Mint Ventures: Is the rapidly growing Morpho a potential rival of Aave?

Original author: Alex Xu, Mint Ventures

introduction

After experiencing the bull-bear cycle of 2020-2023, we found that: in the application layer in the Web3 business world, the only truly established business model category is DeFi, and Dex, lending and stablecoins are still the three cornerstones of DeFi ( The derivatives track has also developed significantly in recent years), and even in a bear market, their business remains strong.

Mint Ventures has written a large number of research reports and analysis articles on Dex and stablecoins in the past. Dex includes many ve (3, 3) projects such as Curve, Trader Joe, Syncswap, Izumi and Velodrome, while stablecoin projects cover MakerDao , Frax, Terra, Liquidity, Angle, Celo and other projects. This issue of Clips will return to the lending industry and focus on Morpho, a new force whose business data has grown rapidly in the past year.

In this article, the author will sort out Morpho’s existing business and the recently announced lending base layer service Morpho Blue, and try to answer the following questions:

What is the current market structure of the lending industry?

What businesses does Morpho encompass, and what problems is it trying to solve? How is the business developing currently?

What are the prospects of the newly launched Morpho Blue business? Will it impact the top positions of Aave and Compoud? What other potential impacts are there?

The content of the following article is the authors staged opinions as of the time of publication. There may be errors and biases in facts and opinions. It is for discussion only. We also look forward to corrections from other investment research colleagues.

Decentralized lending market structure

Organic demand becomes the mainstream of the market and Ponzi color fades

The proportion of decentralized lending’s capital capacity has always been at the forefront. Currently, TVL has surpassed Dex and become the track with the largest capital capacity in the Defi field.

Source: https://defillama.com/categories

Decentralized lending is also a rare business category in the Web3 field that has achieved PMF (product demand fit). Although in the DeFi summer wave of 2020-2021, many projects have also appeared to provide high subsidies for lending behavior through tokens. situation, but this phenomenon has been greatly reduced after entering the bear market.

As shown in the figure below, the protocol revenue of Aave, the leading project in the lending field, began to exceed the incentive withdrawals of its tokens in December 2022, and so far has far exceeded the incentive withdrawals of the tokens (protocol revenue in September was US$1.6 million, Aave Token incentive withdrawal of US$230,000). In addition, Aaves token incentives are mainly used to guide token holders to pledge Aave to ensure repayment when bad debts occur in the protocol and the treasury compensation is insufficient, rather than to encourage users deposit and borrowing behavior. Therefore, Aave’s current deposit and lending behavior is completely “organic” and not a Ponzi structure supported by liquidity mining.

Monthly comparison of Aave’s incentive receipts and protocol income

Source: https://tokenterminal.com/

In addition, Venus, the leading lending protocol on BNBchain, has also achieved healthy operation with protocol income exceeding incentive receipts after March 23, and currently basically no longer subsidizes deposits and lending activities.

Monthly comparison of Venus’ incentive collection and agreement income

Source: https://tokenterminal.com/

However, there are still high token subsidies behind the supply and demand of many lending protocols, and the subsidy value of the protocol for lending behavior is far greater than the income that can be obtained from it.

For example, Compound V3 still provides Comp token subsidies for deposits and borrowings.

Nearly half of USDC’s deposit interest rate on Compound V3 Ethereum mainnet is provided by token subsidies

source:https://app.compound.finance/markets/weth-mainnet

84% of the deposit rate on USDC on the Compound V3 Base mainnet is provided by token subsidies

Source: https://app.compound.finance/markets/weth-basemainnet

If Compound maintains its market share through high token subsidies, then another protocol, Radiant, is a pure Ponzi structure.

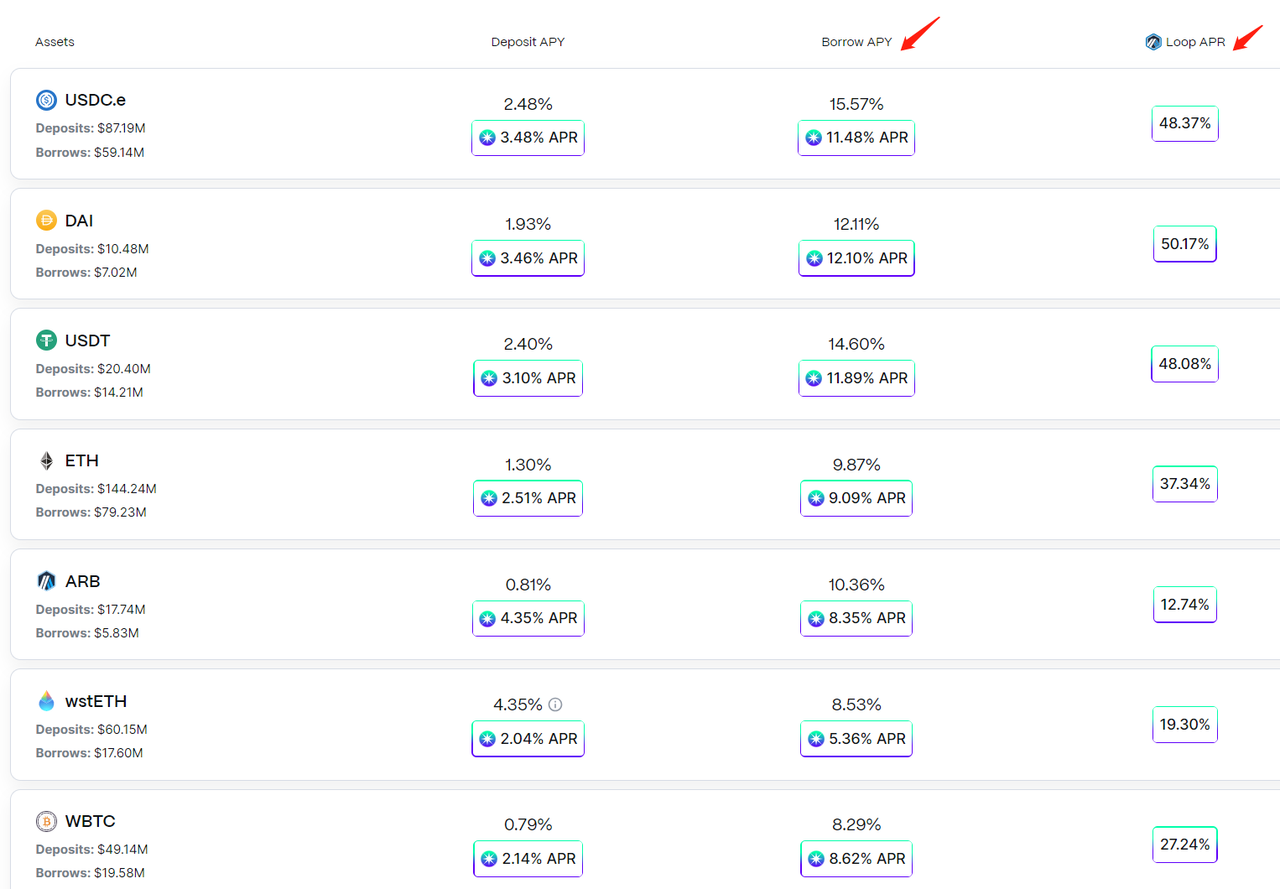

On Radiant’s lending market page, we can see two unusual phenomena:

Source: https://app.radiant.capital/

First, its asset lending interest rate is significantly higher than the market interest rate. The daily stablecoin lending interest rate in the mainstream money market is usually around 3-5%, while Radiant is as high as 14-15%. The lending interest rate of other assets is 8-8% in the mainstream money market. 10 times;

The second is that it mainly promotes revolving loans on the product interface, which encourages users to use the same asset as deposit collateral to repeatedly cycle: deposit-lending operations, and enlarge their total amount of deposits and borrowings through revolving loans to maximize their use of the platform. Mining revenue for the token Radiant. In essence, the Radiant project party is selling the project token RDNT to users in disguise by charging user borrowing fees.

But the problem is that the source of Radiant’s handling fees—that is, users’ borrowing behavior—does not come from real organic borrowing needs, but from the purpose of obtaining RNDT tokens, which constitutes a huge “left foot stepping on the right foot” economic structure. In this process, the lending platform has no real “financial consumers”. Revolving loan is not a healthy lending model, because the depositors and borrowers of the same asset are the users themselves, and the economic source of RDNT dividends is also the users themselves. The only risk-free profit maker is the platform project that extracts profits from handling fees. party (it charges 15% of interest income). Although the project side has delayed the short-term death spiral pressure caused by the decline of RDNT tokens through RDNTs dLP pledge mechanism, in the long term, unless Radiant can gradually shift its business from Ponzi to a normal business model in the future, the death spiral will eventually advent.

But in general, the leading projects in the decentralized lending market, represented by Aave, are gradually getting rid of their reliance on high subsidies to maintain operating income and returning to a healthy business model.

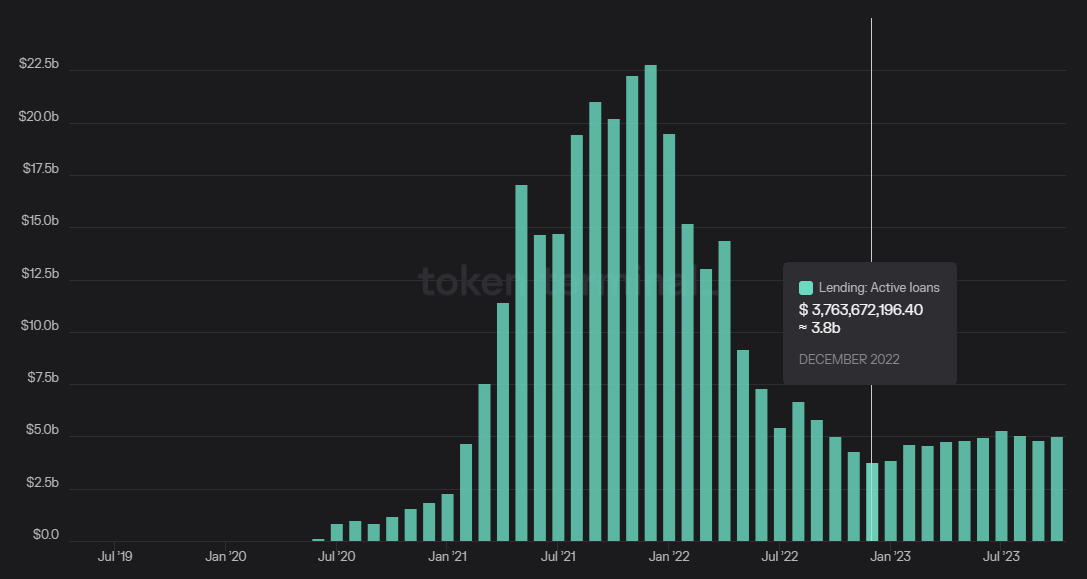

The figure below shows the changes in active loan volume in the web3 lending market from May 2019 to October 2023, from the initial few hundred thousand US dollars to the peak of US$22.5 billion in November 2021, and then to the lowest period in November 2022. 3.8 billion US dollars, now it is 5 billion US dollars. The business volume of the loan market is slowly bottoming out, and it still shows good business resilience in the bear market.

Source: https://tokenterminal.com/terminal/markets/lending

The moat is obvious and the market concentration is high.

Both are DeFi infrastructure. Compared with the fierce competition in the Dex market, the moat of the leading project in the lending track is stronger, which is specifically reflected in:

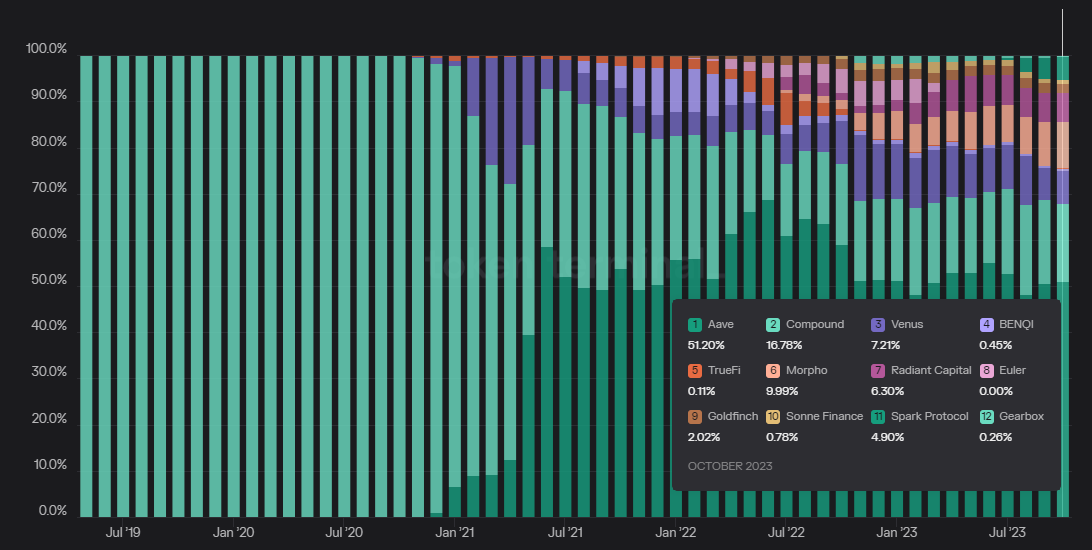

Market share is more stable. The figure below shows the changes in the proportion of active lending volume of each project from May 2019 to October 2023. Since Aave made its debut in mid-2021, its market share has been stable in the 50-60% range. Although the second-place Compounds share has been continuously squeezed, its ranking is still relatively stable so far.

Source: https://tokenterminal.com/terminal/markets/lending

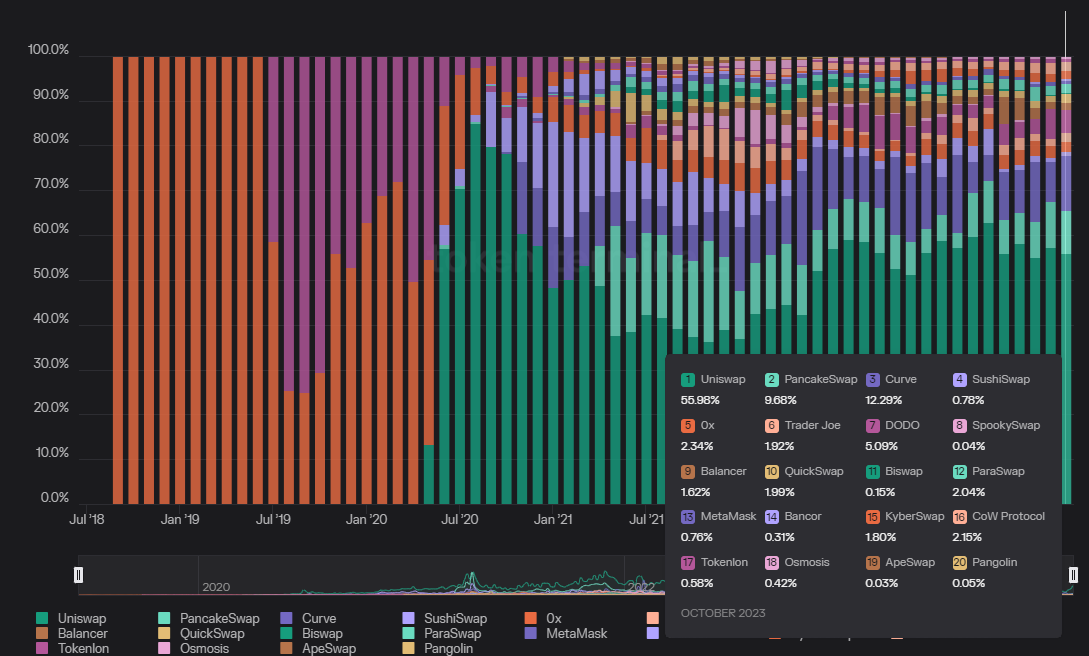

In comparison, the changes in the market share of the Dex track are more dramatic. After the leading project Uniswap quickly occupied nearly 90% of the trading volume market share after its launch, due to the rapid growth of Sushiswap, Curve, and Pancakeswap, the market share increased. It once fell to 37% and is now back to around 55%. In addition, the total number of projects in the Dex track is much greater than that in the loan track.

Source: https://tokenterminal.com/terminal/markets/lending

2. Lending track projects have stronger profitability. As mentioned in the previous section, projects such as Aave have been able to achieve positive cash flow without subsidizing lending behavior, with operating income of about US$1.5-2 million in monthly interest spreads. Most Dex projects, such as Uniswap, have not yet enabled charging at the protocol level (only front-end charging has been enabled), or the value of token emissions used for liquidity incentives is much greater than the protocols fee income, and they are actually operating at a loss. .

The moat source of the head lending agreement can be generally summarized as the brand power in security, and specifically it can be broken down into the following two points:

Long history of security operations: Since the 2020 DeFi Summer, there have been many Aave or Compound fork projects established on various chains, but most of them suffered from stolen coins or large bad debt losses shortly after their establishment. Aave and Compound have not experienced serious currency theft or unbearable bad debt incidents so far. This long-term safe operation history in a real network environment is the most important security endorsement for deposit users. The new lending protocol may have a more attractive concept and higher short-term APY, but it will be difficult to gain the trust of users, especially whale users, before it has been baptized in years.

More abundant security budget: The leading lending agreement has higher commercial income, and the treasury funds are relatively abundant, which can provide sufficient budget for security audit and asset risk control. This is crucial for the development of new features and the introduction of new assets in the future.

Overall, lending is a market that has proven organic demand, a healthy business model, and a relatively concentrated market share.

Morpho’s business content and operational status

Business content: Interest rate optimization

Morphos current online business is a peer-to-peer lending protocol (or interest rate optimizer) built on Aave and Compound. Its function is to improve the funds that are not completely matched in peer-to-peer pool lending protocols such as Aave. Inefficiency problem.

Its value proposition is simple and clear: provide better interest rates for both borrowers and lenders, i.e. higher deposit returns and lower borrowing rates.

The reason why the peer-to-peer pool model of Aave and Compound has low fund efficiency is because its mechanism determines the total size of deposit funds (pool), which is always larger than the total size of lending funds (points). In most cases, the USDT money market There are 1 billion in total deposits, but only 600 million USDT are lent.

For depositors, since the idle 400 million funds must also be allocated with the interest generated by the 600 million loan, each person can be allocated less interest; for borrowers, although only a part of the capital pool has been borrowed, the actual The above is to pay interest for the entire capital pool, and each person bears more interest. This is the problem caused by the mismatch between deposits and borrowing funds.

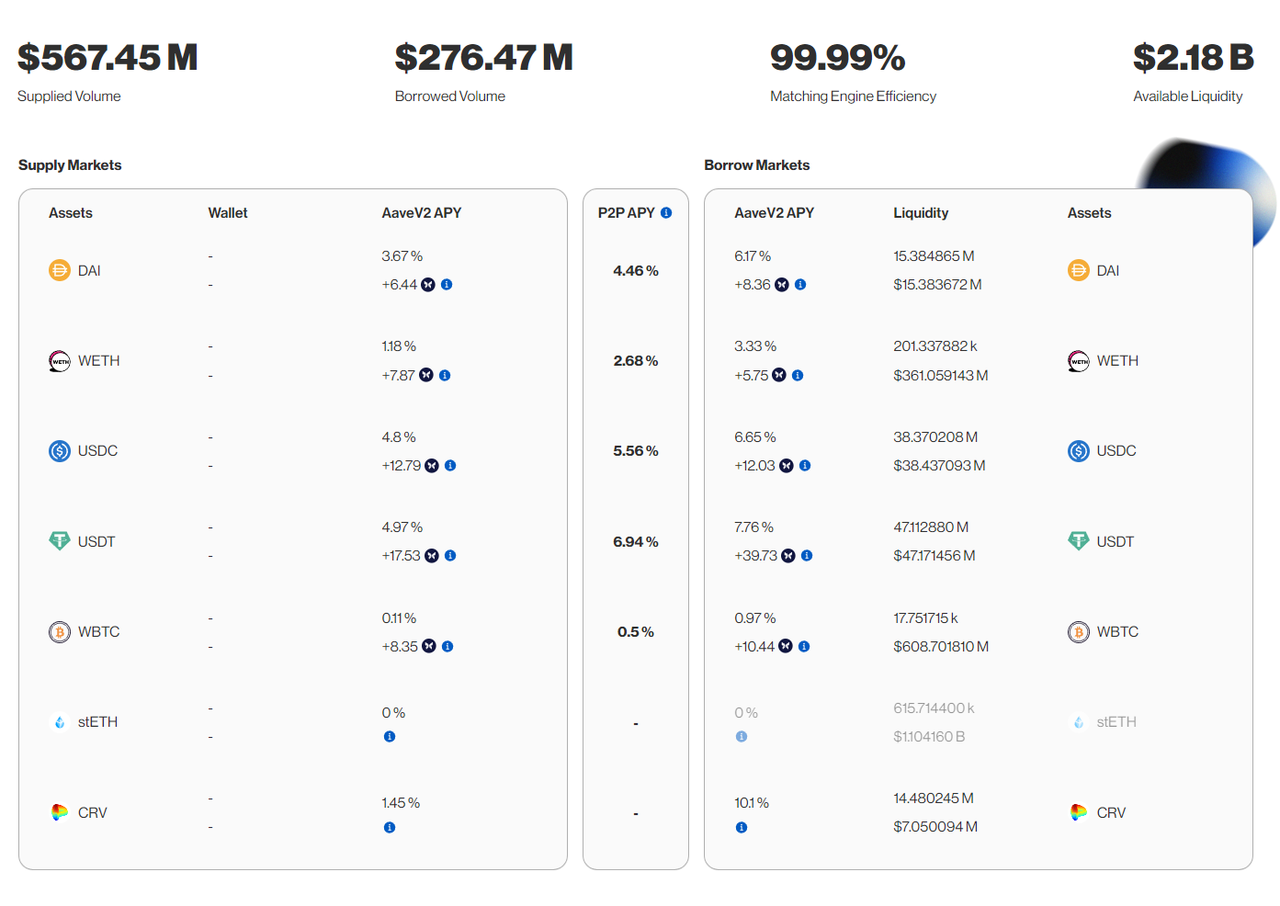

Let’s take the interest rate optimizer module on Aave V2, which currently has the largest deposit business volume of Morpho, as an example to see how Morpho’s interest rate optimization service solves this problem.

Deposit: Deposit user BOB deposits 10,000 Dai into Morpho. Morpho will first deposit the funds into the money market of Aave V2. The deposit interest rate is Aave’s market interest rate of 3.67%.

Borrowing collateral: Borrowing user ALICE first deposits the collateral 20 ETH into Morpho and requests a loan of 10,000 Dai. Morpho will deposit the collateral into the money market of Aave V2.

Deposit and loan matching: Morpho then takes back the 10,000 Dai that BOB previously deposited into Aave, and directly matches and lends it to ALICE. Note that at this time, BOBs deposits completely match ALICEs borrowings. BOBs deposits are not idle and are fully lent out; ALICE only pays interest on the 10,000 Dai it lent, not the entire capital pool. Therefore, under this matching situation, BOB obtains a higher deposit interest rate, that is, 4.46%, than the Aave peer-to-pool model of 3.67%; ALICE bears a lower borrowing interest rate, which is also 4.46%, than the Aave peer-to-pool model, which is 6.17%. , the interest rates of both parties are optimized.

*Note: Whether the P2P interest rate of 4.46% in the example is closer to the lower limit (deposit APY) or the upper limit (borrowing APY) of the underlying protocol is determined by Morphos parameters, which are determined by governance.

Solving the mismatch: Suppose BOB wants to get back the Dai it lent before, but ALICE has not paid back the money. Then if there are no other fund lenders on Morpho, Morpho will borrow 10,000 from Aave using ALICEs 20 ETH as collateral. + The principal and interest of Dai are provided to BOB to complete the redemption

Matching order: Considering the gas cost, the P2P matching of deposit and loan funds is matching large funds first. The larger the deposit and loan funds, the higher the priority. In this way, the proportion of gas consumption per unit of funds will be low. When the gas consumption value of performing matching is too large relative to the amount of matching funds, matching will not be performed to avoid excessive wear.

Source: https://aavev2.morpho.org/?network=mainnet

Through the above explanation, we find that the essence of Morpho’s business is to use Aave and Compound as a capital buffer pool to provide interest rate optimization services for deposit and loan users through matching.

The ingenuity of this design is that through the composability of the DeFi world, Morpho attracts users’ funds in a blank-handed manner. For users, the attraction is:

1.TA can obtain the same financial interest rate as Aave and Compound at the worst in Morpho, and when matching occurs, its benefits/costs will be greatly optimized.

2. Morphos products are mainly built based on Aave and Compound, and the risk parameters are also completely copied and executed. Its funds are also allocated in Aave and Compound, so it has inherited the brand reputation of the two old protocols to a great extent.

This ingenious design and clear value proposition allowed Morpho to obtain nearly US$1 billion in deposits just over a year after its launch, ranking second only to Aave and Compound from the data.

Business data and token status

business data

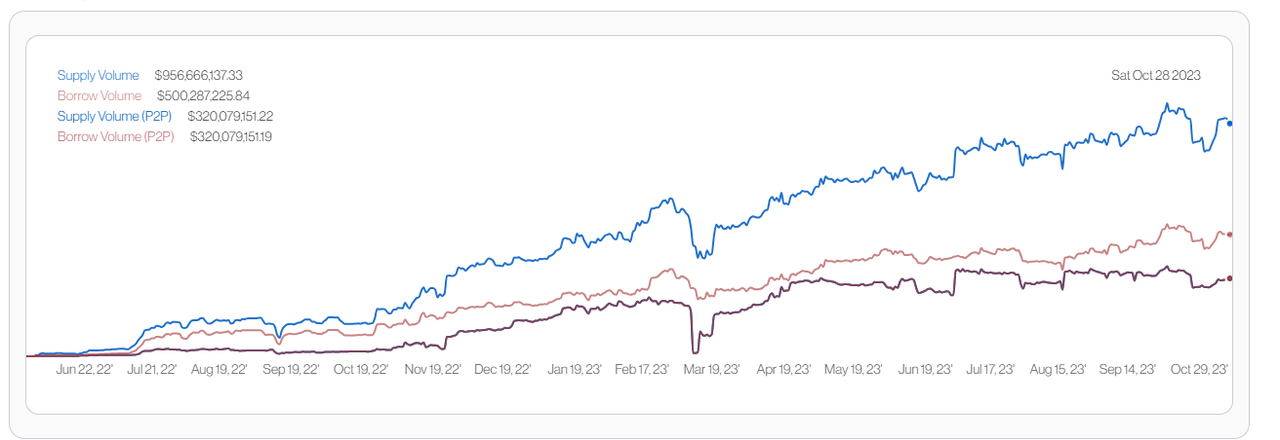

The chart below shows Morpho’s business trends for total deposits (blue line), total borrowings (light brown line), and matching amounts (dark brown).

Source: https://analytics.morpho.org/

Overall, Morphos business scale continues to grow, with the deposit fund matching rate reaching 33.4% and the borrowing fund matching rate reaching 63.9%. The data is quite beautiful.

Token situation

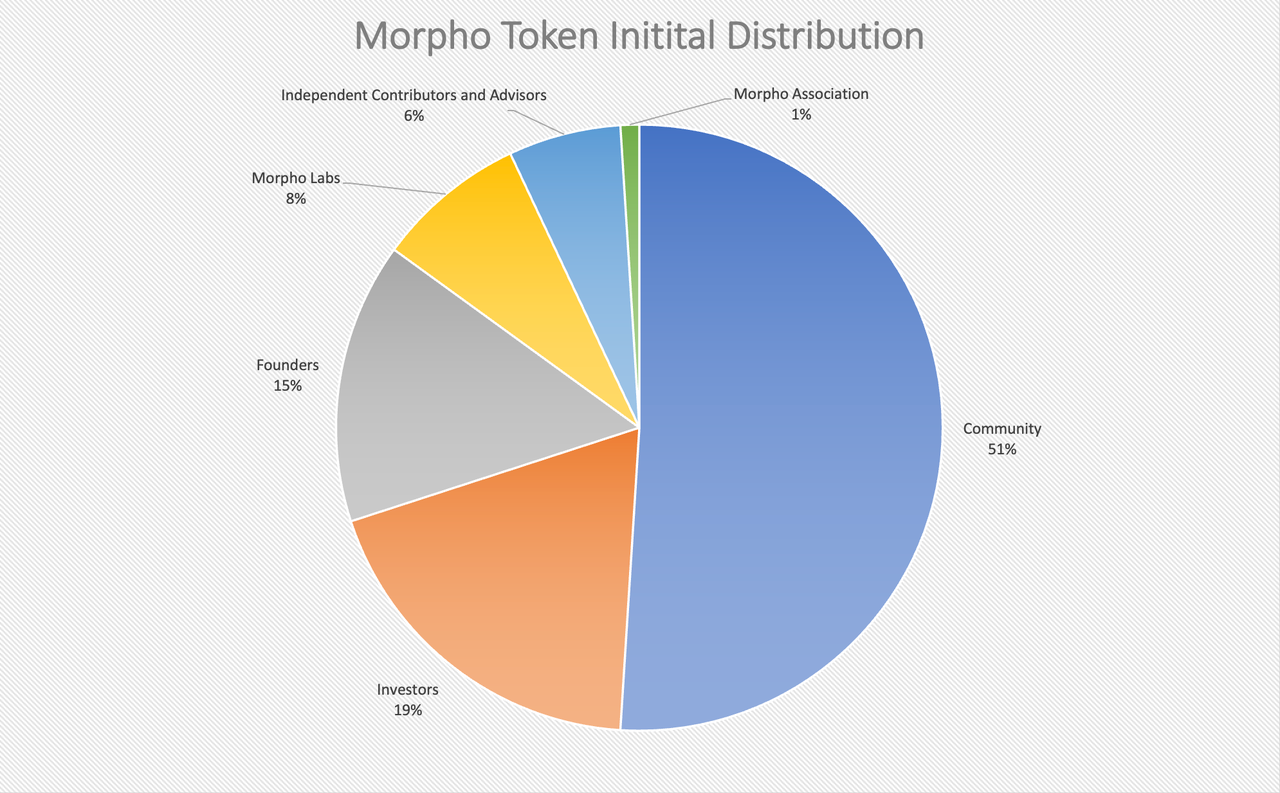

Source: official documentation

The total number of Morpho tokens is 1 billion, of which 51% belongs to the community, 19% is sold to investors, the founders and the development company behind it, Morpho Labs, and the operating organization Morpho Association own 24%, and the remaining goes to consultants and contributors.

It is worth mentioning that although Morpho tokens have been issued and used in voting decisions and project incentives, they are in a non-transferable state. Therefore, it does not have a secondary market price. Users and investors who receive tokens can participate in voting governance, but cannot sell them.

Unlike projects such as Curve, which hard-code the future output and incentives of tokens, Morphos token incentives are determined in batches, quarterly or monthly, which allows the governance team to flexibly adjust the intensity and incentives of incentives according to market changes. specific strategies.

The author believes that this is a more pragmatic approach, and may become the mainstream model of token incentive distribution in Web3 business in the future.

On the behavioral objects of incentives, Morpho simultaneously incentivizes deposit and borrow behaviors. However, the current distribution of Morpho tokens in incentives is not large. In the past year or so, only 30.8 million have been distributed, accounting for 3.08% of the total. Moreover, judging from the incentive period and the corresponding token distribution in the figure below Look, official token spending on incentives is decreasing rapidly, and the reduction in spending has not slowed down the growth of Morphos business.

This is a good signal that Morphos PMF is relatively sufficient and user demand is becoming more and more organic. The community token share is 51%, and currently there is nearly 48% left, which leaves ample budget space for business incentives in new sections in the future.

However, Morpho does not currently charge for the service.

Team and financing

The core team of Morpho comes from France, and most of the base members are in Paris. The core members of the team have their real names. The three founders are all from the telecommunications and computer industries, and have a background in blockchain entrepreneurship and development work.

Morpho has conducted two rounds of financing, namely a $1.3 million seed round in October 2021, and an $18 million Series A round of financing in July 2022 led by A16z, Nascent, and Variant.

Source: official website

Source: official website

If the above financing amount corresponds to the officially disclosed 19% investor share, then the corresponding comprehensive project valuation is approximately US$100 million.

Morpho Blue and its potential impact

What is Morpho Blue?

Simply put, Morpho Blue is a permissionless lending base layer. Compared with Aave and Compound, Morpho Blue opens up most lending dimensions, so anyone can build a lending market based on Morpho Blue. The dimensions that builders can choose include:

What to use as collateral

What to use as a loan asset

What oracle to use?

What are the loan to loan ratio (LTV) and liquidation ratio (LLTV)?

What does an interest rate model (IRM) look like?

What value will this bring?

In the official article, a summary of the features of Morpho Blue includes:

Trustless because:

1. Morpho Blue cannot be upgraded, no one can change it, and follows the principle of minimal governance

2. Only 650 lines of Solidity code, simple and safe

Efficient because:

1. Users can choose higher LTV and more reasonable interest rates

2. The platform does not need to pay third-party audit and risk management service fees

3. Singleton smart contract based on simple code (singleton smart contract refers to the agreement using one contract to execute rather than a combination of multiple contracts. Uniswap V4 also uses a singleton contract), which significantly reduces gas costs by 70%

Flexible because:

1. Market construction and risk management (oracles, lending parameters) are permissionless and no longer adopt a unified model, that is, the entire platform follows a set of standards set by DAO (the models of Aave and Compound)

2. Developer-friendly: Introducing a variety of modern smart contract models, account management implements GAS interaction and account abstraction functions, and free flash loans allow anyone to access assets in all markets simultaneously with one call, as long as they are repaid in the same transaction That’s it

Morpho Blue adopts a product idea similar to Uni V4, that is, it only makes the basic layer of a large type of financial services, and opens up the modules above the basic layer to allow different people to come in and provide services.

The difference from Aave is that although Aaves fund deposits and borrows are permissionless, what kind of assets can you deposit and borrow in Aave, are the risk control rules conservative or aggressive, which oracle is used, and what are the interest rates and liquidation parameters? Settings, these are formulated and managed by Aave DAO and the various service providers behind the DAO such as Gaunlet and Chaos, which monitor and manage more than 600 risk parameters on a daily basis.

Morpho Blue is like an open lending operating system. Anyone can build a lending portfolio that they think is optimal on Morpho Blue like Aave, and professional risk management institutions like Gaunlet and Chaos can also go to Look for partners in the market to sell their risk management services to obtain corresponding fees.

In the author’s opinion, the core value proposition of Morpho Blue is not to be trustless, efficient and flexible, but to provide a free lending market where participants in all aspects of the lending market can collaborate here to provide customers in all aspects with richer services. Market selection.

Is Morpho Blue a threat to Aave?

maybe.

Morpho is a bit different from many previous Aave challengers, and it has accumulated some advantages over the past year or so:

1 billion funds under management, which is already in the same order of magnitude as Aave’s 7 billion funds under management. Although these funds are currently sitting in Morpho’s interest rate optimizer function, there are many ways to import them into new functions.

Morpho is the fastest growing lending protocol in the past year, and its tokens are not officially circulated, which leaves a lot of room for imagination. The launch of its major new features can easily attract user participation.

Morpho’s token budget is sufficient and flexible, and it has the ability to attract users through subsidies in the early stage.

Morpho’s stable operation history and amount of funds have given it a certain accumulation in security brands.

Of course, this does not mean that Aave will definitely be at a disadvantage in future competitions, because most users may not have the ability and willingness to choose services from many lending solutions. Currently, Aave DAO outputs under the unified management model Lending products may still be the most popular in the end.

Secondly, the Morpho rate optimizer largely inherits the safe credit of Aave and Compound, which allows more funds to be used with confidence over time. But Morpho Blue is a brand new product with separate code, and whales must have a period of hesitation before committing to it. After all, the theft of the previous generation’s main permissionless lending market like Euler is still happening before our eyes.

Furthermore, Aave is fully capable of building a set of functions similar to Morphos interest rate optimizer on existing solutions to meet users needs to improve fund matching efficiency and squeeze Morpho out of the P2P lending market. Although this possibility seems unlikely at present, because Aave also issued Grants to NillaConnect, a P2P lending product similar to Morpho, in July this year, rather than doing it itself.

In the end, the lending business model adopted by Morpho Blue is not fundamentally different from Aave’s existing solution. Aave also has the ability to observe and imitate Morpho Blue’s excellent lending model.

But in any case, after Morpho Blue goes online, it will provide a more open lending testing ground, providing the possibility of participation and combination in all aspects of lending. Will these newly connected lending groups emerge with solutions that are enough to challenge Aave?

Well see.