Original author: Meta Era guest author Shark

Since the Hong Kong Financial Services and the Treasury Bureau issued the Policy Declaration on the Development of Virtual Assets in Hong Kong, one year has passed. How many virtual asset exchanges have the Hong Kong Securities Regulatory Commission brought under its umbrella? What is the origin, background and business scope of these exchanges? Next, we will find out with everyone.

In October 2022, the Financial Services and the Treasury Bureau of Hong Kong issued the Policy Declaration on the Development of Virtual Assets in Hong Kong, which clearly stated that virtual asset exchanges will be licensed in an opt-in manner to enable them to access more people in the Hong Kong market. Investors, the licensing system will allow virtual asset exchanges to develop new distribution channels in Hong Kong, which will benefit Hong Kong’s huge asset and wealth management market worth more than US$4.5 trillion.

Not only that, the Financial Services and the Treasury Bureau of Hong Kong has also made it clear that it is willing to contact the global virtual asset industry and invite relevant exchanges to explore business opportunities in Hong Kong. The Hong Kong Securities and Futures Commission will provide guidance on how retail investors can trade virtual assets under the new licensing system. conduct public consultation to the appropriate extent. So, one year later, how many virtual asset exchanges have been “acquired” by the Hong Kong Securities Regulatory Commission? What is the origin, background and business scope of these exchanges? Next, we will find out with everyone.

In fact, the Hong Kong Securities and Futures Commission has published a number of lists of licensed and applying virtual asset trading platforms on its official website on September 29. As of now, it has covered a total of 8 exchanges under its jurisdiction - 2 Already licensed, 5 companies are applying.

(Note: The information in the above table was obtained on October 16, 2023)

First, let’s take a look at two licensed virtual asset trading platforms, namely OSL Digital Securities Limited, a subsidiary of BC Technology Group, and Hash Blockchain Limited, a subsidiary of HashKey Group.

(The picture comes from the official website of the Hong Kong Securities Regulatory Commission)

For companies that want to obtain a Hong Kong cryptocurrency license, HashKey Exchange and OSL Exchange are just the instructions they need that are being updated in real time. As the first batch of companies to obtain a Hong Kong cryptocurrency license, they are With all the attention on our shoulders, we are moving forward with Hong Kong’s increasingly improving cryptocurrency policy.

They are not only the leading wolves lurking in the history of Hong Kong’s cryptocurrency development, but also the first users after Hong Kong opened virtual asset trading. Next, let’s take a detailed look at the actual situation of these two virtual asset trading platforms.

1、HashKey Exchange

Trading platform overview:The operating entity of HashKey Exchange is Hash Blockchain Limited, headquartered in Hong Kong. As a compliant digital asset trading platform operator, it holds Type 1 (securities trading) and Type 7 (providing automated trading services) licenses issued by the Hong Kong Securities Regulatory Commission. HashKey Exchange has also received ISO 27001 information security management system certification and ISO 27701 privacy information management system certification.

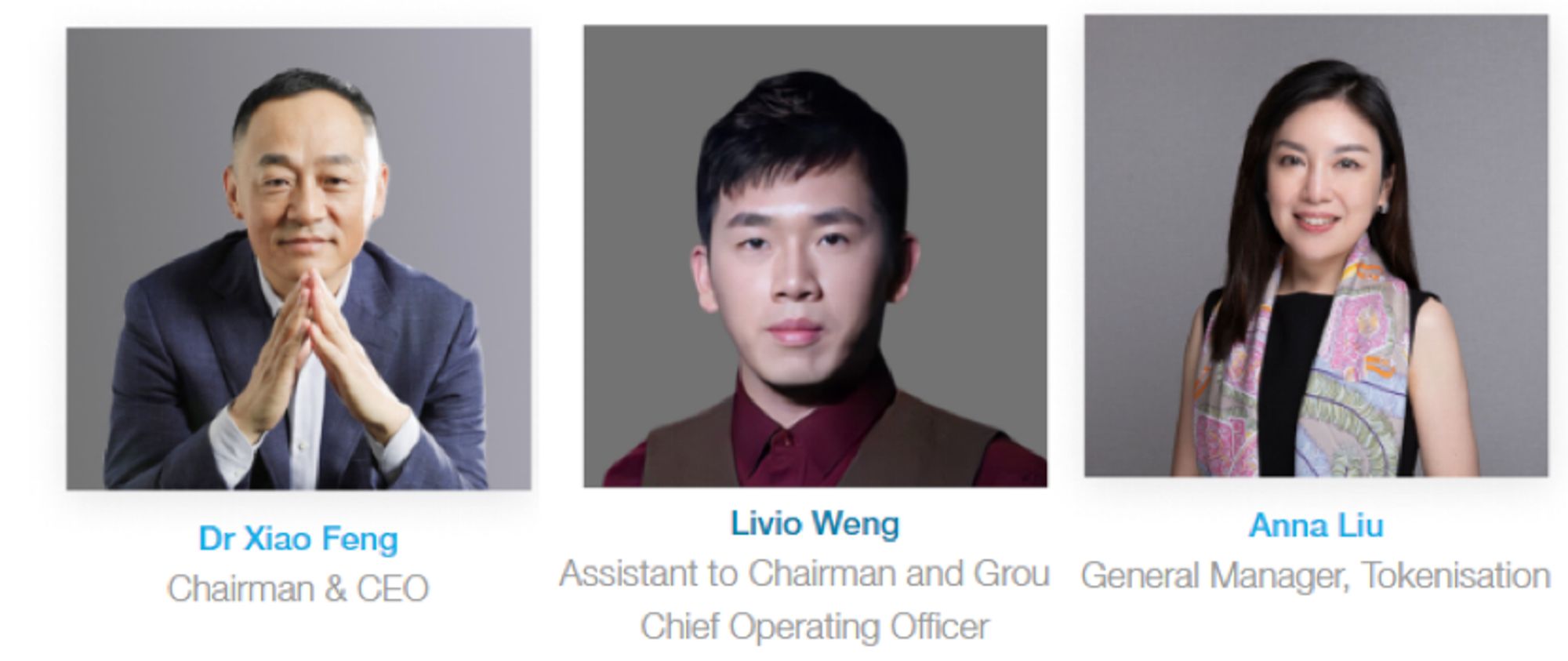

Main member background:According to public information, HashKey Exchange is a trading platform under the HashKey Group, and the chairman of the HashKey Group is Xiao Feng, the founder of Wanxiang Blockchain Laboratory. Dr. Xiao Feng was the Chief of the Securities Management Office of the Shenzhen Special Economic Zone Branch of the Peoples Bank of China, Deputy Director, Deputy Director and Director of the Shenzhen Securities Management Office, Deputy Director of the Securities Administration Office. In 2018, HashKey Group was formally established to transform into digital asset financial services, and Wanxiang Blockchain Lab itself has invested in multiple districts. Blockchain projects, such as Ethereum, ConsenSys, Polkadot, MakerDAO, etc.

Another core team member of HashKey Exchange is Weng Xiaoqi, the former vice president of brand public relations of Huobi. He currently serves as COO of HashKey Exchange and is also the assistant to the chairman of HashKey Group. In addition, the official website of HashKey Group shows that its general manager of tokenization is Liu Jia. He has served as the groups legal director and has worked for Tencent, Skadden, Skadden, and Beijing Guofeng Law Firm for many years. His main practice areas are private equity and investment funds. , cross-border investment and mergers and acquisitions, and domestic and overseas capital markets.

Crypto business scope: According to the HashKey Exchange official website, it currently provides four types of trading pair services: USD, HKD, USDT and USDC. In addition to BTC and ETH trading services, HashKey also launched the AVAX/USD trading pair on September 28. In addition, HashKey Exchange currently supports bank transfer services in 17 countries and regions, including Singapore, the United States, Israel and other places. Withdrawal users need to ensure that the bank account opened under their name is in a qualifying jurisdiction allowed by the Securities Regulatory Commission.

2、OSL Exchange

Trading platform overview:OSL is supported by financial technology and digital asset company BC Technology Group (863.HK). In addition to brokerage, custody, and exchange, it also provides comprehensive services such as software as a service.

Main member background:BC Technologys CFO Hu Zhenbang has more than 16 years of experience in the financial field. He has worked in many companies such as Hong Kong listed technology companies, investment banks and the Big Four accounting firms. Diao Jiajun, the head of regulatory affairs, has served as Yunfeng Financial Group Co., Ltd. (its The Group General Counsel (whose shares are listed on the Main Board of The Stock Exchange of Hong Kong Limited) and the Asia Legal and Compliance Head of Cantor Fitzgerald and BGC Partners was appointed as an executive director of BC Technology Group Co., Ltd. on July 11, 2019.

Encryption business scope:OSL, which holds Type 1 and Type 7 licenses, provides comprehensive services including brokerage, custody, exchange, software as a service, etc. In September this year, OSL announced that its custody and automated trading services (ATS) have passed the authoritative SOC 2 Type 2 service qualification audit focuses on Hong Kong security token business and supports trading of BTC and ETH. Currently, its service targets are mainly institutions and professional investors.

Next, there are 5 virtual asset trading platforms that are applying for licenses:

3、BGE

Trading platform overview:BGE was established in 2021 and is a wholly-owned subsidiary of the listed company HKE Holdings. HKBGE wholly owns HKBGE TSP Limited. HKBGE TSP Limited has obtained a TCSP license (trust or company service provider license) under AMLO in September 2021. To provide virtual asset custody services for HKBGEs trading platform, BGE began preparations in 2022 and has applied for a VATP license.

Main member background:On February 1, 2023, Ouyang Jiannan, one of the founding members of the HashKey Group, was appointed as the director and CEO of HKBGE. The CEO was Thor Chan, the former CEO and co-founder of the encryption exchange AAX. In addition, HK BGE currently has only two directors, including Ou Jinpei and Ji Danna, who are the companys operations director and business development director respectively. The companys website is currently only open to invited professional investors.

Encryption business scope:The BGE official website shows that it is not currently in official use, and displays prompts such as under trial operation and stay tuned for official opening.

4、HKbitEX

Trading platform overview:HKBitEX was established in 2019. Its full Chinese name is Hong Kong Digital Asset Trading Co., Ltd.. It is reported that it is also one of the first institutions to apply for VATP to provide digital asset trading services. Its current service targets are mainly professional and institutional investors.

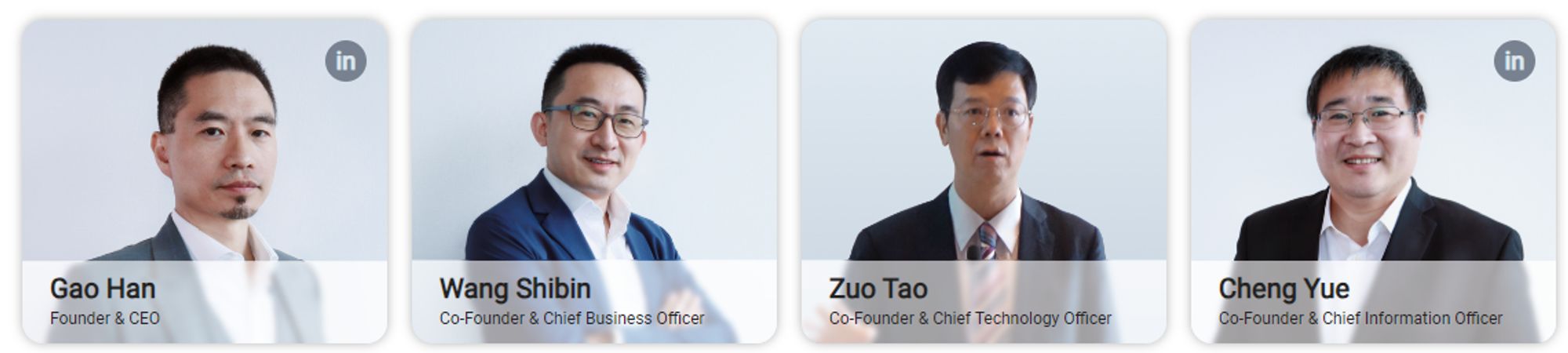

Main member background:The HKBitEX website shows that the companys executives have a very strong background. It is reported that its chief development director Shi Lin was the co-head of the Hong Kong Listing Review Team before 2020, but resigned in July 2021; another key figure is Gao Han, the founder of HKBitEX, who was He works at the Hong Kong Stock Exchange and participates in the Hong Kong Stock Connect, Bond Connect, etc. The platform also has many former employees of the Hong Kong Stock Exchange. Gao Han also serves as the chairman of Taiji Capital Group. HKBitEX is a virtual asset exchange business under the group. Taiji Capital previously announced the issuance of the first real estate fund security token offering (STO) for professional investors, and is also the first fund tokenized fundraising model approved by the Hong Kong Securities Regulatory Commission.

Encryption business scope:According to the official website of HKBitEX, it currently mainly provides USD and USDT trading pair services for BTC and ETH. In addition, the exchange also supports over-the-counter trading and digital asset custody services.

5、HKVAX

Trading platform overview:HKVAXs Chinese name is Hong Kong Virtual Asset Exchange. The company announced on August 11 that it had received a notice of in-principle approval from the Securities and Futures Commission to conduct Type 1 and Type 7 regulated activities. It is expected that its core products include over-the-counter Trading (OTC) brokerage services, institutional-grade trading platforms, and 100% guaranteed custody services, but they are not currently listed on the licensed list.

Main member background:The HKVAX website shows that the company has three co-founders, among whom Chief Executive Officer Ng Wai Leung was once the Managing Director of CITIC Futures International and is currently the Vice Chairman of the Financial and Treasury Services Committee of the Hong Kong General Chamber of Commerce (HKGCC). Another co-founder and chief operating officer, Fok Siu-leung, is a qualified accountant registered with the Hong Kong Institute of Certified Public Accountants and is a representative of the Hong Kong Institute of Certified Public Accountants tax examination scoring team. The third co-founder and technical director Liu Cheng comes from Alibaba and Ant Financial and has performed well in blockchain technology and digital currency.

Encryption business scope:HKVAX currently provides 24/7 global over-the-counter trading services for institutional and professional investors. It also has a virtual asset trading platform and corresponding virtual asset custody services (it obtained the Hong Kong TCSP license in the second quarter of this year).

6、VDX

Trading platform overview:VDX is a subsidiary of Victory Securities, an established local securities firm in Hong Kong. In February this year, Victory Securities announced that the Hong Kong Securities and Futures Commission had accepted Victory Digital Technology Co., Ltd. (Victory Digital Technology, a subsidiary of the group) on February 2, 2023. associated companies) to submit applications for licenses to carry on Type 1 and Type 7 regulated activities.

Main member background:The executive directors of Victory Digital Technology include Gao Juan, Chairman of the Hong Kong Securities Association, and Victory Securities was founded by Dr. Gao Detai, who has won the World Outstanding Chinese Award and is known as the Gold Medal Broker. The company is also a qualified overseas institution recognized by the China Securities Regulatory Commission. Investors (QFII).

Encryption business scope:VDX provides digital asset custody services and is regularly audited by the Big Four accounting firms, in addition to providing products, services and technology to financial institutions and individual professional clients in the areas of compliance, trading, regulatory, financial and risk reporting Customized solutions.

7、Meex

Trading platform overview:Meex was founded in Hong Kong and is supported by a local consortium. It is currently in operation and is preparing to apply for No. 1, 7 and VASP licenses from the Hong Kong Securities Regulatory Commission with the assistance of Hong Kong Junhe Law Firm. Meex is also a formal member of the Hong Kong Web3 Association.

Main member background:MEEX co-founder and Co-CEO Simon Wu is a well-known virtual asset security technology expert in the industry. His technical team is from the core technical team of the worlds leading virtual asset trading platform. The management team includes Hong Kong Securities Regulatory Commission No. 1, 4, and 9 Licensed company executives, virtual asset industry operations executives, Hong Kong licensed lawyers and other people with experience in virtual assets and Hong Kong compliant financial institutions, but the public information of the other co-founder Kiki Kwok and Co-CEO Jason Feng less.

Encryption business scope:Meex currently supports cryptocurrency spot trading, but only supports USDT trading pair services for BTC and ETH. Its APP has been listed on the Apple App Store and Google Play. In addition, Meex also provides cryptocurrency storage services, but all businesses are only open to legal residents who are over 18 years old and hold valid identity documents in non-restricted areas.

Summarize

Since the end of 2022, when Hong Kong announced that it would embrace virtual assets and prepare to build a world virtual asset center, the Hong Kong government has made a series of arrangements on regulatory standards. Generally speaking, Hong Kongs current virtual asset regulatory framework generally includes virtual assets into licensing-style financial regulatory system.

The recent JEPX case is the trigger for the Hong Kong Securities Regulatory Commission to announce the latest regulatory optimization measures. However, it is a blessing in disguise. As the Securities Regulatory Commission’s series of rapid responses and measures are promoting the maturity of the Hong Kong Web3.0 market, Supervision and industry self-discipline are also being further strengthened.

Even though this road towards compliance is full of ups and downs, the ancient proverb has already given us a motto for moving forward - the road is long and long, and I will pursue it up and down. We are already on the road, and these are the hurdles we will eventually overcome.