Original Author: Ryan, gt, coucou

first level title

secondary title

1.1 NFTFi

Before explaining NFTFi, you need to understand two basic concepts about NFTFi

NFT (Non-Fungible Token): A digital asset based on blockchain technology, each NFT has a unique identity and value. Unlike interchangeable tokens in cryptocurrencies, NFTs represent unique assets such as digital artwork, virtual real estate, virtual items, game props, and more. The uniqueness and indivisibility of NFTs make them very popular in the field of digital collectibles and culture.

DeFi (Decentralized Finance): A financial system built using blockchain and cryptocurrency technology, designed to achieve decentralized, transparent, and trustless financial transactions. DeFi applications provide various financial services through smart contracts, such as lending, debt collateralization, trading, asset management, etc., without the intermediary of traditional financial institutions.

NFTFi, or"NFT Finance"secondary title

1.2 NFT Leasing

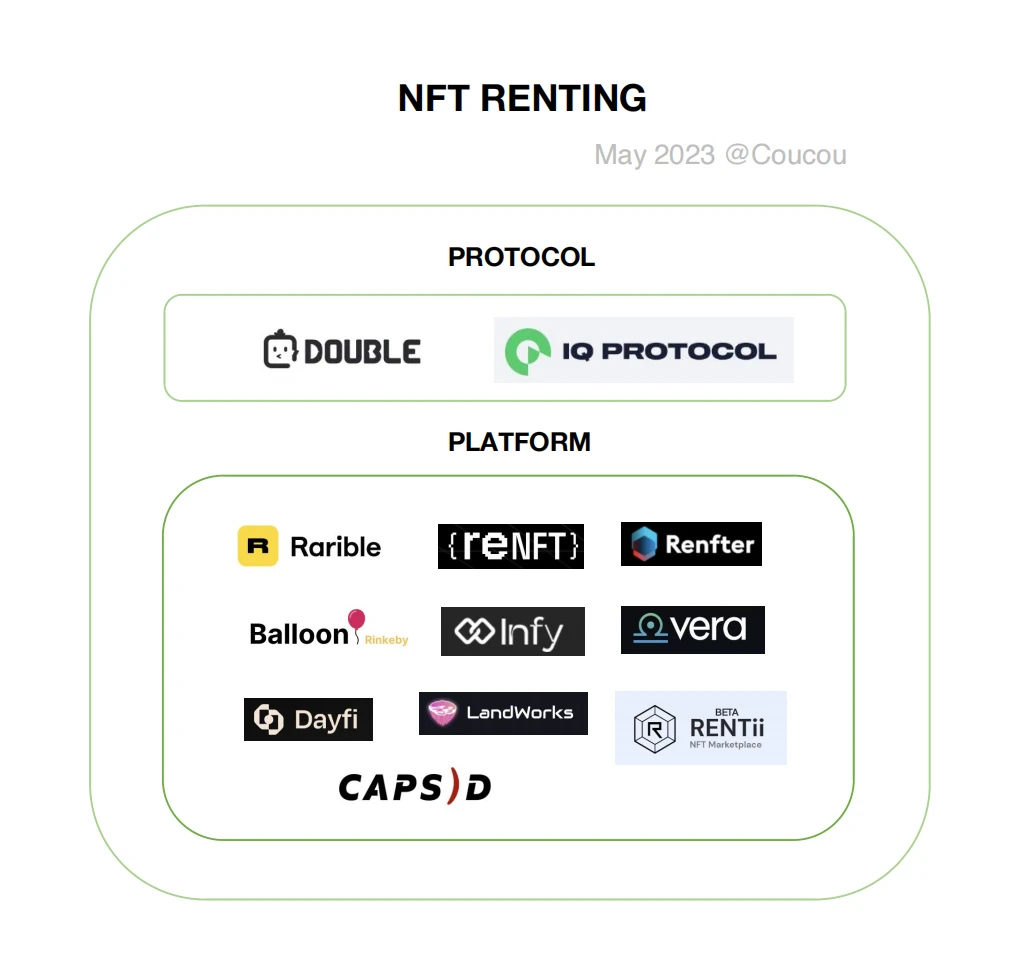

NFT leasing refers to the process of trading NFTs as leased assets. In the traditional leasing model, people can rent various items, such as cars, houses or equipment, while in NFT leasing, people can rent digital artwork, game props, virtual real estate or other types of NFT. The NFT rental track can currently be divided into two categories: protocol and platform. In terms of protocols, Double Protocol and IO Protocol are well-known NFT leasing protocols. In terms of platforms, platforms such as Rarible and reNFT are high profile.

Common NFT leasing methods:

Fixed lease period: Users lease NFT and choose a fixed lease period, such as one week, one month or longer. Users pay the corresponding rent, during which they can enjoy the rights to use NFT. Once the lease period ends, the user will lose the right to use the NFT.

On-demand lease: Choose the time to lease NFT according to your own needs, without being limited by a fixed lease period. Users may be required to pay rent by the hour, by the day, or by other units of time. This approach provides greater flexibility, allowing users to determine the length of the lease based on actual needs.

Shared leasing: Multiple users can jointly lease the same NFT, and share the use rights and rental fees according to the agreed method. This method can distribute the rental cost to multiple users, reduce the burden on a single user, and enable more people to enjoy the value of NFT.

Lease repurchase: Some NFT rental platforms provide lease repurchase options, allowing users to choose to convert the rent paid into an NFT purchase fee after the lease period ends. This method gives users the opportunity to decide whether to purchase after understanding and experiencing NFT during the lease period.

At the same time, according to whether the assets are mortgaged, they can be divided into:

Mortgage Lease NFT

Mortgage leasing is a mortgage-based NFT leasing method, which usually requires the lessor to provide a certain amount of cryptocurrency as collateral to ensure payment ability and responsibility during the lease period. The collateral can be digital assets such as ETH, BTC, or other NFTs. In this leasing method, NFT owners mortgage their NFT in the smart contract to obtain a certain amount of collateral tokens. Renters can use these tokens to lease NFT. When the lease expires or the rent is not paid on time, the collateral will be deducted a certain penalty or confiscated.

Projects that adopt mortgage leasing can better guarantee the payment ability and responsibility of the lessee, and also provide certain risk protection for NFT owners. There are already some NFT projects that mortgage leases, such as reNFT, NFTfi, etc.

Unsecured Lease NFT

Collateral-free NFT leasing allows users to rent NFTs without providing collateral and return them after the lease period ends. This model is very attractive for users who do not have enough collateral or do not want to take the risk of collateral.

The Double Protocol proposed a standard called ERC-4907, which designed a new type of NFT, the doNFT. This NFT has an expiry date and a guaranteed expiration time. This means that users can rent NFT for a certain period of time, and after the lease period ends, the NFT will be automatically returned to the original holder. This model is different from the traditional NFT ownership model, it is more like a lease agreement, which can help users save costs and risks. In addition, Double Protocol also provides an NFT wrapping method called wNFT. Instead of receiving the original NFT directly, the user receives a wrapped NFT with the same characteristics and backed by the original NFT. When the lease time expires, the wrapped NFT will be destroyed to ensure the security of the original NFT.

secondary title

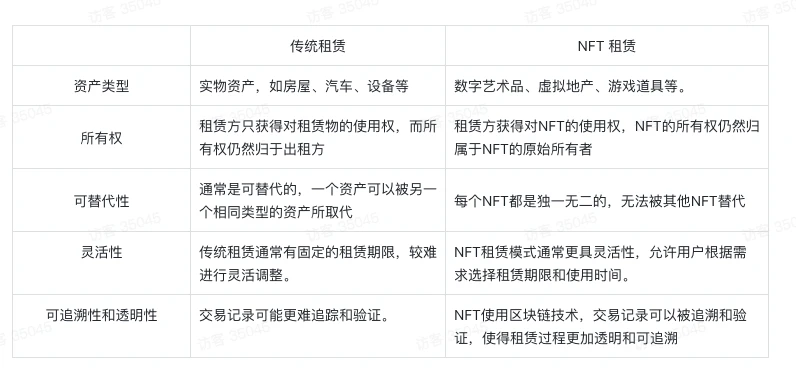

1.3 Comparison between NFT leasing mode and traditional leasing mode

first level title

2. The operating mechanism of NFT leasing

secondary title

text

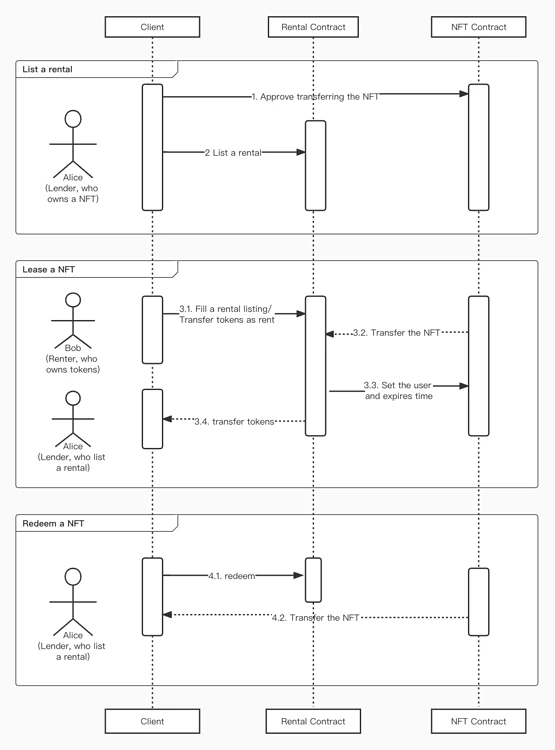

ERC-4907

In NFT leasing, the lessor usually transfers the NFT to a designated smart contract and sets conditions such as the lease term and lease fee. The lessor can obtain the right to use the NFT by paying a certain lease fee. During the period of use, he can enjoy the rights and interests brought by the NFT, such as income, voting rights, etc., and also needs to bear certain risks. People suffer losses. At the end of the lease period, the NFT will be automatically transferred back to the lessors wallet. The figure below shows an example of a leasing function.

Now suppose Alice holds an NFT, and Bob intends to lease this NFT. Then there will be 4 pieces of business logic, namely:

Alice authorizes the lease contract to transfer the NFTs she holds.

Alice lists her NFT, marking it available for rent.

Bob chooses the rental time according to his own needs. After he chooses, he transfers the rent to the lease contract. The rent is calculated based on the unit rental price and the rental time. After transferring the rent, the lease contract will transfer the NFT listed by Alice to Bob, and set the renter as Bob, and the expiration time is Bobs lease time.

After the lease expires, Alice can withdraw her NFT from the lease contract.

text

ERC-5006

secondary title

text

ERC-4907

The core of NFTs successful leasing is to separate its use right from ownership. ERC-4907 uses the dual role owner and user to divide permissions, and the role has a validity period, which means that the lessees permissions will be automatically terminated after expiration without further verification. Any on-chain operation.

The ERC-4907 protocol mainly provides three functional interfaces, namely setUser, useOf and userExpires. These three interfaces will be introduced below.

setUser mainly sets the new user and expiration time for the listed NFT. Inside the function, it is first necessary to check whether the NFT is owned by the sponsor, and if so, write the leaser information.

userOf can query the current user of an NFT. Returns an empty address if the current NFT is not leased or the lease has expired.

text

ERC-5006

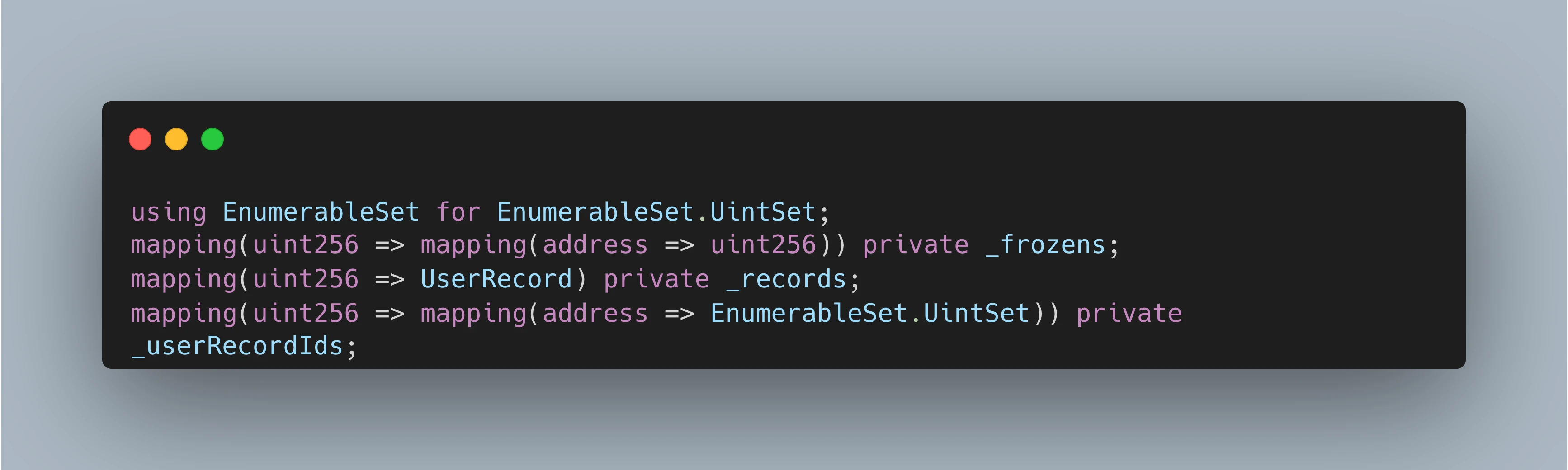

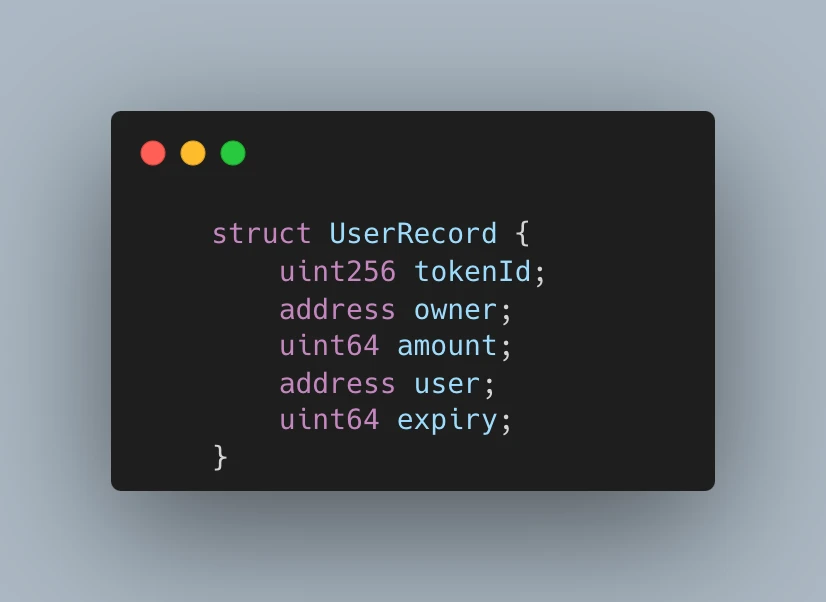

ERC-5006 is an extension of ERC-1155, which proposes an additional role - user, which defines two core variables

UserRecord defines a rental record.

_frozens defines the frozen balance of the address corresponding to the token ID after leasing.

_records defines the mapping table for recording token leasing records, and UserRecord records a token leasing record, where the dual roles owner and user are recorded for permission division.

_userRecordIds defines each token ID and a Mapping, which is the relationship between each user address and the token lease record ID of the address.

The ERC-5006 protocol mainly provides five functional interfaces, namely usableBalanceOf, frozenBalanceOf, userRecrodOf, createUserRecord and deleteUserRecord.

usableBalanceOf is used to query the available balance of a token leased by a lessee.

frozenBalanceOf is used to query the frozen balance of a token held by the leasing party.

userRecrodOf is used to query a token leasing record.

createUserRecord is used to create a token holding record.

first level title

secondary title

text

Classification of gamers

According to whether they like games and whether they hold encrypted assets as the horizontal and vertical axes, users can be divided into four quadrants:

Game enthusiasts and hold encrypted assets

Like games, enjoy the fun brought by games, and hold encrypted assets.

Game enthusiasts but do not hold crypto assets

I like games and enjoy the fun brought by games, but I do not hold encrypted assets, and there are high threshold restrictions for playing encrypted games.

Non-game enthusiasts but want to try crypto games

Not a game lover, but want to try crypto games.

Non-game enthusiasts but hold crypto assets

I am not a game lover, but I hope to make money by playing games on behalf of others.

Pain Points of Web 3 Gaming

As a traffic portal of Web 3, Web 3 games undertake the function of educating Web 2 players and guiding more Web 2 users into Web 3. However, due to the particularity of Web 3 games, there are the following challenges:

High barriers to entry continue to dissuade traditional users.

Most games adopt the method of stitching Web 2.5. Non-encrypted players play games without the blockchain version, and Web 3 players play blockchain games. There is a split in the economic system.

Therefore, there is a lack of a way to lower the barrier to entry and allow non-crypto users to experience Web 3 games in a smooth way. One way of thinking is to directly lower the threshold, such as using abstract accounts. Another way of thinking is to transfer the high threshold and let Web 3 players bear the high threshold, similar to helping to open a ChatGPT account. NFT lending is exactly the second way of thinking. It not only allows more non-encrypted players to enter the game, but also allows players with low asset holdings and even zero-dollar parties to enter the game.

Rentals in the Web 2 Games Marketplace

In fact, leasing also exists in the Web 2 game market, and the core lies in resource allocation, that is, to realize the exchange of time and money between groups with abundant time but insufficient wealth and sufficient time but abundant wealth. Here, leasing can be divided into two types according to the purpose:

Get rent:

In Web 3, there is not only rent, but also additional gold.

Spend money to get achievements and experiences in the game:

In Web 3, this is almost non-existent.

However, the advantage of Web 3 is that algorithms built through blockchain and smart contracts ensure a trustless environment. Whereas in most Web 2 games, rentals are unofficial, off-site, with plenty of scams and distrust. Although the cost of identity fraud on the chain is too low, everyone can easily create anonymous addresses, but in game scenarios, game data has become a hidden cost of fraud.

In the traditional time-poor but rich gamer, they either just pay money for a better gaming experience, or earn a fixed amount of money (i.e. entry fee, no ongoing income). But in Web 3, leasing is more of an investment. Individual investors can invest their assets more reasonably through borrowing and lending, so as to obtain continuous income.

Early exploration of NFT leasing

In the early days, many prominent GameFi projects such as Axie Infinity and StepN have seen off-market NFT lending. From this, we can also see that NFT leasing has exposed some problems in the GameFi 2.0 era:

Bring out a mature gold mining industry chain, destroy the balance of the game economic system, and accelerate the games death spiral. But in fact, even if the lease is not open, this problem cannot be avoided. In addition, most players in current GameFi games are mainly playing gold.

Leasing releases too many uncertain and uncontrollable factors, which can easily lead to difficult control of game values and accelerate collapse.

However, the advantages of leasing are also obvious. As can be seen from the player numbers of Axie and StepN, leasing is beneficial for both parties:

It lowers the threshold for users, opens up the game market, and allows more players who not only want to make money to enter the game, which is conducive to the game ecology.

Because leasing to others can make more money, it increases the willingness of large whales to invest funds.

Application Status of NFT Leasing in Web 3 Games

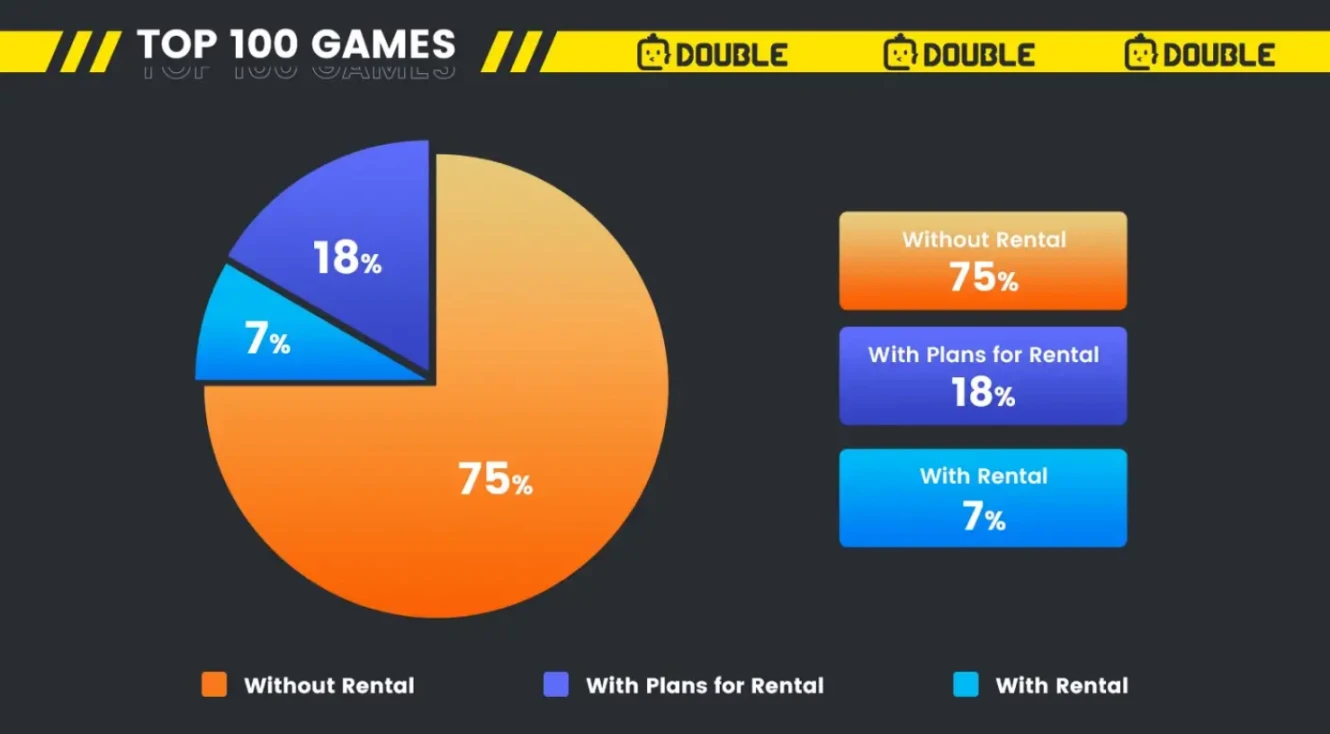

Based on the data from mymetadata.io ranking the games with the highest average daily unique active users in 30 days on June 12, 2022, we can find that the current stage of Web 3 games

7% of games have their own NFT rental marketplace/feature.

18% of games have not yet implemented NFT leasing, but have publicly expressed interest or committed to doing so in the future.

75% of games have not yet implemented NFT leasing, nor have they publicly expressed interest or made a commitment.

However, while only 7% of games have their own NFT rental market/feature, rental games represent a disproportionate 20.4% of the player base.

Special forms of NFT leasing in Web 3 games

The characteristics of the game also allow NFT leasing to give birth to new organizational forms in Web 3 games, including guild leasing and project built-in leasing systems.

The most famous example of guild leasing is YGG (Yield Guild Games), originally known for providing Axie leasing services for Axie Infinity players. This model takes the guild as the main body to purchase a large number of game assets and then rent them out to game users, but at the same time it also brings a lot of pressure to the game side. From the perspective of the game side, the guild is a tool for growth, but it also brings a potential Sword of Damocles. Therefore, if gamers can acquire new customers and find healthy and suitable users at a low cost, they will most likely not choose guilds.

secondary title

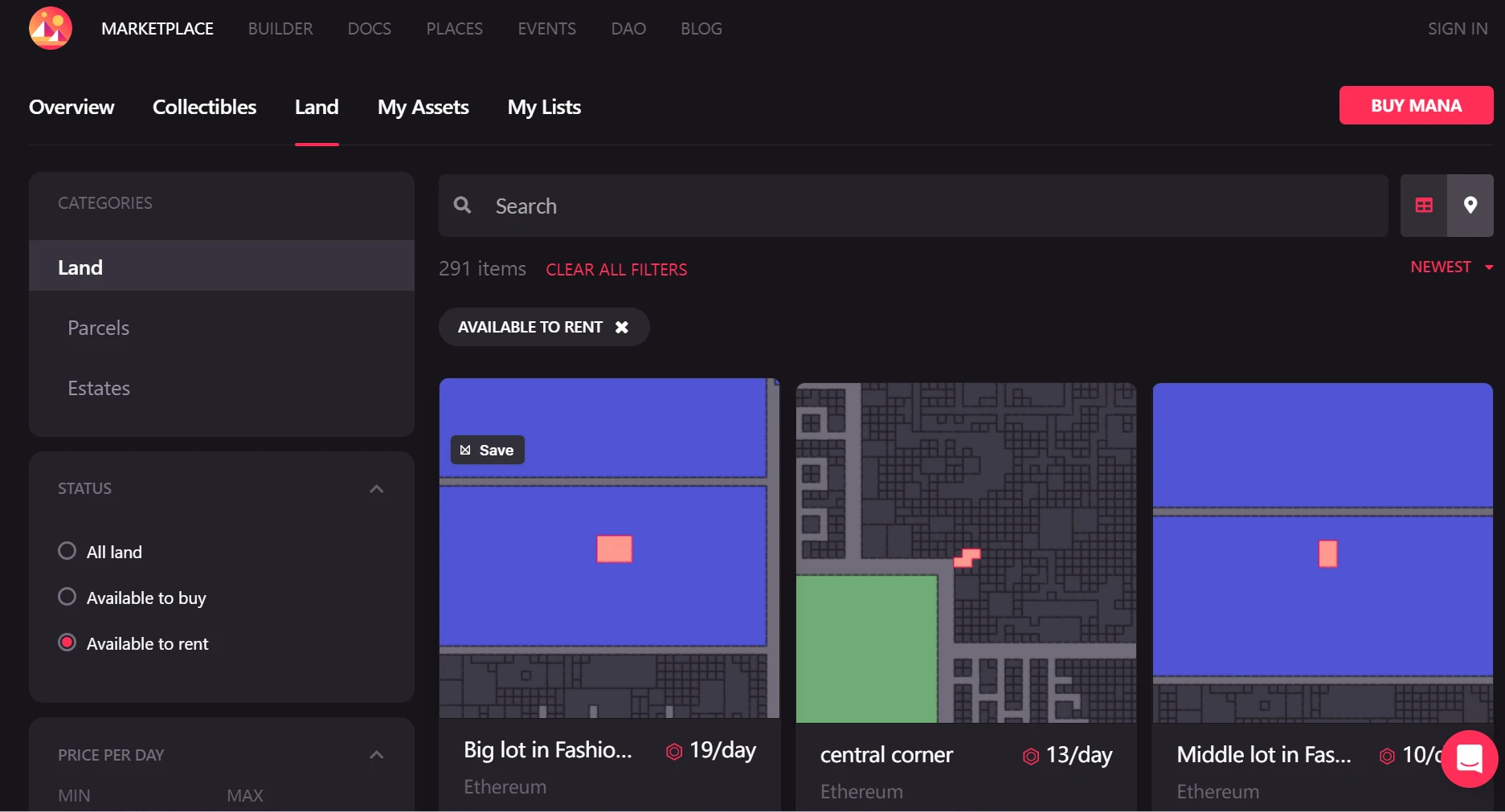

3.2 Application of NFT lease in Metaverse

text

Brief Analysis of Leasing Solutions

By utilizing ERC-4907, the Double NFT leasing protocol runs on two main smart contracts: a marketplace contract and a doNFT factory contract. The doNFT Factory smart contract adds new NFT contracts to the platform, while the Market smart contract handles all NFT rentals. The Dual NFT Leasing Protocol allows for the leasing of any ERC 721 based NFT.

When tenants pay rent for an NFT, they will receive a doNFT. A doNFT is minted by a doNFT contract created by a doNFT factory. DoNFT is ERC-721 compatible and has a duration list with a start and end time. The duration specifies that the owner of the doNFT has the right to use a certain NFT for an agreed upon period of time.

text

The Fashion Industry Enters the Metaverse

The metaverse land leasing business will shine as the fashion industry enters the metaverse. The second Metaverse Fashion Week (MVFW) organized by Decentraland will officially kick off in March 2023, and brands such as Adidas, Dolce Gabbana, Balmain, Coach and Tommy Hilfiger will all appear. Although the popularity of the metaverse has weakened after 23 years, many brands have instead increased their investment in the metaverse, trying to use new products and marketing methods to gain growth in new tracks (whether it is users or profits) ).

They acquired digital real estate, invested in virtual advertising, and hosted wearable contests and fashion shows. These include Adidas, Burberry, Dior, Dolce Gabbana, Gucci, Nike and many more. Meanwhile, a growing number of digitally native brands have sprung up, like DressX, which sells virtual wearables ranging from basic undershirts to warrior outfits made of digital metal. This, combined with the creator economy and scope of digital ownership that NFTs bring, has the potential to democratize traditionally elite industries.

secondary title

3.3 Application of NFT leasing in the community

business model

business model

The community is the basis for community equity NFT leases. A community can be a virtual community or a physical community. The lessor is the core participant of community equity NFT leasing. The renter can rent community NFT tokens through the leasing platform, and enjoy the right to use specific rights and interests of the community within a certain period of time. During the lease period, the renter can participate in community activities as an NFT holder in the community, or obtain corresponding community rewards. The leasers rent will be paid to the leasing platform, part of the rent will be used as the income of the leasing platform, and part of the rent will be distributed to the contributors or holders of the community as a community reward. In addition, the leasing platform is an intermediary platform for community equity NFT leasing. The leasing platform provides NFT leasing services for the community, and collects a certain percentage of handling fees from the rent as its own income. Leasing platforms can also promote their brands and services through NFT leasing activities.

The business model of community equity NFT leasing mainly includes the following aspects:

1. Platform charges:The rental platform charges the renter a certain handling fee or rent.

2. Community benefits:The rental platform cooperates with the community, and the platform collects a certain percentage of rent as its own income, and the remaining rent is distributed to the contributors or holders of the community.

3. Brand promotion:first level title

secondary title

4.1 Advantages of NFT leasing

Summarizing the advantages of the above three scenarios, the advantages of NFT leasing are as follows:

Lowering the threshold: NFT leasing can lower the threshold and cost, and allow more users to enter. Whether it is games, metaverses or communities, it is beneficial to the ecology, encourages more user participation, and enhances interactivity and community cohesion.

Improve asset liquidity: NFT leasing can improve asset liquidity. Make it easier for people to buy, sell, lease and invest in virtual assets.

Provide financial support: NFT leasing can increase the inflow of funds, provide financial support for the sustainable development of the project ecology, and promote its development and growth.

secondary title

4.2 Challenges and risks faced by NFT leasing

Summarizing the above three scenarios, the challenges and risks faced by NFT leasing are as follows:

Market bubble risk: Excessive speculation of NFT market prices may lead to instability and investment risks.

Legal and regulatory risks: Ownership and leasehold interests in virtual assets may involve complex legal and regulatory issues, and risks in compliance and legal protection need to be carefully considered.

Technical security risks: Transactions using NFT leases may involve technical obstacles, smart contract vulnerabilities, and network security risks.

Market demand and acceptance risk: Successful implementation of NFT leasing also requires market demand and broad acceptance.

Uncertainty of rental price: The rental price is affected by market supply and demand and other factors, and the price fluctuates greatly. It is difficult to guarantee the stability and fairness of the rental price.

first level title

5. Future development of NFT leasing

Summarizing the above three scenarios, we believe that the future development of NFT leasing will present the following three trends

In the future, NFT leasing will achieve a higher degree of automation and autonomy with the support of smart contracts and blockchain technology. In addition to technical specifications, market norms and standards will be specified to create a smoother and low-threshold user experience while ensuring that the rights and interests of all parties are protected. The future NFT leasing model will be more flexible, intelligent and diversified, and can be personalized according to the needs of participants to meet different usage scenarios and business models.

With the development of NFT in the future, there will be more and more application scenarios of NFT, including social, metaverse, games and other fields. As more rights and more scenarios emerge, NFT leasing will also benefit from these new application scenarios, with more gameplay and empowerment. At the same time, the trend of globalization will also bring more opportunities for NFT, promote the global development of NFT leasing, and attract more participants and users. In this context, NFT leasing will continue to innovate and develop, becoming an indispensable part of the future Web 3 ecosystem.

6. Summary

6. Summary

first level title

References

https://baike.baidu.com/item/%E7%A4%BE%E5%8C%BA%E6%B2%BB%E7%90%86/8480079

https://blog.chain.link/nftfi/

Interpretation of EIP-4907 protocol_jason

https://ethereum-magicians.org/t/eip4907-erc-721-user-and-expires-extension/8572/15

The second Decentraland Metaverse Fashion Week was very good, don’t do it again next time

Decentraland grantee, Double Protocol, has launched a new, custom LAND leasing system.

https://www.odaily.news/post/5184454

https://www.odaily.news/post/5182717

https://github.com/ethereum/EIPs/blob/master/EIPS/eip-5006.md