Original author: Lisa, LD Capital

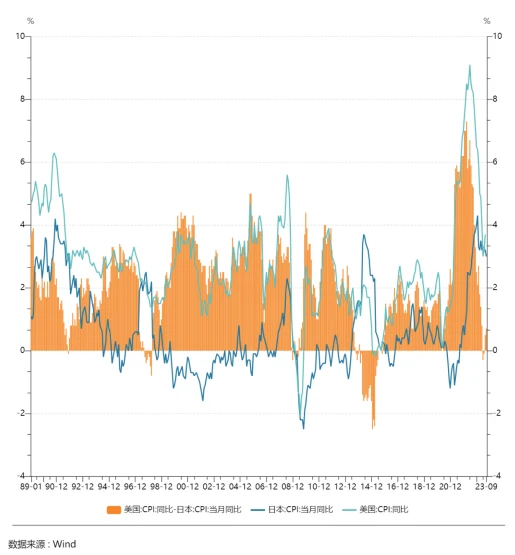

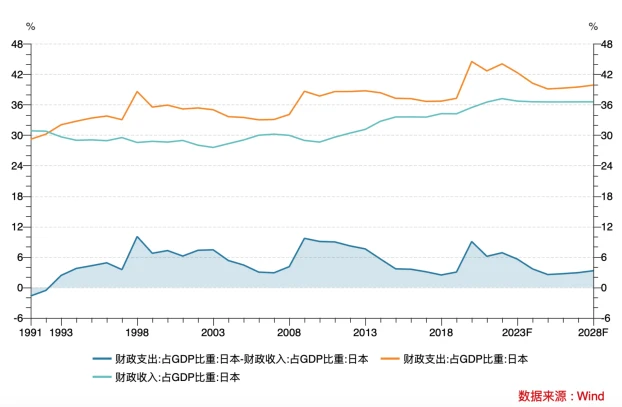

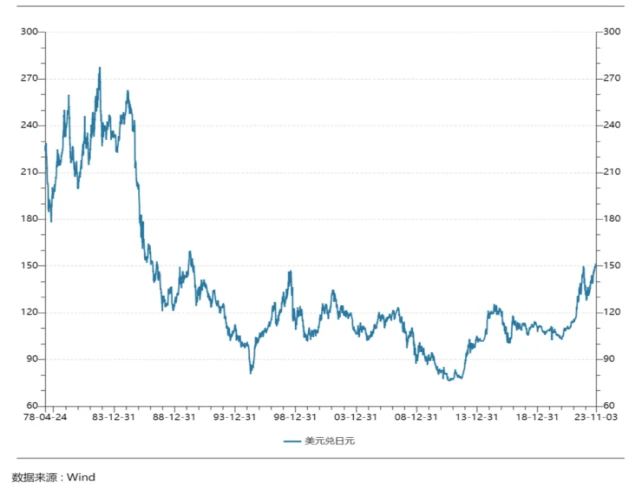

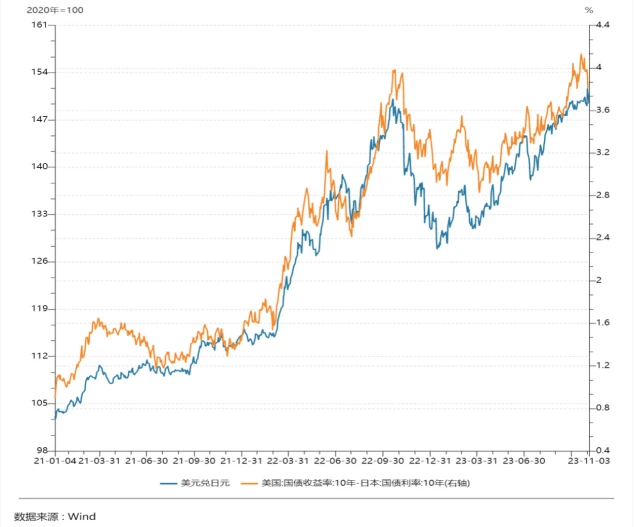

Since the beginning of this year, the yen has depreciated sharply against the backdrop of the widening interest rate differential between the United States and Japan. The U.S.-Japan exchange rate reached a maximum of 151.77 on October 31, which is extremely close to the high point of the U.S.-Japan exchange rate last year. At the same time, Japans core CPI growth rate has continued to be higher than 2% since April 2022. The core CPI growth rate excluding fresh food and energy also exceeded 2% in October 2022. The market is optimistic about the Bank of Japan (Bank of Japan, Bank of Japan). Japan) is expected to end its ultra-loose monetary policy and withdraw from the YCC. The worlds most dovish central bank has turned.

1. Review of the trend of the Japanese yen

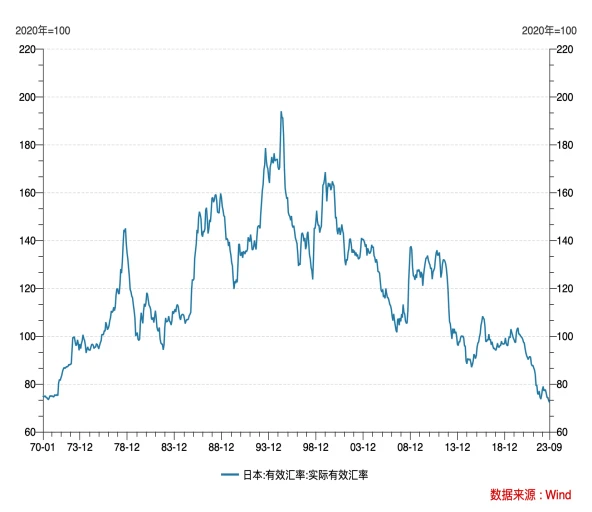

Looking back at history, the Japanese yen exchange rate has generally gone through the following stages over the past 40 years.

After the Plaza Accord in 1985, major central banks jointly intervened in the foreign exchange market to promote the devaluation of the US dollar. In the following three years, the Japanese yen exchange rate more than doubled, from 243 yen/USD in September 1985 to November 1988. of 121 yen/USD.

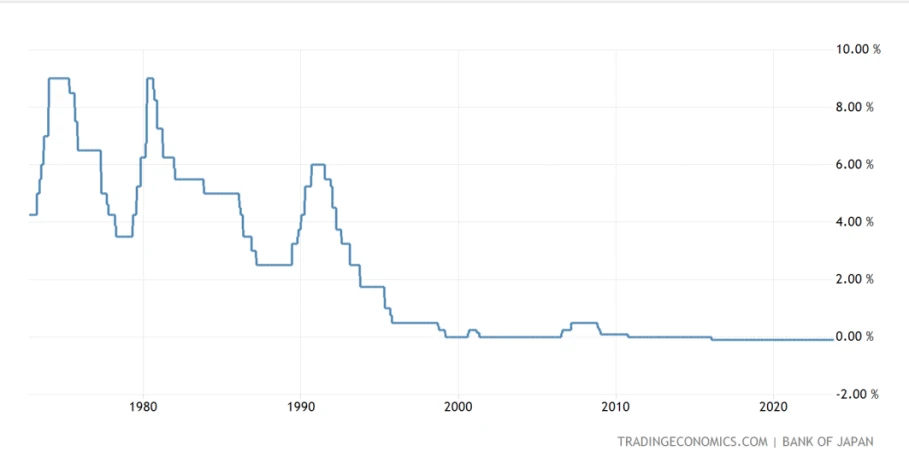

From 1989 to 1990, the Bank of Japan aggressively raised interest rates from 2.5% to 6% in order to curb asset bubbles. This led to the bursting of the Japanese stock market bubble in early 1990, and the Japanese yen exchange rate rose to the level of 160 yen/USD in April 1990, becoming The highest level in 32 years.

Bank of Japan base interest rate

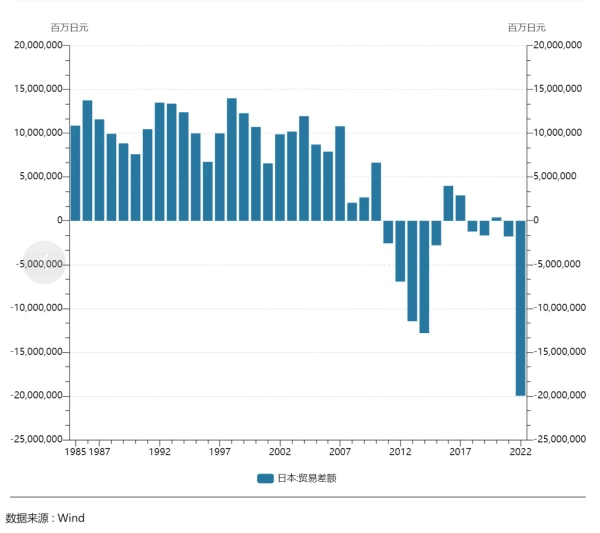

Thereafter, the yen exchange rate appreciated for five consecutive years to around 80 yen/USD in April 1995. The reasons behind this are (1) the monetary policies of the United States and Japan are synchronized, and the interest rate differential between the United States and Japan is generally at a relatively low level; (2) Japan’s inflation rate dropped sharply after the bubble burst, and the gap between the CPI growth rates of the United States and Japan expanded, supporting Japan through purchasing power parity. (3) Although domestic demand is relatively insufficient, Japans advantageous industries maintain strong exports to support the growth of Japans trade surplus; (4) Japans expansion of fiscal deficit has a crowding-out effect on private investment, leading to an increase in private sector borrowing costs , rising interest rates, etc.

After 1996, Japans policy interest rate began to be maintained near zero, causing the yen exchange rate to fluctuate cyclically mainly in response to the monetary policies of the worlds major central banks such as the Federal Reserve.

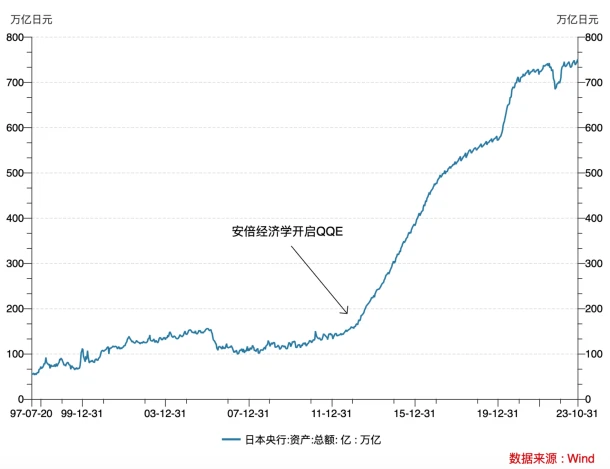

After Shinzo Abe came to power at the end of 2012, he teamed up with Central Bank Governor Haruhiko Kuroda to launch an extremely loose monetary policy (QQE), and implemented negative interest rate policy and YCC for the first time in 2016, which promoted the continued depreciation of the Japanese yen exchange rate.

The Japanese yen exchange rate since 2021 has been highly linked to the interest rate differential between the United States and Japan.

Judging from the real effective exchange rate, the purchasing power of the Japanese yen has been declining since 1993 and has reached the lowest level since 1970, which is far lower than the historical average.

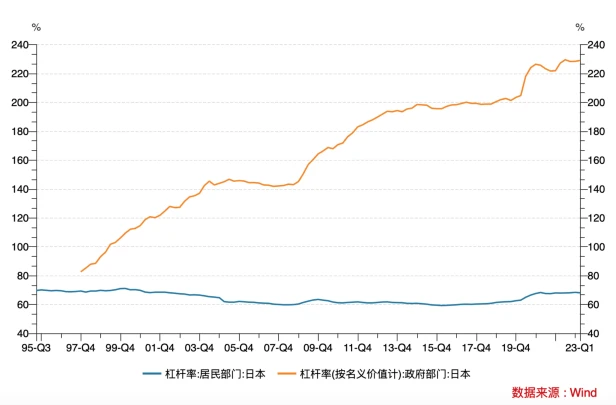

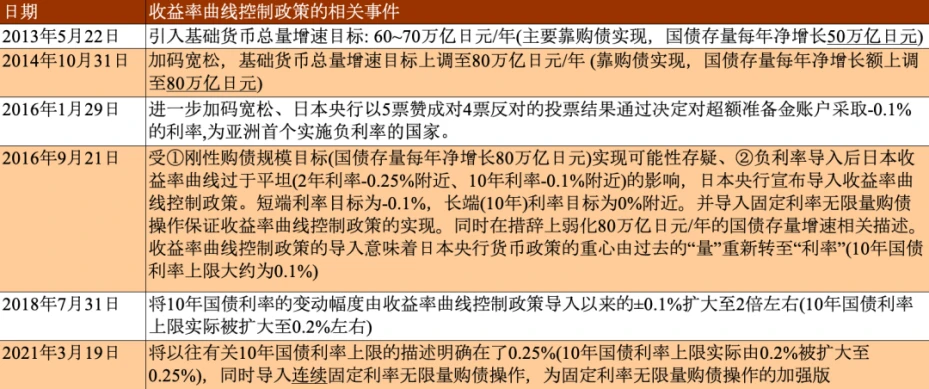

2. Background, influence and adjustments of YCC

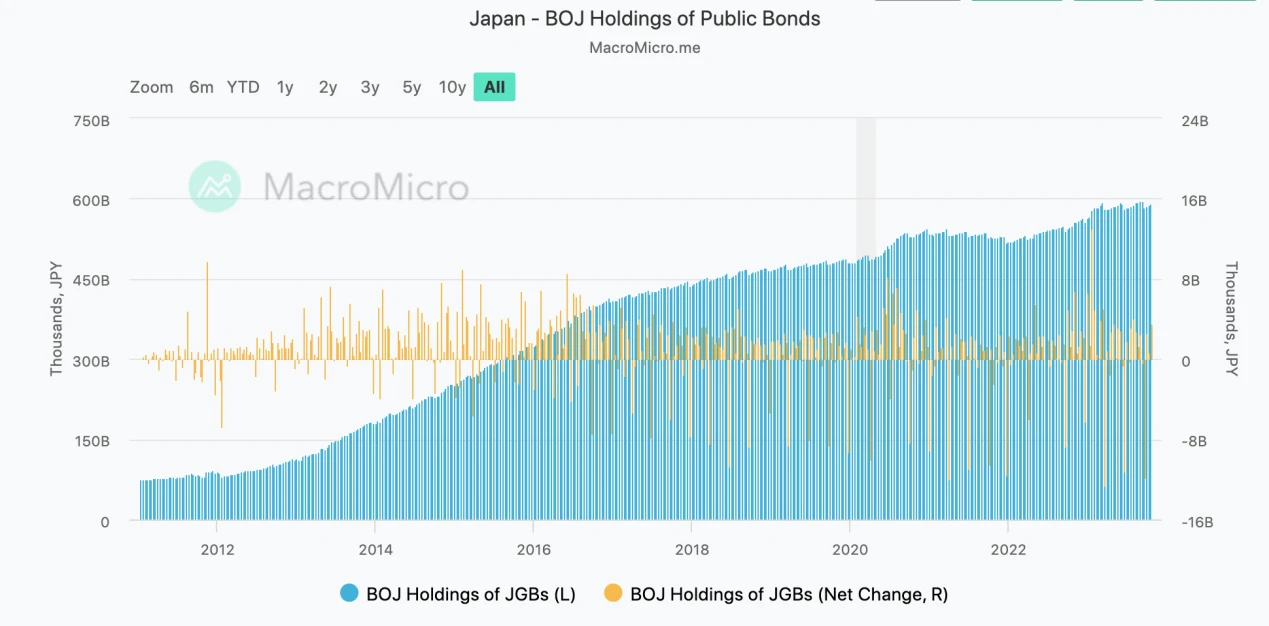

Since the launch of Abenomics, Japan has been in an extremely loose financial environment for a long time. In order to achieve the year-on-year inflation target of 2%, the Bank of Japan introduced the annual target of increasing the total amount of base money by 60 to 70 trillion yen and 80 trillion yen in 2013 and 2014 respectively, mainly through bond purchases. Japan The stock of government bonds held by the central bank should increase by a net annual rate of 50 trillion and 80 trillion yen.

In January 2016, it further adopted an interest rate of -0.1% on the excess reserve account, becoming the first country in Asia to implement negative interest rates. However, since then, Japan’s CPI has not seen a significant improvement year-on-year.

Source: Bank of Japan, CICC’s series of research reports on the Bank of Japan

Against this background, the Bank of Japan announced the introduction of yield curve control (YCC) policy at its interest rate meeting on September 21, 2016, through fixed-rate unlimited bond purchases to convert the 10-year Japanese government bond yields into The Bank of Japans short-term interest rate target is -0.1% and the long-term interest rate target range is ±0.1%. Since then, the focus of the Bank of Japans monetary policy has shifted from quantity to interest rate. . The policy interest rates of YCC and the Federal Reserve are both price-based monetary policies. The difference is that the Federal Reserves federal funds rate refers to the interest rate in the interbank lending market, its most important overnight lending rate, while YCC controls long-term interest rates.

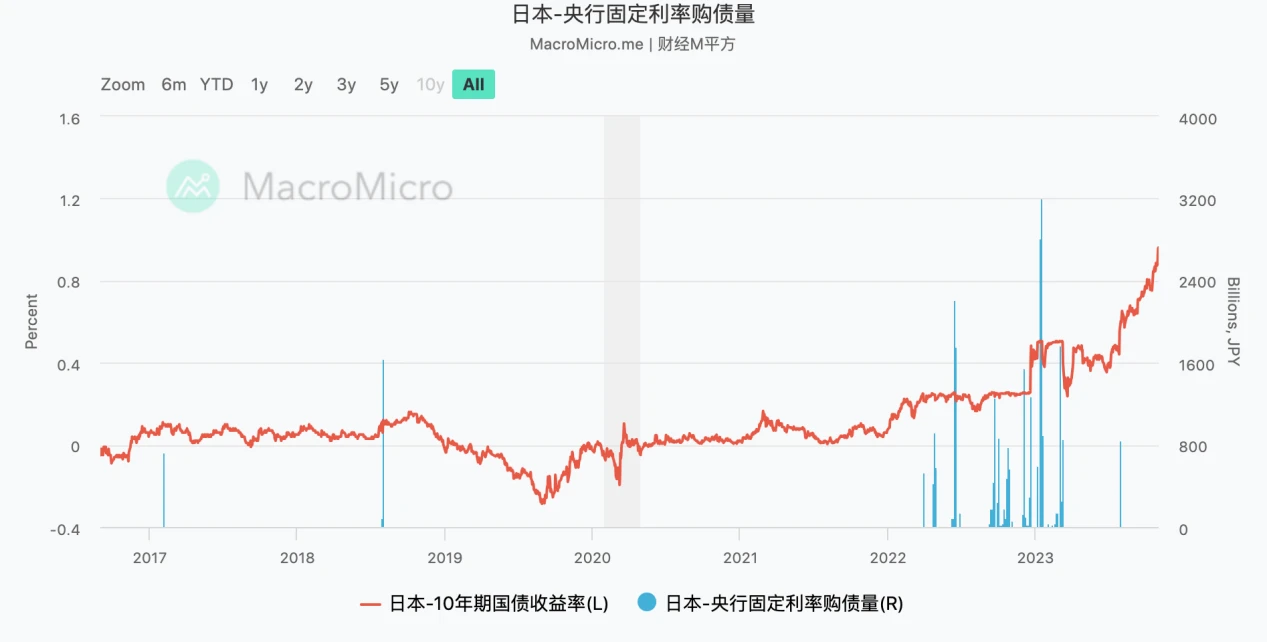

Historically, the Bank of Japan implemented unlimited fixed-rate bond purchase operations.

Government bond assets held by the Bank of Japan (trillion yen)

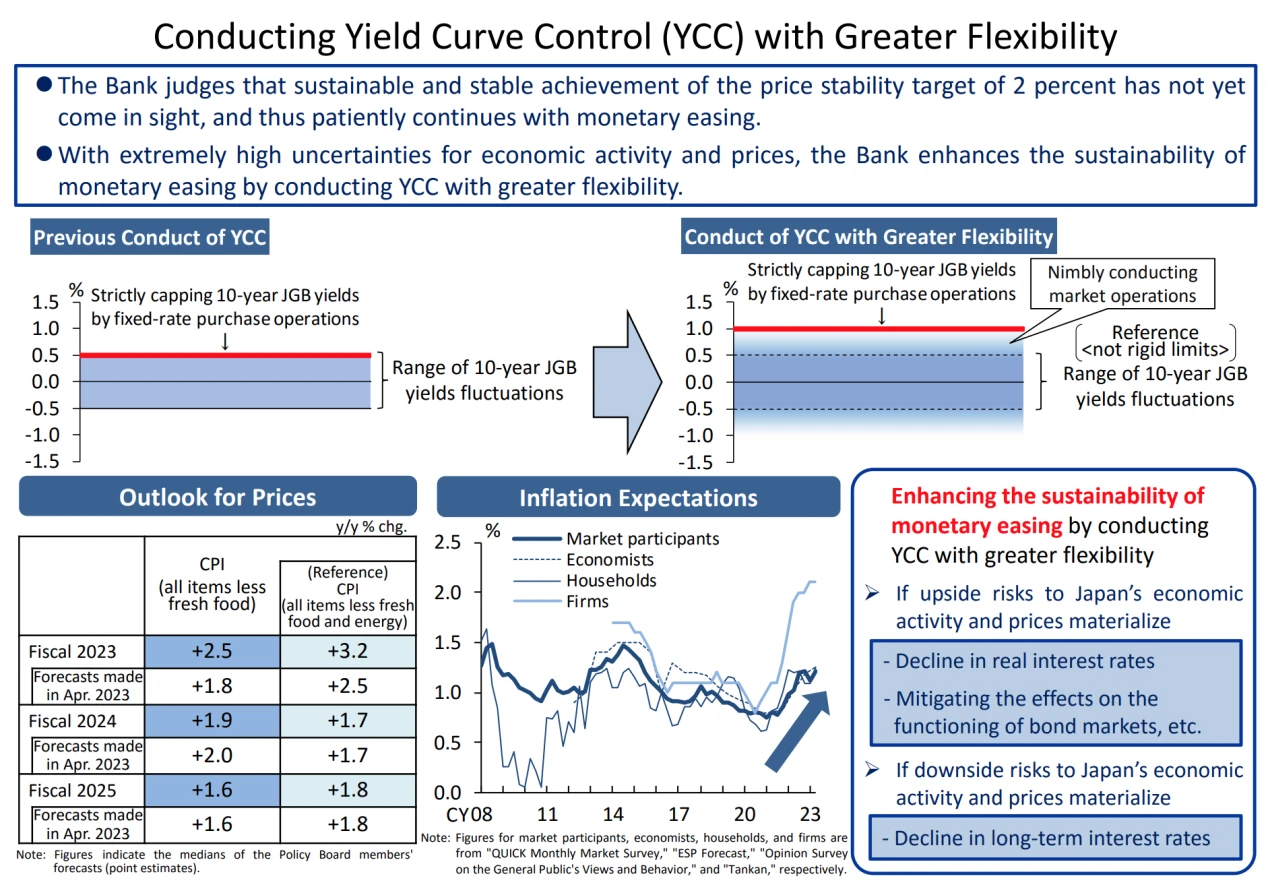

The floating range of YCC was adjusted from ±0.1% to ±0.2% in mid-2018, to ±0.25% in early 2021, and to ±0.5% in December 2022. This adjustment exceeded market expectations and was announced in the Bank of Japan announcement Afterwards, Japans 10-year government bond yield rose sharply by 21 BP from 0.25% to 0.46%.

On July 28, 2023, the Bank of Japan once again adjusted the yield curve control policy and raised the theoretical upper limit of the ten-year government bond from 0.5% to 1%. On the one hand, it retained the ±0.5% range, and on the other hand, it stated that the regulation will be more precise. Flexible, allowing the 10-year government bond yield to exceed the upper limit of 0.5%. At the same time, the Bank of Japan will purchase 10-year Japanese government bonds at a price of 1% every working day through fixed-rate acquisitions, thereby substantially increasing the long-term The interest rate cap was expanded from 0.5% to 1%.

After this meeting, unlike the appreciation after the adjustment of the YCC range in December 2022, the yen still maintained a depreciation trend. The yen exchange rate depreciated from around 141 to the 150 mark. The main reasons behind this are that (1) the adjustment did not significantly exceed market expectations; (2) after the July meeting, the Bank of Japan conducted unplanned bond purchases twice when the 10-year government bond yield exceeded 0.6% and 0.65%. Intervention in the government bond market kept the 10-year JGB yield around 0.65% before September. The Bank of Japans tolerance for the rate and extent of rising yields was less than market expectations.

Until September 9, the Yomiuri Shimbun published Kazuo Uedas first media interview since becoming the governor of the Bank of Japan in April. The interview released a hawkish signal, suggesting that the normalization of monetary policy is accelerating, and the markets expectations for the Bank of Japan to raise interest rates have increased. , Japanese bond yields began to rise, rising sharply to 0.9% before the next interest rate meeting (October 31); (3) Even if government bond yields rose significantly, U.S. bond yields also rose, causing U.S. and Japanese interest rates to widen , the momentum of depreciation of the yen has not been suppressed.

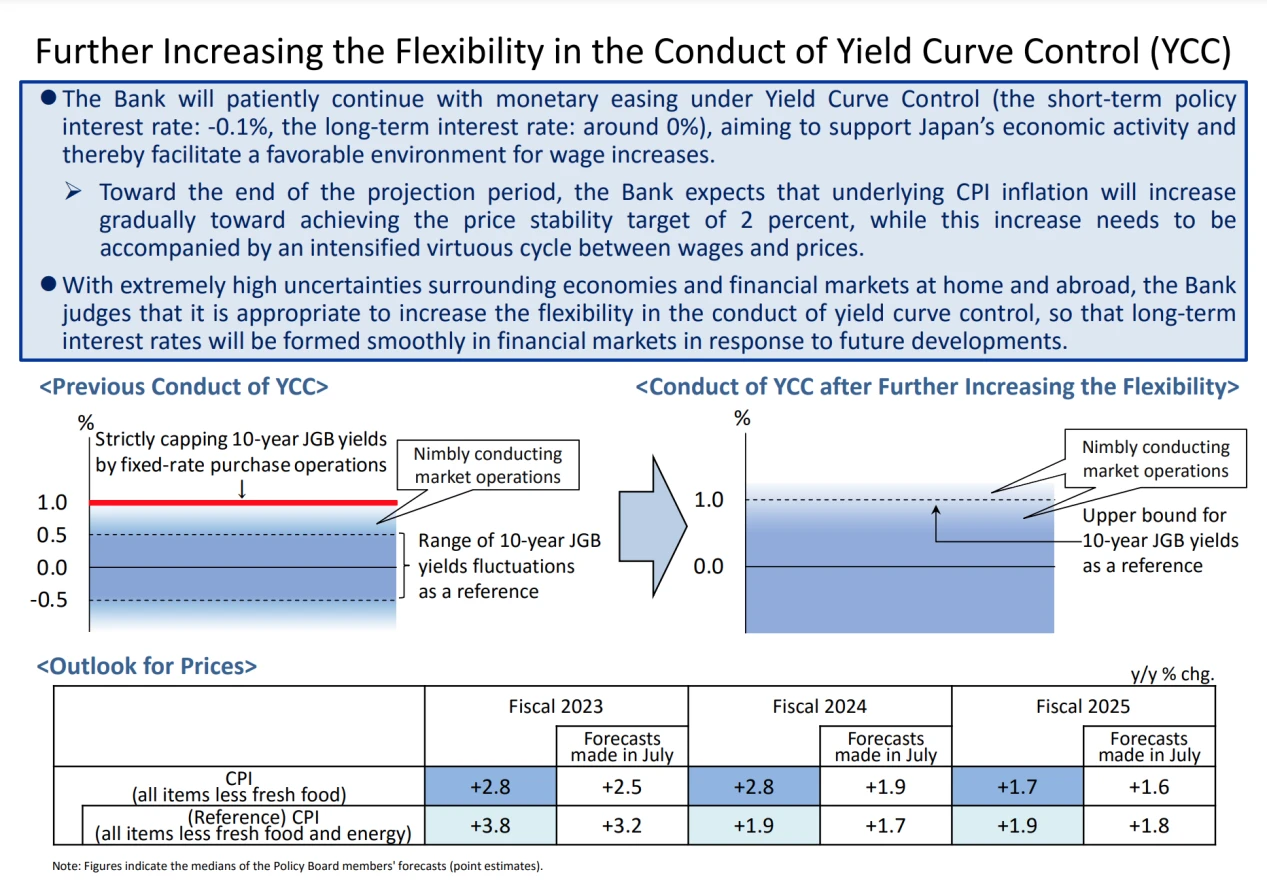

The Bank of Japans interest rate meeting on October 31, 2023 maintained the short-term interest rate at -0.1% and the long-term interest rate at 0%, but stated that the 1% yield on the 10-year government bond was only used as a reference and not as an absolute upper limit, essentially removing the 1% interest rate. % upper limit. At the press conference after the meeting, Kazuo Ueda said that after the 10-year interest rate is higher than 1%, the Bank of Japan will respond flexibly based on the level and speed of change of interest rates. Overall, the Bank of Japans stance is relatively vague, and it did not explicitly mention withdrawing from YCC. However, when the upper limit of yield is no longer a rigid rule and is only used as a reference, it can be understood to a certain extent as a substantial withdrawal from YCC. The Bank of Japans cautious and subtle stance this time The wisdom of the golden mean is that the upper limit has not been raised but the essence has been raised. YCC has not let go but has left itself a way out. The Bank of Japan has not shown its trump card to the market while leaving itself room to act according to circumstances. The reason is also that Japan has experienced a lost 30 years, during which the long-term accumulated debt, high balance sheet and stubbornly low inflation have made the Bank of Japan hope to gently and slowly reverse this unprecedented extreme monetary policy. Any radical measures or market Interpretation is likely to put Japan facing another crisis. After this meeting, the market believed that the Bank of Japan was dovish, and the US-Japan exchange rate rose to around 151.7 that day. The market may further test and observe the Bank of Japans tolerance for rising interest rates and the extent of its intervention in the government bond market.

3. Japan’s economy continues to recover

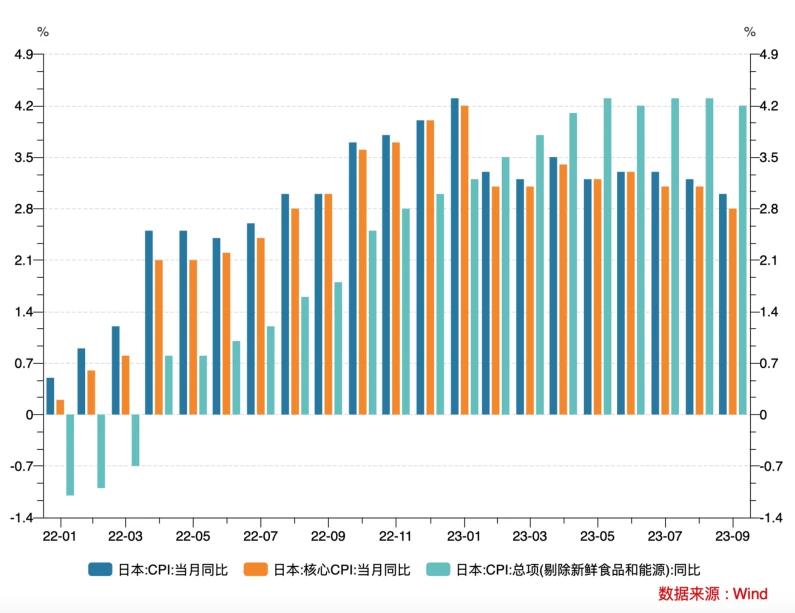

The trend of Japans inflation is a key factor in determining the central banks policy and the trend of the yen exchange rate. Inflation in Japan has been rising since 2022. After entering 2023, CPI fell from 4.3% in January to 3% in September. At the same time, core CPI (excluding fresh food and energy) remained strong and resilient, rising from 3.2 to 4.2% year-on-year. .

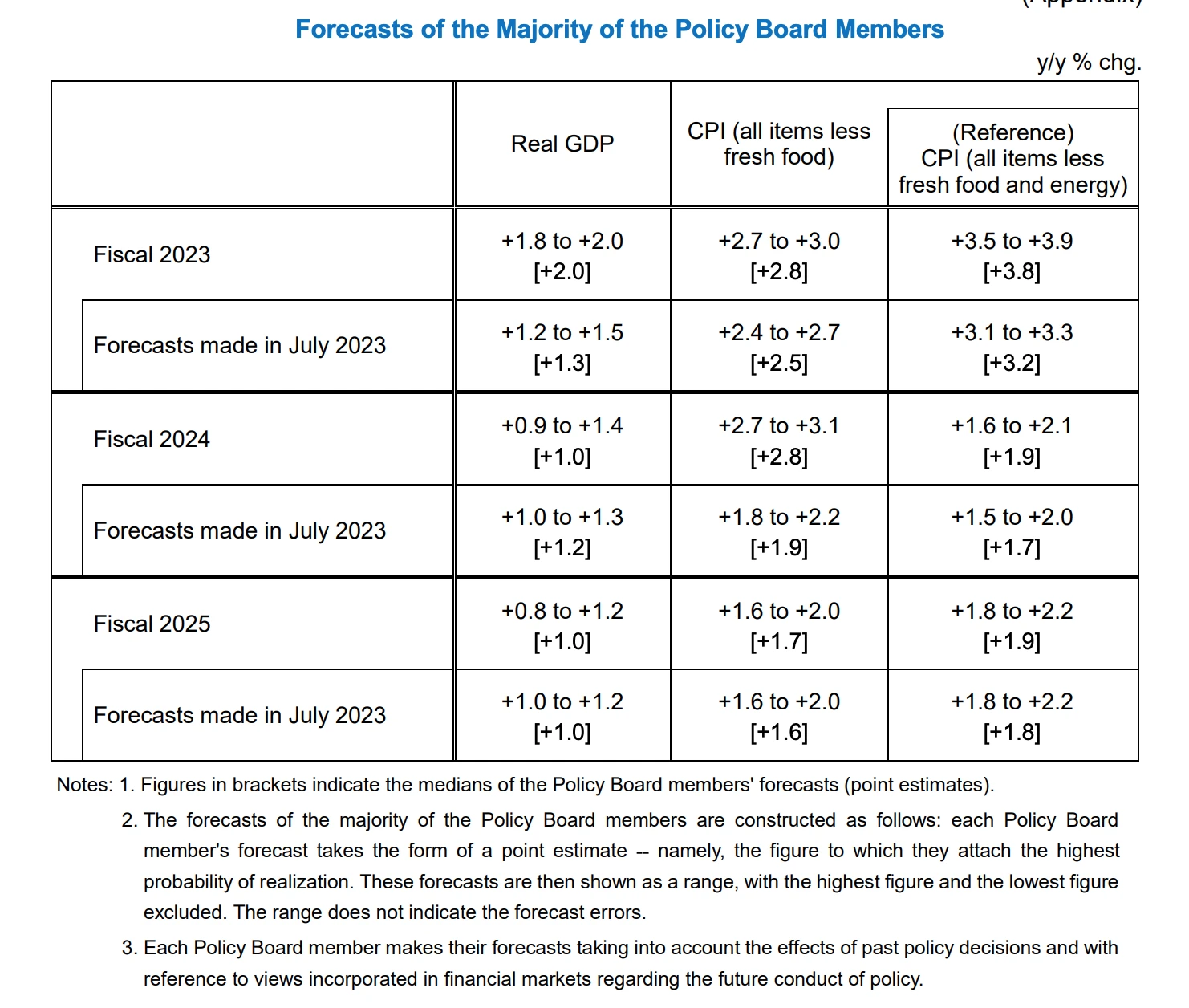

At this meeting, the Bank of Japan raised its inflation and economic growth forecasts, raising the year-on-year growth rates of CPI (excluding fresh food) by 0.3 pct, 0.9 pct, and 0.1 pct for the 2023-2025 fiscal year to 2.8%, 2.8%, and 1.7%; 2023 – The core CPI (excluding fresh food and energy) in fiscal year 2025 is raised by 0.6 pct, 0.2 pct and 0.1 pct year-on-year to 3.8%, 1.9% and 1.9%; the median GDP growth forecast in fiscal year 2023 is raised by 0.7 percentage points year-on-year to 3.8%, 1.9% and 1.9%. 2.0%, with the median forecast for fiscal 2024 lowered by 0.2 percentage points to 1.0%. The sharp increase in inflation forecasts at this meeting shows that endogenous inflation pressure in Japan has further increased, and the Bank of Japan is increasingly confident in achieving the 2% inflation target. At the same time, the subtle number of 1.9% was used twice for the inflation forecast, which is just below the policy target of 2%, reflecting the relatively cautious attitude of the Bank of Japan and not wanting the market to prematurely price in monetary policy normalization expectations.

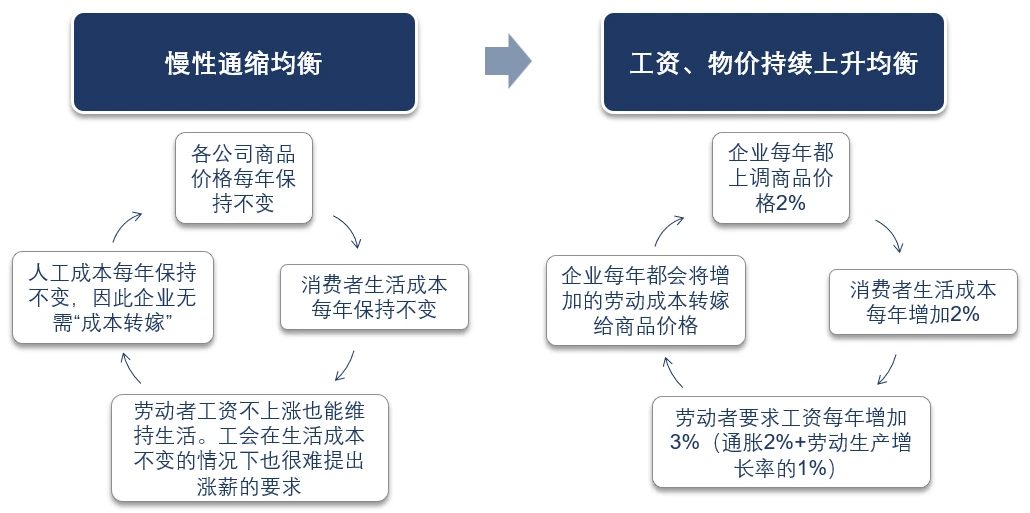

The Bank of Japans concern in adhering to an ultra-loose policy stance since 2022 is that Japans island countries are lacking in resources and are very dependent on imports of energy, food, etc. A large part of the rise in CPI comes from imported goods caused by the depreciation of the yen and rising commodity prices. inflation, rather than demand-pull inflation; and an intended reversal of deflationary expectations that Japan has had for too long. From the perspective of wage growth, output gap, GDP, etc., Japans economy continues to recover, and this concern is gradually being digested.

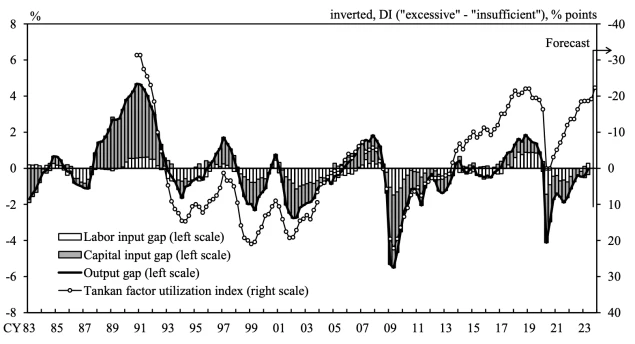

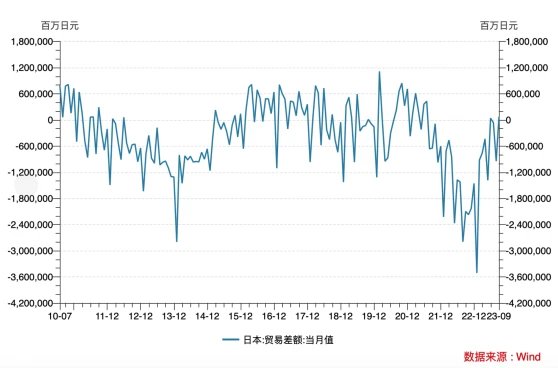

According to data released by the Bank of Japan on October 4, the output gap (the difference between actual output and potential output) continues to close and is about to turn from negative to positive; Japans trade deficit gradually narrows.

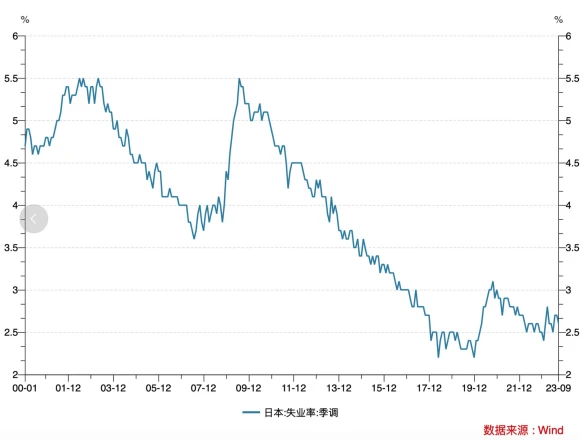

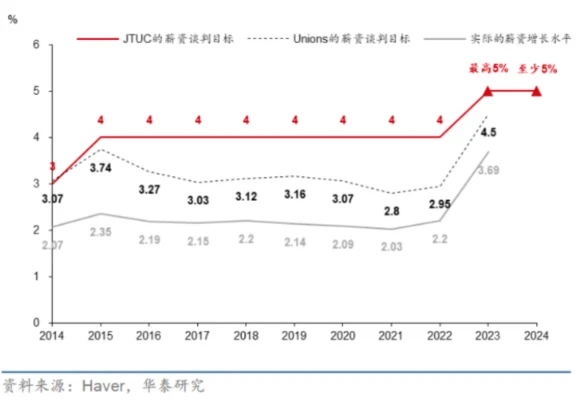

Japanese wages are rising, the unemployment rate is at a historically low level, and the Japanese labor market is generally tight. The National Federation of Labor Organizations of Japan plans to target a salary increase rate of more than 5% in the 2024 Spring Festival, which may further push up the wage growth rate in the 2024 Spring Festival. It can be seen that during 2022-2023, Japan reversed the trend of no salary increase for more than ten years for the first time, broke the chronic deflationary equilibrium, and began to enter a positive cycle of demand-driven salary increases and price increases. This is Japans Expect decades of economic results.

In terms of fiscal policy, the Kishida Fumio government launched stimulus policies that exceeded expectations. The Japanese government held an interim cabinet meeting on November 2 and approved an economic stimulus plan with a total scale of more than 17 trillion yen, which includes temporary income tax cuts, subsidy payments, extended energy price subsidies, etc., totaling more than 17 trillion yen. 17 trillion yen. Japan’s Cabinet Office estimates that the above-mentioned fiscal stimulus will boost GDP by 1.2 percentage points over the next three years.

4. The impact of carry trade

For a long time, Japan has been a depression for global interest rates. Coupled with the Japanese yens good liquidity and complete financial system, it has become the best liability target in global carry trades. Japanese housewives who use carry trades to earn interest rate differentials are called Mrs. Watanabe, and Japanese housewives carry trades generally bear the risk of exchange rate fluctuations. Carry transactions of international financial institutions generally lock in exchange rate risks by lending Japanese yen and borrowing U.S. dollars through interest rate swaps. Since the central bank holds a large proportion of Japanese yen assets and maintains zero interest rates for a long time, the Japanese yen often adjusts reversely following the fluctuations in the currency cycles of major overseas economies such as the Federal Reserve. During the global interest rate cut cycle, the Japanese yens carry trades decreased and showed a relative strength; during the global interest rate hikes, the carry trade positions increased and showed a relative weakness, which promoted the Japanese yen to become a safe haven currency. During the 1998 Asian Financial Crisis, the 2008 Global Financial Crisis, the 2003 SARS epidemic, and the 2020 COVID-19 epidemic, the Japanese yen showed relative strength, reflecting its risk-averse attributes.

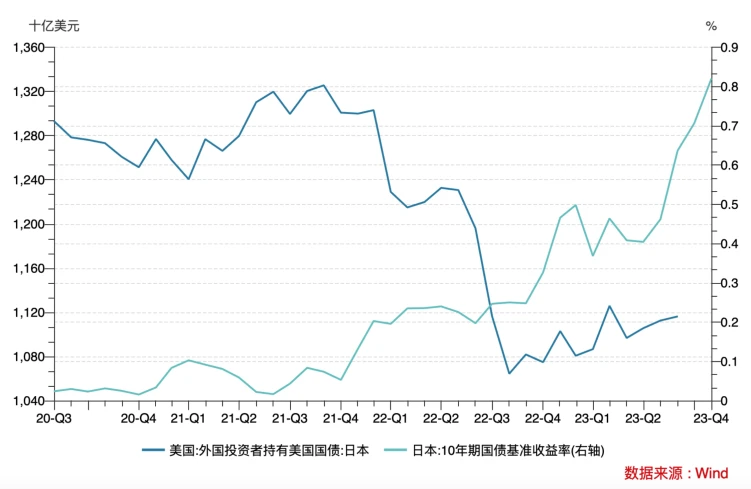

In the future, if Japans 10-year government bond yields continue to rise, it will increase the cost of carry transactions, causing capital to flow back to Japan, pushing up U.S. bond yields, and creating an appreciation impetus for the Japanese yen. This series of domino effects has triggered market concerns. The unwinding of yen carry trades has led to concerns about a global liquidity crunch. CICC believes that the risk of Japanese investors selling U.S. debt significantly is limited. The first reason is that since mid-December last year, the 10-year interest rate on Japanese bonds has risen by about 70 basis points, but the U.S. Treasury bonds held by Japan have not fallen during this period. Since the beginning of 2023, the cumulative net purchases of foreign debt (mainly U.S. debt) by Japanese investors have been at a historically high level.

5. Future Outlook

With the output gap turning positive, wages continuing to grow and inflation expectations rising, Japan is emerging from the low inflation era that has plagued it for decades. The normalization of the Bank of Japans monetary policy is the general trend, and there is room for a structural increase in Japanese government bond interest rates. The Bank of Japan is expected to adopt a relatively vague and cautious stance to slowly expand and exit the YCC fluctuation range, while retaining the option of intervening in the government bond market in order to avoid a huge sell-off of government bonds in the market and a sharp shock in the financial market. On the other hand, the Federal Reserves November monetary policy meeting announced its decision to suspend interest rate hikes again. The ISM manufacturing PMI and new non-farm employment data in October were both lower than expected. The market generally believes that the Feds interest rate hike cycle has come to an end, while the Bank of Japan is in This is the beginning of this round of tightening. In the long run, the interest rate spread between U.S. and Japanese government bonds will narrow. At the same time, from a technical perspective, the U.S.-Japanese exchange rate has not broken through last years high point of around 151.94, forming a double-top pattern. The Japanese yen is more likely to reverse its decline in the future.