first level title

1. Macro

inflation

inflation

In 2022, affected by easing, wars and supply chains, U.S. inflation will hit a 40-year high. According to the data, inflation has peaked, but it is still far from the Feds goal of 2% to 3%.

secondary title

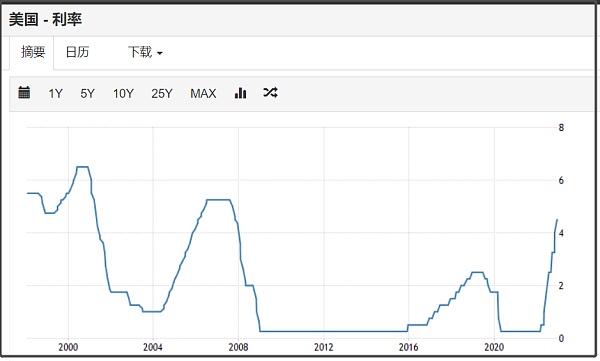

hike

In 2022, the Federal Reserve will raise interest rates seven times in a row, and the federal funds rate will range from 0% to 0.25% to the current 4.25% to 4.5%.

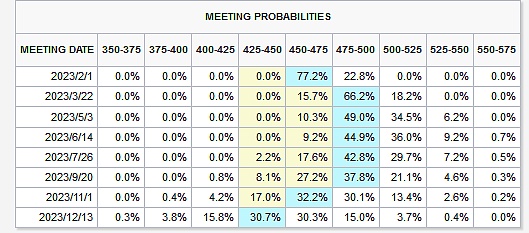

In 2023, according to the CME FedWatch Tool, the market believes that the most likely path is to raise interest rates by 25 bps in February and 25 bps in March, and then maintain interest rates at 4.75% ~ 5% until the end of the third quarter of 2023 (maintaining high interest rates About half a year), the first rate cut of 25 bps will appear in November 2023.

If the markets expectations are true, a new round of easing cycle will start at the end of 2023, and the market may react early by the end of the first quarter.

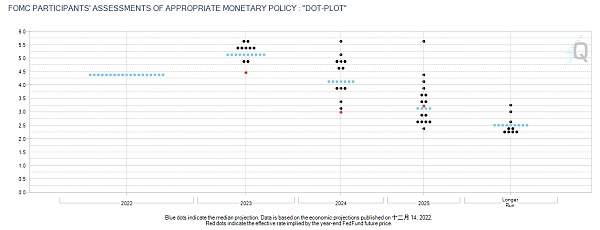

However, there is a contradiction between the market and the Fed. According to the minutes of the December FOMC meeting and the dot plot, most Fed officials have raised their peak interest rate, that is, the expected level of terminal interest rate, to above 5%, implying that the rate hike will be slower but not Rates will eventually be higher, and none of the participants projected that it would be appropriate to start lowering the federal funds rate target in 2023.

secondary title

Short form

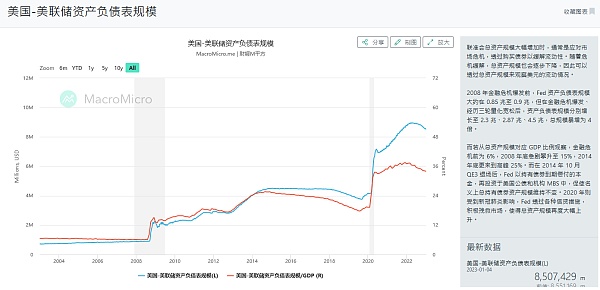

The original plan for the first phase (June-August 2022) is to reduce the upper limit of US$30 billion in treasury bonds and US$17.5 billion in agency bonds and mortgage-backed bonds (MBS) per month. The upper limit of holdings was increased to US$60 billion in treasury bonds and US$35 billion in agency bonds and MBS. The condition for stopping the shrinkage of the balance sheet is to start to slow down and stop the shrinkage of the balance sheet when the reserve level is slightly higher than the Fed considers the ample reserve level (ample reserve).

The Fed’s balance sheet shrinkage is proceeding as planned, and the size of the Fed’s balance sheet has dropped from nearly $9 trillion to about $8.5 trillion, but Powell hinted in a speech at the end of November that the Fed would shrink its balance sheet in a way that may lead to Manage its balance sheet in a manner that closes early.

Shrinking the balance sheet has little impact on the whole, and has less impact on the market than raising interest rates, and has received less attention.

The New York Fed survey in November showed that the market widely expects the Fed to stop shrinking its balance sheet in the third quarter of 2024, which is broadly in line with our expectation that QT will end by mid-2024 as the Fed begins to see a shortage of reserves .

secondary title

Agency Outlook to 2023

a. Goldman Sachs Macro Outlook 2023: This Cycle Is Different

The U.S. economy avoids recession, GDP maintains growth, unemployment will not rise significantly, but the Fed will not be dovish, and will continue to raise interest rates 3 times by 25 Bps in 2023 and will not cut interest rates

b. Morgan Stanley: 2023 Investment Outlook

Fed tightening continues, cost of capital rises

Mild economic recession, the companys profits are being squeezed, and its performance is declining. We are optimistic about equity investment in the long run and pay attention to companies with business moats

c. JPM: A bad year for the economy, a better year for market

In 2023, the Federal Reserve is unlikely to cut interest rates, and the reduction of balance sheets will be weakened; the United States and Europe will have a mild recession, and they are optimistic about the Chinese economy and emerging markets; a mild recession has been priced in by the stock market. Lift (because 2022 fell too much), annual bullish

d. Merrill Lynch: 2023 Year Ahead: Back To The New Future

The Q1 economic data has deteriorated across the board, and the Fed has stopped raising interest rates; a moderate economic recession in 2023 (already priced by the bond market), the Fed’s shift to (cutting interest rates) is at the end of the year, and corporate profits are falling; stocks perform well in the second half of the year, and the 60/40 strategy has excess ; 2023 will start a bull market

e. BlackRock: A new investment playbook

The long-term mild recession of western economies, underweight European and American stocks, the valuation and profit decline brought by the recession have not yet been priced; neutral on Asia, Chinas steady growth (cannot boost the global economy), optimistic about Southeast Asia

Allocate high-grade corporate bonds in developed countries, invest in assets linked to inflation, and fight recession

f. Zoltan Pozsar, Analyst, Credit Suisse: War and Commodity Encumbrance

As economic wars (such as Sino-Global cooperation) impact the US dollar system, the United States will restart quantitative easing (referring to the central bank’s purchase of government bonds) in the summer of 2023

The 60/40 stock-bond strategy is invalid and should be changed to 20/40/20/20, corresponding to cash, stocks, bonds and commodities respectively.

g. Bank of America Chief Strategist—Michael Hartnett

In 2023, the global economy will experience a mild recession, the inflation rate will decrease, the Chinese economy will recover, interest rates, yields, spreads, the US dollar, and oil prices will peak, US stocks will remain flat, and gold prices will rise.

The U.S. CPI and PPI have reached their peak, and interest rate hikes have led to stagflation. The performance of U.S. assets in 2023 will be worse than the global average. The corresponding strategy is to short the U.S. dollar and go long on emerging market assets

In the first half of the year, I was bearish on risky assets such as stocks and bullish on long-term U.S. bonds

h. Standard Chartered Chief Strategist—Eric Robertsen— 2023 Black Swan

In the first half of the year, the United States fell into a severe economic recession, the unemployment rate of corporate bankruptcy increased, risky assets plummeted (the Nasdaq fell 50%, BTC fell 70% to 5000), oil prices plummeted 50% (recession + Russia-Ukraine conflict), the dollar plummeted, the euro rose, and the currency Austerity; eventual global recession

Republicans to impeach Biden by 2024

summary:

summary:

Inflation has peaked and started to fall, but the timing of the easing cycle is difficult to predict. There are contradictions between the market and the Fed’s statements. The attitudes of institutions are both long and short. Most agree with the mild recession of the economy and the continuous tightening of liquidity.

There are a lot of data, news and factors that need to be considered in macro factors, and the logical chain of information transmission to prices is very complicated. At the current point of time, instead of predicting the good and bad of macro data, directly focusing on the market price behavior has a higher winning rate. Although the income is reduced, it is relatively safe.

first level title

secondary title

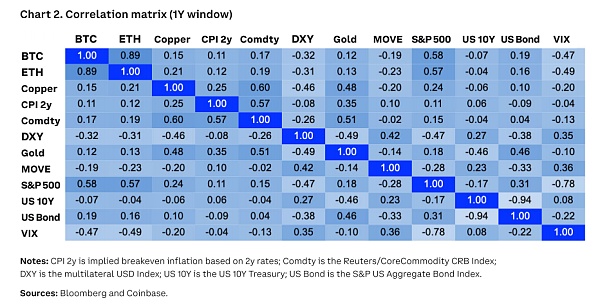

US Stocks-Crypto Market Correlation

The encryption market has been deeply influenced by US stocks. Based on observations in 2022, it will even follow the trend of US stocks at the minute level. During the trading hours of US stocks, the encryption market will also be significantly active, with increased volatility and trading volume.

secondary title

US stocks - 2022 will kill valuation, 2023 will kill profit

Major U.S. stock indexes had their worst year since 2008.

In 2022, the Dow fell 8.8%, the SP 500 fell 19.4%, the Nasdaq fell 33%, and the Russell 2000 fell 21.7%.

The Nasdaq fell far more than the average, mainly due to the fact that technology stocks were greatly affected by interest rate hikes and their valuations fell (PE fell by 40%, similar to 2008); and if a recession occurs in 2023, corporate profitability is expected to decline, and the Dow and SP There is a downward momentum.

From the chart, the SP 500 is still in a downward trend. The lowest point in 2022 is around 3491. It is currently suppressed by the red downward trend line. If it cannot break through, the probability of touching 3600 again is very high.

If it breaks through the suppression and the short-term high of 4100, it will be treated as a reversal and turn to bullish thinking.

Carve a boat and ask for a sword:

Referring to the market from 2007 to 2009, the SP fell 56% from its peak in October 2007 to the bottom in March 2009 (about 74 weeks), then rebounded 45% from the bottom until the end of July 2009 to confirm the reversal (about 20 weeks) ).

secondary title

Michael Hartnett forecast

When we planned the fourth quarter of 2022 at the end of September, we mentioned:

Wall Street is currently divided on some forecasts for the bottom (based on inflation falling to 5% and unemployment rising to 4%). The bottom predictions for the SP 500 range from 3000, 3300, 3400, 3600 points, and the accuracy rate this year Michael Hartnett, the highest, believes that the bottom position can be established at 3600, the position can be increased at 3300, and the full position can be reached at 3000. At present, the SP 500 index has broken the previous low, the lowest is 3623.”

Since then, the SP 500 dropped to around 3500 in October, and closed at 3983 on January 12. If the transaction is carried out according to Micheals plan, the current floating profit of the bottom position is 10%.

At the end of 2021, Wall Street was bullish and chanted the slogan of rate hike bull. Micheal was one of the few big shorts, predicting the plunge in the first half of the year. But he is not an always bearish, always correct analyst. In July, he predicted the rebound of the SP to 4,200 points, and at the high point, he called out the worst September prediction in history, almost betting on it All the major bands in 2022, with little difference in the predicted points, are known as the most pessimistic but most accurate analyst on Wall Street.

He predicts that risk assets will fall to a greater extent in the first half of 2023, and the US stock market yield will be 0% for the whole year. We understand that the current position is the relative high point of the rebound, and the possibility of a callback in the next six months is relatively high, so we can continue to build positions at the above key positions.

secondary title

Mike Wilson forecast

Mike, like Micheal, was one of the few big shorts at the end of 21, and in the subsequent market, he turned to longs in July and predicted the bottoming out of 3700~4200, and in early December predicted the recent 11~12 months The high point of the rebound is 4100 ~ 4200, and it is predicted that it will call back to 3800 points.

Mikes forecast for 2023 is relatively pessimistic, and he believes that the SP will fall to 3000 points, mainly based on the following logic:

1) Actively managed funds in the United States are all reducing their holdings

2) The dual logic of valuation decline caused by tightening and recession leading to profit decline. He believes that the current market estimates of EPS are too high. The actual situation is similar to that in 2008. The decline in performance has led to a decline in stock prices, which the market has not yet priced in;

3) He predicted that the stock risk premium will continue to rise, that is, the current price is not attractive enough, and there will be a subsequent decline.

secondary title

Crypto Sector Stocks vs BTC

In addition to the extremely high correlation, the volatility of crypto-related stocks is even higher than that of BTC itself, which has greater flexibility; however, COINBASE has not shown a comparative advantage since its listing (probably because it entered a bear market shortly after listing), and it also fluctuates almost simultaneously in time .

Reasons may be:

1) Listed companies are affected by more factors such as operating conditions, performance, competition, and supervision;

2) The decline of BTC in the first half of the year was not too much affected by the expectation of macro interest rate hikes (shown that the supply of stable coins has not decreased significantly), while the opposite is true for US stocks;

image description

COIN, daily chart

The price of Coinbase has rebounded by about 40%+ from the lowest point. Cathie Wood bought about $3 million in stocks in December, which may be the performance of the bottom of the market. If the rebound continues to be strong, it can be considered that the bottom has been seen and the bulls reversed.

summary:

summary:

According to analysts predictions, U.S. stocks may bottom out in the first half of the year, with positions on the left at 3600, 3300, and 3000, and the reversal may occur in the second half of the year.

first level title

3. Crypto Market

image description

secondary title

Trend of BTC and ETH in 2022

image description

BTCSP 500, 2022 daily line

The birth and design mechanism of BTC originated from the original intention of creating a decentralized currency and payment system, based on the idea of resisting currency over-issuance, which is also the main narrative. Another narrative is the hedging property of digital gold.

However, judging from the latest round of bull-bear cycles, the bull market comes from the liquidity spillover caused by the release of water in the United States, while the bear market comes from the liquidity crunch. Therefore, the correlation with gold is extremely low, and its tradability is far greater than its monetary attributes and narrative.

image description

ETHSP 500, 2022 daily line

Judging from the trend since the stETH incident, BTC hit a new low this year, while ETH stopped falling and rebounded before the new low, and BTC is relatively weaker than ETH.

In addition to narratives such as ETH upgrades, network activities in applications such as DeFi and NFT also support their prices (deflation).

secondary title

Historical market rotation

Green is BTC market share, K line is BTC price, weekly line

Similar to the logic of A-shares weighting the stage, growing and singing, the big market in the encryption market is usually initiated by BTC. When BTC is sideways, Altcoin will make up for the increase and show stronger flexibility.

According to the historical market, it is necessary to pay attention to the price start of BTC, and make a rotation timing through the exchange rate of Altcoin/BTC.

Potential bearish: DCG Genesis bankruptcy, exchange Gemini bankruptcy

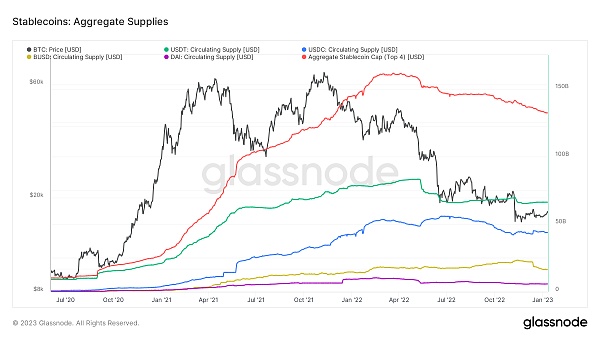

Stablecoin Liquidity

Stablecoin Liquidity

The rise of the bull market is inseparable from the increase of stablecoins (injection of external liquidity), and there is a spiral relationship between the price and the supply of stablecoins.

secondary title

track

Similar to our judgment for the fourth quarter of 2022, we continue to be optimistic about infrastructure, including: Ethereum L2, L0, new public chain, privacy

Added DeFi track, mainly:

RWA: the migration of real world assets RWA to the chain

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToros global investment. The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Liquidity pledge

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToros global investment. The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst Young, KPMG, HNA Group , Bank of America and other well-known international companies.