Special analysis by Ouke Cloud Chain Research Institute: In the future, there will be a new era of crypto asset ETF compliance

Original author: Dr. Yi, special researcher of Ouke Cloud Chain, senior practitioner of traditional financial institutions, more than ten years of macroeconomic research experience, and nearly ten years of alternative asset investment research experience.

Since the market fell into a deep bear in 2022, various news has been difficult to make ripples, and even the management scale of Bitcoin futures ETF has stopped growing. However, the news that BlackRock applied for the issuance of a Bitcoin spot ETF caused a stir and quickly aroused market sentiment, and the discussion on related topics has remained high. Investors often refer to the historical development of gold ETFs and imagine the huge increase that the approval of Bitcoin spot ETFs will bring to the progress of the industry; on the other hand, Bitcoin will become increasingly important in the upcoming U.S. election in 2024. In order to win votes from the crypto community, the Republican Party has significantly softened its attitude; at the same time, the future of crypto asset spot ETFs deserves attention. Well-known asset management giants have quietly submitted applications for Ethereum spot ETFs, and players can also devote some of their energy to focusing on its progress.

1. Taking history as a mirror, we can see the rise and fall - tracing the origins of the development of gold ETFs

Recently, with the market’s eager expectations for Bitcoin spot ETFs, the current situation of Bitcoin futures ETFs is slightly bleak. The SEC has approved seven Bitcoin futures ETFs based on CME contracts, giving them a significant head start. However, due to problems such as slippage, transaction fees and futures premium caused by rolling positions, its holding costs are high and it is trapped in the dilemma of slow growth in management scale. As of now, its total AUM is still just over $1 billion.

Source: USA TODAY, Ouke Cloud Chain Research Institute

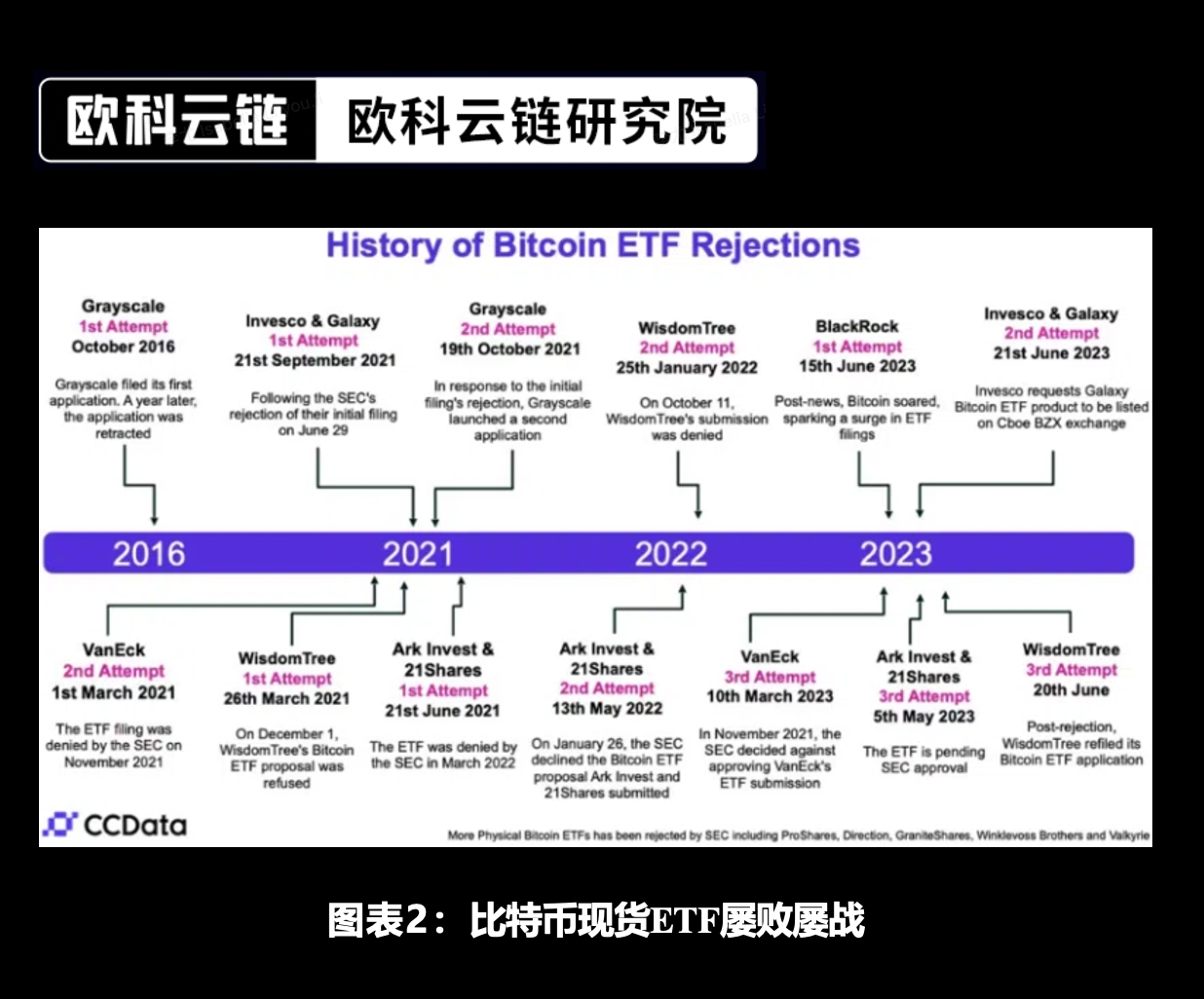

In comparison, Bitcoin spot ETFs do not suffer from the above disadvantages. On June 15, 2023, BlackRock, the world’s largest asset management company, submitted an application for the Bitcoin spot ETF iShares to the SEC. The giant’s AUM is nearly $10 trillion, and its brilliant record of 576 ETF applications approved 575 times has reignited the market’s hopes for the approval of a Bitcoin spot ETF. Later, many TradFi giants followed suit, including Wisdom Tree, Invesco, Galaxy, etc.

However, the SEC believed that BlackRock did not have sufficient conditions to apply and did not disclose the cryptocurrency exchanges that signed the Surveillance Sharing Agreement (SSA), so it rejected its initial application.

BlackRock subsequently designated Coinbase as an SSA partner and resubmitted its application in response to the SEC’s comments.

Source: CCData, Ouke Cloud Chain Research Institute

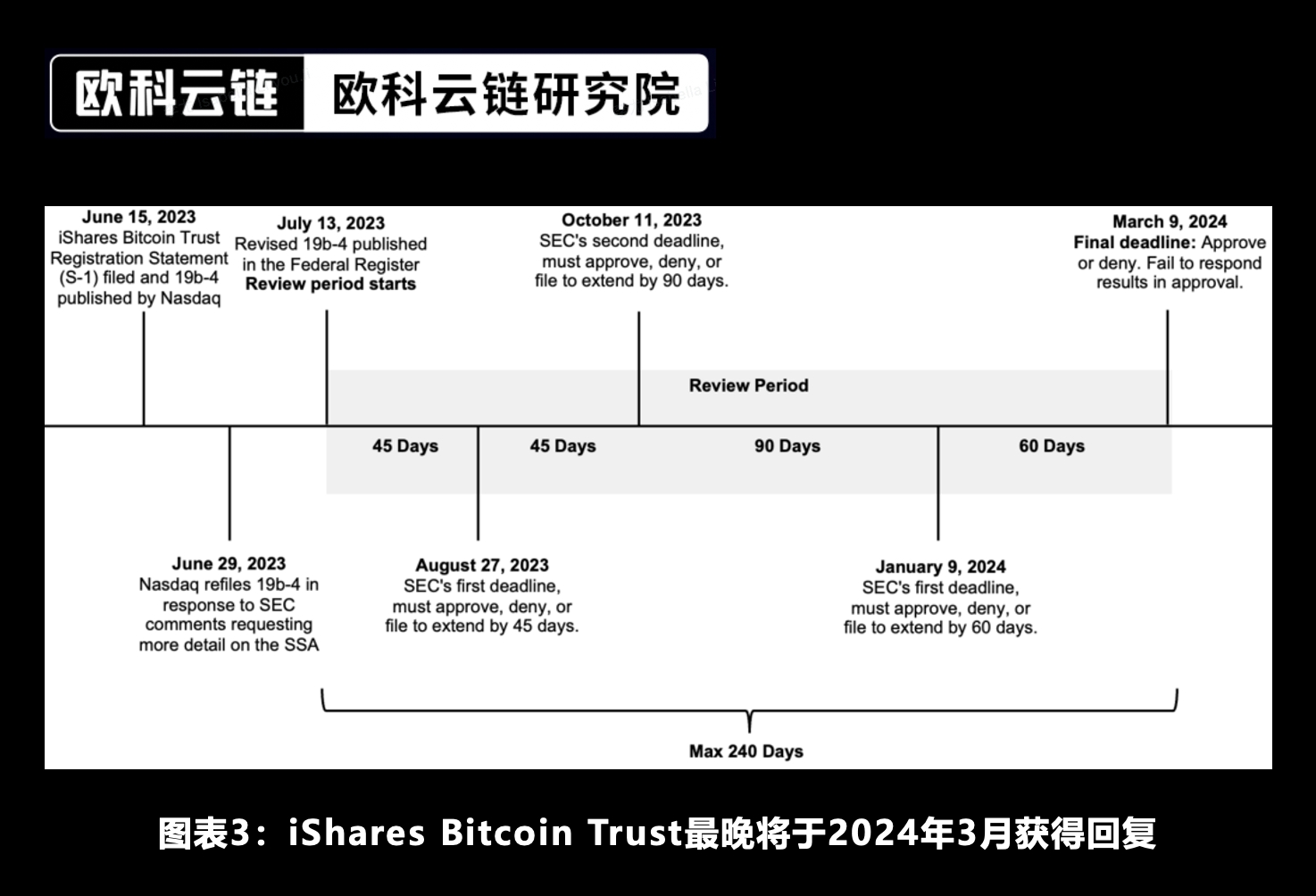

According to the SEC’s response deadline, its deadline to respond to iShares’ filing is March 9, 2024.

Source: GSR, Ouke Cloud Chain Research Institute

The results of iShares are inconclusive, but BlackRock’s CEO called Bitcoin the digital gold of the 21st century, so looking back at the history of gold ETFs is highly informative.

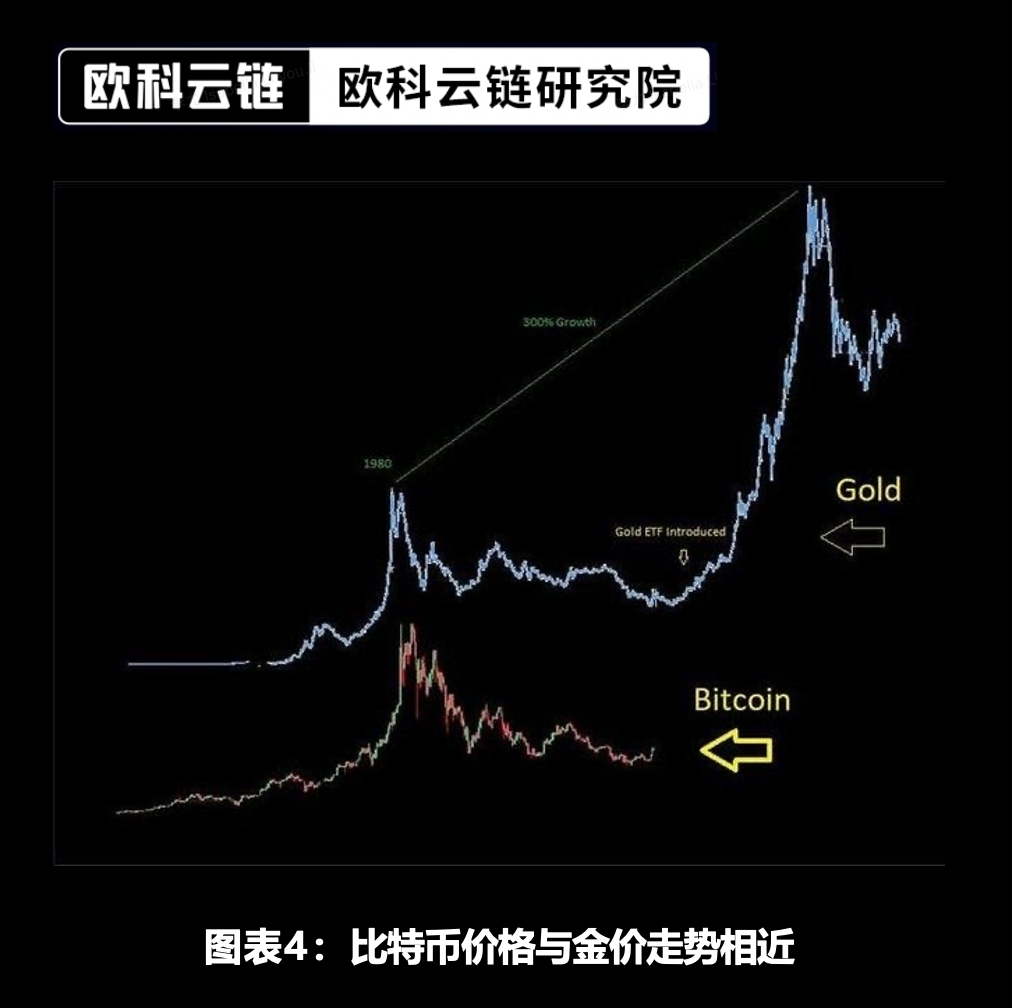

Analogous to the transformative impact of gold ETFs on the gold market, Bitcoin spot ETFs may trigger qualitative changes in the market. On November 18, 2004, the first gold ETF, SPDR Gold Trust ETF (GLD), issued by State Street Bank, was listed on the NYSE. This ETF significantly lowers investment entry barriers to the gold market and solves the problems of warehousing and transportation. History doesn’t repeat itself, but it may rhyme, and Bitcoin spot ETFs may spark the same revolution. Investors can hold Bitcoin for the long term through ETFs without having to worry about private keys and custody.

Based on price performance, gold ETFs have attracted a large number of new investors and incremental funds, thus driving the rapid growth of gold prices. From the listing of GLD to mid-2011, gold was basically on a continuous upward trend, reaching a peak in August, skyrocketing from approximately US$450/ounce to approximately US$1,900/ounce, an increase of more than 300%, and an average annual compound growth rate of approximately 8 %. GLD has fallen 45% over the past five years and into late 2020 before returning to those highs. It can be seen that more convenient market access and more transparent market mechanisms mean more investors, resulting in an overall steady growth in prices.

Source: Crypto Goose, Ouke Cloud Chain Research Institute

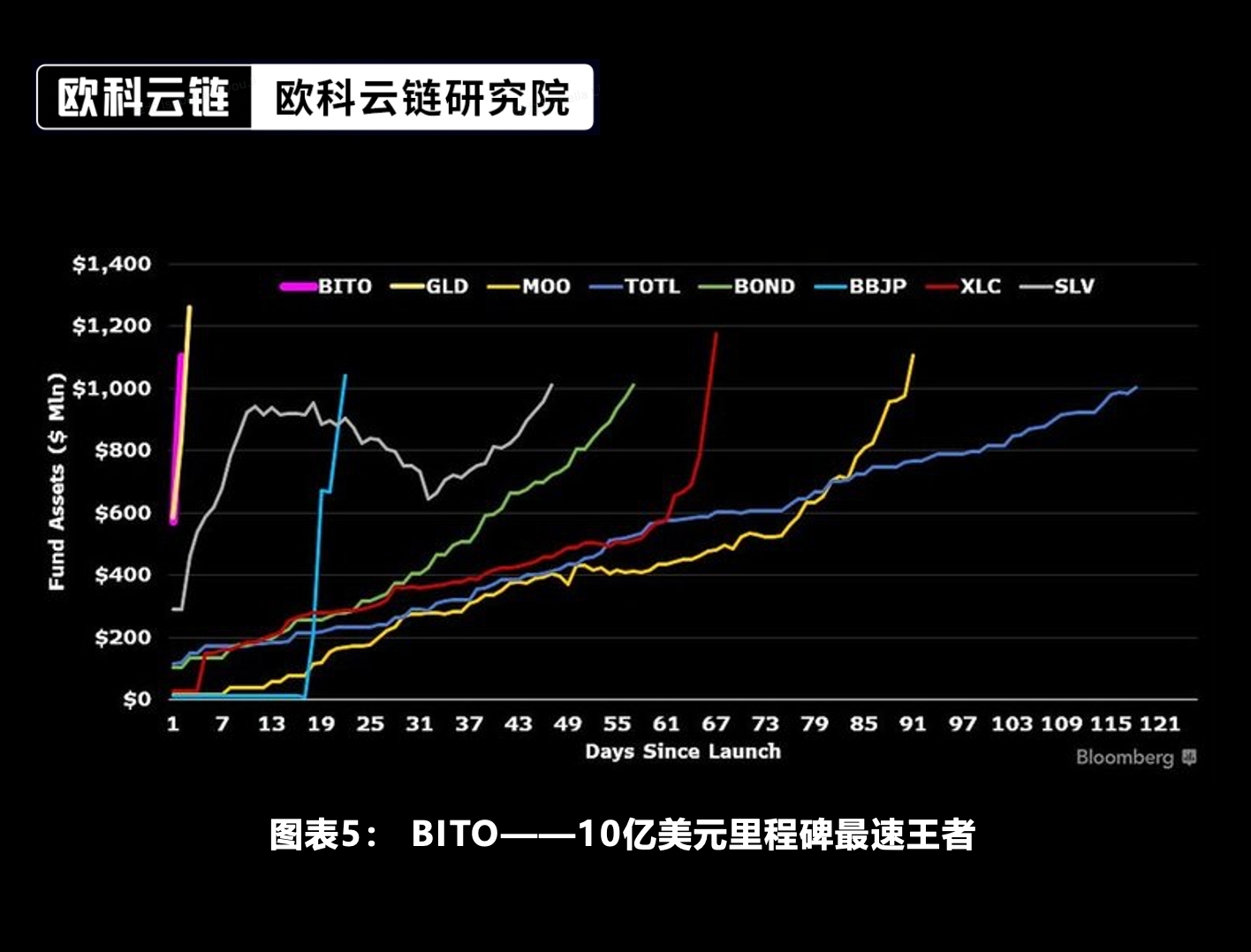

Extrapolating from the AUM growth rate, the Bitcoin spot ETF may set a new record. The first gold ETF hit $1 billion in AUM in 3 days, a record that stood for 18 years. Another ETF to reach that number in a short period of time is ProShares’ 2021 Bitcoin futures ETF BITO, which attracted $1 billion in liquidity in 2 days. Given that the Bitcoin spot ETF has many advantages, it is expected that it will have a high probability of breaking the record set by BITO again.

Source: Bloomberg, Ouke Cloud Chain Research Institute

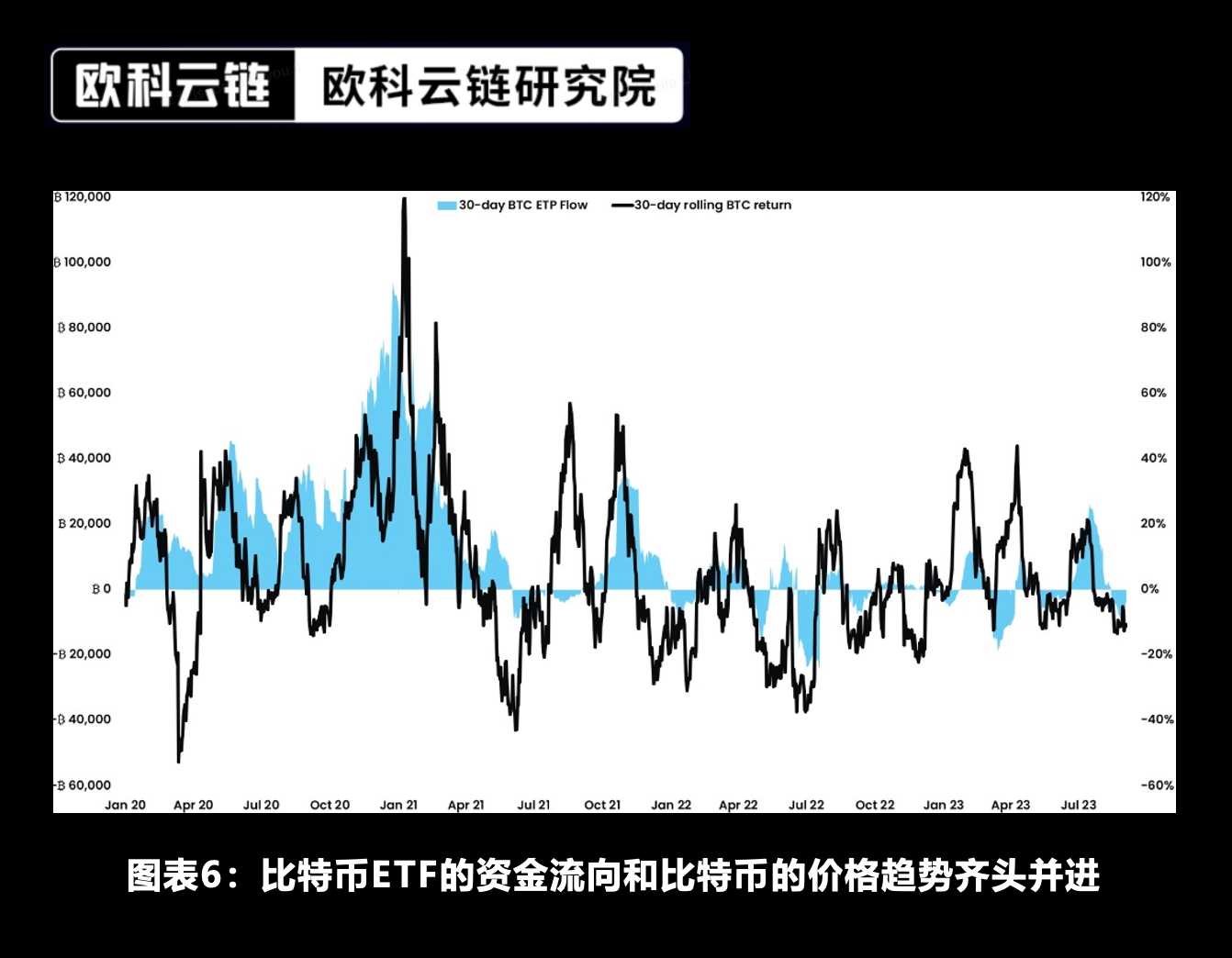

Quantitative changes in funding will also lead to a stronger Bitcoin price. When more and more money flows into ETFs, net buyers will provide strong momentum for Bitcoins price growth. Such relationships are particularly significant when extreme flows occur. The huge inflow of funds will strongly boost the market, while the continued outflow of funds will have a negative impact on the market.

Source: K 33 Research, Grayscale, Bloomberg, Bytetree, Ouke Cloud Chain Research Institute

2. Hidden political variables—U.S. presidential election

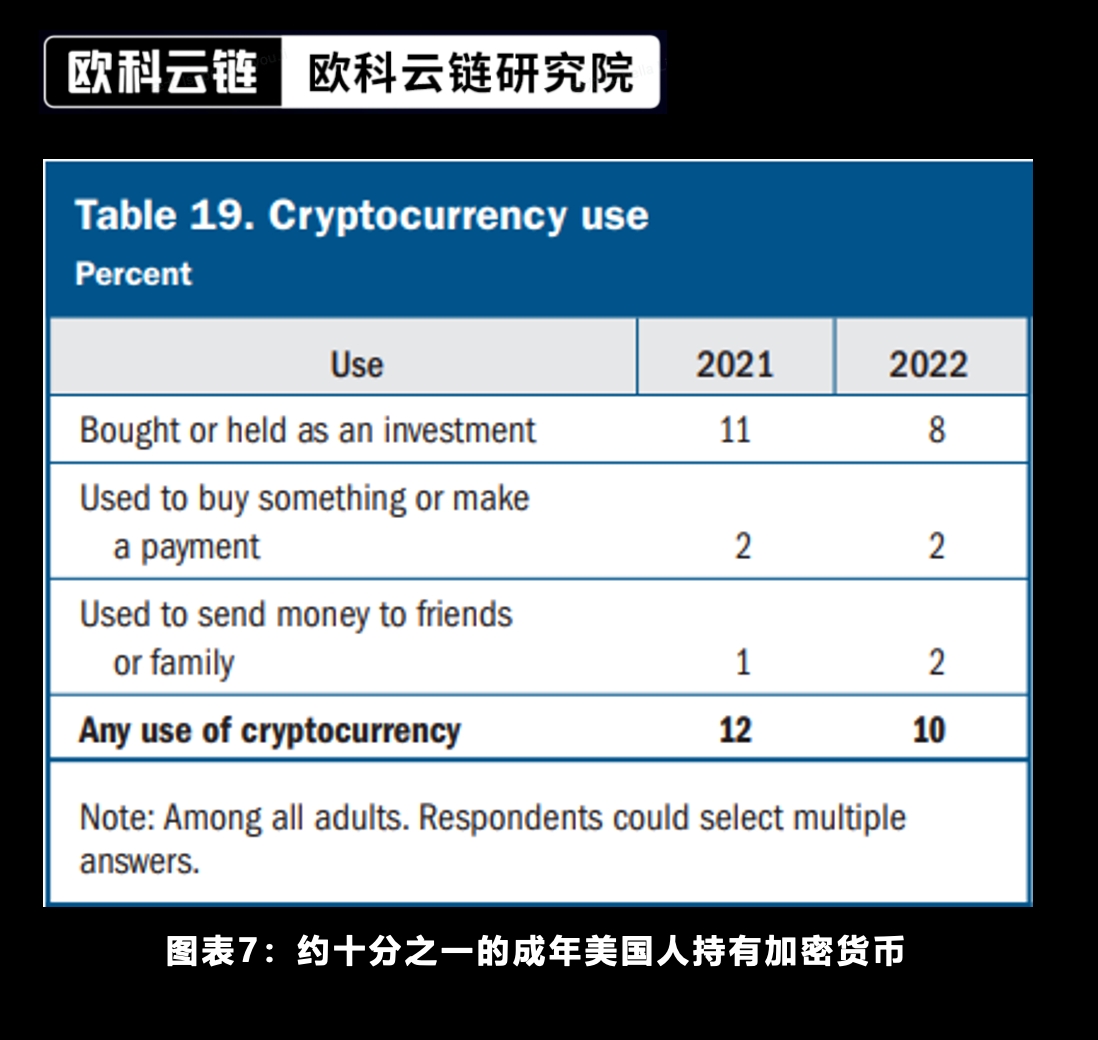

Since Bitcoin spot ETFs face extremely high regulatory risks, the presidential election will be a major political factor influencing the SECs decision. The Federal Reserve estimates that 8%-11% of Americans use cryptocurrencies, enough to influence the election.

Source: Federal Reserve, Ouke Cloud Chain Research Institute

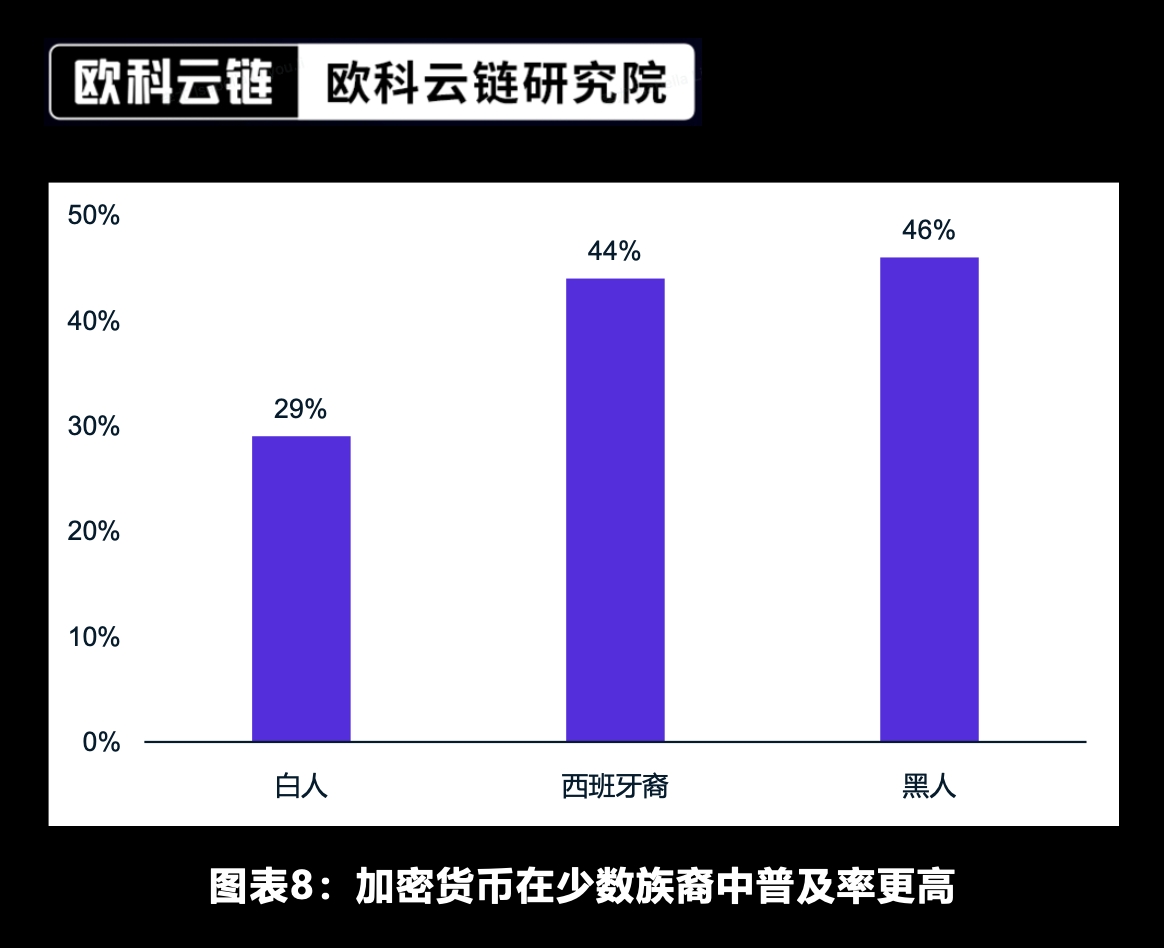

Among them, ethnic minorities are key voters in the presidential election. This becomes even more important when a candidate’s stance on cryptocurrency policy may directly impact portfolio performance. According to Plaid’s report “The Fintech Effect,” 44% of Hispanics and 46% of African Americans believe cryptocurrencies are more accessible than TradFi.

Source: Plaid, Ouke Cloud Chain Research Institute

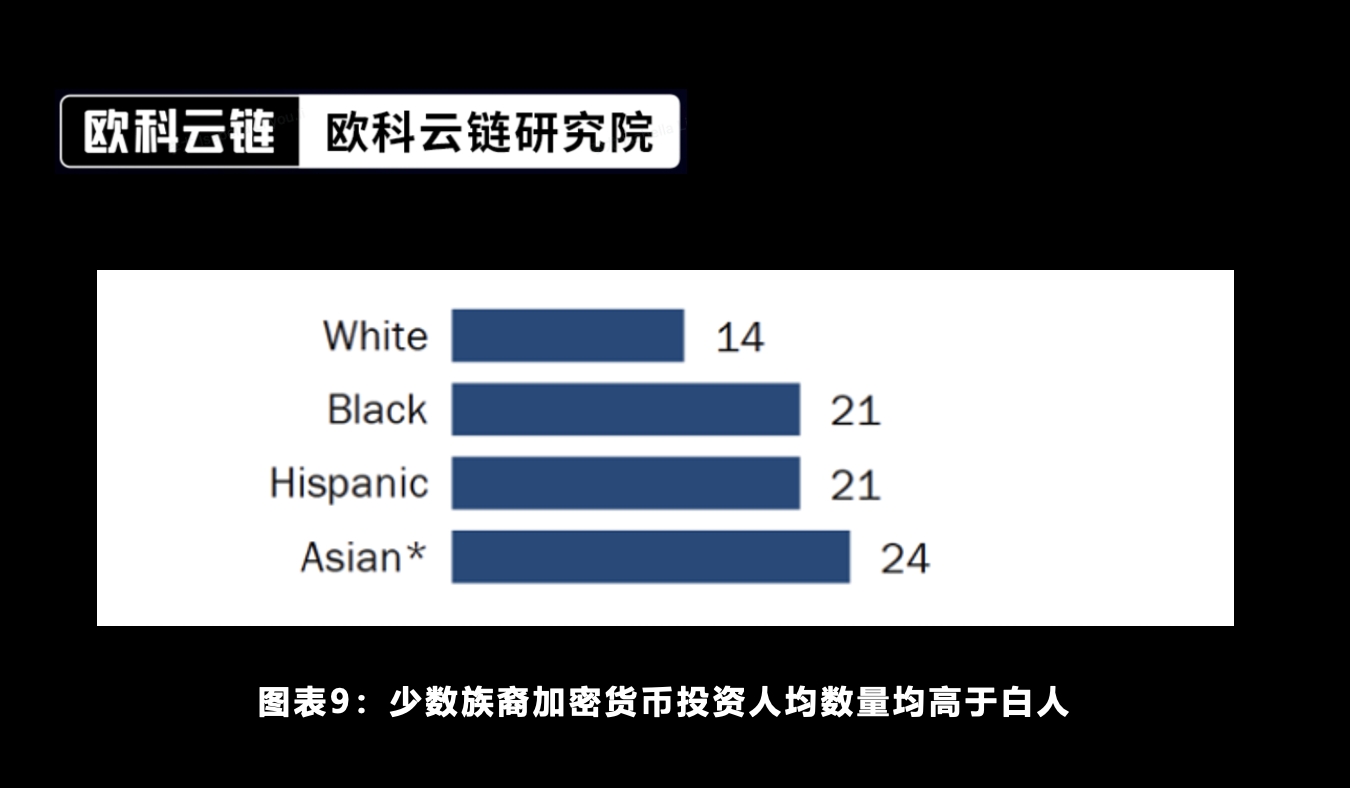

Meanwhile, comparative data from the Pew Research Center proves that cryptocurrency investing is the only asset class in which minority voters outnumber whites per capita.

Source: Pew Research Center, Ouke Cloud Chain Research Institute

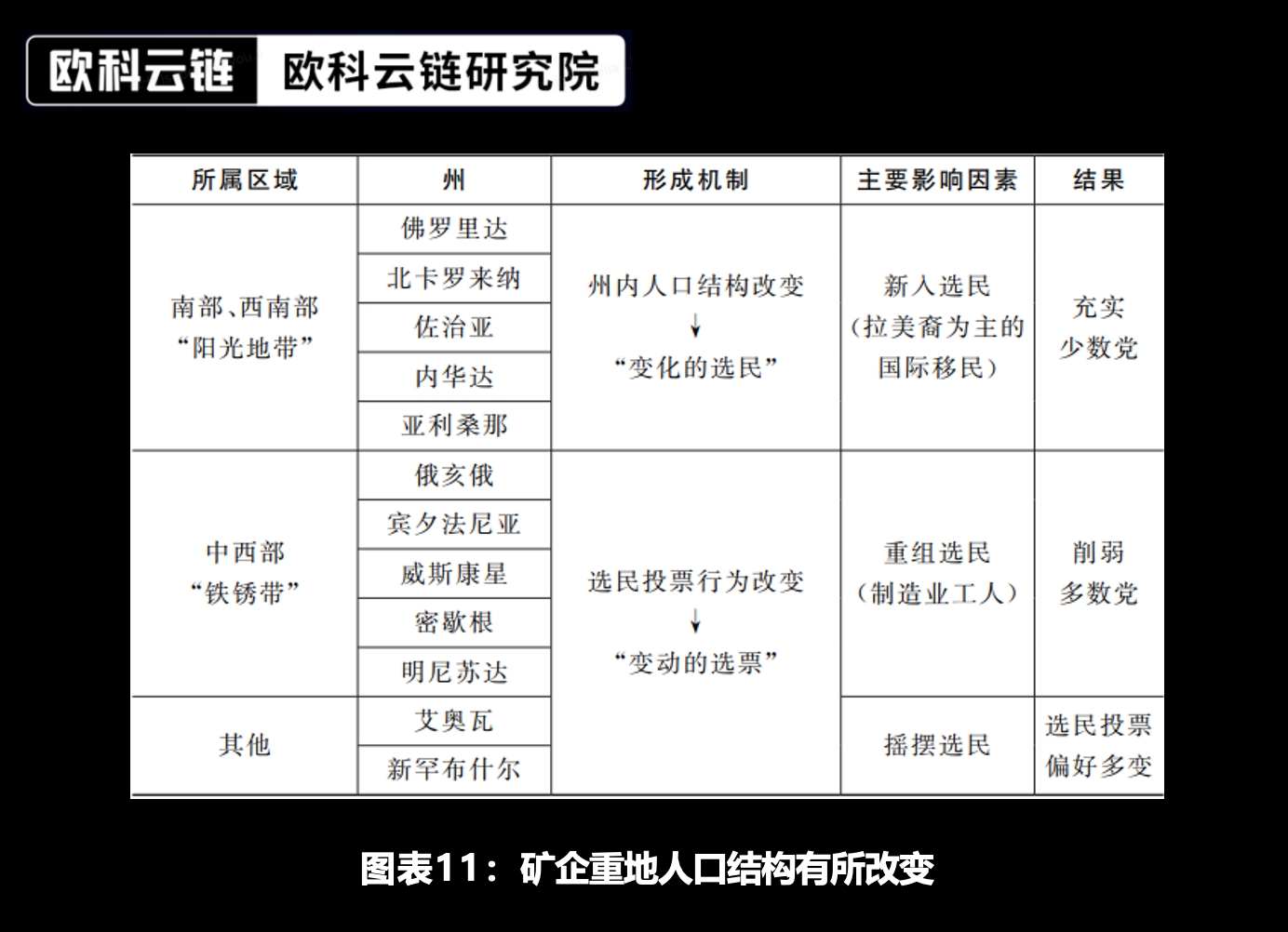

Additionally, implementing anti-Bitcoin mining policies may negatively impact candidates in the 2024 elections. A large number of Bitcoin mining machines operate in swing states. Their combined computing power accounts for about 40.2% of the total computing power in the United States and is a key vote bank in the U.S. election. Bitcoin mining companies employ large numbers of local voters, increase fiscal revenue, and revitalize perennially lagging regions.

Source: Cambridge Digital Assets Programme, Ouke Cloud Chain Research Institute

The anti-Bitcoin mining tax policy will threaten employment and revitalization in many swing states, and therefore may encounter resistance from key constituencies.

It is worth noting that the demographic structure of swing states is also changing. States such as Georgia and North Carolina are continuing to have an influx of international immigrants, mainly Hispanics. The dual factors of mining hubs and minority investment preferences will have a high probability of affecting the election trend, which will then affect the SECs decision on Bitcoin. Spot ETF ruling.

Source: Tsinghua University Institute of International Relations, Ouke Cloud Chain Research Institute

Since taking office in January 2021, the Biden administration has maintained a tough policy stance on cryptocurrencies and proposed a 30% digital asset mining energy tax on Bitcoin mines, but has not implemented the same standards for other similar data centers.

From a game theory perspective, a very small number of American voters will vote for a candidate just because they oppose Bitcoin. After all, Bitcoin will not affect most people. However, there may be a group of pro-Bitcoin U.S. citizens who will vote for a candidate simply because he or she favors Bitcoin.

Compared with the Democratic Party’s continued crackdown on cryptocurrency, the change in the Republican attitude is particularly obvious. Former Republican SEC Chairman Jay Clayton, who once sued Ripple, now believes the agency engaged in excessive regulation and should approve a Bitcoin spot ETF.

Typically, a new team of SEC commissioners is formed about six months after a new president takes office, as was the case under Biden and current SEC Chairman Gary Gensler. As a result, Democrats currently hold a majority on the SEC commissioner team.

To eliminate partisan divides within the SEC, commissioners must be politically equal. Former SEC lawyer John Reed Stark predicted that if the Republicans are elected, Gary Gensler will most likely step down early, and Hester Pierce, the most senior official on the current team, will serve as interim chairman to achieve a bipartisan balance within the SEC.

It is worth mentioning that Hester Pierce, also known as “Crypto Mama,” has advocated for the United States to use the European regulatory structure MiCA as an enforcement model and has opposed multiple actions taken by the SEC against the encryption industry. If he becomes interim SEC chairman, regulatory enforcement against the industry is expected to be significantly reduced, if not completely halted.

In this case, 1) the SEC may shift its focus to fraud cases rather than registration violations, such as the failure of CEXs, broker-dealers or clearing agencies to register as cryptocurrency trading platforms; 2) favorable conditions for Bitcoin spot ETFs Potential approval and other significant regulatory measures that would benefit the crypto industry.

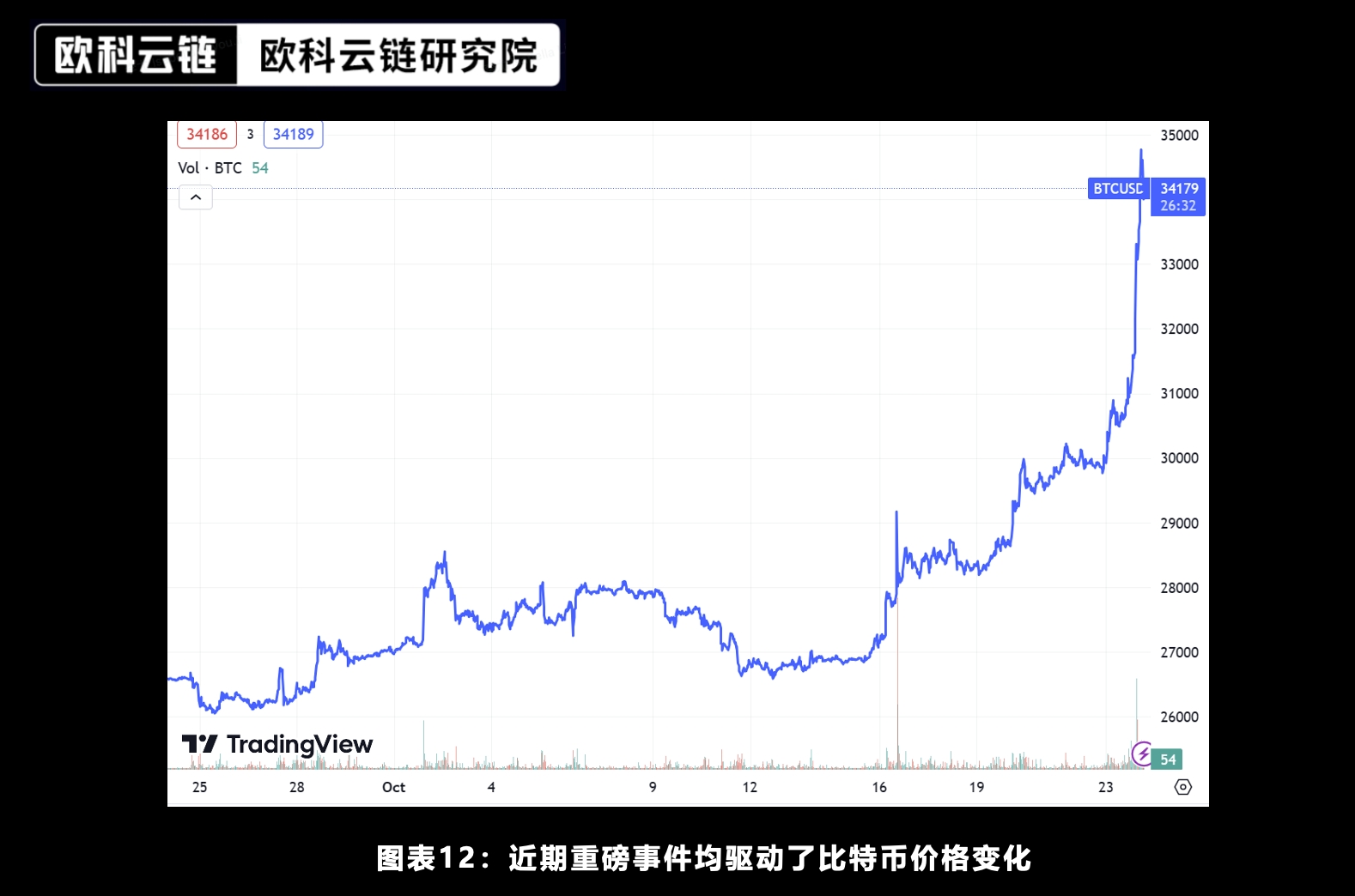

3. One more thing—Ethereum Spot ETF

In the past week, two heavyweight events occurred in the market that were enough to change the direction of the results of the Bitcoin spot ETF. On October 14, 2023, the SEC decided not to appeal the court’s ruling in favor of the GBTC conversion ETF, increasing the likelihood that the Bitcoin spot ETF will pass muster. The news greatly cheered the market, with Bitcoin prices surging above $27,000. Two days later, another major positive news occurred. Cointelegraph, the industrys top media, announced on On October 24, Bloomberg ETF analyst Eric Balchunas posted on social media that BlackRock’s Bitcoin spot ETF has been listed on the Depository and Clearing Corporation (DTCC), with the stock code IBTC, which is a step in the ETF listing process. , is also the first Bitcoin spot ETF to be listed on DTCC. As the news came to light, the price of Bitcoin once again stood above 30,000 US dollars, and once hit the 35,000 US dollars mark.

Source: TradingView, Ouke Cloud Chain Research Institute

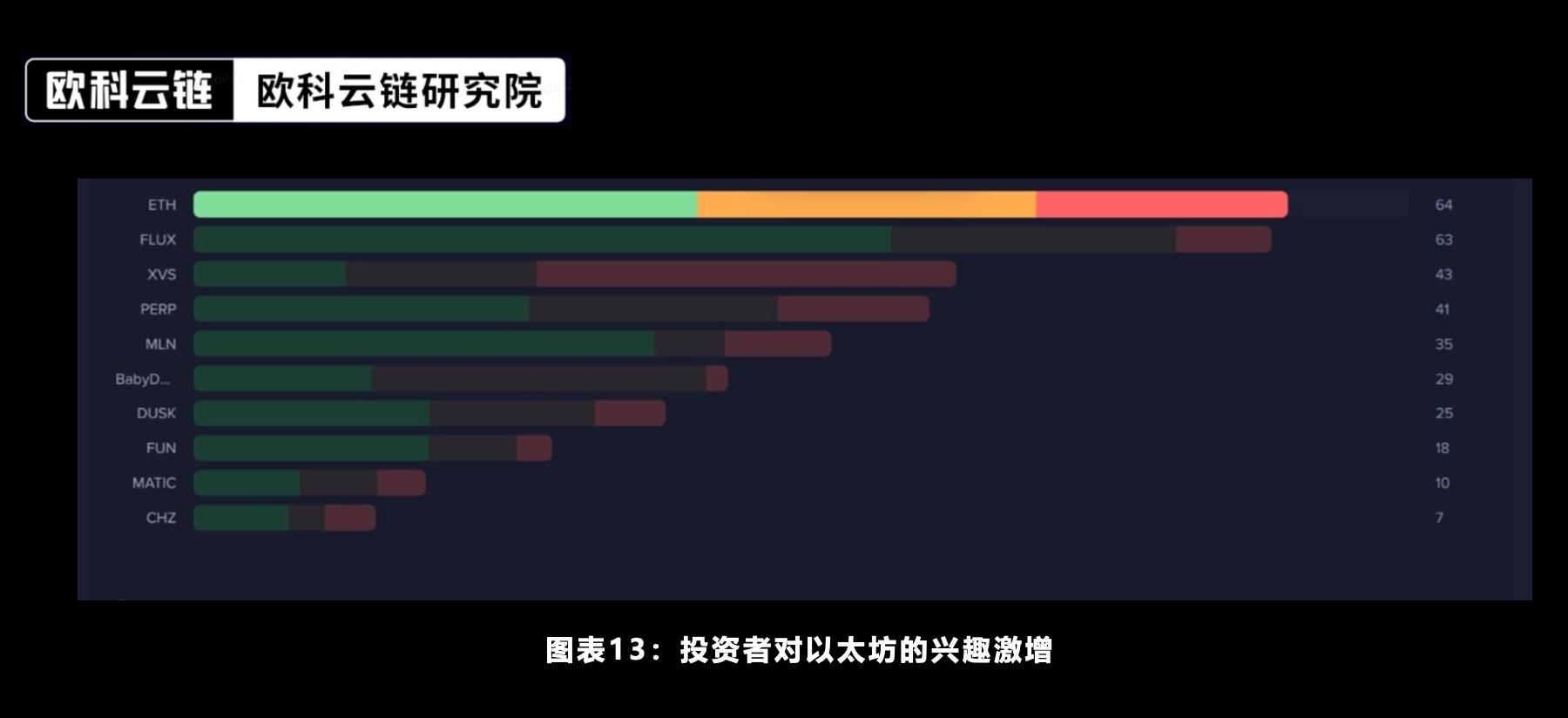

In addition to the advancement of Bitcoin spot ETFs, traditional financial markets also maintain strong interest in Ethereum, the second largest cryptocurrency in the industry.

Source: Santiment, Ouke Cloud Chain Research Institute

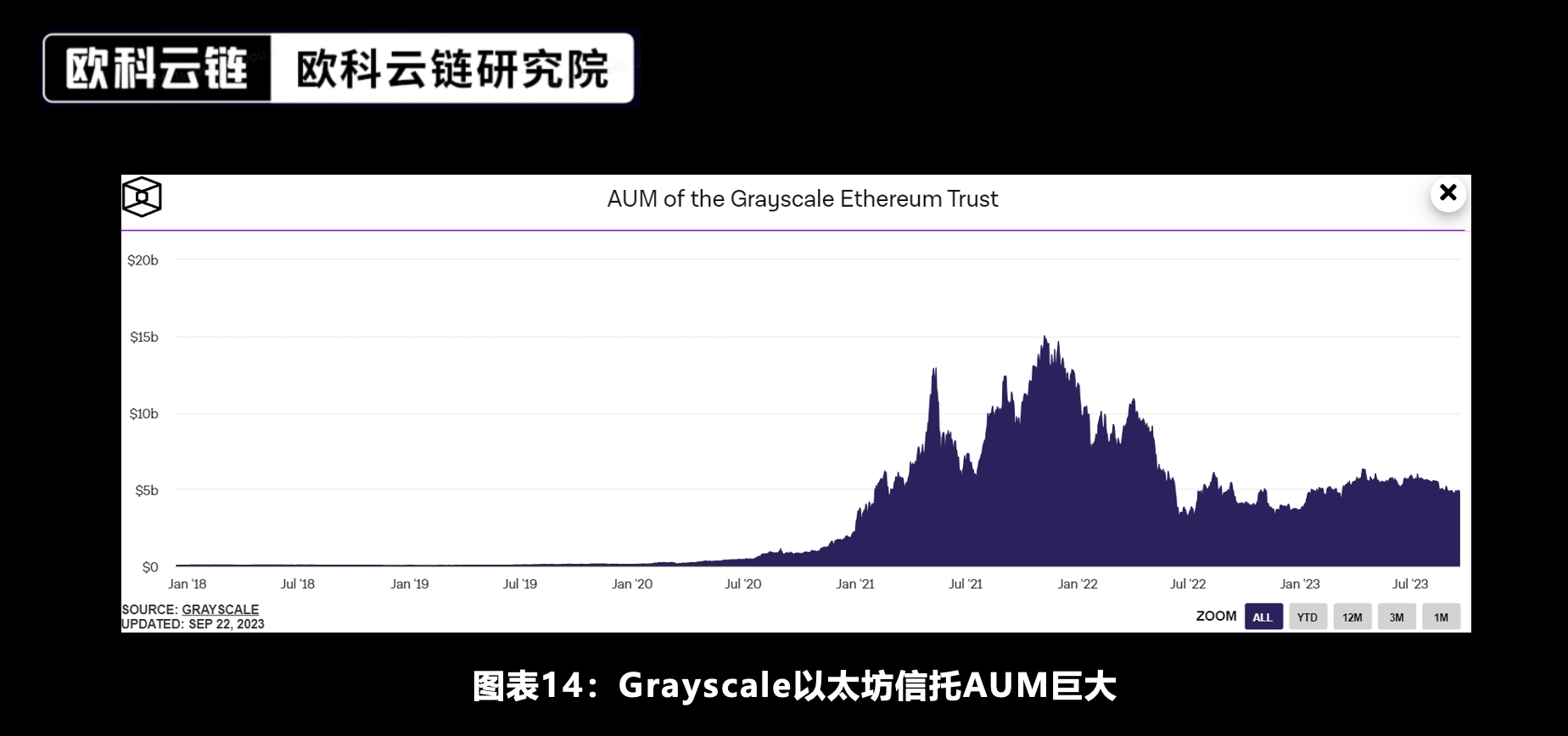

Now, in addition to the Bitcoin spot ETF, investors can also pay attention to the progress of the Ethereum spot ETF. On September 7, 2023, Ark Invest and 21 Shares teamed up to try out the first Ethereum spot ETF. On October 2 of the same year, Grayscale also applied to convert its Ethereum Trust into a spot ETF. Currently, the trust is the world’s largest Ethereum investment vehicle, with a management scale of nearly $5 billion, accounting for approximately 2.5% of the total circulating supply of Ethereum.

Source: THE BLOCK, Ouke Cloud Chain Research Institute

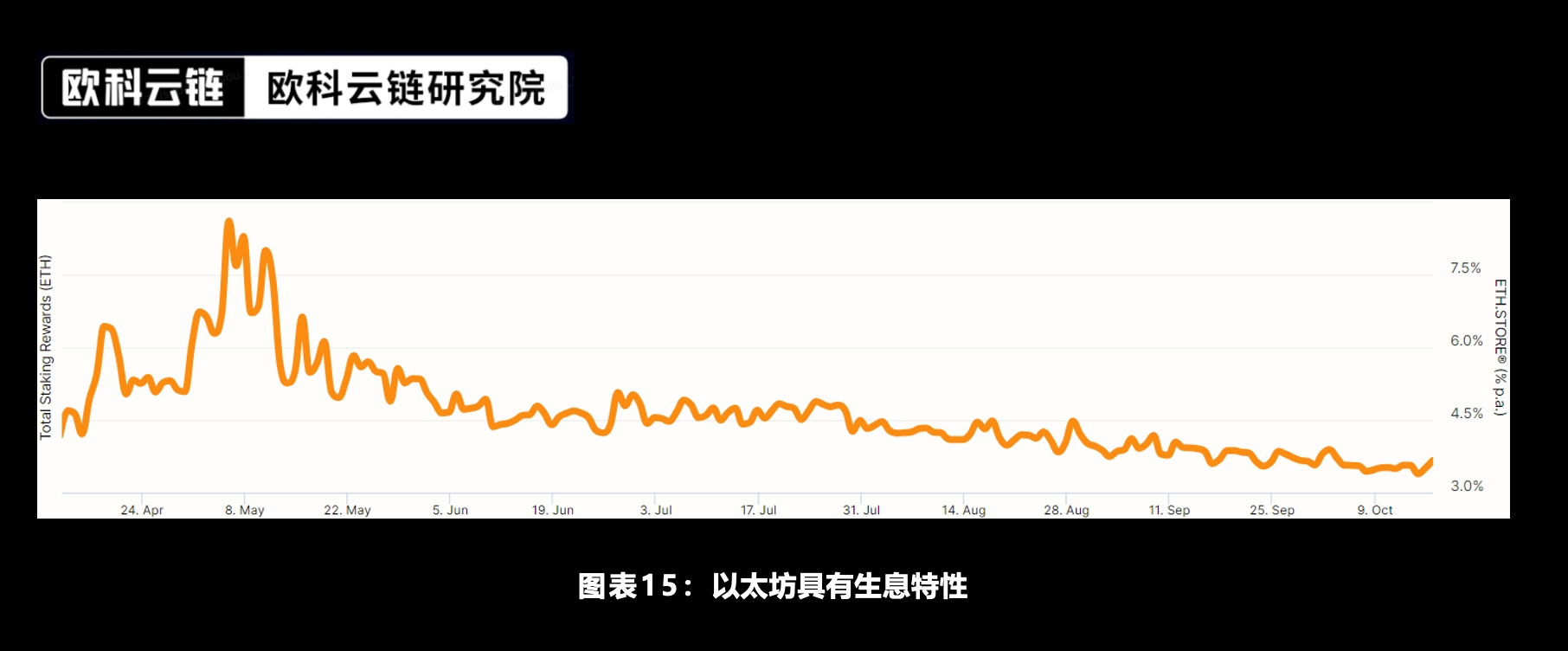

Given Ethereum’s staking reward mechanism, it has yield properties and can therefore be classified as a security. Moreover, the SEC has always regarded Ethereum as a security. According to the rule of exclusion, if the SEC approves the Bitcoin spot ETF, it should take the same approach to the Ethereum spot ETF; if the SEC believes that the essence of Ethereum is a security and is applicable to the Howey Test, then it does not have the qualifications Reasons to reject Ethereum spot ETF. To sum up, in terms of probability alone, the Ethereum spot ETF is more likely to be approved than the Bitcoin spot ETF.

Source: Beaconcha.in, Ouke Cloud Chain Research Institute

Ethereum’s innovative staking mechanism will trigger investor demand and attract them to participate in liquidity staking to enhance returns from holding ETFs. Pledgers can maintain liquidity even if assets are locked using a liquidity staking protocol, which will provide investors with tradable derivative tokens. By contrast, when investors lock their money in government bonds, they no longer have access to liquidity. Generally speaking, investors prefer a shorter redemption period, and liquid staking allows them to participate in staking and earn income while maintaining liquidity without locking up.

4. Conclusion - the future

As the Bitcoin spot ETF approaches, the compliance of the crypto industry may usher in a breakthrough from 0 to 1. This means that in the future, mainstream crypto-assets represented by Bitcoin and Ethereum can become optional investment options for mainstream institutions and public investors along with traditional stocks, bonds, and commodities. For digital currency assets, it is expected to bring more incremental funds, while for traditional financial institutions, it can also bring more investment options in a high interest rate environment, which is undoubtedly a win-win situation.

From a long-term perspective, under the general trend of the future integration of the crypto industry and traditional finance, a question worth thinking about is: whether the final form of integration is to use crypto assets to dress up like traditional assets to cater to the needs of traditional financial institutions. Regulatory requirements? We believe this may be a gradual merger process. On the one hand, crypto assets are accepted by mainstream investors in a more compliant manner, and on the other hand, by mapping more real-world assets (RWA) on the chain. , to supplement traditional commercial banks through on-chain financial development and inject more vitality into traditional finance. Although this future has not yet arrived, we believe that one day it will come and the future will come.

*The views expressed in this article are those of the author alone and are not investment advice.