From the on-chain data of FERC-20, we can see the activity curve of new concepts in the current market

Original author:@DodoResearchOriginal author:

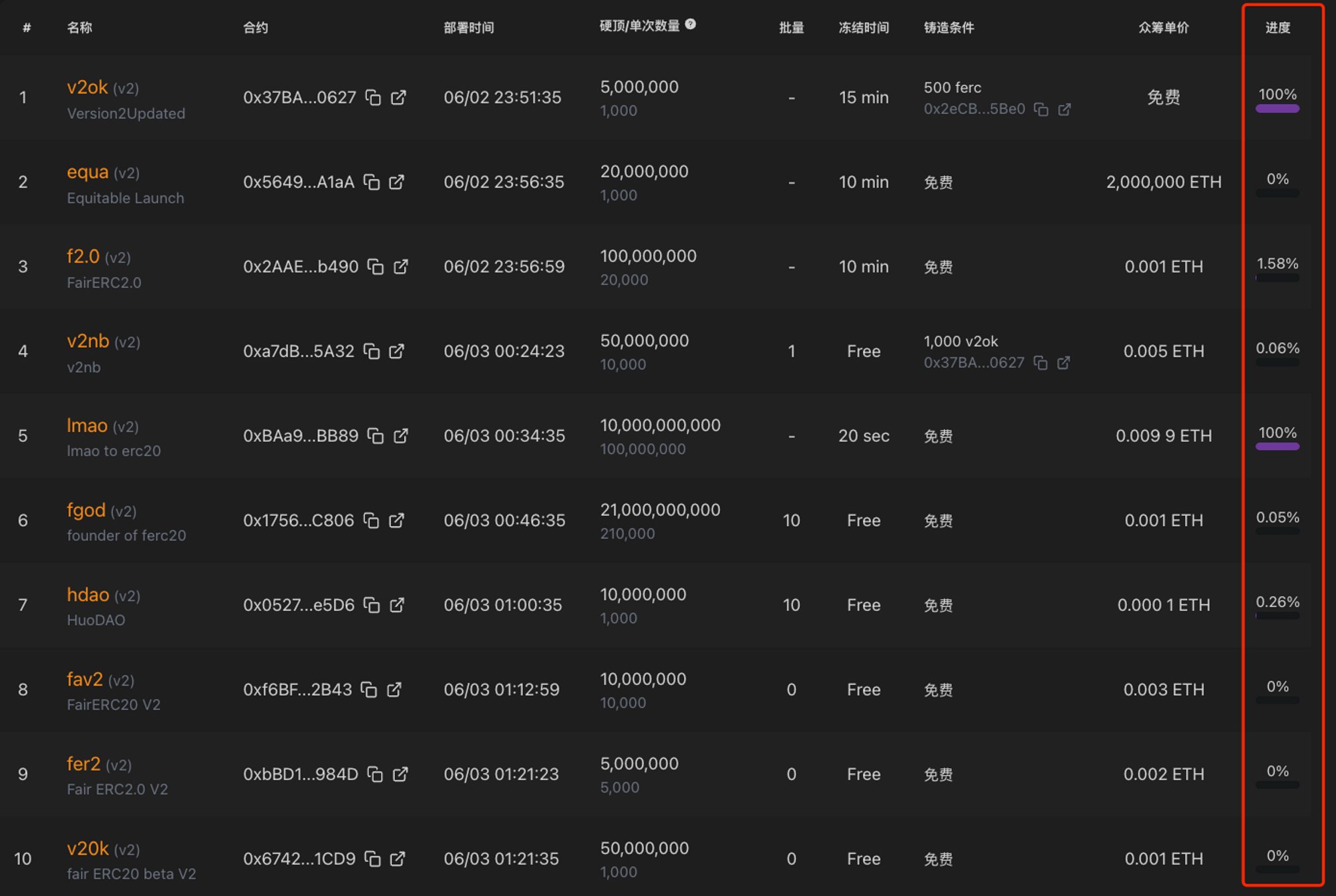

, compiled by Odaily Xiaofei FERC 20 Last week, @jackygu 2020 launched the concept of fairness on Ethereum

, trying to bring BRC-20's Fair Launch back to Ethereum, which has aroused discussion and attention in the community.

FERC 20 can be seamlessly integrated in DeFi, with features such as lock-up period and crowdfunding attributes, preventing front-end transactions and robots. This article will evaluate FERC 20 performance data since its introduction. It can be seen that in the current sluggish market situation, after the emergence of new hot spots, the activity will be greatly reduced after the short-term hype of speculative funds and the departure of profit-making addresses. Long-term development requires more practical application construction.

FERC 20 overview:

FERC 20 allows tokens to be deployed by any address using a four-letter identifier. Any address can mint FERC 20 tokens. A total of 14,939 addresses have participated in minting since May 31, making 139,551 transactions (an average of 9.3 per address).

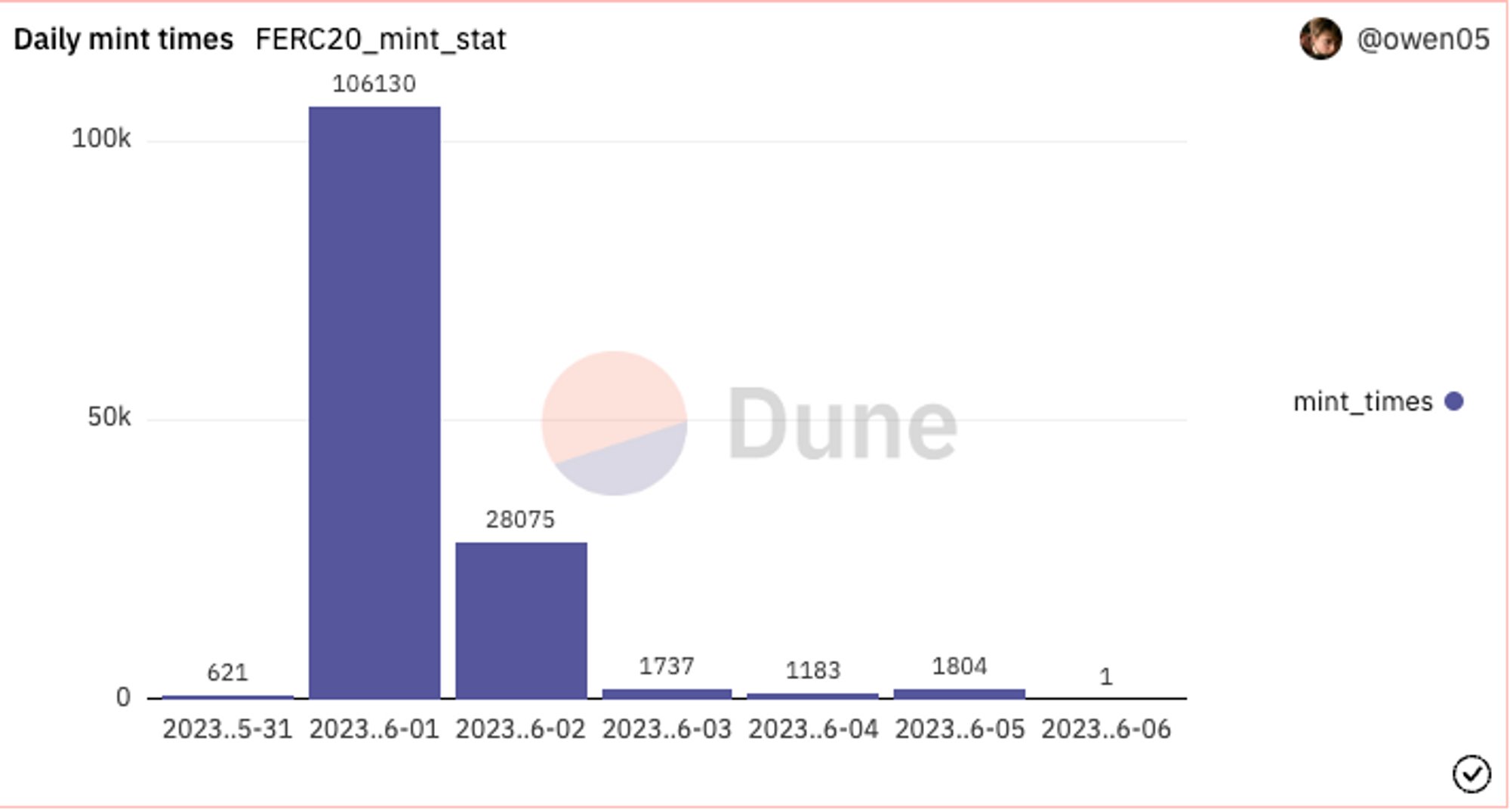

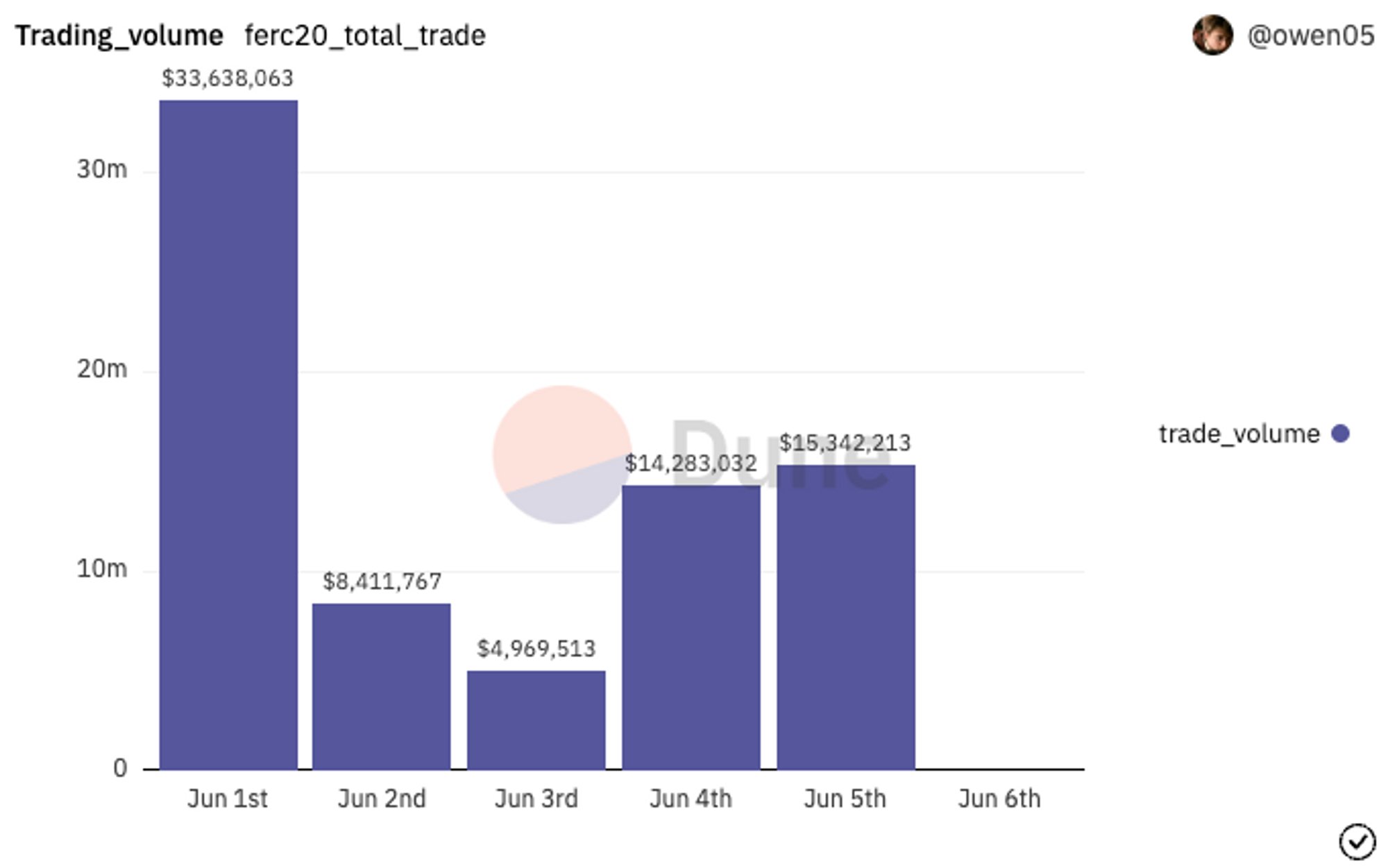

FERC 20 daily volatility data:

On June 1, a peak was observed. A total of 13,519 addresses participated, initiated 106,310 minting transactions, and minted 116 FERC 20 tokens. However, activity showed a clear downward trend.

About FERC:

The first token deployed on Fair ERC 20, $FERC, has grown 10x from $0.1 to $1.15 since June 1st.

The liquidity on Uni is close to $900,000, and the transaction is relatively active, exceeding $10 million on June 1 and June 5.

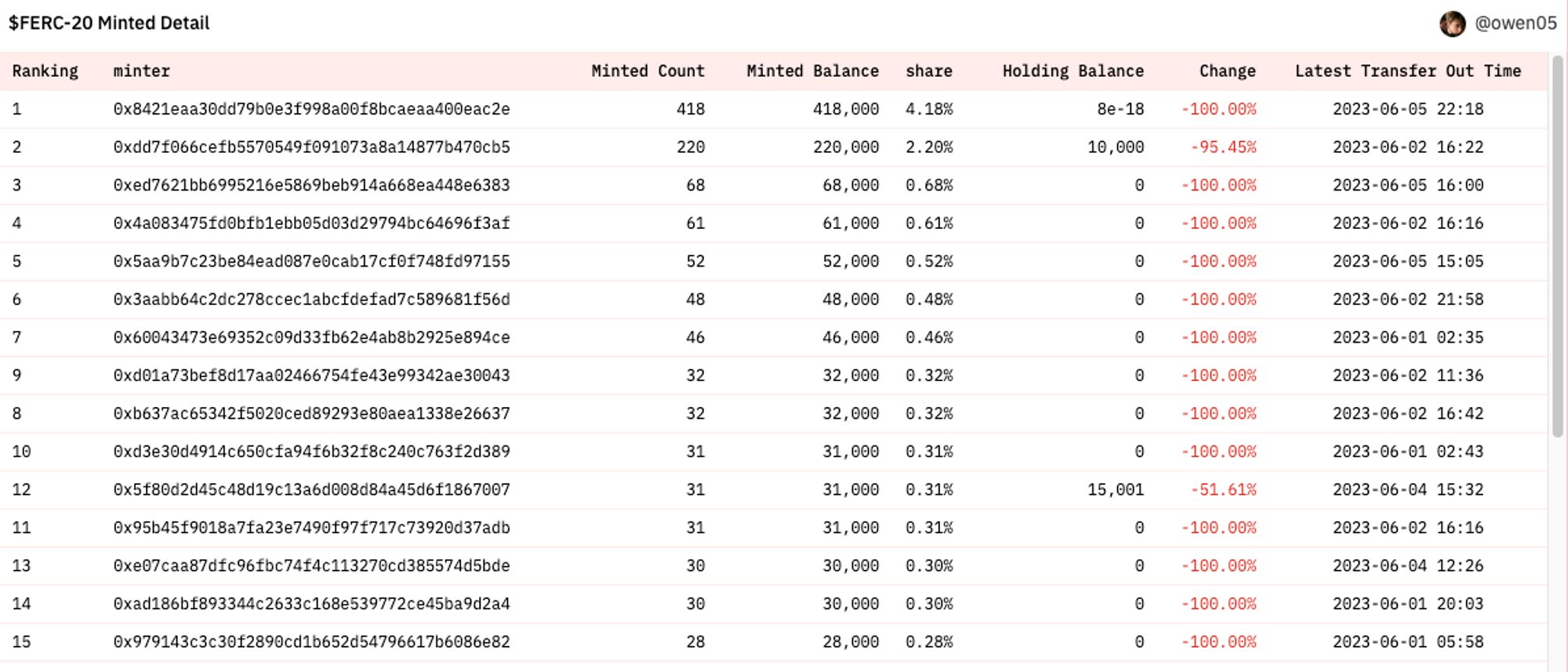

About FERC's minting:

Of the top 15 addresses holding the most minted tokens, 13 have fully sold their tokens, while the remaining two have sold 95% and 50% of their tokens, respectively.

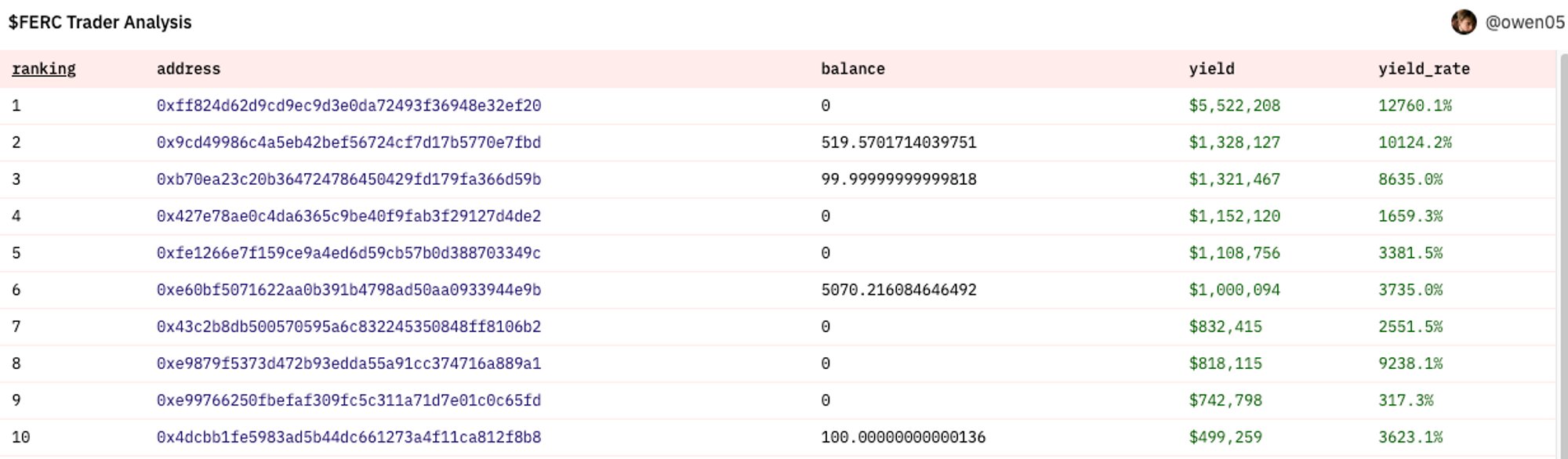

Profit address:

The top 10 profitable addresses each earned more than $500,000, with the top address earning a profit of $5.52 million.

FERC 20 Transaction Statistics:

On June 1st, total FERC 20 transaction volume reached $33.64 million, with $FERC contributing nearly half of it. But from June 2-5, $FERC dominated with nearly 80% while other tokens were relatively weak.

FERC’s transaction addresses accounted for about 70% of all FERC 20 addresses, only dropping to about 50% on June 4th.

FERC transactions accounted for about 60% of all FERC 20 transactions, but fell below 40% on June 4.

FERC transactions accounted for about 60% of all FERC 20 transactions, but fell below 40% on June 4.

Overall active limited: