Author: The Creator and Ownership Economy

Over the past two decades, free platforms have commoditized and devalued content. A powerful quote describes the situation:

If I do a job in 30 minutes, its because I spent 10 years learning how to do it in 30 minutes. You owe me years, not minutes.

However, Web3s ability to create digital scarcity has the potential to lead to a reversal of this trend. Today, this article will:

Analyzing the history of the creator economy and the role of Web3

Review the current state of the creator economy and some of the key issues it faces

A deep dive into the utility of the Web3 ownership economy in the creator economy

Explore the current state of the creator ownership economy and the tools available to creators

Attempt to predict the long-term development trend of the creator economy

Part.1 Background setting

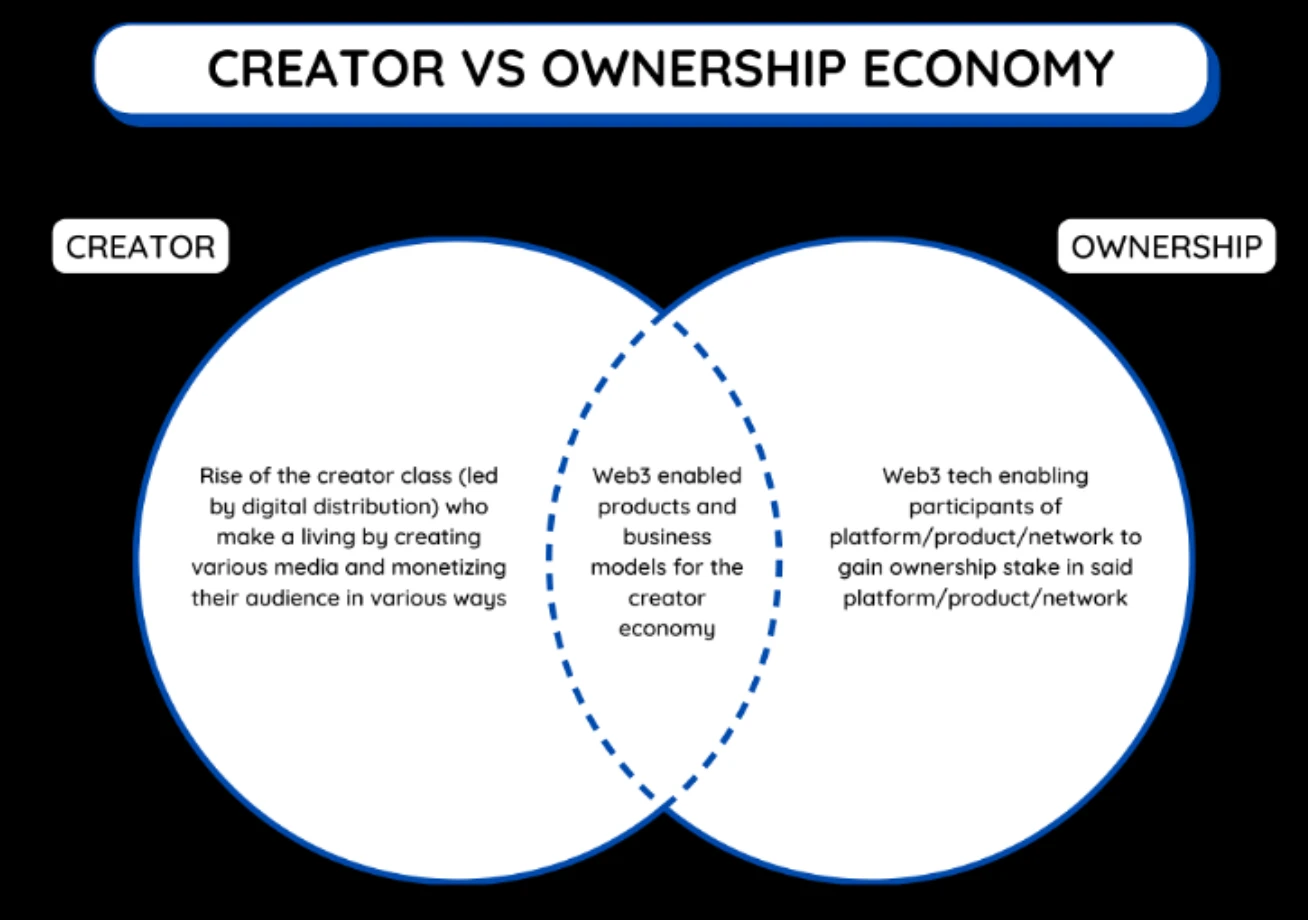

There is no uniform definition of creators and creator economy. In order to facilitate the discussion, we first set the background through some key definitions.

Creator: An individual (or group of individuals) who produces media that has educational and/or entertainment value, with the goal of growing an audience.

Creator economy: The rise of a class of creators (led by digital distribution) who earn income by creating content and monetizing their audience in various ways.

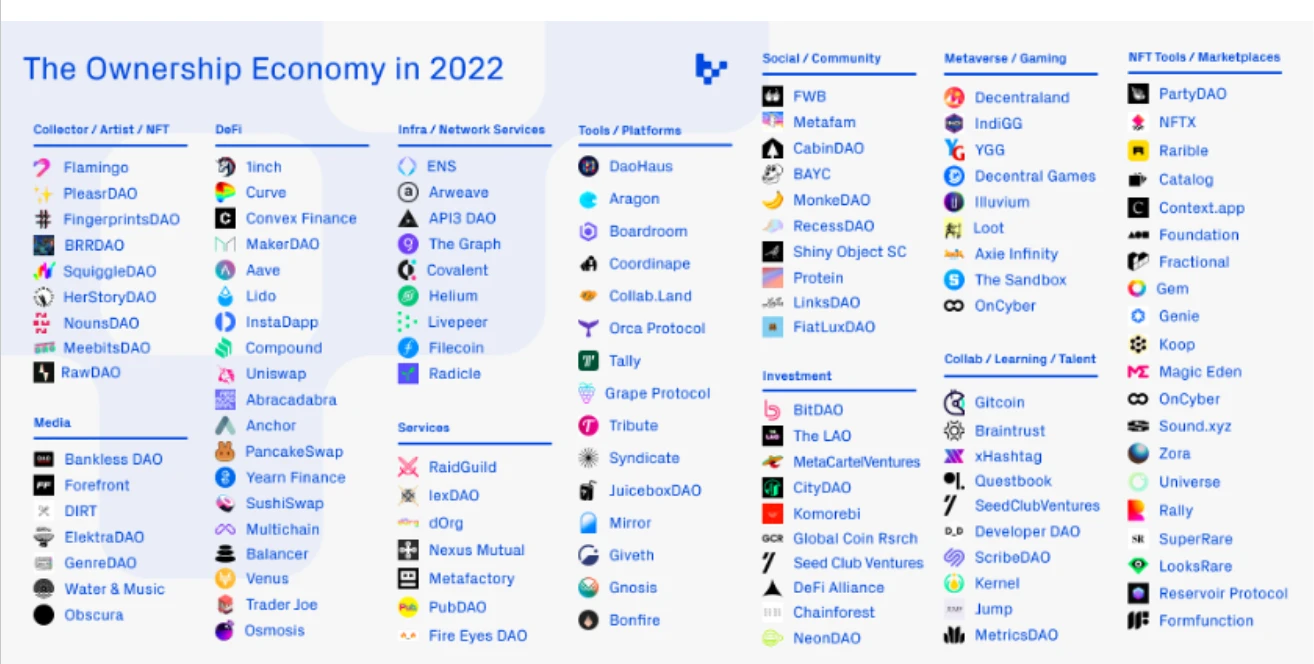

Ownership economy: Ownership economy means that the next generation of products/services will be owned and operated by its participants through the use of tokenized incentives. This permeates all industries - entertainment, decentralized finance, infrastructure, consumer, etc.

Figure 1: The relationship between creators and the ownership economy

Part.2 Creator Economic Development History

To better understand how the creator economy has evolved over time, we have broken it down into four distinct eras — the enthusiast era, the distribution era, the independent era, and the ownership era.

1. The age of fans began with the rise of social platforms such as Myspace and Friendster, and the early development of Facebook. These platforms are characterized by two-way attention, paying attention to people you know in real life, and there is no value accumulation.

2. With the rise of influencer creators and platforms like Instagram, YouTube, and Snapchat, came the era of publishing/distribution. These platforms are characterized by one-way attention, that is, following people you have never met but who provide you with entertainment/educational value, and the value begins to accumulate in the hands of various stakeholders through advertising.

Advertising business models include:

display static/video advertisements to users;

Paid endorsements of products/services;

affiliate marketing.

In effect, these platforms become a promotional channel for other businesses to achieve their goals. As Mario Gabriele of The Generalist puts it, creators pay for the resources they put into content creation, viewers pay for that effort with their attention, and advertisers buy the attention creators accumulate.

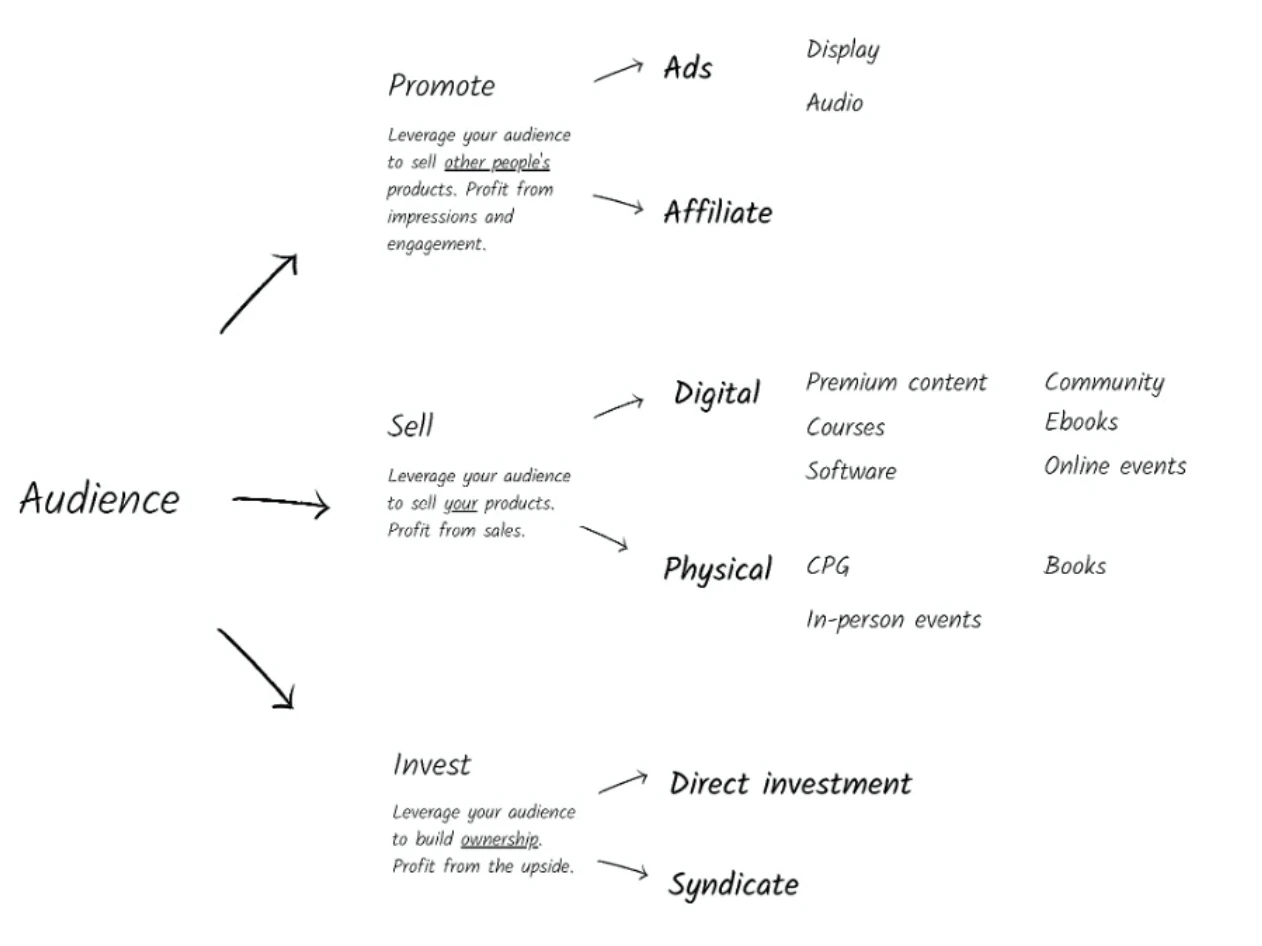

3. The Indie Era is ushered in by the Distribution Era The shift in platforms as the primary means of revenue generation for creators. The transition from being a creator selling other brands to being a brand. Creators are now taking advantage of platforms like Shopify, Substack, and Patreon to sell their products and services. This not only gives them more value, but also deepens fan relationships.

Sometime between the distribution era and the indie era, creators, after reaching a certain scale, start investing as a third mode of value creation. Its definitely nascent, and only a few investors have taken this leap (e.g., Sway Boys Animal Capital), but we believe the space is underexploited, largely because of education and infrastructure invested in their specialty - creation The author economy - was and is not offered to long tail creators.

4. This brings us to the age of ownership, Web3s introduction to the creator economy. While well explore this section in more depth later, this marks the introduction of new tools that blur the lines between creators and audiences and create value by creating micro-economy for each creator, thus reducing creator/audience The transactional nature of the fan relationship, rather than a one-dimensional business model.

The image below, courtesy of Mario Gabriele, illustrates the above dynamics:

In short, creators and users today create the most value but only capture a portion of it, while the platforms themselves capture a disproportionate amount.

This is due to the following reasons:

Since content can be copied and consumed infinitely, consumption is concentrated on content produced by a selected number of creators. For example, if a doctor is 10% more authoritative and professional than everyone else, they wont attract more than 10% of their needs - theyll attract all of them. Likewise, everyone wants to consume only the absolute best content. As a result, income is concentrated among these select best creators, making it difficult for most to make ends meet.

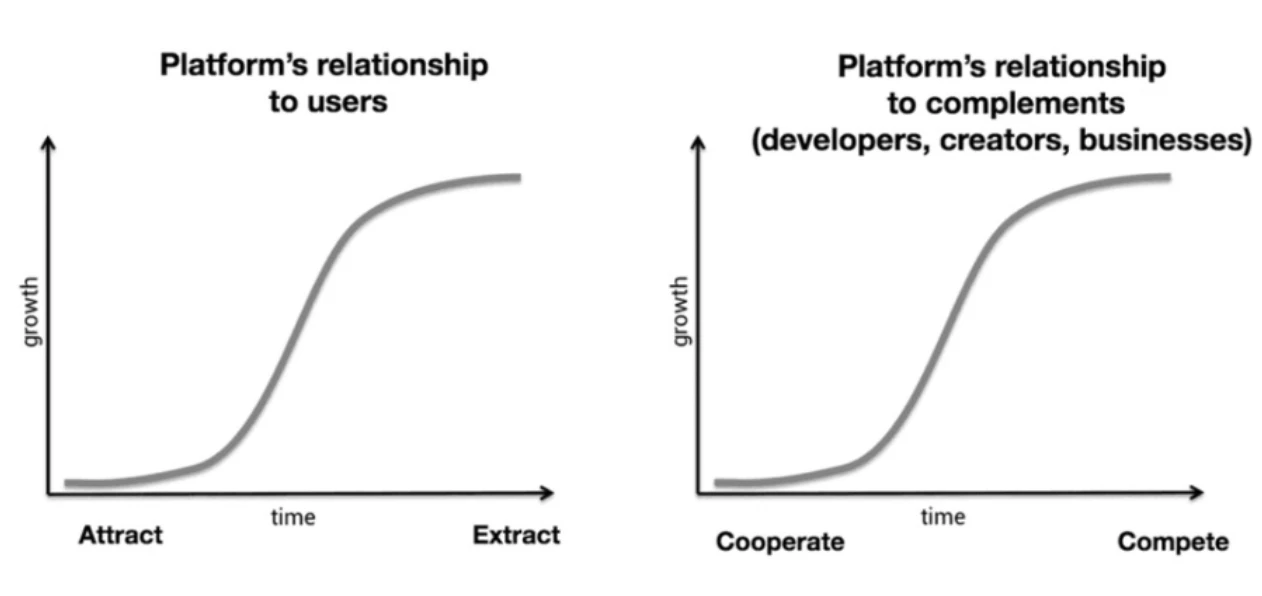

As Chris Dixon pointed out, in the early days of centralized platforms, it was a positive sum behavior to attract as many participants as possible. However, when the growth of participants reaches the top of the S-curve, the relationship becomes zero-sum, from collaboration to extraction. Now, the network effects are too strong for users to simply abandon the platform. You can better understand this dynamic here.

The fundamental issue here is that all centralized platforms (since the shareholders are separate entities from the platform participants) need to be valuable as a company. Unfortunately, they can only do this if they extract as much value as possible from the value generated by platform participants.

Therefore, to make a platform as friendly to creators as possible, it must enable creators to enjoy rights and interests.

Currently, employee stock ownership plans (ESOPs) aim to align incentives between employees and platforms. However, this is constrained by legal and financial infrastructure across geographies and socio-economic contexts, and only for platform operators rather than creators, as they are the platform’s cash cow and primary users. Since creators are arguably the most value-added stakeholders, and ESOPs are unable (or at all) to adequately compensate them, creators are currently unable to effectively benefit from the time they spend on the platform.

In summary, creators do not own the content, third-party developers have no control over the code, all platform participants cannot influence the policies or decisions of the platforms used, and the main business model is an opaque, ad-based one, Gives a huge advantage to enclosed garden decks.

Part.3 So what is the promise of Web3

As mentioned earlier, the ownership economy assumes that the next generation of products/services (across industries) will be owned and operated by its participants through the use of tokenized incentives. Ownership is expressed through economic benefits, governance rights and/or social influence.

This world is enabled by Web3 technology, especially the emergence of tokens, which are similar to IP, HTTP, SMTP, etc., and are a protocol-level innovation. Think of tokens as an internet-native property rights system - for the first time ever, you can actually own a piece of the internet. This piece can represent anything from a simple JPG to part of any internet product/service you use. As examples, Bitcoin and Ethereum were the first large-scale user-owned networks.

Using tokens as ownership assets and coordinating structures like DAOs, creators can own not only the content they produce, but the platform itself. Since participants will be owners, they can collectively make policy and product decisions for the platform, with no external pressure to extract profits.

Part.4 The difference between tokens and equity

Allows anyone with an internet connection to interact with tokens, while also allowing for smooth and instant transfers. Unlike equity shares, they are not restricted by geographic boundaries. This easy accessibility is what made Sponsored+ possible. Patronage+, created by Jesse Walden, is a new paradigm where supporting creators is not only an act of altruism, but also an investment. In other words, patronage with profitable potential.

One can codify rules in tokens (a medium of value exchange) to facilitate business relationships, which today requires a 3rd party to enforce. For example, digital scarcity can be programmed through NFTs, which allows creators to realistically value their essentially digital creations. Its more about restoring creators pricing power than artificially limiting consumer choice.

Another example of programmability is composability. Now, building on top of someone elses work (eg, a remix) doesnt prevent the original artist from being financially compensated, because royalties can flow to wallet X every time any value is transferred to wallet Y.

Due to the on-chain nature of the token, creators can verifiably know the quality of followers through different parameters (such as when individuals support, how much content is consumed, financial contributions, etc.). If the creators agree, the data will be integrated into their future work and create more customized content for their fans. Creators can also offer super-professional perks to their “real” fans and engage with fans more effectively, allowing them to build a tighter community that will stand the test of time.

Tokens allow creators to generate more value from ardent fans, enabling deeper monetization. This leads to a tiered strategy of offering products/services for each level of fandom while increasing the upside potential for creators’ superfans to create value.

In addition to monetization, creators can also inject utility into tokens, allowing fans (token holders) to actively participate in content creation, rather than just passive consumers. Interesting experiments of this type are Shibuya and Mad Realities.

Since tokens can fundamentally align platform growth and its participants, it could result in larger, more robust networks than weve seen so far. Since the platform will serve users rather than shareholders, users may not want to optimize stock prices, which completely reverses Milton Friedmans view that the main goal of all companies is to generate profits for shareholders. However, easily tradable creator tokens do introduce speculative risks, which can destabilize incentives.

Finally, Web3 can return value to digital content through digital scarcity. Over the past two decades, free platforms have commoditized and devalued content. As a result, the act of paying for content has been greatly reduced. However, the ability to create digital scarcity has the potential to reverse this trend. Heres a helpful quote to help understand why this is important:

If I do a job in 30 minutes, its because I spent 10 years learning how to do it in 30 minutes. You owe me years, not minutes.

While digital scarcity isnt beneficial for every medium, the ability for creators to make their work scarce opens up monetization use cases.

For example, an artist doesnt need to give up her Spotify streaming -- instead, she can use music NFTs, limited-edition drops, and other perks to reach her most ardent fans while maintaining a presence on Spotify for a bigger, more universal reach audience.

Part.5 Ownership Tools

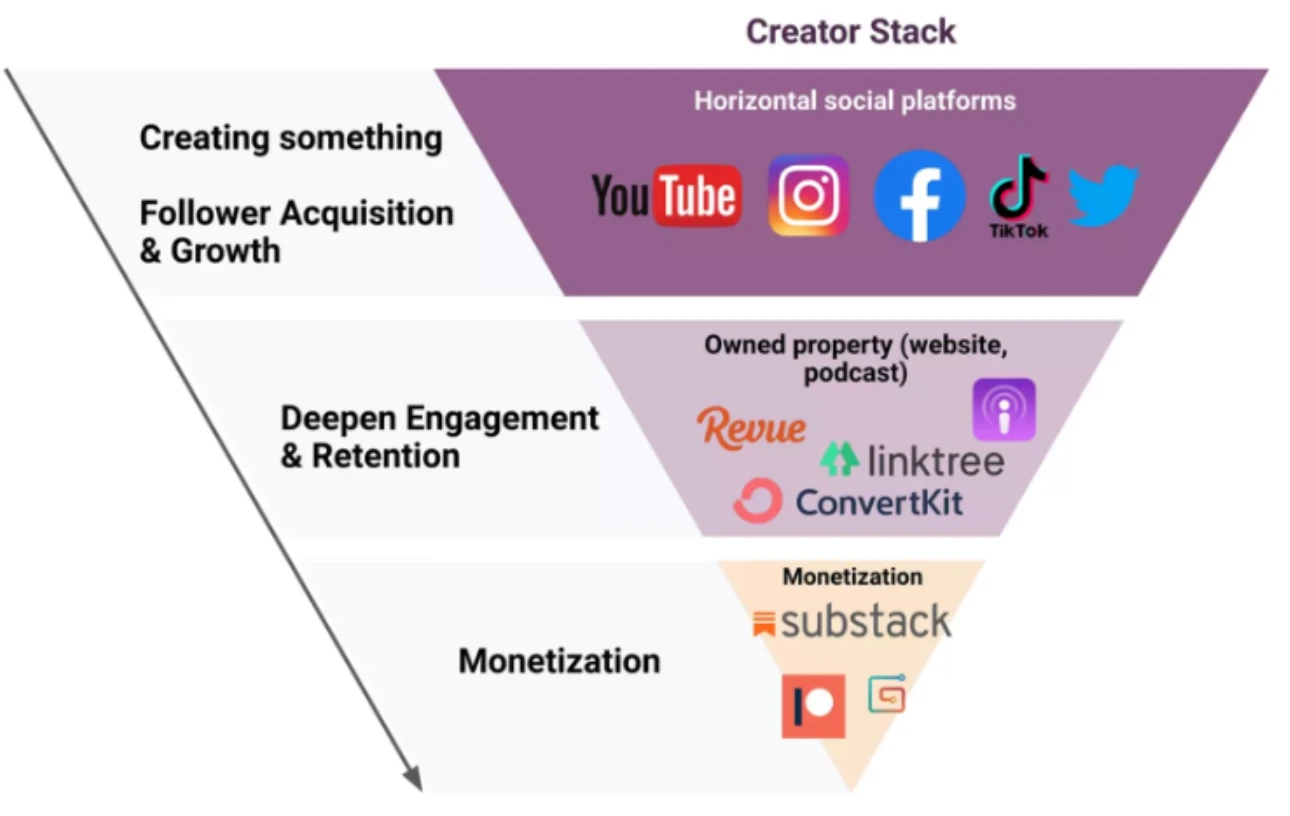

The total addressable market for disruptive innovations is unknown. This holds true for the creator economy, as the willingness and ability to become creators increases due to new platforms, technologies, and social trends (e.g., COVID). Thus, while the market size cannot be determined, the categories of tools can be grouped into those that aid in content production, growing/attracting audiences, and monetizing and managing the business. The figure below is a visual representation.

That said, Web3 tools built specifically for the creator economy tend to fall into two categories: reborn and nascent tools, ie tools that mimic Web2 solutions, and novel tools for on-chain needs. An example of a reborn tool is Audius, which is trying to be a decentralized Spotify. On the other hand, an example of a nascent tool is Collab.land, which provides software to tokenize online group chats.

That said, we believe Web3 tools for the creator economy will still broadly fall into the above categories: those that help with content production, growing/engaging audiences, and monetizing and managing businesses.

While the picture we paint seems almost utopian, there are several reasons why such user-owned platforms have not yet become widely available.

First, the user-owned platform requires a basic level of Web3 technical knowledge, an understanding that most people do not possess. There needs to be a critical mass on the new platform to incentivize users to migrate to the new platform, as it involves incurring substantial switching costs. And, as weve said many times before, UI/UX needs further simplification to reach critical mass.

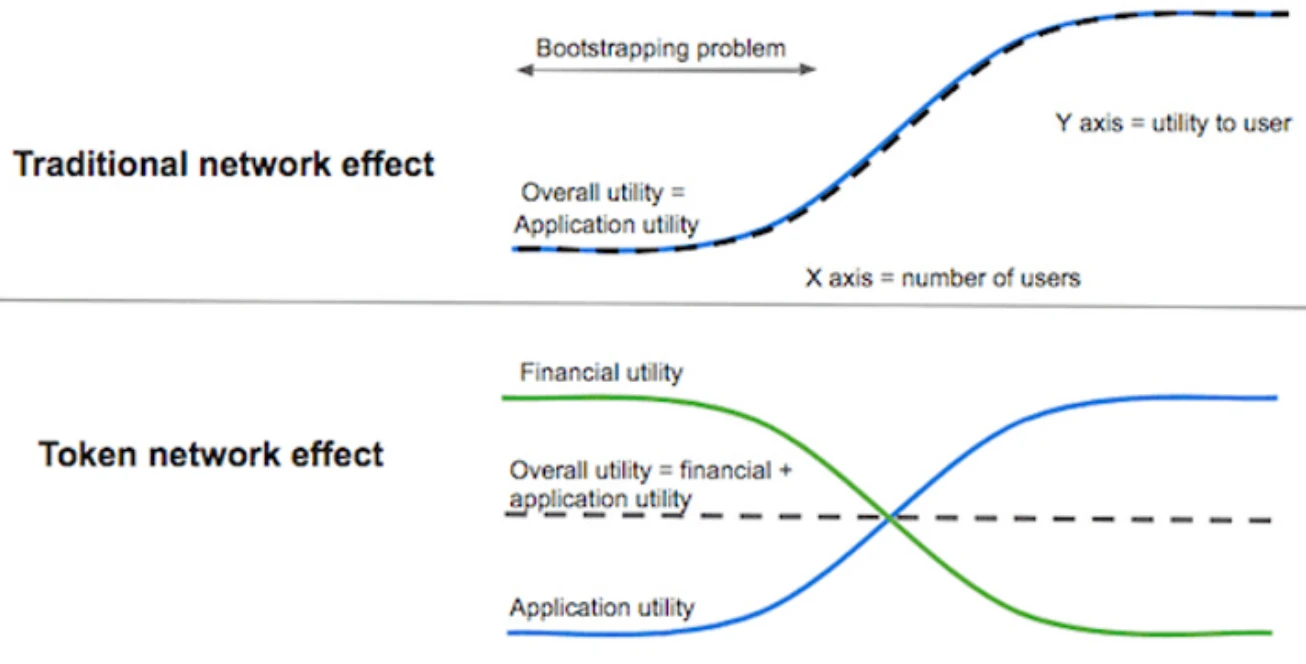

Such platforms represent the first instance where we can use economic incentives (such as tokens) to channel network effects.

While tokens can quickly launch a network, they are by no means a substitute for product-market fit, nor is it clear that they will provide a sustained advantage in maintaining and growing the network over time. At the end of the day, there is still a need to build something that people want. For example, OpenSea, without a token, is still ahead of all competitors that have launched tokens (SuperRare, Rarible, etc.).

Part.6 Potential Development of Creators

More funds need to be deployed. From this perspective, as of mid-2022, Red DAO is the largest deployer of capital in digital fashion. Cumulatively, they have invested about $10 million. Fashion is a multi-trillion dollar industry that can use digital engagement far more effectively than it currently does.

More creators become investors. While this trend started years ago (Dr. Dre and Beats, Diddy and Ciroc, etc.), Web3 tools now allow smaller creators to invest in brands and products that resonate with them.

The creator middle class will grow significantly. As it becomes easier to monetize creative pursuits (based on the twin assumptions of increased support tools and individual willingness to pay), a larger group of creators will be able to generate sustainable income from their creative work.

The rise of influencer/content creator incubators. Chinas impact incubators have scaled up, such as Jake Pauls Team 10. While this is an area with huge potential, capturing a small percentage of creator revenue is a thorny issue.

Additional monetization tools can unlock the creator middle class and make creative pursuits more accessible. Limiting the audience to 1,000 or 100 true fans allows creators to earn a steady income and increases the number of people who can make a living pursuing their creative endeavors.

All in all, the road ahead is long. Creator growth potential is high, and while there are many headwinds, they are not insurmountable. If the UI/UX and educational challenges of Web3 can be solved in the long term, then the creator and ownership economy may very well reach the peak of its potential.