1. Policy overview

As the largest financial trading market in Asia, Hong Kong is an important bridge for many financial institutions in the Mainland to seek external development. Compared with the difficulty in applying for financial licenses in the Mainland, Hong Kong’s securities and futures market adopts an access system. As long as it meets the requirements of the Hong Kong Securities Regulatory Commission, you can apply. Among the 10 types of licenses managed by the Hong Kong Securities Regulatory Commission, each type of license corresponds to a business. To engage in the corresponding business, you must obtain the corresponding license. Only after obtaining the license can you become a licensed person stipulated by the Hong Kong Securities Regulatory Commission.

License plates No. 1-10:

2. License classification

As an asset company, our research mainly focuses on the applications for No. 1, No. 4 and No. 9 licenses

The so-called 149 license is actually a combination of Type 1, Type 4 and Type 9 licenses.

(1) Type 1 license Dealing in Securities

Type 1 license, that is, a securities trading license. Only after obtaining a Type 1 license can you provide securities transactions (such as the trading of stocks, stock options and bonds) and provide brokerage services to customers in Hong Kong. It is equivalent to mainland securities companies providing customers with stock trading services. If a financial institution wants to conduct securities trading activities in Hong Kong, it needs to hold a first-class license, so the first-class license is the most common among the ten types of licenses, and the number of individuals and institutions holding licenses is also the largest among all licenses.

(2) Type 4 license Advising on Securities

Type 4 license - a license to provide securities advice to clients (provide consulting fee services to professional investors), only after obtaining a Type 4 license can you provide securities investment advice to clients in Hong Kong and publish relevant research reports. Many enterprises will choose to apply for the No. 1 license and the No. 4 license at the same time.

The main service of the Hong Kong No. 4 license is to provide opinions on securities, but don’t think that there is no risk in providing opinions, because in the financial circle in Hong Kong, if you mislead the relevant professional investors, the Hong Kong Securities Regulatory Commission will impose fines. At the same time, Hong Kong No. 4 Licenses can be revoked at any time.

(3) Type 9 License Asset Management

Type 9 licenses provide asset management licenses. Only after obtaining Type 9 licenses can you issue funds in Hong Kong and manage client funds, etc. It is equivalent to the private equity fund license in the Mainland. Holding this license means that you have obtained a passport in the international capital market. You can not only directly participate in overseas investment, but also manage the funds of overseas investors. (Regulated activities include real estate investment schemes, securities or futures contracts, etc.)

secondary title

Card 9 advantage

1. Overseas investment

To expand the scope of overseas investment targets, Hong Kong has relatively few restrictions on the investment targets of asset management institutions. Asset institutions can invest in various overseas equity assets and derivatives, and can also reverse invest in A shares at the same time.

2. Increase asset allocation options for domestic clients

Hong Kong faces the global capital market and has a wider range of investment types. It can design more diversified fund products for customers for different types of customers to choose from. With the increasing demand for diversified allocation of high-net-worth customers, obtaining the No. 9 license can better meet customer requirements and provide more diversified services to high-net-worth customers.

Overseas investors usually have stronger risk tolerance and discrimination. Although the screening of private equity companies is more stringent, once selected, the proportion of long-term holdings of funds is higher and more stable. Overseas investors are also more tolerant of performance requirements. Many private equity funds only need to run some reference indexes to extract income.

3. Tax incentives

Hong Kong’s tax rate is lower than that of the mainland, and additional tax incentives are introduced every year, and Hong Kong companies can enjoy the tax incentives. Therefore, setting up a fund management company in Hong Kong can reduce the relatively large tax burden. (If the Hong Kong limited company has an annual profit of less than 2 million Hong Kong dollars, it only needs to pay 8.25% of the net profit tax; if the Hong Kong limited company has an annual profit of more than 2 million Hong Kong dollars, the net profit of more than 2 million is subject to 16.5%.)

4. Build an international investment team and deploy globally

There are more than 3,200 financial institutions licensed by the Hong Kong Securities Regulatory Commission, and more than 40,000 licensed employees. It has a rich reserve of high-end financial talents, who can quickly build an international investment team and gradually deploy global asset management business.

secondary title

License route application method

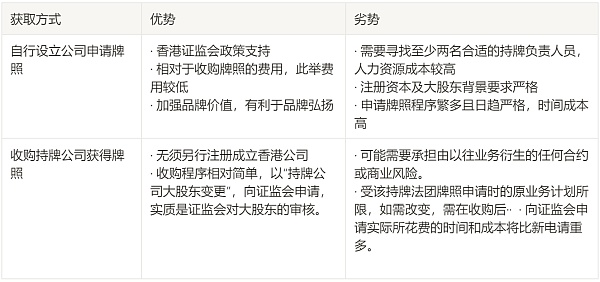

One path is to apply by yourself, and the other is to buy a shell company (acquisition).

Method 1: Acquisition

Acquisition is not as simple as everyone thinks, it is to take the company down. As you all know, if you buy an A-share shell company in China, you also need to get the approval of the China Securities Regulatory Commission / Industrial and Commercial Bureau, and it is the same in Hong Kong. The Hong Kong Securities Regulatory Commission stipulates that if a licensed shell company changes its major shareholder, it needs to go to the Securities Regulatory Commission for approval. The concept of a major shareholder is very broad in Hong Kong, and holding 10% of the shares counts. But the Securities Regulatory Commission will intervene and replace the new shareholders views on the company, so you may need to submit a new business plan.

Licensed RO:

Another relatively big problem is the need to find a licensed RO, which is a scarce resource. If you buy a shell, you may bring several ROs to work for you for 3-6 months, but each agency will eventually need to find ROs independently. To replace the RO, the China Securities Regulatory Commission also needs to approve it. Therefore, when buying a shell company, you may have a smooth negotiation with a shell seller in the early stage, but the replacement procedures in the later stage will take at least 3-4 months. Generally speaking, the control is relatively low.

149 License market price

Based on the market conditions before 2020, it would cost tens of millions of Hong Kong dollars to acquire a Hong Kong company with a 149 license, because the Hong Kong 149 license can already be used as a symbol of a powerful wealth management company, so there are many companies that want to acquire it. (But now because of the epidemic, many brokerages have closed their doors. According to the current market situation, the 149 license acquisition fee may have dropped to 2 million Hong Kong dollars.

Method 2: Apply directly

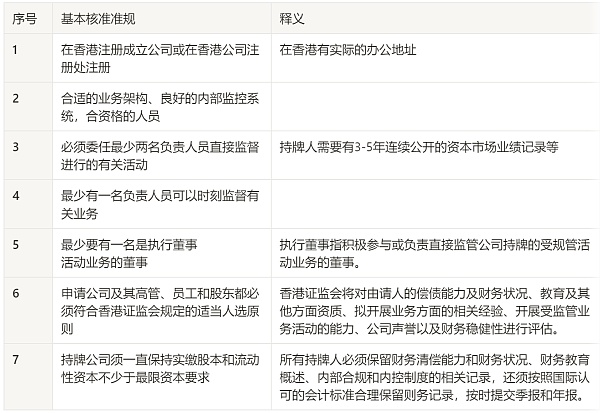

If it is to apply for a license, assuming that the company has been established in Hong Kong, the total time will be 6-9 months. Calculated, the time cost of the two ways is about the same. The direct application method needs to meet the following seven elements:

Condition 1 for directly applying for No. 9 license plate: company requirements

To apply for Hong Kong No. 9 license, the following conditions must be met:

The applicant must be a company incorporated in Hong Kong or a non-Hong Kong company registered with the Hong Kong Registrar.

The company must have an appropriate business structure, a good internal control system, and qualified personnel and teams (the China Securities Regulatory Commission will strictly review the composition of the team and the background of key members).

A company must have a minimum of 2 responsible officers, at least 1 of whom must be an executive director.

The applicant must meet the Fit Proper requirements, and the applicants major shareholders (holding more than 10% of the licensed companys equity), directors and senior management must meet the Fit Proper requirements.

Fit Proper qualification requirements:

Good financial status and repayment ability, not facing bankruptcy or failing to repay debts.

Qualified academic qualifications or industry qualifications, such as bachelor degree or above in accounting, economics, finance, finance and other related majors, or related professional qualifications such as Chartered Financial Analyst.

Have no disciplinary records or criminal records from domestic or foreign regulatory agencies for at least 5 years.

Resume has certain industry-related experience.

Condition 2 for Direct Application for No. 9 License: Funding Requirements

If the applicant is applying for a No. 9 license holding client assets, the minimum paid-in capital is 5 million Hong Kong dollars, and the working capital is not less than 3 million Hong Kong dollars.

If you do not hold client assets, there is no minimum paid-in capital limit, and the minimum liquidity is 100,000 Hong Kong dollars;

The company registration capital requirements for No. 4 and No. 9 licenses are the same. An account must be opened with a bank in Hong Kong. In addition, it is necessary to submit the shareholders capital source certificate and legal certificate, the capital requirements of the planned business, the requirements for registered capital, etc.

There are also clear requirements for regular reporting of financial status. The No. 4 and No. 9 licenses are also subject to the conditions for holding client assets. Holding funds requires submitting financial reports every quarter. Can.

The process of applying for a license is not a one-off process, and generally requires at least half a year of material preparation and other matters. It is especially reminded that even after the license is obtained, there will be many restrictions. Therefore, without the assistance of a professional organization, it is very likely that various important details will be missed.

Condition 3 for direct application for No. 9 license plate: regulations for practitioners

A license is required for each regulated activity, and corresponding licensed personnel are required to operate it. In other words, if you have a No. 1, No. 4, or No. 9 license, then your company must also have practitioners with corresponding licenses.

Practitioners - Responsible Officer (Responsible Officer, commonly known as RO), is actually the risk control officer often called in China. An institution or company needs to hire at least 2 ROs to maintain a license, and ROs cannot work part-time in other companies. The role of RO is more like taking the salary of a licensed company, but it is actually a supervisor assigned by the Hong Kong Securities Regulatory Commission.

Another thing to emphasize is the issue of compliance. In Hong Kong, violating the regulations of the Securities Regulatory Commission may result in civil or criminal penalties, depending on the severity of the violation. The company and the hired RO are respectively responsible for compliance.

Among them, the person in charge of the RO is divided into big and small cards. The big-name RO has previous experience as a person in charge of relevant licenses. Small-brand ROs are personnel who have passed HKSI (Hong Kong Securities Futures) related examinations and only have relevant industry experience. Judging from the market data of No. 9 RO, if the RO does not participate in the company’s management and operation, the monthly salary of pure listing is about 50,000 Hong Kong dollars. If the RO is required to participate in the company’s operation and management, the monthly salary will be as high as 80,000-100,000 Hong Kong dollars. (It is recommended to find two ROs for #4+9 license plate, one big and one small)

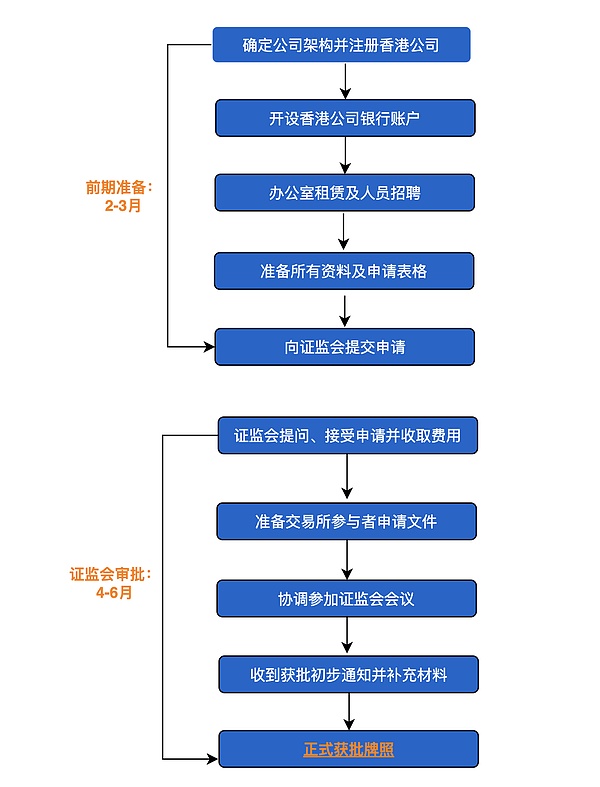

4. Hong Kong No. 9 license application process

The Hong Kong Type 9 license application process consists of two parts:

1. Preparatory work

Including company structure establishment and company registration, Hong Kong company account opening, office leasing and team building, preparing all materials and application forms, and submitting the application to the Hong Kong Securities Regulatory Commission. The whole process is expected to take 2-3 months.

2. Approval by the Hong Kong Securities Regulatory Commission

Including questions from the CSRC, accepting applications and charging fees, preparing application documents for exchange participants, coordinating participation in CSRC meetings, receiving initial notifications of approval and supplementing materials, and finally officially obtaining a license. The entire process is expected to take 4-6 months. Some steps may be handled multiple times. It is recommended to prepare in advance and reserve sufficient time.

V. Experience and Suggestions on Applying for Hong Kong No. 9 License

According to the past application approval history, there are two important suggestions:

1. Build a two-tier holding company structure

When setting up the company structure, in order to avoid changes in important actual controllers such as Hong Kong companies and shareholders applying for licenses, it is necessary to file with the Hong Kong Securities Regulatory Commission. It is recommended to build a layer of holding company B on top of company A applying for a license. The entry and exit of the company only need to be handled at the level of the holding company B, and there is no need for the licensed company A to file with the Hong Kong Securities Regulatory Commission, reducing maintenance costs (the method most companies in the market are using).

2. Prepare funds

Prepare funds in advance. The Hong Kong Securities Regulatory Commission requires applicants to provide proof of funds when approving. Because the country has foreign exchange control, large amounts of funds need to be planned in advance.

about Us

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToros global investment. The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst Young, KPMG, HNA Group , Bank of America and other well-known international companies.