1. DeFi

1. DeFi

1. Cetus

May 2, 2023

Seed round: Undisclosed amount

Lead investors: OKX Ventures, KuCoin Ventures

Investors: Comma 3 Ventures, NGC Ventures, Animoca Ventures, IDG Capital, Leland Ventures, AC Capital, Adaverse, Coin 98 Ventures, etc.

Cetus is a DEX based on Sui and Aptos (Move series L1). It is characterized by the ability to provide liquidity within a specific range and achieve high capital efficiency.

2. Fedi

May 3, 2023

Series A: $17 million

Lead investor: Ego Death Capital

Investors: TBD (Blocks subsidiary focused on the Bitcoin Lightning Network), Kingsway, Trammell Venture Partners, Timechain

Fedi is a platform that uses Bitcoin and the Lightning Network (reducing the risk of a single point of failure) to help the community collaboratively manage assets and data. Currently Fedi has developed a wallet and plans to add chatting, web browsing and running dApps in the future.

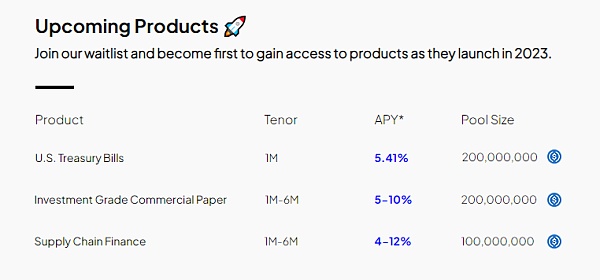

3. Opentrade

May 4, 2023

$1.5 million

Investors: Circle Ventures, Kronos Research, Kyber Ventures, Polygon Ventures, Outlier Ventures

Opentrade is an RWA protocol that allows Web3 institutions to invest in a wide range of investments on the protocol, including US Treasuries and commercial paper, by depositing stablecoins.

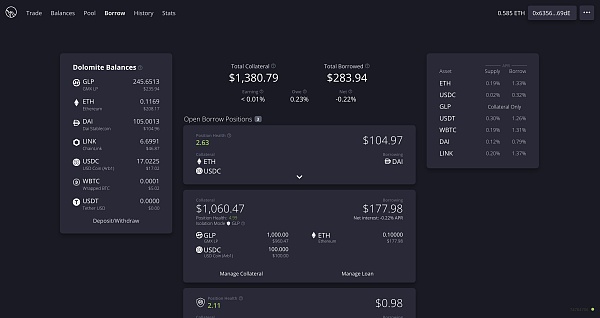

4. Dolomite

May 13, 2023

$2.5 million

Lead investor: Draper Goren Holm, NGC

Investors: Coinbase Ventures, WWVentures, 6th Man Ventures, etc.

Dolomite is an Arbitrum-based DEX that provides functions such as lending, margin trading, and spot trading.

5. Hourglass

May 17, 2023

Seed round: $4.2 million

Lead investor: Electric Capital

Investors: Circle Ventures, Tribe Capital, Coinbase Ventures, Hack VC

Hourglass is a DeFi protocol that introduces a new concept called Time-Bound Tokens (Time-Bound Tokens) to help other DeFi protocols (DEX, lending, LSDFi) guide liquidity.

Liquidity is very important in the DeFi world. However, there are many unpredictable factors, including that users can withdraw liquidity at any time. If users continue to withdraw cash and the agreement cannot dispose of assets in time, the agreement will have liquidity problems and may even go bankrupt.

To solve this problem, Hourglass provides users with an additional reward: if Alice has 10 Frax Ethereum (10 frxETH) and commits to stake it on the Frax protocol for about a month, Hourglass will issue TBT in exchange for 10 frxETH and a month expected return value. In this way, the Frax protocol guarantees liquidity of at least 10 frxETH for a month, and Alice is rewarded for doing so because she clearly defines the time frame.

At the same time, Hourglass also developed a trading market for TBT. For example, if Alice wants to sell her 10 ETH worth of TBT before the expiration date, she needs to match a buyer. Of course, buyers may not want to pay 10 ETH because they cannot transfer assets for a month, so they can submit the discounted amount they want based on opportunity cost. Alice can choose the submitted order in the background.

6. Azteco

May 18, 2023

Seed: $6 million

Lead investor: Jack Dorsey (CEO of Block)

Investors: Lightning Ventures, Hivemind Ventures, Ride Wave Ventures, Aleka Capital, Visary Capital, Gaingels, etc.

Azteco is a platform that makes it easy for the unbanked to buy Bitcoin (skip downloading a centralized exchange to buy and today), where users can buy Azteco vouchers and exchange them for BTC.

2. CeFi

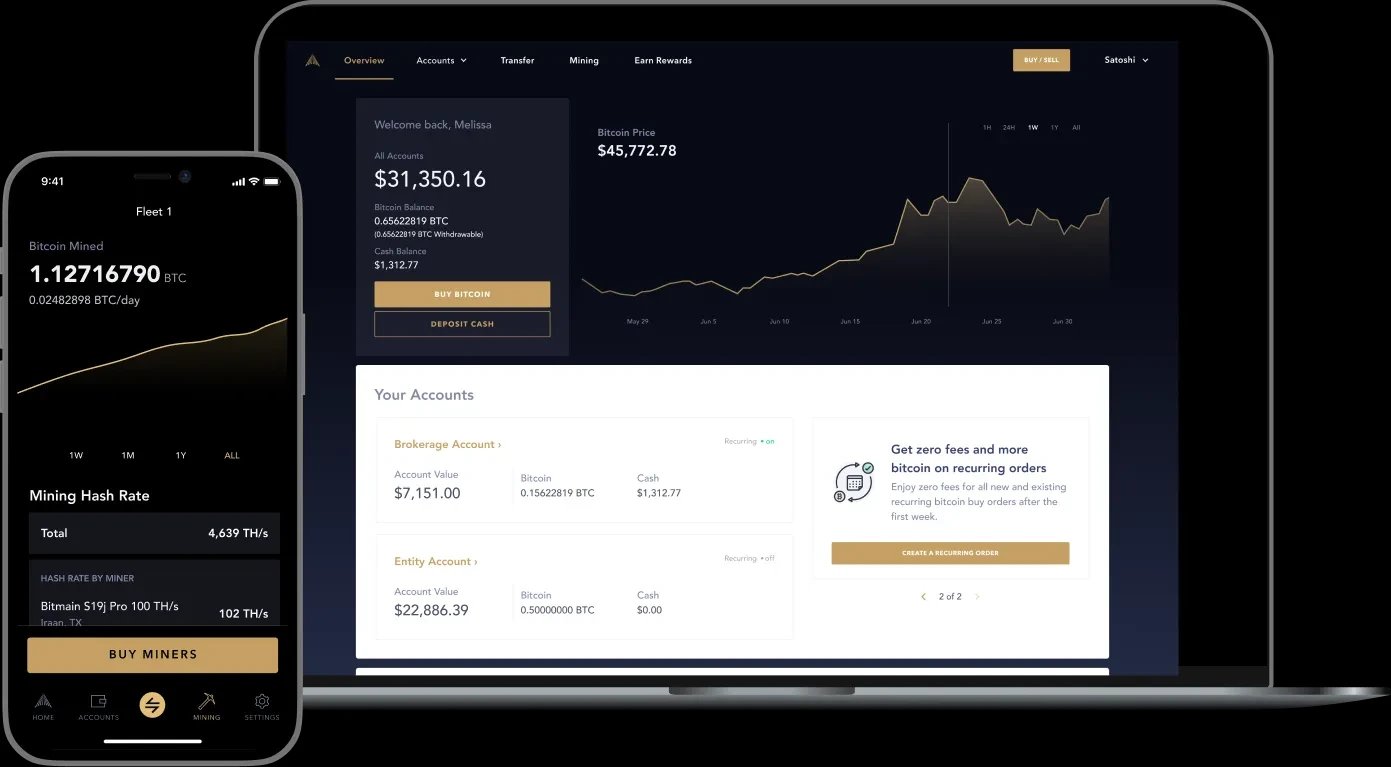

7. River Financial

May 16, 2023

Series B: $35 million

Lead investor: Kingsway Capital

Investors: Peter Thiel (PayPal Associates), Cygni, Goldcrest, Valor Equity Partners

River Financial is a centralized bitcoin-focused exchange that provides bitcoin mining machine trading, custody and mining services. Additionally, it provides an API for businesses to easily use the Lightning Network.

3. NFT/Game

8. Vibe

Seed round: $4 million

Seed round: $4 million

Investors: Alchemy, Aglaé Ventures, P Nation (record company run by Uncle Psy), etc.

Vibe is an NFT distribution platform, and its advantage is that even if you dont know how to code, you can use various functions to productize NFT, including NFT loyalty programs, creating offline events, redeeming physical goods, etc. Through Vibe, creators can interact with fans in various ways.

9. Artifact Labs

May 8, 2023

$3.25 million

Lead investor: Blue Pool Capital

Investors: Animoca Ventures

Hong Kongs South China Morning Post spun off its NFT business last year and established Artifact Labs, which aims to preserve real-world historical events on the chain (NFTize reports or objects). For example, the company NFTized artifacts from the Titanic.

It is worth mentioning that Blue Pool Capital, which manages part of the wealth of Ma Yun and Cai Chongxin, has completed 8 investments in the encryption industry, including 5 NFT projects, namely The Sandbox, Metaplex, Animoca Brands, Fast Break Labs and Artifact Labs. In addition, Bluepool Capital also invested in CeFi project FTX, L1 project Polygon, and Solana-based decentralized exchange Aver.

10. Aether Games

May 9, 2023

$4.5 million

Investors: Mysten Labs, Polygon, Magic Eden, Polkastarter, Cogitent Ventures, Ultra, GSR Ventures, Emurgo, Master Ventures, Eclipse

Aether Games is a game studio that produces various NFT games, including the collectible card game Cards of Eternity and the 3D action game Gate of Eternity.

11. Artizen

May 11, 2023

$2.2 million

Investors: Consensys Mesh, Animoca Brands, Protocol Labs, etc.

Artizen is a decentralized crowdfunding platform that allows investors to raise funds for projects related to art, science, technical design, and more.

12. Pudgy Penguins

May 10, 2023

Seed round: $9 million

Investors: 1kx, Big Brain Holdings, Kornos, Ethersole, CRIT Ventures, KuCoin, CoinGecko, Puzzle Ventures, Shima Capital, Old Fashion Research, Origin

Launched in April 2022, Pudgy Penguins featuring animated penguin characters is currently one of the popular PFP NFT projects on Ethereum. Pudgy Penguins not only issues NFTs, but also sells NFT-based physical toys.

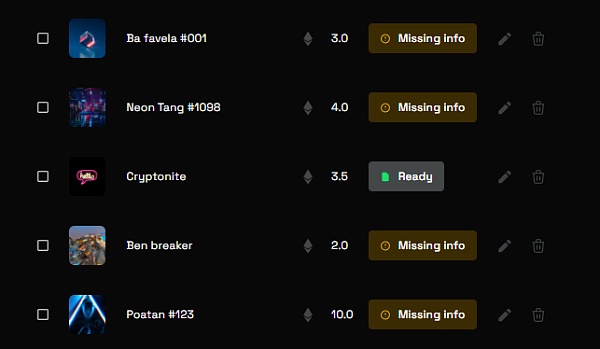

13. Izumo

May 16, 2023

Angel: $2.2 million

Investors: Hiroaki Kitano (CTO of Sony Group), Jaynti Kanani (Founder of Polygon), Kevin Lin (Co-founder of Twitch, CEO of Metatheory), Richard Ma (CEO of Quantstamp), Suji Yan ( Mask Network CEO), etc.

Izumo is a platform that helps streamers, artists, musicians, and vloggers monetize their content.

14. Tabi

May 29, 2023

Angel: $10 million

Investors: Animoca Brands, Draper Dragon, Hashkey Capital, Infinity Crypto Ventures, Youbi Capital, etc.

Tabi (formerly Treasureland) is an NFT market based on the BNB network. Its main functions include NFT transactions, Launchpad, creation of task activities, etc.

4. L1/L2

15. Nolus

May 2, 2023

Seed round: $2.5 million

Investors: Dorahacks, Everstake, Cogitent Ventures, Token Metrics Ventures, Autonomy Capital, etc.

Nolus is a Cosmos SDK-based L1 focused on lending services. Unlike other lending protocols, it is not over-collateralized, allowing users to borrow more funds relative to collateral, with less risk of liquidation. As a member of the Cosmos multi-chain ecosystem, Nolus also supports Cosmos cross-chain protocols IBC and ICA, allowing interoperability with other chains.

16. Anoma Foundation

May 31, 2023

$25 million

Lead investor: EMCC

Investors: Electric Capital, Delphi Digital, Dialectic, KR 1, Spartan, NGC, MH Ventures, Bixin Ventures, No Limit, Plassa, Perridon Ventures, Anagram, Factor, etc.

The Anoma Foundation is a Switzerland-based nonprofit that develops Anoma, a full-stack architecture that helps developers build dApps, and Namada, an intent-centric L1 that allows for private transactions, where every party in the transaction can individually choose which assets they want to send or receive).

5. Web3 service

17. Story Protocol

May 17, 2023

Seed round: $29.3 million

Lead investor: a16z

Investors: Hashed, Mirana Corp, DAO 5, Samsung Next Fund, Two Small Fish Ventures, Berggruen, SLVC

Story Protocol is a platform that allows IPs to be created and managed on-chain. No more public information, but with investment from top VCs, its worth keeping an eye on for the long haul.

18. LabDAO

May 24, 2023

$3.6 million

Lead investors: Gumi Cryptos Capital, Maven 11

Investors: North Island Ventures, Seed Club Ventures, ID Theory, Road Capital, Curve Labs, gmjp.lol, Molecule, Gnosis DAO, The LAO, Orange DAO, Beaker DAO, Spaceship DAO, Balaji Srinivasan

LabDAO is a life science research-focused DAO organization where researchers can pitch research ideas for investment or find partnerships.

19. Tools For Humanity

May 25, 2023

Series C: $115 million

Lead investor: Blockchain Capital

Investors: a16z, Bain Capital Crypto, Distributed Global

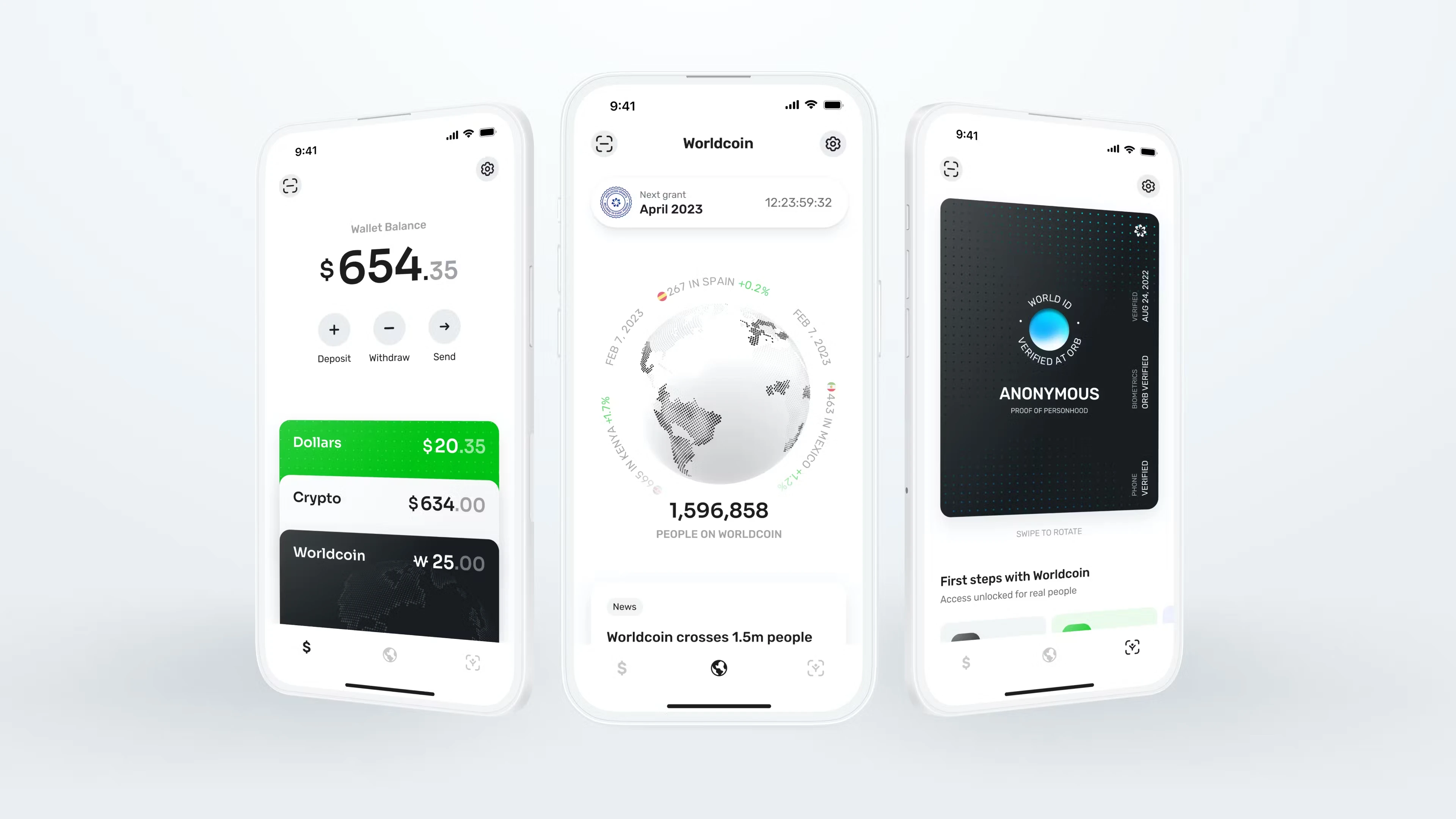

Tools For Humanity is the company behind Worldcoin, and despite the bear market in the crypto market, the project has attracted significant investment. Worldcoin uses token airdrops as a means of rewarding people around the world for authenticating human identities through an iris recognition device called an Orb and creating a digital identity, the World ID.

Worldcoin co-founder Sam Altman is also the CEO of OpenAI. He believes that artificial intelligence will make most people unemployed in the future, so UBI (universal basic income) will be crucial.

Therefore, Worldcoin aims to: verify and create peoples identities in the digital world, and provide them with a basic income.

20. Transak

May 31, 2023

Series A: $20 million

Lead investor: CE Innovation Capital

Investors: SBI Ven Capital, Sygnum, Azimut, Third Kind Venture Capital, UOB Venture Management, Signum Capital, Animoca Brands, Genting Ventures, Istari Ventures, No Limit Holdings, Woodstock Fund, IOSG Ventures, KX, Axelar, Tokentus, The Lao , and more

Transak is one of the largest Web3 payment services out there, allowing users to make fiat payments on any platform or dApp that integrates the service.Cryptocurrency” exchange function.

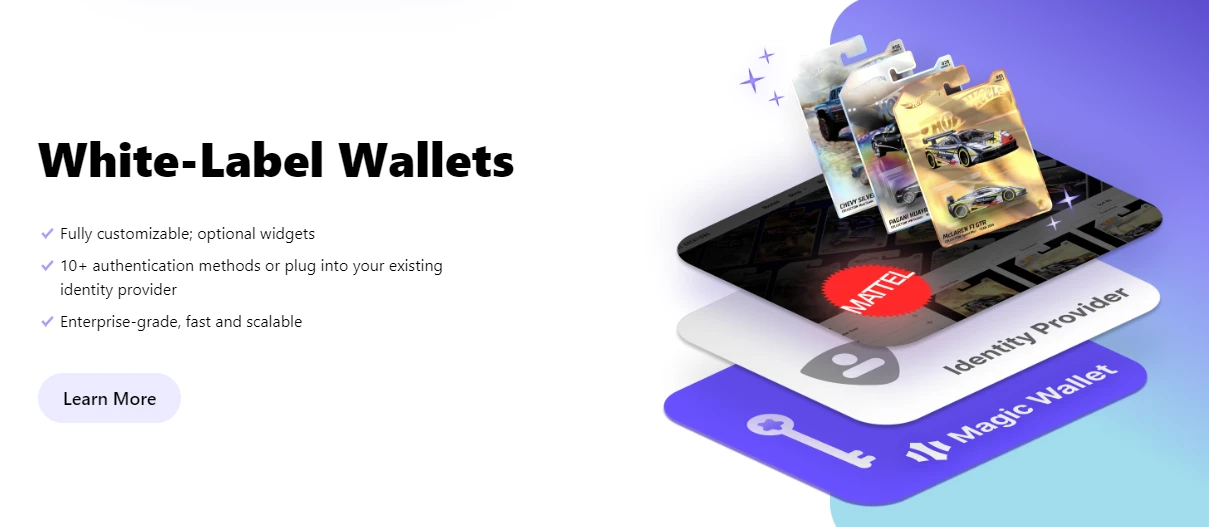

21. Magic

May 31, 2023

Strategy: $52 million

Lead investor: PayPal Ventures

Investors: Cherubic, Synchrony, KX, Northzone, Volt Capital, etc.

Magic is a wallet-as-a-service company that aims to abstract away the complexity of Web3 and provide enterprises and users with a customizable encrypted wallet as simple as Web2. To date, Magic has created over 20 million wallets and is used by over 130,000 developers.

6. Infrastructure

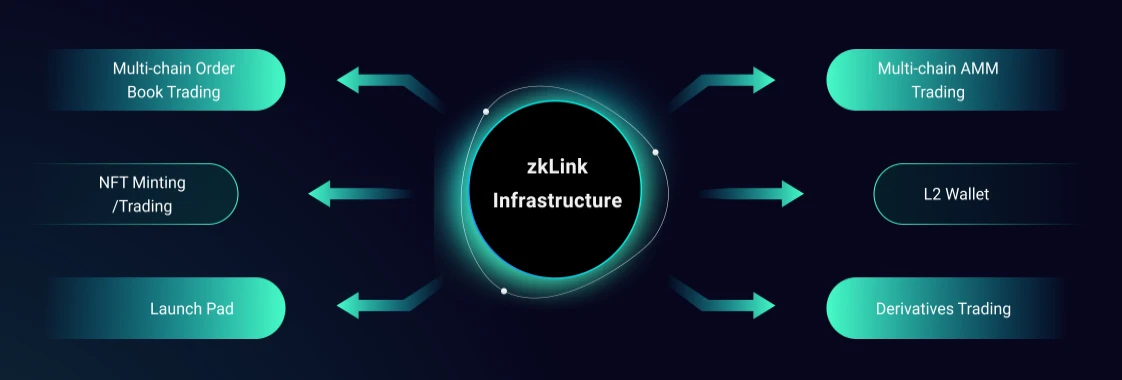

22. zkLink

May 4, 2023

Strategy: $10 million

Investors: Coinbase Ventures, Ascensive Assets, SIG DTI, BigBrain Holdings, Efficient Frontier, etc.

zkLink is a zk-SNARKs-based L2 protocol that focuses on multi-chain transactions. The currently supported networks include Ethereum, BNB Chain, Polygon, Avalanche, zkSync, Scroll, etc. In addition, developers can use its API to create a wider range of cross-chain products, including cross-chain DEX and cross-chain NFT market, etc.

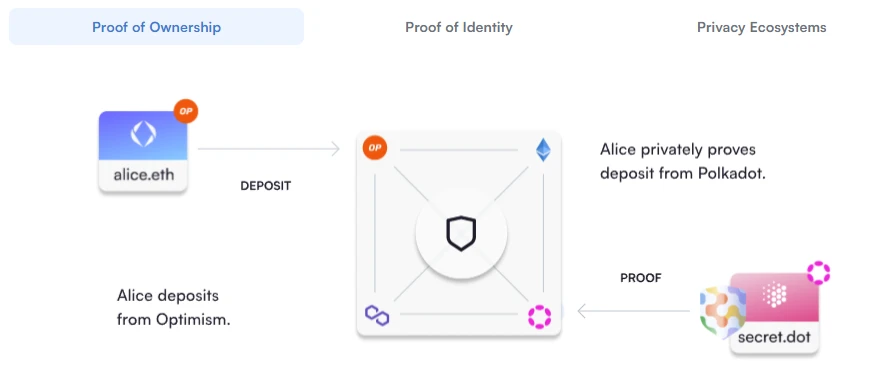

23. Webb

May 8, 2023

Seed round: $7 million

Lead investors: Polychain Capital, Lemniscap

Investors: Zee Prime, CMS Holdings, etc.

Webb is a privacy cross-chain protocol based on ZK technology. Its flagship product Hubble Bridge allows users to transfer assets, verify identities, and send messages between multiple networks.

24. Airstack

May 17, 2023

Pre-seed: $7 million

Lead investor: Superscrypt

Investors: Polygon, Hashed Emergent, NGC, Primal Capital, UOB Ventures, Signum Capital, etc.

Airstack is a blockchain data platform that allows developers to easily query data from multiple networks. It has also developed an artificial intelligence assistant for users that can make queries by asking. For example, ask Help me find the wallet address of a holder with more than 10,000 MATIC, Ai Assistant will automatically provide the query results.

25. PYOR

May 19, 2023

Seed round: $4 million

Lead investor: Castle Island Ventures

Investors: Hash 3, Antler, Future Perfect Venture, Force Ventures, CoinSwitch Ventures, Coinbase Ventures, Balaji Srinivasan

According to the Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.