Binance Research Institute and Binance VIP & Institutional announced their survey and research report on institutional-grade crypto asset users on June 30th. The survey results show that 63.5% of Binance VIP users and institutional users are optimistic about the development of crypto assets in the next year. The vast majority (88%) of the respondents also expressed optimism about the development of crypto assets in the next ten years.

In addition, many institutional users believe that an increase in real-world use cases (26.9%) and regulatory clarity (25.3%) will drive the mainstream adoption of crypto assets. This proportion is much higher than the factor of price (3.4%). It is clear that institutional users adopt a long-term strategy and have a lower sensitivity to short-term market fluctuations.

From March 31st, 2023, to May 15th, 2023, Binance conducted a comprehensive survey of 208 VIP and institutional users, covering demographics, attitudes towards crypto asset investments, preferences, level of mainstream adoption, and motivations. The main survey findings include:

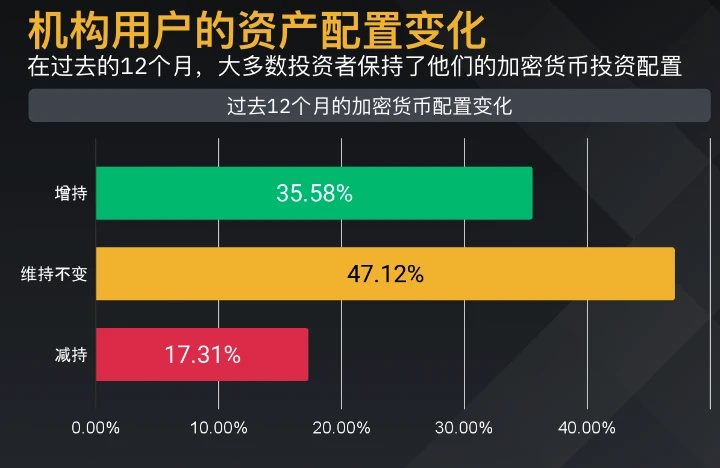

● Asset allocation by institutional users: Despite the average market situation last year, the majority (47.1%) of investors still retained crypto assets in their portfolios, and more than one-third of investors (35.6%) increased their holdings of crypto assets. Only a small number of investors (17.3%) reduced their holdings of crypto assets.

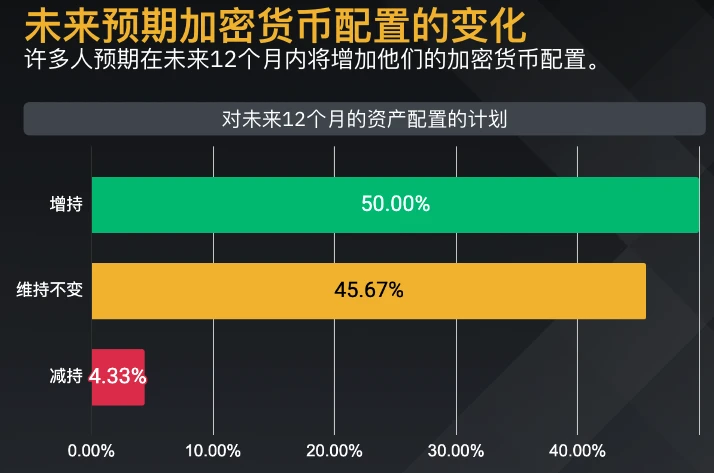

● Future allocation intentions: Most users believe that they will increase their allocation (50.0%) or maintain their current allocation (45.7%) of crypto assets in the next 12 months. Only 4.3% of investors believe they will reduce their holdings of crypto assets.

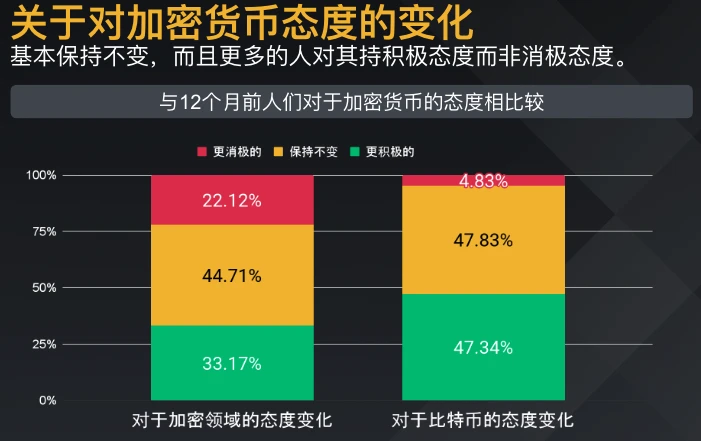

● More bullish on Bitcoin: In the past year, market sentiment towards Bitcoin and the entire cryptocurrency industry has remained relatively unchanged (at 47.8% and 44.7% respectively), but users are more bullish on Bitcoin compared to the overall cryptocurrency market (47.3% vs. 33.2%). At the same time, 22.1% of investors are bearish on the overall cryptocurrency market, while only 4.8% are bearish on Bitcoin.

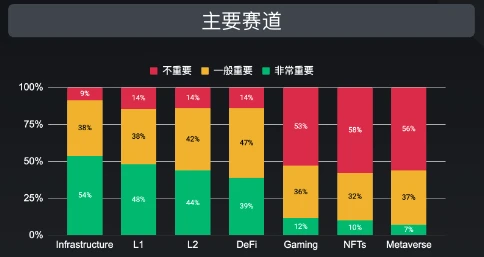

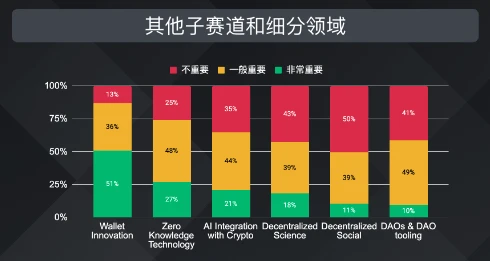

● Infrastructure and innovation: 53.9% of investors state that infrastructure projects are their highest priority, followed by Layer 1 and Layer 2 technologies (48.1% and 43.8% respectively). When asked about specific areas, 51.0% of users believe that innovation in the wallet sector (such as self-custody and UX/UI improvements) is also important.

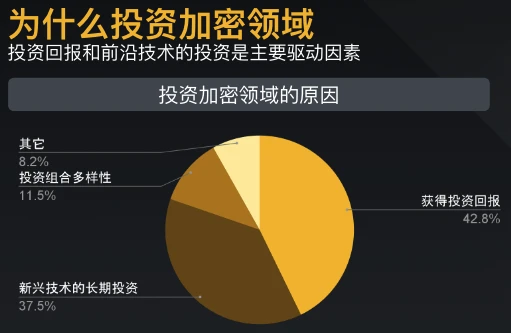

● Investment motivations: 42.8% of investors state that the potential for high returns is the biggest attraction of cryptocurrency investments. Additionally, 37.5% of investors say that long-term investment in emerging technologies is their primary motivation.

● Trading Platform: Centralized trading platforms are still the preferred platform for institutional users in institutional trading activities (90.5% ) and custody activities (58.2% ). The three main factors that users consider when choosing a trading platform are liquidity (28.0% ), security (26.0% ), and reputation (22.5% ).

Catherine Chen, Director of Binance VIP and Institutional Clients, said, "Institutional users typically take a long-term strategy when entering new markets. According to our survey, these users are optimistic about cryptocurrencies in the long run and believe that use cases can drive adoption more than prices. Therefore, we believe that they also adopt the same strategy for cryptocurrencies. These survey findings also match Binance's steady growth in institutional clients (since the peak of the bull market in Q4 2021, the number of institutional users has grown by 89% ). We will study this survey report together with our users and apply the research results to our products."

Click here to access the survey report.

Disclaimer

The Institutional Crypto Outlook Survey report is compiled and published by Binance Research. It does not constitute market forecasts, investment advice, investment strategies, or promotion or sales of any securities or crypto asset products. The terms and viewpoints used in the report are intended to enhance readers' understanding of the industry and promote responsible development of the industry. They do not constitute definitive legal opinions and do not represent the official position of Binance. The viewpoints presented in the report are the author's own as of the above-mentioned date and may change depending on circumstances. The information and viewpoints contained in the report are derived from proprietary or non-proprietary information sources recognized by Binance Research. Binance does not guarantee the comprehensiveness, accuracy, and reliability of such information and viewpoints and disclaims any responsibility for any errors or omissions (including any liability for personal loss caused by negligence). The report may contain forward-looking information that does not conform to historical facts. This information may contain elements of prediction and conjecture. Binance does not guarantee the realization of any predictions in the report. Readers should exercise their own judgment in using the information contained in the report. The report is for informational purposes only and does not constitute any investment advice, investment strategy, or promotion or sales of any securities or crypto asset products. In countries and regions where the sale of securities and crypto asset products is prohibited by law, no sales of securities and crypto asset products shall be conducted. Investment is subject to risks, and caution should be exercised when entering the market.