this year was accompanied by the rise in CPI data, which is clearly in line with the characteristics of a stagflation period. Since the beginning of the third quarter, the CPI data has declined, while the output gap data is at a low level, and according to recent economic data such as PMI, the output gap data in the fourth quarter may decline again, so we can roughly judge that we are currently in a period of deflation. And according to the Fed’s rate hike route, this cycle of rate hikes may last until the first quarter of 2023, so it can be inferred that until then it will generally be a period of deflation. According to the analysis framework of Merrill Lynch Clock, the period of deflation is characterized by downward inflation and slowing economic growth. At this stage, the optimal allocation of assets is bonds; stocks are preferably defensive stocks and long-term growth stocks.

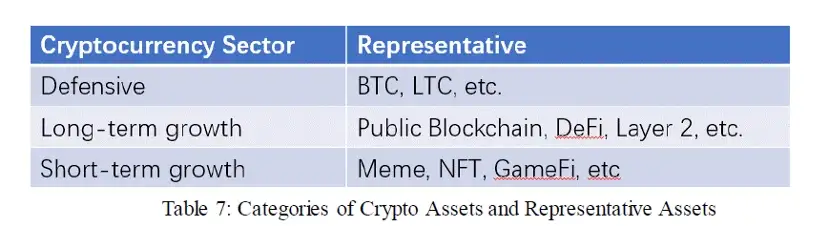

Next, we can learn from the division method of stock types to divide cryptocurrencies into defensive currencies and cyclical currencies. Among them, cyclical currencies can be divided into long-term growth currencies and short-term theme currencies, as shown in the following table:

first level title

4. Summary and main points of using the Merrill clock model

The Merrill Lynch clock model is a macroeconomic analysis and asset allocation model proposed by Merrill Lynch in 2004. It uses output gap and CPI data as the two major indicators to measure economic growth and price level, and through the analysis of the data of the United States since 1970, it draws a series of conclusions, that is, according to the alternating rise of output gap and CPI data The economic cycle can be divided into four periods, which are recession period, recovery period, expansion period and stagflation period. These periods appear one after another and constitute a complete economic cycle cycle. Based on the clock theory derivation and data verification, we have given the optimal asset allocation in each cycle.

After the global financial crisis in 2008, central banks represented by the Federal Reserve have implemented low interest rate policies for a long time and used quantitative easing many times to stimulate the economy. This has had some impact on the analysis framework of the Merrill Lynch clock, which is mainly manifested in: the duration of the recession period and the stagflation period are shortened, and the duration of the recovery period is longer; the complete cycle of the Merrill Lynch clock no longer exists, and each cycle alternates The volatility of various assets has increased, and stocks have performed well throughout the economic upswing period; strong assets in different clock cycles still conform to the framework of Merrill Lynch clocks.

When using the Merrill Lynch clock, you need to pay attention to the following points:

Options for output gap data. Since the output gap data is an estimate, each agency has its own calculation method, which leads to slight differences in the data of different agencies. This may lead to discrepancies due to different data when we use the Merrill Lynch clock frame for period division.

The output gap data is also released quarterly in most institutions, so to obtain data with a higher frequency, you can choose to choose economic indicators to construct the data. Then the choice of indicators and the method of construction will affect the accuracy of the data.

The reason why we hope to get higher frequency and more accurate data is that in addition to using this model to clarify the current economic cycle we are in, we also hope to accurately judge the timing of cycle transitions, so that we can adjust asset allocation in a timely manner to gain benefits and avoid risks. Therefore, judging the time point of Merrill Lynch's clock cycle switching is a major point in the use of this model.

On the basis of the previous analysis, we analyzed the position of the cryptocurrency industry in the Merrill Lynch analysis framework, which stage of the Merrill Lynch clock the current time belongs to, and the current optimal asset allocation. We have come to the following conclusions: we are in a period of stagflation; the optimal allocation in the current cycle is bonds; defensive stocks and long-term growth stocks are preferred in the sector allocation of stocks; defensive stocks such as BTC and LTC are preferred within the cryptocurrency field Type currencies and long-term growth currencies such as ETH and MATIC.

disclaimer

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding research and exploration in various fields of blockchain, with a view to pan-blockchain As the research object, the research objectives are to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of blockchain industry. The main research contents include industry trends, technical paths, application innovation, Pattern Exploration, etc. In line with the principles of public welfare, rigor, and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms, and build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical foundation and trend judgment to promote the healthy and sustainable development of the entire blockchain industry.

contact us:

Consulting email: research@huobi.com

Official website:https://research.huobi.com/

Twitter: Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Telegram: Huobi Research

https://t.me/HuobiResearchOfficial

disclaimer

1. Huobi Blockchain Research Institute does not have any relationship with the projects or other third parties involved in this report that affect the objectivity, independence, and impartiality of the report.

2. The materials and data cited in this report are all from compliant channels. The sources of the materials and data are considered reliable by Huobi Blockchain Research Institute, and necessary verifications have been carried out for their authenticity, accuracy and completeness , but Huobi Blockchain Research Institute does not make any guarantees about its authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice on relevant digital assets. Huobi Blockchain Research Institute is not responsible for any losses caused by the use of the content of this report, unless it is clearly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose the ability to make independent judgments based on this report.

4. The information, opinions and speculations contained in this report only reflect the judgment of the researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you want to quote the content of this report, please indicate the source. Please let me know in advance if you need to quote a lot, and use it within the scope of permission. Under no circumstances shall any quotation, abridgement and modification contrary to the original intention be made to this report.