Recently, there has been shocking news from the Sequoia Capital venture capital team, with two cryptocurrency investors leaving their positions. These two investors had invested in the collapsed cryptocurrency exchange FTX, causing Sequoia Capital to lose $214 million. The turmoil at Sequoia Capital also indirectly reflects the investment and financing situation in the cryptocurrency market in the first half of this year. Based on the data from the first half of the year, the overall investment and financing situation is extremely bleak, with financing amounts nearly halved compared to the previous period.

However, it is not all bad news. The turbulent market is also considered the best time for wise investments. In the first half of this year, the VC circle saw the emergence of a "dark horse" - DWF Labs, which made a total of 32 investments, far surpassing other investment institutions. Their official website claims to invest in an average of 5 projects every month regardless of market conditions.

On the other hand, in the first half of this year, the cryptocurrency secondary market emerged from the shadow of the deep bear market of the previous year. The price of Bitcoin rose from a low of 16,477.6 USDT to a high of 31,550 USDT, with a peak increase of over 90%. The upward trend provided investors with a glimmer of hope. Perhaps, with the secondary market coming out of the bear market, the investment and financing situation in the primary market will improve in the second half of the year.

I. Overall Situation: Bleak Investment and Financing, Financing Amounts Nearly Halved

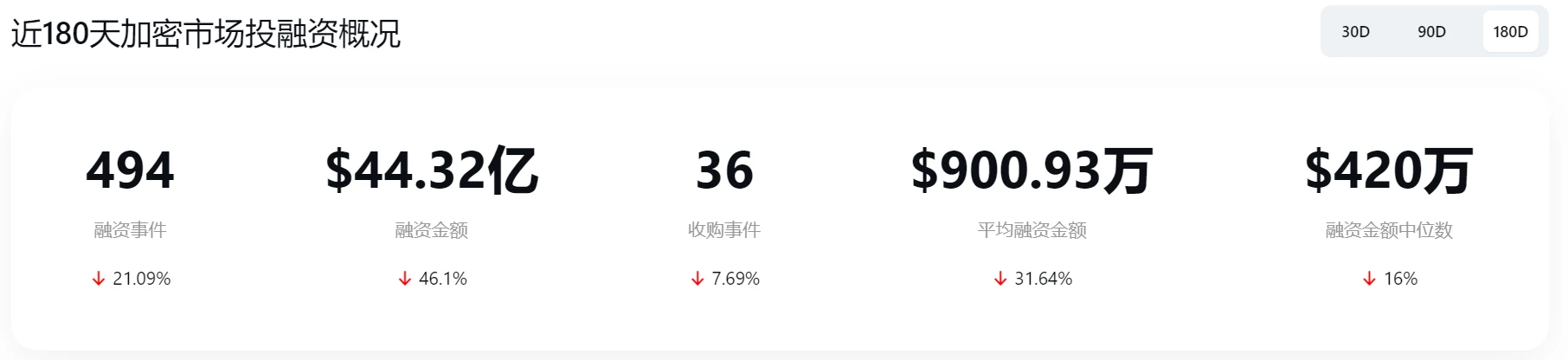

First, let's look at the overall investment and financing situation in the market over the past half-year. Since the collapse of LUNA and FTX last year, the global cryptocurrency market has entered a deep bear market. Whether it's Bitcoin or NFT, whether it's the primary market or the secondary market, it can be described as a desolate landscape. From the data, we can see that both the financing amount and the number of financing events have experienced a significant decline compared to the second half of last year, with the financing amount decreasing by 46.1%, nearly halved.

II. Declining Investment Amounts and Numbers, Infrastructure Remains the Hottest Track

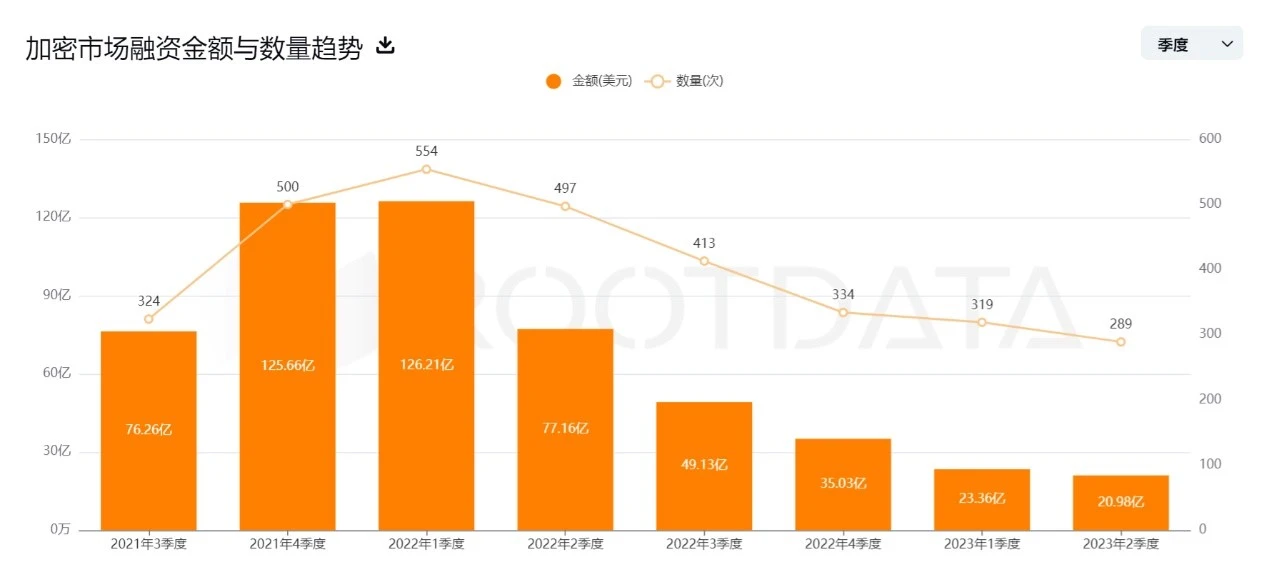

From the trend perspective, both the number and amount of investments have been declining for five consecutive quarters since the first quarter of last year. Currently, institutions remain cautious when it comes to investment, and there are still no signs of the investment and financing bear market hitting its bottom.

Source: ROOTDATA

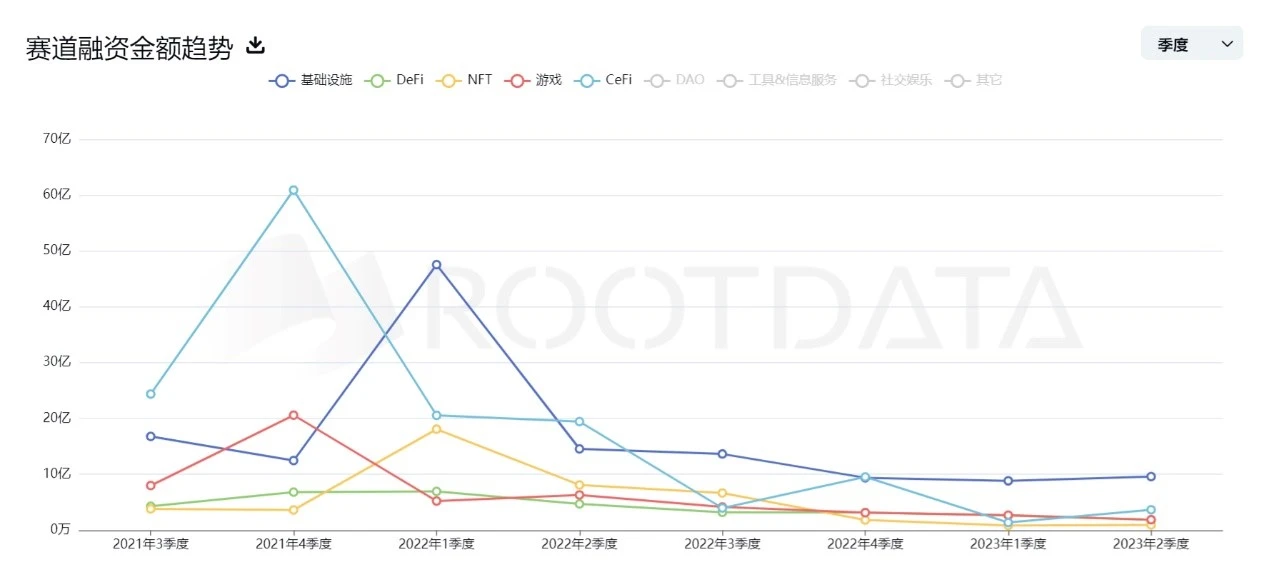

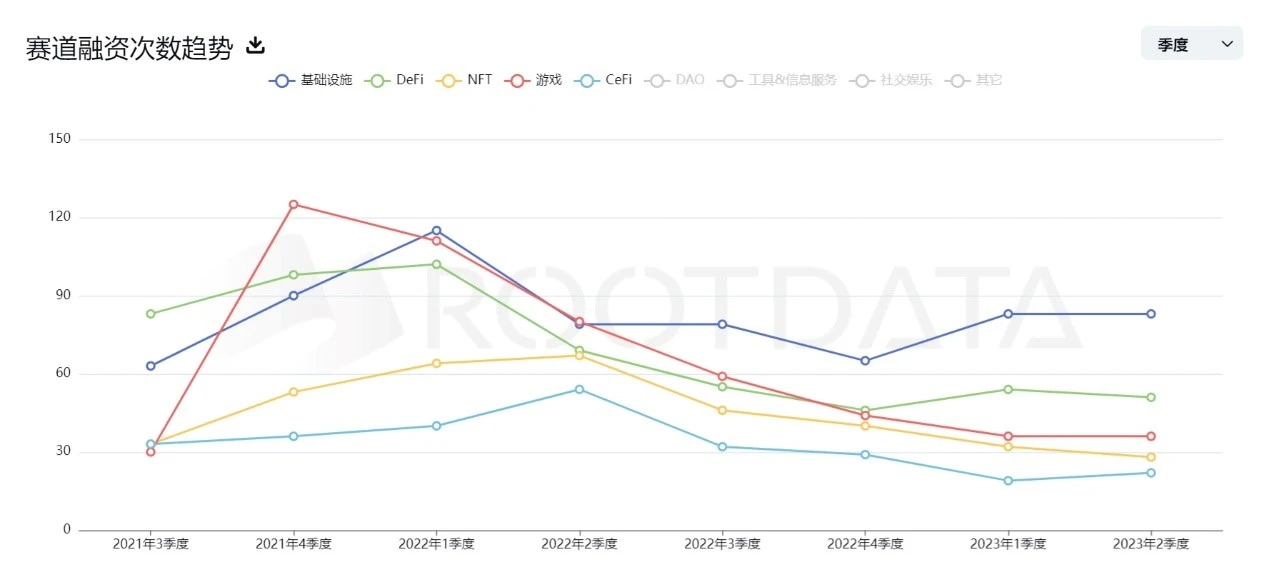

From the perspective of race classification, infrastructure is currently the most popular among institutional investors, ranking first in terms of financing amount and number of times in all races. However, in terms of average financing amount per transaction, CeFi has the highest average. It seems that although the number of financing transactions in CeFi is small, each transaction can raise a considerable amount of money.

Source: ROOTDATA

If we look at it from a vertical perspective, the financing amount in all races is declining.

Source: ROOTDATA

Unit: billion US dollars. Source: ROOTDATA

Unit: billion US dollars. Source: ROOTDATA

The number of financing transactions has rebounded slightly this year, but it still lags behind the previous peak.

Source: ROOTDATA

Source: ROOTDATA

Financing frequencies of each track. Source: ROOTDATA

From the perspective of projects, the top ten projects in terms of financing amount are Blockstream (Infrastructure), LayerZero (Infrastructure), Worldcoin (Digital Currency), Ledger (Infrastructure), Auradine (Infrastructure), Chain Reaction (Infrastructure), Taurus (Infrastructure), Salt Lending (CeFi), Unchained Capital (CeFi), and EOS (Infrastructure).

Surprisingly, among the top ten financed projects, the infrastructure track occupies 7 seats, CeFi occupies 2 seats, and digital currency occupies 1 seat. It seems that infrastructure is well-deserving of being the most favored track by investors. The prosperity of Web 3 applications requires strong and robust infrastructure as a guarantee. In periods of uncertain industry development prospects, investing in "shovels" is often the optimal choice.

III. Market Witnessed"Dark Horse" Investor, Investing in 32 Projects in Six Months with Generous Moves

According to our incomplete statistics, the institution with the most investment occurrences in the first half of this year is DWF Labs, with a total of 32 investments, making it a "dark horse" in the VC circle this year.

Investment occurrences by investors. Source: ROOTDATA

DWF Labs is not a traditional giant, but an emerging investment firm established in 2022. DWF Labs is a Web 3 venture capital and market maker, providing market making, secondary market investment, early stage investment, over-the-counter (OTC) trading services, token listing, and consulting services for Web 3 companies.

The investment philosophy of DWF Labs is somewhat radical, as stated on its official website, "Investing in an average of 5 projects per month regardless of market conditions." Andrei Grachev, Managing Partner of DWF Labs, stated in an interview that the current volatile market is the best time to enter the investment field, and they have accumulated enough funds from profits to invest in projects. In most cases, DWF Labs invests in projects by directly purchasing tokens.

In addition, DWF Labs is part of Digital Wave Finance (DWF), which is one of the world's top cryptocurrency traders, trading spot and derivatives on more than 40 top exchanges. Perhaps the powerful background is also an important source of confidence for this "newcomer" to take aggressive actions in a bear market.

It is worth noting that the renowned investment firm a16z did not appear in the top ten rankings. In the first half of 2023, a16z made a total of 14 investments, significantly fewer than the 25 investments in the second half of last year. The decrease in the number of investments by a16z may also reflect another aspect of the crypto market downturn.

Let's take a look at the "investment preferences" of some famous investment firms:

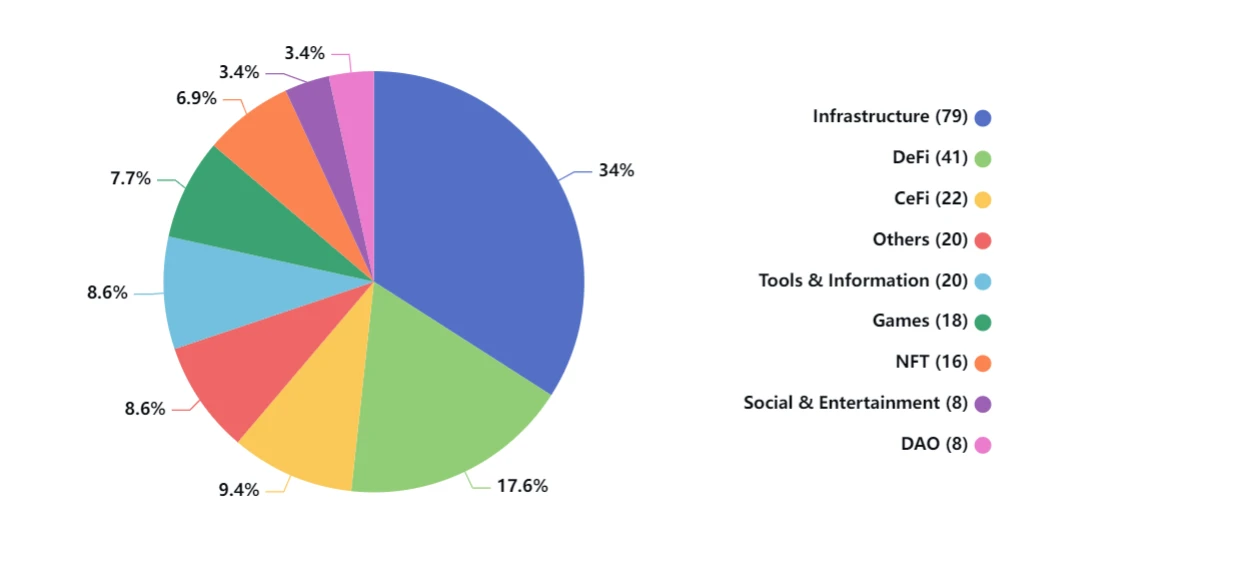

Investment landscape of HashKey Capital. Source: ROOTDATA

HashKey has a strong preference for infrastructure, accounting for over one-third of all investment projects at 34%. The second and third preferences are DeFi (17.6%) and CeFi (9.4%) respectively.

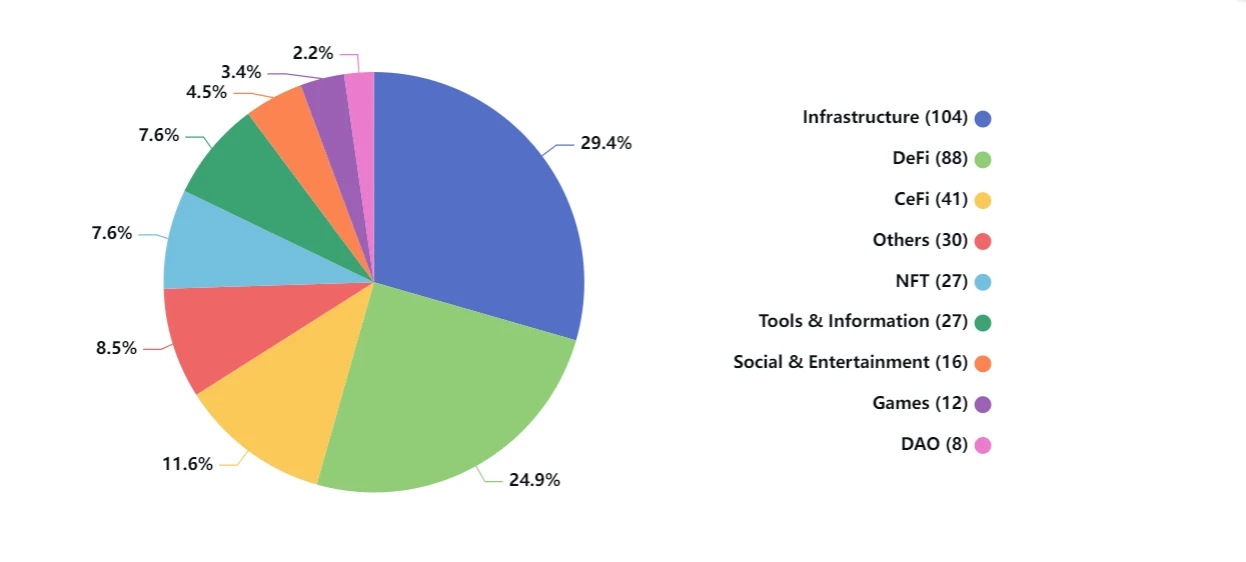

Coinbase Ventures Invest Map. Source: ROOTDATA

Coinbase Ventures also prefers to invest in infrastructure (proportion: 29.4%), but compared to HashKey, the investments are more evenly distributed. The second highest investment is in DeFi (24.9%) and the third is in CeFi (11.6%), both proportions higher than Hashkey.

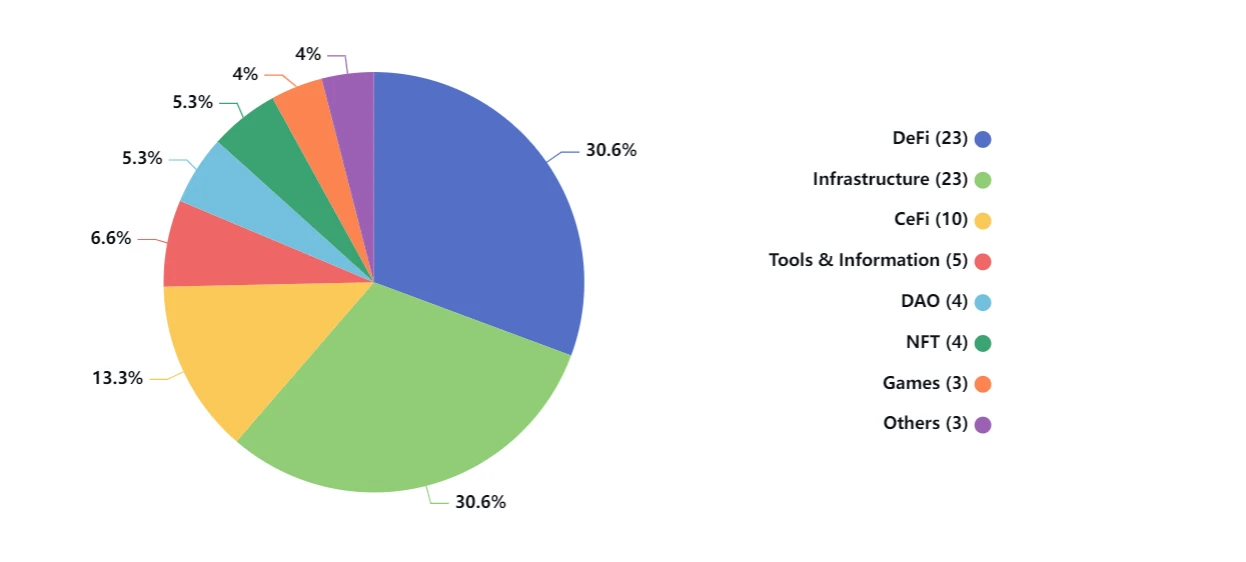

Circle Ventures Invest Map. Source: ROOTDATA

Circle Ventures prefers to invest equally in DeFi and infrastructure, both with a proportion of 30.6%. The third highest investment is in CeFi (13.3%).

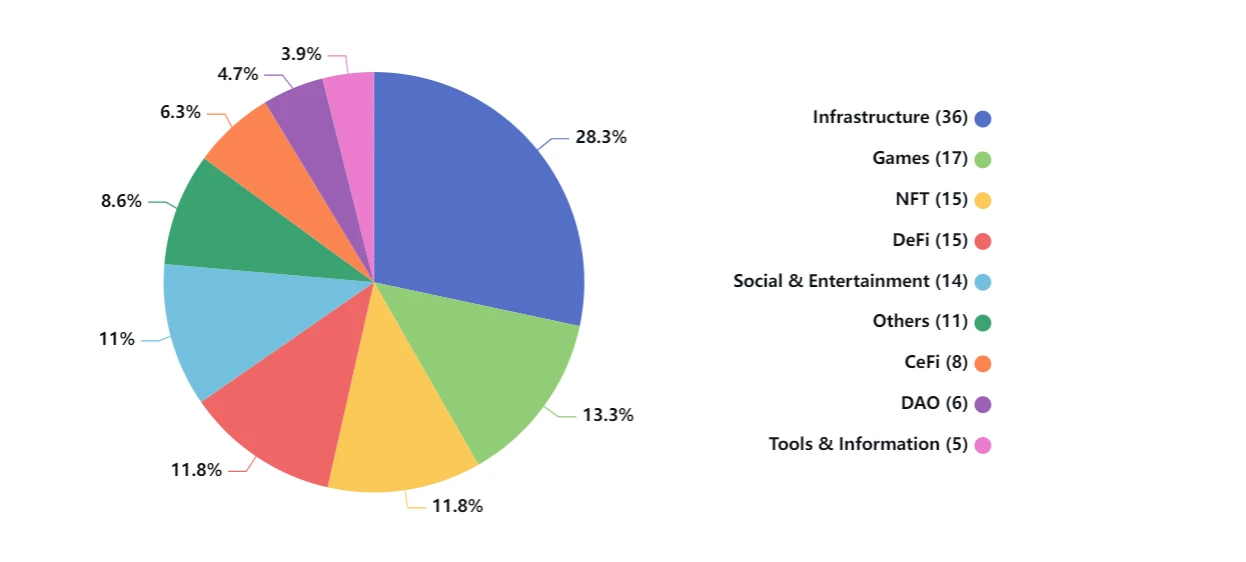

a 16 z Invest Map. Source: ROOTDATA

Unlike the preferences of the previous three institutions, the investment preferences of a 16 z are more unique. Unlike the preferences of the previous three institutions in infrastructure, DeFi, and CeFi, a 16 z's second and third investment preferences are games and NFT. a 16 z's investment also appears to be more "even". In addition to infrastructure holding the top spot (28.3%), the proportions for Games (13.3%), NFT (11.8%), DeFi (11.8%), and Social & Entertainment (11%) are almost the same.

Four, Top Ten Most Popular Projects

In the first half of this year, the top ten projects with the highest funding amounts are as follows:

1. Blockstream

Blockstream is a leading blockchain development company established in 2014. Blockstream's core focus is to develop new infrastructure for traditional financial systems, with key development centered around Bitcoin sidechains and other blockchain-related applications. Their flagship technologies include their implemented Lightning protocol and the Elements Project, which is a blockchain platform supporting open-source sidechains. Blockstream has launched many products such as Liquid (a Bitcoin-based inter-exchange settlement network), Blockstream Green (a secure Bitcoin wallet), as well as other products providing real-time and historical cryptocurrency trading data, and hosting services for Bitcoin mining operations.

Investors include well-known investment firms such as Blockchain Capital and Ethereal Ventures.

2. LayerZero

LayerZero is a cross-chain interoperability protocol designed for lightweight message passing. LayerZero provides trusted and secure message delivery with configurable trustlessness.

The investors include Coinbase Ventures, Circle Ventures, Binance Labs, a 16 z Crypto, and FTX Ventures. It seems that many top institutions are very optimistic about the project.

3.Worldcoin

Worldcoin is a new global cryptocurrency designed to be the largest and most inclusive cryptocurrency network by offering Worldcoin for free to everyone. Worldcoin has built a device called Orb, which captures a person's eye image and converts it into a short digital code to check if they are registered. If not, they will receive a free share of Worldcoin. The original image does not need to be stored or uploaded.

The investors include Coinbase Ventures, a 16 z Crypto, Blockchain Capital, and others.

4.Ledger

Ledger is a cryptocurrency hardware wallet company that develops secure and infrastructure solutions for individuals and companies using unique proprietary technology, as well as blockchain applications.

The investors include Blockchain Capital and others.

5.Auradine

Auradine is dedicated to developing breakthrough scalability, sustainability, and security solutions for future internet infrastructure, supported by revolutionary blockchain, security, zero-knowledge, and artificial intelligence technologies.

The investors include DCVC, Mayfield, and others.

6.Chain Reaction

Chain Reaction is redesigning the future of blockchain and privacy technology through accelerated computing performance. The company collaborates with cloud service providers and data centers to optimize energy-efficient, high-performance computing using custom ASICs and system modifications. Its 3 PU™ (Privacy Protection Processing Unit) greatly accelerates real-time operations on encrypted data for privacy-enhancing technologies, transforming the cloud into a trusted environment and enabling vertical industries reliant on privacy big data to utilize the cloud (including financial institutions, healthcare and pharmaceuticals, defense and government, and oil and gas).

The investors include Morgan Creek Digital, Hanaco Ventures, etc.

7. Taurus

Taurus offers enterprise-grade infrastructure for issuing, custody, and trading any digital assets including staking, tokenized assets, and cryptocurrencies. Taurus also operates a regulated private assets and tokenized securities market.

The investors include Tezos, Credit Suisse, etc.

8. Salt Lending

SALT lending offers personal and business loans to members using blockchain assets as collateral.

9. QuickNode

Unchained Capital is a bitcoin-native financial services company offering collaborative custody, trading desk, bitcoin-back lending, and bitcoin retirement accounts.

The investors include Valor Equity Partners, NYDIG, etc.

10. EOS

EOS public blockchain is built on the open-source software framework, EOSIO, empowering developers to create decentralized applications for the real world.

The investors include DWF Labs, etc.

V. Conclusion

Looking at the overall situation of primary market investment and financing, off-market investors lack confidence in the entire crypto market, with both the amount and quantity of investments significantly decreasing compared to previous years. However, even in such a poor market, there are aggressive players like DWF Labs who are "bottom fishing," interpreting the investment philosophy of "others fear, I am greedy."

R3PO believes that we should not be too pessimistic about the dismal primary market situation, as the secondary market has gradually begun to emerge from the bearish shadow. Generally speaking, the investment conditions of the primary and secondary markets will not deviate for a long time, and the profit effect of the secondary market will inevitably transmit to the primary market. Therefore, even in a deep bear market, one should remain sensitive to investment and financing conditions. Tracking the projects and tracks that investors favor may be the triggering point for a new round of crypto bull market.

Copyright statement: If you need to reprint, please contact the assistant on WeChat. We reserve the right to pursue legal liability for unauthorized reprinting or plagiarism.

Disclaimer: The market carries risks, and investments should be made with caution. Readers should strictly comply with local laws and regulations when considering any opinions, viewpoints, or conclusions in this article. The above content does not constitute any investment advice.