Original Author: Mo Ke

first level title

Current state of the NFT market

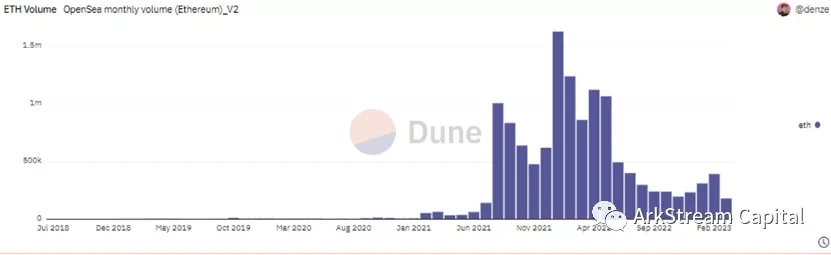

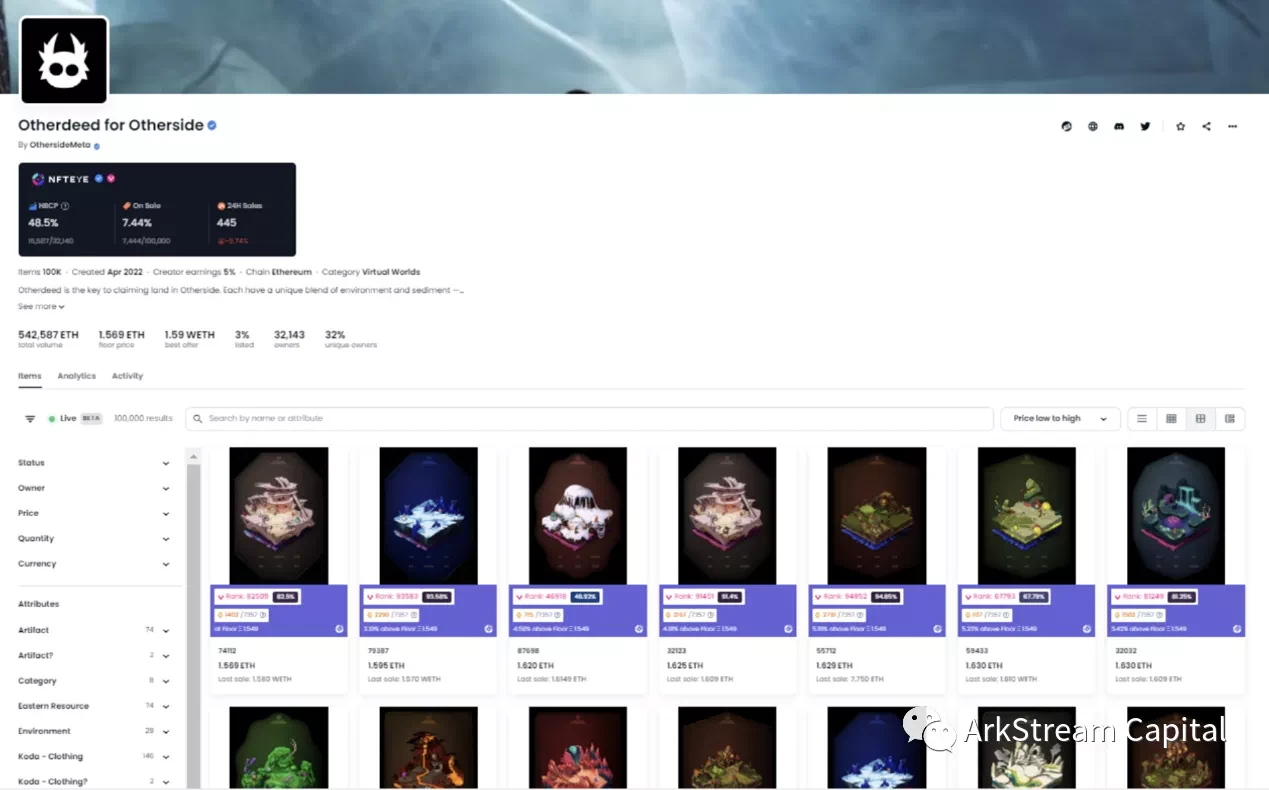

image description

OpenSea monthly transaction volume (dune)

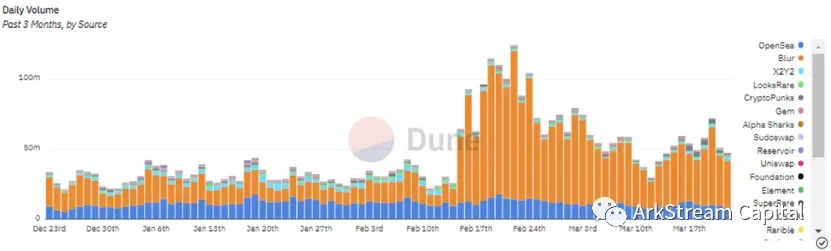

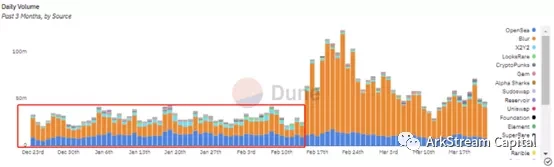

image description

NFT Marketplace daily trading volume (dune)

From the transaction data of NFT Marketplace, we can clearly draw several conclusions.

1. The art NFT Marketplace has lagged behind the comprehensive NFT Marketplace (actually PFP).

2. Blurs trading volume has surpassed OpenSea before the 2-15 airdrop.

3. After experiencing the climax and disillusionment of the NFT market in 2022, it has returned to a benign market in the first quarter of 2023.

Arkstream has always been paying attention to NFTfi. We believe that NFT, as a proof of ownership, has its long-term existence value, and this value will not be clouded by the downturn of the entire NFT market.

first level title

secondary title

Consistency and non-consistency of NFT

As the name implies, the full name of NFT is Non-Fungible Token, which refers to non-homogeneous tokens. Compared with the simple consistency of FT (Fungible Token), NFT includes two attributes of consistency and non-consistency.

According to the current trading activity of NFT in the market, there are mainly two categories: NFT artwork and NFT PFP. As humans become more and more entangled with the internet, the PFP is a better avatar for online identities. This can explain why PFP is more important in the NFT field than NFT artwork.

NFT artwork, only non-uniformity. NFT PFP is usually composed of series, including consistency and non-consistency. NFT PFP is the Web3 expression of pop art, and the common logic behind it is repeated subjects + random variables.

Industrial repetition forms a commonality, and the commonality unites the community for consistency. The scarcity of variables artificially creates inequality and marks the level of social status. For human beings who naturally love to pursue inequality, the chain of contempt of class is the rigid need of the bottom of human nature. The author believes that consistency is prior to non-consistency in order, and only consistency can produce the value hotbed of NFT PFP, and the non-consistent social discrimination value can grow. The value of PFP is directly proportional to the energy of the community.

secondary title

NFT royalties

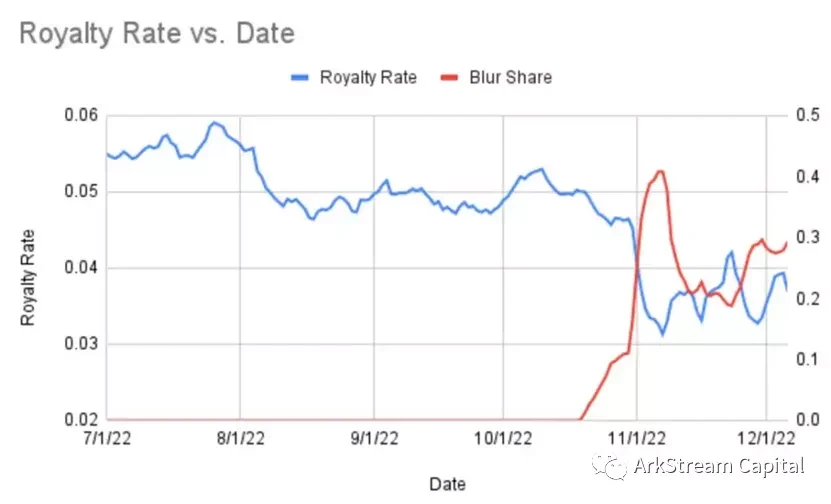

It will be clearer to interpret the royalty issue that is more noisy in the industry under the framework of consistency and non-consistency.

NFT artworks carry the artists artistic value, and its unique expression, it does not require high turnover, but rather lies in the collection value. In the life cycle of NFT artwork, it will increase in value over time. Van Gogh was unmarried and impoverished all his life, and enjoyed all the glory after his death. The high royalties of NFT can prevent this tragedy from happening again, allowing the time value of NFT artwork to be returned to the artist earlier. Therefore, high royalties are very suitable for the characteristics of NFT artworks.

In the early days, NFT PFP inherited the high royalties of NFT artwork. The author believes that such industry inertia is a big problem. As discussed above, because the consistency of PFP is prior to non-consistency, and the value of PFP relies heavily on community energy. Therefore, high circulation is more conducive to the value growth of PFP. PFP needs to capture greater community value through better liquidity and lower friction. The author originally thought that the royalties of PFP would be completed in the competition among PFPs. Unexpectedly, in the end, the fluidity war between Blur and OpenSea completed this matter by the way.

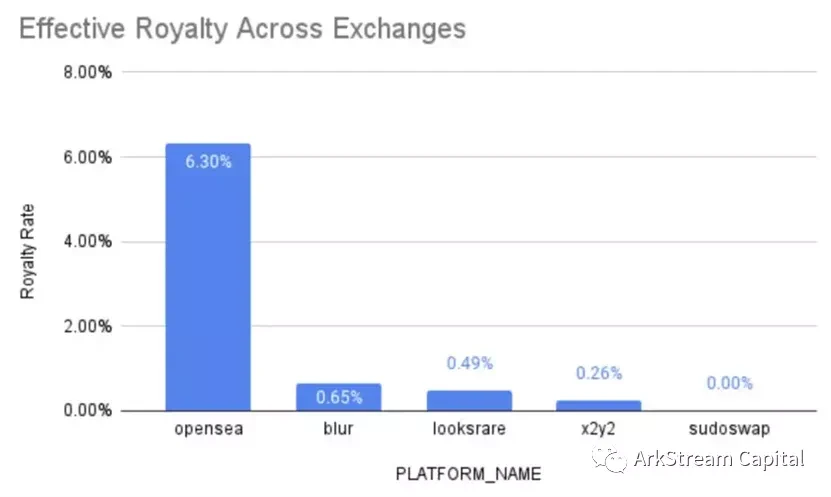

According to NFTstatistics.eth data from Proof Research Director, Blurs overall average royalty rate is only 0.65%, which has led to a decline in royalties in the overall NFT market.

Many NFT project parties have complained about this. What the author wants to say is, where do these project parties come from? They take the profits of the market bonus period for granted. Take Phantabear, a project I am more familiar with, as an example. The accumulated sales are 35,735 ETH, the royalties are 7.5%, and the accumulated royalties are 2,680 ETH. According to ETH= 1,700 $, it is equivalent to 4.5 million US dollars. These costs are not fed back to the construction of the project itself, but are divided up by the founders. Not to mention the cost of Mint. Phantabear is just one of many non-personal NFT projects.

by: Phantabear is a money-making project that the founders Mark and Will took advantage of Jay Chous reputation. In the later period, Jay Chou was willing to take over because of his personal reputation because of Phantabear. However, the two founders have been unable to reach a re-clarification of powers and responsibilities, which led to the fact that the project failed.

secondary title

NFT Marketplace Competitive Landscape

Strictly speaking, NFT Marketplace can be subdivided into three categories, CLOB Marketplace/AMM Protocol/Aggregator (aggregator).

The earliest players of Aggregator were Gem and Genie, which were acquired by OpenSea and Uniswap respectively. Rather than saying that they are Aggregators, it is better to say that they are OpenSeas batch operation tools.

Aggregator started from Genie, and after Genie opened the market, Gem entered the market with more usable and convenient products. At the same time, it is also more customer-friendly, and has better publicity and capital support. Based on the above Everything, Gem has won the initial competition of the NFT aggregation platform. However, Gem was not happy for a long time. When OpenSeas challengers gradually appeared, a stronger Aggregator Blur appeared, but Blur was more like draining its own Marketplace. An Aggregator who doesnt want to be a Marketplace is not a good Aggregator.

By: X2Y2 also has the function of Aggregator, but the aggregator of X2Y2 is not so much an aggregator, it is better to say that it provides a batch transaction function of LooksRare and OpenSea by the way.

secondary title

Trading Experience and Liquidity War

image description

image description

OpenSea trading interface

Blurs excellent trading experience is why Blur was able to gather some early users. It is also the reason why so many Aridrop Hunters are willing to invest resources and time on Blur before issuing tokens.

But for the discussion of COLB Marketplace, the author wants to focus this topic on liquidity. As a market, the greatest value lies in providing the best liquidity to users. In the LP scheme first designed by Uni on DeFi, and the 0-slippage betting and GLP design of GMX, which suddenly emerged on Arbitrum, all efforts were made to exert force on liquidity.

As the earliest NFT Marketplace, OpenSea provides an Offer buy order function in addition to the List NFT sell order. However, the convenience and batch performance of Offer’s buy order function are not very good, which limits the liquidity of buy orders. When the author holds a large number of single-series NFTs, shipping is a headache. The author once wondered whether OpenSea did it deliberately in order to maintain the price performance of the overall NFT market. Because of the better order book functionality, it should not be that hard in theory.

When LooksRare was launched, we discussed its token economic model. It started with the logic of transaction mining. The history of transaction mining can be traced back to 2018. It was not until after the DeFi craze that liquidity mining was generally adopted in the market.

In the observation of the liquidity mining launched by Compound in 2020, we analyzed its differences from the 2019 Dapp frenzy and the earlier transaction mining of Fcoin and Longbi.com.

The problem with transaction mining is that it will generate idling. No matter how you do trading wash, it will generate garbage transactions for token incentives. These junk transactions do not generate retained value and are not conducive to the growth of liquidity. For players who do not have enough technology to mine at low cost and can only take the initiative to mine, their transactions are instantaneous and there is no inertia. When the token incentive starts to be halved, the liquidity will also increase followed by rapid attenuation. This means high cost and low efficiency of mining subsidies.

The advantage of liquidity mining is that, first, it provides real liquidity, and LP bears the risk. Second, it is lazy. Most LPs do not switch their LPs frequently. In DeFi, we even see that some dead projects have hundreds of thousands of U of Farm funds left. And in addition to mining rewards, LP also has dividends for transaction fees. This increases their retention even more.

In Arkstream’s token economics thinking, we believe that a good token economic design must satisfy:

1. The project party is deeply aware that token incentives are a kind of debt behavior, and carefully designs and discharges them.

2. Token incentives must motivate behaviors that positively promote the long-term value of the agreement.

3. Token incentives must be applied to protocols with network effects.

The above three are indispensable.

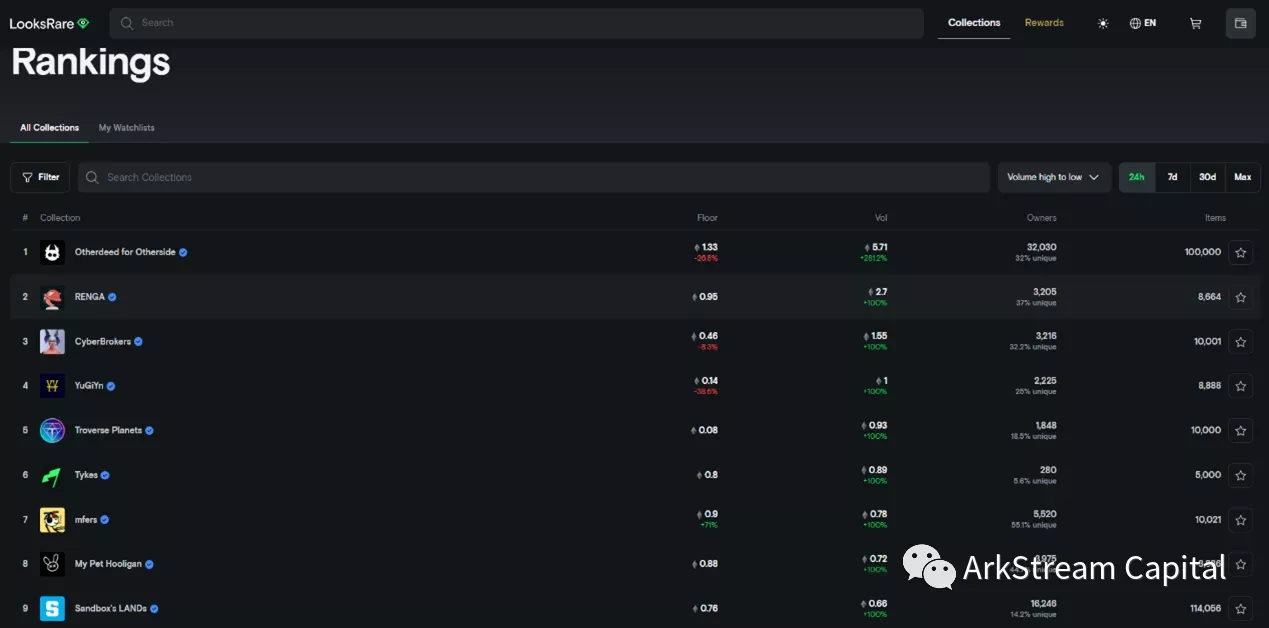

image description

image description

LooksRare Trading Volume Ranking (LooksRare official website)

image description

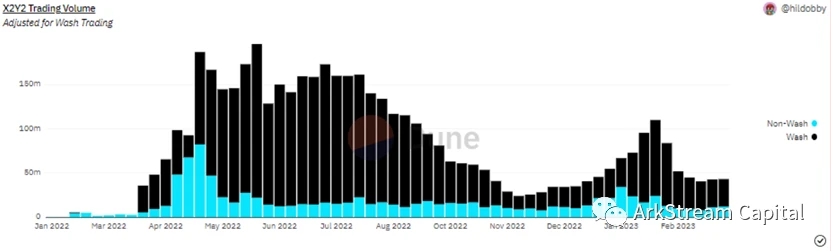

X2Y2 wash trading(dune)

Liquidity is two-way, and for the NFT market, the biggest problem is not the lack of seller List, but when you want to ship, there are not enough counterparties to undertake the selling pressure of NFT. Therefore, in terms of liquidity, Blur thinks more than LooksRare and X2Y2.

image description

NFT Marketplace daily trading volume (dune)

Before the official release of $BLUR, such a two-way liquidity scheme has already had a huge positive stimulus on Blurs trading volume. This is clearly a successful airdrop scheme.

first level title

text

But Blurs liquidity solution, I think it is still not the best solution. Compared with Uniswaps LP liquidity design, Blurs BID appears to be inert enough.

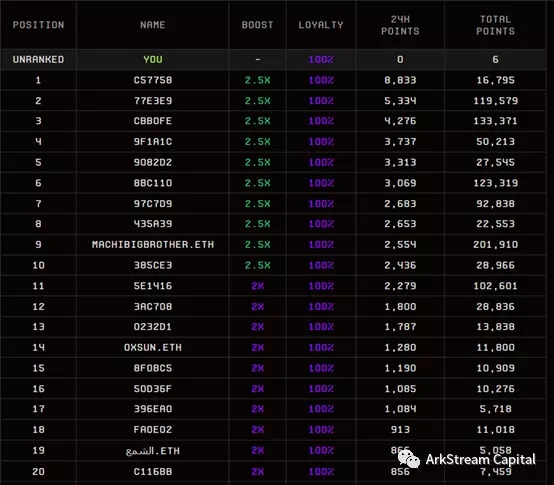

image description

Blur BID Points Ranking

image description

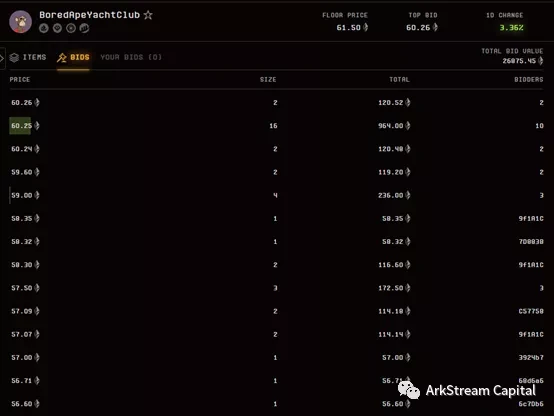

image description

MAYC BID Wall

BAYC is afraid of MACHIs smashing because of its strong position in MACHI, and has no big funds to BID 1/2/3 files.

And the 2/3 file of MAYC has a lot of funds in BID. These obvious buy walls are all for BID points. Apart from these obvious buy walls, there are not many real liquid market makers.

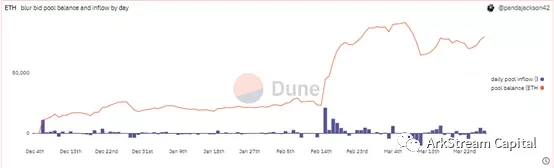

image description

Blur BID pool balance (dune)

And because Blur is now a 0-fee mechanism, apart from the token incentive itself, it cannot provide incentives to LPs through handling fees like Uni. A benign system, when the token incentive itself is removed, can still have incentives for LP Provider to provide liquidity. When $BLUR was launched on Uniswap, there were a lot of players who were willing to go in to do LP. In order to earn LP transaction fees, some friends entered first, and the transaction fee on the same day was dug back to 50% of the cost.

first level title

text

text

text

If there is no BID competitor, the project team may be content with swiping Blur points, but once retail investors or robots also participate in BID, after accumulating enough BID depth, they will immediately withdraw their Bid, and then The NFT in hand is sold to these bidding retail investors and robots.

In this carnival, NFT project parties and whales obtained valuable liquidity, while liquidity market makers obtained precious $BLUR.

Therefore, the author believes that Blur’s token economy needs to be upgraded to increase the cost of these arbitrageurs. Arbitrageurs are an injury to the system.

text

future outlook

text

text

image description

Tensor trading interface

Tensor includes Tensor Trade (Aggregator) and Tensor Swap (AMM’s Protocol). In terms of user experience, its direction is similar to that of Blur, and it is committed to providing richer information (NFT floor price K-line) and additional transactions. Experience (richer order functions) to users.

first level title

Blur and OpenSeas Cliff Racing

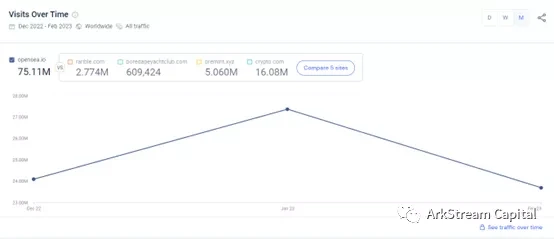

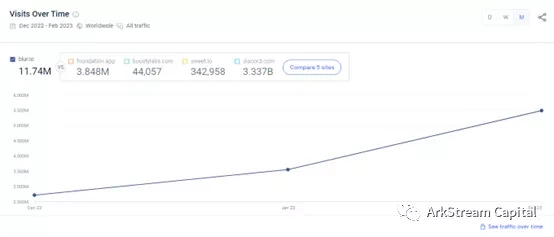

image description

image description

Blurs traffic in the last 3 months (Similarweb)

From the perspective of traffic, OpenSea has been hit hard because of Blur’s currency issuance.

On the other hand, Blurs pressure is not small. After the layoffs in 22 years, the number of OpenSea employees was disclosed by the media to be about 230. The last round of funding was 300 million US dollars, and the blood bar is still relatively thick. Blur has disclosed a financing amount of 14 million US dollars. Although the cost is less, there are fewer bullets. No matter in law (SEC supervision) or in the market, Blur with 0 handling fee has no way to increase its own income by charging handling fees, nor can it give any empowerment to $BLUR. It can be said that Blur and OpenSea are both Pulled into the cliff traffic jam, and played a game where death is the end.

first level title

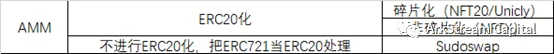

text

In the direction of AMM, there are not only Sudoswap, but also the early NFT 20/Unicly, but the early solutions usually have additional fragmentation, or ERC 20.

This process does not help the liquidity of NFT itself much. The author thinks that Sudoswap’s approach is relatively back to basics.

Standard AMMs can only handle the consistency of NFTs. Sudoswaps approach to dealing with inconsistency is to use the multi-Pool model to allow users and the market to adjust themselves to match different rarity levels into Pools at different pricing levels. Then integrate it through the front end. This design has a certain ingenuity, but in practice, this layering is not enough to deal with the complex rarity problem, and in fact it does not solve the problem.

The author had high hopes for Sudoswap in the early days, and paid special attention to the Sudoswap airdrop process. In the face of the powerful competitor OpenSea, the competitive format of the entire NFTfi is not like DeFi back then. A large part of Uniswaps growth is due to the bear market in 2018-2019, which gave it time to accumulate its users.

And dont wait for Sudoswap, not incentivizing is equal to death. To some extent, Web3 is an enhanced version of Web2, especially on the Matthew Effect. Web3 comes with a turbocharged version of the Matthew Effect. Those who have been paying attention to DeFi for a long time will find that from 2022 to the present, the DEX on the ETH chain, the capture ability of long-tail tokens is basically on the Uni side. Except for 1inch and curve, which have their own positioning, other DEXs, whether they are Both the market value and trading volume have been greatly squeezed.

image description

Sudoswap data kanban (dune)

In direct contrast to Blur, Sudoswap’s airdrop killed it. After the airdrop, there is no coherent token incentive plan to provide liquidity support for its own AMM.

Summarize

Summarize

Although Blur still has a lot of flaws, and the price of $BLUR has been sluggish since its launch, and the community is also criticizing $BLUR’s empowerment, the author believes that Blur is committed to improving the liquidity of the NFT market, making it possible to At the time node, it stands in a very important ecological niche. Based on sufficient liquidity, there will be a second chapter of NFTfi. Just like the T 1 DeFi based on Uniswap and AAVe, there will be room for the growth of T 2 DeFi such as YFI and 1inch.

The cliff traffic jam between Blur and OpenSea is only the first chapter of the prologue of this infinite war of NFTfi, let us keep a close eye on NFTfi.