This article is from The Block, authored by James Hunt

Summary:

- Jameson Lopp, Chief Technical Officer of Casa, stated that the Lightning Network has been criticized for its complexity and reliance on custodial solutions, but it still remains a promising scaling solution for Bitcoin.

- The recent surge in Bitcoin network activity over the weekend, along with the debate surrounding Ordinals and script, and Casa's move to offer Ethereum support, were also discussed in the interview below.

Jameson Lopp, Chief Technical Officer of Casa, a Bitcoin wallet provider, defended the Lightning Network in an interview, addressing recent criticisms. The Bitcoin network has experienced multiple anomalies recently, alongside the ongoing debate surrounding Ordinals and script.

The Lightning Network aims to solve Bitcoin's scalability issues through fast and cost-effective bi-directional payment channels built on top of the Bitcoin blockchain. However, since its launch in 2018, the Lightning Network has faced criticism from the wider cryptocurrency industry.

Recently, the Lightning Network was once again attacked by insiders within the Bitcoin community, with Fiatjaf, the founder of the decentralized social media protocol Nostr, describing it as "a bunch of ugly, hacky, and complex hacks."

Another criticism is that many users rely on custodial solutions like Wallet of Satoshi to interact with Bitcoin, despite the convenience they offer. However, there is also a risk associated with these solutions: the projects may potentially "exit scam" in the future.

In response to these concerns, Lopp acknowledges that the complexity of the Lightning Network leads to a trade-off between convenience and custodial solutions. However, he points out that the actively developing system is far from complete, and engineers are working to address the remaining complexities.

Lopp states, "There's no doubt that the Lightning Network is complex, and complexity means that you have trade-offs, which is one of the reasons why many people end up using custodial solutions. Custodial platforms have the ability to hide a lot of complexity, which is why they can attract more users, as they provide a more user-friendly solution."

"But on the other hand, we keep learning that this is an ecosystem in active development, so it is far from being finished," Lopp continued, "When you encounter complexity, one of the jobs of an engineer is to try to figure out how to abstract it, to learn from these edge cases that come up because of complexity and how we write software, and to propose best practices for how to deal with them, ideally in as automated a way as possible."

"So, this means it is challenging and we still have a long way to go, but I see everything evolving in a positive direction," he added.

Concerns about Lightning Network Custodianship

Regarding the risks associated with custodian Lightning solutions, Lopp said, "This is an age-old balance between convenience and sovereignty. I'm more optimistic about Lightning wallets that can provide better sovereignty, in part because projects like LDK have improved efficiency, and users can run a so-called Lightning network node in a mobile app. But it's different from what people traditionally think of as a Lightning node: it's effectively a full Bitcoin node and a Lightning network node on the same machine, and they're 'talking' to each other."

"The key is as long as you control the private keys," he continued, "So, I'm very interested to see how that continues to evolve. I know that there are definitely some projects doing that. For example, Zeus, which is one of my favorite Lightning wallets, allows me to connect to a full setup that I have running on a server somewhere. I know they've been going down that path as well, trying to build a more convenient self-custody mobile device."

He added, "There is still hope, but it's a long-standing issue of whether self-sovereign projects can compete with the convenience and ease of use of custodial solutions. Because ultimately, people will choose what's easiest."

As for self-custody solution provider Casa, Lopp said its customers are mainly high-net-worth individuals and small teams managing assets worth tens of thousands to millions of dollars, and their demand for solutions like the Lightning network is not high.

"Currently, the demand for the Lightning network is very low among our customers, and I don't think there will be much demand because our customers often live in developed countries where there is already a good payment infrastructure," he said. "They know what the Lightning network is, but for them, it's not a solution they need in their daily lives."

Lightning Network vs Ark

Lopp also believes that comparing the well-established Lightning network, which has been operating with real funds for about five years, with newer alternative solutions is unfair.

"I forgot if Fiatjaf is a fan of Ark," Lopp said, "but you see a lot of people talking about Ark. It's a very new project and hasn't been adopted in the real world yet."

Ark is another Layer 2 protocol for Bitcoin, designed to make user onboarding easier without the need to open and close channels.

"So when I see people trying to directly compare the Lightning Network to Ark, I can't help but laugh. I think the Lightning Network has been operating with real money since around 2018, while Ark hasn't actually been running as a production software project," Lopp added. "Of course, it has potential, but I don't think the Lightning Network will step aside. It's quite a large ecosystem, but it's still gradually maturing."

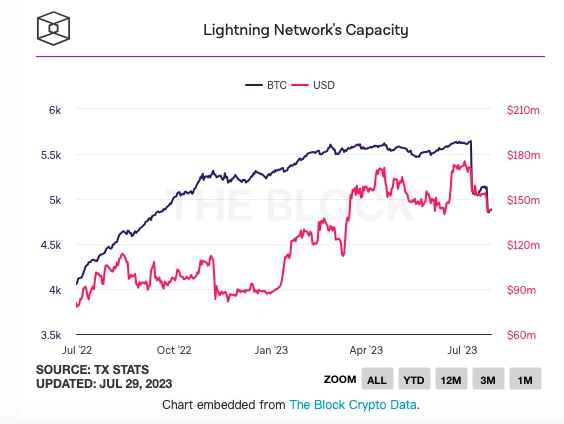

Data from The Block shows that earlier this month, the Lightning Network capacity reached 5,640 BTC, worth $175.2 million, reaching a new all-time high. These highs surpassed the previous peak set in April and then fell back in July.

Medium of exchange or store of value?

Lopp also delved into the narrative of Bitcoin as a medium of exchange and store of value. While some believe Bitcoin should purely be a simple financial medium of exchange and have made some progress in that regard, particularly through the Lightning Network, the reality is that given the capital gains tax imposed on each use of Bitcoin for purchases, achieving regular payments may still be a long-term goal.

Others argue that Bitcoin is a long-term store of value that can help protect savings from the impact of inflation.

"I've always felt that you can argue which one is more important, whether it's a store of value or a medium of exchange, but I generally think the store of value market is much larger," Lopp said. "I mean, look at the entire payments industry, while they (Bitcoin users) do indeed handle a lot of funds back and forth, the actual value captured by that industry pales in comparison to store of value means like gold, real estate, or other types of assets."

"From my perspective, at least for people in first world countries, payment is not really a necessity," he continued, "but I do think that for people in countries without banking infrastructure, payment can be much more interesting. Although I cannot immediately tell you how big the market for such a system is."

"But allowing people to essentially skip traditional banking, like we've seen in Africa, where people skip landline-based internet and go straight to the mobile age. I believe we can easily see the same thing happen with their payment systems, where they never had traditional credit cards, and they might just use some kind of mobile-based encrypted payment system," Lopp added.

Casa's stance on Ethereum support

Casa helps users protect their crypto assets in multisignature wallets instead of single wallets, and in June expanded its support for Ethereum self-custody vaults, which was originally announced in November 2022. Despite criticism from Bitcoin maximalists, Casa stated that this move was in response to customer demand. "Support for Ethereum through smart contracts has become technically reasonable in recent years, aligning with market demand," the company said at the time.

When asked about the impact on customer growth, Lopp said, "We're still in the depths of a bear market, so everything is in a standstill, but I think we're ready for the market recovery."

"We have many customers who already hold Ethereum, perhaps they use different solutions or maybe they keep their Ethereum on exchanges or elsewhere, and they have been setting up their wallets and getting acclimated," he continued, "So for us, it's a matter of actual usage and demand. We receive all types of random one-off requests, but Ethereum, especially stablecoins, are indeed our customers' highest demand."

"We focus on helping people get access to what's most valuable to them, which often includes Bitcoin, Ethereum, and stablecoins," Lopp said.

Are stablecoins Casa's next target?

As one of the most needed features for Casa customers, stablecoins are likely to become the next asset supported by Casa's solution.

"Yes, of course. That's the missing piece," Lopp said, "People may feel uncomfortable using fiat currency on the blockchain or elsewhere. But I can speak for myself on this issue. I don't make many high-value payments, but when I do, I often choose wire transfers or stablecoins."

"If I find myself in a situation where I have to choose between the two, I would always choose stable coins because for me, it's just a matter of time. Making that decision is not difficult, for example, it would take me half an hour to an hour to fill out the paperwork for a wire transfer, and then it usually takes several hours to a whole workday to process it. But if I want to send a stable coin transfer, it only takes less than five minutes."

When discussing the transfer of stable coin issuance on Bitcoin to other blockchains over time, Lopp said it comes back to convenience.

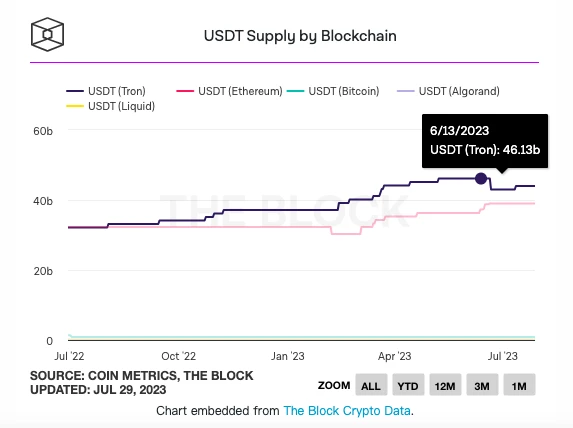

"Again, convenience is the real issue," Lopp said, "USDT was initially based on Bitcoin, but from a technical perspective, it is more cumbersome. USDT is currently also running on Liquid (a Bitcoin sidechain). But I think the network effects of Liquid limit its usage."

Ethereum and Tron currently dominate the market for stable coins like USDT.

Lopp continued, "When it comes to stable coins, I am a highly agnostic person. I have never sent a stable coin transfer on Tron, but I wouldn't be opposed to it because, at least for me, it's a quick in-and-out operation and I'm not looking for long-term value storage. I don't really care about high censorship resistance either. Just as long as the transfer can be done quickly and smoothly."

"Of course, stable coins themselves are a single point of failure," he added, "they have centralized issuers who often have the power to blacklist funds. I see their utility, and of course, many people adopt them, not just users in the first world, but I think we also see many people from third world countries prefer stable coins in many cases."

Casa is unlikely to return to Bitcoin hardware products

Lopp said that some people may still remember Casa nodes in the early adoption of the Lightning Network, but the company is unlikely to launch such products again. Due to complexity and limited demand from non-technical users, Casa would face challenges if it ventures into plug-and-play Bitcoin node business again. Considering the difficulties of maintaining and supporting hardware products, Casa will no longer offer such products.

"The main business of Casa is to solve complex problems and provide a user-friendly interface around it, guiding users on how to use the technology's best practices without having to understand everything that happens behind the scenes." Lopp said, "While I think we have done a good job in improving the UI of Bitcoin and Lightning Network nodes, the real difficulty we encounter is the complexity when you sell a piece of hardware, especially a network hardware, and deploy it into an unknown environment."

"Coupled with our preference for user privacy, we really don't know what will happen with these boxes placed in customers' homes." Lopp continued, "Therefore, inevitably, when they encounter some kind of problem, which could be network-related, a hard drive failure, or something else, from the perspective of after-sales support, it is very heavy and time-consuming, and then debugging at the engineering level (requires) trying to gain enough information to understand what went wrong, so that we can tell the customer what to do."

"So, while it is a good thing to empower people to run their own nodes, there are too many resources needed to help and maintain non-technical individuals to operate at this level, and I don't think people are willing to pay enough fees to support us to make a profit." he added.

"We are not the first and certainly not the last company to do plug-and-play, node-based devices." Lopp said, "Most of the projects before us are no longer in existence. I suspect that many of the projects currently running may not last long, unless they come up with some other business product lines that can help subsidize some additional resources and cost demands."

"In short, there weren't enough people willing to buy into this market from the beginning." he continued, "I may limit the number of people to around 10,000. So even if your market is fully saturated (which I think we are basically saturated), from the company's perspective, there is still a big problem, which is how do you grow this market?"

"This business is not easy," Lopp added.

Mysterious Bitcoin Memepool Activity Draws Attention

According to Lopp, over the weekend, the Bitcoin network experienced a total of 30 MB of transaction surge, with fees paid being approximately 10 times higher than necessary, causing severe congestion in the memepool and significantly increasing the cost of adding transactions to the next block, delaying users' transaction processing for hours or even longer.

Lopp, in an interview, has just begun to investigate the reasons behind this event - Coinspaid may have been targeted by a hacker attack. Coinspaid is an Estonia-based crypto payment processor that handles payments for several crypto gambling sites. This situation has caused some crypto gambling platforms to suspend withdrawals, leading to further speculation about potential hacker attacks.

Lopp said that Coinspaid may also be related to the Alphapo hack that happened at the same time. ZachXBT, the chain detective, said on Tuesday that Alphapo and Coinspaid attacks were carried out by the same group, and the North Korean hacker group Lazarus Group may be related to the hack.

Coinspaid initially remained silent about the matter, but finally confirmed on Wednesday night that it was attacked on July 22, resulting in the theft of $37.3 million. It also suspected that Lazarus Group was behind the attack, but assured users that the transactions were being reprocessed and customer funds were not affected.

Debate on Ordinals and Inscriptions

Earlier this year, Ordinals and Inscriptions on Bitcoin became increasingly popular, leading to an increase in transactions and fees, which sparked a debate on whether inscriptions representing NFTs and BRC-20 tokens should exist on Bitcoin.

Some believe that these factors are unintended consequences of the Bitcoin SegWit and Taproot upgrades, making inscriptions more economically viable and should be removed from Bitcoin. Others argue that this unexpected consequence is a part of any upgrade and should continue to be used as long as users comply with Bitcoin's rules.

"Embedding arbitrary data in the Bitcoin blockchain has always been possible," Lopp said, "Now, you could argue that the Taproot upgrade made it easier for developers to do so, and therefore, a creative developer wrote tools to make it easier for others to do so. But I think it’s fundamentally a question about how Bitcoin should be used."

"One perspective is more subjective, believing that we should only allow simple and pure financial transactions, and Bitcoin is just money. The other perspective is that Bitcoin is a programmable currency protocol that should be open to people as long as they operate within the rules," Lopp continued, "The subjective perspective is that we will choose arbitrary types of transactions that we don't like and call them spam. However, from a more technical and objective standpoint, which is where I stand, the entire anti-spam mechanism around Bitcoin is economic. If you pay a market price, a competitive fee for any valid transaction you post on the network, then you should expect to be able to get it into the blockchain."

Just as Lopp predicted, the adoption of these inscriptions gradually faded from people's sight after the initial hype wave, although they may be used as a symbol of luxury status in the future.

"The development of things is very similar to what I expected. This was an initial hype wave, and at least from the current market situation, people are not willing to pay too much for it. We are still in the depths of a bear market, so if you have patience, you can generally be spared from this hype," said Lopp.

"But in reality, I have always been saying from the beginning that this type of data storage on the Bitcoin blockchain may be one of the most expensive in any type of storage system in the world. So, I have never opposed this idea, but I always feel that even if you think it has indeed gained a lot of adoption, in the end, it will be downgraded to a more niche, more expensive type of data and art,"

"So what whales might be interested in is probably just showing off, like 'look, I bought all this expensive block space a long time ago,' maybe it will be ridiculously expensive in ten years, and then no one will be able to make such a big bet. And there's another cool thing, you can put it on your resume or boast about it. Art in general is a luxury item, right? It's like saying I own it, others can't, maybe that makes me feel better," he added.

Ultimately, Lopp believes that NFTs are more likely to be widely adopted on other cheaper and faster blockchains, but "it all comes down to demand," he admitted, "which is something I have never been good at predicting because what I'm interested in usually doesn't appeal to the mass market."

And the debate about inscriptions will undoubtedly continue for a while.