, compiled by Odaily Xiaofei@whaleswoosh, compiled by Odaily Xiaofei

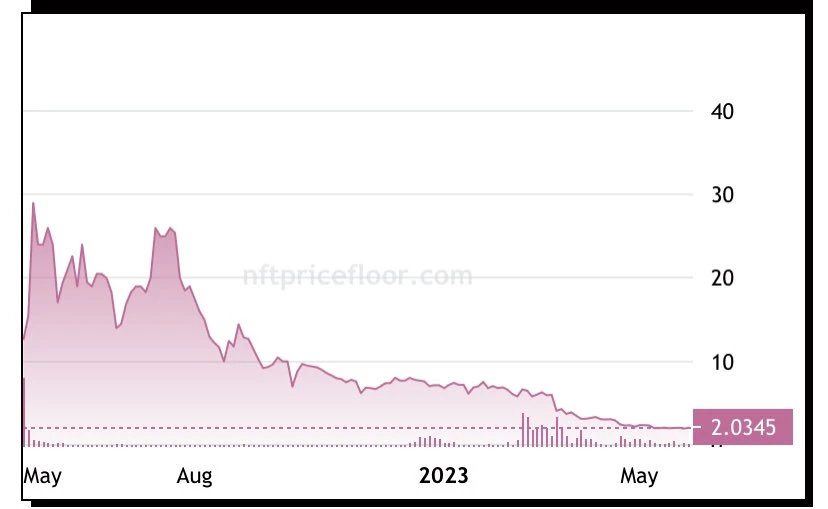

This article focuses on how Moonbirds reduced from the highly anticipated next BAYC to the NFT project in Web3 that has been heavily hyped and its price has repeatedly bottomed out. (Odaily Note: According to Blur data, the floor price of Moonbirds as of press time is 2.05 ETH)

Recently, because Kevin made some controversial remarks on Twitter Space (Odaily Note: When Kevin talked about BAYC, he said that if it is denominated in USD, BAYC’s drop from the high point is even greater, and Moonbirds should not be blamed only. comments caused dissatisfaction in the community), Moonbirds and its co-founder Kevin Rose have once again become the focus of the NFT market, I think this is a good opportunity to look back, how Moonbirds and its parent company PROOF fell into this situation of everyone screams What about?

The start of Moonbirds is very promising. Tens of thousands of people have signed up for their pre-sale. The sale price is 2.5 ETH. Its founder, Kevin Rose, is even known as the NFT leader. In the following days and weeks, the base price soared to 40 ETH (valued at about $120,000 at the time), and since then, the floor has fallen by more than 95%. The decline was larger than any other blue-chip NFT project in the same period.

In my opinion, there are six main reasons for this:

1. Ryan Carson is the former COO of PROOF, he left the project a few days after the pre-sale, which is not accepted by people. His performance damaged PROOFs reputation. (Odaily Note: Ryan Carson launched the NFT fund 121 G before announcing his resignation. After being criticized by the community, he announced his resignation, and was again criticized for using his position to buy rare Moonbirds. Although he later clarified that he bought it after the public sale, it was still questioned by the community. this february,His new project Flux has been questioned by many investors about transparency.)

2. Moonbirds proposed the concept of soft staking, which is a wonderful idea, but the nesting rewards did not meet expectations, and the prizes (socks, purses, etc.) did not meet expectations.

3. Moonbirds initially adopted a holder license system similar to BAYC (simply speaking, the rights belong to the holder), but in August 2022, the team decided to switch to CC 0 (Creative Commons, Open License, Mfers is also such ), the incident happened suddenly without prior consultation, and the holders felt betrayed.

4. Earlier this year, PROOF abruptly canceled the highly anticipated PROOF conference, followed by the abandonment of the metaverse planning Highrise and Moonbirds tokens. So back-and-forth that, in the public eye, its vision for the project has disappeared.

5. PROOF puts nearly 50% of its total reserves in bankrupt Silicon Valley banks. While the funds are currently safe, it raises questions about financial responsibility, such as poor communication and risk management.

6. Overall, the key issue may be the large gap between expectations and reality. The starting point of Moonbirds is too high, the narrative is too full, and the continuous operational mistakes and insufficient understanding of the dynamics of the NFT market make them take many wrong steps.

So, are the Moonbirds all over? I do not think so. We’ve all seen the revival of many crypto projects, and in theory Moonbirds has everything it takes, but it’s obviously not going to be easy to do it again.