Galaxy: If the spot Bitcoin ETF is approved, how big will the target market be?

This article comes fromGalaxy official blog, titled “Sizing the Market for a Bitcoin ETF”

Original author: Charles Yu

Odaily Translator - Nian Yin Si Tang

Approval of a U.S.-regulated spot Bitcoin ETF would be one of the most impactful catalysts for Bitcoin (and cryptocurrency as an asset class) adoption.

What Bitcoin ETFs Mean

Why is a Bitcoin ETF a better solution than current investment vehicles?

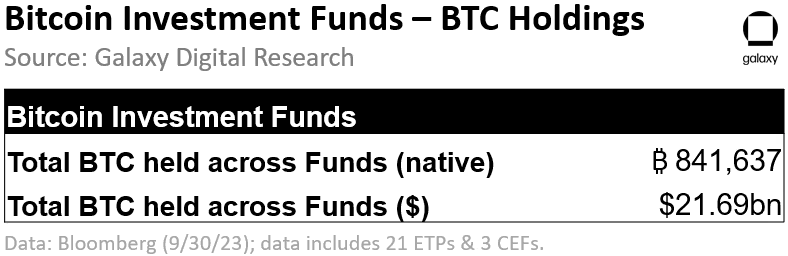

As of September 30, 2023, the total number of Bitcoins held by Bitcoin investment products (including ETPs and closed-end funds) was 842,000 Bitcoins (approximately $21.7 billion).

The disadvantages of these Bitcoin investment products for investors are obvious – in addition to high fees, low liquidity, and tracking errors, these products are inaccessible to a broad group of investors that represent a significant portion of wealth. Similar tracking inefficiencies exist for other investment options that add indirect exposure to Bitcoin (e.g., stocks, high-frequency trading funds, futures ETFs). Many investors are unwilling to deal with the administrative burden of owning Bitcoin directly, which involves wallet/private key management, self-custody, and tax reporting.

Spot ETFs may be suitable for any investor who wants to invest directly in Bitcoin without having to own and manage Bitcoin through self-custody, and offer a number of benefits compared to current Bitcoin investment products and options, such as:

Increase efficiency with fee, liquidity and price tracking.While Bitcoin ETF applicants have not yet listed fees, ETF fees are generally lower compared to hedge funds or closed-end funds, and a large number of ETF applicants will likely aim to keep fees low to remain competitive. A spot ETF will also provide greater liquidity because it can be traded on major exchanges, and it can gain exposure to Bitcoin by tracking the price of Bitcoin better than futures products or proxies.

Convenience.Spot ETFs can give investors exposure to Bitcoin through a wider range of channels and platforms, including a range of established providers that investors are already familiar with. It provides a more accessible channel for retail and institutional investors than direct holdings, which require a degree of self-education and have higher management costs.

Compliance.Compared to existing Bitcoin investment products, spot ETFs may meet more stringent compliance requirements set by regulators regarding custody setup, oversight and bankruptcy protection. Additionally, ETFs could provide market participants with greater price transparency and discovery, which could help reduce Bitcoin’s market volatility.

Why is a Bitcoin ETF important?

Bitcoin Spot ETFs Two main factors that may have a particular impact on Bitcoin’s market adoption are: (i) expanded accessibility to the wealth segment; (ii) formalization through regulators and trusted financial services brands Recognition, greater acceptance of Bitcoin;

-Accessibility

Expand access to retail investors and institutions.The range of Bitcoin investment funds currently available is limited and includes products primarily driven by wealth advisors or offered through institutional platforms. ETFs are a more straightforward, compliant product that will increase investment opportunities for more investors, including retail investors and high-net-worth individuals. Rather than relying on wealth management firms, ETFs can be used by a wider range of clients, including investing directly through brokerages or RIAs (which are prohibited from directly purchasing spot Bitcoin).

Distribute through more investment channels.Without Bitcoin investment solutions like spot ETFs, financial advisors/fiduciaries cannot consider Bitcoin in their wealth management strategies. The wealth management sector holds a large amount of capital that has been unable to directly access Bitcoin investments through traditional channels – with an approved spot ETF, financial advisors can start directing their wealth clients to invest in Bitcoin.

More opportunities for wealth.Baby boomers and earlier (age 59+) hold 62% of U.S. wealth, but only 8% of adults over 50 are invested in cryptocurrencies, compared with 25% of adults ages 18-49. % (data from Federal Reserve, Pew Research Center). Offering Bitcoin ETF products through a familiar, trusted brand may help attract more older, high-net-worth individuals who are not yet involved.

-Acceptance

Formal recognition/legitimacy from a trusted brand.Bitcoin ETF applications have been submitted by a large number of established financial firms - formal recognition/validation by these mainstream firms could improve perceptions of the legitimacy of Bitcoin/cryptocurrency as an asset class and could attract greater acceptance and adoption . According to Pew Research, of the 88% of Americans who have heard of cryptocurrencies, 75% are not confident in the way they currently invest, trade, or use cryptocurrencies.

Address compliance issues; regulatory clarity will attract more investment and development.SEC approval of ETFs could alleviate many of investors safety and compliance concerns because ETFs are regulated investment products with more comprehensive risk disclosures. It will also provide long-required regulatory transparency to market participants in order to conduct business in the crypto industry. A more developed regulatory framework will attract more investment and development, making the United States more competitive in the crypto industry.

Return/acceptance of BTC portfolios as an asset class.Bitcoin can provide diversification benefits and higher returns to investment portfolios, regardless of where the portfolio allocation is drawn from. To help guide investment management decisions, more retail investors and financial advisors are turning to model portfolios and automated solutions, which increasingly use ETFs and incorporate other asset classes to provide investors with more Multiple risks optimize returns. A longer track record could support the case for Bitcoin to be used in more investment strategies in investment portfolios.

How much inflow will Bitcoin ETF approval bring?

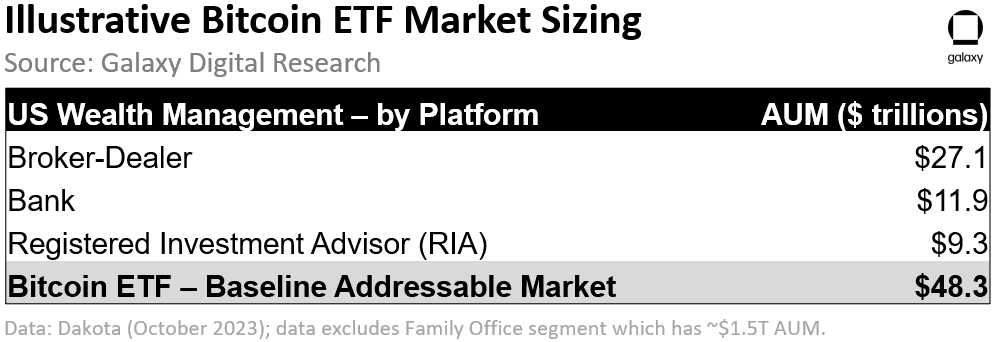

For the accessibility reasons noted above, the U.S. wealth management industry is likely to be the most accessible and immediate market from which an approved Bitcoin ETF will derive the most net new accessibility.As of October 2023, broker-dealers ($27 trillion), banks ($11 trillion) and RIAs ($9 trillion) had a combined $48.3 trillion in assets under management.

In our analysis, we applied $48.3 trillion as a baseline TAM among selected U.S. wealth management aggregators (excluding the family office channel that manages approximately $2 trillion), although the addressable market for Bitcoin ETFs (addressable The indirect impact of approval of the Bitcoin ETF could extend far beyond U.S. wealth management channels (e.g., international, retail, other investment products, and other channels) and could attract additional capital flows into the Bitcoin spot market and investment products.

(Note: While we employ a TAM-style analysis to estimate inflows into Bitcoin ETFs, we acknowledge that inflows into Bitcoin ETFs may also drive new net inflows rather than simply move away from existing allocations - so , applying percentage capture assumptions to the estimated TAM numbers does not fully reflect our view of how Bitcoin ETFs will be adopted, as it does not capture this new demand flow.)

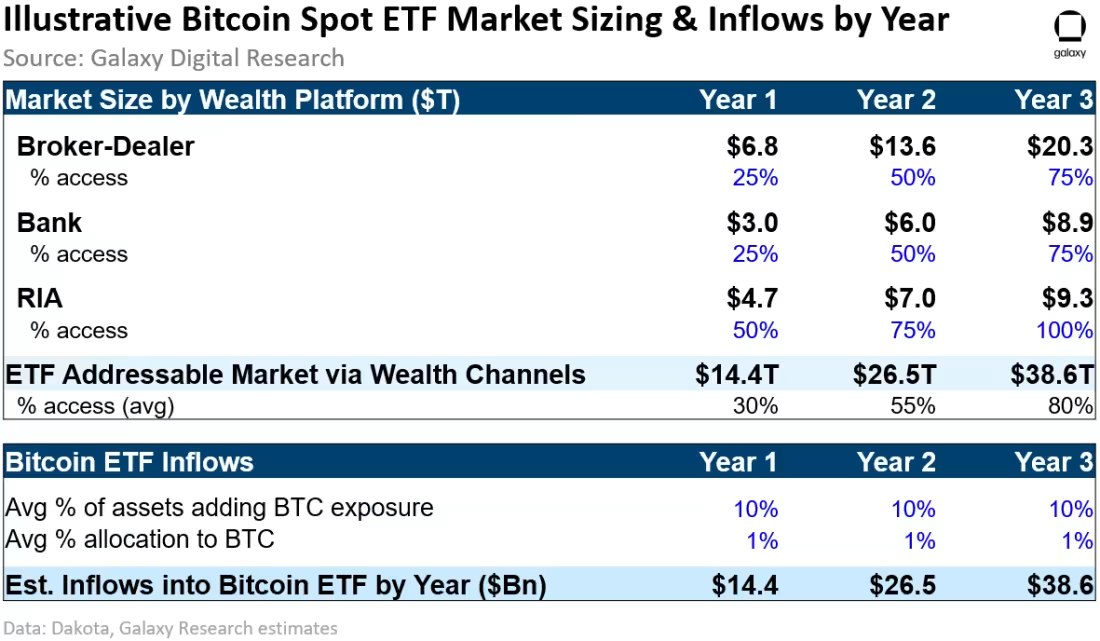

The entry cycle for Bitcoin ETFs in these areas is likely to last several years as channels open up. The RIA channel, which primarily consists of more sophisticated independent registered investment advisors, may be granted access earlier than advisors at banks and broker-dealers, and thus their share of initial access is larger in our analysis. For bank and broker-dealer channels, each individual platform will decide when to unlock access to Bitcoin ETF products for its advisors — with some exceptions, bank-affiliated financial advisors cannot offer or recommend specific investment products unless Obtain approval from the platform. Platforms may have specific requirements before offering new investment products (e.g., a track record of more than 1 year or AUM of a certain magnitude, general suitability issues, etc.), which will affect the entry cycle.

We assume the RIA channel will start growing at 50% in year one and increase to 100% in year three. For the broker-dealer and bank channels, we assume slower growth starting at 25% in the first year and steady growth to 75% in the third year.Based on these assumptions, we estimate the addressable market size for a U.S. Bitcoin ETF to be approximately $14 trillion in the first year after launch, approximately $26 trillion in the second year, and $39 trillion in the third year.

Based on these market size estimates, if we assume that 10% of available assets in each wealth channel are in Bitcoin, with an average allocation of 1%, we estimate that Bitcoin ETFs will see $14 billion in inflows in the first year after launch. It will increase to US$27 billion in the second year and US$39 billion in the third year. Of course, if the Bitcoin spot ETF application is delayed or rejected, our analysis will change due to timing and entry restrictions. Alternatively, our estimates may be too aggressive if poor price performance or any other factors cause Bitcoin ETF admissions or adoption to be lower than expected. On the other hand, we believe our assumptions about investment channels, exposures and allocations are conservative, so inflows may also be higher than expected.

Potential impact on physical BTC

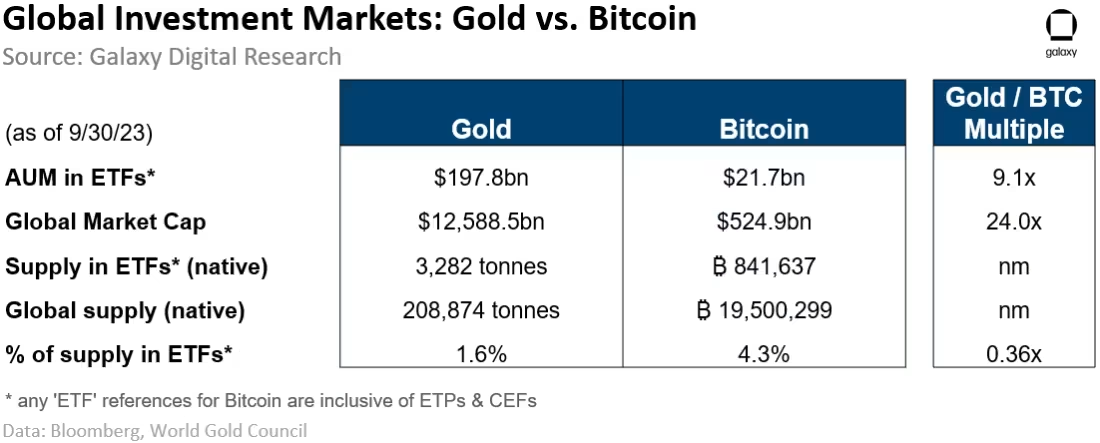

According to the World Gold Council, as of September 30, 2023, global gold ETFs held a total of approximately 3,282 tons (AUM of approximately US$198 billion), accounting for approximately 1.7% of gold supply.

As of September 30, 2023, the total number of Bitcoins held by investment products (including ETPs and closed-end funds) reached 842,000 (AUM approximately $21.7 billion), accounting for 4.3% of the total Bitcoin issuance.

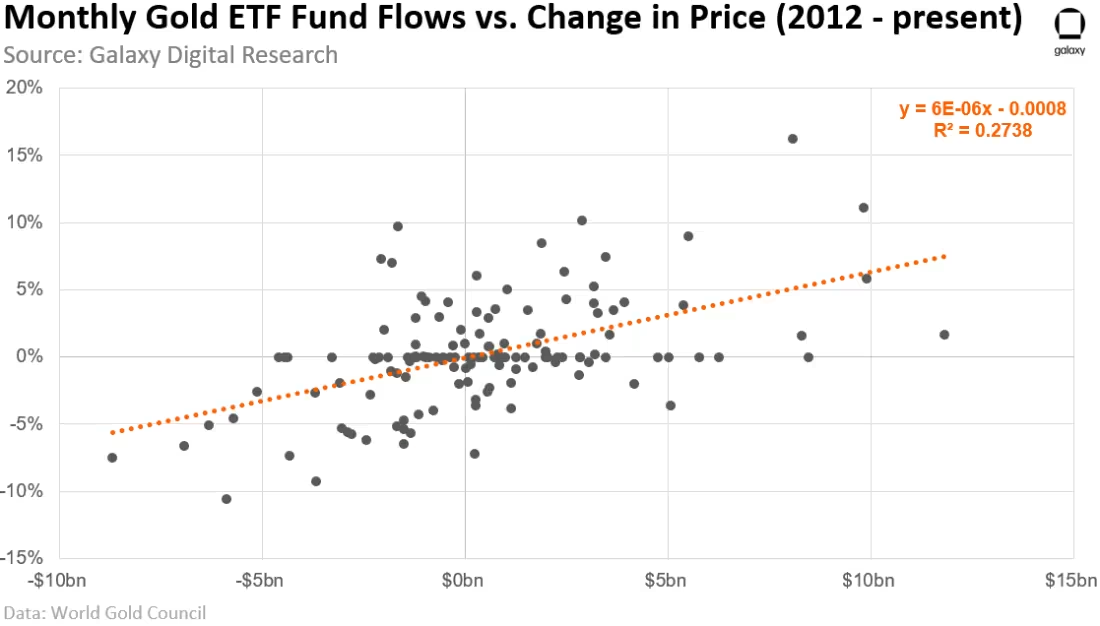

Compared to Bitcoin, the market capitalization of gold is approximately 24 times that of Bitcoin, while the supply of investment instruments is reduced by 36%, so we assume that equivalent US dollar inflows have an impact on the Bitcoin market compared to the gold market. The impact is approximately 8.8 times.

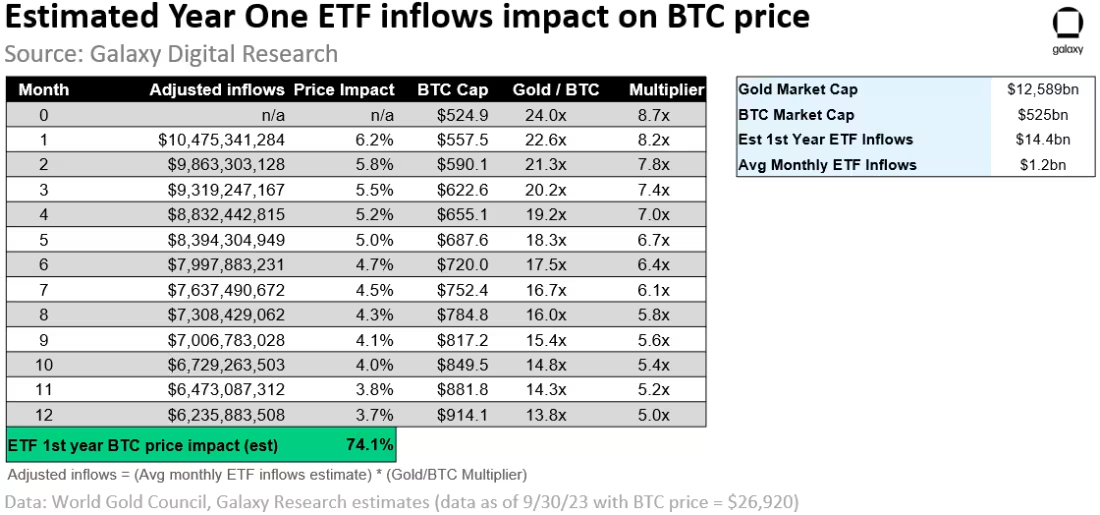

If we apply the estimated $14.4 billion in first-year inflows (about $1.2 billion per month, or about $10.5 billion adjusted using an 8.8x multiplier) to the historical relationship between gold ETF fund flows and gold price changes ,We estimate the first-month spot ETF price impact on Bitcoin to be +6.2%。

Keeping the inflows constant, but adjusting the multiplier downward each month based on changes in the gold/bitcoin market cap ratio due to rising bitcoin prices, we can see monthly returns gradually ramp up from +6.2% in the first month That dropped to +3.7% in the last month of the first year, resulting in an estimated 74% increase in Bitcoin price over the first year of ETF approval (using a September 30, 2023 Bitcoin price of $26,920 as a starting point).

ETF’s broader financial impact on Bitcoin market

The above analysis estimates potential inflows into U.S. Bitcoin ETF products. However, the second-order effects of a Bitcoin ETF being approved could have a larger impact on Bitcoin demand.

In the short term, we expect other global/international markets to follow the U.S.s lead and approve and make similar Bitcoin ETF products available to a wider range of investors. In addition to ETF products, a variety of other investment vehicles may add Bitcoin to their investment strategies (e.g., mutual funds, closed-end funds, private equity funds, etc.), spanning investment objectives and strategies. For example, Bitcoin exposure can be increased through alternative funds (such as currencies, commodities and other alternative funds) and thematic funds (such as disruptive technology, ESG and social impact).

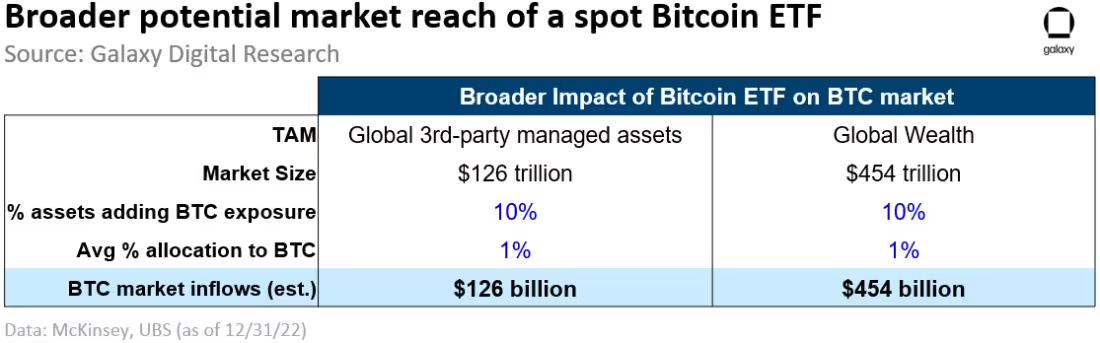

In the longer term, the addressable market for Bitcoin investment products is likely to expand further to all third-party managed assets (around $126 trillion in AUM, according to McKinsey) and even more broadly to global wealth (according to UBS data, which is US$454 trillion). Some believe that as Bitcoin monetizes, it will systematically reduce the monetary premiums applied to other assets such as real estate or precious metals, thereby significantly expanding Bitcoins TAM.

Based on these market sizes, and holding our adoption/allocation assumptions constant (10% of funds adopt Bitcoin, with an average allocation of 1%), we estimate potential new incremental inflows into Bitcoin investment products over the long term It will be between $125 billion and $450 billion.

in conclusion

Applicants have been seeking to list a spot-based Bitcoin ETF for a decade. During this time, Bitcoin’s market capitalization rose from less than $1 billion to $600 billion today (and as high as $1.27 trillion in 2021). During this period, global Bitcoin holdings and usage rose dramatically, with many different types of wallets, cryptocurrency exchanges and custodians emerging around the world, as well as traditional market access vehicles. But the United States, the world’s largest capital market, still lacks Bitcoin’s most effective market access tool—a spot-based ETF. Expectations are rising that ETFs will be approved soon, and our analysis suggests these products are likely to see significant inflows, driven primarily by wealth management channels that currently do not have access to safe and efficient Bitcoin exposure at scale.

Inflows from ETFs, the market’s narrative around Bitcoin’s upcoming halving (April 2024), and the possibility that interest rates have or will peak in the near term, all suggest2024 could be a huge year for Bitcoin。