10 Images Analyzing 4 Types of Classic Tokenomics Models

Original author: @DodoResearch

#Tokenomics is the cornerstone of #DeFi projects. For users, understanding the source of incentives and how they are allocated is crucial. Additionally, the existence of a flywheel also contributes to the sustainability of token economies.

Here, we present 10 Value Flow cases covering 4 classic Tokenomic models.

0. This tweet will cover:

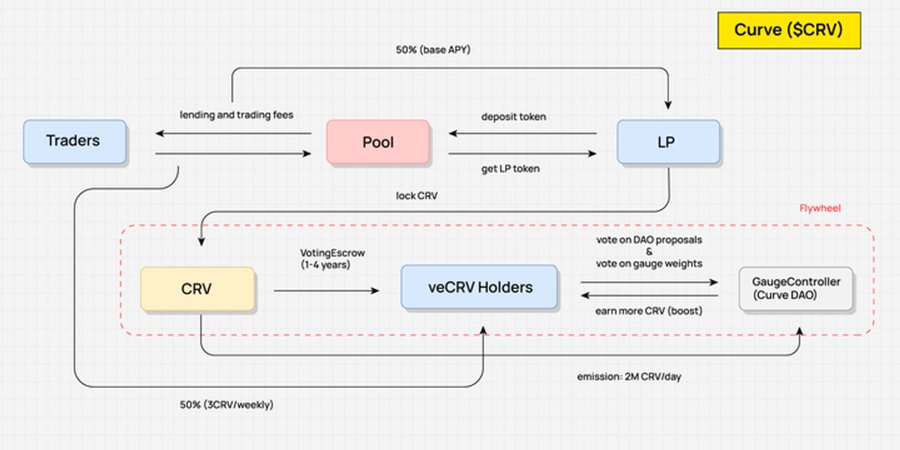

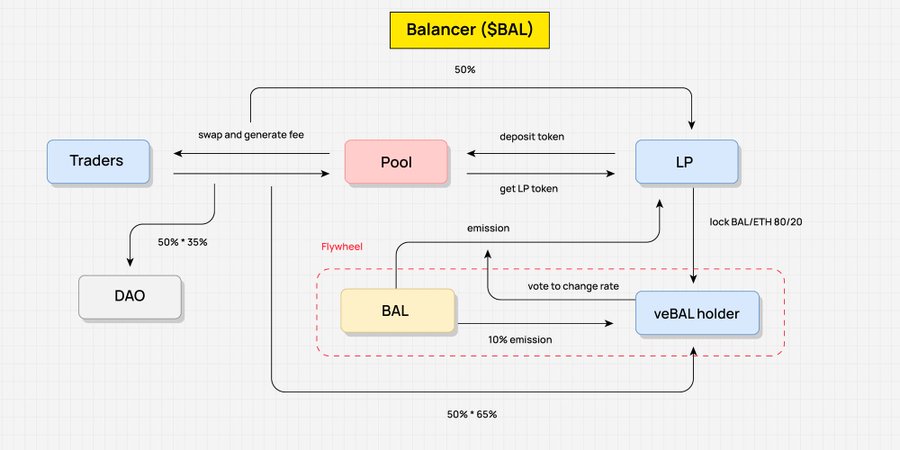

vote-escrowed model: @CurveFinance, @Balancer

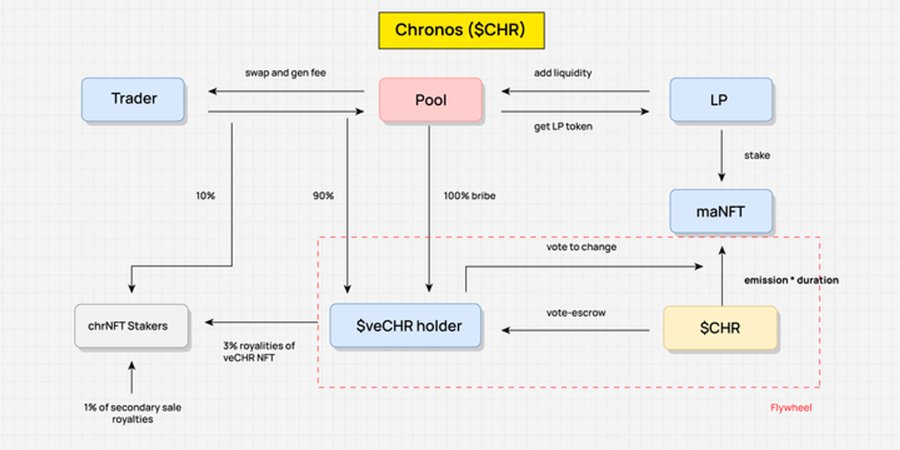

ve(3, 3): @OlympusDAO, @VelodromeFi, @ChronosFi_

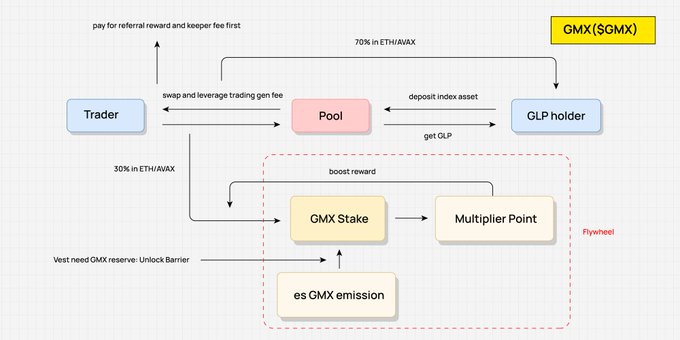

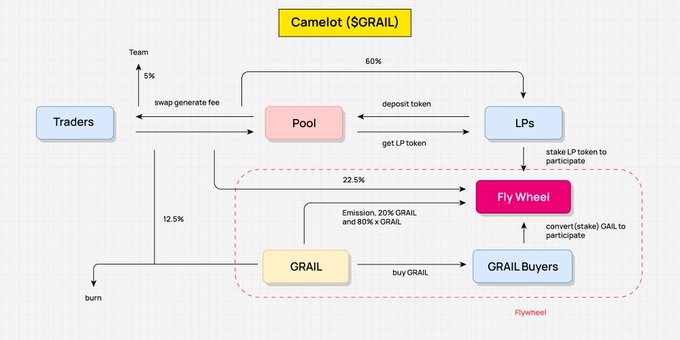

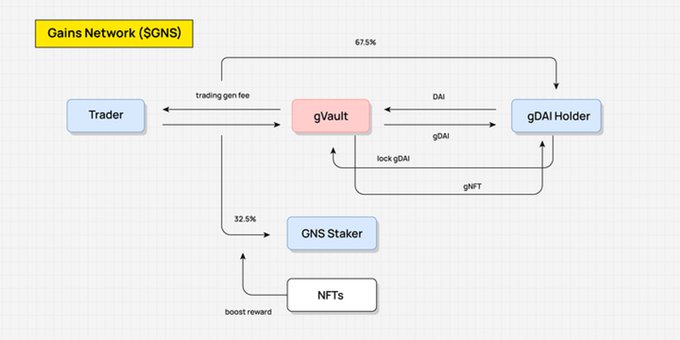

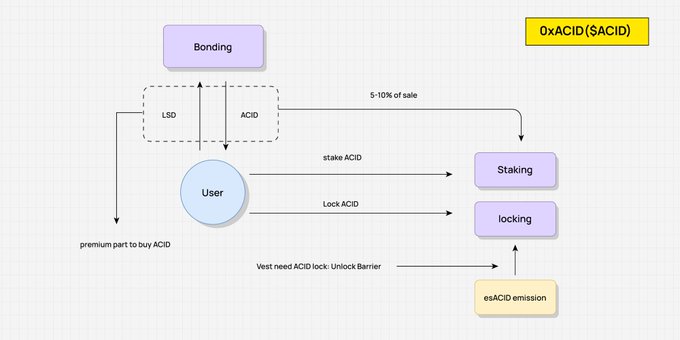

es Model: @GMX_IO, @CamelotDEX, @0xAcidDAO, @GainsNetwork_io

Lending: @AaveAave

How to visualize Value Flow

1. vote-escrowed model

In the ve model, users lock protocol tokens in exchange for veTokens. Only with veTokens, users can get a share of protocol fees, token appreciation, and voting rights. Voting rights determine the allocation of token issuance, which is closely related to the profitability of veToken holders.

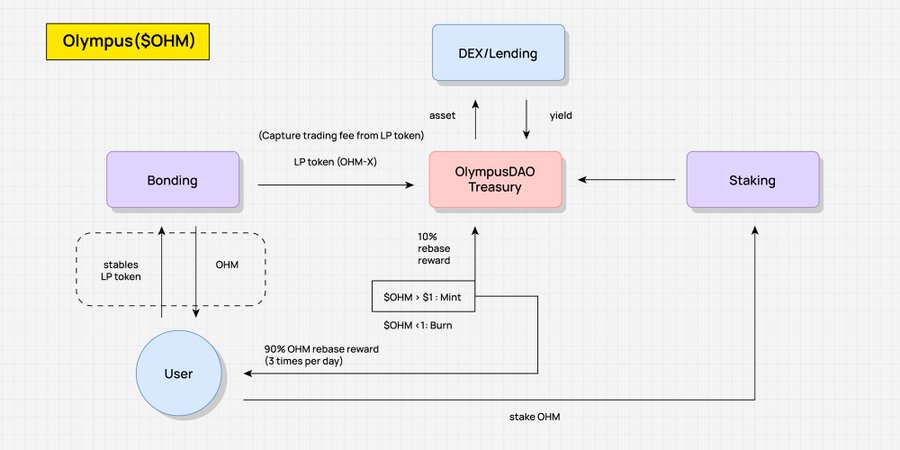

2, ve( 3, 3)

( 3, 3) means the most beneficial state - it can only be achieved when all participants choose to stake protocol tokens. At this point, both participants and the protocol are in a win-win situation.

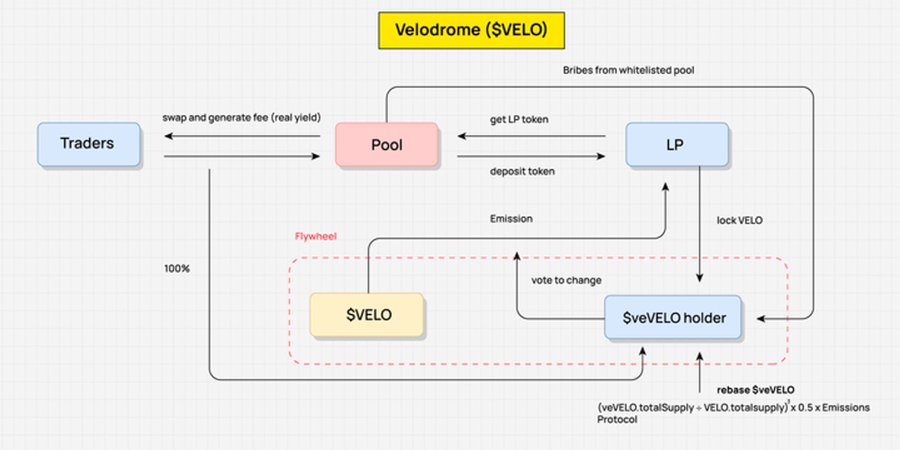

3, ve( 3, 3) is the combination of ve model and ( 3, 3)

It improves the allocation method of protocol fees, where users can only enjoy the transaction fees generated by the pool they voted for, encouraging users to vote for pools with the highest liquidity. Based on Olympus' classic rebasing mechanism, later projects such as Velodrome reduced the rate of inflationary rewards for ve token holders, while Chronos completely eliminated the rebasing mechanism.

4. es Model

The key design in the es model is the introduction of unlocking barriers. To attribute the value of esToken, users need to stake a higher quantity of protocol tokens. If a user decides to exit the game, unattributed esTokens will still remain in the protocol, "saving" the release of protocol tokens.

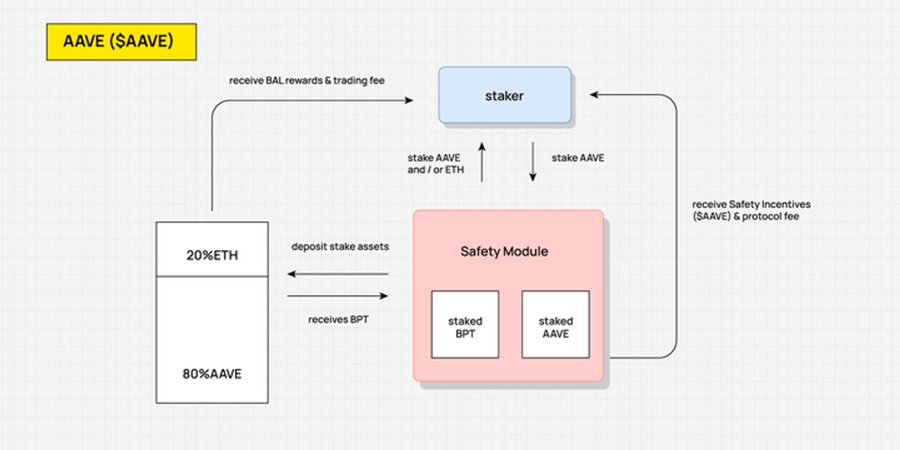

5. Lending

In DeFi lending protocols, tokens are primarily used for governance and collateral. In AAVE, users are incentivized to collateralize $AAVE in the safety module to earn safety rewards and protocol fees.

6. How to Illustrate Value Flow

When studying Tokenomics, the abundance of information and numbers in project documents can be overwhelming. To extract key information related to Tokenomics, you can ask three questions: 1) How are protocol fees and token issuance allocated? 2) Who are the recipients of these incentives (LP, locker)? 3) Is there a flywheel, and how is it formed?

7. Tips

Mark the generation of protocol fees/token release and connect them to different recipients; Connect participants and outcomes (e.g., veToken holders -> token release); Use different colors to represent Pools, Tokens, participants.

Finally

We believe that Value Flow is a great foundational framework that can be used as a tool to better understand Tokenomics. We share it here and encourage everyone to use our method to illustrate more Value Flows to decode new DeFi projects. If you have better ideas or different opinions on any part of Value Flow, please feel free to send us a private message or leave a comment below.