Crypto market secondary fund Metrics Ventures September market observation guide

The overall market was sluggish in September, with many indicators at the lowest levels for the year.Bitcoin and Ethereum chip data showed massive losses, chips were sold, and contract positions dropped significantly.

MVC buy operation.We made a modest buying move in mid-September, buying ~20% of our Ethereum position. The transaction price was around $1,600. This mainly refers to the following positive signals: after three months of fluctuations in chips, potential selling pressure has been released to a certain extent; market sentiment shows panic, etc.

The main contradiction in the market is still the lack of funds, this contradiction cannot be resolved now.

The monthly report Waiting for the fish to die in the wet market is a metaphor for our current investment strategy. Before determining the trend,We will be patient and wait for the real configuration point to appear.

This article is Metrics Ventures’ review and comments on the overall market conditions and market trends of the crypto asset market in September.

The title of this monthly report comes from a famous meme. An aunt went to the wet market to buy fish. She stood by the stall and kept staring at the fish. The vendor was puzzled and asked the aunt which fish she liked, why didnt she buy it? The aunt said The same fish costs 13 yuan for live fish and 3 yuan for dead fish. I am waiting for it to die. This is similar to the mentality of all the secondary investors who hold more coins in the market now. They sit on the sidelines and observe quietly, just waiting for the live fish to die. , will end up snapping up bargains.

Of course, our mentality is similar. The lively token 2049 conference in September was like a wet market. Some of the fish inside had turned white, and there were still some big and small fish that looked fat and fluttering. In fact, everyone They all know very well that they cant run around for much longer.

We carried out some position building activities in mid-September, mainly buying about 20% of the ETH position, and the average transaction price was around US$1,600, because the position building signals we have been observing have some marginal changes in sentiment and chip levels. .

From the chip level, we can observe that as the market declines, Bitcoin accumulates in the chip-intensive area of $29,000-$30,000, and begins to move to the $25,000-$26,000 line, indicating that before Because the Bitcoin ETF is surrendering intensively through expectations and the XRP/DCG litigation is expected to be positive, cutting off the meat and selling chips, and the amount of funds on the market provides a relatively supportive buying order. ETH also has corresponding chip characteristics. Currently, the proportion of ETH chips that have realized losses on the chain is close to 50%, which is similar to the characteristics of previous panic bottoms. It also shows that bloody chips at the spot level are being thrown out. (Through the observation of on-chain data, we also found that on September 10th and 11th, Arbitrum experienced a large-scale whale cutting behavior, with a general loss range of 30-40%. This also means that since June, large investors And the whales patience with the market has finally come to an end.)

From an emotional perspective, market sentiment also quickly turned pessimistic.

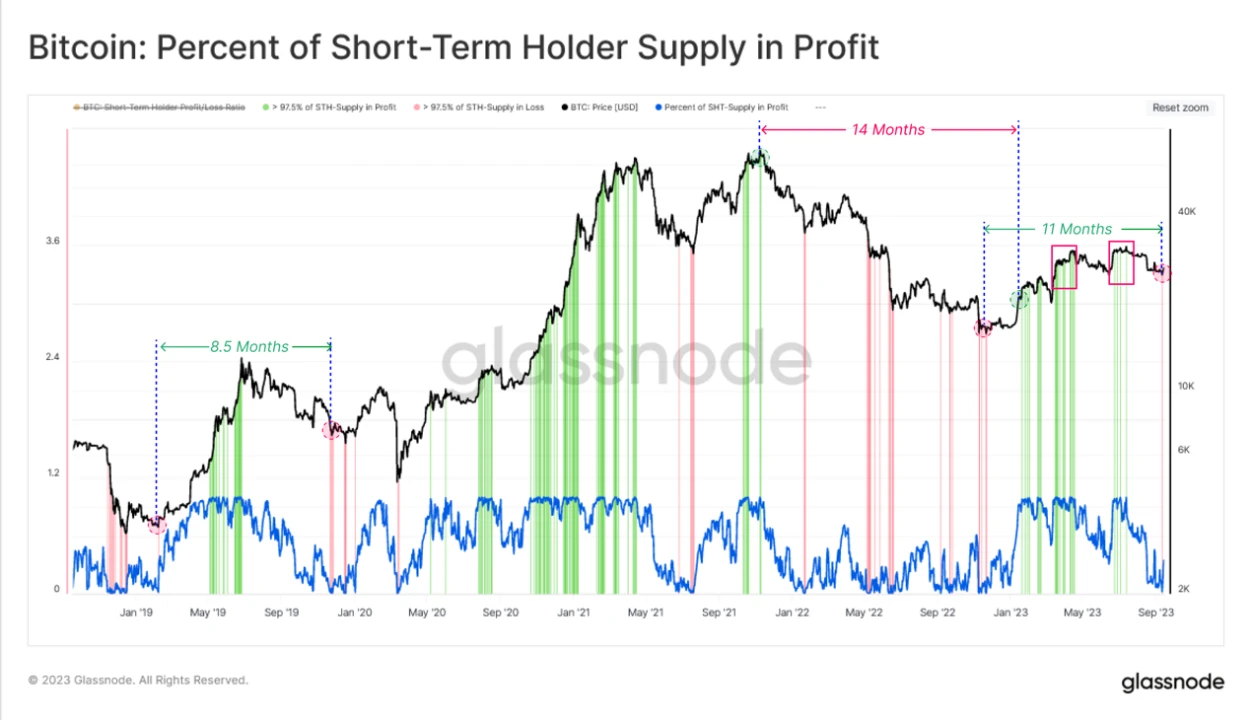

As can be observed from the picture above, after nearly 11 months of market correction, more than 97.5% of short-term BTC chips are in floating losses, falling from $30,000 to $25,000. The absolute drop does not seem to be huge. , but the pain of selling is actually very severe. Market clearing at this level should be able to buy about a month of market cooling-off period.

Observing from the contract position data, in early September, the BTC contract position of the Binance platform alone dropped from the peak of $4.81 B to $2.88 B, a drop of about 40%. At the most depressed moment of the market in early January 2023, this number was $2.5 2B. During the U.S. banking crisis in March, this figure was approximately $2.85 B, indicating that the failure of a series of positive expectations in September indeed greatly destroyed the confidence of players on the market, and the market leverage was relatively strong. Moreover, throughout September, the OI position of the contract recovered slowly, the fee rate was medium, and it was basically in a depressed mood where no one dared to go long or short.

If we look more carefully, we can roughly observe from the hourly trend of BTC in the figure below. The markets narrow fluctuations in September are really a hell mode for contract funds. The door-drawing phenomenon is frequent, and positions are liquidated when it rises and when it falls. , it rose first and then fell, and it was even liquidated repeatedly (poor). So in fact, it is obvious that the sentiment of Bitcoin at $27,000 is actually more depressed than the sentiment at $16,000. The characteristics of a deep bear are obvious. The entire September and even October are in the stage of shock digestion and selling pressure.

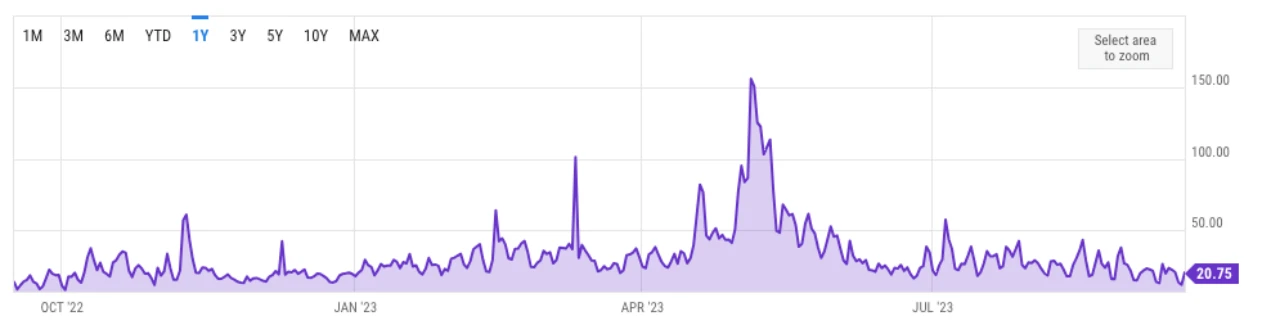

Not only is the spot and contract sentiment on the market depressed, but even the on-chain Meme market that extreme left-wing players in the industry like to speculate is completely cool. As shown in the figure below, the ETH network Gas base hit a new low during the year. ETH has rarely entered an inflationary state since the completion of Merge. Compared with the freezing point in December 2022, backtesting from the Mempool transaction data we monitored, there is no transaction tax code. The activity of the currency dropped sharply.

Not only that, in September 2023, the DEX trading volume has not yet exceeded 30 B, which is not as good as the 40 B in December 2022. It has also recorded a record low of DEX single-month trading volume since 2021 - this is also in line with our Intuitively feeling the market sentiment, the market enthusiasm for BTC at US$27,000 is actually more sluggish than when it was at US$16,000.

When we observed that the market was stuck and the market was cutting, and the mood was extremely depressed, we chose to enter the market to buy lows on a small scale. This does not mean that we believe that the market will have any significant rebound opportunities in the short term, but that the current position has released bloody spot chips (the proportion of chips that have realized losses is high), and the leverage cleaning is relatively thorough (positions are close to the lowest in the year, with more The short-to-short ratio is low), the sentiment is extremely depressed (the volume and energy are weaker), and the market has given a signal that it is inclined to take over. It is currently a position with a good risk-benefit ratio. As a long-term allocation, the price is reasonable, even if there is a possibility of short-term If there are signs of plummeting risk, we can also stop the loss at a price with clear goals and minimal cost.

When we observed that the market was stuck and the market was cutting, and the mood was extremely depressed, we chose to enter the market to buy lows on a small scale. This does not mean that we believe that the market will have any significant rebound opportunities in the short term, but that the current position has released bloody spot chips (the proportion of chips that have realized losses is high), and the leverage cleaning is relatively thorough (positions are close to the lowest in the year, with more The short-to-short ratio is low), the sentiment is extremely depressed (the volume and energy are weaker), and the market has given a signal that it is inclined to take over. It is currently a position with a good risk-benefit ratio. As a long-term allocation, the price is reasonable, even if there is a possibility of short-term If there are signs of plummeting risk, we can also stop the loss at a price with clear goals and minimal cost.

It happens that some screenshots about the BTC calendar effect have been widely circulated in the market recently. The main meaning is that the cryptocurrency market performance in October is very likely to be very good, and there will be a vigorous Alt Season. The calendar effect is a mystery, and we don’t have much optimistic expectations for the market in October.

At present, the market has barely breathed a sigh of relief from the reduction game. The total market value of the top five stablecoins has not dropped significantly in the past month. At most, it can be regarded as an upgrade to a stock game. In this case, the market is still mostly an oversold rebound, with limited room for upside, and the driving force for the rise is also at the spot level. Since all players on the floor generally have low positions, there is some buying power to cover shorts. Through market research, we found that secondary institutions and individual investors with capital of more than 100 million US dollars all choose to carry out small-scale bargain hunting with a fixed investment mentality.

If there really is a so-called alt season, due to weak market liquidity and low market capitalization, some short-covering funds may bring huge gains, but there will also be a large number of altcoins competing for funds from each other, resulting in a very rapid rotation of themes. It is violent, the market has poor sustainability, and it is estimated that it will not be able to produce considerable money-making effects. The value of participating in short-term trading is low, and if you dont escape quickly enough, it will become an unfortunate exit from liquidity.

The market has froze, with volatility hitting new lows one after another. The proportion of long-term chips that are locked up has slowly increased. Short-term investors have repeatedly chased higher prices and cut their flesh, leaving us with a dull feeling of being unable to get up or down - the markets insecurities. The main contradiction is still the lack of funds, which cannot be solved now.

The core constraint of the main conflict still lies with the Federal Reserve. The Federal Reserve suspended an interest rate hike at its interest rate meeting in September, but the market interpreted it as that interest rates will remain high for a long time. During the National Day holiday, the U.S. government’s budget resolution for the new fiscal year was also closed. The key point is that U.S. bond yields have risen back to 2008 levels, U.S. stocks, gold and crude oil have plummeted, the U.S. dollar has risen, overseas markets have been severely shaken, and there are signs of tight liquidity. This is also the main consensus in the current crypto market. Those who have not lost money yet The whale players who are naked and staring at the fish pond from the sidelines are generally waiting for the collapse of the US stock market in 2023 Q4-2024 Q1, using the collapse of the US stock market or an interest rate cut as a signal to confirm that the fish has completely died (the ghost of 312 memory is echoing) .

We remain concerned about this, but would still like to emphasize that we will not rely on macro information to guide investment decisions in the crypto market starting in 2023. We are not macro experts. The end of the interest rate hike cycle does not mean the beginning of the interest rate cut cycle. Each interest rate cut waits for risks to appear before lowering it again and again. This is not an a priori signal; the end of each interest rate hike cycle , there will be a bubble bursting in some corner of the earth, and it is not necessarily the US stock market that will burst this time; whether it will collapse, and when it will collapse; all these are of little help to our shuttle decision-making.

In short, the market is short of money now, and we don’t know where the live money comes from for a while. What we need to face may be a situation where Bitcoin fluctuates infinitely sideways in the 15% fluctuation space. Fish, fish, when will you die?

To sum up, the cryptocurrency market remained in the doldrums in September and we remain cautious. Until market capital improves, volatility and shock may continue. We will continue to pay attention to the fundamentals, make timely allocations, and wait patiently for the real buying point.

about Us

Metrics Ventures, also known as MVC, is a data- and research-driven secondary market liquidity fund led by a team of experienced crypto professionals. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC cooperates with senior crypto community influencers to provide long-term enabling capabilities for projects, such as media and KOL resources, ecological collaboration resources, project strategies, economic model consulting capabilities, etc.

Welcome everyone to DM to share and discuss insights and ideas about the market and investment of crypto assets.

Please contact us at: ops@metrics.ventures.

Our research content will be published simultaneously inTwitterandNotion, welcome to pay attention.