In this study, we will share the following four key points:

1. Comparison and business chain analysis of the license status of the three top digital asset management companies and exchanges in the Hong Kong Securities Regulatory Commission.

2. Consolidated and documented interviews with a Hong Kong professional law firm and compliance personnel regarding the Hong Kong No. 1479 license.

3. Analysis of VASP virtual asset service provider license

4. Analysis of CSOP Bitcoin Futures ETF Ethereum Futures ETFs application path

secondary title

Case sharing 1

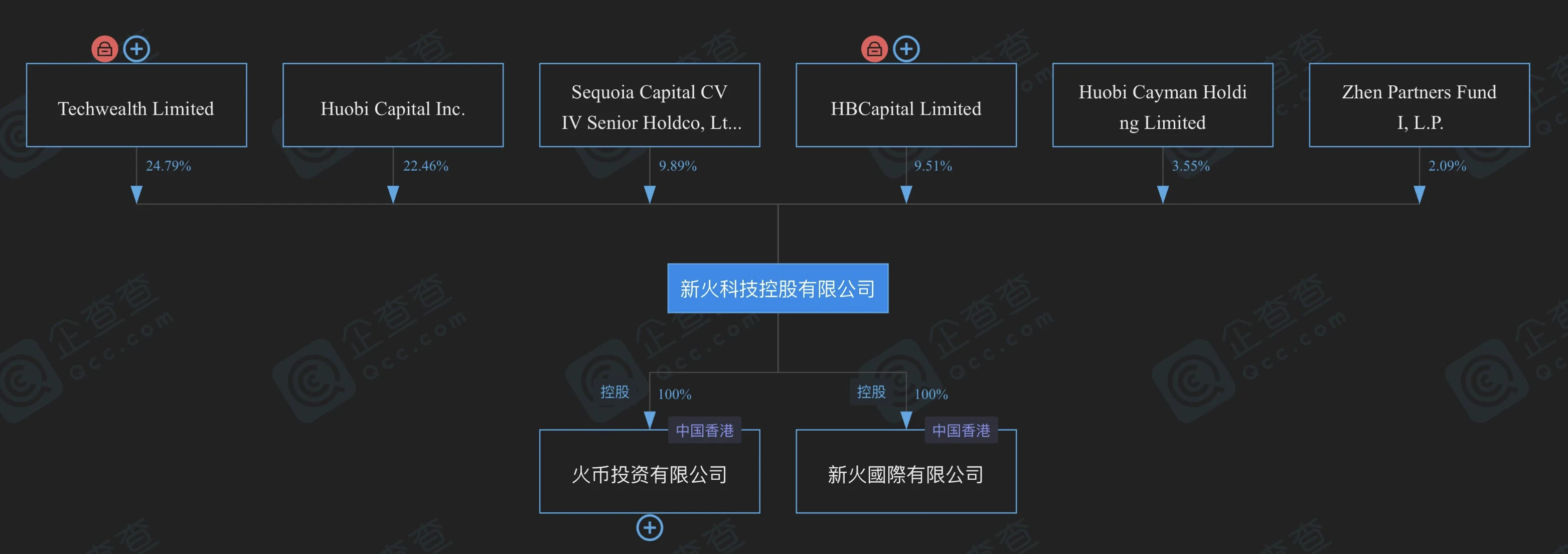

Xinhuo Technology License Holder: #L 4 L 9

At present, Xinhuo Technologys subsidiaryNew Huo Asset Management (Hong Kong) Limited Xinhuo Asset Management (Hong Kong) LimitedIt has successfully obtained Type 4 (advising on securities) and Type 9 (asset management) licenses issued by the Hong Kong Securities and Futures Commission respectively; a subsidiary of Xinhuo Technology has also obtained the US Financial Crimes Enforcement Agency (FinCEN) license. The Money Services Business Registration License (MSB) issued by the Canadian Financial Transaction and Reporting Analysis Center (FINTRAC) issued the MSB license.

Xinhuo Technology’s financial report shows that virtual asset lending and over-the-counter transactions accounted for more than 90% of the total revenue, which contributed 9.057 billion Hong Kong dollars in revenue, accounting for 96% of the group’s total revenue. The virtual asset ecosystem includes asset management, virtual asset trading platform, virtual asset lending, over-the-counter transactions, and virtual asset mining related businesses.

Note: If you want to manage the customers capital account on a firm basis, you need a No. 9 license, such as Xinhuo Technology.

secondary title

secondary title

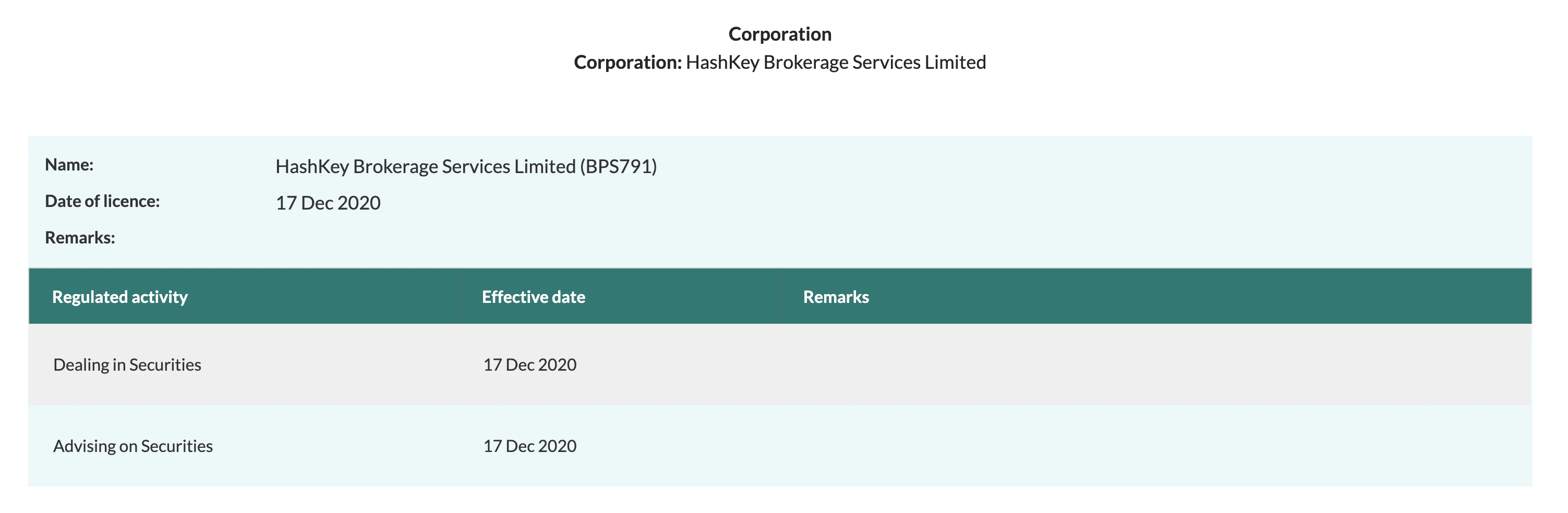

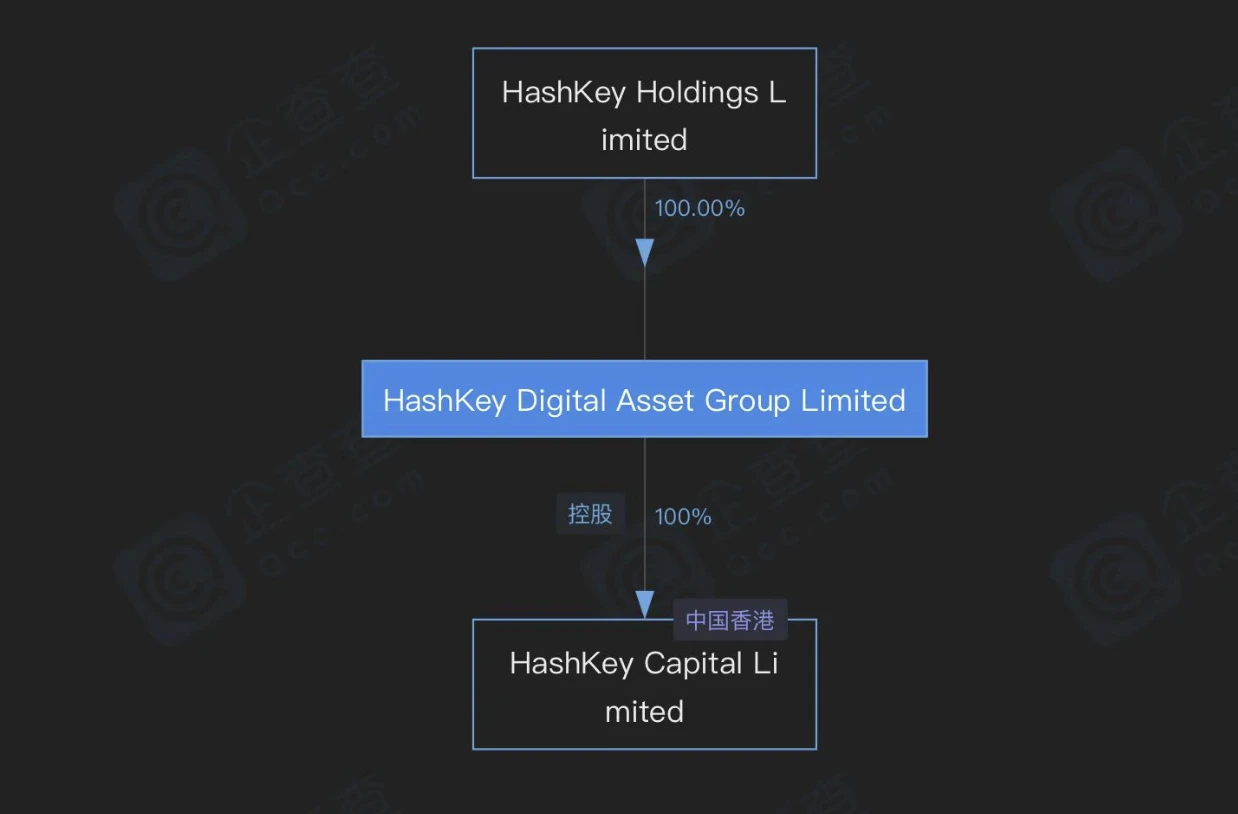

Case Study 2: HashKey Group (Hashkey Holding Limited)

HashKey Group is the second virtual asset trading service provider. The trading platform operated by its subsidiary Hash Blockchain Limited provides trading services including cryptocurrencies and virtual commodities, such as Bitcoin, Ethereum, stable coins and security tokens. Obtaining a license means that Hashkey Group is approved asQualified professional institutions, and can provide brokerage and automatic trading services for professional investors, and assist them in participating in tokenization projects.

Hashkey Brokerage Service Ltd.: #L1 & L 4

Hash Blockchain Limited: #L1 & L 7

HashKey Pro is HBLs institutional virtual asset trading platform, which will provide professional investors with automated trading services such as Bitcoin, Ethereum and other cryptocurrencies, as well as stable coins, security tokens and other innovative assets electronic transactions).

Hashkey Capital Limited: #L 9:

secondary title

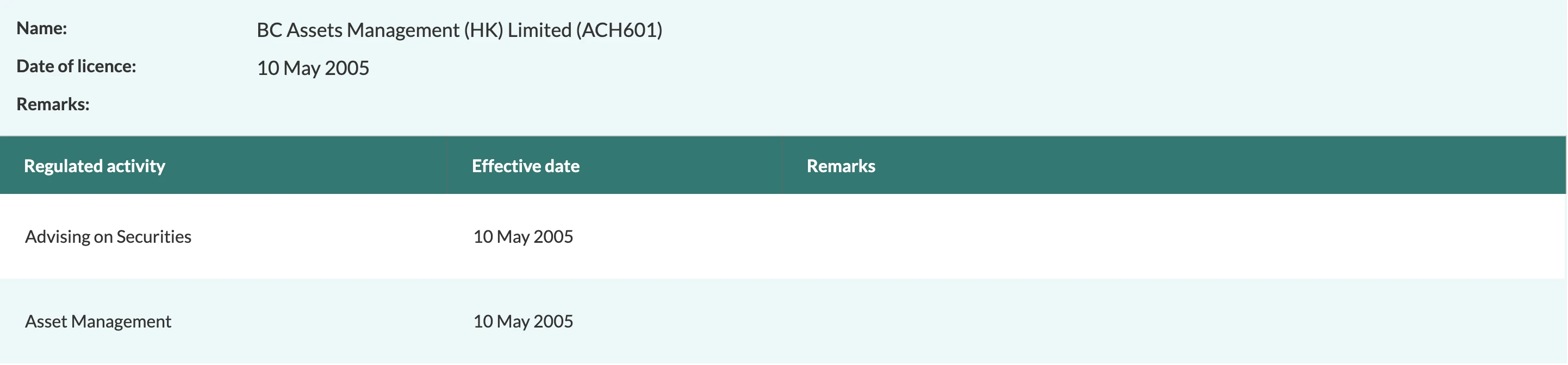

Case Study 3: BC Technology Group Subsidiary - OSL Digital Securities Limited

OSL Digital Securities Limited (#L1 L7)

OSL Exchange under BC Technology Group is the first digital exchange in Hong Kong that can conduct compliant licensed transactions.

OSL provides software-as-a-service (SaaS), brokerage services, electronic trading platforms and digital asset custody services to institutional clients and professional users.

OSL Exchange provides an institutional-level all-weather trading system, equipped with order matching technology, digital asset traceability and tracking technology, and transaction monitoring system. Customers can trade digital assets through the OSL exchange, including Bitcoin, Ethereum, and security tokens that have been strictly screened by the platform and the China Securities Regulatory Commission.

OSLs services also include over-the-counter transactions, intelligent inquiry and electronic transaction services, allowing traders to use high-traffic asset pools for digital asset lending services, and at the same time ensuring timely and secure settlement of digital assets.

OSL Digital Securities Limited: #1 & 7

BC Assets Management: #1 & 9

BC Global Asset Management Limited: #1 & 4 & 9

2. Records of interviews with senior law firms in Hong Kong:

Q1: What are the scope of business that applicants for #L 4 L 9 licenses can do, and what kind of company structure is required?

A 1: Whether No. 9 license is compliant depends on what kind of virtual assets you want to manage, or what kind of assets are in your fund managers investment portfolio. If the asset types in the investment portfolio do not meet the requirements, you You need to apply for a No. 9 license, but you don’t need a No. 9 license to buy or hold Bitcoin, Ethereum, or other types of stable coins. Only the trading of securities products and securities tokenization products requires a No. 9 license, such as STO.

About Asset Classes

The transactions of digital currencies such as Bitcoin/Ether are defined by the Hong Kong Securities Regulatory Commission as commodity transactions, which are the same as gold and natural gas, and do not fall under the jurisdiction of the SFC.

ETF: If the ETF portfolio includes bond/STO products, it must hold a No. 9 license. SFC will strictly review the coverage of the investment portfolio in each fund. If it does not comply with the rules, the related illegal products of the fund must be closed.

Suggestion: You can set up a company overseas, such as the Cayman Islands, and collect overseas or Hong Kong funds. This is a gray area for the supervision of small and medium-sized asset management companies.

Q2: What is the regulatory scope of VASP?

A 2: VASP mainly supervises centralized virtual digital asset trading platforms, such as OSL Hashkey,

Pay special attention to that digital asset trading platforms cannot trade bond-type products (STO), and the platform needs to have good and compliant STO products to be included in the list of compliant platforms websites by VASP (such as OSL, Hashkey, two companies holding #L1 L7 Financial License)

Interview record of Hong Kong license compliance consultant:

Q1: After obtaining the No. 9 license for asset management, what can and cannot be done?

A 1 : Definitely not able to do such asQuantitative business,Summarize

Summarize: Applying for #L 9 attaches great importance to the ROs experience, shareholder background, Fund Strategy, Operation, Due Diligence, Custody, Counterparty Risk, etc. Theoretically, if small and medium-sized asset management companies want to play side-by-side, especially those related to digital assets, they should be careful. Recently, SFC has taken a tougher attitude, and there will be an Enforcement Letter for mandatory shutdown. If the product is not compliant, the suggestion is If you dont want to apply for a No. 9 license, you can place the main body of the company overseas and use the No. 1 license to distribute in Hong Kong.

Q2: If we only manage our own money, or the money of less than 5 investors, and not retail investors, do we need a No. 9 license?

A 2: In theory, you don’t need a license to manage your own funds, and you don’t need a license if you invest in the form of shareholder (shareholder contribution).

For example, if there are only 3 or 4 well-connected investors, the risk of being supervised by SFC is very low. But if you go to hk to raise funds through formal channels, you need No. 9. In short, this is a gray area. As long as you don’t do business like hospitality and financial management, the risk is relatively small, so be careful.

Q3: Our company has a customer of the exchange, and wants to get the No. 1479 license, and 7 must be required. May I ask the question about the license path of the No. 7 license and the requirements of the applicant?

A 3 : At the stage of preparing to apply for the No. 7 license, you must do a cleanup of the company background and system. SFC will review whether your company’s business outside the application is compliant and legal, and whether your company and the applicant are a Proper Person. Meet the requirements of the China Securities Regulatory Commission for compliance personnel.

Summary: It is recommended to do the companys Cleanup Re-organize first, (it is recommended to use a new Hong Kong company, separate the main company, and use a subsidiary to apply for relevant licenses)

Case time OSL: 2 years; Hashkey: 2 years

As a new platform, you may not be able to obtain a license, but it is recommended to start your business in Hong Kong (sfc depends on whether your products are qualified and product quality), then do a cleanup of the company structure and background, and then cooperate with vasp regulations, and then Submit an application, which can give your company more lifelines during the application period, (provided that you cannot do securitized virtual assets, (sto)

Q4: Questions about bank supervision:You need to know whether your bank is sensitive to va, because many banks will close accounts if they design virtual assets, and banks are not very supportive

It is recommended to open an account with an overseas bank for record support

The bank will ask a lot of transfer questions,

DBS Bank of Singapore? Not too open, need to use their own trading platform

Q 5: Apply for #1479, one time application or separate application, application agency service fee?

# 7 is separated and applied separately because it is an electronic exchange.

To apply for No. 7 license, it is recommended to find at least3 ROs, but considering that it is difficult to select a No. 7 RO, it is difficult to find an RO, and it is even more difficult to find an RO with a No. 7 license and experience, so it is more difficult to apply. The recommended lead time is 2 years.

Shortcut: Find someone with experience outside to help the internal RO manage the business (three ROs are better, because the requirements are high)

Staffing: 10+ (mic+operation)

Do company personnel have to pay taxes in Hong Kong?

There is no requirement, but important people in the company system need to appear in Hong Kong, and the RO needs to be in Hong Kong, because if the company violates the regulations, SFC will find the person in charge.

#1 is easier to comply with the regulations

#4 , 9

Look at the RO, if the RO is strong, the chances of applying are great, the fastest is 6-9 months, and the maximum is 2 years.

See if the funds strategy is compliant.

Need 2 ROs: 2, 1 big-name RO, the other can be conditional, as long as you have experience

Does the RO need to leave directly? You can use your name to apply first, and then come over

In addition, mic, 2 operation personnel each. Funds: Prepare working capital available for one year:HKD 20 million

first level title

VASP virtual asset service provider license (for retail customers)

1. Application Requirements

The effective date of the VASP Amendment Draft is March 1, 2023.

Any individual or organization that operates or provides any virtual asset services in Hong Kong needs to obtain a VASP license issued by the Securities Regulatory Commission, otherwise it will be a crime.

From March 1, 2023, virtual asset service providers (such as cryptocurrency exchanges, asset management platforms, etc.) must obtain a VASP license issued by the Hong Kong government to carry out virtual asset service business and marketing in Hong Kong.

All exchanges operating before March 1, 2023 will have a 9-month transition period to apply for a VASP license from the China Securities Regulatory Commission on November 30, 2023. If the application is rejected, the applicant must notify Close its business and move out of Hong Kong within three months or before the end of the 12-month customs clearance period.

What is virtual asset service?

Institutions under jurisdiction:

It is mainly a platform for centralized virtual asset trading services (CEX)

Hong Kong-based cryptocurrency exchange

An offshore exchange aggressively marketed to the Hong Kong public

Non-jurisdictional institutions:

An institution that has been approved by the China Securities Regulatory Commission to obtain the No. 1 license (securities trading) and No. 7 license (providing automated trading services).

Stored value instruments that have been regulated by the payment system; virtual assets of games are not under the jurisdiction of the new licensing system.

Whether NFTs will be governed by the new licensing regime is unclear.

Requirements for exchanges:

The first step is to have a compliant trading platform recognized by the Hong Kong Securities Regulatory Commission. At present, there are two virtual asset trading platforms in Hong Kong that have completed the filing, such as OSL and HashKey.

The second step is to have a product. The trading platform needs to have a security token product that has been designed and can be legally promoted on the platform.

Specific requirements (basically the same as the application process for a financial license):

1. A Hong Kong registered company with a fixed place of business in Hong Kong;

2. Hong Kong VASP license applicants are required to appoint at least 2 responsible officers to oversee the operation of the VASP and ensure compliance with AML/CTF and other regulatory requirements.

3. Requirements for VASP responsible personnel:

At least one responsible officer must be the executive director of the VASP;

If the VASP has more than one executive director, they must all be appointed as responsible officers;

At least one responsible officer must be permanently stationed in Hong Kong;

There must be at least one responsible person available to oversee all operations involving virtual assets at all times.

4. For licensed representatives, approval from the SFC is required.

first level title

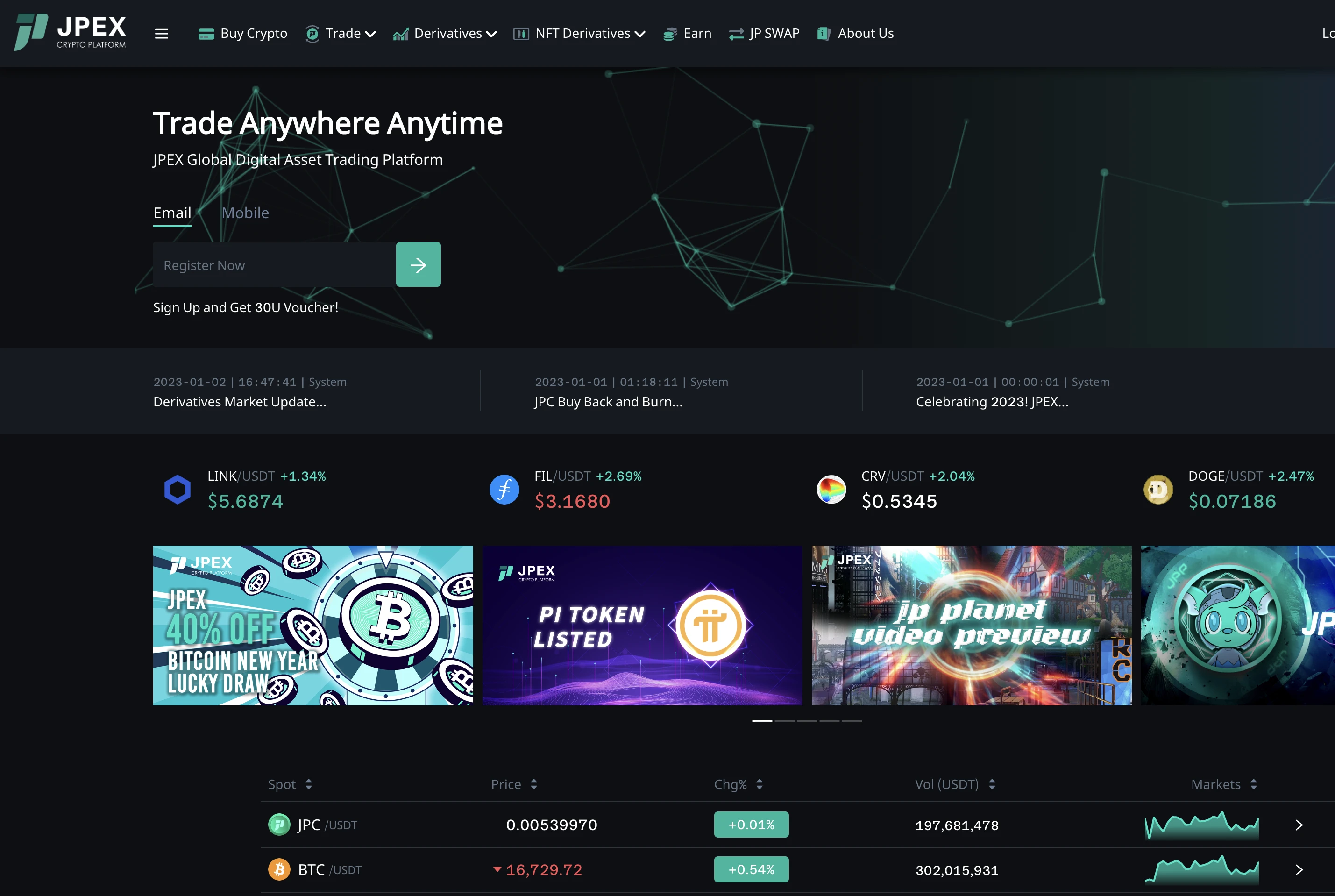

The SFC will regularly publish the list of suspicious companies in 2023

first level title

#JP-EX

CSOP Bitcoin Futures ETF Ethereum Futures ETF

CSOP is the first asset management company established overseas by a mainland Chinese fund company. It not only has strong assets and a solid background, but also has been operating in good condition.

CSOP has made arrangements for licensing in Hong Kong in advance many years ago, and has been approved by the Hong Kong Securities Regulatory Commission to hold No. 1, No. 4 and No. 9 licenses. In addition, CSOP has always had a good frontier vision and is very interested in virtual assets. In February last year when the Metaverse concept was hot, it even launched the Metaverse/Web3 concept ETF.

CSOP recently officially launched two virtual asset ETFs, CSOP Bitcoin Futures ETF and CSOP Ethereum Futures ETF, which will be officially listed and traded on the Hong Kong Stock Exchange on December 16.

The virtual asset ETF launched by CSOP this time does not directly invest in virtual assets, but mainly invests in CME Group’s Bitcoin futures and Ethereum futures.This time, the two ETFs adopt an active investment strategy in order to achieve long-term capital growth.

ETF application:

As the first ETF of this type to be approved by the Hong Kong MPFA, CSOP has also made a lot of preparations for the approval. According to Hexian (Deputy Managing Director), CSOP had put forward appeals and suggestions with industry elites in the early stage, hoping to promote the passage of relevant bills and provide members of MPF schemes with more diversified investment options, so as to better grasp the Opportunities for the development of the Mainland bond market.

secondary title

1. What is a virtual asset ETF?

ETFs are divided into stock ETFs, bond ETFs, cross-border ETFs, commodity ETFs, and exchange-traded money funds according to the type of investment underlying assets or operating modes. andVirtual currency ETF is a special ETF with a specific virtual currency as the investment target, so far it is still a traditional and new thing:The traditional thing is that the essence of virtual currency ETF is still a fund;What is new is that it operates with virtual currency as an investment target.

Regarding the relevant regulations on operating Bitcoin ETFs, the Hong Kong Securities Regulatory Commission has already explained to the outside world in 2017.Certified by the Hong Kong Securities Regulatory CommissionBitcoin futures have"futures contract"The traditional features of Bitcoin futures, even though the underlying assets of Bitcoin futures are not regulated by the Securities and Futures Ordinance,But Bitcoin futures are still considered a futures contract.

in addition,

in addition,License No. 1 (securities trading) is required to promote funds investing in Bitcoin futures, License No. 9 is required to manage the fund (providing asset management), and License No. 5 is required to provide advice services on Bitcoin futuressecondary title

2. How to operate virtual currency ETF in Hong Kong in compliance?

(Analysis of its background information and licensed status)

(1) Regarding license issues

According to the above-mentioned Circular issued by the Hong Kong Securities Regulatory Commission, operating virtual asset ETFs in Hong Kong needs to hold a No. 2 license.The reason why CSOP was able to land first without No. 2 license is that the virtual asset ETF launched by CSOP does not directly invest in virtual assets"futures contract", but by investing in the Bitcoin futures and Ethereum futures of the Chicago Mercantile Exchange.

In this way, from the perspective of investment structure, the Bitcoin Ethereum ETF issued by CSOP is already a third-tier financial product, which can be realized with the license No. 149. In other words, CSOP’s ETF is just a fund product, and CSOP Yings business actually belongs to"and"and"manage” the fund". In this way, on the basis of holding No. 1 and No. 9 licenses, it can be allowed by the Hong Kong Securities Regulatory Commission to open ETFs. And if you want to operate a futures contract that directly invests in virtual assets, you cannot escape the application for the No. 2 license (futures contract).

(2) Requirements for professional investors

Currently, the entry threshold for investing in this virtual asset ETF is 7.8 million Hong Kong dollars. Compared with the Hong Kong Securities Regulatory Commissions requirement to invest in virtual asset financial products"Professional Investor Standards"(8 million Hong Kong dollars for individuals and 40 million Hong Kong dollars for institutions) are not in the same order of magnitude at all. Is this the Hong Kong Securities Regulatory Commissions liberalization of investor access thresholds? the answer is negative.

Hong Kongs financial regulators always do the most conservative things in the most cutting-edge fields. For financial stability considerations, financial products involving virtual assets"professional investor"The threshold may be slowly lowered in a short period of time, but it is absolutely impossible to let go directly. As for the Bitcoin Ethereum ETF issued by a British company in the south, as mentioned earlier, the two are actually a fund that does not directly invest in virtual assets, so there is no need to be subject to"professional investor"Rules bound.If futures contracts that directly invest in virtual assets appear in the future, investors still need to meet the corresponding threshold.

(3) Can mainland investors purchase virtual asset ETFs?

no.

CSOP clearly stated in the announcement: legal persons or natural persons in Mainland China are not allowed to directly or indirectly purchase CSOP’s virtual asset-related products without obtaining all necessary government approvals in Mainland China in advance. The announcement also stated that the financial products sold in Hong Kong are only open to Hong Kong residents, and mainland Chinese citizens who want to buy such financial products can only choose to buy them abroad.

The approval of the issuance of two virtual asset ETFs in Hong Kong is a milestone event in the field of virtual assets. It not only promotes the concept of virtual assets, but also marks the future development of virtual assets and related financial products in Hong Kong. space.about Us

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToros global investment. The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst Young, KPMG, HNA Group , Bank of America and other well-known international companies.