Original author: Chen Zhitang

Recently, Ouke Cloud Chain Research Institute released a blockbuster reportGlobal Banking Crypto Map 2023, arousing widespread attention from the banking industry and financial regulatory agencies. By breaking down the encryption layout of more than 70 banks around the world, the report believes that with the increase in global adoption and the maturity of related technologies, crypto assets have become an innovative area that cannot be ignored or missed by the banking industry.

As a senior practitioner in a traditional financial institution, Mr. Chen Zhitang not only has decades of experience in banking, but also has in-depth research and unique insights into Web3 and encrypted assets. Coincidentally with Ouke Cloud Chain Research Institute, Mr. Chen Zhitang also believes that crypto assets are an unavoidable market for banks, and Hong Kong can become a testing ground for crypto asset innovation and continue to play the role of a bridge between the East and the West.

Based on his continuous research and thinking on virtual assets, Web3.0 and the banking industry, Mr. Chen Zhitang recently completed the article Thinking about Digital Transformation: Web3.0 and Banking. Mr. Chen Zhitang stated in the article that compared with virtual asset investment and RWA direction, stablecoins are most suitable for the nature of banking business and have the clearest entry path at present. Hong Kong banking entities can provide stablecoin-related services to individual customers by participating in the stablecoin business, and provide bank settlement services to qualified virtual asset service providers (VASPs). When the customer base increases, they can establish a quasi-SEN with reference to Silvergate bank. Payment settlement system.

In Mr. Chen Zhitangs view, banks participation in virtual asset layout can not only achieve brand promotion effects, but also improve customer structure and enrich revenue sources. More importantly, the introduction of virtual assets will completely reshape the banks product system. These thoughts are similar to the conclusions of the Global Banking Encryption Landscape 2023 report by the Ouke Cloud Chain Research Institute.

This article is published in a special edition for the benefit of readers.

A review of the Hong Kong government’s Web3 policy

The Hong Kong government is promoting the construction of a world virtual asset center with an unusual speed and attitude.

According to PANews, the Hong Kong government has introduced policy guidelines related to virtual assets since 2018. However, before 2023, the relevant policies did not attract a lot of attention from the market. After 2023, due to the Hong Kong government’s regulations on virtual assets and Web3 .0 Positive changes in policies. The Hong Kong government and institutions at all levels, including the regulatory agencies the Hong Kong Monetary Authority and the Hong Kong Securities and Futures Commission, have intensively launched various declarations and policies of practical significance, and promoted the implementation of virtual asset businesses at the practical level. These This initiative has greatly attracted the attention of Web3.0 industry participants around the world.

Hong Kongs policy on promoting virtual assets is particularly prominent in the context of Chinas strict ban on crypto asset trading and the United States strict supervision of virtual asset exchanges. Therefore, it is inevitable to speculate whether the Hong Kong government has communicated with the central government on the development of virtual assets. Furthermore, under the historical background of China-US decoupling, can Hong Kong continue to be an international financial center and rely on virtual assets to break the situation? The Hong Kong governments concerted policy advancement at least demonstrates the courage and determination of the rulers, and is very contrary to tradition. To the surprise of financial institutions and Web3 institutions, this also led to a rare situation where the Hong Kong Monetary Authority called on banks to open accounts for crypto asset service providers, but there were still few responders.

In the shadow of the policy, there are also cryptocurrency or stablecoin exchange shops in Hong Kong. The nature of the business of these money change shops is indistinguishable from the regulatory scope issued by the Hong Kong Monetary Authority and the Hong Kong Securities and Futures Commission, but I have never heard of money change shops needing to apply with the above regulatory agencies. This may have something to do with the fact that the regulatory agency for traditional currency exchange shops is the Hong Kong Customs and Excise Department.

Reactions and actions of different institutional entities towards virtual assets

In view of China’s strict virtual asset management policies, let’s first look overseas. Even after years of development, foreign institutions’ participation in virtual assets is still considered outside the mainstream. The three most famous institutions before 2023 are MicroStrategy, Grayscale Trust and Tesla.

MicroStrategy, Grayscale Trust, and Tesla were regarded as the vanes leading Bitcoin investment in the last bull market. Especially under Musk’s huge personal influence, the price fluctuations of Bitcoin, Dogecoin and other cryptocurrencies often coincided with horse racing. Sk’s Twitter content generates huge correlations.

In 2023, the cryptocurrency noise from traditional financial giants has re-attracted attention to the cryptocurrency market.

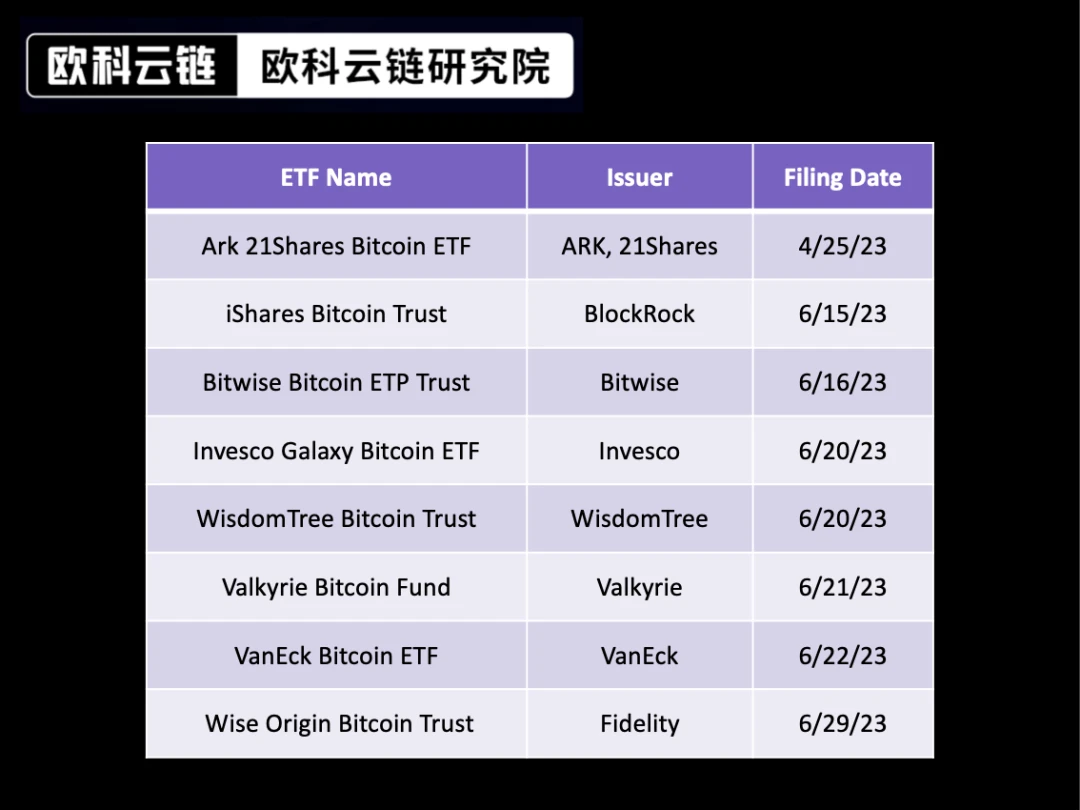

On June 15, 2023, BlackRock, the worlds largest asset management company, applied for a spot Bitcoin ETF to the U.S. Securities and Exchange Commission (SEC); since 2023, 8 large U.S. financial institutions have submitted Bitcoin spot ETFs to the U.S. SEC. ETF application.

On August 7, 2023, the American payment giant Paypal announced the launch of its stable currency PayPal USD (PYUSD), becoming the first technology giant to issue a stable currency. Patrick McHenry, chairman of the U.S. House Financial Services Committee, issued a statement saying, This is a clear signal that stablecoins (if issued under a clear regulatory framework) have the potential to become the backbone of our 21st century payment system.

The choice between the asset management giant and the payment giant demonstrates the attraction of virtual assets to the traditional financial industry. In the banking industry, both traditional commercial banks and modern technology banks have pioneers in active deployment.

In 2020, DBS Bank announced the launch of DBS Digital Exchange to create a comprehensive digital asset ecosystem for corporate and institutional customers and qualified investors. Services include: security token issuance, digital currency Transactions, and digital custody services, etc.

In terms of technology banks, even though Silvergate bank and Signature bank failed in this year’s U.S. dollar interest rate hike cycle, their successful experiences in the crypto-asset industry are still important examples for the banking industry to participate in the virtual asset industry.

Take Silvergate Bank, for example. The company didn’t start out in the cryptocurrency space, but actually started as a bank specializing in real estate financing. In January 2014, Silvergate Bank saw an opportunity where most banks were reluctant to provide virtual asset-related services, a situation very similar to the current situation in Hong Kong:

At the time, most banks were reluctant to touch virtual assets and would even close individual customers accounts if they were found to be transferring funds to or from cryptocurrency exchanges.

Buying and selling cryptocurrencies in USD is a 24/7 global activity, but buying and selling USD currencies requires using the traditional financial system, which is very slow and requires compliance with the official working hours of the clearing system.

Therefore, Silvergate Bank created a real-time payment system Silvergate Exchange Network (SEN) to facilitate cryptocurrency transactions, allowing easy transactions between bank accounts around the clock, and settling payment activities for both parties immediately and at any time, which is not possible with traditional banks after hours. Handling cross-border business is completely different, attracting a large number of institutional traders and cryptocurrency exchanges.

The SEN system allows customers to voluntarily deposit tens of billions of dollars without requiring Silvergate to pay interest at all, resulting in a large number of zero-cost and low-cost deposits. Silvergate Banks customer deposits have grown nearly sevenfold since 2017, to more than $11 billion at its peak.

Signature Bank has also developed Signet, a similar real-time payments system.

Even if both of the above-mentioned banks declare bankruptcy in 2023, the low-cost capital accumulation and profits that crypto-friendly banks can bring will be an attractive cake for every bank.

In Hong Kong’s local market, according to Bloomberg, ZA Bank, Hong Kong’s largest virtual bank, is promoting cryptocurrency and fiat currency exchange services. Yao Wensong, CEO of ZhongAn Bank, said in an interview on April 11 that ZhongAn Bank will act as a settlement bank, allowing customers to withdraw cryptocurrencies in Hong Kong dollars, U.S. dollars and other currencies after depositing crypto tokens on licensed exchanges.

This business model is already running on HashKey and OSL, currently two of the most well-known licensed cryptocurrency exchanges in Hong Kong. ZhongAn Bank will also provide the same services to other exchanges after they obtain licenses.

Participation directions that Hong Kong banking entities can choose

Judging from the policy orientation of Hong Kong and the business directions of large overseas entities, virtual asset investment, stable currency business, and real world asset tokenization (Real World Asset, RWA) are the three main business directions. From the perspective of banks, compared with virtual asset investment and RWA, stablecoins are most suitable for the nature of banking business and have the clearest entry path at present.

There are currently three mainstream development methods for stablecoins, namely asset-backed stablecoins represented by USDT and USDC, cryptocurrency-collateralized stablecoins represented by DAI, and algorithmic stablecoins represented by UST.

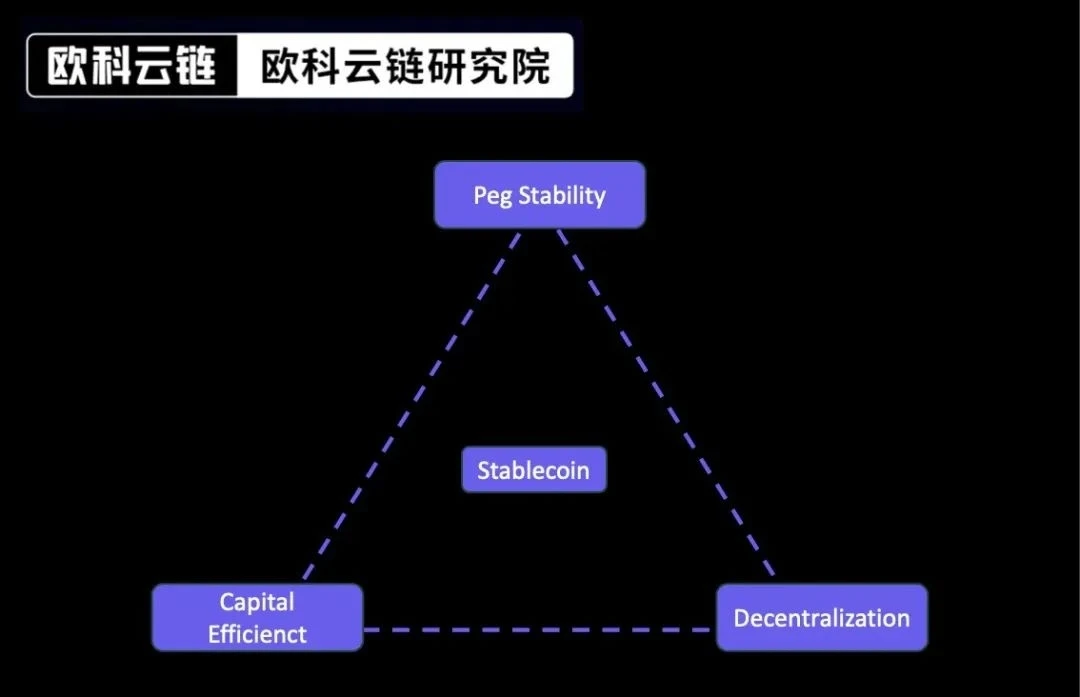

Each stablecoin design has its own unique flaws. In the industry, these trade-offs are often referred to as the “Impossible Stablecoin Triangle” because it is impossible to achieve all three features simultaneously in one design: peg stability, decentralization, and capital efficiency. The current situation is that stablecoin projects can only give priority to two of the three features. In other words, if a stablecoin project wants to gain advantages in two aspects, it must make compromises in the third aspect. all in all:

Asset-backed stablecoins, such as USDC and USDT, are known for their stability and capital efficiency, and are backed by 1:1 collateral, but they are all centrally controlled, which brings dependency risks, as we have seen with USDC Exposure to Silicon Valley Bank and the opacity of USDT.

Crypto-collateralized stablecoins like DAI bring stability and decentralization benefits, but they require higher collateralization rates for minting, making them less capital efficient than other options.

Algorithmic stablecoins, like UST, have the advantages of decentralization and efficient capital, and have a unique peg maintenance mechanism, but they all lack operational history, and their mechanisms have inherent problems, bringing potential risks of price instability.

Because of the above unstable triangle problem, stablecoins are also called the Holy Grail of Web3, and every stablecoin issuing company is seeking different solutions.

Judging from the policy guidance of the Hong Kong Monetary Authority, currently only asset-backed stablecoins are allowed to carry out business to ensure a 1:1 price linkage mechanism between stablecoins and legal currencies and avoid subsequent fluctuations. As for asset-backed stablecoins, USDT, as a stablecoin issued by an unregulated object, is bound to be excluded. Therefore, compliant stablecoin companies such as Circle and Paxos that have obtained regulatory compliance licenses will be banks preferred partners.

Business direction and profit analysis of banks choosing stablecoins

Banks participating in stablecoin business have the following business directions:

1. Provide stablecoin related services to individual customers

One of the most worthy of development scenarios in the crypto ecosystem is deposit and withdrawal channels. For individual investors, remittance and exchange services between legal currency and stable currency are the most needed, but currently, except for Zhongan Bank, no larger bank in Hong Kong has made a clear statement.

In fact, banks could gradually advance stablecoin services for individual customers.

The first is the remittance business between individual customers and compliant stablecoin issuing companies. The remittance business has the lowest compliance cost. The bank reviews the source of personal funds according to the current anti-money laundering/anti-terrorism requirements. The remittance also abides by the current anti-money laundering/anti-terrorism requirements. It is a traditional legal currency outbound remittance business.

The second is to receive U.S. dollar remittances (or other compliant legal currencies in the future) from individual customers from compliant stablecoin issuing companies. Since individual customers also need to undergo KYC/AML procedures at compliant stablecoin companies, the remittance bank of compliant stablecoins also performs KYC/AML procedures when remitting money. In theory, there is no difference from the current legal currency inward remittance business.

Finally, banks can consider corporate cooperation with compliant stablecoins to provide fiat currency and stablecoin exchange services for individual customers. In this model, compliant stablecoin companies exist as counterparties to banks.

2. Provide bank settlement services to qualified virtual asset service providers (VASPs)

The current market situation faced by banks in Hong Kong is the same as that faced by Silvergate Bank in the United States at that time. Banks are hesitant to provide bank accounts for VASPs. Even after two HKMA meetings, no bank is willing to make a clear stance. This is in any case Both are rare in a business type.

Banks can consider negotiating with Hashkey and OSL, two exchanges that have obtained licenses, to provide them with bank accounts. The main direction is remittance business with compliant stablecoin companies, and between individual customers and the two exchanges. Deposit and withdrawal business, and fund custody business if the exchange issues its own stable currency in the future.

3. As the customer base increases, establish a SEN-like payment and settlement system based on Silvergate bank

As the banks encrypted customer base increases, the bank can consider establishing a SEN-like payment and settlement system based on Silvergate bank. The system is similar in form to a banks clearing system. If all is cleared within the bank, the initial development cost will not be a huge investment for the bank.

In terms of bank income, it is reflected in:

1. Distinctive brand promotion effect

As announced by ZhongAn Bank, under the publicity of major media, those who dare to position themselves as a crypto-friendly bank will gain huge exposure and traffic. If it is a traditional small and medium-sized bank, it will be an excellent opportunity to reform its own image and enhance its own brand. Even if it is unable to carry out large-scale business due to compliance costs, it will maintain a distinct positioning and first-mover advantage in the industry.

2. Opportunities to improve customer structure

Investors in the virtual asset industry are mostly young people, especially Generation Z born after the 1990s. In the current situation where there are few crypto-friendly banks to choose from, banks that provide deposit and withdrawal services will strongly attract these young customers to open accounts. For traditional small and medium-sized banks that mainly serve middle-aged and elderly customers, it is a very good improvement for customers. Structure opportunities.

For corporate customers, taking the 150 customers who have settled in Cyberport as an example, a bank that claims to be cryptocurrency-friendly will achieve point-to-point marketing effects and attract customers from an industry to open accounts.

In terms of cross-border customers, under the background that trading of virtual assets is prohibited in China, opening an account in Hong Kong with the opportunity to trade virtual assets will be very attractive to Chinese residents. It is no exaggeration to predict that the purchasing objects of tourists visiting Hong Kong, from luxury goods in the past to insurance and time deposits now, will become virtual assets in the future.

3. Potential stablecoin profit opportunities

Putting aside simple exchange spread income (actually this part of the income is already very considerable), stablecoins currently have excellent profit opportunities.

Take USDT issuer Tether as an example. According to its 2023 Q2 report, the total assets of USDT have reached the current US$86 billion from 66 billion at the beginning of the year, of which more than 55 billion US dollar assets are used to invest in risk-free assets such as US bonds. , most of the profits come from this.

According to reports, Tether achieved profits of more than $1 billion in the Q2 quarter and $1.48 billion in the Q1 quarter. Tether is expected to earn $4 billion in profits this year. That’s more profit than global asset management giant Blackrock, which employs just over 50 people.

Taking Slivergate bank as an example again, its SEN system absorbs a large number of deposits at zero cost and low cost, providing a large amount of financial support for its investment in bonds and loans.

For small and medium-sized banks, they have great disadvantages in terms of funding sources compared with large banks. For example, they have disadvantages in settlement systems when competing for CASA deposits. They have disadvantages in loan pricing when competing for deposits from large blue-chip customers. In the interbank lending market, There is also the disadvantage of credit rating.

Therefore, if a large number of low-cost funding sources can be obtained through the virtual asset industry, it will provide strong support for banks to develop asset business, and the level of net interest margin will be improved.

4. The introduction of virtual assets will reshape the bank’s product system

The way virtual asset distributed ledgers operate will completely reshape the bank’s product system.

In terms of clearing and settlement, stablecoins running on the Ethereum network can completely operate without the traditional SWIFT system. Banks traditional clearing and settlement have a new way of integrating capital flow and information flow.

In terms of lending, personal loans based on cryptocurrency mortgages can improve the current personal credit products in the Hong Kong banking market. The personal credit products of Hong Kong banks are mainly personal credit loans and personal house mortgage loans. Even time deposits are 100% The process of pledged personal loans is also cumbersome and complex. Cryptocurrency mortgage loans based on DEFI technology or even Web2.0 technology can greatly release the liquidity of personal assets and also bring new asset types and income sources to banks.

Asset tokenization can bring interesting changes to bank payments. Taking time deposits as an example, if they are tokenized, holders can make external payments for part of the time deposits, and the payment comes with accurate interest, making the assets divisible, transferable and infinitely extensible.

In terms of bank customer KYC, if the concept of Soul Bound Token (SBT) is introduced, relying on the banks completed KYC results, customers can achieve unified identity authentication within the ecosystem formed by the bank and its partners through SBT.

The most traditional safe deposit box business has also undergone new changes after injecting the concept of virtual assets. For example, banks can provide customers with private key custody services.

All of this is because the concept of virtual assets has produced practical needs and far-reaching changes.

Risks and Choices

The banking industrys slow response to virtual assets is certainly due to traditional conservatism under strong bank supervision, but the following risk factors are also the reasons for banks indecision.

1. Compliance risks

Virtual assets have higher anonymity than traditional assets. Even for simple remittance services, it is difficult to identify the source of the customers funds. Under increasingly high anti-money laundering pressure, banks are facing additional anti-money laundering costs and potential anti-money laundering risks. Naturally he is unwilling to take the initiative.

In addition to calling on banks to provide account opening services, the Hong Kong Monetary Authority should actively discuss anti-money laundering standards for virtual assets with the industry. Supervisory authorities and the industry should jointly formulate direct, clear, and enforceable anti-money laundering guidelines for virtual assets to facilitate banks’ business operations.

2. Technology risks

Virtual assets have completely different operating methods, which have put forward new requirements for banks in preventing online fraud, key management, asset custody, etc. At this stage, when bank practitioners generally have not yet formed an understanding of crypto assets, the management of technological risks It is a huge challenge, and it has also caused banks to not easily get involved in virtual assets.

To carry out such business, banks not only need to form a talent reserve within themselves, but also need to form supporting services in the industry, such as technology companies with professional services, systematic asset custody companies, etc.

3. Strategic risks

The strict ban on virtual assets in China is one of the factors that Hong Kong banks must consider in their actions. Hong Kong banks basically have businesses or branches within the country, and Chinese banks needless to say. Therefore, Hong Kong banks not only need to consider Hong Kong’s local policies, but also need to take into account domestic policy risks.

The Hong Kong government should communicate and report to the central government and clearly convey information to the industry. Hong Kong banks carrying out virtual asset business in Hong Kong, if it complies with the regulatory framework of the Hong Kong government, will not violate relevant policies in China, so as to solve the worries of Hong Kong banks. .