A detailed explanation of Uniswap's newly introduced cross-AMM protocol, UniswapX.

Since the launch of the first version of the Uniswap protocol in 2018, on-chain transactions have grown exponentially. Uniswap now supports millions of users, hundreds of use cases, and $15 trillion in trading volume.

To further develop on-chain transactions and improve self-custody swaps, Uniswap has announced the launch of a new permissionless, open-source (GPL), Dutch auction-based protocol called UniswapX for trading across AMMs and other liquidity sources.

Currently, a beta version of this protocol is available on the Uniswap Labs interface for Ethereum mainnet and will expand to other chains and Uniswap wallets in the future.

UniswapX will gradually implement:

Aggregated liquidity sources to improve exchange value

Protection against MEV

Gasless transactions (swaps)

Zero cost for failed transactions

Expansion to support cross-chain gasless transactions in the coming months

UniswapX: The Next-Level Aggregator

Onchain routing is an increasingly important and complex problem. The innovation of onchain transactions has led to explosive growth in liquidity pools. New fee tiers, new L2 solutions, and more onchain protocols will spread out liquidity. Uniswap plans to build thousands of custom pool designs on Uniswap v4, making routing more challenging. However, as liquidity sources grow, providing competitive prices requires manual integration and a large amount of ongoing maintenance and work.

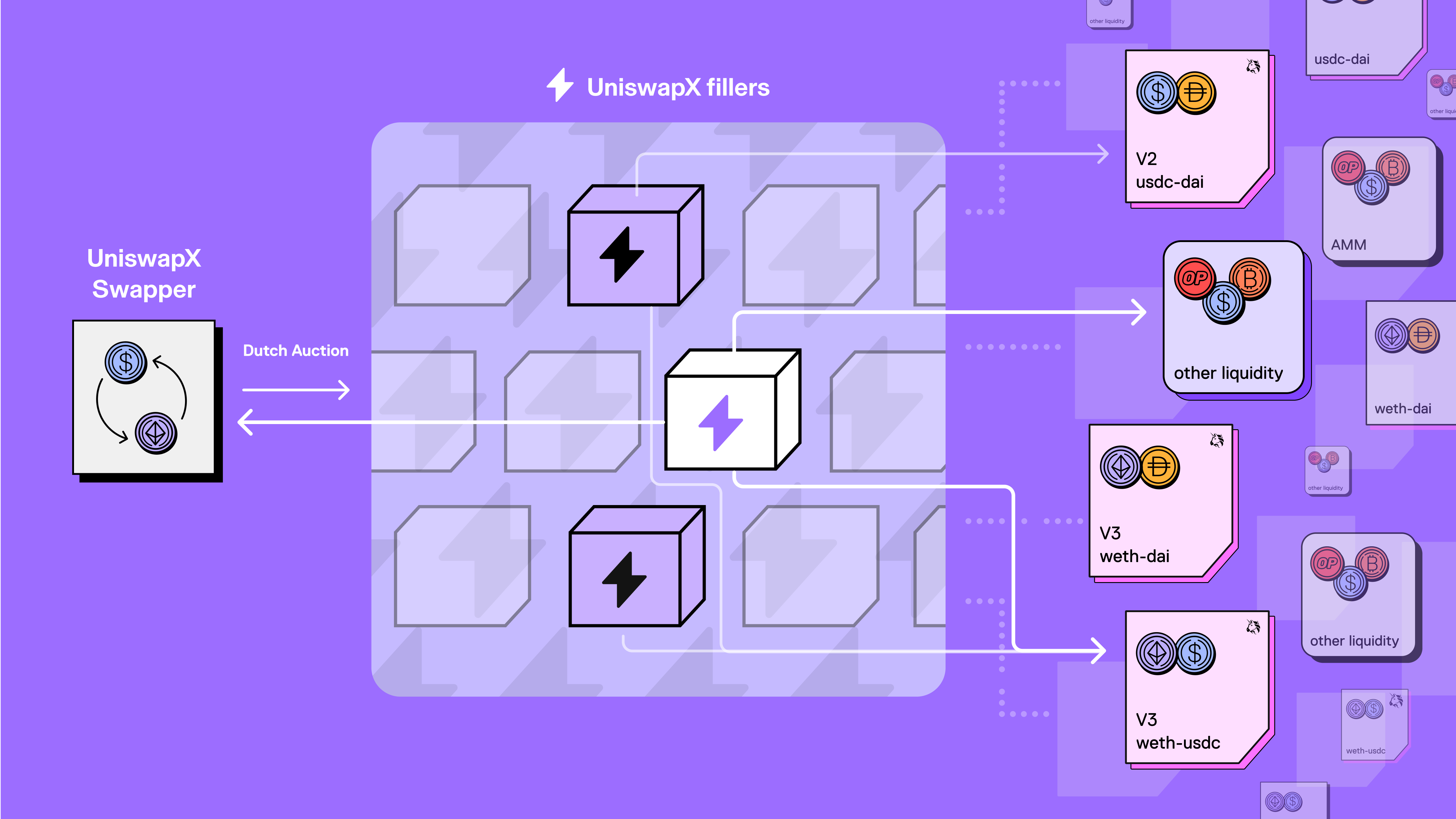

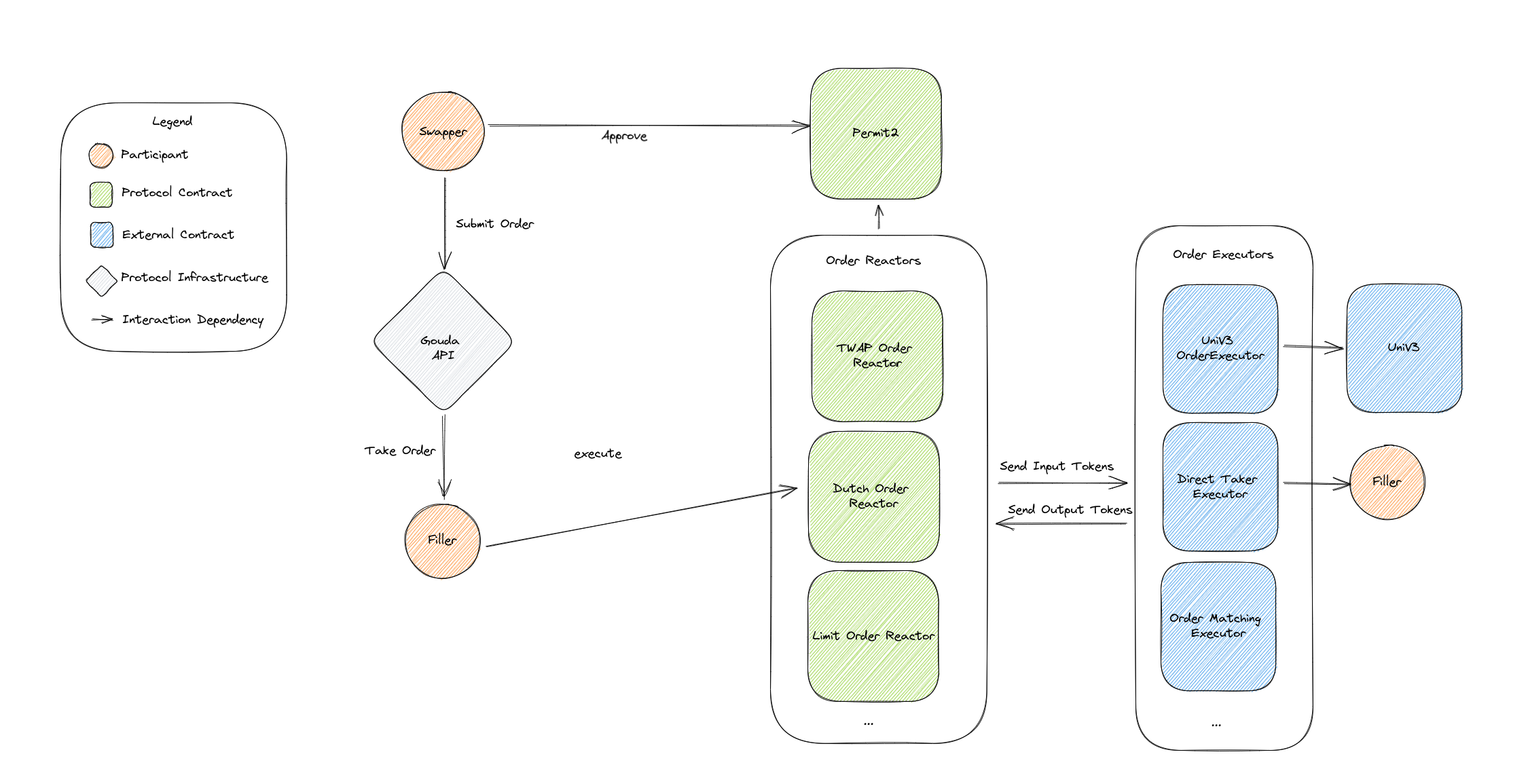

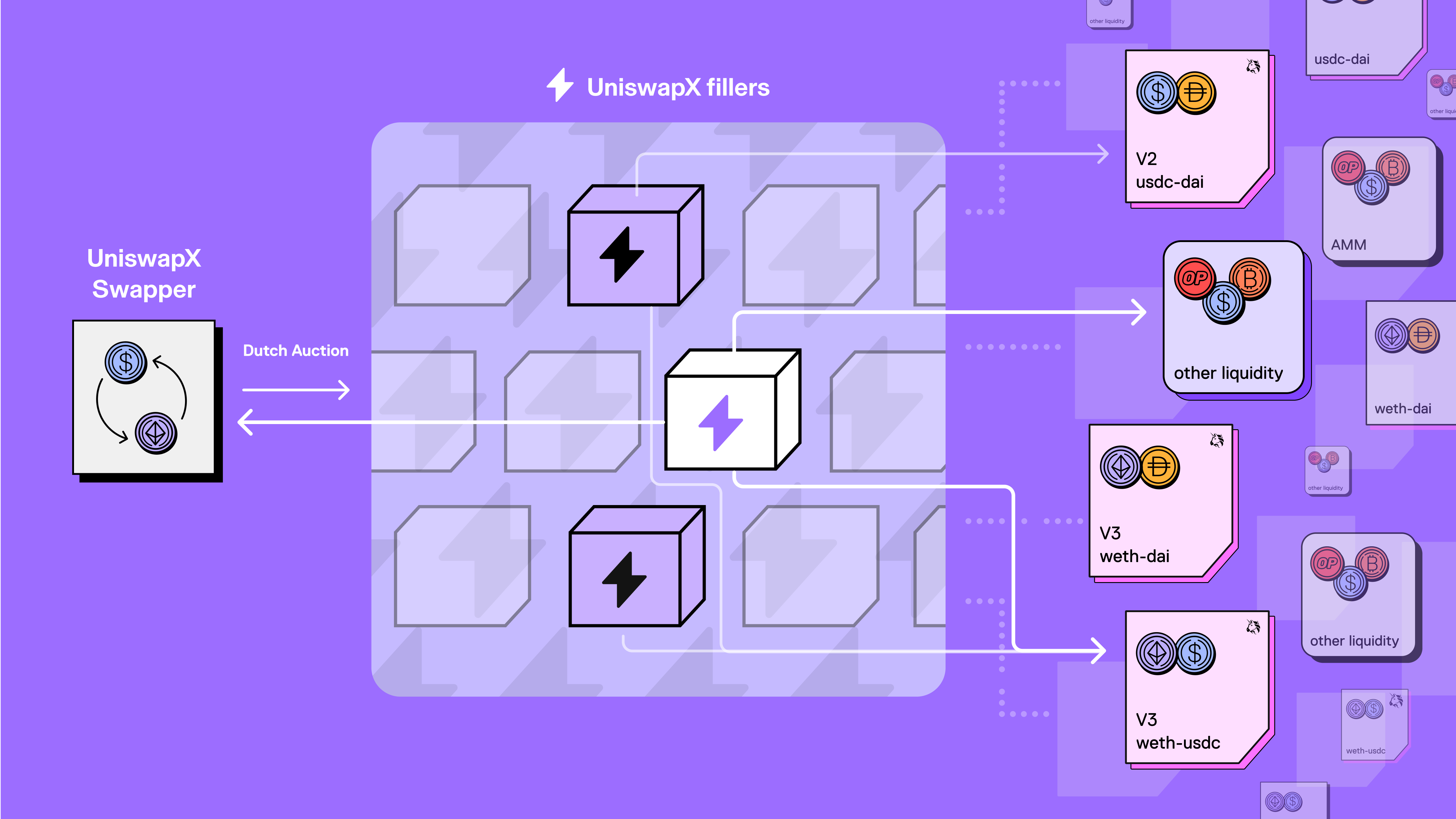

UniswapX aims to solve this problem by outsourcing the complexity of routing to an open network of third-party builders, who compete using onchain liquidity such as AMM pools or their own inventory to fulfill exchanges.

With UniswapX, traders will be able to use the Uniswap interface without worrying about getting the best price, and the trades will always be recorded and settled transparently on-chain. All orders are supported by Uniswap's smart order routing, which compels builders to compete with Uniswap v1, v2, v3, and v4 once it is launched.

How does UniswapX work?

Gasless Exchanges - No cost for failed transactions

Through UniswapX, traders sign a unique off-chain order that is then submitted on-chain by a builder who pays the gas on behalf of the trader. Because traders do not need to pay gas, they do not need the native network token of the chain (e.g., ETH, MATIC) to trade or pay for failed transactions. Builders account for the gas fee in the quoted price but can compete for the best price by batching multiple orders to reduce transaction costs.

In certain cases, users still need to pay gas, for example, the initial token approval for Permit 2. Additionally, native network tokens need to be wrapped when being sold, which consumes gas fees.

MEV Protection

MEV is one of the biggest issues facing on-chain exchanges today, leading to increased transaction costs.

With the help of UniswapX, MEV that could have been captured through arbitrage trading will be returned to the traders through price improvement. UniswapX also helps users avoid more explicit forms of MEV extraction: orders executed using builder inventory cannot be sandwiched in between and builders are incentivized to use private transaction relays when routing orders to on-chain liquidity venues.

Cross-Chain

UniswapX's cross-chain version is expected to be launched later this year, combining exchange and bridging into one seamless operation. Through cross-chain UniswapX, traders will be able to swap between chains in a matter of seconds. Traders will also have the option to receive specific assets on the target chain instead of bridge-specific tokens.

Launching UniswapX

UniswapX is an immutable smart contract that is fully permissionless. No one, including Uniswap Labs, can modify or pause the contract. The early builders are ready and waiting to ensure proper auction starting prices and fast order execution, with the expectation that the builder network will rapidly expand with user adoption. Currently, ABDK has extensively tested and audited the code for UniswapX, and Uniswap offers bug bounties. Traders always maintain self-custody of their funds. Assets are only transferred out of their accounts once orders are executed and they receive trading proceeds.

Similar to the Uniswap protocol, UniswapX includes a protocol fee switch that can only be activated by Uniswap governance (Uniswap Labs is not involved in this process).