Original source:Ebunker

Limited institutional interest in Ethereum amid bear market backdrop

Against the backdrop of the crypto bear market, six different Ethereum futures financial instruments officially began trading starting on October 2, but there is currently no renewed enthusiasm for ETH among institutional investors. The total first-day trading volume of the ETH futures ETF was less than $1.5 million, compared with more than $1 billion in first-day trading volume for the first BTC futures ETF (BITO) in 2021, according to Bloomberg data. In other words, the net inflow of funds into the ETH futures ETF on the first day was less than 2% of BITO.

Duong, head of Coinbase Research, believes that there are several main reasons for the above differences:

First, the market timing of ETF launches is different. Proshares’ BTC futures ETF was launched during the 2021 crypto bull cycle, when market liquidity was abundant, while the ETH futures ETF was launched during the current bear market cycle, which is severely starved of funds.

Secondly, investment advisors have different levels of familiarity. Investment advisors are generally more familiar with BTC, and BTC can be more easily integrated into their clients portfolios. ETH is generally considered a more complex investment product that is not well understood and accepted in the traditional investment community.

Third, changes in expectations at the legal level. Judge Katherine Polk Failla labeled ETH a crypto commodity in the recent Risely vs Uniswap court ruling. This may have raised market expectations for the ETH spot ETF, while the ETH futures ETF lost enthusiastic market response.

Judging from capital flows, the crypto bear market is still having a huge impact on institutional capital. According to Coinshares, there have been net outflows of funds in 24 of the 39 weeks since 2022, accounting for 61.5% of the entire period. Changes in institutional interest in cryptoassets can also be seen in fund flow data: ETH has seen $101 million in outflows this year as of October 4, while BTC has seen $219 million in inflows during the same time frame. However, BTC and ETH have seen relatively similar weekly net inflows recently, at $16.4 million and $12.9 million respectively.

Generally speaking, although the ETH futures ETF has been cold, its trading volume is still at a normal level for a new ETF, and it has also played a positive role in institutional investment interest. However, due to the bear market background and other reasons, the overall crypto market needs to turn around. Only after the market warms up can it attract more institutional capital inflows.

Potential Risks of Ethereum Staking

On October 5, JP Morgan released a research report pointing out the centralization problem of the Ethereum network, and pointed out that the ETH staking yield dropped from 7.3% before the Shanghai upgrade to 5.5%, which is in line with the traditional financial market that is still rising. Compared with the yield, ETHs attractiveness as an investment target has declined.

The report states that the top five liquidity staking providers Lido, Coinbase, Figment, Binance and Kraken control 50% of ETH pledged volume, with Lido accounting for almost one-third of the total ETH pledged volume.

Liquidity staking platform Lido is viewed by the cryptocurrency community as a superior alternative to centralized exchange staking platforms. Currently, in an effort to mitigate centralization risks, Lido has been expanding its list of node operators, aiming to prevent any single entity from controlling a majority of staked ETH.

In addition, in order to combat the centralization risk of the Ethereum blockchain, the Ethereum community began to promote distributed validator technology (DVT), such as SSV, Obol, etc. DVT allows multiple node operators to run a validator. This is done to reduce the risk associated with validators without impacting the blockchain.

Another concern raised by JP Morgan is the practice of rehypothecation of liquid pledged assets. This involves the issue of reusing liquidity tokens as collateral in various DeFi protocols. This practice could trigger a chain reaction of liquidations if the value of the pledged assets suddenly plummets, or is compromised due to a malicious attack or protocol vulnerability.

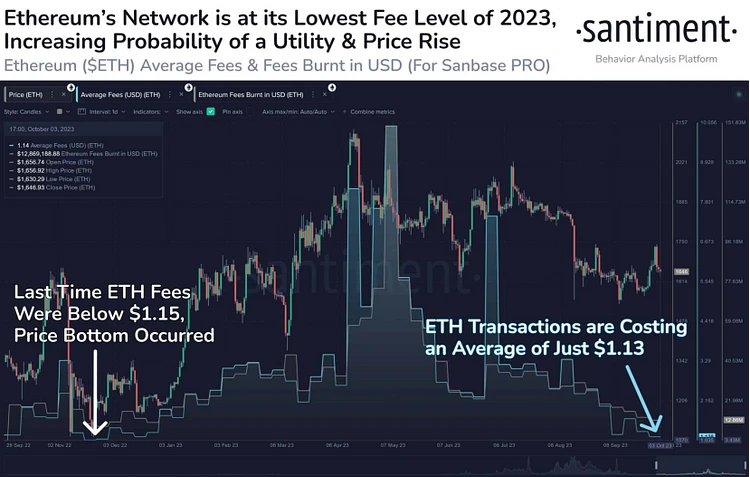

Ethereum gas fees hit bottom

Ethereum gas fees have fallen to their lowest level in nearly a year, according to on-chain analytics platform Santiment. The average cost of transactions on the Ethereum chain in the past week was only $1.13, which is significantly lower than in early May. It’s worth noting that the last time gas fees were under $1.15, ETH price was right at the bottom.

L2 is paving the way to scale Ethereum

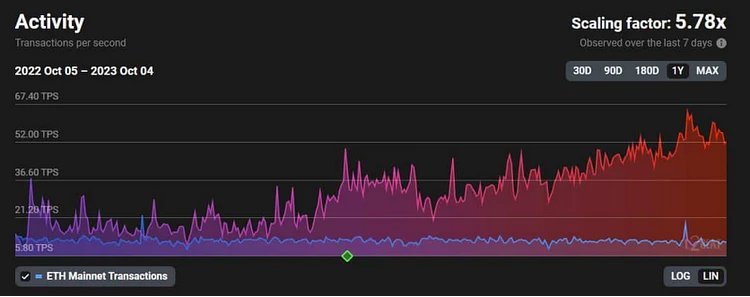

Ethereum gas fees have dropped significantly, related to the adoption of L2 scaling solutions. Due to its advantages in cost and efficiency, a large number of users have poured into L2, resulting in a significant increase in L2s block space demand.

According to data from L2Beat, deal activity for L2 scaling solutions saw a significant uptick in 2023. Judging from the data of the past week, L2’s TPS has reached 5.78 times that of the Ethereum blockchain.

In essence, L2 is fulfilling its original purpose of easing the transaction burden on the Ethereum main chain and assisting its expansion. Santiment believes that lower gas fees can promote the usage of the Ethereum network and attract more decentralized applications and smart contracts. In the long term, as the Ethereum network gains greater adoption, the price of ETH will also increase.

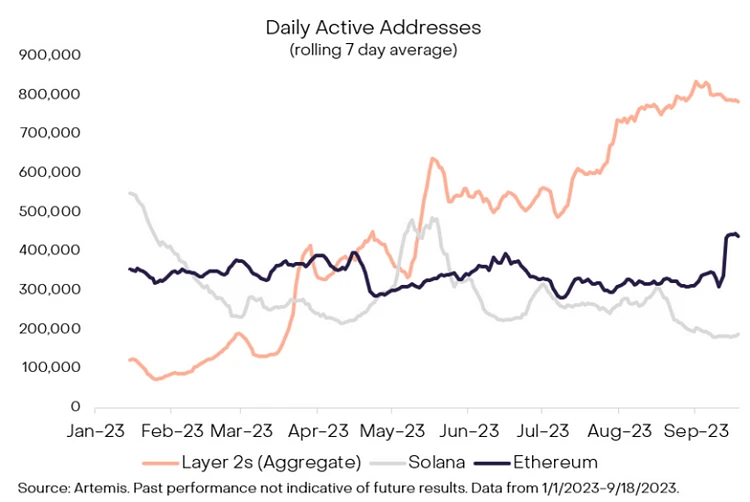

Recently, Grayscale Research Report also pointed out that L2 is paving the way for the expansion of Ethereum. From a functional point of view, L2 can enhance the scalability of Ethereum and reduce network costs for users by 100 times. Coinbase’s launch of BASE (Ethereum’s L 2 blockchain) in August this year also marked a strong endorsement of the Ethereum ecosystem and opened its decentralized applications to 100 million Coinbase users.

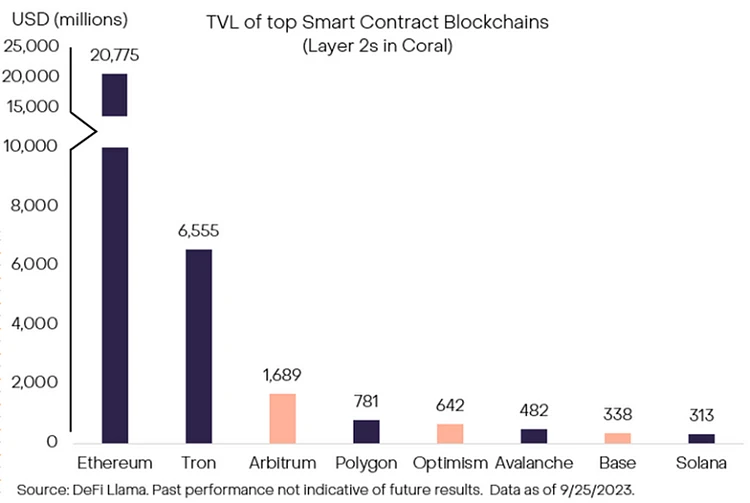

Coinbase is trying to clear the way for mass adoption of DAPPs based on its own Ethereum L2 BASE. If some alternative L1 fails to gain traction due to small security budgets and lack of liquidity, integration into Ethereum L2 may become a more attractive option.

Usage of Ethereum’s L2 scaling solution has been growing over the past year, with L2’s total daily active addresses surpassing the leading L1.

In addition to active addresses, Total Value Locked (TVL) is equally important and reflects the extent to which users trust their funds to a specific blockchain. The top-performing L2s (including Arbitrum and Optimism) all have higher TVL than Ethereum competitors L1 (Solana and Avalanche), which illustrates the markets general trust in the Ethereum ecosystem as a whole and the attractiveness of scaling solutions.

As the network scales, more activity will be moved to cheaper L2. In return, L2 accumulates value directly back into Ethereum. Specifically, for every transaction on L2, users pay a transaction fee. L2 keeps a portion of the fees (the current average profit margin is about 1/4), while Ethereum network validators capture the remaining 3/4.

For every transaction sent by L2, the Ethereum network also burns a small portion of the total supply of ETH. Therefore, incremental activity on Ethereum L2 directly accumulates value for ETH. If Ethereum’s L2 continues its positive development trajectory, they will solidify Ethereum’s position as the leading L1 blockchain.

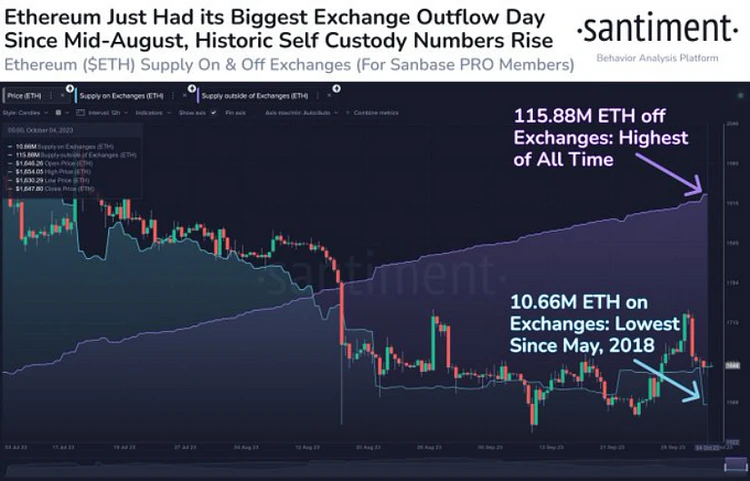

ETH balances on centralized platforms hit 5-year low

According to Santiment data on October 5, the number of ETH in cryptocurrency trading platforms has dropped to 10.66 million, the lowest value since May 2018. In contrast, 115.88 million ETH are stored outside centralized exchanges, the highest amount in history.

On October 4, approximately 110,000 ETH (valued at over $180 million) was withdrawn from the centralized exchange, which was the largest single-day ETH outflow from the centralized exchange since August 21. The above phenomena are generally regarded as the markets long-term optimism about the valuation of ETH assets, demonstrating investors long-term confidence.