After three years, the Ripple case finally comes to an end. XRP rises in response, with a 65% increase in the 24-hour period on July 14th. The price of XRP even reached a high of 0.94 USDT, ranking fourth in market cap, only behind BTC, ETH, and USDT. Following this, various exchanges have opened XRP trading, including Coinbase, Upbit, and BitGo. The average daily spot trading volume of XRP has increased by nearly 4 billion USD since the ruling.

Apart from XRP, the entire cryptocurrency market is also in a joyous atmosphere, with BTC and ETH breaking new highs at 31,550 USDT and 2,000 USDT respectively.

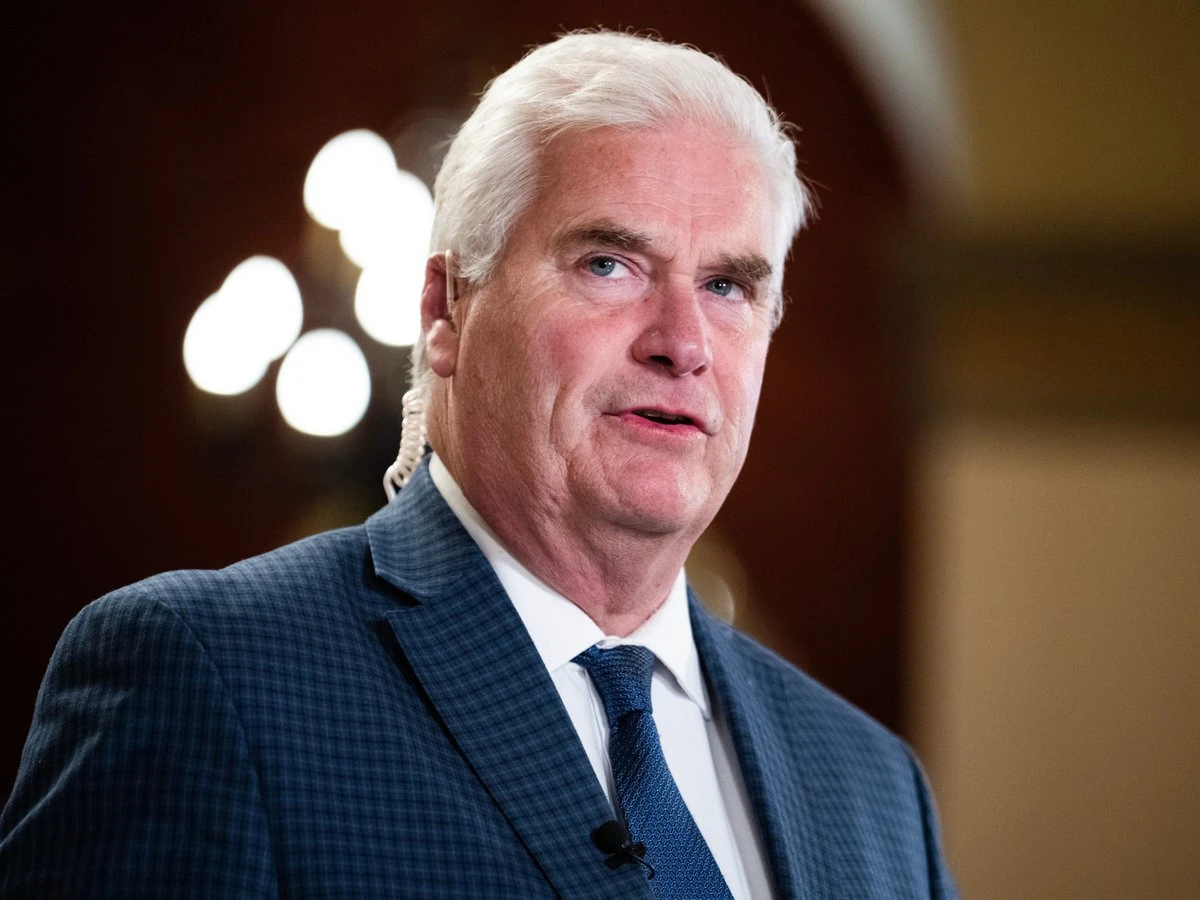

In addition to the relentless resistance from native cryptocurrency enthusiasts against the U.S. SEC, this outcome is also thanks to the support from "crypto-friendly" lawmakers. Today, Odaily will introduce a man who has been active in the cryptocurrency industry, Tom Emmer, the Majority Whip of the U.S. House of Representatives, who has launched bills such as "The Securities Clarity Act," "SEC Stability Act," and "Blockchain Regulatory Certainty Act."

According to public information, Tom Emmer, born in 1961, holds a Bachelor's degree in Political Science and a Juris Doctor degree. He joined the U.S. House of Representatives in 2015 and is a member of the House Financial Services Committee as well as the House Republican Steering Committee. Recently, he was elected as Majority Whip for the 118th Congress.

After the conclusion of the Ripple case, Tom Emmer posted on social media, "The Ripple case is a milestone development that establishes the independence and distinction of tokens from investment contracts, regardless of whether the token is part of an investment contract. Now, let's make it law."

The "make it law" that Tom mentioned refers to May 18th, when he and Representative Darren Soto announced the bipartisan "The Securities Clarity Act." This bill argues that current securities laws do not differentiate between assets and the potential securities contracts they may or may not belong to. Numerous cryptocurrencies...Originally, it may be issued as part of a securities contract, but once the project is fully developed and decentralized, tokens may belong to different categories, such as commodities.

If assets and securities contracts are not distinguished, token projects that need early funding for development will be unable to break free from the securities framework once they become decentralized, thus hindering the use of these tokens and only harming token holders' interests.

The "Clarity for Cryptocurrency" bill introduces a new key term, "investment contract asset," into existing securities laws, enabling crypto projects to fully realize their potential in a compliant manner and allowing the United States to participate in global competition in the next generation of the internet. This legislation is crucial for ensuring robust domestic innovation and maintaining global competitiveness for the United States.

In Tom's view, the strong regulatory actions taken by the SEC regarding cryptocurrencies are playing political games. As early as March 16, 2012, Tom accused the SEC of abusing its power to investigate cryptocurrency companies and sent a letter to SEC Chairman Gary Gensler on behalf of both parties in the United States, requesting the SEC to publicly collect standard procedures and ensure that these investigations do not violate the Paperwork Reduction Act, which restricts the federal government's burden and investigative powers on private enterprises and the public.

Institutions such as Coinbase have been calling for clarity in regulatory legislation in the United States, and Tom has been committed to this as well. In addition to the aforementioned "Clarity for Cryptocurrency" bill, on March 23, 2023, he and Darren Soto reintroduced the "Blockchain Regulatory Certainty Act" to Congress. This bill ensures that blockchain developers who do not custody consumer funds, as well as non-custodial service providers (including miners, validators, and wallet providers), should not be considered money transmitters and should not be subject to the same level of regulation as cryptocurrency exchanges that provide custody services.

It is understood that the "Blockchain Regulatory Certainty Act" was initially proposed on August 17, 2021, but did not progress further.

On June 6th, the SEC sued cryptocurrency exchange Coinbase in a federal court in New York, and on June 13th, Tom Emmer and Congressman Warren Davidson proposed the "SEC Stability Act".The bill aims to remove Gensler from the position of SEC chairman and reform the SEC. "American investors and industry deserve clear and consistent oversight, not political games," said Tom Emmer in a press release. "The US SEC Stability Act will make sensible changes to ensure that the priority of the US SEC is the protection of investors they are responsible for, not the whims of its reckless chairman." Although the process of "regulatory clarity" in the cryptocurrency market is difficult and long, it is because of the persistent support of individuals like "Tom Emmer" that one day we may see a spring in regulation, no longer involving years of litigation or forced settlements, but rather a thriving cryptocurrency development under legal supervision.