Original - Odaily

Author-husband how

Editor - Qin Xiaofeng

FTX-related events have always been the focus of market attention. Recently, FTX-related wallets have frequently transferred large amounts of assets out of suspected liquidations, causing concern and panic in the crypto community.

In fact, on September 14, the court approved the FTX asset liquidation plan:The liquidation limit is capped at US$50 million in the first week and US$100 million in subsequent weeks; however, the liquidation limit can be negotiated with creditors, with a maximum cap of US$200 million.The liquidation process is also relatively clear, excluding some tokens that need to be unlocked.Most of the remaining tokens are eligible for liquidation, with Bitcoin and Ethereum requiring 10 days’ notice to the committee of creditors, the special committee and the U.S. Trustee before they can be sold.

However, since the liquidation plan was approved, FTX/Alameda’s related wallets have not done much. Apart from depositing part of SOL and ETH into Figment for pledge, the remaining positions have not changed.

As the crypto market has risen in the past two weeks, FTX/Alameda-related addresses have frequently experienced large-scale changes, transferring multiple currencies to exchanges, triggering market concerns about the liquidation of FTX assets leading to a market decline.

Odaily has organized, made statistics and analyzed the recent token outflows from FTX/Alameda related addresses.

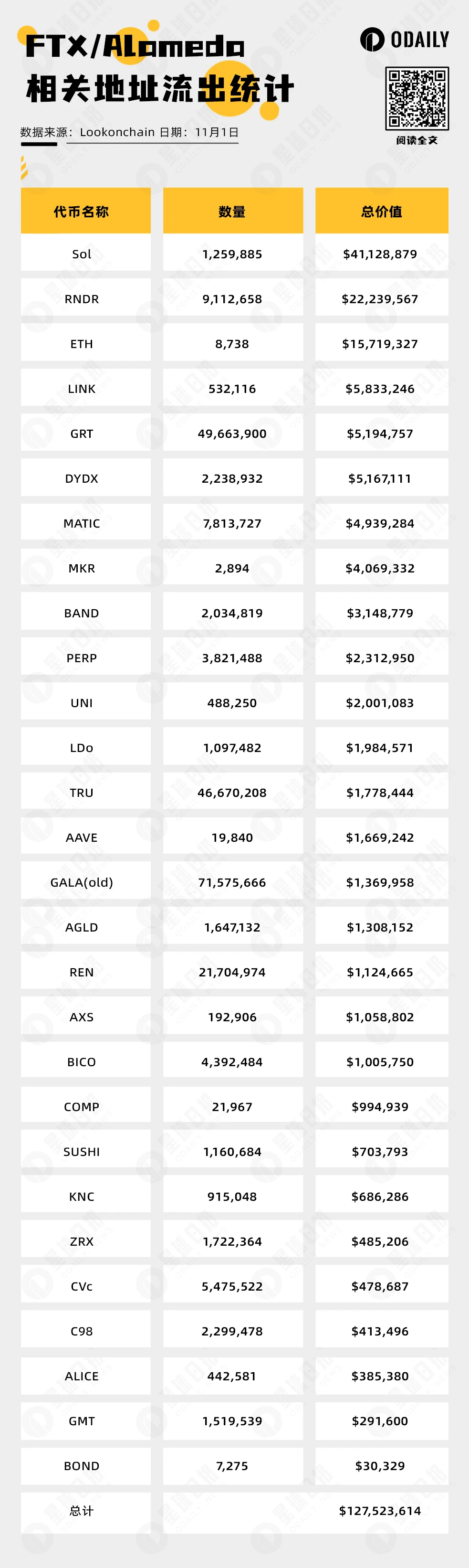

FTX/Alameda related address token outflow statistics

In the past week, FTX/Alameda related addresses have deposited money into Binance and Coinbase.Approximately $128 million in token assets.The following figure shows the token asset outflow statistics of FTX/Alameda related addresses in the past week:

As can be seen from the figure above, the number of token types that have flowed out in the past seven days is 28, of which 19 tokens have an outflow amount exceeding US$1 million.

The top three outflows of tokens are: SOL has an outflow of approximately 1.26 million tokens, worth approximately US$41 million; RNDR has an outflow of approximately 9.11 million tokens, worth approximately US$22 million; ETH has an outflow of approximately 87.38 million tokens, with a value of approximately US$22 million. Approximately $15.7 million.

(Odaily: The above amount is calculated based on the market price at the time of deposit on the day, and the data comes from FTX/Alameda’s 8 hot wallet addresses and 2 SOL cold wallets.)

FTX token asset liquidation will have less impact on SOL

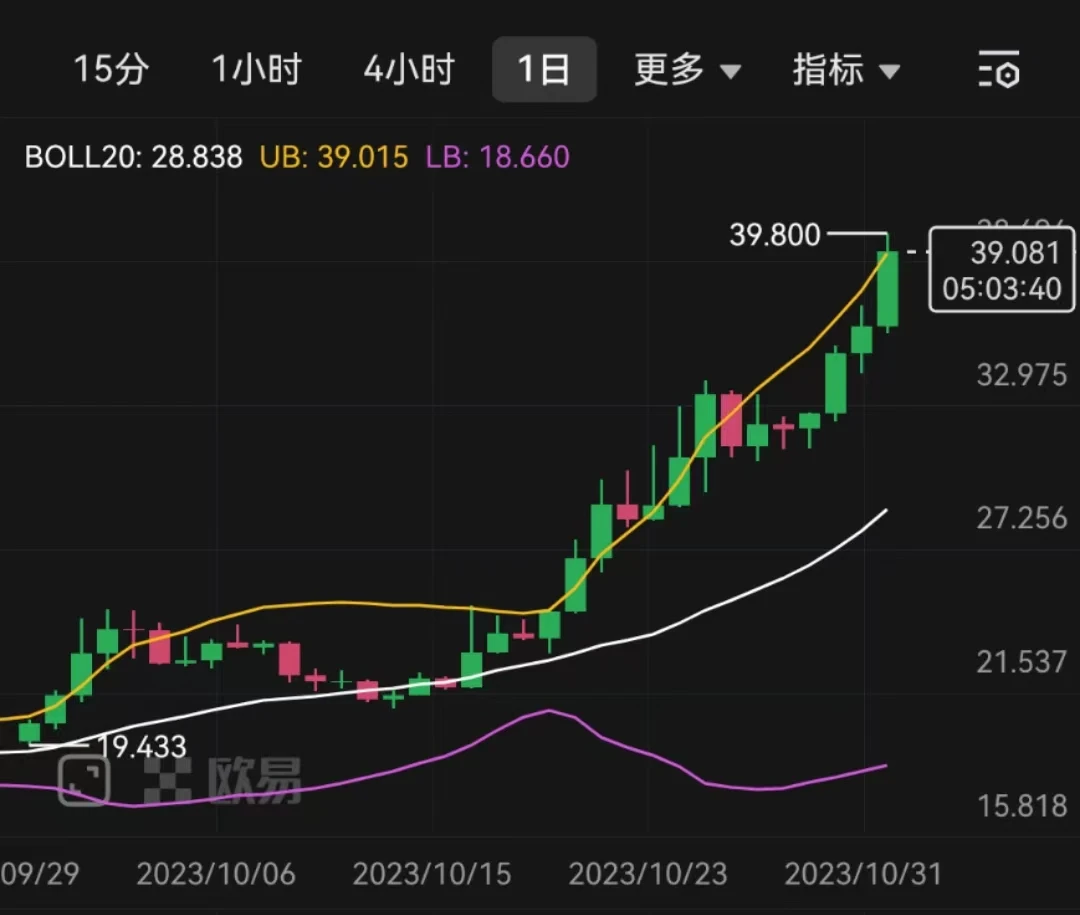

Starting from October 25, FTX/Alameda related addresses have successively deposited tokens to the exchange. As the token with the highest value outflow from FTX-related addresses, the price of SOL has not been negatively affected, but has gone against the flow.

(SOL Price Daily Chart)

OKX Ouyi market shows that the price of SOL has continued to climb from 30 USDT on October 25 to todays highest point of 39.8 USDT, setting the highest level since September last year. It is still maintained around 39 USDT, with an increase of more than 20% in the past week.

according toCoinGeckoThe data shows that Solana’s trading volume in the past seven days has averaged around US$1 billion; the total value of SOL deposited into the exchange by FTX-related addresses at that time was approximately US$41 million. Taken together, the impact of these liquidations on SOL, which has higher liquidity, is not obvious.

Other small currencies with a holding value of more than one million US dollars in FTX wallets, such as BICO, AXS, etc., generally have a market value of more than 100 million US dollars, and the pressure caused by liquidation is not great. The prices of related currencies have followed the market in the past two weeks. Go higher.

In fact, the essence of FTX token asset liquidation is to maximize profits. In particular, most of FTXs SOL holdings are restricted by the structured unlocking plan. A short-term one-time sell-off will not earn more profits.

According to Odaily’s previous articleDismantling FTXs $3.4 billion position, how much selling pressure is there on the top ten currencies? 》, as of August 31, the FTX wallet addresss holdings were US$3.4 billion; as of today, FTXs total holdings exceeded US$5 billion - due to the recent rise in the market, the price of SOL has doubled, the price of Bitcoin has increased by 30%, and the price of other currencies has increased by 30%. Each species also has a certain increase.

It can be seen from this that market conditions are important to FTX’s liquidation, and FTX’s liquidation team Galaxy Digital will not be eager to sell and drain market liquidity. Secondly, as mentioned at the beginning of the article, the weekly limit of the court-approved FTX asset liquidation plan is only $200 million, which will not cause much fluctuation in the current market liquidity. Finally, the liquidation of FTX token assets does not rule out the possibility of over-the-counter OTC transactions; when the liquidation plan is approved, news of institutions such as DWF purchasing FTX token assets over-the-counter frequently appears in the news.

Overall,The FTX liquidation team may be more concerned about the impact of liquidation on the market than we are, and the selling pressure caused by liquidation on the market is not as great as imagined. The crypto community does not need to panic too much.