Crypto market secondary fund Metrics Ventures blockchain research report introduction:

1. Although the market’s current attitude towards Web2.5 games is not positive,We believe that Web2.5 games will still attract the introduction of game producers by virtue of their unique advantages in game distribution and customer acquisition, and the growth of the supply side and technology side will lead to an explosion of demand side.

2. In the Web2.5 game track, we pay special attention to the game platform track.The game platform will have a stronger narrative space and life cycle, and occupy an important position on the supply and demand sides of chain games.

3. Based on the business model and token empowerment method,We divide game platforms into four types: strong binding type, medium binding type (public chain type), medium binding type (investment type) and weak binding type, and believes that the medium-binding type is a healthier and horizontally scalable way, and has a benign interest binding with the game.

4. We analyze high-quality game platform projects in the industry from the three dimensions of strategic narrative, business capabilities and token economics. After comparison,We believe that Merit Circle is the most eye-catching project in this field and has a high investment value for money.Merit Circle has transformed from a game guild to a game platform and then to the development of a game public chain. It has strong strategic narrative capabilities, product development capabilities and game resources. However, its valuation is still at a low level within the industry and it still has strong room for development.

Crypto market secondary fund Metrics Ventures blockchain research report text:

1 The beginning of the story: Why are we optimistic about the game platform track?

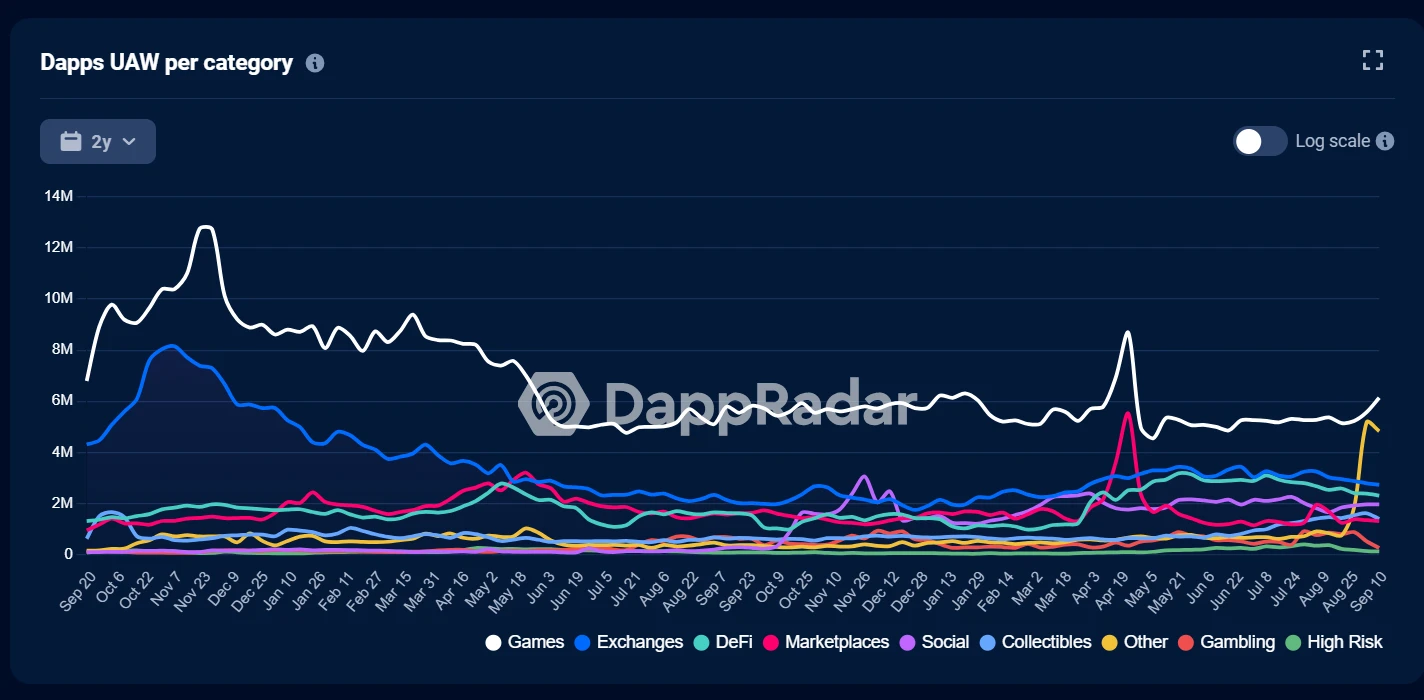

Although the dominance of blockchain game users continues to decrease after the Gamefi wave recedes, we see that games are still the most active part of the entire industry. According to DappRadar data, as of the second quarter of 2023, the number of daily independent active wallets in the gaming industry was 699,956, accounting for 36% of the total industry participation. Although it is the lowest level since the third quarter of 2021, it is still ahead of the Other types of applications.

Crypto Game can be divided into multiple categories depending on how on-chain the game is.

From Web2 games to complete Web3 games (full-chain games), multiple links need to be crossed in the middle, including assets on the chain, transactions on the chain, achievements on the chain, economic models on the chain, core logic on the chain, etc. Many blockchains now The game has completed the up-chaining except for the core logic, and is called Web2.5 Game.

In the recent market, the development and prospects of full-chain games have been widely discussed, becoming one of the hottest narratives in blockchain games. However, with the widespread pursuit of full-chain games, we see that the business model of Web2.5 Game is still of great significance to the entire game industry, even if Web2.5 games have fallen to freezing point——Web2.5 games use NFT and token incentives to reduce game distribution and customer acquisition costs, while breaking regional restrictions, allowing games to have global traffic and global capital liquidity on the first day, and have a strong role in improving game distribution efficiency. Advantage.

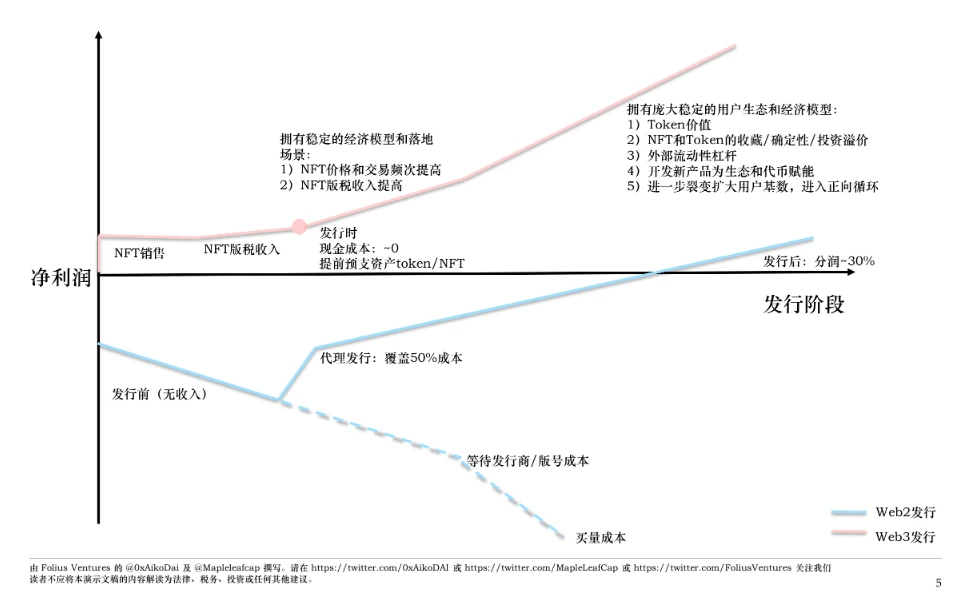

(For the full life cycle of Web2 and Web3 distribution, please refer to the research by Folius Ventures in the figure below, original text https://docsend.com/view/4rm9mp56ypr5ae6p)

The customer acquisition cost of game distribution with NFT is close to 0. In contrast, the customer acquisition cost of Web2 games is relatively expensive: among them, the customer acquisition cost of RPG and SLG games is 60-150 U/person, and the customer acquisition cost of strategy, Casual and Midcore games range from 6-20 U (the data comes from interviews with practitioners and may have certain deviations from actual statistics).

These advantages will have strong appeal to traditional game producers. The continued attraction of Web2.5 games on the supply side will promote the richness of production content in this field and produce truly playable and sustainable games born in Web3. In the world, with the development of AA wallets and the development of layer 1, layer 2 and even layer 3 application chains with high TPS and low gas fees, the threshold of the Web3 world will be further lowered, becoming more common and user-friendly, and on-chain operations will also be Gradually disappear into the game world, bringing a smoother experience.The rich game content brought by the supply side and the user experience optimization brought by the technology side will affect the demand side of Web2.5 games, which is very likely to drive the next explosion of the entire industry.At present, this point cannot be achieved in the short term in immature full-chain games, whether from the supply side or the demand side. Therefore, we believe that this is a unique advantage of Web2.5 games, and it is also very good from a cycle perspective. Layout timing.

These advantages will have strong appeal to traditional game producers. The continued attraction of Web2.5 games on the supply side will promote the richness of production content in this field and produce truly playable and sustainable games born in Web3. In the world, with the development of AA wallets and the development of layer 1, layer 2 and even layer 3 application chains with high TPS and low gas fees, the threshold of the Web3 world will be further lowered, becoming more common and user-friendly, and on-chain operations will also be Gradually disappear into the game world, bringing a smoother experience.The rich game content brought by the supply side and the user experience optimization brought by the technology side will affect the demand side of Web2.5 games, which is very likely to drive the next explosion of the entire industry.At present, this point cannot be achieved in the short term in immature full-chain games, whether from the supply side or the demand side. Therefore, we believe that this is a unique advantage of Web2.5 games, and it is also very good from a cycle perspective. Layout timing.

But we still have to pay attention to the problems existing in Web2.5 games and the difficulties they faced after the last wave of P2E. The life cycles of these games are generally short, especially P2E games. The main reasons are that the life cycles of their assets are relatively short, the economic system in the game is too simple and crude, lacks a balancing mechanism, and the capitalization process of the entire game is too obvious. , too fast, too early to realize, and the players participating in the game have too strong speculative attributes.

We believe that Web2.5 games should focus on two core logics:

First, playability and gameplay

The second is the advantages compared to Web2 games in terms of game distribution and customer acquisition.

The last round of P2E focused too much on the second logic and ignored playability. Web2.5 games that are healthier and more sustainable should have both, with richer content, stronger gameplay, and scientific And the design of an economic system of a certain complexity to avoid the asset structure being too single and capitalizing too quickly in the early stages of the game. Under such a game design, we believe that the development of the content supply side and infrastructure side mentioned above can bring about the growth of the demand side, thereby promoting the development of the Web2.5 game industry, and now chain games are also moving in this direction. develop.

To sum up, we believe that Web2.5 games will still have relatively high growth space and development potential. As mentioned above, there is a certain gap between this and the current market understanding of Web2.5 games. The market’s understanding of Web2.5 games Project valuations are generally underestimated, and at the same time negative and pessimistic sentiments dominate, believing that P2E is dead. Especially in a market environment where Fully on-chain game narratives are generally pursued, Web2.5 games seem to have become an outcast in the market.

Listening to Thunder in Silence, there is a certain gap between our understanding of Web2.5 games and the general market understanding. This is an important reason why we currently believe that this track has investment potential and ambush value.

In the development of Web2.5 games, we are particularly optimistic aboutGame platform/game ecologytrack, because:

Every Web2.5 game has its own life cycle. On the one hand, the game itself (whether it is a Web2 or Web3 game) has a life cycle. On the other hand, the token economics of the Crypto project also have its own life cycle. Compared with a single game project, the game platform and game ecology have a longer life cycle, will be less affected by the life cycle of a single game, have stronger resilience and risk resistance, and have more trial and error. Space and time to find truly healthy and fun game projects. The recently popular game project Parallel TGC released a proposal in January 2022, announcing that it would be integrated into the Echelon Prime Foundation ecosystem and transform from a single game to a game platform, which is also an example of this trend.

From the perspective of game manufacturers (supply side): the game platform and game ecology have multiple game resources such as funds, Web3 player communities, incubation capabilities, etc., covering multiple links in the game industry chain, and will become an important entry point for new games. window. In the bear market where the NFT market is generally sluggish, only relying on the sale of NFT for a single game to achieve a cold start makes it more difficult to obtain early financing and reduce customer acquisition costs. The resources of the game platform can further reduce the customer acquisition cost of new games, and the game platform will also pass The design of the token economic system captures part of the value of many single game projects in the Web2.5 game track.

From the perspective of game players (demand side): Whether they are Web2 users or Web3 users, the guidance of the chain game navigation page is in demand and valuable, and can enable users to find games that better meet their needs. More importantly, the painless blockchain infrastructure provided by the game platform can reduce users losses in the process of converting from Web2 to Web3, lower the game threshold, and optimize the game experience.

In order to break out of the P2E cycle, it is necessary to separate content creation and user acquisition, reduce the financial attribute of game content production, and extract as much as possible the financial attribute of customer acquisition, that is, professionalize the Web3 game platform and integrate it with games A token economic cycle system that is not directly related to the content reduces the cost of acquiring customers for the game. Although the current gaming platform has not completely separated the two, the blockchain gaming field is the most likely track to develop in this direction.

At present, the main categories we consider this track to include are:

game production

Publishing platform and ecosystem

Post-P2E Game Guild

Game public chain

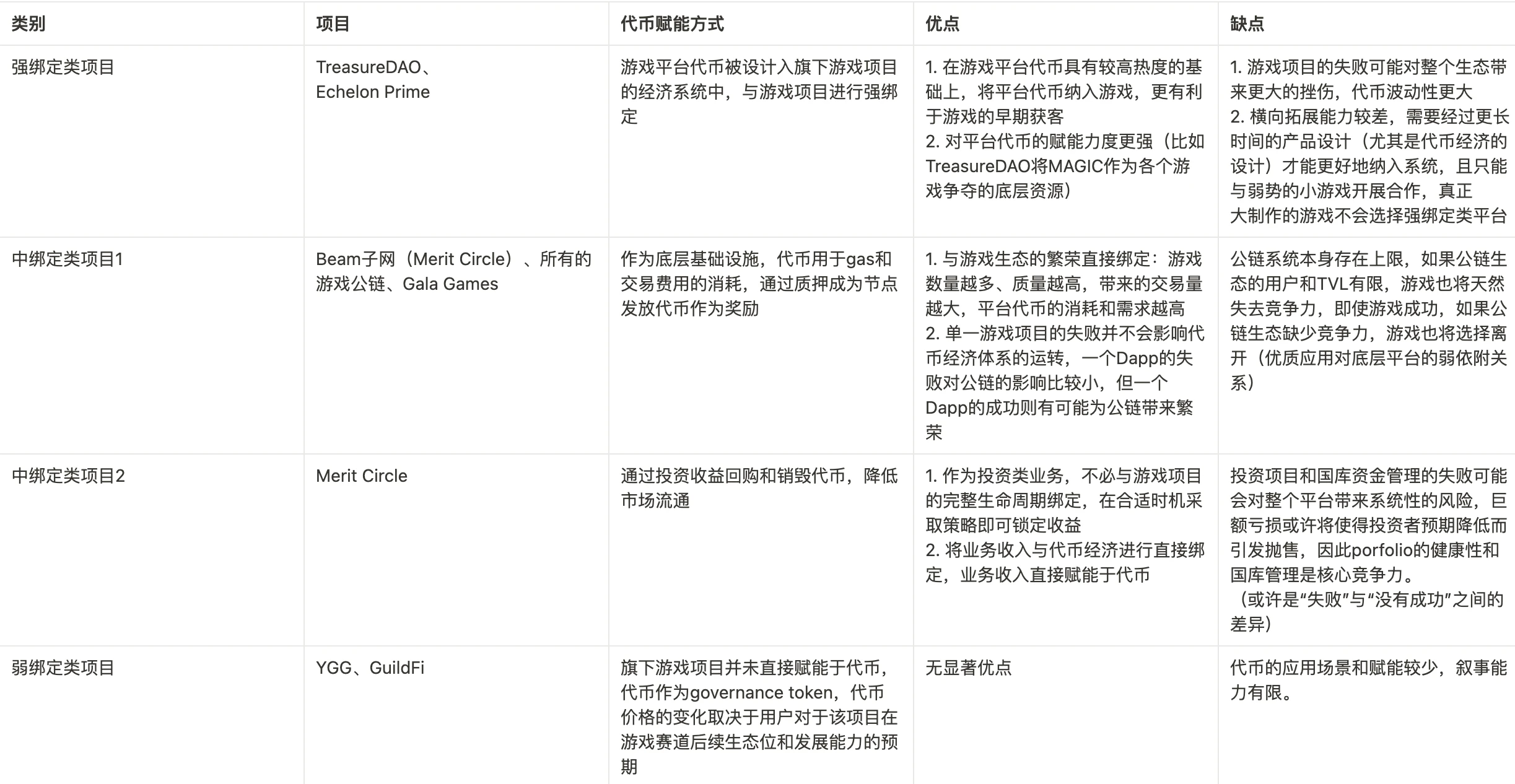

Among them, according to the strength of the binding relationship between the game platform and a single game project, especially the strength of the binding relationship between the business model and the token economic model and the game, we divide these projects into four categories. Among them, Xterio has not yet issued tokens and token economics. We will not classify it here, but only introduce the fundamentals of the project.

From the perspective of the industry chain and business model, the game platform should play a role in helping games with early development, design, testing and customer acquisition. It should become the infrastructure of the chain game industry and obtain corresponding value for this part of the service. It is deeply bound to the game and becomes part of the games economic system.

In addition, the economic system of early games is prematurely bound to the game platform token, which is more likely to strengthen the speculative and financial attributes of the game and accelerate the life cycle of the game. Among the games on existing strongly bound game platforms, in addition to sharing underlying tokens, the interoperability scenarios between games we can see are still relatively limited, so it is too early to call it an integrated ecosystem. Too early. Of course, if the game basically lacks the empowerment of platform tokens and the business and token models are separated, it will also lack the narrative ability to attract investors.

To sum up, from the perspective of business types and token empowerment methods, we believe that medium-bound game platforms are the healthiest type. They have an independent set of economic and business cycle logic and are truly independent of games. The infrastructure and service providers of the Web2.5 Game have strong horizontal expansion capabilities of the ecosystem. At the same time, its economic model also ensures that it can directly benefit from the success of the game ecosystem, which is a benign interest-binding relationship.

Further, we will conduct a comparative analysis of the above-mentioned game platforms from several aspects such as strategic narrative, business capabilities and token economics, and give some of our thoughts and judgments at the end of the article based on project valuation.

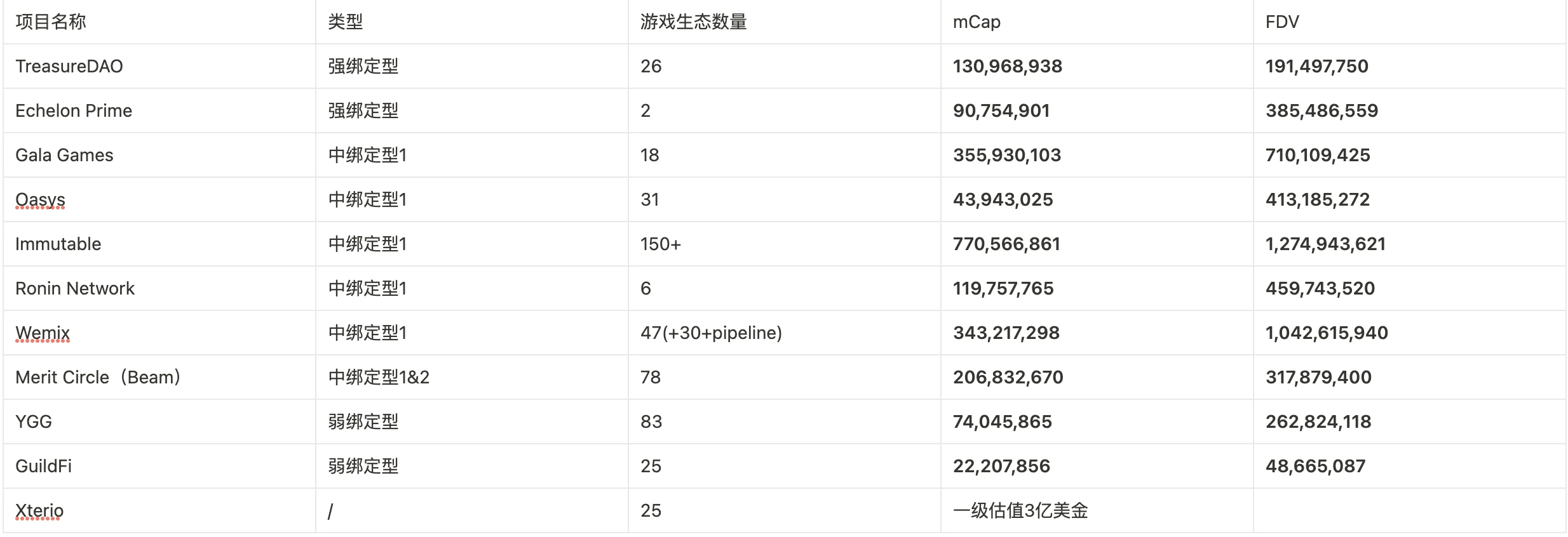

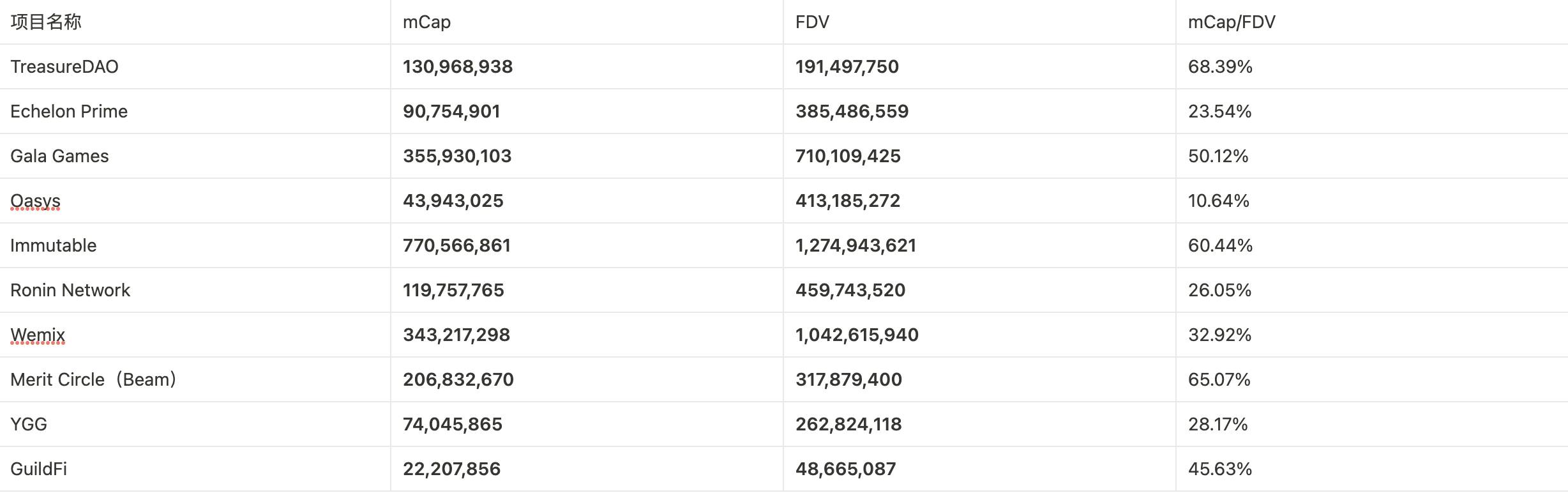

(Token mCap and FDV data time: 2023/10/24, source:https://coinmarketcap.com/)

2 Strategic narrative and business capabilities: Sustained development or stagnation?

2.1 Strategic narrative and fundamental analysis

TreasureDAO and Echelon Prime hope to tell the story of an integrated game ecosystem. There is a unified basic token in the system, and interoperability can be achieved between games. TreasureDAO has been called the Nintendo of the crypto world in many research reports. .

Specifically, TreasureDAO was born in the Loot ecosystem, and later developed independently into a decentralized game ecosystem built on Arbitrum, built around MAGIC. Every project in the TreasureDAO ecosystem is built around the MAGIC token. On this basis, every project Projects can launch their own tokens. As a project born out of the Loot ecosystem, TreasureDAO had a firm community consensus in the early days. In the later development process, it developed a development kit that is friendly to game developers and spawned a series of high-quality games. Its ecological popularity has also exploded with the explosion of The Beacon. The birth of this game reached its peak in a short period of time.

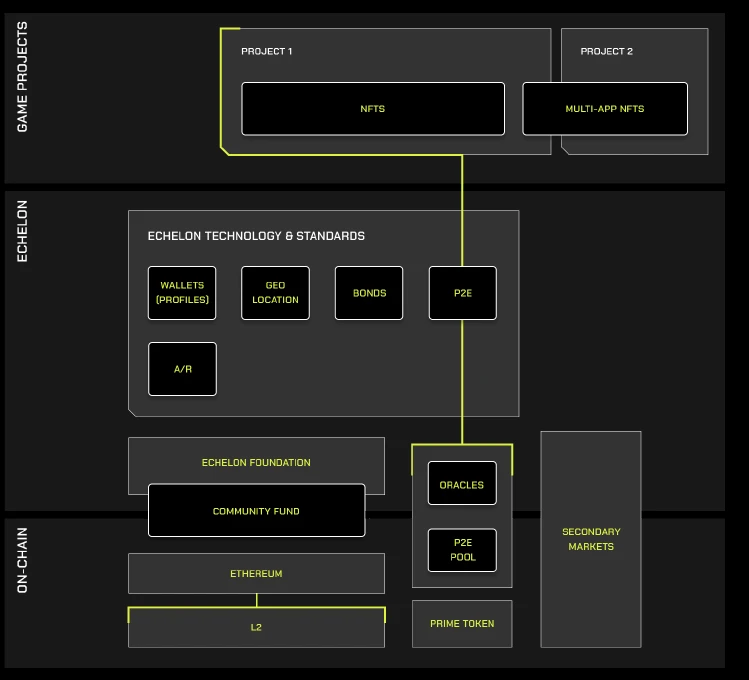

The Echelon Prime Foundation was transformed and upgraded from Parallel. It is an ecosystem dedicated to the development of games and P2E businesses. It will provide infrastructure and a common basic token PRIME for games in the ecosystem. It aims to provide infrastructure (including user Inb 0x for secure communication on the wallet side, end-to-end encryption, bond across multiple game user groups, dedicated NFT distribution mechanism, oracle, etc.) to support a larger game ecosystem. The structure of the Echelon ecosystem is shown in the figure below.

Echelon Prime was born out of Parallel TCG. The game has investment from Paradigm and the endorsement of developers and designers from major game companies. It is also a hot topic that has attracted much attention and anticipation in the field of chain games recently. Parallel Colony, which it is developing, also has AI game experience. Narrative, but it still focuses on P2E narrative logic, which may have certain limitations on the expansion of its subsequent narrative space. Currently, there are only two games in the ecosystem, Parallel TCG and Parallel Colony, and there is still great uncertainty in terms of business. , it can even be said that the current speculation on PRIME is still speculation on the narrative of the game rather than the narrative of the game platform.

Gala Games is a game aggregation and distribution platform on Ethereum, and it was also the leading platform in the last chain game bull market.

The ecosystem mainly includes five parts, game platform, game, database, random algorithm and node network. Among them, the decentralized node network is the foundation of Gala Games. By holding Gala Games’ creation nodes, users can vote to decide which games Gala Games will launch and obtain the operating income of Gala Games and games. According to official website data, there are currently 44,433 genesis nodes online. In addition, through a random distribution algorithm, NFTs from games within the platform are airdropped to genesis nodes as rewards. Gala Games received development funds through genesis node sales and received the projects start-up capital without financing. On September 4 this year, it was announced that the Gala platform would be fully migrated to GalaChain before the end of the year. Follow-up progress still needs to be observed. The ecological progress on its platform is also relatively slow, and subsequent business capabilities still need to be observed.

Xterio is a game production and distribution platform. It also provides developers and players with painless tools and infrastructure to promote the production and distribution of chain games, and is committed to building a GaaS platform.. Xterio’s technologies include CPDM (using ZKP technology to achieve NFT interoperability and privacy protection between different games), AI (collaborating with Palio to integrate AI into games and providing AI toolkits for developers), etc. Xterio not only has its own game development team, but also publishes and supports third-party games, including investments in Web3 game studios Overworld and GamePhilos, and has game resource support from FunPlus, Com 2 us, and XPLA.

Game public chains are an important category within the game platform. Public chain-level narratives also give these projects higher valuations, providing soil for games with high TPS and low gas fees.Technically speaking, it includes L1, Ethereum L2, Avalanche subnet and the developing L3, but the game resources that can be mastered and attracted are the moat for its development. We take stock of the currently developing game public chains.

Wemix and Oasys are public game chains from South Korea and Japan respectively.

Wemix is created by Wemade, which released the flagship game MIR 4, and the founding members of Oasys include the co-founder of YGG, the CEO of the blockchain game company double jump.tokyo, the president and CEO of Bandai Namco Research Institute, and the co-founder of Sega Chief Operating Officer, etc., and has 21 institutional nodes to maintain the operation of the network, most of which are well-known gaming companies and crypto investment institutions in the industry.

Ronin Network is powered byFrom Sky Mavis, the producers of Axie Infinity, is an EVM blockchain specially built for games.

Immutable, the development company of the blockchain game Gods Unchained, has developed two Ethereum Layer 2 for NFT and Gamefi projects.Immutable X and Immutable zkEVM respectively, among which Immutable Net is Ethereum ZK-Rollup Layer 2 built using Polygon Edge.

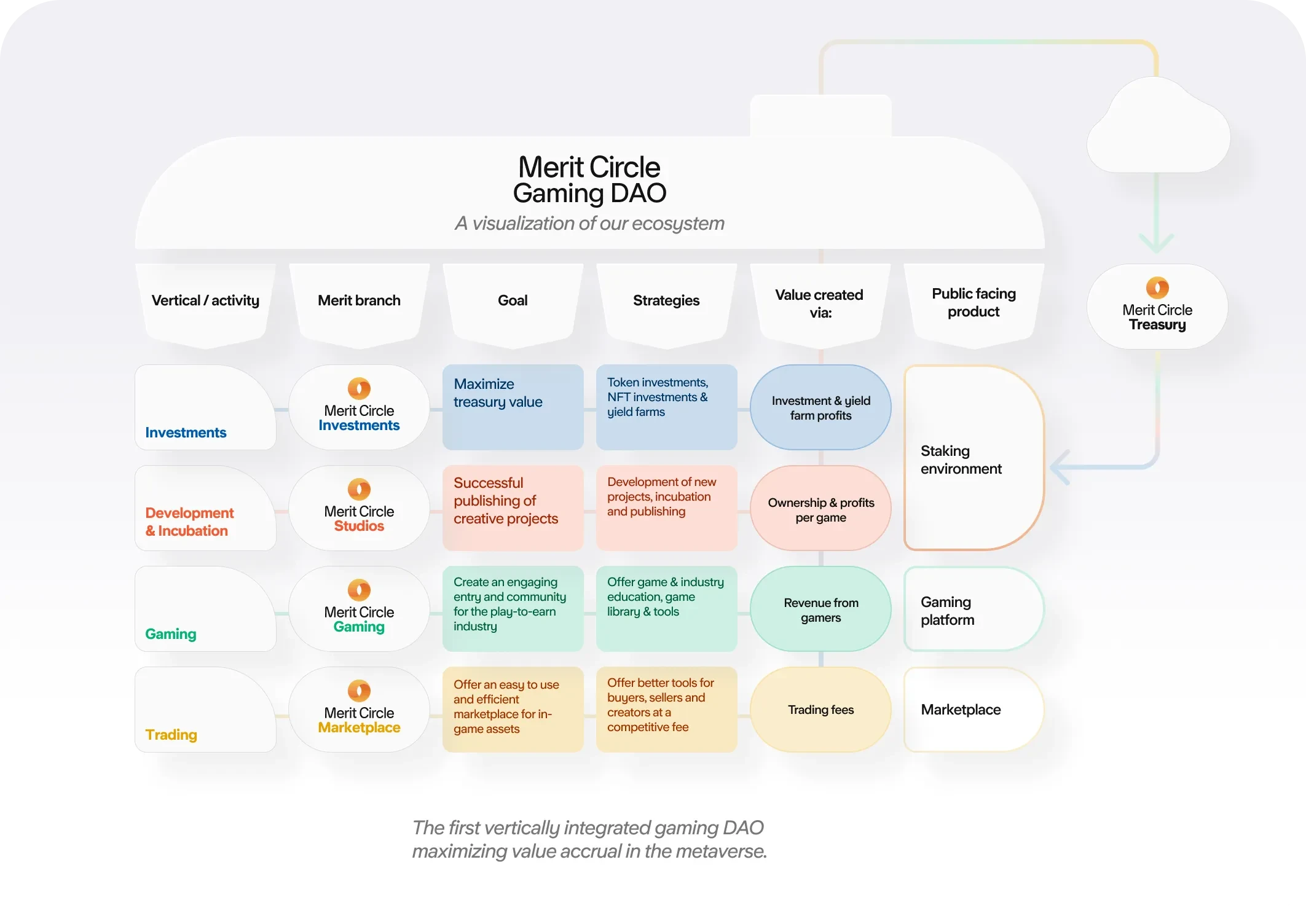

The strategic direction of Merit Circle has undergone tremendous changes since the last round of Gamefi bull market. It has transformed from an guild with an unestablished business model to a game platform integrating investment business and game public chain. Its narrative transformation has been decisive and clear. strategic development planning and high execution capabilities.

Merit Circle’s current main business lines mainly include four parts:Investments/Gaming/Studios/Infrastructure, covering multiple links of the game industry chain from incubation, investment to infrastructure, and announced that it has completely closed the scholarship project, demonstrating its strategic determination to transform from a game guild to a game platform.

Among them, investment is the most important business of Merit Circle, and its investment targets include tokens, NFTs, equity, and pledge operations; Studios is committed to incubating and promoting innovative projects with breakthrough concepts; Gaming, as an aggregation platform for games, also provides Inspiring community activities, member education and practical tools; the core part of Infrastructure is the recently launched Beam subnet. Merit Circle also passed the proposal to exchange MC tokens for BEAM tokens, and the narrative of the game chain will become its follow-up main strategic direction.

YGG and GuildFi have transcended the limitations of the original gold mining union, and currently still maintain the narrative of a game guild, focusing on investment, cooperation and incubation of game projects, as well as player education, expansion of guild members and community networks.

In addition to its scholarship program and cooperative incubation game projects, YGG has also partnered with the creator education platform Nas Academy to establish Web3 Metaversity, which enables YGG guild badge holders to learn new skills and discover income and career opportunities. The launch of GAP (Guild Advancement Program) is also committed to motivating and uniting guild members, while developing the gaming community through the expansion of SubDAO, and developing e-sports. GuildFi grew out of Thailands largest gaming community and guild. In addition to its investment business, GuildFi has also developed an achievement system and Metadrop Launchpad to incentivize player participation. The resources and industrial chain status of the two major game guilds in the field of chain games are still very important. In particular, YGG’s leading position in chain games cannot be underestimated. However, as analyzed above, the narrative and business of the two projects have nothing to do with token empowerment. Directly related, whether its business growth can drive currency prices is an important consideration.

2.2 Business capability analysis

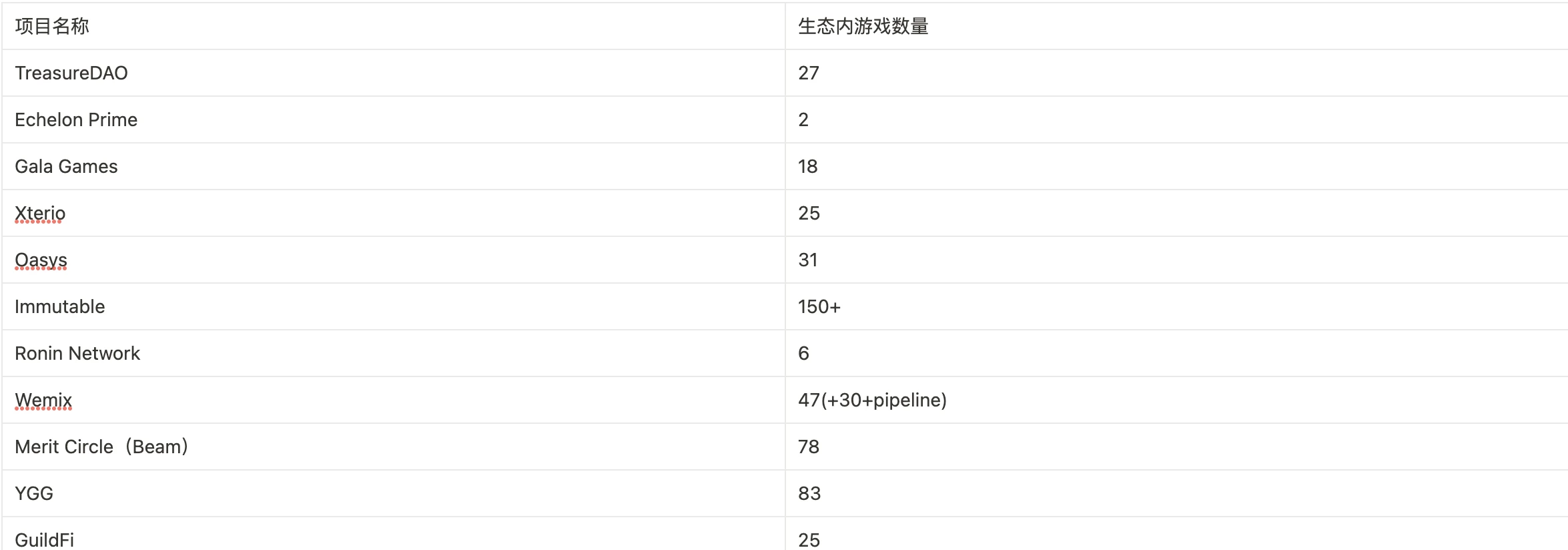

This article compares the business capabilities of game platforms based on the number and development of game ecosystems. For the three investment platforms Merit Circle, YGG, and GuildFi, their returns and risks are greatly affected by the stability of treasury funds, so we need to further compare their investment returns and treasury management capabilities.

2.2.1 Game ecological development

Currently, the number of games in each project ecosystem is shown in the table above, and the specific analysis is as follows.

A total of 27 games are on display on the TreasureDAO official game platform, among which the more popular games include The Beacon, Realm, BattleFly, etc. The current infrastructure in the ecosystem includes the ecological hub Bridgeworld, Trove, MagicSwap, TreasureTag and the achievement system. TreasureDAO emphasizes cross-game connectivity within the ecosystem. The most direct way is to use MAGIC as a common underlying token. A more progressive way is to open up the connection between multiple games. For example, the attempt made in Bridgeworld Harvester combines The Beacon, Knights of the Ether is included in Bridgeworld, but currently there are relatively few gameplays of this type.

TreasureDAOs daily active users dropped significantly after the popularity of The Beacon faded. The MAU in July was only about 10,000, compared with about 9-10w at the end of 2022. The monthly data of Marketplace Volume was about $1M in July. It can be seen that popular games have indeed brought a large increase in users, but the life cycle of the game itself is extremely short, and the game expansion ability is limited, and users will also be lost quickly.

There are only two games in the Echelon ecosystem, Parallel TCG and Parallel Colony. Currently, TCG is in the beta testing stage and Colony is still in the development stage. Parallel TCG is a collectible sci-fi NFT trading card game based on the ETH chain. Players can purchase and collect cards, and flexibly use different cards to combine decks that comply with the rules to play games and obtain rewards. Parallel Colony is a narrative game that combines artificial intelligence, ERC-6551, and The Sims-like gameplay.

There are a total of 18 games on Gala Games, but currently there are only 6 Live games, and the remaining 12 are in the development stage. Relatively speaking, Gala Games game ecology has been expanding slowly. It neither continuously launches new games nor has any well-known hit games. Gala Games announced the development of its own game, Layer 1 Project GYRI, or Gala Chain, in February 2022, but there is currently little information on the progress of the project.

Xterio currently has 25 announced projects, including 4 self-developed and 21 cooperative projects. Currently, most games are still in the pre-registration and development stages, especially the 4 self-developed projects are not all open and require further independent development. The game undergoes market testing.

There are a total of 6 Verse in the Oasys ecosystem, which is the Layer 2 where Dapp is deployed, with a total of 31 games, 17 of which are now playable.

Immutable’s game ecosystem is developing rapidly. Immutablewith GameStop、Warner Games、iLogos、MineloaderandSecret 6 Waiting for the establishment of a cooperative relationship, there are a total of 150+ NFT and game projects in the ecosystem, and the official website lists 74 of them. Some of them are new projects that have been cooperated after the launch of Immutable zkEVM, and are not yet open to the public. In addition, the ecologically owned out-of-circle games include Illuvium, Gods Unchained, etc. According to Footprint data, the transaction volume of games on ImmutableX has maintained a relatively stable leading position in the past three months. After the introduction of Immutable zkEVM, the Immutable ecosystem will also be further expanded.

Ronin is still more like an Application-specific chain for Axie Infinity. The official website shows only 6 games including Axie Infinity, but according to DappRadar data, only Axie has a relatively high UAW. With the huge traffic of Axie, Ronins transaction volume still maintains a good position among the game public chains, but new game public chains are already squeezing Ronins space, and if there are no introduction of new projects, it will also face sluggish subsequent development.

The Wemix ecosystem currently includes 47 projects, including 32 game projects, 5 DeFi projects and 9 NFT projects. In addition, the WEMIX PLAY platform has more than 30 game pipelines.

Merit Circles current token and equity investment in game projects covers 78 projects. Its project types include single games, game infrastructure and game platforms, including many projects backed by investment from large institutions such as OhBabyGames, Gameplay Galaxy, Delabs Games, Roboto Games, etc. . It is worth mentioning that Merit Circle recently disclosed the product details of its Avalanche game subnet Beam. Beam cooperated with Openfort to develop account abstraction, launched the Beam Companion mobile app to help users manage in-game assets, and the Sphere NFT market for ecology NFT transactions within the game, and the Beam SDK is provided to help developers quickly build in the ecosystem. A series of painless infrastructure is of great help in introducing game developers, improving game player experience and achieving user retention, and provides support for the ecological development of the Beam subnet. provides the basis.

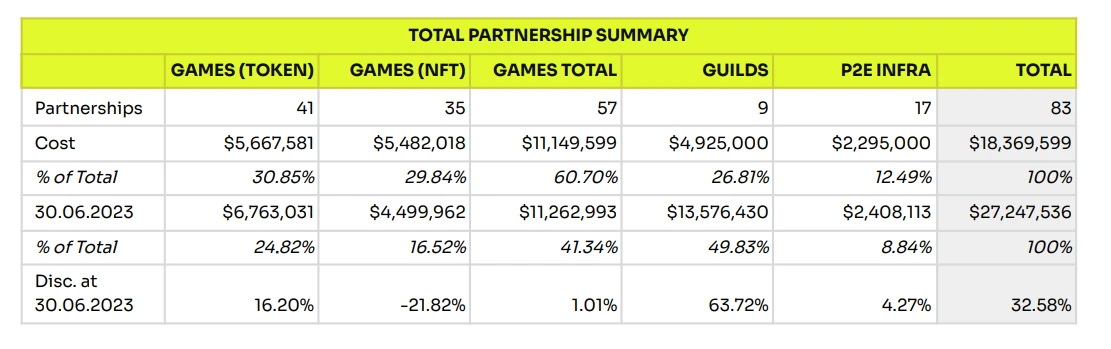

YGG currently has partnerships with 83 projects, including 57 games, 17 P2E infrastructure and 9 game guilds. It is worth noting that as of June 30, 2023, game guilds had the highest share and also brought the highest return ratio to YGG.

GuildFi has not announced the specific number and details of its early investment and strategic cooperation games, but only 25 games are listed on its Games Portal, most of which are earlier projects. Compared with other projects, its external cooperation and ecological expansion are The ability is slightly inferior.

2.2.2 Comparison of investment business capabilities of Merit Circle, YGG, and GuildFi

We conducted a horizontal comparison of the investment capabilities of three investment platforms: Merit Circle, YGG, and GuildFi.

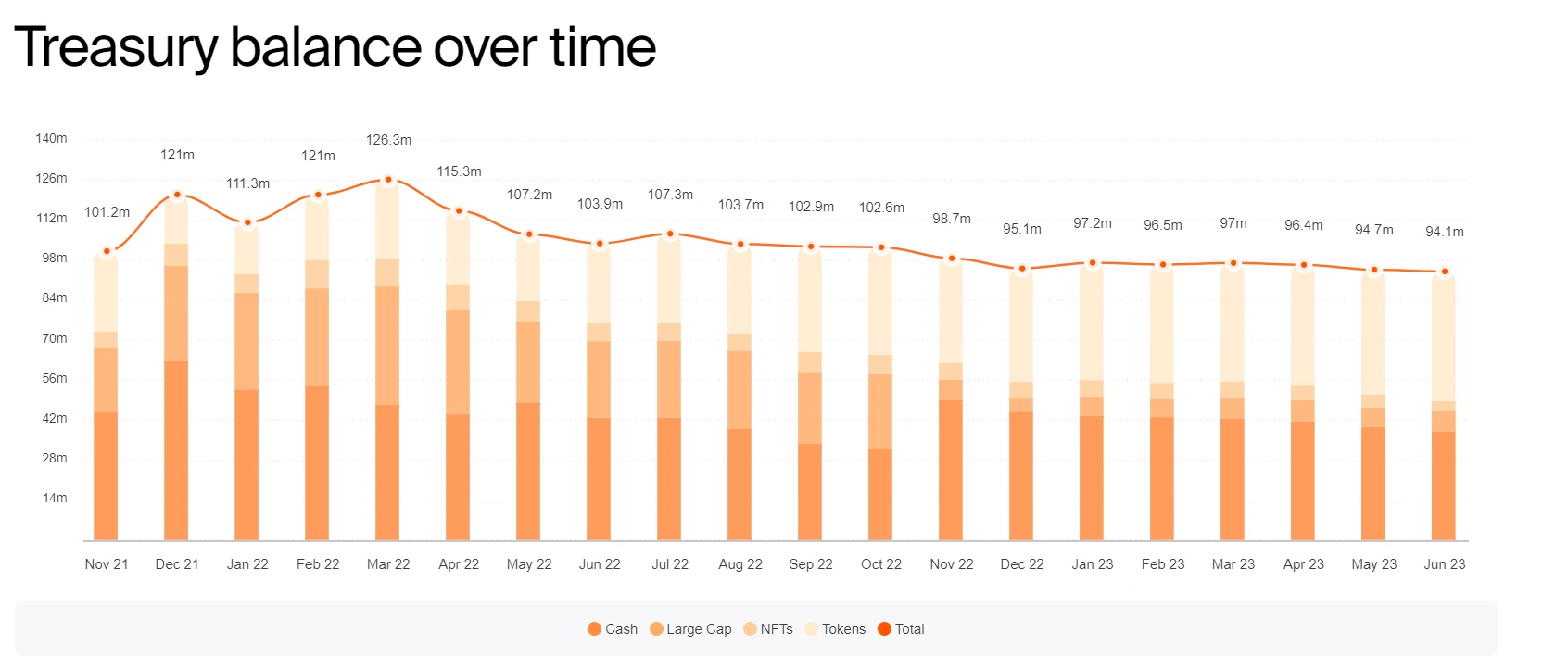

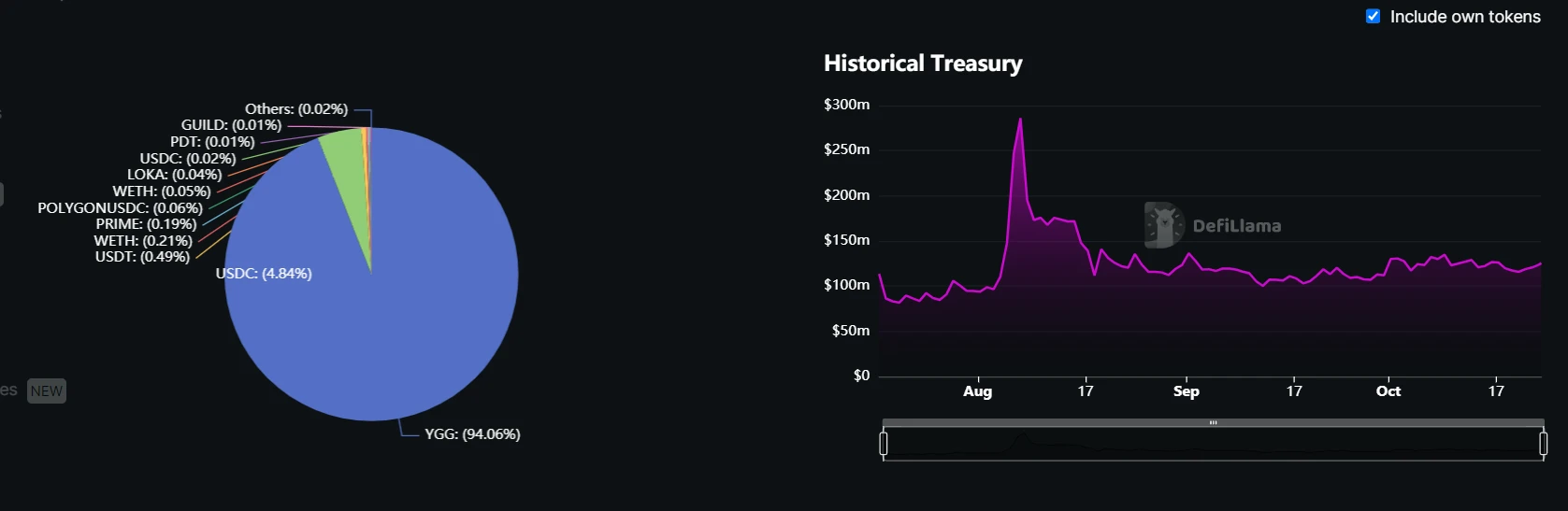

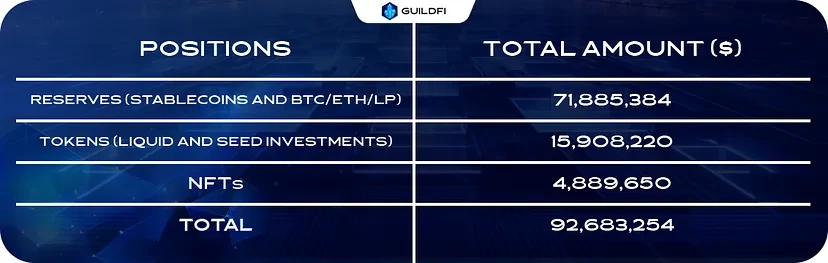

From the perspective of treasury fund distribution and treasury management capabilities, Merit Circle has a large treasury ($94.1 m), and has disclosed its treasury fund distribution in detail in the Dashboard. As of June 23, 2023, AUM has decreased by 25.49% from ATH, which is relatively low among many game guilds. Extremely low drawdown. At present, among the treasury funds, the total stablecoin amount is $38.1m, accounting for 40.49%, and the rest is mainly primary investment equity. According to Defillama data, up to 94.05% of the tokens in the YGG treasury ($123.77) are YGG. The ability to resist risks is very poor. Also because of the massive drop in YGG currency prices, the YGG treasury AUM has dropped by more than 90% compared to ATH. The AUM of GuildFis treasury funds is $92.68M, and the total stablecoin and BTC/ETH/LP positions are as high as $71.89M, accounting for 77.57%. It is the highest proportion of stablecoins and blue-chip crypto assets held among the three guilds. According to its published wallet address and Debank data, GF tokens in the treasury account for a very high proportion of its total Tokens. therefore,Merit Circle’s treasury management capabilities are slightly better among the three, and it has made a more reasonable allocation of stable currency reserves and investments. More than 94% of the YGG token reserves in the YGG treasury are obviously unreasonable. GuildFi’s large proportion of stable currency Although the risk of the configuration is extremely low, it raises concerns about its game investment and external cooperation capabilities.(The following are the treasury reserves of Merit Circle, YGG and GuildFi in order).

From the perspective of investment mechanism and risk management and controlMerit Circle has made clear efforts here. MIP-6 has established a de-risk evaluation mechanism so that DAO can exit the investment target when certain conditions are met. For example, when the target reaches 10 times, it will be sold directly. Principal shares of assets are used to control risks. YGG and GuildFi currently have no relevant mechanisms.

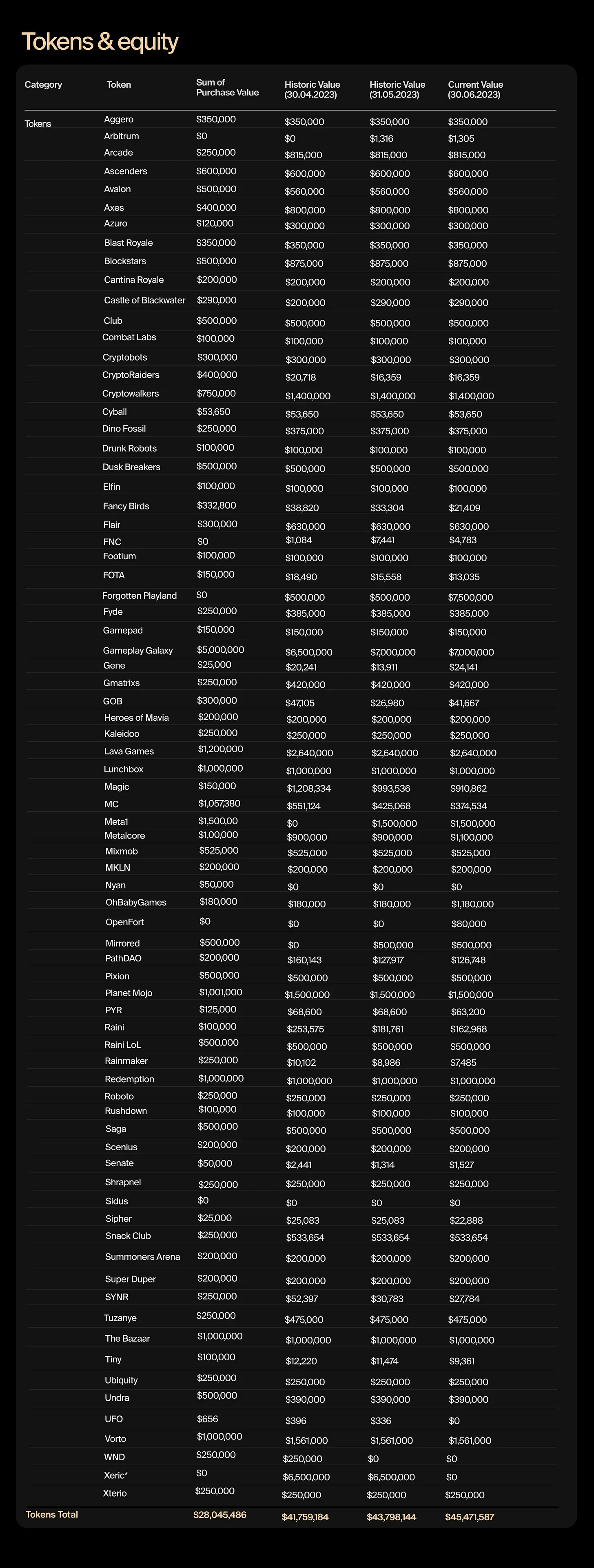

From the perspective of investment income, the latest financial report released by Merit Circle shows that its total investment in Tokensequity (sum of purchase value) is $28,045,486, the current value is $45,471,587, and the floating profit is 62%. The total investment in NFT (sum of purchase value) ) is $4,834,000, currently worth $3,404,852, and is in a loss state. Judging from the sum of the two, the floating profit is 48.65%. YGG’s current total investment (sum of purchase value) is $18,369,599, and its current value is $27,247,536, with a floating profit of 32.58%. The guild’s investment and game Token have brought good returns. GuildFi did not disclose specific income data and investment targets.Therefore, the rate of return of Merit Circle is slightly better, but in the overall environment of the blockchain game track, the overall investment income of each project is not much different, and they all suffered losses from NFT investment, so we still value it more. Investment capabilities and potential, such as treasury management capabilities, risk control capabilities and game ecological accumulation.

3 Tokenomics: How to get a piece of your game’s success?

(Data time: 2023/10/24, source:https://coinmarketcap.com/)

In terms of token circulation and future unlocking, currently only TreasureDAO and Merit Circle have high circulation, and the circulation of most other projects is less than 50%. Considering the potential selling pressure brought by future unlocking, Merit Circle and TreasureDAO are facing Downside risks are lower.

In terms of token supply methods and empowerment scenarios, the supply and empowerment methods of tokens are basically the same for game ecology and game public chains: users obtain tokens through mining (public chain staking or game mining) , the tokens are further used as payment media within the ecosystem (NFT transaction base currency or on-chain gas fees) and game consumption tokens. Some tokens are consumed and re-enter the circulation system (such as PRIME, and then re-enter rewards after consumption) issued in the allocated contract), and some are burned (such as GALA, WEMIX, etc.). Among them, TreasureDAO’s game ecology is more tightly bound to tokens. MAGIC tokens will be used as rewards directly issued by some games and are also the basic conditions for participation in multiple games. MAGIC is also regarded as a core resource that various game projects need to compete for.

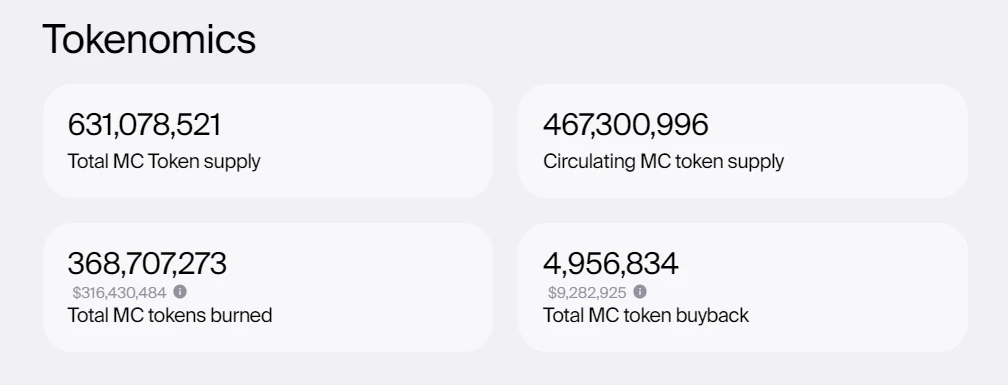

The token economics of game guild platforms are slightly different. Merit Circle, as a game guild that has undergone major strategic transformation, has richer token empowerment methods. Its main consumption scenarios include the following four:

Governance: Any user holding MC tokens can propose and vote on MIP. It is worth mentioning that Merit Circle has a very high level of DAO governance. Currently, a total of 29 MIP votes have been conducted, which are mainly used to determine the strategic development direction of Merit Circle. The key to Merit Circle’s multiple key businesses can be seen in these MIPs. node. MIP-2 formed an investment committee and investment authority to manage the investment business, MIP-6 created a structural approach to reduce risks when early token and NFT investments become liquid, and MIP-4 determines the gaming platform and NFT market In the development of MIP-17, the structure of DAO was reorganized. The recently completed MIP-28 and 29 passed the proposal to convert MC tokens into BEAM tokens.

Investment buyback and burning: Merit Circle will buy back MC tokens and burn them part of the investment profits, reducing the market circulation of MC. Currently, a total of 368, 707, 273 tokens have been withdrawn from circulation.

Gas fee consumption of Beam subnet: Beam is a subnet developed by Merit Circle on Avalanche that focuses on the game ecology. MC (BEAM) will be used as the consumption token of gas fee, which greatly increases the empowerment method of Merit Circle. , while its investment business is making excellent progress, it has the narrative ability of a game public chain. Currently, MIP-28 and 29 have decided to convert MC into BEAM tokens at a ratio of 1:100 to increase the empowerment of the public chain narrative to the MC ecosystem.

In contrast, the token economics of YGG and GuildFi, which are both from gaming guilds, are relatively weak. The main application scenario is staking to obtain token income. Among them, YGG Reward Vault is the core empowerment of YGG tokens. With Guild Badges YGG members can pledge YGG tokens and receive game token rewards, including LOKA, THG, GHST, and RBW, while GuildFi rewards LP pledges.

4 Conclusion: The next Alpha of the game platform track

Here we provide a summary and comprehensive review of the above projects.From the perspective of token empowerment and business methods, we more recognize the sustainability and health of medium-bound gaming platforms., within this scope, the expansion of Galas game ecosystem is relatively slow, the migration of Galachain requires further observation, and the teams controversial incidents have also caused a big blow to investor confidence. A similar situation was experienced by Wemix. Oasys has a good game resource background, especially from traditional game manufacturers, but it has not yet made a hit game. Its game ecology needs further observation. Its token circulation is only about 10%, which has certain potential downside. risk. Immutable has established two Layer 2 based on Ethereum. The game ecosystem has more than 150 game partners. Its daily transaction volume is in a leading position among the game public chains. It is currently a project with relatively rapid development in the game ecosystem and also has certain star projects. But there is no doubt that it also has the highest valuation, which is even about double that of similar projects. Ronins game ecology is expanding slowly, and it currently still favors Axie Infinitys dedicated chain, and has not yet jumped out of Axie Infinitys single game narrative logic.

Based on the above analysis,Merit Circle is a project that is more eye-catching in this field and has a higher investment performance-price ratio.

From a fundamental point of view, Merit Circle has transformed from a game guild to a game platform and a game public chain. It has a clear strategic development plan and a high degree of execution. It also has narrative space for investment and public chain projects, and its business is extremely scalable. . It is remarkable in game ecology, treasury fund management, team strategic direction and DAO operational capabilities, and is ahead of similar projects. At present, the construction of the Beam subnet has become the main narrative of the next round of Merit Circle. This can be seen from the migration of MC tokens to BEAM tokens. Beam is the current focus of the Avalanche ecosystem. With the game resources of Merit Circle Compared with other game application chains, Beam is easier to attract project parties to settle in and complete the initial launch.

Secondly, judging from the project valuation, MC’s current FDV is$ 317, 879, 400 , the current valuation of game platform projects is still relatively low. Compared with its fundamental narrative and business capabilities, it is relatively underestimated, and has a good investment performance-price ratio.

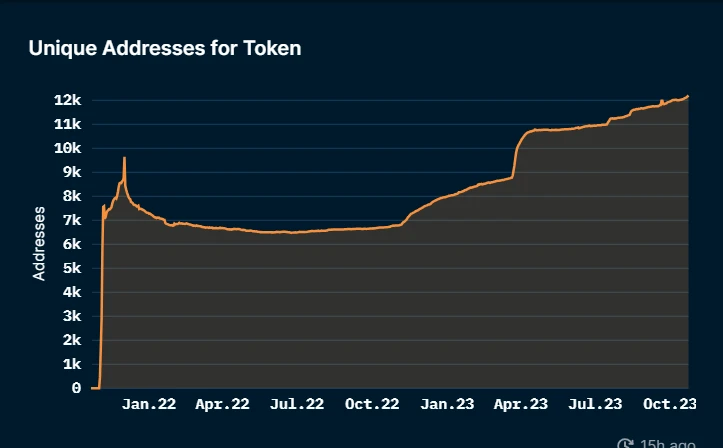

Third, in terms of the chip structure of the token, the current circulation of MC is relatively high, and the subsequent unlocking selling pressure is relatively small. Judging from the on-chain data, the number of its Holders has increased rapidly since the end of 2022, and the current number of Holders is around 12,000. , twice as much as at the end of 2022. Currently, the number of Holders is still growing slightly and steadily. Basically all chips have been held for more than one month. The proportion of long-term holding users is very high. There are still 85 addresses holding positions among the top 100 addresses. In terms of chip structure, the proportion of the top 5 is relatively stable, about 25%.

To sum up, we believe that Merit Circle is a project worthy of layout and attention in the Web2.5 game platform and even the entire Web2.5 game track.

In addition, among other types of projects, the game ecosystem represented by TreasureDAO has strong crypto-native attributes. With the popularity of The Beacon, it has successfully become the largest game ecosystem on Arbitrum. We will keep an eye on its subsequent ecological expansion. Echelon Prime is still in its infancy as a gaming platform, with a card game narrative supporting FDV that is comparable to other platforms. Xterio has certain technical advantages and game resource background. The current primary valuation is relatively high. We need to continue to track the economic model, secondary market performance and game development of XTER after its release. As old game guilds, YGG and GuildFi have been exploring the construction of game communities. They still have deep accumulation in the industry chain and deserve continued attention. Their expansion in token empowerment may bring about an increase in token prices.

about Us

Metrics Ventures, also known as MVC, is a data- and research-driven secondary market liquidity fund led by a team of experienced crypto professionals. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC cooperates with senior crypto community influencers to provide long-term enabling capabilities for projects, such as media and KOL resources, ecological collaboration resources, project strategies, economic model consulting capabilities, etc.

Welcome everyone to DM to share and discuss insights and ideas about the market and investment of crypto assets.

Please contact us at: ops@metrics.ventures.

Our research content will be published simultaneously on Twitter and Notion, please follow:

Twitter: https://twitter.com/MetricsVentures