There is a special whale on the Bitcoin Rich List: "United States Government".

It currently owns 3 large Bitcoin addresses, ranking 5th, 8th, and 13th on the BitInfoCharts Top 100 Richest Bitcoin Addresses list (the ranking has changed for the 13th address as BTC has been transferred), with a total of approximately 205,539 BTC.

These Bitcoin addresses are all proceeds from illegal activities, involving the Bitfinex hack, the darknet Silk Road, and the Silk Road hacker James Zhong.

On March 14th this year, the United States Government sold a portion of the Bitcoin from one of these addresses, worth nearly $300 million. At that time, it caused a fluctuation of about -6% in the overall Bitcoin market. According to documents, the US Government plans to sell the remaining Bitcoin from that address again this year. This will be a key event that investors will be closely watching.

Now, let's take a look at the current situation of the United States Government's Bitcoin holding addresses. At the same time, let's predict the timing, quantity, and potential impact of the next public sale of large Bitcoin holdings by the United States Government.

Bitfinex Hack Case Address

The address with the highest number of Bitcoin currently held by the United States Government is: bc1qazcm763858nkj2dj986etajv6wquslv8uxwczt, second only to the cold wallet addresses of Binance, Bitfinex, and Robinhood.

The Bitcoin in this address was seized from the Bitfinex hack. On August 2, 2016, Bitfinex was attacked by hackers and approximately 120,000 BTC was stolen. Approximately 94,643 BTC has been recovered and deposited into this address by the United States Government on February 1, 2022.

Since the Bitcoin was deposited into this address on February 1, 2022, there have been no other transaction activities.

Important information about the address:

Balance: 94,643 BTC

Initial activity date: February 1, 2022

Incoming and outgoing transactions: Deposited 94,643 BTC on February 1, 2022

Silk Road Darknet Case Address

The address with the second-highest number of Bitcoin held by the United States Government is: bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6

Bitcoin in this address comes from the Bitcoin dark web Silk Road. The US government seized approximately 69,370 BTC from an unidentified hacker named "Individual X". The assets were confirmed to be related to Silk Road and were deposited into this address on November 4, 2020.

Since the deposit of Bitcoin into this address on November 4, 2020, there have been no other transaction activities.

The important information of the address is as follows:

Balance: 69,370 BTC

Initial active time: November 4, 2020

Transactions: Deposited 69,370 BTC on November 4, 2020

Silk Road Hacker James Zhong Case Address

The last address held by the US government with a large amount of Bitcoin is: bc1qmxjefnuy06v345v6vhwpwt05dztztmx4g3y7wp

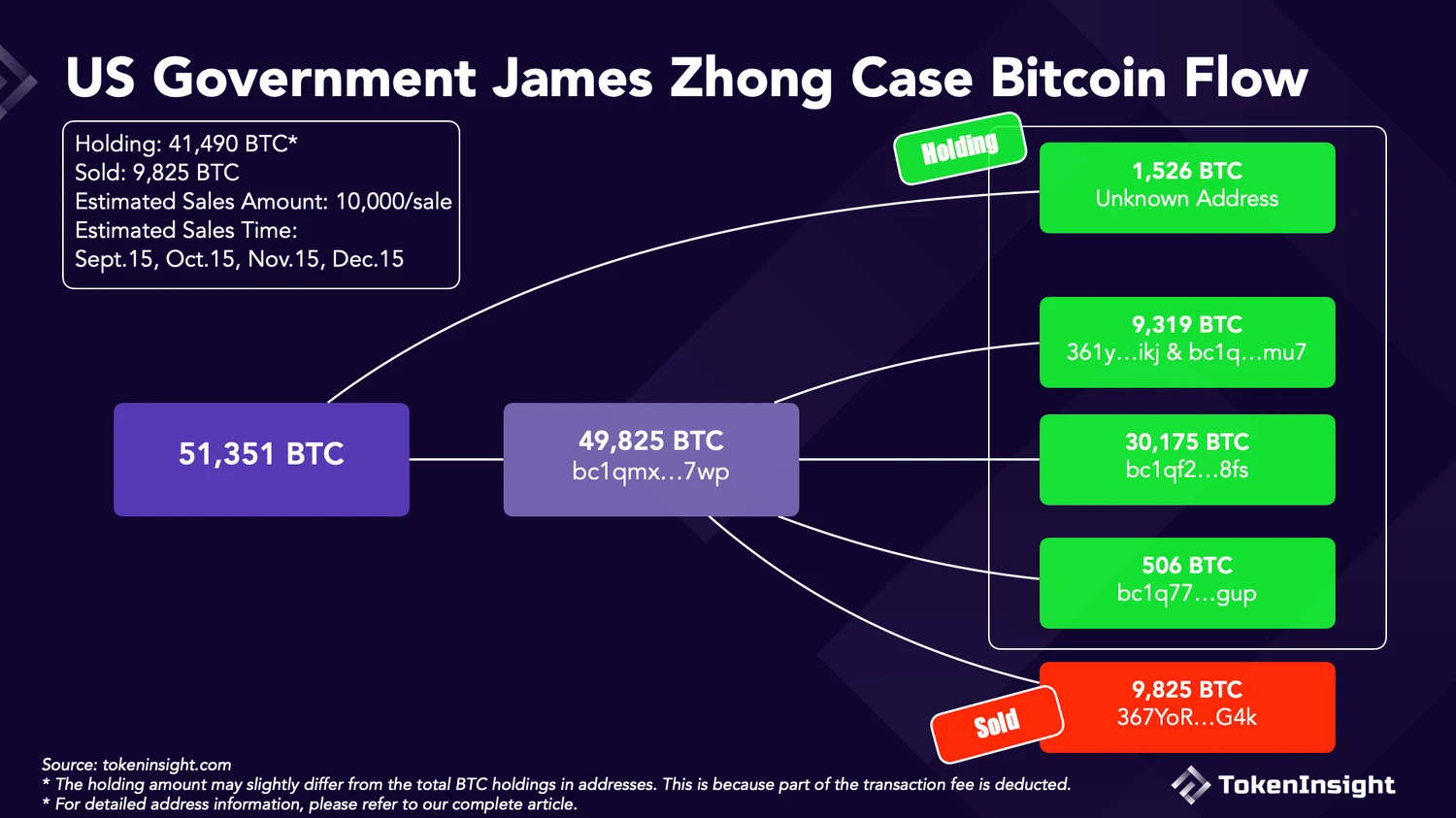

The Bitcoin in this address comes from the James Zhong Case related to Silk Road. The US government seized approximately 51,351 BTC from Silk Road hacker James Zhong, of which 49,825 BTC was sent to this address. The remaining 1,526 BTC was sent to another Bitcoin address.

Different from the previous two addresses, this address has had multiple outgoing transactions since the deposit of Bitcoin. The current balance has been cleared to zero.

According to the case file released by the United States Southern District Court of New York on March 31, 2023, the US government sold 9,861 BTC on March 14, 2023, with a net profit of approximately $215,522,416. The remaining 41,490 BTC will be liquidated in four batches by the US government within this year. The liquidation auction will be conducted publicly by the U.S. Marshals Service. However, the specific time and amount of the liquidation are not yet specified.

The important information of the address is as follows:

Balance: 49,825 BTC (previous) ➡️ 0 BTC (now)

Initial active time: March 26, 2022

Transactions:

Deposited 49,825 BTC on March 26, 2022;

Withdrew 9,000 BTC on March 8, 2023; Withdrew 40,000 BTC; on March 8, 2023;

Withdrew 319 BTC on July 12, 2023; Withdrew 506 BTC on July 12, 2023;

According to mempool.space's statistics, the two Bitcoin transactions withdrawn on March 8th were sent to 3 different addresses, as follows:

9,000 BTC was sent to an address in one single transaction. Subsequently, this amount was combined with the 319 BTC withdrawn on July 12th and transferred multiple times to internal addresses of the U.S. government.

40,000 BTC was split into 30,175 BTC and 9,825 BTC, which were sent to two addresses respectively. The 9,825 BTC was sent to an address at Coinbase address, and together with the 36 BTC later transferred, underwent clearing auction (totaling 9,861 BTC). The 30,175 BTC was sent to another address belonging to the U.S. government address, awaiting further clearing.

Flow of Bitcoin in the James Zhong case involving the U.S. government

Some Predictions

Sale Time and Amount Predictions

According to court documents, the US government has 4 more plans this year to sell the Bitcoin related to the James Zhong Case. Based on chain data, it is currently approaching mid-September, and the 4 addresses holding the James Zhong Case Bitcoin have no transaction activities. Therefore, we speculate two possible scenarios:

If the original selling plan is maintained, the remaining 4 months of this year, the US government needs to complete 4 sales, one in each of September, October, November, and December, with an average of approximately 10,000 per sale. According to previous sales times (2023-03-14), these 4 sales are likely to be scheduled in the middle of each month, namely September 15th, October 15th, November 15th, and December 15th.

If the US government does not conduct the first round of James Zhong Case Bitcoin sale in September, for the purpose of stabilizing the market, the US government is likely to postpone the sale plan and postpone the full liquidation of the remaining Bitcoin until next year.

Market Volatility Prediction

On March 8, 2023, the US government made two large Bitcoin transfers, totaling 49,000 BTC, to a new address. This includes 9,825 BTC sold to Coinbase. This raised concerns among investors about Bitcoin selling pressure, and the price of Bitcoin fell 6% from March 8 to March 10 (starting to recover on March 11). At the same time, the entire crypto market also experienced some fluctuations, with all major cryptocurrencies experiencing varying degrees of decline (around 2% to 6%).

Therefore, based on the above historical data, we speculate that the price fluctuation of Bitcoin caused by the remaining sales amounts being similar to that of March 8 would be around -2% to -6%.

Future Sales Plan Prediction

According to the US government's plan, all remaining Bitcoin in the James Zhong Case address will be sold. The next Bitcoin that may be sold is likely to come from another address related to the Silk Road. There are two specific reasons for this:

The Bitcoin in that address is also related to the Silk Road case. This case has been nearly 13 years old, and the case details are clear, and the main culprit, Ross William Ulbricht, has agreed to auction all the Bitcoin in that address by the US government.

Silk Road Case is the address currently holding the second largest amount of bitcoins by the US government. After the liquidation of all bitcoins in the James Zhong Case, if there is a need for the liquidation of large amounts of bitcoins, it undoubtedly is the best choice.

Summary

Traders must pay attention to three bitcoin addresses owned by the US government: bc1qazcm763858nkj2dj986etajv6wquslv8uxwczt, bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6, and bc1qmxjefnuy06v345v6vhwpwt05dztztmx4g3y7wp

This year, the address of the James Zhong Case should be closely monitored: bc1qmxjefnuy06v345v6vhwpwt05dztztmx4g3y7wp

This year, the US government will liquidate the remaining bitcoins in the James Zhong Case address in 4 batches, totaling approximately 41,490.72 BTC

The estimated sale dates for the remaining bitcoins in the address are Sept. 15, Oct. 15, Nov. 15, and Dec. 15, at an average rate of 10,000/sale

Each sale of the remaining bitcoins could cause a price fluctuation of approximately -2% to -6%

The next address to be liquidated is most likely the Silk Road Case address: bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6